Publications Mergers & Acquisitions Quarterly Switzerland – Third Quarter 2012

- Publications

Mergers & Acquisitions Quarterly Switzerland – Third Quarter 2012

- Christopher Kummer

SHARE:

While the number of Swiss M&A transactions remained constant in the third quarter of 2012, disclosed deal volume declined significantly when compared to the previous quarter, indicating a drop in average deal size.

Looking ahead, the current floor of the Swiss Franc to the Euro could still foster cross-boarder transactions by Swiss acquirers, whereas economic uncertainty, primarily caused by the Eurozone crisis, is expected to lead to further hesitation in M&A transactions. Consequently, a limited number of deals as well as rather moderate deal volumes are expected for the last quarter of 2012 as well as the beginning of the 2013.

Swiss M&A market Q3 12 and outlook 2012/2013

M&A market Q3 2012

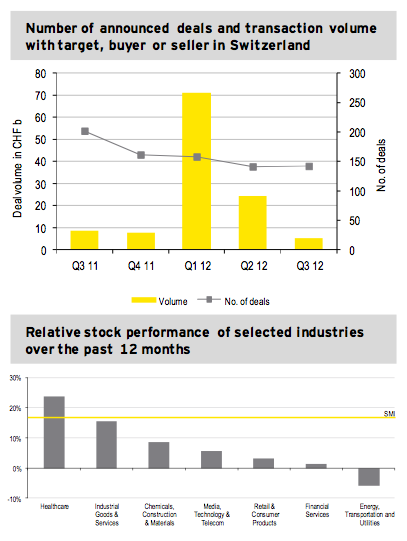

The Swiss M&A market showed moderate deal activity in the third quarter of 2012. With 142 announced M&A transactions, the number of deals in Q3 held constant compared to the last quarter and remained on rather low levels, when compared to the second half of 2011 and the beginning of 2012. With regards to deal volume, figures declined for the second consecutive quarter to merely CHF 5.2b; the lowest value since the second quarter 2010. When compared to the previous quarter, transaction volume declined by a sharp 80%.

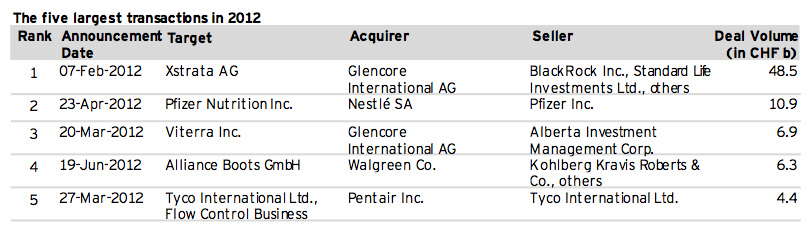

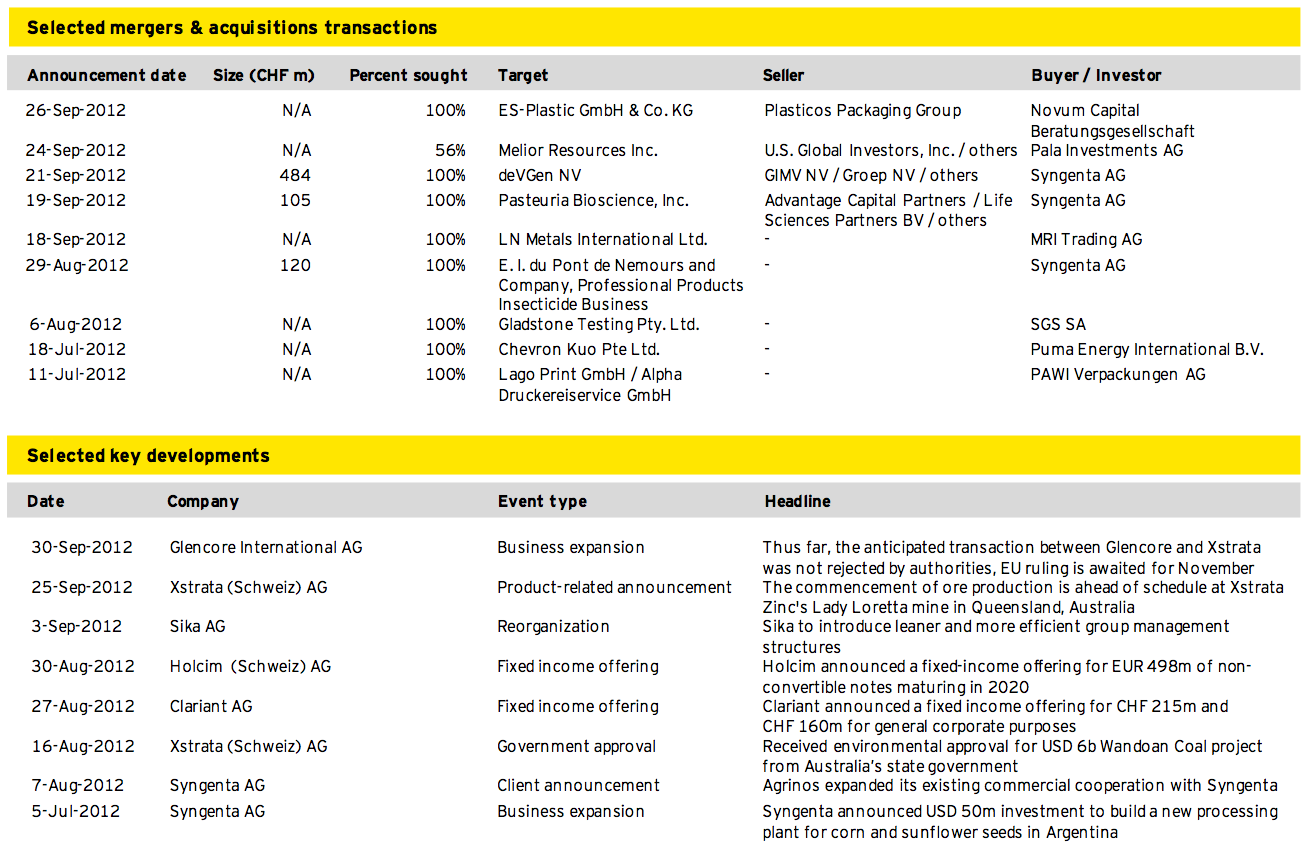

The decline in deal volume is largely explained by the absence of large transaction announcements with Swiss participation during the third quarter, such as the Glencore/Xstrata transaction in Q1 12 or the Nestlé/Pfizer Nutrition deal in Q2 12. Consequently, the list of the five largest transactions announced in 2012 remained unchanged.

During the last quarter, the Swiss Market Index trended upward and closed with a 6% increase in stock performance. Over the trailing twelve month period ended 30 September 2012, the index gained over 17%. Although the performance in the last quarter was positive, the future market development is to be viewed with caution, due to a conservative economic outlook in Switzerland and several European countries.

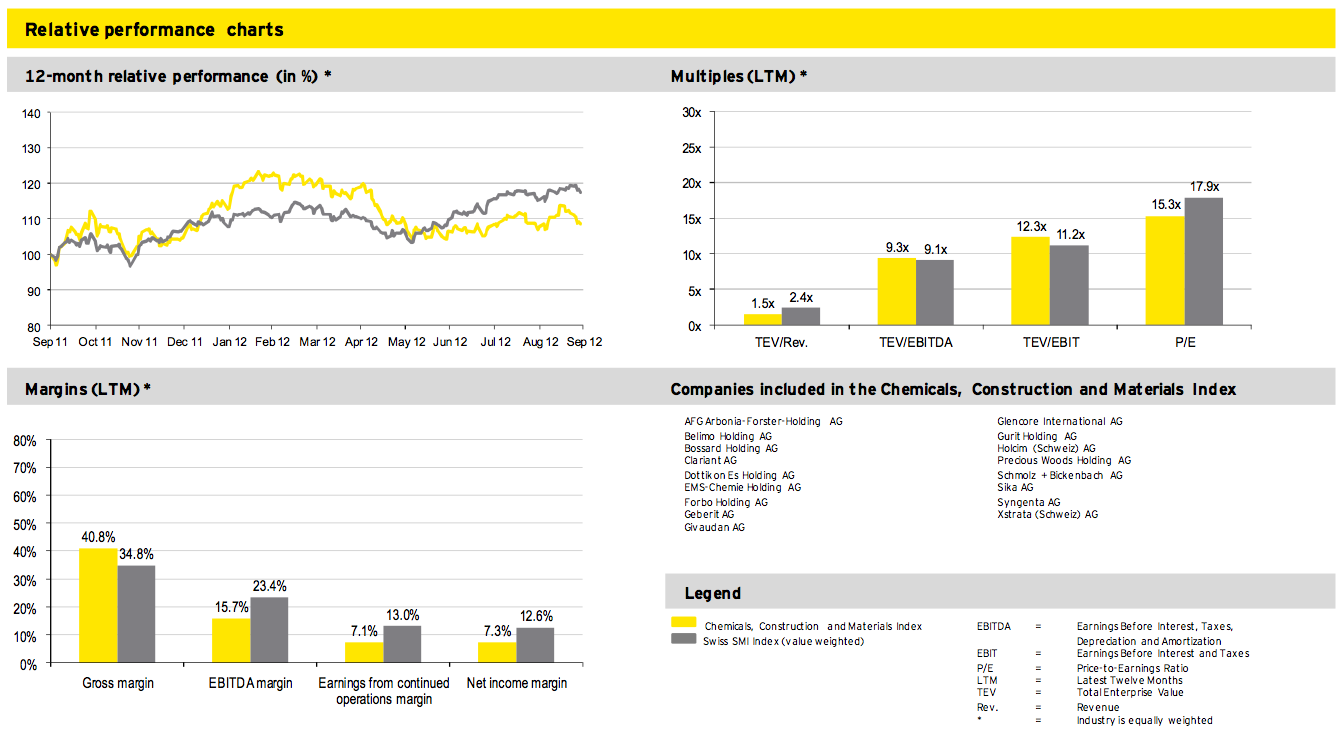

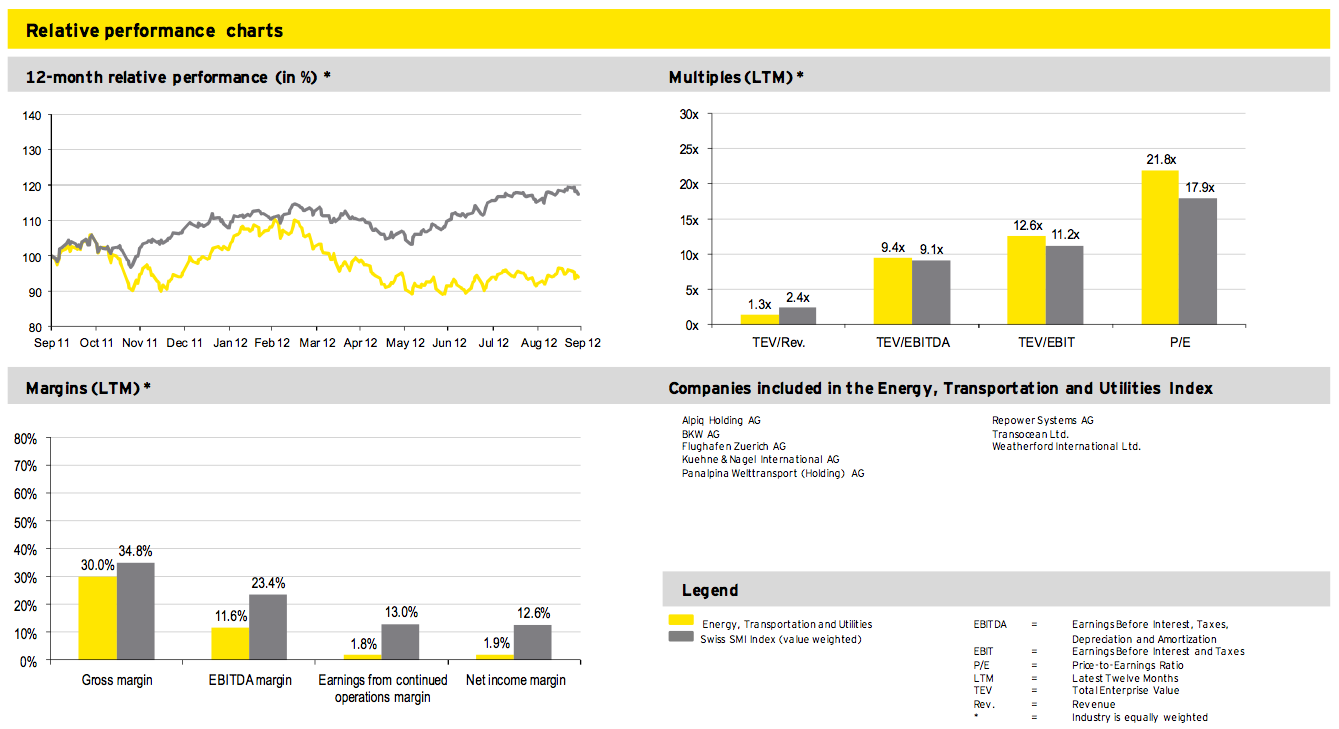

After four quarters of mainly negative trailing 12-month industry stock performance, Q3 12 showed a positive development for most of the equally-weighted industry sectors for the preceding twelve month period ended 30 September 2012. Similar to Q2, the best performing industry was the Healthcare sector, improving its performance by over five percentage points during Q3 12 and reaching a positive performance of over 23% for the last twelve months. The only sector showing negative results was the Energy, Transportation and Utilities industry, down approx. 6% in this period.

Transactions by industry and size

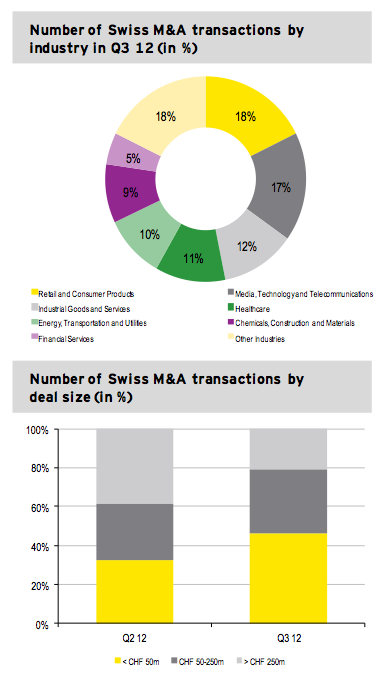

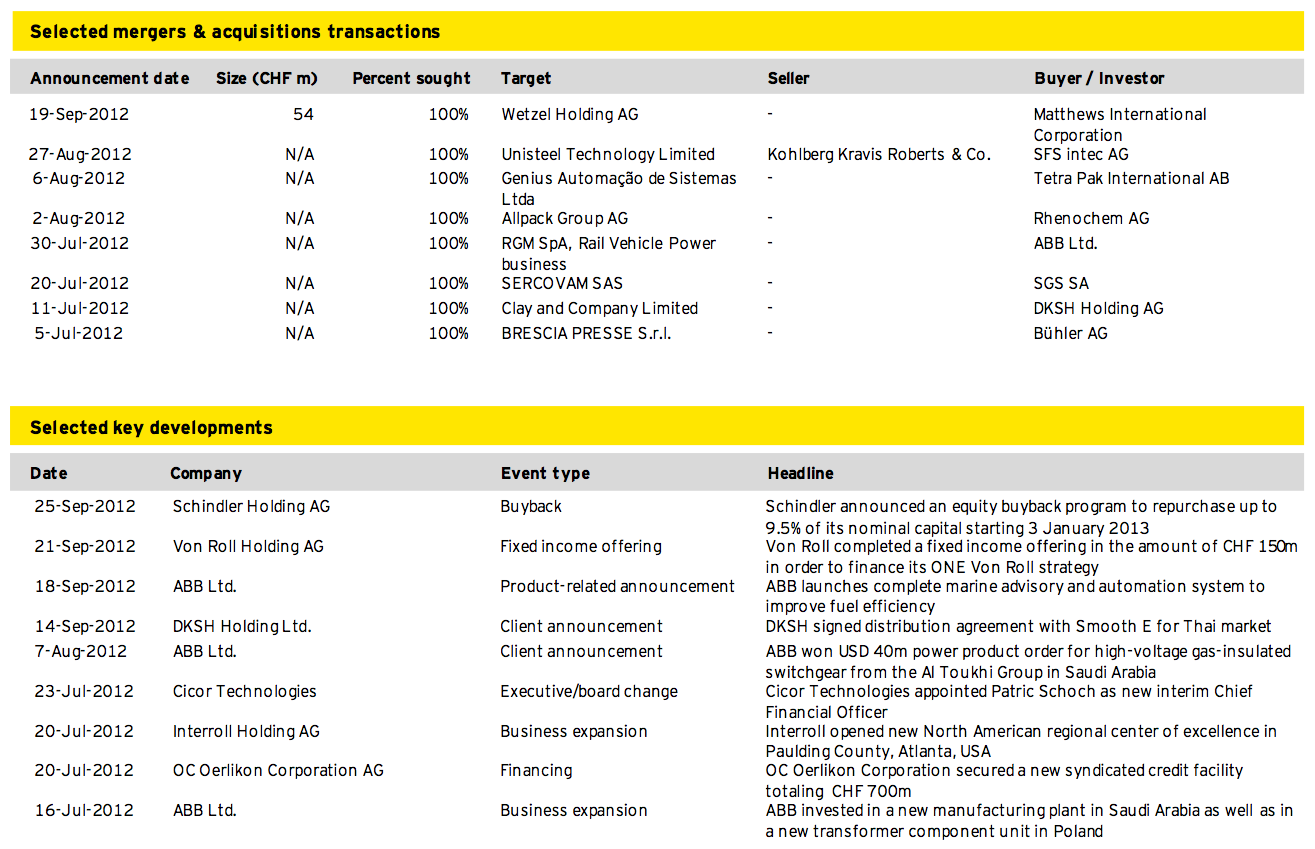

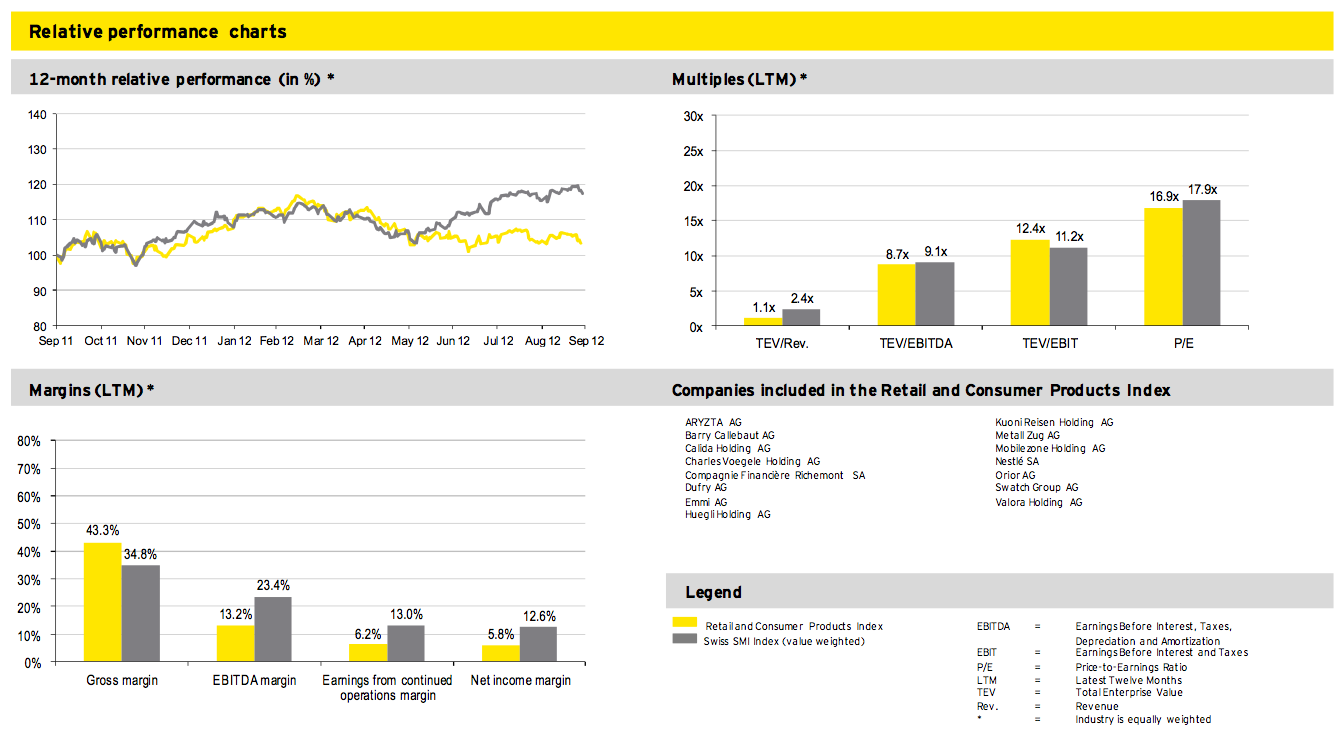

During the last three-month period, Retail and Consumer Products was the most active industry in Switzerland. In terms of number of M&A Transactions, the sector contributed 18% to all announced deals. Together with Media, Technology and Telecommunications as well as Industrial Goods and Services, reaching 17% and 12% respectively, these top three sectors accounted for approximately 47% of all Swiss-based M&A transactions.

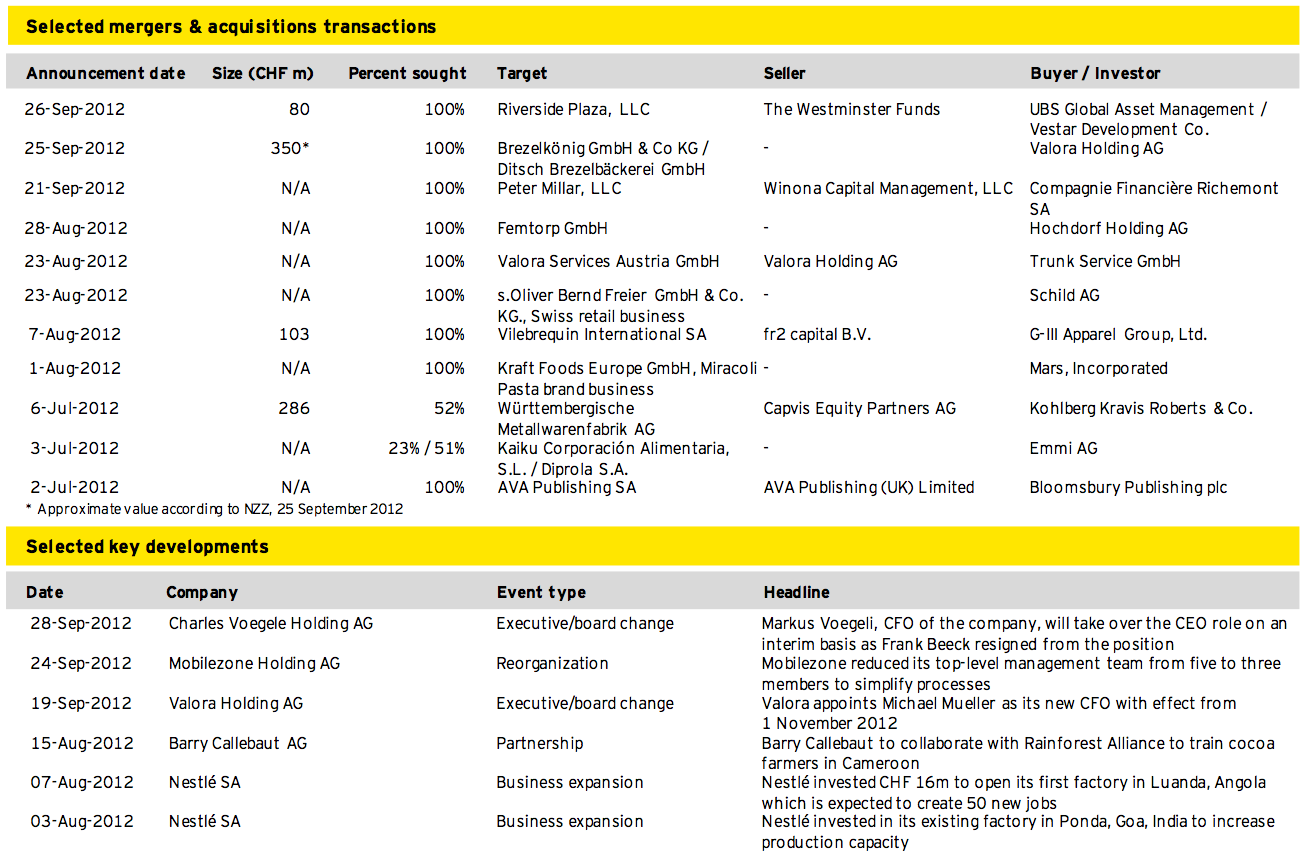

Two of the largest transactions in the Retail and Consumer Products sector include the acquisition of Brezelkönig GmbH & Co KG/Ditsch Brezelbäckerei GmbH by Valora Holding AG and the majority stake in Württembergische Metallwarenfabrik AG by Kohlberg Kravis Roberts & Co (KKR). In this transaction, Swiss-based private equity fund Capvis sold its shareholding for approximately CHF 286m to KKR.

In comparison to the previous quarter, the number of transactions in the Retail and Consumer Products sector increased most, growing by four percentage points. The number of transactions in the Healthcare sector also demonstrated growth signs, with an increase of one percentage point. In Financial Services, the share in transactions of 5% remained relatively stable compared to the second quarter of 2012. The largest decline in terms of number of transactions was observed in Media, Technology and Telecommunications as well as the Industrial Goods and Services sector, both declining by four percentage points in Q3 12. Chemicals, Construction and Materials as well as Energy, Transportation and Utilities both recorded a decrease of one percentage point.

In the third quarter 2012, the share of small transactions was on the rise and accounted for 48% of all announced transactions with disclosed deal value, increasing by 16 percentage points. As transactions in the mid-market segment increased from 29% in Q2 12 to 34% in Q3 12, the number of deals with large deal volumes declined significantly, from 39% in Q2 12 to 18% in Q3 12.

Outlook 2012/2013

In its most recent publication in September 2012, the Swiss State Secretariat for Economic Affairs (SECO) decreased its GDP-growth forecast for 2012 from 1.4% to 1.0%, as the international economic downturn left its traces in Switzerland in the recent past. Despite this development, the Swiss economy is still performing better than most other European economies. Assuming that the economic as well as financial situation on European level is not deteriorating any further, the Swiss economy and especially the export-oriented sectors are expected to improve its performance during 2013. Hence, SECO’s GDP-growth forecast for 2013 remains unchanged at 1.4%.

According to Ernst & Young’s most recent Global Confidence Barometer, uncertainty in regards to the Eurozone crisis is largely prevailing and continues to be the dominating force influencing M&A activity across Europe. With the implementation and effectiveness of solutions remaining to be seen, potential acquirers are reluctant to take on risks. Companies that have existing cash reserves are again becoming increasingly hesitant to use such reserves for transactions and instead reduce debt balances or treasure up liquidity to overcome harder economic times. Consequently, boardroom priorities rather focus on improving fundamentals than on generating top-line growth through M&A transactions.

A second factor that is likely to reduce future M&A activity, according to our study, is an increasing valuation gap between buyers and sellers. Coupled with a sharp decline in sellers that are willing to come to the deal table, from 31% of respondents in April 2012 to 19% this September, the business case for M&A is threatened. This is further underlined by feedback from senior executives on their appetite for M&A, with only 25% of respondents expected to pursue acquisitions in the next twelve months – a record low since the study began in 2009 and a further decrease from the April study that showed 31%.

All in all, the strong Swiss Franc benefits Swiss acquirers willing to do deals abroad, while economic uncertainty in the European Union as well as the faltering economic outlook causes hesitation among companies to execute transactions. Hence, Swiss M&A activity for the last quarter of 2012 is expected to result in limited activity. It is likely that these trends also continue into the beginning of 2013.

Private equity statistics: GSA and Europe

Private equity Q3 2012

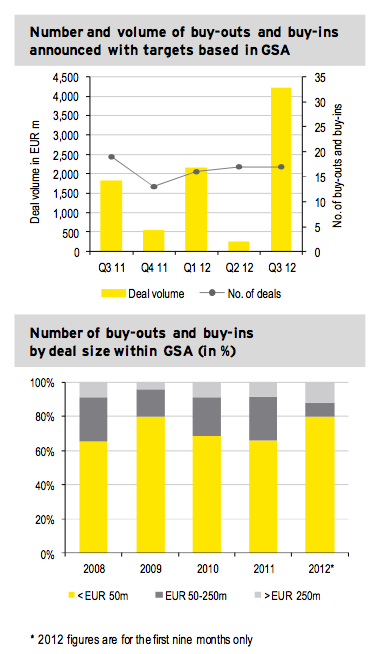

With 17 transactions during the third quarter of 2012, the numbers of private equity (PE) deal activity in Germany, Switzerland and Austria (GSA) remained at the same level as in Q2. However, as deal volume of total buy-outs and buy-ins in GSA was low in Q2, transaction volume rose substantially when compared to the previous quarter. Relative to Q3 11, deal volumes in Q3 increased by over 131% and reached EUR 4.2b, a record high since our Quarterly-series began in Q4 08. This record high in Q3 is largely attributable to a variety of large deals executed in Germany, e.g. Montagu Private Equity sold BSN Medical and Charterhouse Capital Partners acquired Bartec from Capvis.

In the first nine months of 2012, leveraged buy-outs with a size of less than EUR 50m still constituted the bulk of PE activity in GSA, with approximately 80% of total deal volume. The aforementioned increase in large PE deals during Q3 12 in Germany impacted the distribution of deal size, as deals with a volume above EUR 250m now represent 12% of all PE transactions in GSA in 2012 – the highest value since 2008 on a year on year basis. Mid-sized deals between EUR 50-250m decreased to 8%, the lowest value since 2008.

The number of buy-outs and buy-ins in the GSA PE market constituted over 16% of the total number of PE deals closed in Europe during the third quarter 2012. Furthermore, disclosed deal volume by PEs in GSA accounted for over 35% of European PE transactions. In comparison to the rest of Europe, the UK PE market remains the largest, with 31 deals accounting for a total deal volume of EUR 4.1b, even if the French PE market came close, with 30 transactions and deal volume of almost EUR 1.7b. The number of PE deals and deal volume in the UK represented roughly 29% and 35% of European PE deal activity, respectively.

Industry overview

Chemicals, Construction and Materials

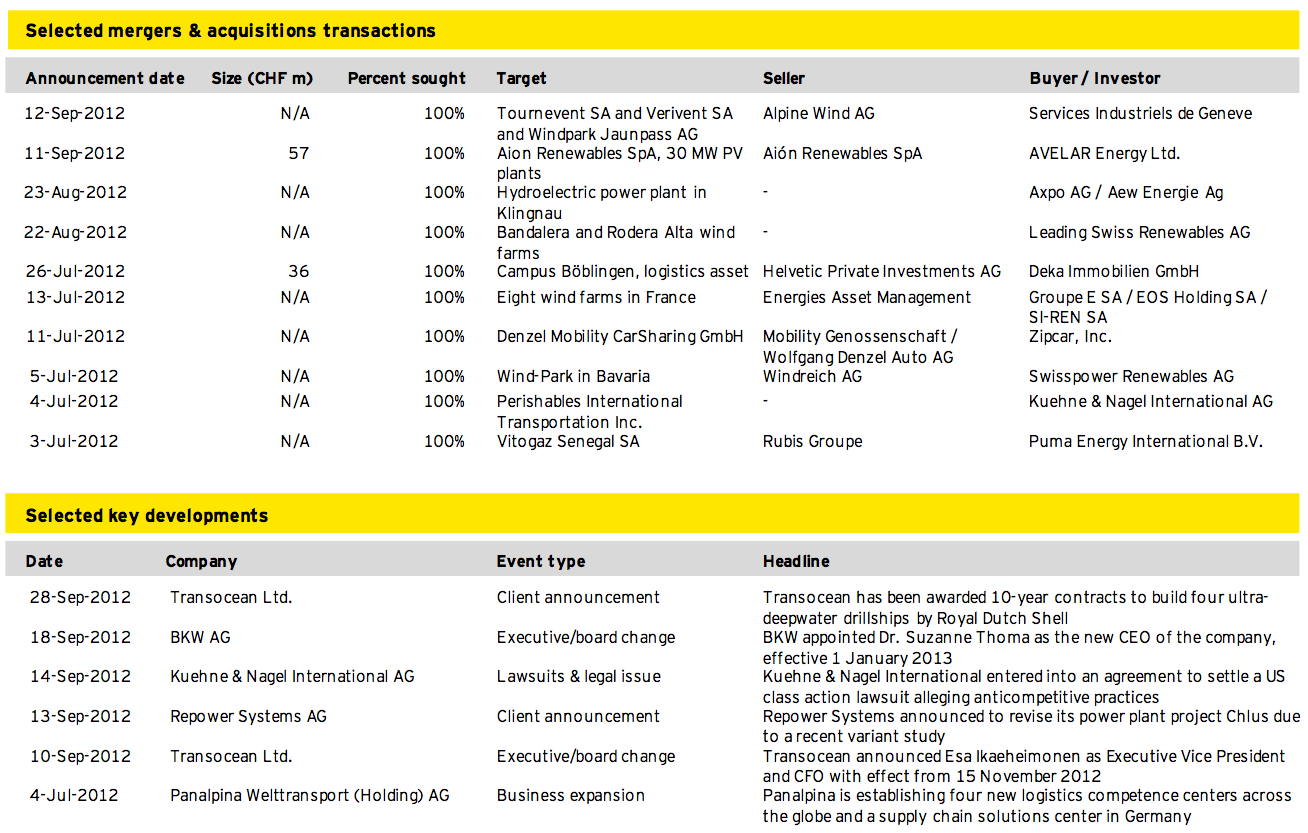

Energy, Transportation and Utilities

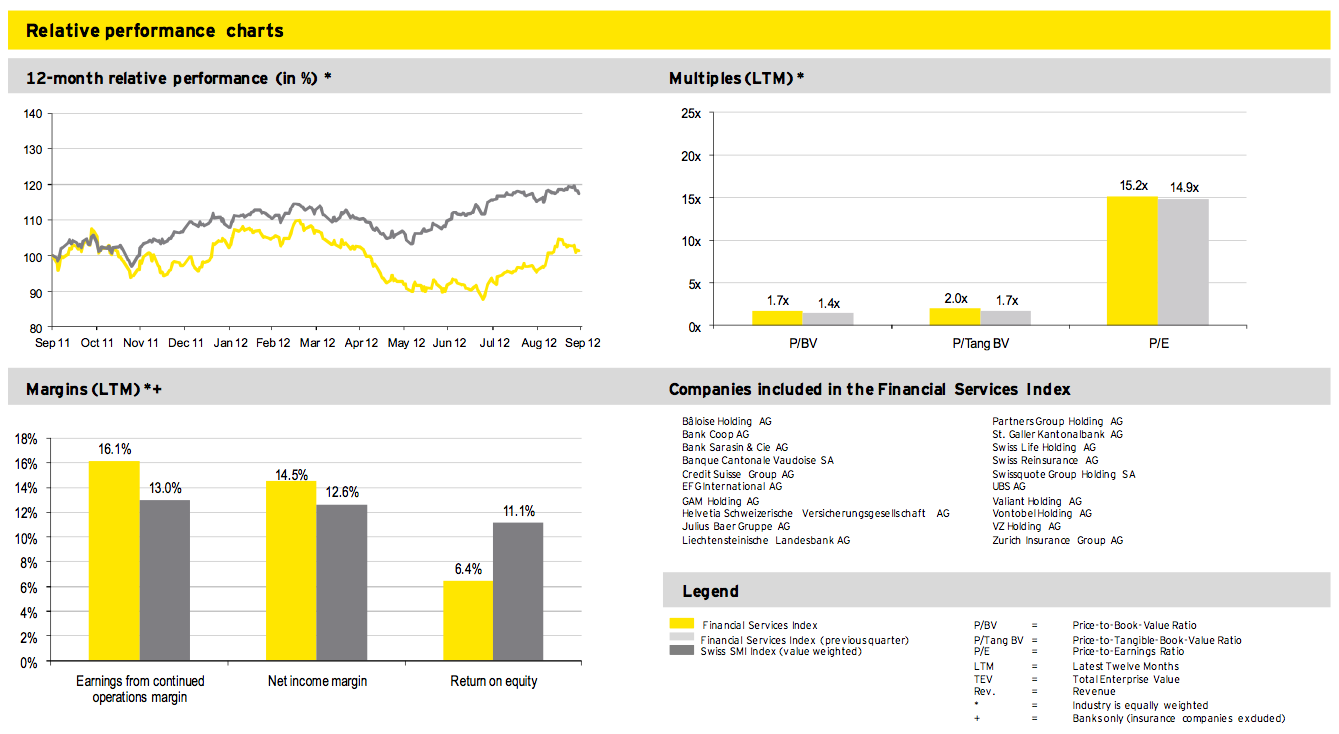

Financial Services

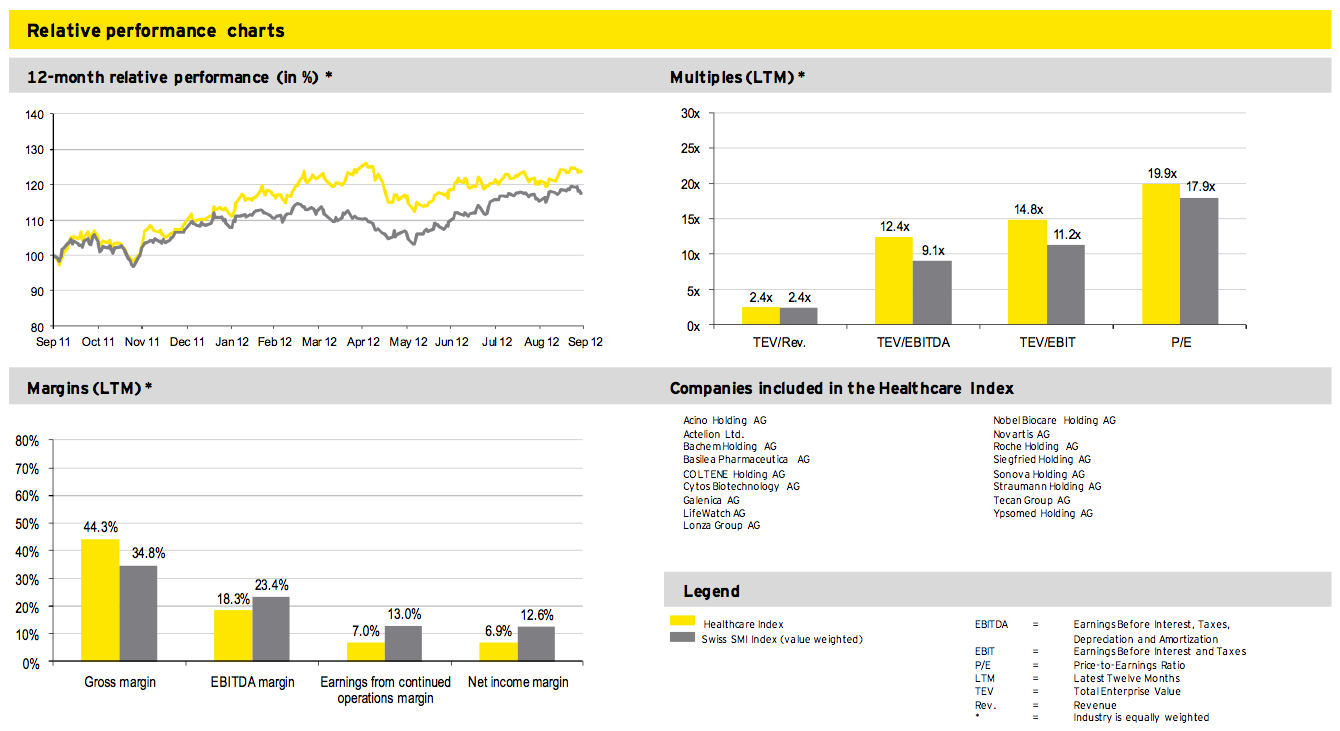

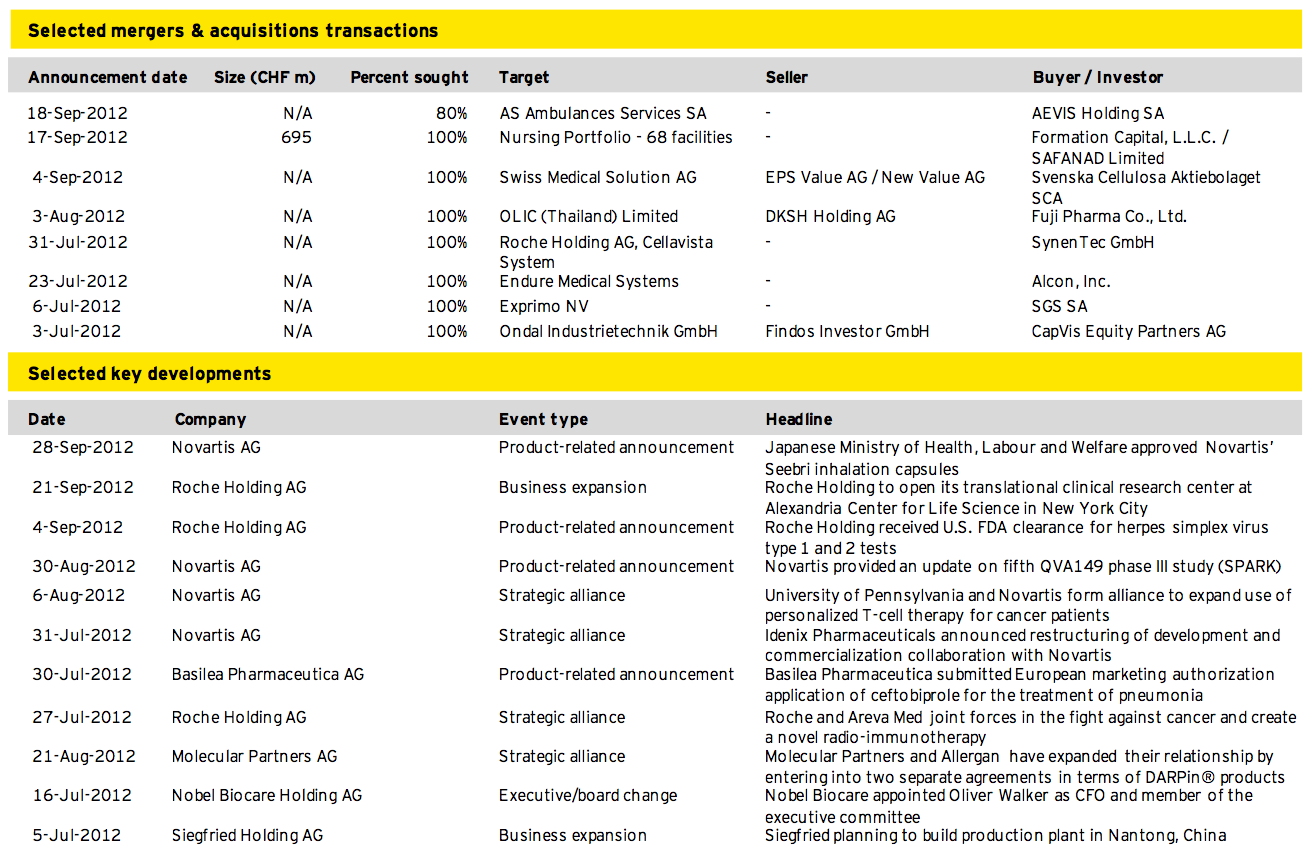

Healthcare

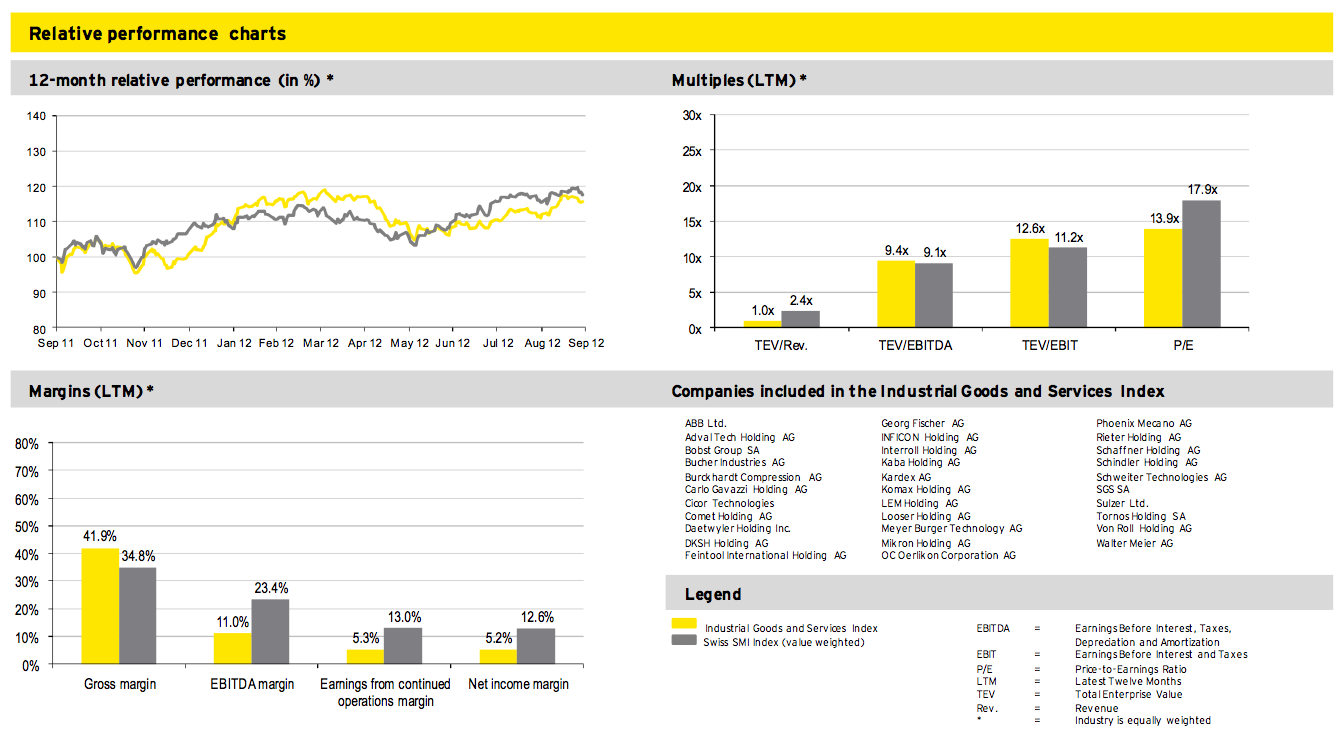

Industrial Goods and Services

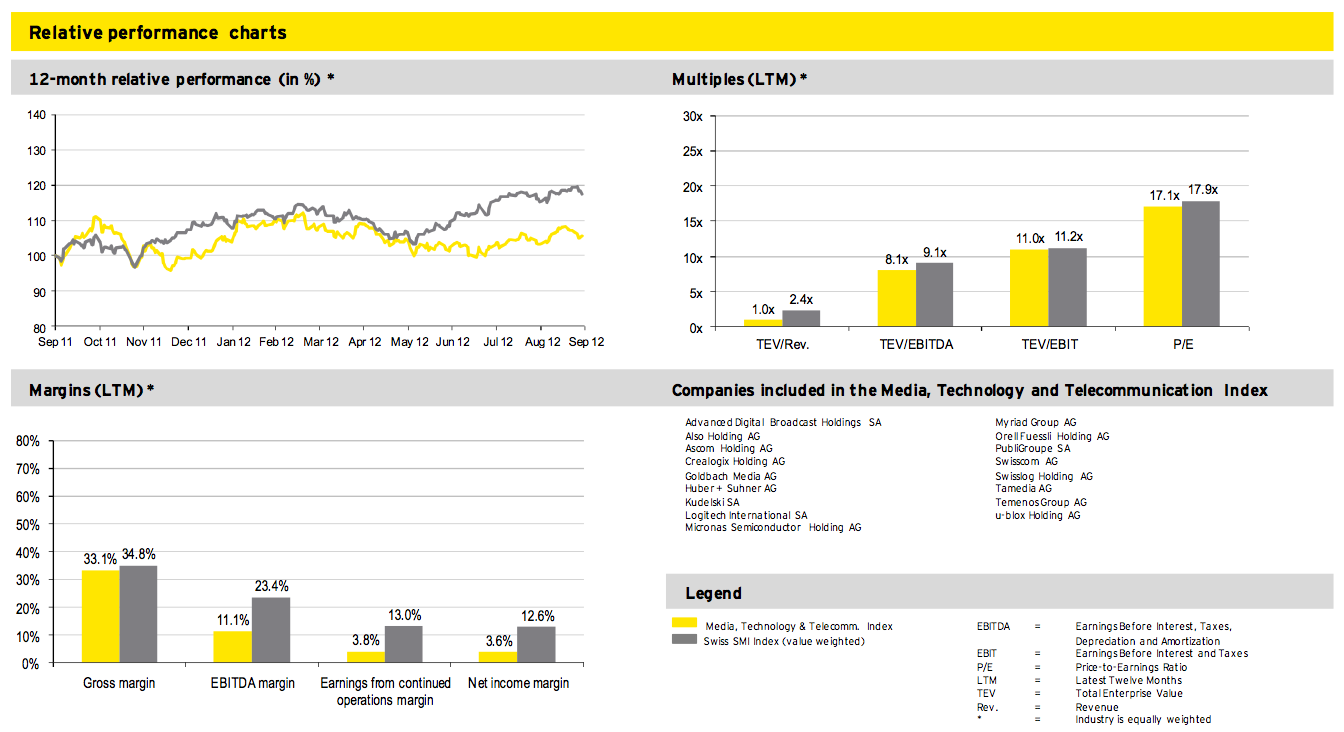

Media, Technology and Telecommunications

Retail and Consumer Products

Deal of the quarter

Deal summary

In the third quarter 2012, our deal of the quarter features the sale of a majority stake in Württembergische Metallwarenfabrik AG (WMF) by Capvis funds (Capvis). Capvis sold its shareholding via its investment company Crystal Capital GmbH to Finedining Capital GmbH, a corporation controlled by Kohlberg Kravis Roberts & Co. L.P. (KKR) for EUR 238m (CHF 286m). The shareholding owned by Capvis represents approximately 52% of ordinary shares as well as 6% of preferred shares in WMF. Capvis acquired the participation in WMF in a proprietary transaction from Deutsche Bank, Munich Re and Württemberger Leben in 2006. During Capvis ownership, WMF mastered the financial crisis well, as EBITDA of WMF more than doubled, thanks to the positive performance in the coffee machine business and strengthening the lifestyle brand WMF.

Going forward, KKR intends to acquire 100% of WMF and made a public tender offer for the remaining shares with the same conditions offered to Capvis. WMF’s management board as well as the supervisory board consider KKR’s offer of EUR47.00 per ordinary share to be financially adequate, but deem the offer of EUR 31.70 per preferred share too low. Hence, the board did not give any recommendation whether shareholders should accept the takeover offer, based on a recent press release.

Deal rationale

► KKR announced to support WMF’s strategy to continuously expand in international markets, especially Asia and the UnitedStates, and focus on profitable growth.

► KKR further intends to encourage WMF’s potential to penetrate existing markets.

► In order to implement these strategic intentions, KKR’s longstanding expertise as well as its global network are believed to be particularly useful for WMF.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter