Publications Measuring Merger Odds For European Banks

- Publications

Measuring Merger Odds For European Banks

- Bea

SHARE:

By Thierry Pascault, Kirsten Bremke and Boris Piwinger – A.T. Kearney

The pace of mergers and acquisitions is once again on an upswing. As deals become fast and furious, which are the best bets? Our study of the European banking industry points to where the smart money is.

The consolidation of the European banking industry is about to accelerate. So far, most consolidation has been domestic, and many more domestic opportunities still exist. But the recent merger announcement between Banco Santander Central Hispano and Abbey National represents the beginning of a new phase. These two banks are getting a jump on cross-border consolidation, trying to get big before someone bigger gets them.

But did they make the best deal? Should Santander and Abbey National have paired with each other, or were there missed golden opportunities with other companies? What determines merger success and what should European banks look for in a merger partner?

The goal of mergers and acquisitions should always be clear: Create value through meaningful growth. To determine how to best accomplish this goal, A.T. Kearney undertook a study of merger strategies, seeking a stable framework for analyzing conceivable deals. How much value can a given merger generate? Should you seek to expand in a geography or business segment? Which specific deals offer the best value creation potential?

This article presents the results of our study. We examine the forces driving the coming consolidation, determine how market value is created and why some mergers are better than others. We also highlight promising deals among European players.

Grow or Die

In any market, consolidation and profitability are highly correlated. For example, markets where banks are highly concentrated generate higher profits. In Germany, which is among the least consolidated markets, most banks struggle with below-average profitability. On the other hand, in consolidated markets, such as Sweden and the Netherlands, a small group of players dominates and captures most of the growth. The Swedish firm Nordea, for example, is a leader in both revenue and value growth.

These results mirror those of industries worldwide. In a comprehensive 25-year study, A.T. Kearney found that all industries go through stages of consolidation. The consolidation level can be mapped over time on a curve — we call it the Merger Endgames curve. Following the formation of a market (or a market-redefining event such as significant deregulation), industries go through phases of consolidation that eventually lead to a point in which a handful of firms dominate the global market.

Through consolidation, the NUMBER OF BANKS IS EXPECTED TO DECLINE BY MORE THAN TWO–THIRDS within the next 10 years.

Our experience with other industries suggests that the banking industry is about to move into the definite upswing portion of the Merger Endgames curve. Today’s figure of 20,000 banks is expected to decline by about one-third within the next five years and by more than two-thirds within the next 10 years.

Creating Market Value

Mergers are unstoppable. But not all mergers are created equal. Some will optimize a company’s profitability and enhance its capital; others will drag a company into underperformance. What strategies lead to success?

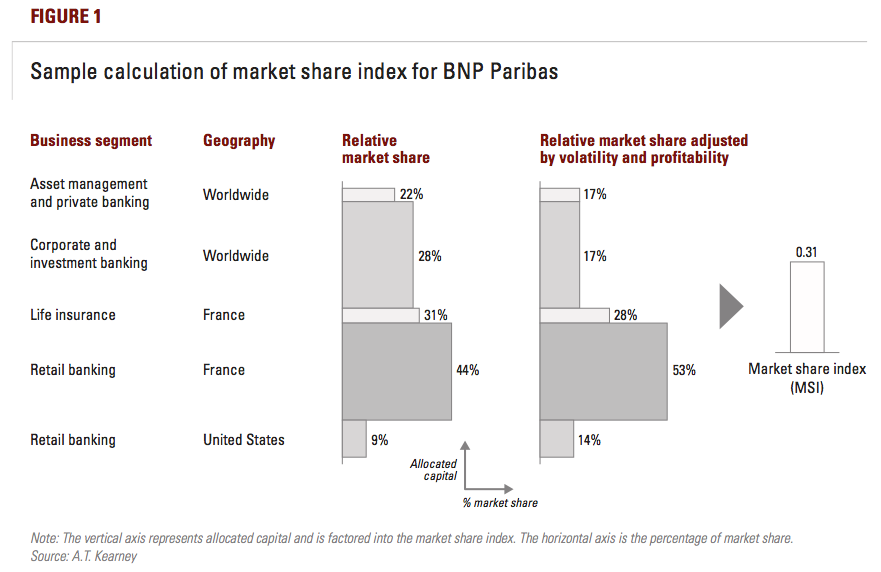

Basic strategic theory says that value depends on relative market share. To gain insight into relative market share, however, some adjustments to the raw data are required. Our merger strategies study calculates a market share index (MSI) that considers four factors: strength in each business segment and country, each segment’s relative market share weighted by the capital allocated to that segment, volatility of earnings, and structural profitability. The analysis distinguishes between global and domestic business segments.

For example, BNP Paribas has a market share index of 0.31 (see figure 1). We arrive at that index by summing BNP Paribas’ market share indices in various segments and countries. In each (business and country) segment, the MSI is calculated as the product of relative market share, allocated equity, and factors for the volatility and profitability of the respective segment. Note that corporate and investment banking and French retail banking contribute the major portions of its market share index.

Why do we calculate market share index? Because it correlates strongly with the creation of market value: The higher the market share index, the higher the price-to-book ratio. Price-to-book ratio, also known as price-to-equity ratio, is used to compare a stock’s market value to its book value. A lower price-to-book ratio could mean that the stock is undervalued, or there is something fundamentally wrong with the company.

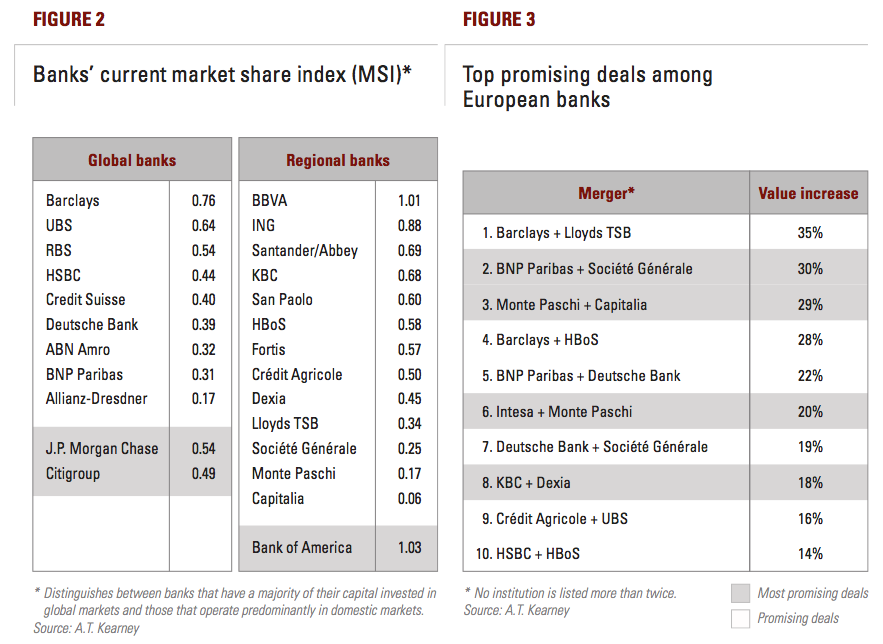

This correlation is not only statistically significant, it also makes intuitive sense. A firm creates real value when it has high market share in a profitable, stable industry segment. It has even more value when it has strong market shares in several such segments. Figure 2 illustrates the current market share index for the leading players in Western European countries.

MSI Measures Merger Success

Our MSI calculation is a powerful tool to analyze potential merger deals. We can compute the MSI for a combined firm by recalculating the relative market share in each business segment. Comparing the MSI of the combined firm with that of the merging firms shows whether the merger is worthwhile. The most promising deals boast a significant increase in MSI — greater than 50 percent for both players.

Of course, deals that produce too high a market share in any business segment must be flagged for possible antitrust conflicts; our methodology accounts for this. The methodology also takes into account potential customer overlap, which can detract from top-line synergies. For example, the pre-merger MSIs of Crédit Agricole and Crédit Lyonnais, based on a 2002 analysis, were 0.50 and 0.14, respectively. The weighted average MSI of the two firms independently before the merger was 0.36. The merger increased the MSI to 0.57, creating value primarily in two segments: corporate and investment banking and retail banking in France.

One of the most valuable features of this analysis is that it can help predict the new price-to-book ratio for the combined firm, which means we can examine promising deals based not only on their weighted market share, but on how stock markets should value the deal. For example, in the planned merger of Santander and Abbey National, our analysis shows that Santander’s MSI would decrease from 0.81 to 0.69. The weighted MSI of the two firms independently before the merger is 0.69; after the merger, it is still 0.69. Since the MSI does not change, the price-to-book ratio does not change. Therefore, based on our analysis, we would advise against the merger because it does not create value.

What We Now Know

Our study led to several key findings. For example, we found that most top deals are led by global banks that leverage their market positions. And while 80 percent of all mergers can generate value, it is only if they are successfully managed. However, few mergers can generate more than a 20 percent price-to-book increase.

Figure 3 lists the most promising deals, the majority of which are domestic. Synergies within a segment and country drive up the market share index, while mergers across countries create significant synergies only in global business segments, asset management, and corporate and investment banking, at the expense of revenue overlaps. However, three of the top promising deals cross borders, indicating that international merger- and acquisition-based growth is becoming more meaningful.

Clearly, markets such as Germany and to some extent Italy are penalizing their leading financial institutions that are aiming to grow their core businesses. The value resulting from domestic mergers is limited due to the high level of fragmentation of the market. Conversely, because of the high profitability of the U.K. market, U.K. banks feature prominently among the most promising deals.

The authors gratefully acknowledge the significant contribution of Jean-Eric Pacini, a vice president in the firm’s financial institutions practice, based in Paris.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter