Blog Webinar Recap: Biggest Mistakes of Private Company Valuations 2024

- Blog

Webinar Recap: Biggest Mistakes of Private Company Valuations 2024

- IMAA

SHARE:

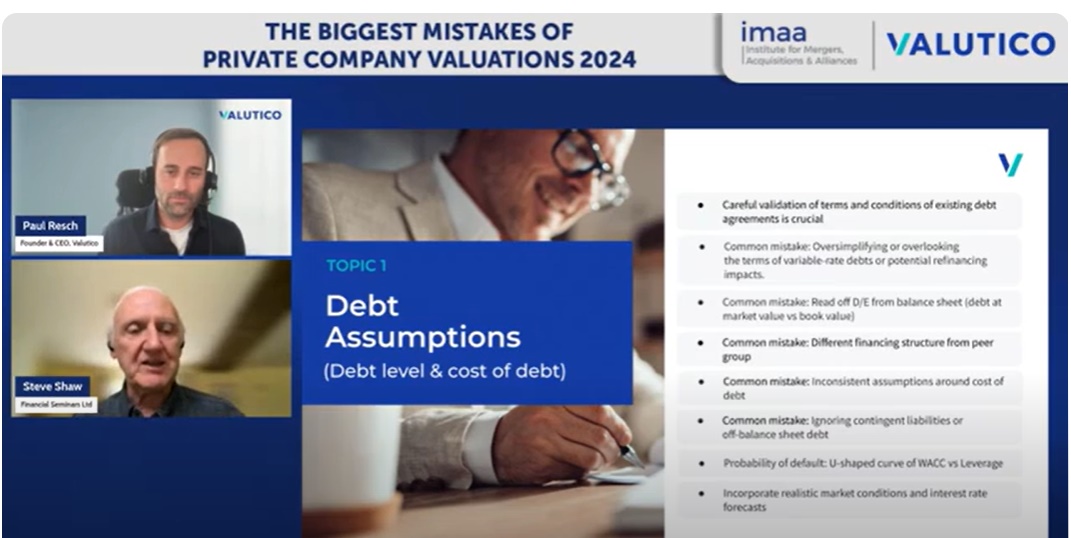

Hosted by IMAA, this insightful webinar featured Paul Resch and Greg Brown from Valutico, and Valuation thought leader Steve Shaw, discussing critical mistakes in private company valuations. From debt mismanagement to inconsistent cash flow projections, the session provided essential insights for valuation professionals. The experts shared practical advice on avoiding these common errors through improved methodology and the use of innovative valuation technology.

Key Topics Covered

Debt Assumptions:

One of the most frequent mistakes involves inconsistencies between market and book values of debt, contingent liabilities, and reading off debt/equity ratios from the balance sheet. Shaw emphasized the importance of reviewing contingent liabilities and how different types of buyers (trade, private equity) affect debt assumptions.

Excess Cash vs Operating Cash:

Resch explained the difficulty in determining excess cash. Businesses often require cash to operate, especially in cyclical industries, and misclassifying this cash can lead to significant distortions in valuation results. Proper analysis of cash flow is essential for accurate categorization.

Working Capital and Terminal Growth Assumptions:

The speakers highlighted errors often made in terminal period assumptions. For high capital-intensity industries, companies often underestimate future capital requirements. Shaw pointed out that underinvestment in the terminal period could lead to undervaluation.

Comparators for Betas and Multiples:

Shaw explained that picking inappropriate comparators can lead to skewed results. He advised focusing on value drivers like growth, profitability, and risk when selecting peers. One attendee asked about finding comparators for niche industries, to which Shaw suggested looking at companies with similar business models, even if they are outside the industry.

Enterprise vs Equity Value:

Many practitioners confuse these two, leading to valuation errors. Shaw mentioned that understanding how debt and other liabilities are treated is crucial, especially in companies with significant debt obligations.

Inconsistent Cash Flow Projections:

Resch discussed the danger of projecting overly optimistic growth without corresponding investments, particularly in high-growth sectors. Shaw added that cyclical industries often require multiple scenarios to avoid overvaluing future cash flows.

Q&A Highlights

During the Q&A, a participant asked about discrepancies between perceived and actual market values of companies. Shaw explained that inflated expectations, especially from private company owners, often stem from unrealistic projections or misjudging market conditions. Another attendee asked about the common errors when evaluating strategic acquisitions. Shaw recommended conducting scenario analysis to separate synergistic value from fair value.

Another participant inquired about red flags in financial statements that could lead to valuation errors. Resch highlighted common concerns like owner-driven salary distortions and off-balance sheet items such as real estate owned by shareholders but used by the company.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter