Publications Mergers & Acquisitions Quarterly Switzerland – First Quarter 2014

- Publications

Mergers & Acquisitions Quarterly Switzerland – First Quarter 2014

- Christopher Kummer

SHARE:

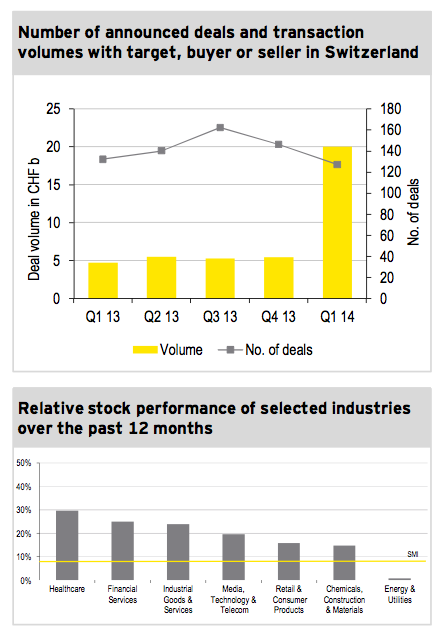

Following a year of subdued performance, the Swiss M&A market got off to a remarkable start in the first three months of 2014, with a significant increase in deal volume despite a decrease in the number of deals.

Looking forward, large transactions are expected more often in the Swiss M&A market as executives’ risk appetite for strategic and transformational deals has increased. The favorable financing conditions prevailing at present will help drive this trend, although continuing economic and geopolitical risks in some areas could disrupt the bright outlook.

Swiss M&A market Q1 2014 and outlook 2014

M&A market Q1 2014

► Overall, the Swiss M&A market was characterized by the return of mega deals in Q1 2014. In other words, deal volume in Q1 2014 represents 96% of the entire deal volume in 2013.

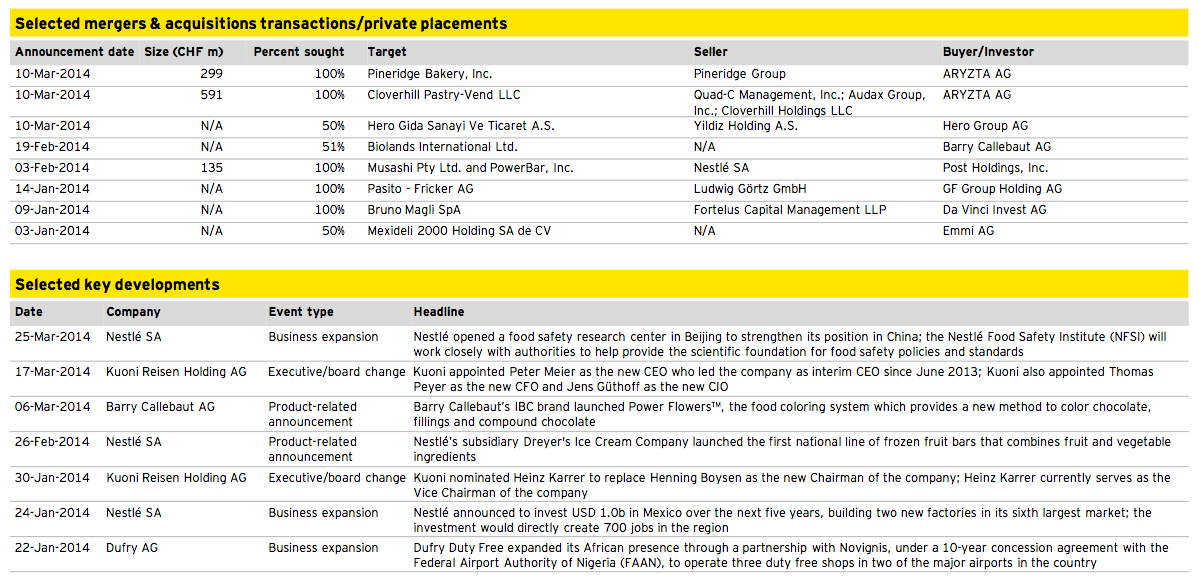

► With regards to disclosed deal volume, figures increased by a considerable 271% (from CHF 5.4b in Q4 2013 to CHF 20.0b in Q1 2014), reaching the highest deal volume per quarter since Q2 2012. In contrast, the number of announced transactions – 127 – represents a decrease of about 13% compared to the last quarter in 2013.

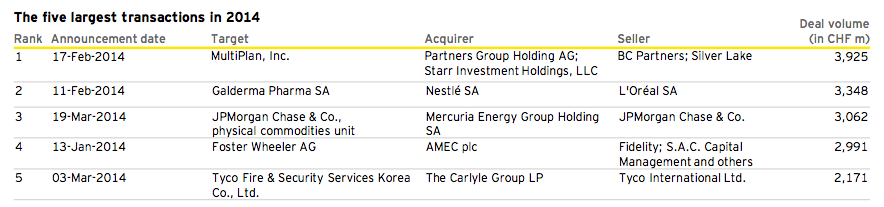

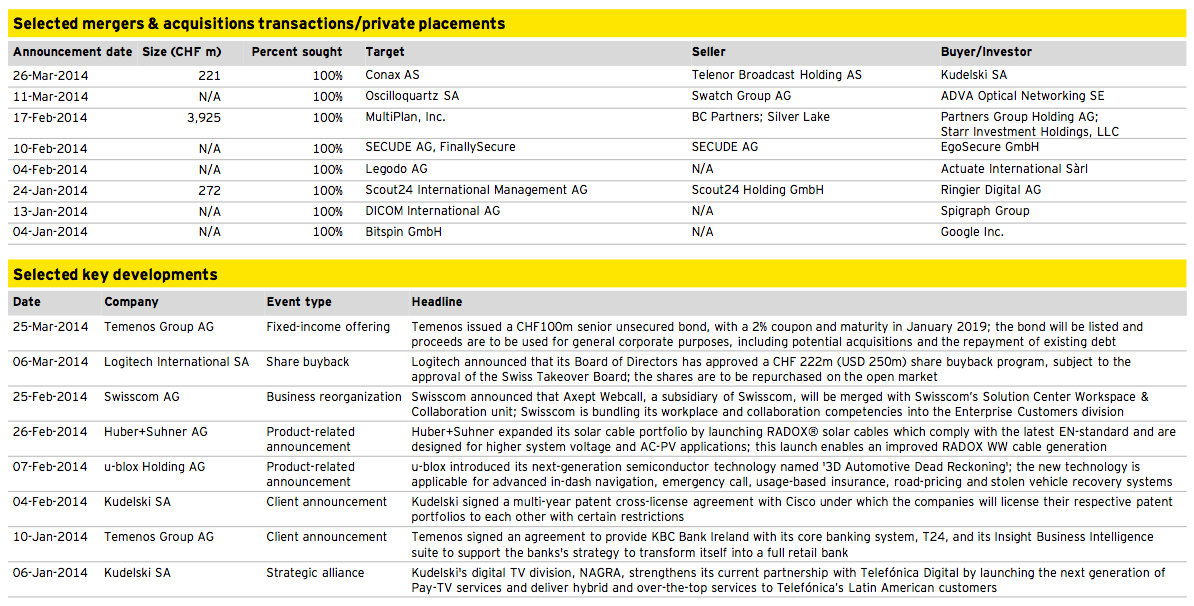

► Deal volume was mainly driven by large transactions, with 6 deals being valued above CHF 1.0b. The largest deal of the first quarter of 2014 was the acquisition of MultiPlan by Starr Investment and Swiss based Partners Group for CHF 3.9b, accounting for 20% of total transaction volume in Q1 2014.

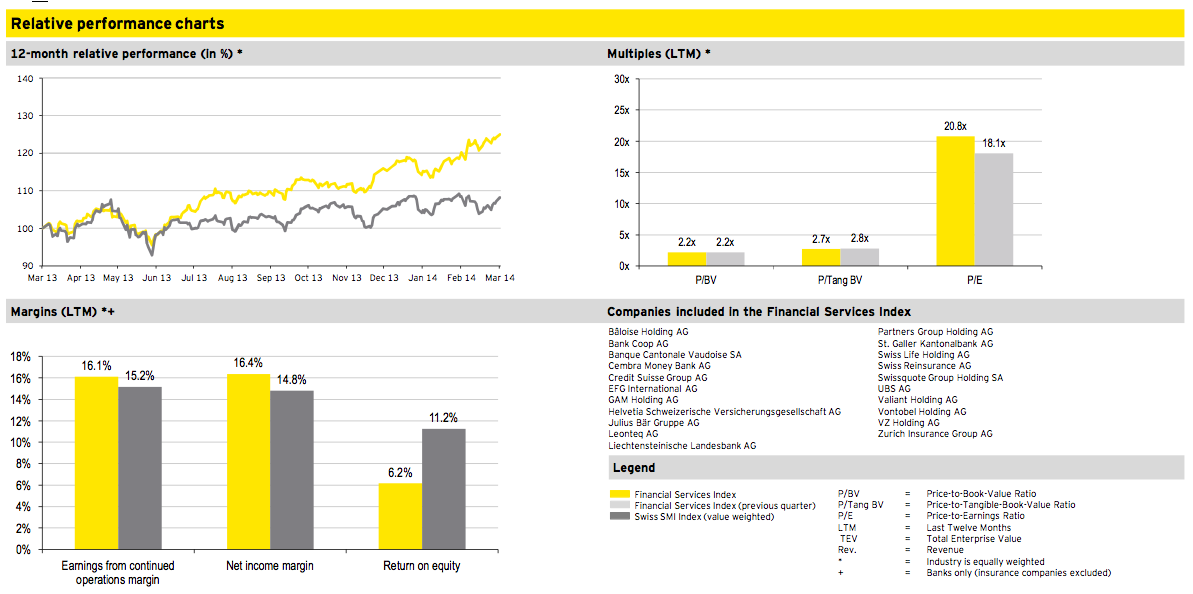

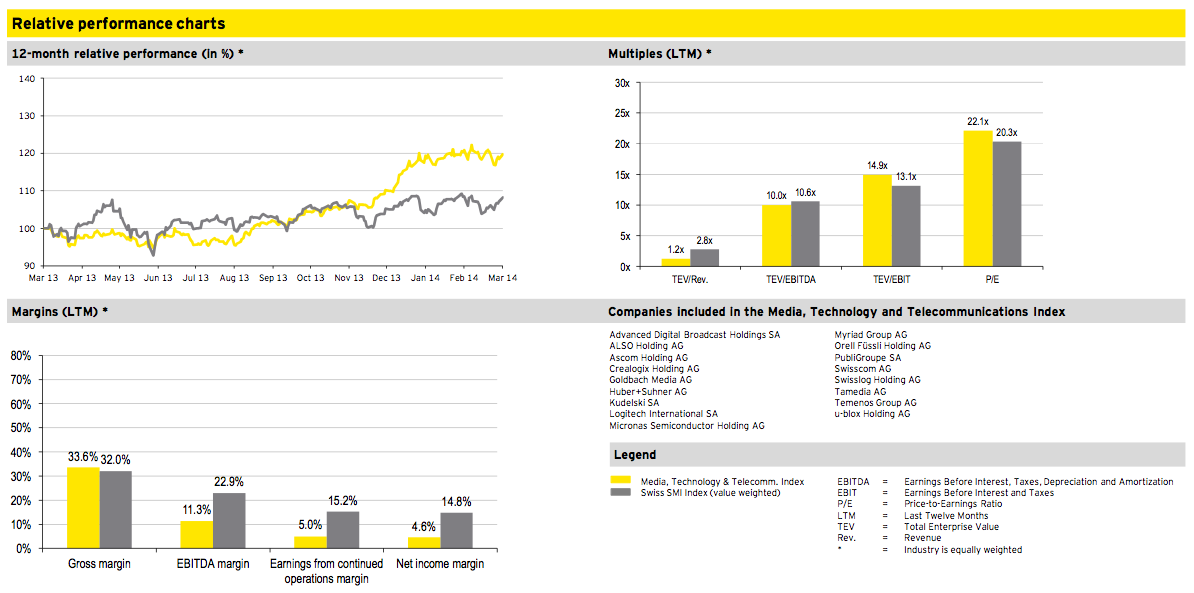

► While the Swiss Market Index gained nearly 16% in the first quarter of last year, the SMI performance was modest in the first three months of 2014, climbing 3%. The development in Q1 2014 was driven by a difficult market environment influenced by factors such as the Crimea crisis or the modest economic development in China. Over the trailing 12-month period ended 31 March 2014, the index gained over 8%.

► Similarly to the last quarter of 2013, all of the equally-weighted industry sectors achieved a positive stock performance over the last twelve months ended 31 March 2014. Healthcare displayed the strongest industry performance with an improvement of nearly 30% or approximately 3.6x the SMI performance.

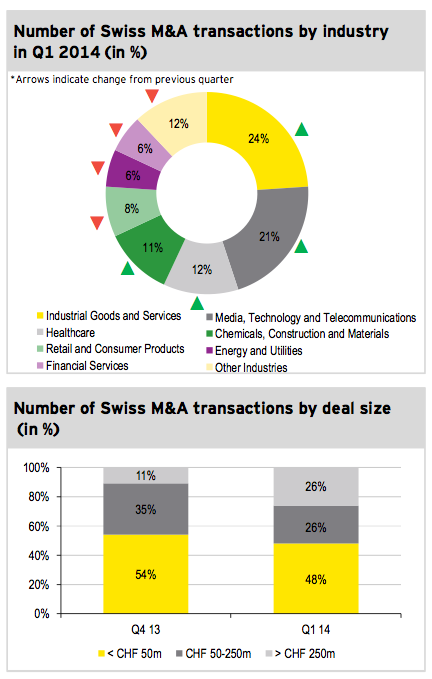

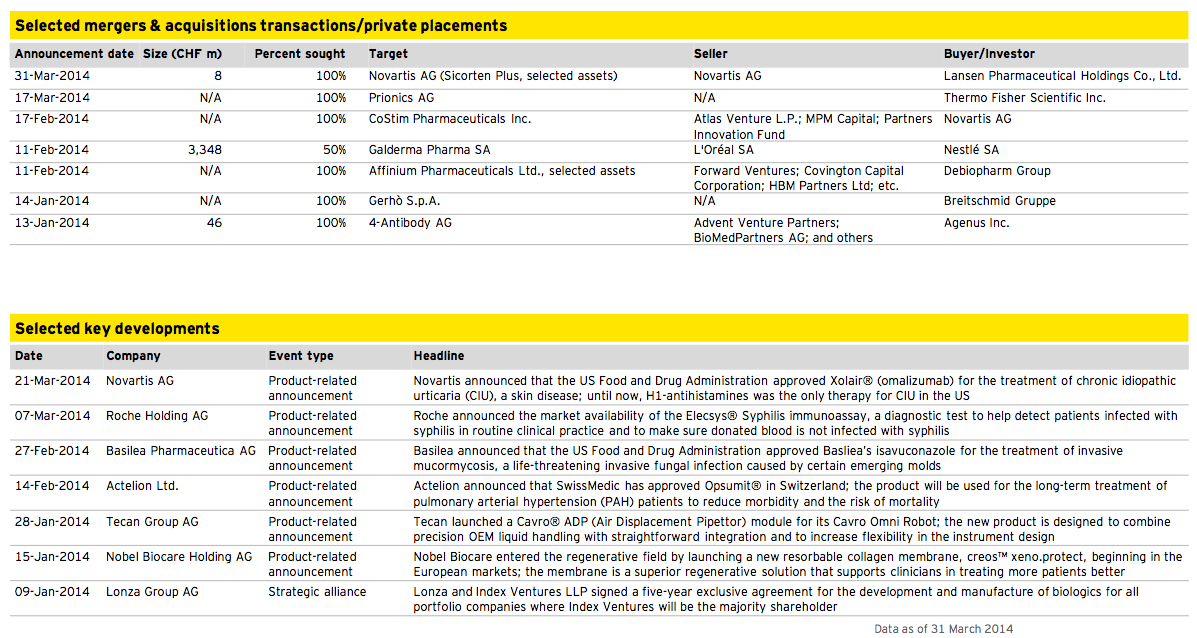

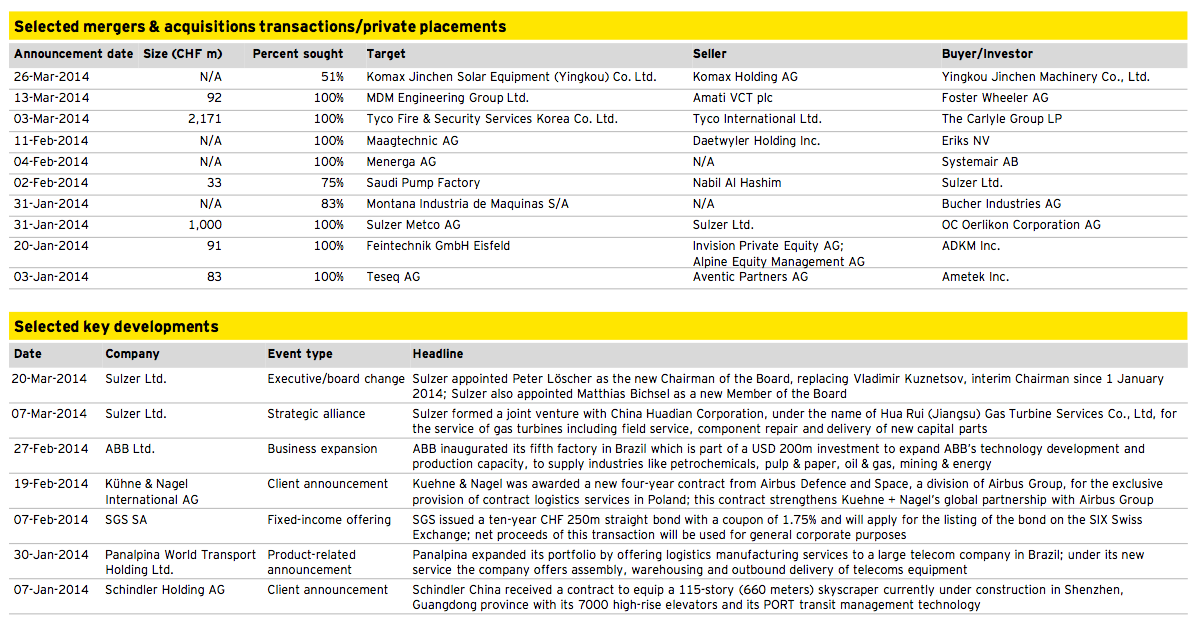

► In the first quarter of 2014, Industrial Goods and Services was the most active industry in Switzerland, contributing 30 transactions or 24% to all announced 127 deals. Together with Media, Technology and Telecommunications as well as Healthcare, which contributed 21% and 12%, respectively, these top three sectors accounted for more than half of all Swiss based M&A transactions.

► Industrial Goods and Services deals saw an increase of 6 percentage points compared to the previous quarter – the largest gain among all industry sectors. Within this sector, the acquisition of Tyco Fire & Security Services Korea by The Carlyle Group from Swiss based Tyco International for CHF 2.2b represented the largest disclosed deal.

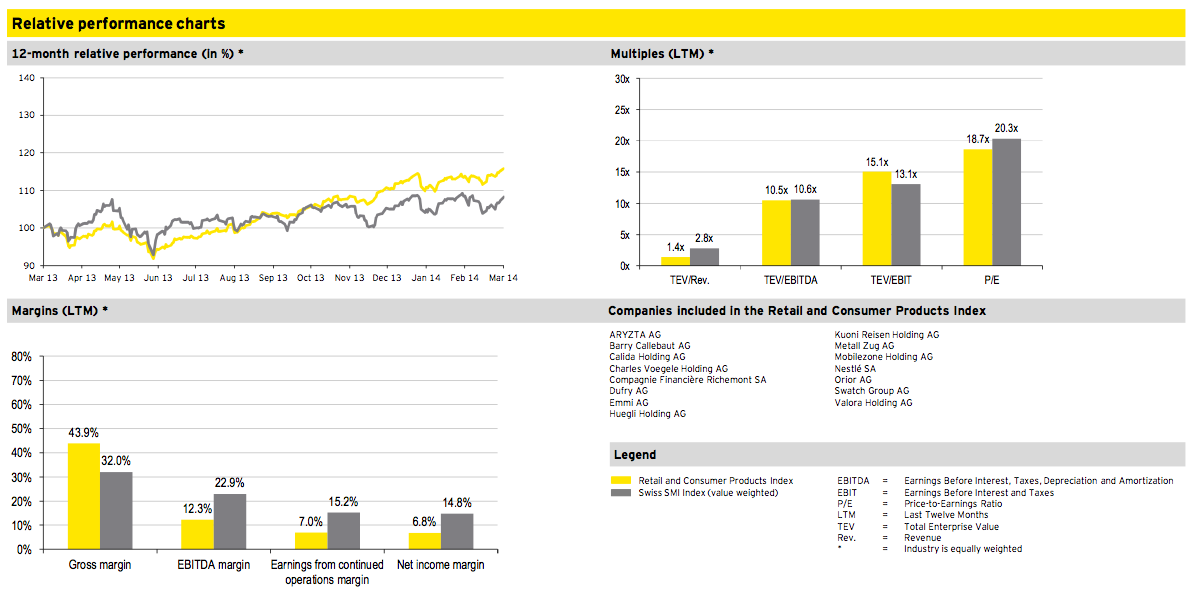

► The Retail and Consumer Products sector recorded the largest decrease in terms of the number of transactions observed among all industries in Q1 2014, with a decline of 8 percentage points, followed by Financial Services with a decline of 4 percentage points.

Transactions by size

► In the first quarter of 2014, transactions with disclosed deal size above CHF 250m more than doubled their share compared to the last quarter of 2013. This represents the largest share per quarter since Q4 2012 and allowed for a considerable increase in total deal volume in Q1 2014.

► The share of small transactions of less than CHF 50m and mid-market deals between CHF 50-250m both decreased accordingly.

► Deal size was disclosed in 31% of all announced transactions in the first quarter of 2014.

Outlook 2014

► In March 2014, the Swiss State Secretariat for Economic Affairs (SECO ) reaffirmed its latest forecast and expects GDP growth of 2.2% for 2014. The positive growth outlook is driven by accelerating exports triggered by a recovering global economy as well as a robust domestic demand.

► M&A market activity in Switzerland looks set to increase in a favorable environment of stable and high valuations and low financing costs. Furthermore, companies are well equipped with solid cash reserves and operate with healthy capital structures. Although these arguments have been applied in the recent past, shareholders are now beginning to increase pressure on companies to benefit from good conditions and implement inorganic growth strategies.

► According to the latest issue of EY’s Capital Confidence Barometer, M&A transactions are expected to be fuelled by rising confidence among executives about the economic outlook, which reached the highest level recorded by the survey in recent years. In combination with indications for companies’ growing appetite to increase leverage as well as a narrowing valuation gap, large transactions with transformational character are expected to be on the corporate agenda for the next twelve months.

► This potential positive impact might be subdued by increasing economic and geopolitical uncertainty such as slowing growth in emerging markets, tapering of quantitative easing in the United States as well as social unrest in Eastern Europe or the Middle East. Additional downside potential stems from the acceptance of the mass immigration initiative and its effect on the relationship between Switzerland and the EU, with potential economic consequences for Switzerland.

► Considering the above, the overall outlook on Swiss M&A activity is optimistic.

Private equity statistics: Germany, Switzerland and Austria

Private equity Q1 2014

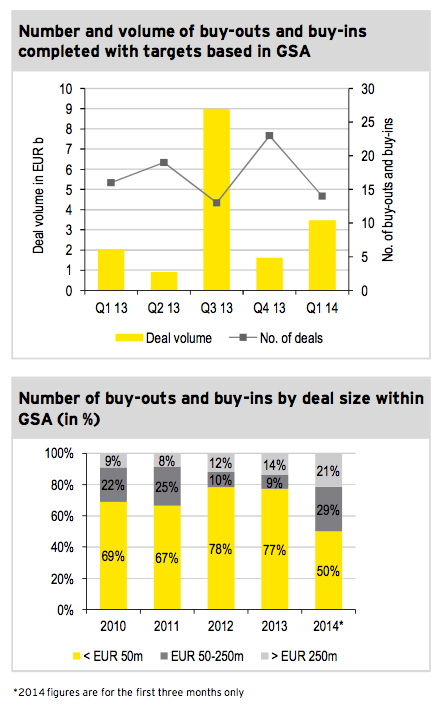

► Completed private equity (PE) deals in Germany, Switzerland and Austria (GSA) achieved a deal volume of EUR 3.5b in Q1 2014, marking the third largest quarterly volume of the last four years. Compared to Q4 2013 and the same quarter of the previous year, deal volume increased by 113% and 71%, respectively.

► In contrast, with 14 PE deals closed during the first quarter of 2014 in GSA, a decrease of nine deals compared to Q4 2013 and two deals compared to Q1 2013 was recorded.

► The number of buy-outs and buy-ins in the GSA PE market accounted for around 11% of the total number of PE deals in Europe during the first quarter of 2014, compared to 19% in Q4 2013.

► In terms of disclosed deal value, GSA based transactions represented approximately 35% of total PE deal volume in Europe – a remarkable increase of 19 percentage points compared to Q4 2013.

► The largest PE deal in GSA was closed in Germany and features Deutsche Telekom’s sale of 70% of its shares in Scout 24 Holding to Hellmann & Friedmann LLC, a US-based private equity firm with a total enterprise value of EUR 2.0b. Deutsche Telekom will retain a 30% minority stake in Scout 24 Holding. This deal significantly contributed to the relatively large PE volume recorded in GSA in the first quarter of 2014.

► The second largest PE deal in GSA took place in Switzerland and refers to the acquisition of VAT Holding AG, the provider of high-end vacuum valves, by Capvis and Partners Group for EUR 653m.

► In the first three months of 2014, the private equity market experienced a significant distribution shift toward mid-sized and large transactions in GSA. Large transactions above EUR 250m increased to 21%, representing the largest share over the last four years.

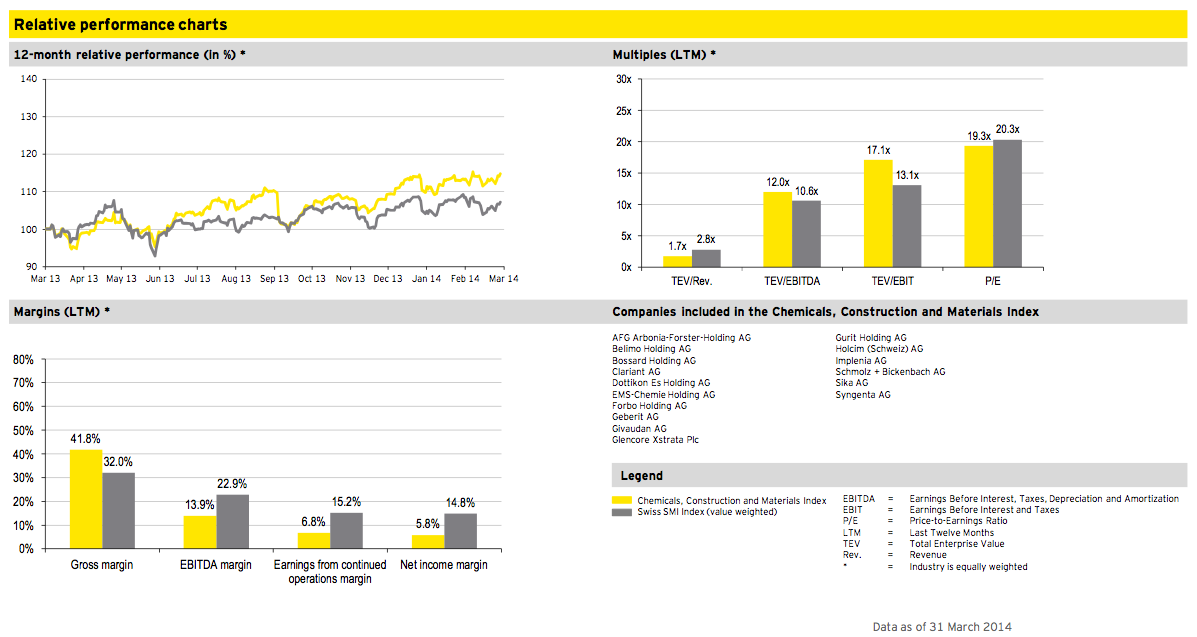

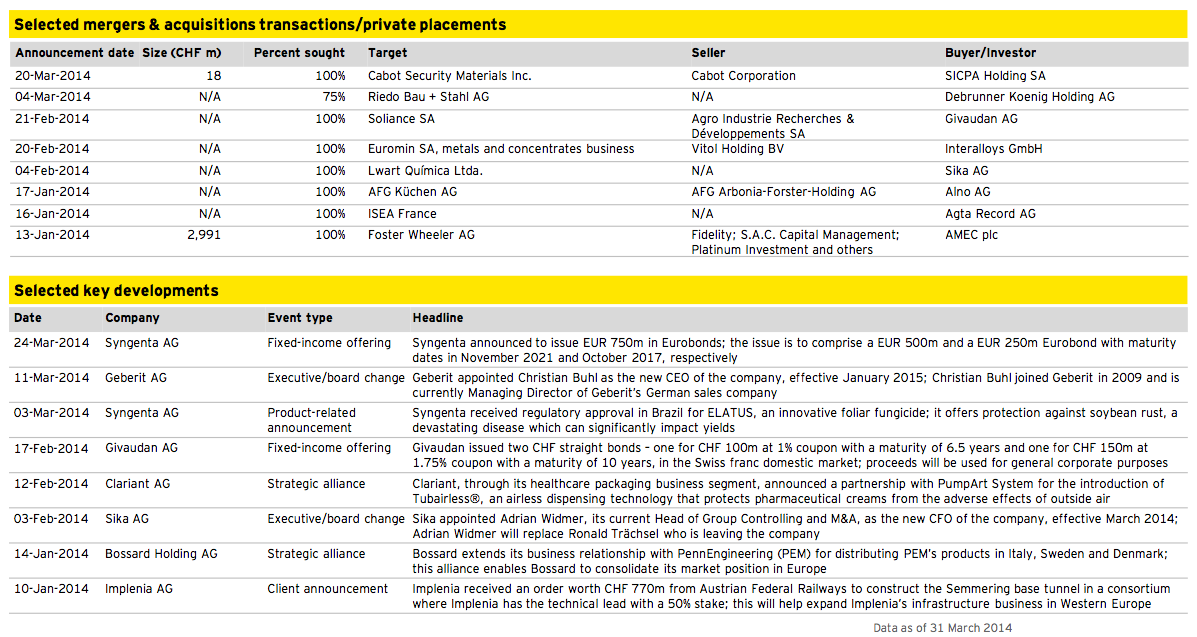

Chemicals, Construction and Materials

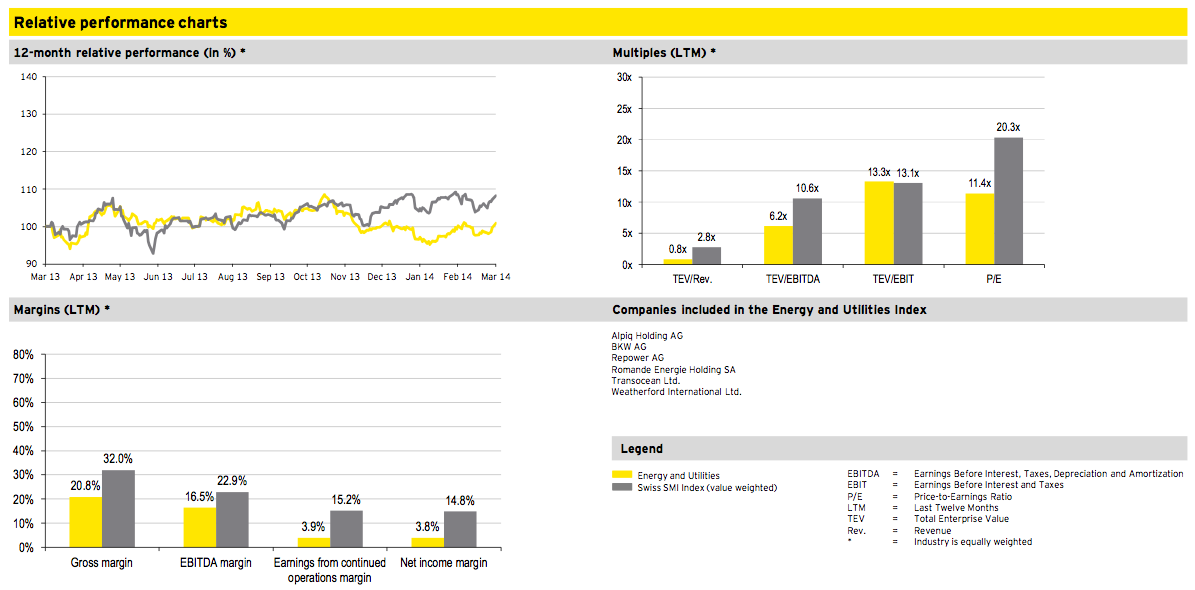

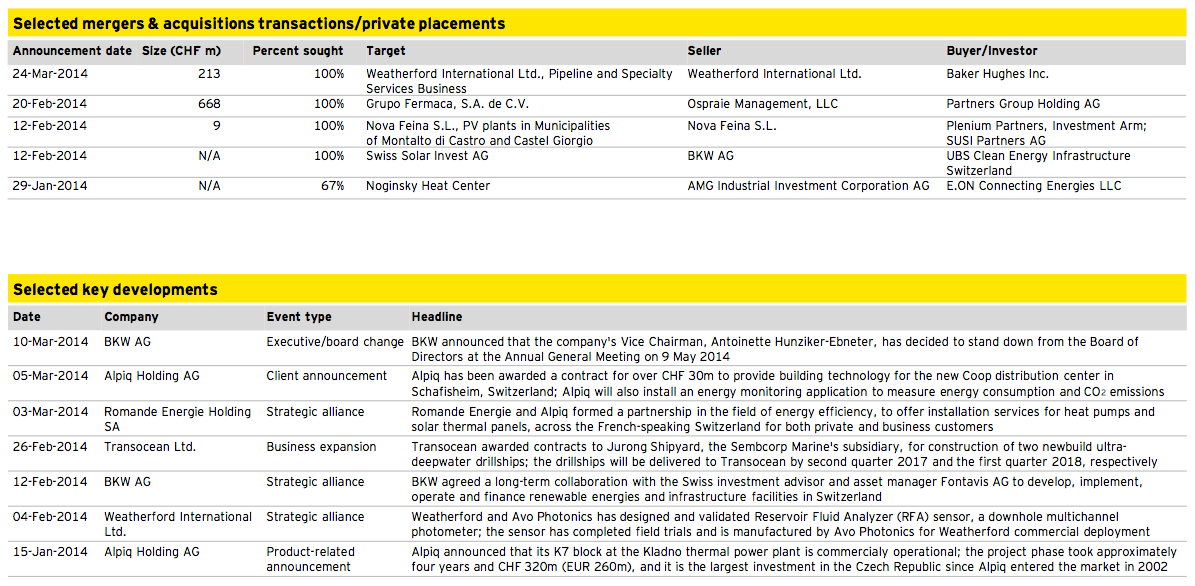

Energy and Utilities

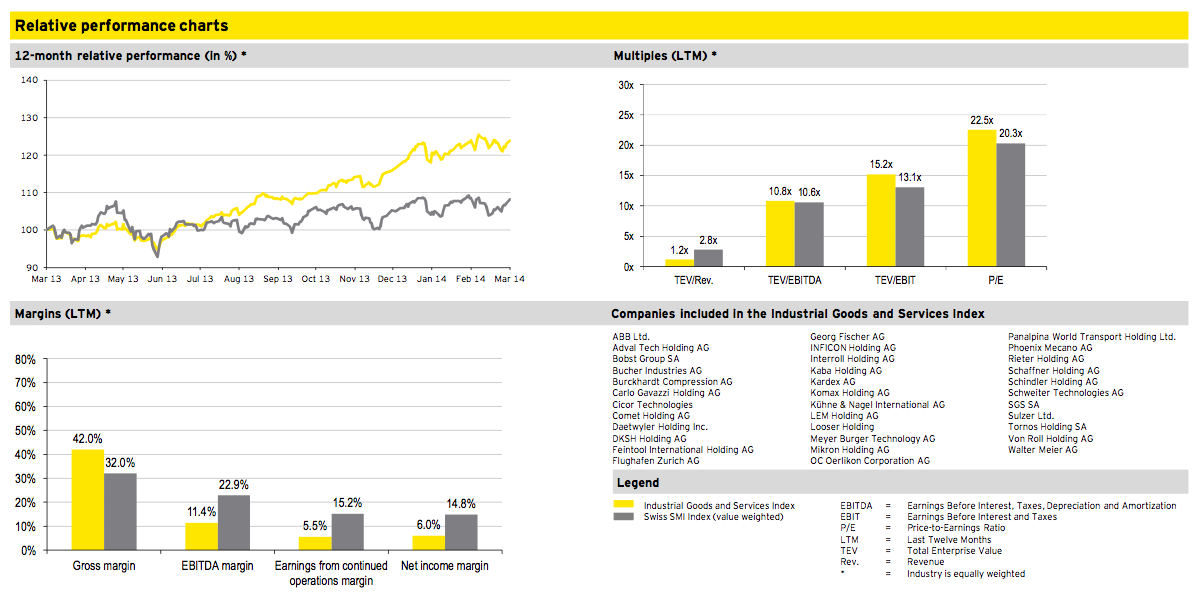

Financial Services

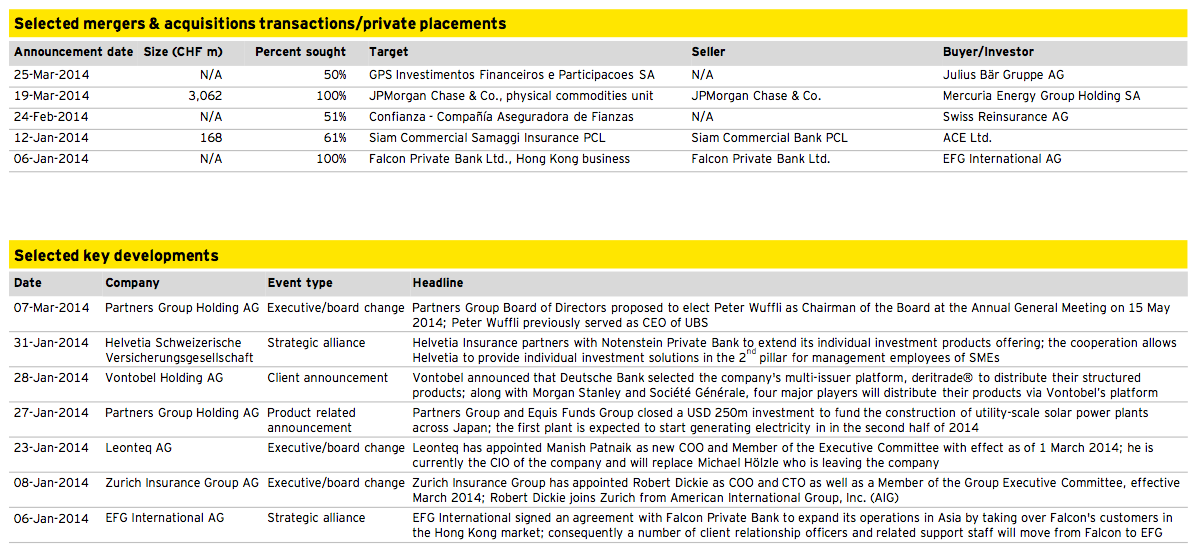

Healthcare

Industrial Goods and Services

Media, Technology and Telecommunications

Retail and Consumer Products

Deal of the quarter

Transaction overview

Deal summary

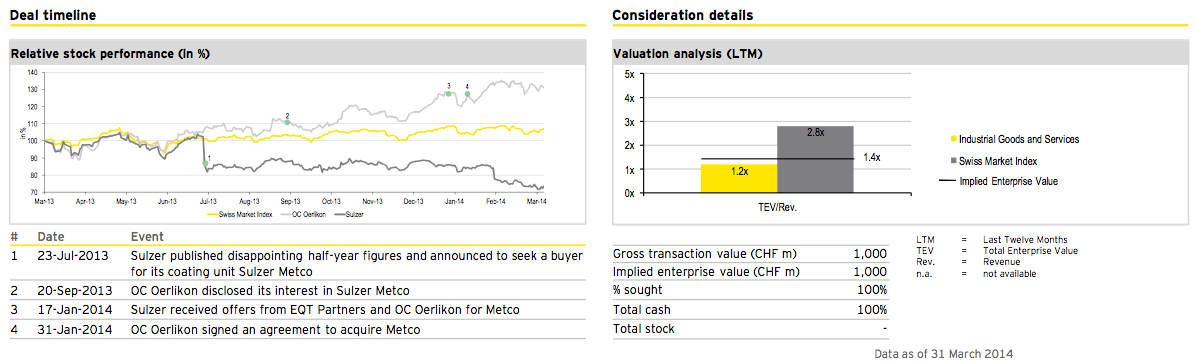

On 31 January 2014, OC Oerlikon Corporation AG signed an agreement to acquire Sulzer Ltd.’s coating unit Metco. The transaction is expected to be closed in the third quarter of 2014, subject to regulatory approval. Oerlikon Balzers, OC Oerlikon’s existing coating division, and newly acquired Metco will be combined in Oerlikon’s new Surface Solutions Segment. With pro-forma sales of CHF 1.2b at 2012 level, equivalent to a 33% contribution to Group sales, the newly formed segment is to become OC Oerlikon’s largest segment. The transaction marks OC Oerlikon’s first major acquisition since it began to actively shape its portfolio in 2010.

Sulzer Metco is a global operator in the thermal spray and surface applications business and generated revenues of about CHF 700m with approximately 2,400 employees in 2012. About half of Metco’s revenue stems from the transportation market.

Deal rationale

► Oerlikon Balzers and Metco are considered complementary with regard to their technological strength, target market and geographical focus, offering good potential to expand Oerlikon’s newly formed segment’s revenue potential.

► The acquisition of Metco increases OC Oerlikon’s coating product and services portfolio by offering its clients both thin-film and thermal spray surface applications. Furthermore, the takeover of Metco allows OC Oerlikon to expand into new end markets such as aerospace, defense, power as well as oil & gas.

► The divestiture enables Sulzer to focus on its three main markets: oil & gas, power and water.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter