Blog Webinar Recap: Unraveling Carve-Out Complexity: Optimizing People Strategy for Success

- Blog

Webinar Recap: Unraveling Carve-Out Complexity: Optimizing People Strategy for Success

- Ces Natividad

SHARE:

Carve-outs are complex processes that require careful planning and execution. The human capital aspect plays a crucial role in ensuring a seamless transition and long-term success. In a recent webinar hosted by the Institute for Mergers, Acquisitions and Alliances (IMAA), experts from Mercer shared essential strategies, insights and best practices to navigate the complexities of M&A carve-outs with confidence.

Key Takeaways on External Drivers for Carve-Outs

There are several interrelated drivers creating the need and the demand in the carve-out space right now.

- Strategic refocusing and shifting priorities

- Private equity dynamics and investment

- Economic and regulatory environment

- Market demand

- Specialized expertise

Many organizations that go through carve-outs are typically complex conglomerates with multiple business operations and different commercial activities. They continually look at where they want to invest and disinvest, which leads to the carve-out. For example, a complex organization decided to invest all its money into technology and carved out its specialized manufacturing business for sale. On the Buyer side of this example, private equity firms and corporate Buyers see investment opportunities in carve-outs due to underinvestment by the parent company.

Carve-outs are typically smaller deals that are more economically feasible for financing. They also avoid heavy regulatory scrutiny, creating significant market demand for specialized expertise in carve-outs.

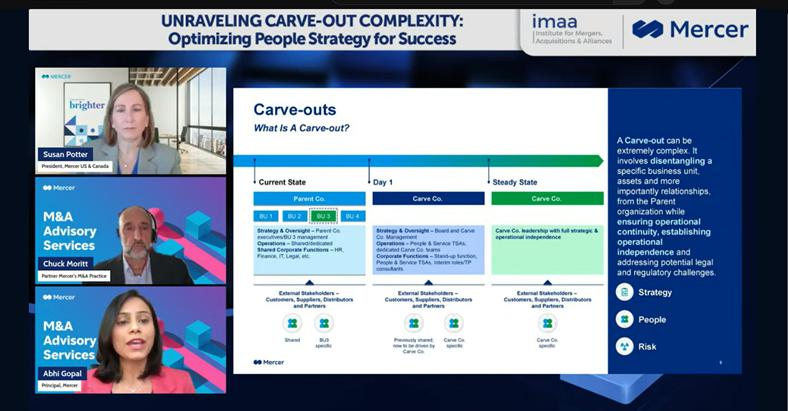

Key Takeaways on Understanding Carve-Outs

A carve-out can be extremely complex. It involves disentangling a specific business unit, assets and more importantly relationships, from the Parent organization while ensuring operational continuity, establishing operational independence, and addressing potential legal and regulatory challenges.

An example is when a business unit is no longer a core asset for the company, thus the Parent decision to do a carve-out. The separated business unit remains entangled with the Parent company in terms of strategy, oversight, shared leadership, operations, and external stakeholders. After the carve-out, the business unit may become a standalone company or be integrated with an existing business, and the Parent company may provide transitional support to ensure continuity. The transition from day one to a steady state depends on negotiations between the Parent and the Buyer, as well as the length of service agreements. The Buyer will also need to address strategy, people issues, and risks for a smooth transition to a standalone or integrated business.

Key Takeaways on Further Understanding Carve-Out Complexity

Dealing with carve-outs can be especially challenging because the Buyer often ends up with an incomplete business. This is particularly difficult for Private Equity Buyers who intend to run the business independently, as they have to rebuild the business to make it suitable and scalable in terms of personnel, structure, systems, and costs.

For instance, if the parent company uses a complex in-house IT system, it may not be suitable for the standalone carved-out business unit, which might only require a simpler off-the-shelf IT system.

The deal structure itself is complex, with different treatments needed for asset and stock structures in the same transaction, especially concerning the people involved.

Acquiring an incomplete business often leads to gaps in leadership, talent, and skills. In many cases, the business unit’s leadership may need to step up to the C-suite role. This can be a challenging transition and may require interim leadership hiring.

The operational strategy and tight timelines further add to the complexity of the transaction, especially when there are high levels of entanglement and no transition service agreements (TSAs).

In many cases, there is no HR TSA in place, which puts significant pressure on the Buyer to have an operational HR function on day one to ensure business continuity.

Additionally, global nuances may result in a staggered close across the globe due to varying laws and regulations in specific countries or regions.

Key Takeaways on People Strategy Considerations During a Carve-out

The HR department plays a crucial role in a carve-out by ensuring that the new business entity is up and running smoothly. This involves considering the organizational structure of the business, which consists of the front, middle, and back offices. The front office includes client-facing operations like sales, account management, and marketing. The middle office supports the front office through functions like strategic sourcing and R&D, while the back office includes support functions such as Finance, HR, IT, Legal, and Risk.

To establish the carve-out and ensure smooth operations, it’s essential to define the operating model and organizational design. Mercer collaborates closely with business leaders to define the different areas of the business and develop a talent strategy through organizational design. This is supported by culture change, communication, and engagement plans to facilitate a smooth transition and retain key talent.

While these aspects are often overlooked, they are critical for a successful carve-out. For example, talent acquisition and hiring may be necessary across the organization, which is not always initially considered in the deal. Additionally, the HR function needs to be set up to support the new enterprise. This involves defining the HR service delivery model, leveraging technology and processes, and managing the employment transition effectively.

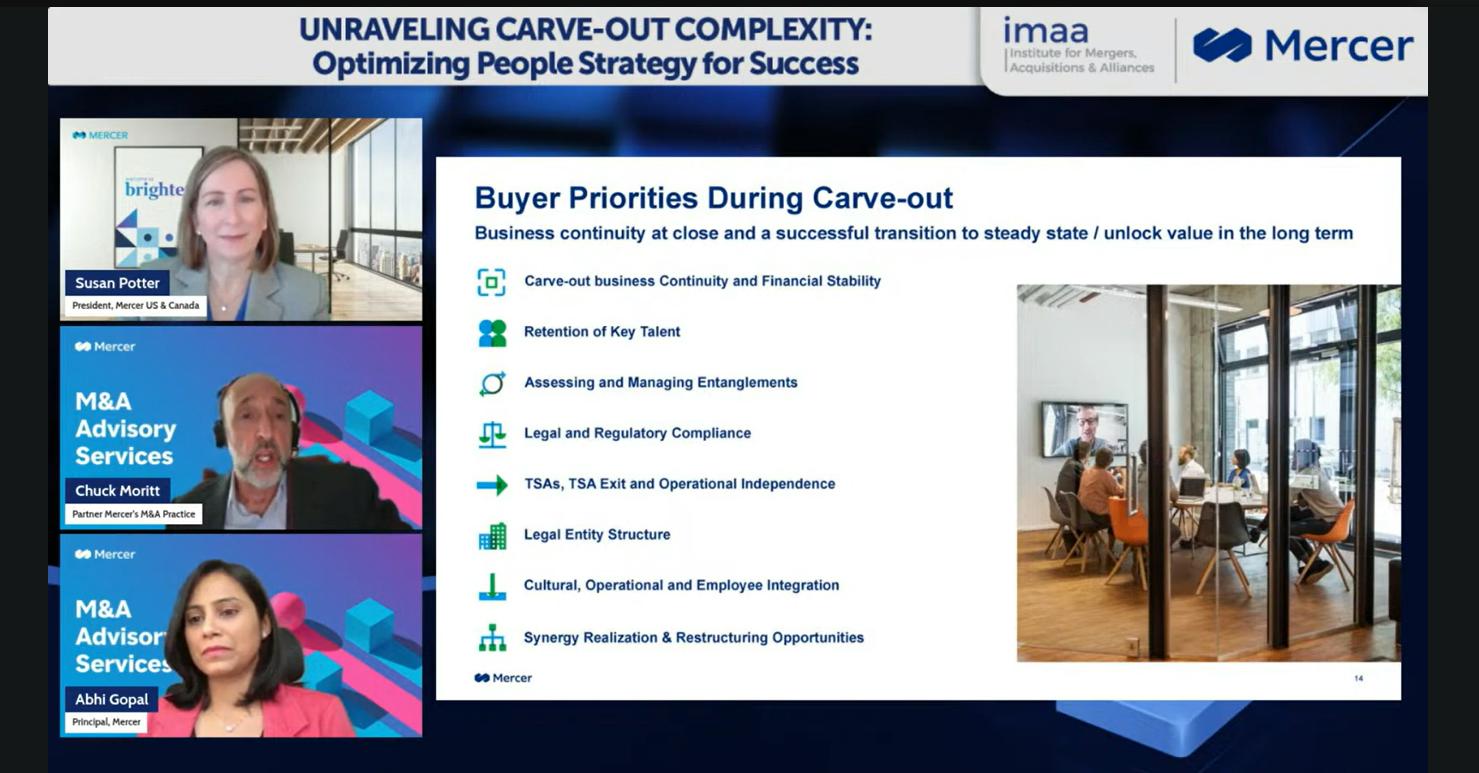

Key Takeaways on Buyer Priorities During a Carve-Out

A Buyer needs to prioritize the following areas during a carve-out:

- Carve-out business Continuity and Financial Stability

- Retention of Key Talent

- Assessing and Managing Entanglements

- Legal and Regulatory Compliance

- TSAs, TSA Exit and Operational Independence

- Legal Entity Structure

- Cultural, Operational and Employee Integrations

- Synergy Realization & Restructuring Opportunities

It is crucial to focus on ensuring business continuity and avoiding any disruptions from an operational, customer, and financial standpoint at the time of closure.

It is also important to look at this from a people perspective to maintain business continuity. This can be achieved by identifying and retaining key talent. According to Mercer, the first step is to ensure that employees are aware of the future opportunities in the new company or under new ownership and stabilize their situation. Employees need to be encouraged to consider the qualitative aspects of the future state in order to stabilize the workforce and retain key talent.

Entanglements refer to how closely integrated the company being carved out is with its parent company. Understanding the depth of this integration while navigating the regulatory environment is essential. Transition Service Agreements (TSAs) are relevant in this context, as they outline the areas where the seller agrees to continue supporting the buyer during the transition. The buyer’s priority is to understand the scope and duration of the TSA and determine the time required to achieve operational independence.

Key Takeaways on Other transaction of Similar Characteristics and Complexities as Carve-outs

There are several transactions of similar complexities as carve-outs, and one of them would be joint ventures or JVs. JVs are messy and challenging. Many carve-outs may, in fact, be JVS when it’s not two parties coming together, but one carve-out where the seller retains financial interest in the company that it’s carving out. Many companies, when they’re doing their strategic evaluation, do want to exit a business, but not entirely. They want to stop investing in it directly, so they’ll keep a financial interest and let somebody else invest in it and operate in it but still reap some of the benefits.

IPOs are a close cousin to a certain degree. Prior to an IPO, a company operates as a private firm, but when it goes public, certain additional operations functions or people roles are needed to facilitate the IPO and enable it to operate as a publicly traded company.

Other similar transactions are Outsourcing deals. For example, a factory building services firm will hire its workforce from a company. This is what we call rebadging people from the seller to the service provider. In essence, this is a carve-out of that distinct work group and subsequent hiring by the service firm.

Case Study: Carving-Out a Global Standalone Business In New Geographies

A real-life and recent case study was also discussed during the webinar and Mercer discussed the specific recommendations and actions that led to successful outcomes.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter