Publications Global Transportation And Logistics M&A Deals Insights Q3 2016

- Publications

Global Transportation And Logistics M&A Deals Insights Q3 2016

- Christopher Kummer

SHARE:

By Darach Chapman, Jonathan Kletzel and Julian Smith– PricewaterhouseCoopers

Executive summary

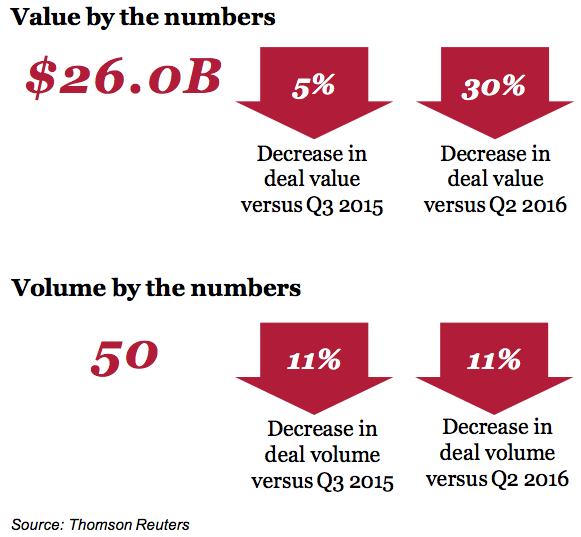

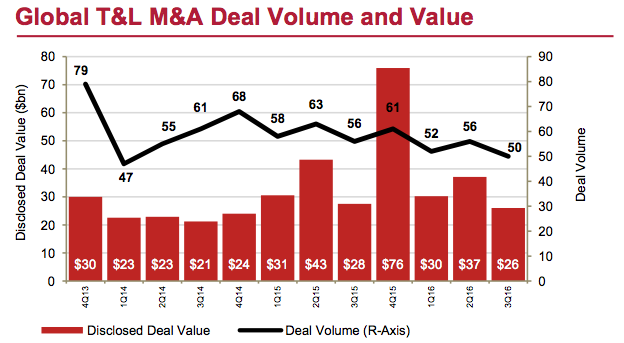

Global transportation and logistics M&A activity remained stable in 2016 with 50+ deals in each quarter, though Q3 2016 was slightly less active. With 50 deals, the quarter saw a decline of 11% in deal volume compared to both Q2 2016 and Q3 2015.

It appears general uncertainties related to the US presidential elections, the long-term impact of Brexit, and China’s economic growth paired with reduced forecasts of international trade activity may have impacted recent M&A activity.

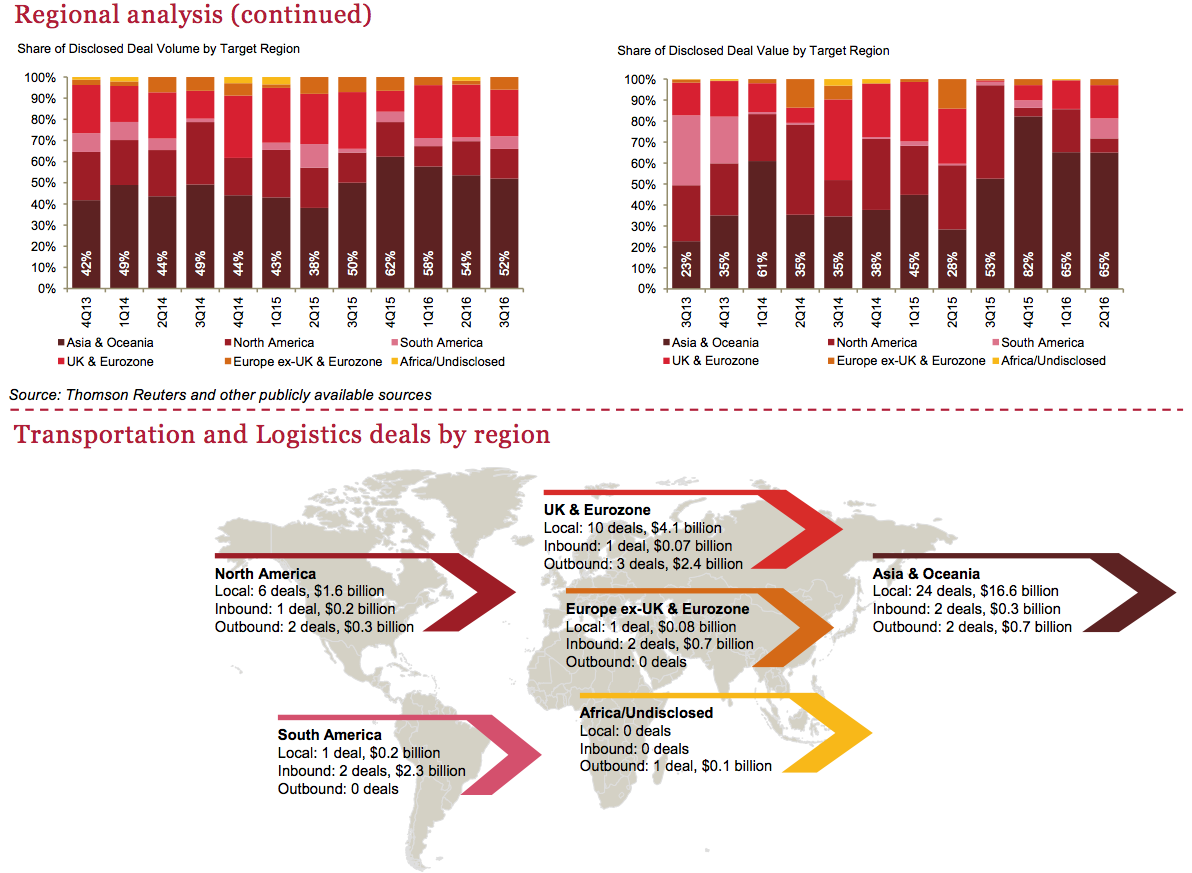

While the Asia & Oceania region continues to lead in M&A activity, South America and Europe (excluding UK & Eurozone) saw an uptick in deal volume and a sizeable increase in deal value.

“Asia and Australia dominated M&A in the Transportation and Logistics sector in Q3 of 2016, largely driven by infrastructure concessions and participants seeking access to capital.” — Darach Chapman, US Transportation and Logistics Deals Leader

Key trends/highlights

• T&L deal activity in Q3 2016 declined 30% from Q2 2016 although overall activity remains strong.

• There were five megadeals with a total aggregate disclosed value of $14.0 billion.

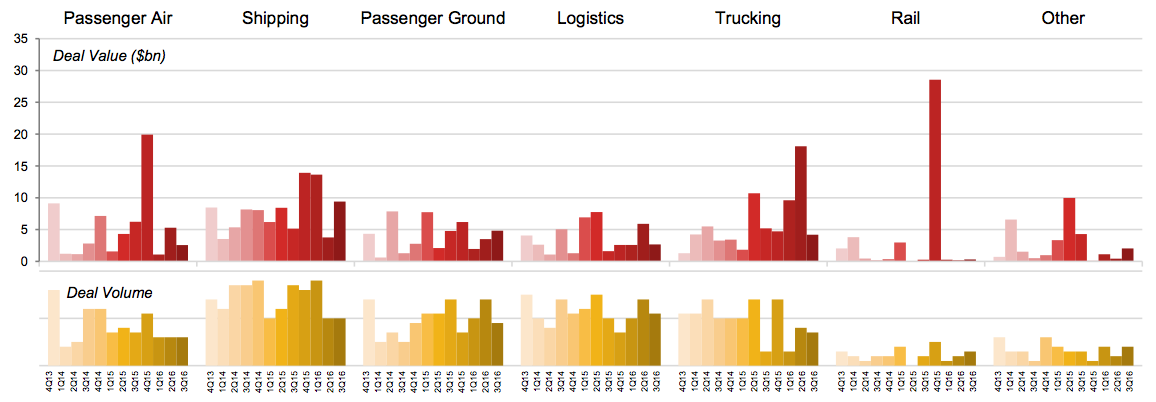

• The Shipping category was stable in deal volume but saw a surge in deal value driven by Investor Group’s acquisition of Port of Melbourne Corp for $7.3 billion—the largest megadeal in the T&L sector this quarter.

• The Rail category recorded quarter-over-quarter deal value growth, although from a low basis. It is also the only category to record a positive deal volume growth, driven by deals in Europe.

• The Logistics category saw a 20% increase in deal volume this quarter on a year-over-year basis. Deal value in this category grew by more than three times to $4.8 billion over the past year.

Highlights of Q3 2016 deal activity

M&A activity remains strong in T&L

Despite a gradual decline in volume, M&A activity remains strong with respect to deal volume and value.

Total transaction value of $26.0 billion is down 30% from Q2 2016, and has decreased marginally from Q3 2015. Fifty deals were announced during Q3 2016, down 11% from Q2 2016 and Q3 2015.

Largest transaction

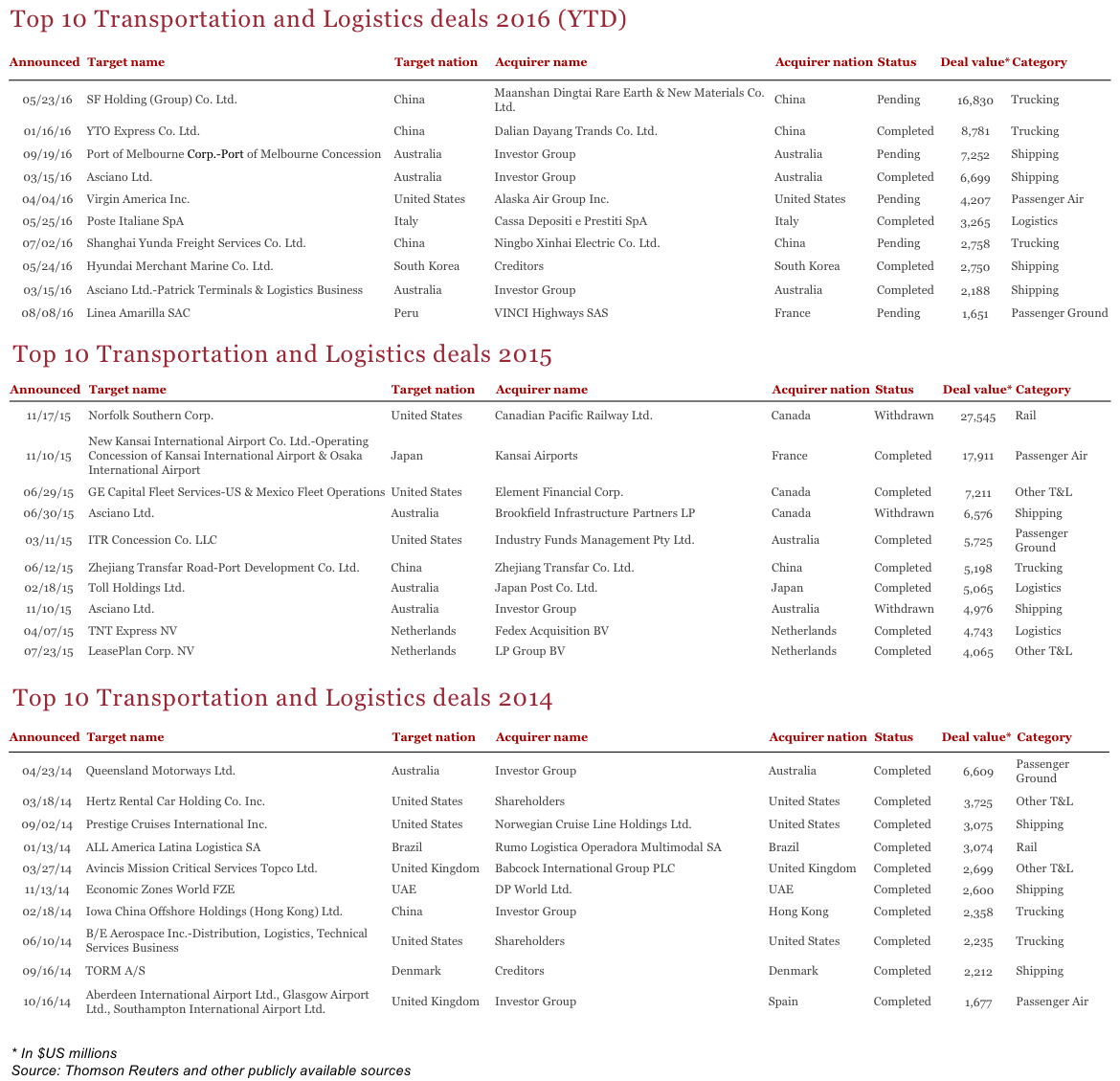

The largest transaction this quarter was a 50-year concession to take over operations at the Port of Melbourne from Australian state-owned Port of Melbourne Corp. The transaction was executed by a diverse group of investors for $7.3 billion.

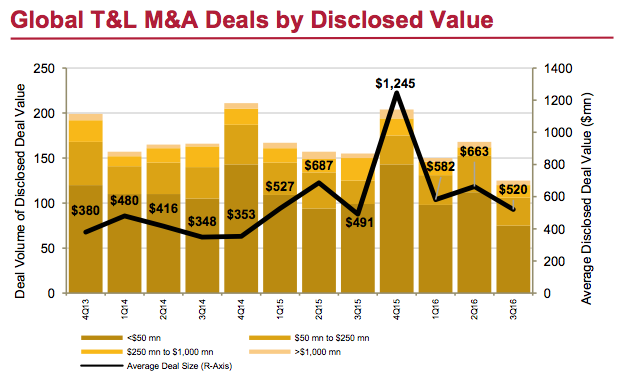

Megadeals

The volume of transactions valued over $1 billion dropped slightly this quarter—with five instead of six megadeals. Megadeals held about 54% share of the total disclosed deal value in Q3 2016.

Sub-sector category analysis

Deal value was led by Shipping in Q3 2016, largely driven by Port of Melbourne’s acquisition. Though relatively small in absolute terms, the Rail category showed positive growth on a quarter-over-quarter and year-over-year basis driven by European activity. Although Logistics deal value and volume declined sequentially, both increased compared to Q3 2015.

Key trends and insights

Financial vs. strategic investors

While strategic investors have historically accounted for a larger share of M&A activity in the sector, Q3 2016 saw financial investors enjoy similar volumes. Total deal volume and value of financial investors grew by 8% and 33%, respectively, while the volume of deals completed by strategic investors in Q3 2016 was the lowest of the last 12 quarters.

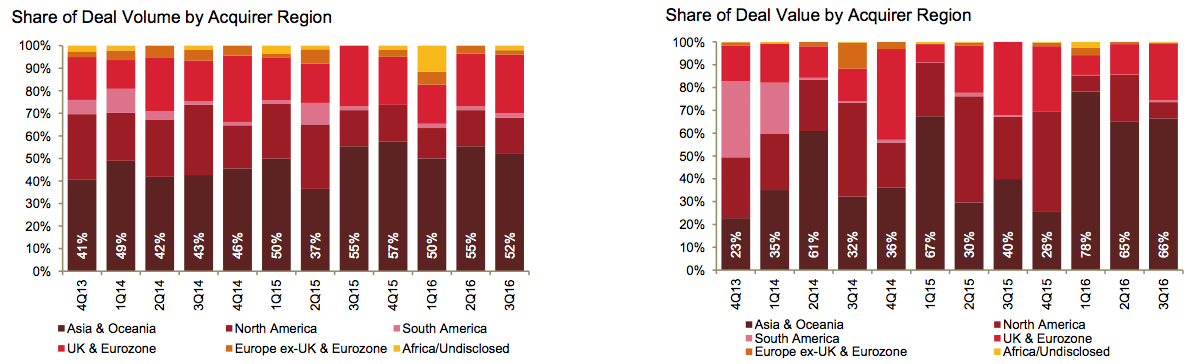

Regional analysis

Local deals (transactions by targets and acquirers within the same borders) continue to account for the majority of transactions globally, while volume of cross-border deals was at its lowest in the last three years. Asia & Oceania continues to have the strongest presence, and consistently accounts for more than half of the overall deal activity by volume.

Recent softness in M&A activity likely to be temporary

While long-term strategic deals, such as infrastructure concessions, continue to get completed, the overall T&L sector experienced a slowdown in M&A activity in the most recent quarter.

This softness, particularly evident in the decline in cross-border and strategic deals, is likely attributable to the current economic uncertainty, in particular around the US presidential elections and the long-term impacts of Brexit.

We believe that underlying fundamentals in the industry—a drive to globalization, corporate outsourcing of the logistics function, the continued global growth in e-commerce and the fragmented nature of some of the key subsectors—will continue to drive growth and associated M&A activity.

Further, we expect Asia to continue to be a strong contributor to this M&A activity, as consolidation of the sector continues in many countries in the region and companies continue to seek access to the capital markets that help them capture these opportunities.

Top 10 Transportation and Logistics Deals

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter