Publications 2022 M&A Year End Analysis

- Publications

2022 M&A Year End Analysis

- Ally Roznelette De Los Reyes

SHARE:

Table of Contents

Global M&A Industry Trends

Now is not the time to fall out of love with M&A.

M&A tends to slow during times of uncertainty or market volatility—but those can be precisely the times when valuations become more attractive and opportunity knocks. Based on our experience, recent deals activity, as well as insight into our clients’ current deals, we are optimistic that exciting M&A opportunities lie ahead in 2023. While overall deal volumes in 2022 were below the record-breaking 65,000 deals in 2021, they remained 9% above pre-pandemic levels. The current market conditions suggest that we are in a sweet spot for M&A, provided that companies have well-thought-out strategies and the financial wherewithal (and in some cases the courage) to make transformational deals—deals that will shape their businesses and contribute to their longer-term success.

In early 2023 the short-term economic outlook remains clouded by global recession fears and rising interest rates as central bankers try to tame record inflation in many regions. When combined with edgy investors still digesting 2022’s steep decline in global stock market valuations, the war in Ukraine, other geopolitical tensions, supply chain disruptions and tightening regulatory scrutiny, it’s no wonder executives have been pushed back on their heels.

Paradoxically, deals done during a downturn are often the most successful[1]. These challenging conditions create opportunities for buyers to achieve better returns and even outsize growth. Right now, thanks to a reset in valuations, lessened competition for deals and new assets coming to market—including from distressed situations—we believe that many C-suites and boards should embrace M&A as part of their strategy. Indeed, some have already begun to open their wallets to capitalise on these opportunities and potentially set the foundation to leapfrog competitors.

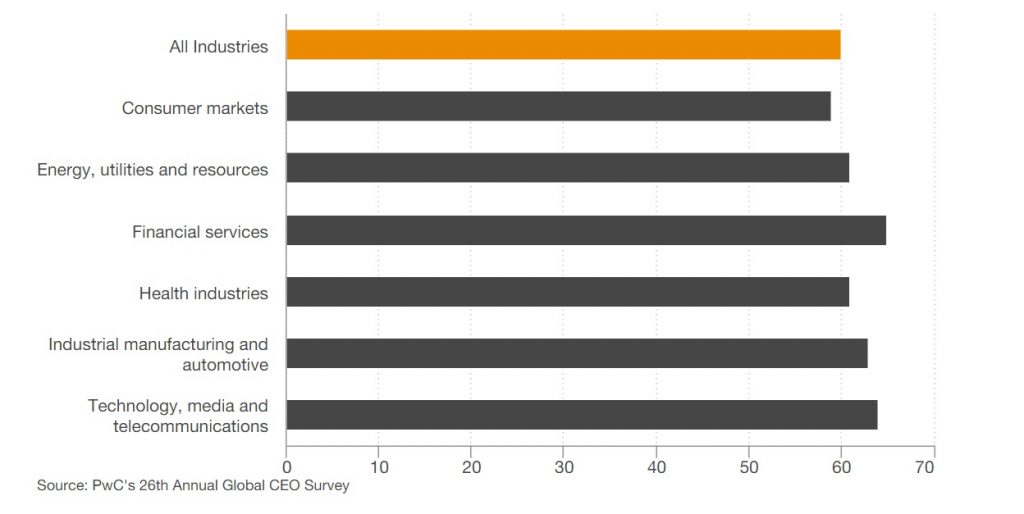

Respondents to PwC's 26th Annual Global CEO Survey who do not plan to delay deals (%)

“Doing transformational deals in today’s climate is not for the faint of heart. However, with the right strategy, the right business case and the courage, CEOs can put some meaningful distance between themselves and their competitors in the long term”

Brian Levy

Global Deals Industries Leader, Partner, PwC US

Overcoming resistance to getting deals over the line

In our 2022 mid-year update, we set out some ideas for how dealmakers can successfully address stakeholder concerns and win trust to get deals done in the current environment. They included building the case for M&A now, focusing on the long term, expanding due diligence and capitalising on the value reset. While some boards’ first instinct when discussing M&A opportunities may be one of hesitation, as macroeconomic risk and recession fears weigh on CEOs’ minds, they need to be aware of how strategic M&A can be a strong lever for sustained growth and transformation. Nearly 40% of CEOs don’t think their companies will be economically viable a decade from now if they don’t transform[2]. This underscores the need to reinvent businesses for the future while also dealing with a multitude of near-term challenges. If CEOs don’t react, they could miss attractive opportunities and potentially open the door to shareholder activism, a trend which has been on the rise.

As such, the time to act is now—particularly for corporate players; however, it’s hard to predict how long acquirors will have to make the bold moves that could change the game in their sector and deliver sustained outcomes. The current market trends are giving rise to a series of headwinds but at the same time creating a dynamic environment for M&A plays. So how can dealmakers navigate this?

Accelerate strategic reviews and portfolio optimisation

During times of uncertainty, companies need to exercise capital discipline and undertake strategic reviews of their business. As CEOs reassess their portfolio against their core strategy, one key question they must address is the extent to which they should continue to invest in non-core or lower-growth areas. Where such assets are marked for divestiture, these will free up cash to reinvest in higher growth areas—and the to-be-divested assets will provide buying opportunities for others. We expect such strategic reviews may also lead to further spin-offs by large conglomerates aiming to become more agile and optimise sustainable capital allocation—following in the footsteps of GE, 3M, GSK, XPO Logistics and J&J, which have recently separated key business units or announced plans to do so.

In other cases, also as part of the portfolio optimisation, assets might be marked for performance improvement to deal with underperformance or to prepare for further economic headwinds. In these situations, we typically see corporate players take action—or stop certain activities—to improve the quality of their sales and customer base, reduce their cost base, and improve their liquidity and working capital management. Recently, a number of large corporates have announced cost-reduction programs including layoffs amid recession fears, but there have also been announcements in new investment areas.

- Building transformation into the narrative

- Get creative on financing

- Use lower valuations as a catalyst

- Seek growth in other markets

- Prioritise workforce strategy

- Scenario plan during due diligence

- Identify additional sources of value

“I see plenty of reasons to be positive about deal activity as we enter 2023. CEOs will have dealmaking firmly on their agendas as businesses continue to optimise their portfolios and consider how strategic M&A can help drive growth and their transformation journey.”

Resetting the field of M&A players

The more fragile market has affected dealmakers unevenly, creating net advantages for some and challenges for others, depending on their respective M&A strategies. Here’s our view on how different players are likely to respond in 2023:

Corporates. Companies with cash on hand and growth ambitions will be well placed in this market. They will have an added edge on acquisitions if their operations fit well with those of the target company. We are seeing a significant increase in carve-outs and expect this divestment trend to continue. Some corporates are facing pressure to deleverage their balance sheets, and many now recognise the need to be agile and are recalibrating their portfolios.

Private equity. Private equity has put record amounts of capital to work over the past few years, accounting for more than 40% of deal values in 2022. This has significantly changed the dynamic of the overall M&A market. PEs will be looking at new deals and will be focused on creating value in their portfolio companies, which in turn will involve optimisation, build ups and divestitures. Fundraising has continued at pace, such that PE dry powder stands at approximately US$2.4tn globally. However, high interest rates and challenges raising financing through leveraged loan markets have slowed buyout activity. But perhaps not for long. As previously noted, PE will find alternative ways to finance important deals and won’t stay on the sidelines. More disciplined firms will try to maintain their investment plans while remaining flexible enough to act quickly on value creation opportunities as they arise. Some of the biggest PE funds have raised credit funds, which opens up new transaction avenues for them in a tough financing market.

SPACs. Special purpose acquisition companies (SPACs) have struggled to close deals, and many are likely to run out of time. During 2022, there were 85 SPAC IPOs which together raised approximately US$12bn in proceeds, a sharp drop from the more than 600 SPAC IPOs which raised more than US$144bn in 2021. Securities and Exchange Commission (SEC) regulations, poor post-IPO performance for SPACs, and difficulties securing private investment in public equity (PIPE) funding have contributed to record redemption rates, lower de-SPAC merger activity and even the termination of several previously agreed SPAC deals.

Credit funds and private markets capital. As banks seek to limit their exposure to some riskier sectors, we expect to see credit funds continue to take share away from banks. They may join forces to do some larger deals but will have the most impact in the mid-market. Their lending is likely to become key to providing much-needed liquidity to the leveraged loan market—in effect, creating a floor under the M&A market.

Venture capital. As investors pull back from riskier investments and reassess valuations, we expect to see some distress in early-stage companies that may struggle to secure further rounds of financing. This may present some interesting acquisition opportunities for corporate players and PEs. One potential bright spot is climate tech investing. PwC’s State of Climate Tech 2022 report found that while the contraction of VC investments in climate tech overall reflects the kind of cyclicality seen elsewhere in corporate dealmaking, the extent of the decline looks far less drastic. In addition, more than one-quarter of all VC funding is going to climate technology, with increased focus on technologies that have the most potential to cut emissions.

M&A resets to pre-pandemic levels

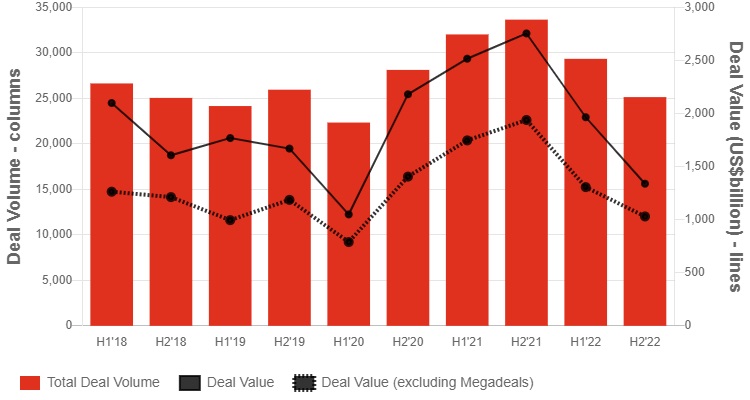

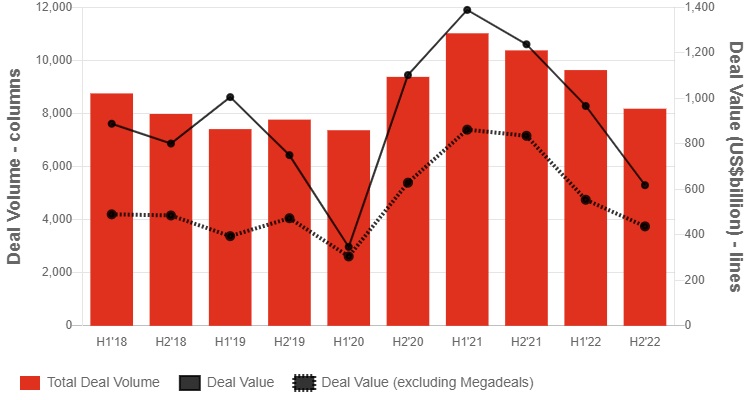

Deal volumes and values, 2018-2022

Sources: Refinitiv, Dealogic and PwC analysis

Global M&A volumes and values declined in 2022 by 17% and 37%, respectively, from record-breaking 2021 levels, although both remained above 2020 and pre-pandemic levels. The high levels of M&A activity from 2021 continued into the early part of 2022, but as headwinds continued to grow, each successive quarter reported a decline in deal activity over the prior one. Deal volumes and values declined by 25% and 51%, respectively, in the second half of 2022 compared to the prior year period. However, trends varied across countries and regions. This is indicative of a broader shift by investors to find opportunities and growth in other markets, as we detail further below:

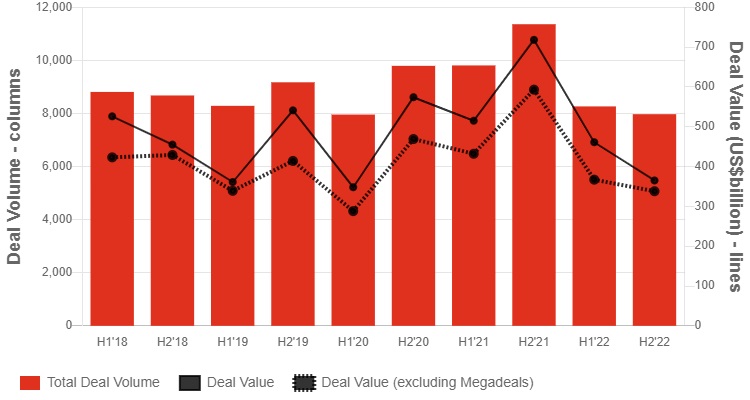

Asia Pacific: Deal volumes and values declined by 23% and 33%, respectively, between 2021 and 2022, with the greatest declines in China, where deal volumes and values decreased by 46% and 35%, respectively. M&A in China has slowed domestically in response to the country’s pandemic-related challenges and weakening demand for exports. Companies seeking access to Asian markets are increasingly looking beyond China—to India, Japan and other countries within Southeast Asia—for investment opportunities. India has emerged as an increasingly attractive destination for investment, overtaking Japan and South Korea in deal values to rank second in the region behind China.

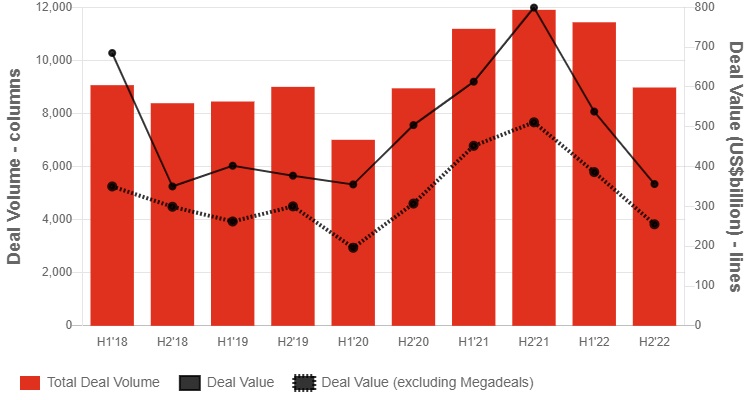

EMEA: M&A performed better in Europe, the Middle East and Africa (EMEA) than in the Asia Pacific and Americas regions, in spite of the impact on markets of higher energy costs and a drop in investor confidence. Deal volumes and values across EMEA declined by 12% and 37%, respectively, between 2021 and 2022. With 20,000 deals in 2022, activity in the region was 17% higher than pre-pandemic 2019 levels.

Americas: Deal volumes and values declined by 17% and 40%, respectively, between 2021 and 2022 due to a combination of macroeconomic, regulatory and geopolitical factors. Deal values were particularly hard-hit, and the number of US megadeals—transactions with a value in excess of US$5bn—almost halved between 2021 and 2022 from 81 to 42, respectively. The decline in the second half of the year was more acute, with just 16 megadeals in the second half of 2022 compared with 26 in the first half of the year.

2023 M&A outlook

We expect 2023 will be an exciting time for M&A, with transformation and transactions at the forefront of CEOs’ value creation strategies. But with recessionary fears remaining on the top of dealmakers’ minds, all eyes will be focused on when the US Federal Reserve will signal an end to interest rate hikes. We believe this will act as a catalyst for greater stability and certainty leading to an upswing in M&A, notably among private equity. As business leaders seek to surmount the varying challenges, M&A—and particularly portfolio optimisation—will be a key tool to help them reposition their businesses, bolster growth and achieve sustained outcomes over the long term.

Footnotes:

[1] Source: PwC. (n.d.). M&A cycles: Fundamental drivers and valuation impacts. https://www.pwc.com/us/en/services/consulting/deals/ma-in-uncertain-economic-times/cycles.html

[2] Source: PwC. (2024, January 15). Thriving in an age of continuous reinvention [Press release]. https://www.pwc.com/gx/en/issues/c-suite-insights/ceo-survey.html

About the data

We have based our commentary on M&A trends on data provided by industry-recognised sources. Specifically, values and volumes referenced in this publication are based on officially announced transactions, excluding rumoured and withdrawn transactions, as provided by Refinitiv as of 31 December 2022 and as accessed on 2 January 2023. This has been supplemented by additional information from Dealogic, Preqin, S&P Capital IQ and our independent research and analysis. This publication includes data derived from data provided under license by Dealogic. Dealogic retains and reserves all rights in such licensed data. Certain adjustments have been made to the source information to align with PwC’s industry mapping.

The chart showing “Respondents to PwC’s 26th Annual CEO Survey who do not plan to delay deals (%)” is based on the original survey question: “Which of the following options best describes any action your company may be considering to mitigate against potential economic challenges and volatility in the next 12 months?” Respondents selected from a list of several options, answering “We do not plan to do this”; “We are considering this in the next 12 months”; “We are already doing / have done this”; or “Don’t know”. The chart displays the percentage of CEOs who responded “We do not plan to do this” to the option “Delaying deals”.

Originally published at PwC

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter