Publications Global Capital Confidence Barometer – Reshaping For The Future

- Publications

Global Capital Confidence Barometer – Reshaping For The Future

- Christopher Kummer

SHARE:

By Pip McCrostie – Ernst & Young

Learning to thrive in a low-growth and volatile environment, companies are taking a pragmatic view, balancing risk and returns.

Our 10th Global Capital Confidence Barometer clearly illustrates the many complex challenges on today’s boardroom agenda. For leading global corporates, striking a balance between risk and reward has rarely been so difficult. Companies are grappling with geopolitical instability, a fragile global economic recovery and seismic shifts in “megatrends” such as structural changes in the workforce and digital transformation — all at a time of unprecedented shareholder activism.

Within this context, our respondents report resilient confidence in the global economy, despite recent geopolitical shocks, low growth in mature markets and slowing growth in BRIC territories. Confidence in credit availability is at its highest in the Barometer’s five-year history, cash is in ready supply and valuation gaps are narrowing.

In the past, all of this would have been a recipe for a wave of M&A. Today, however, executives are navigating complexity with parallel priorities. Management teams look to achieve value today with a renewed focus on cost management and returning rewards to increasingly active shareholders.

At the same time, some executives are also seeking value creation and top-line revenue through innovative organic growth and measured dealmaking. As a result, larger, more transformational M&A is on the strategic growth agenda. Pipelines point to only modest increases in deal activity as low volume becomes the hallmark of a low-growth environment. Increased deal values rather than volumes will likely be making headlines in the coming year. After a prolonged financial crisis and M&A market malaise, companies and boards are opting for quality rather than quantity.

The business world is taking a new shape, one affected by the tapering of fiscal stimulus, shareholder activists, a rebalancing of investment priorities across emerging and mature markets and a relentless drive for innovation across all sectors. With a focus on cost management, higher risk organic growth and — in some cases — large, strategic and transformational deals, leading businesses are responding by reshaping for the future.

Key findings

60% consider cost reduction their primary focus

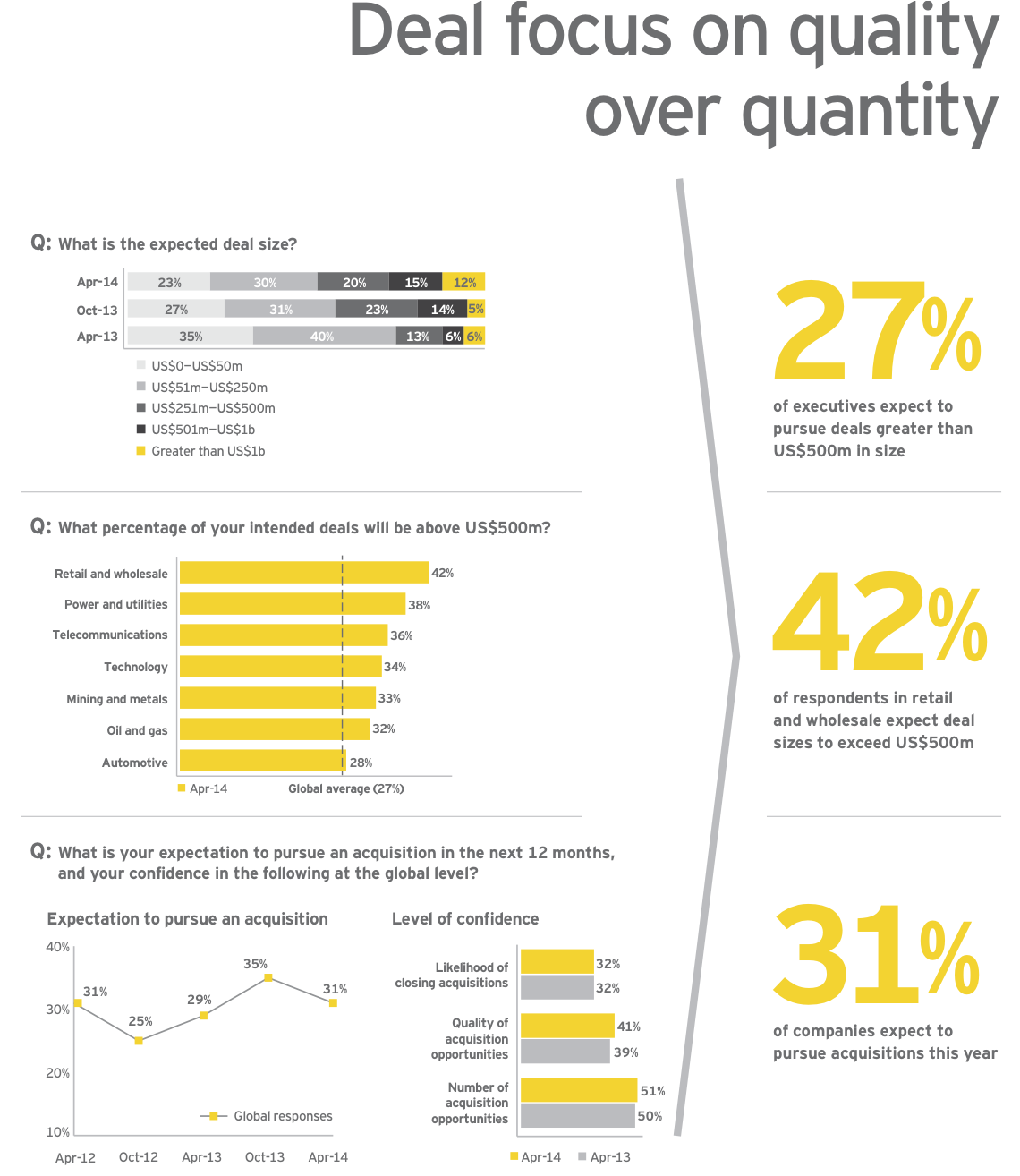

27% expect to pursue deals greater than US$500m in size

31% plan to pursue an acquisition 29% expect deal pipelines to increase

60% see the global economy improving — resilient confidence in the face of shocks

88% view credit availability as stable or improving

65% have confidence in corporate earnings — the highest level in five years

“The business world is taking a new shape — leading businesses are responding by reshaping for the future.”

Economic outlook — despite shocks, recovery is resilient

With executives now confident of a real and sustained economic recovery, global megatrends may have a more transformative impact on their growth strategies.

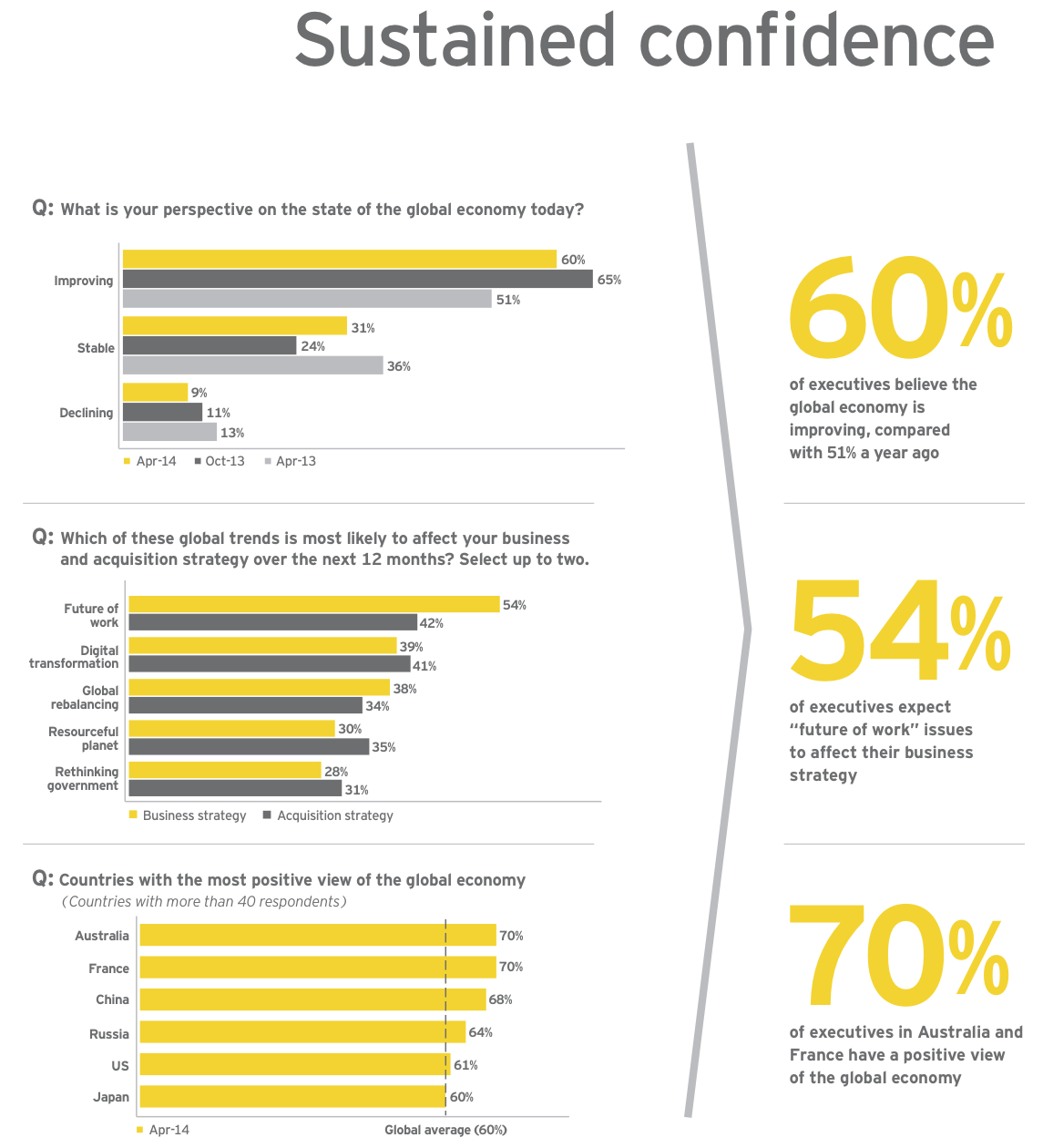

Our respondents’ outlook for the economy is more resilient than at any time in the past few years. Economic pressures and geopolitical shocks — such as slowing emerging market growth, the tapering of quantitative easing in the United States, and unrest in the Middle East and Eastern Europe — temper this confidence to some extent. But the persistence of such shocks means these risks are being factored into long-term business plans. The relative consistency in our respondents’ overall confidence numbers — down slightly from six months ago, but still up solidly from 12 months ago — points to an improving outlook.

• Executives remain confident in global economy

Executives’ confidence in the economy remains up considerably from a year ago, buoyed by strengthening business fundamentals. The percentage who see the economy declining fell to 9% — the lowest level since the Barometer launched five years ago.

• Global megatrends converging to shape business and acquisition strategies

Macro trends affect companies’ corporate strategies, which can have a direct impact on acquisition behavior. When asked which trend could have the greatest impact over the next 12 months, more than half of executives pointed to the trend commonly called “the future of work” — skills shortages, competition for talent and changing employer-employee obligations, among other issues. This set of issues is expected to have the largest impact on both business and acquisition strategies. Large proportions also pointed to digital transformation (e.g., big data, cloud and mobile technologies) and global rebalancing (e.g., developed/emerging market definitions, the growing middle class), all of which may also be contributing to a shortage of skilled talent.

• Mature economies remain most confident in global economy

By and large, the most developed economies continue to express the greatest confidence in the strength of the global economy, consistent with our last Barometer. Among the BRICs, China and Russia are most positive on global economic prospects. And the United States’ confidence ranks slightly above average.

Evidence of a real recovery

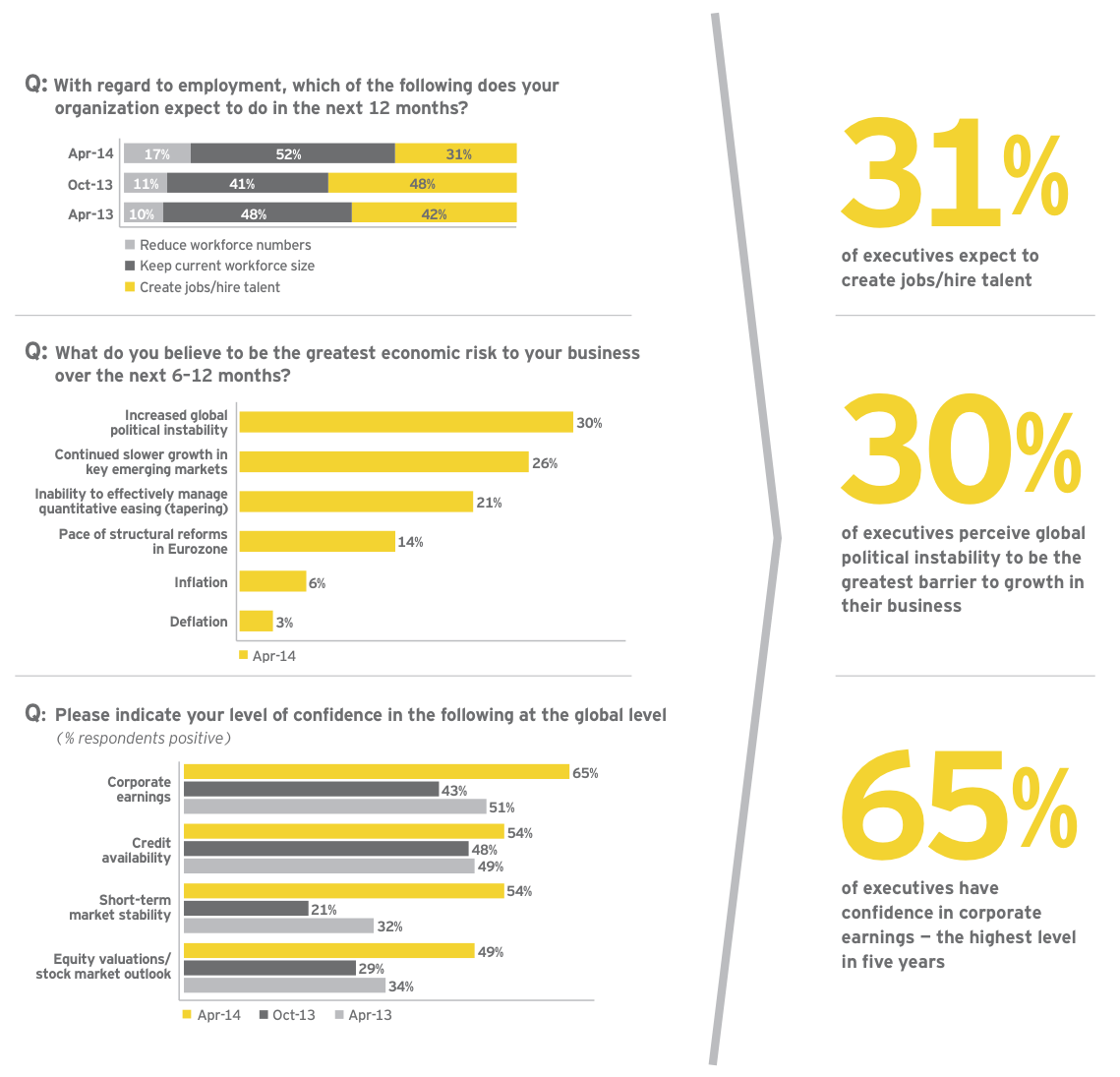

• “Future of work” megatrend likely affecting job creation

Job creation expectations have decreased significantly across the majority of sectors. Employment continues to lag behind the global economic upturn, which may reflect longer-term structural changes in the workforce; digital transformation is making many jobs obsolete, while at the same time creating new ones. Additionally, spare capacity may be contributing to the slowdown in job creation.

• Political instability and slowing growth in emerging markets are key economic risks

Throughout the five-year history of the Barometer, geopolitical shocks have persistently reined in our respondents’ economic and business confidence. While corporate leaders now factor some global risk into their business, specific macro events can affect near-term confidence. Looking just at the next 6 to 12 months, executives say the greatest risks to their businesses center around emerging markets, fueled by both political instability and slowing growth.

• Confidence seen across key financial indicators

Strong evidence that the recovery is real can be found among our respondents’ perception of various financial indicators — they are up in all categories, many significantly, showing increasing confidence in the global outlook. Confidence in corporate earnings, in particular, is at an all-time high in our Barometer; and year-over-year growth in such indicators as credit availability and stock market stability shows similar conviction.

Credit available to fuel larger deals

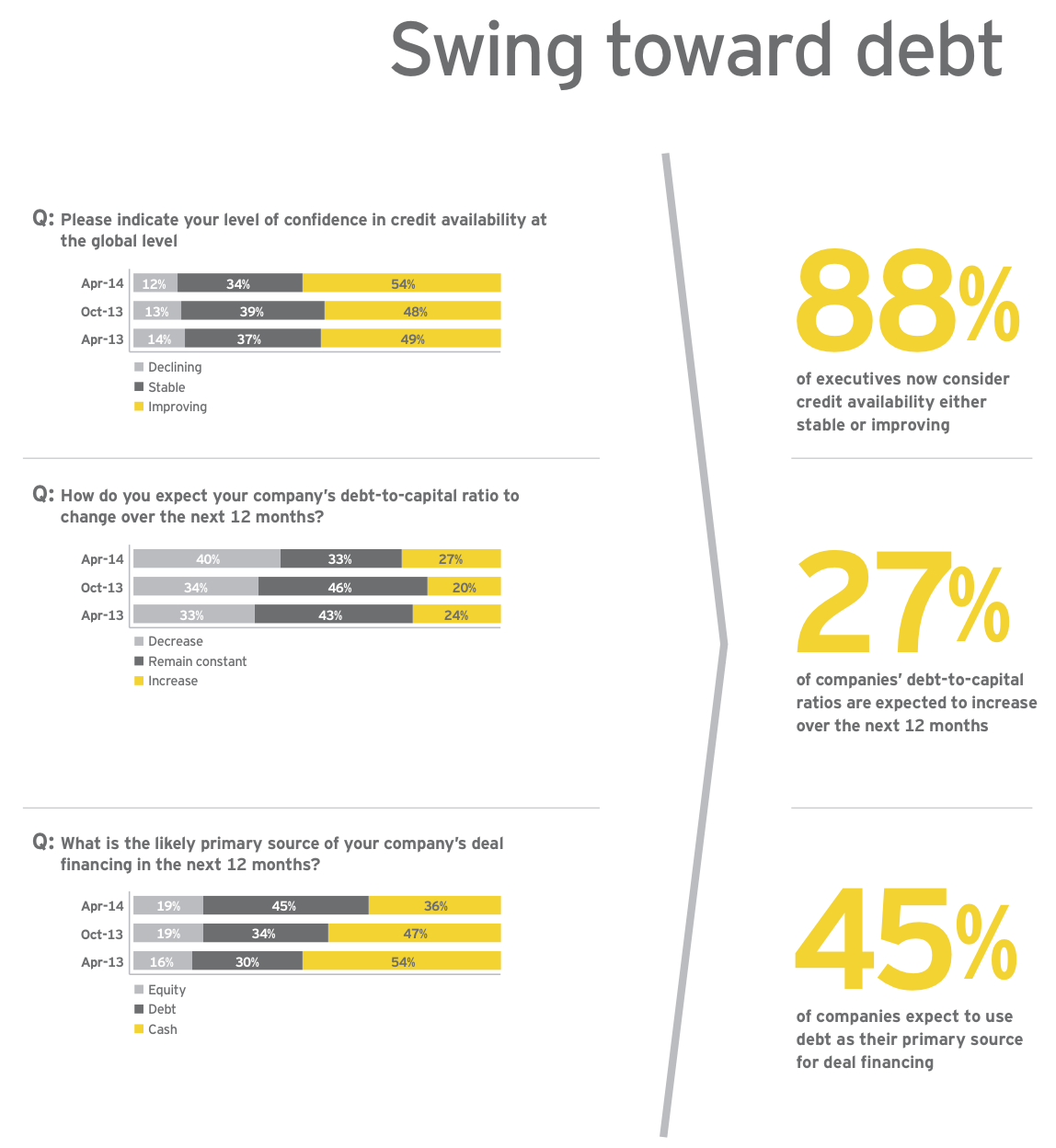

Over several Barometers, companies have indicated that credit is broadly available — but now executives indicate a greater interest in putting debt to work.

Companies’ growing willingness to add leverage to their balance sheets suggests deal activity increases when confidence and deal appetites converge. Although deal volumes will remain subdued in the near term, with debt financing increasingly available — often at very low cost — larger deals will be on the agenda as companies use debt to finance high-value strategic moves.

• Confidence in global credit availability at an all-time high

Respondents’ confidence in credit availability at a global level is at its highest level ever in the Barometer. We are seeing a significant increase in availability of credit to the corporate sector coupled with overall stabilization in credit conditions. Growing and persistent confidence in the availability of financing — particularly for larger, well-rated firms — provides a favorable platform for selective dealmaking.

• Use of leverage expected to rise

Debt-to-capital ratios have largely remained stable over the last year, but we may see shifts over the next 12 months. With interest rates expected to increase, there is a rush of companies positioning to lock in longer term financing at current low rates.

• Significant increase in use of debt to finance acquisitions

As executives seek to maximize returns, they anticipate a notable increase in usage of debt as a percentage of purchase price. Despite record cash balances, the currently advantageous terms on debt financing are spurring a shift from cash to debt.

Cost control and growth compete for top spot on the boardroom agenda

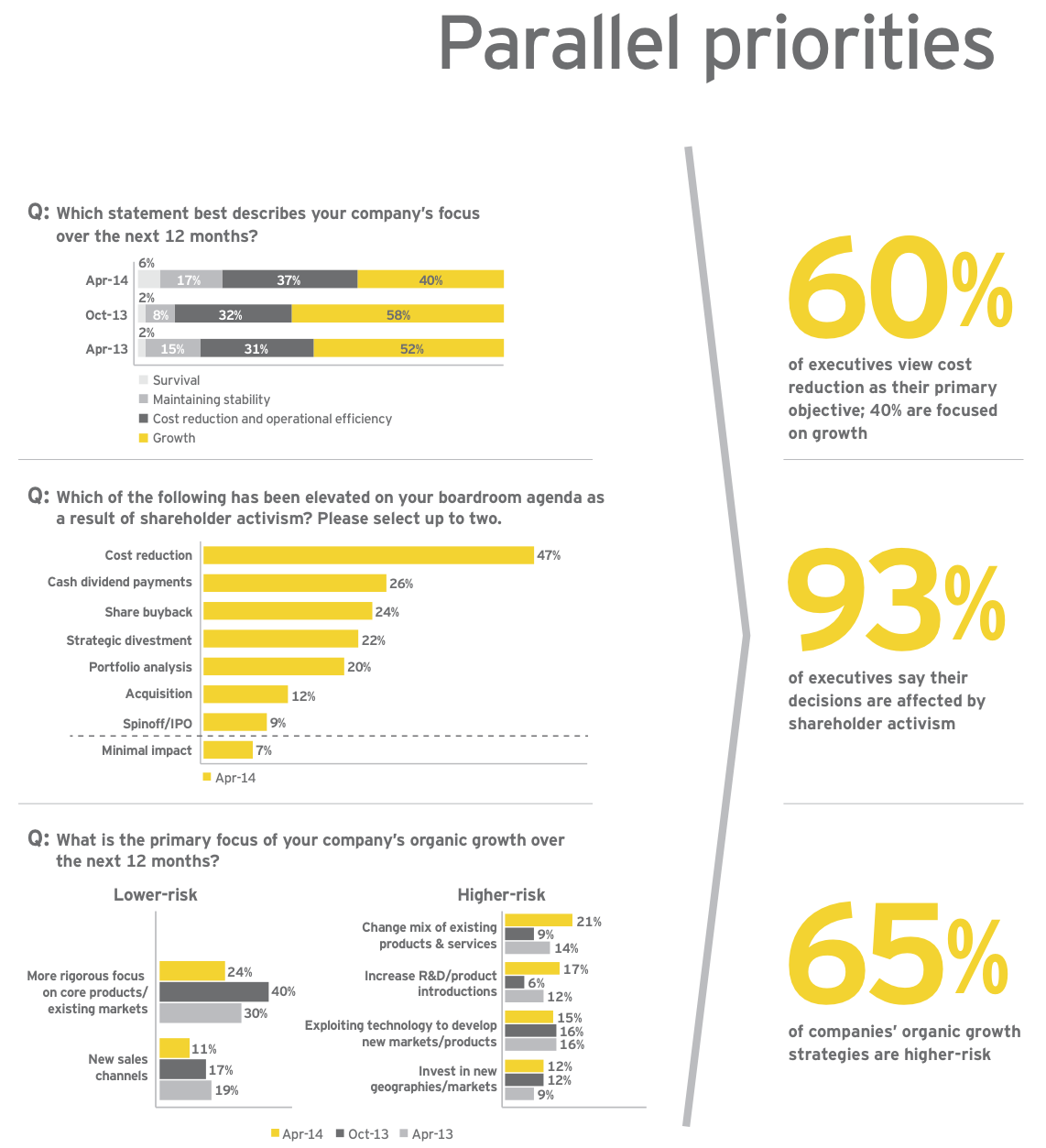

Cost management is now a permanent feature amid a low-growth future.

For several years now, companies have been rewarded for cost-cutting and an aversion to risk. But cost reduction is no longer just an operational issue but also a strategic imperative, and often a key area of focus for activist shareholders.

Growth takes new directions, and innovation takes center stage.

In parallel to managing costs, companies are turning their attention to innovative organic growth, extending beyond their core revenue base.

• Balanced focus on growth and cost reduction

The pressure remains for companies to grow, in spite of slower long-term GDP growth. But lessons learned from the global financial crisis mean that closer scrutiny of cost structures and operational efficiency is now the norm. What is emerging is a model whereby companies increasingly seek out new organic growth opportunities — but do so within a strong framework of operational efficiency and cost management.

• Shareholder activism prompting action — and laser focus on costs

Nine out of 10 executives say issues raised by shareholders have shaped their boardroom agendas. Shareholder activists typically focus on organizations with high expense ratios; multiple, disparate and sometimes non-core operating units; and concerns around capital allocation. In turn, boardrooms have responded by focusing on, respectively, operational efficiency and cost reduction; spinning off non-core units via strategic divestments; and returning capital through buybacks and dividends. The renewed focus on innovative cost management can be seen as a response to increasingly influential shareholder activism.

• Companies begin to innovate and pursue higher-risk organic strategies

A secular shift to lower long-term global economic growth, coupled with competitive disruption, has prompted companies to consider higher-risk approaches to organic growth. We have seen a major increase in companies looking to change their mix of existing products and services. In addition, research and development efforts have nearly tripled over the last six months, suggesting greater optimism that innovation can generate growth.

M&A — measured moves, bigger deals

Increasing deal value could be the M&A story of the next 12 months.

Deal volumes — currently at record lows — are expected to increase only marginally; and large, transformational deals will make headlines rather than any significant increase in global deal activity. Although companies do expect global deal volumes, as well as their own deal pipelines, to improve, near-term deal volume expectations are flat. From a value perspective, the deals they do pursue will continue to be larger and more strategic. Key sectors planning transformational deals include retail and wholesale, power and utilities, telecommunications, technology, mining and metals, and oil and gas.

• Expectations for larger deal sizes rising

Companies’ intentions to engage in larger deals (greater than US$500m) over the next year are up strongly, having doubled in 12 months. This is a sign that plans for transformational acquisitions, particularly among larger companies, are on the rise. In addition, given that the number of companies planning acquisitions over US$1b has more than doubled in six months alone, we can expect an increase in headline- generating, high-value strategic deals in the coming year. For leading companies, quality rather than quantity will be at the heart of their M&A strategies.

• Sectors that define the big deal landscape

While an expectation for larger deal sizes is consistent across most sectors, certain sectors stand out in this important measure. Respondents in asset and real estate-intensive industries such as retail, power and utilities, telecommunications, oil and gas, mining and metals, and automotive expect to pursue the biggest of the big deals (defined as US$500m or more in deal value). Technology respondents also expect to pursue larger deals, where high multiples are likely a key factor.

• Nearly one-third expect to pursue acquisitions

Over the past two years, the intent to pursue deals has remained within a tight range as companies have closely monitored the global economy and looked for signs of sustained recovery. Currently, 31% of companies expect to pursue acquisitions in the next 12 months. Respondents’ confidence in the number, quality and likelihood of closing deals is holding steady. However, this will likely translate into only a modest increase in deal volume as the baseline for M&A activity is reset lower in a slow-growth environment.

Strategic deals to complement growth

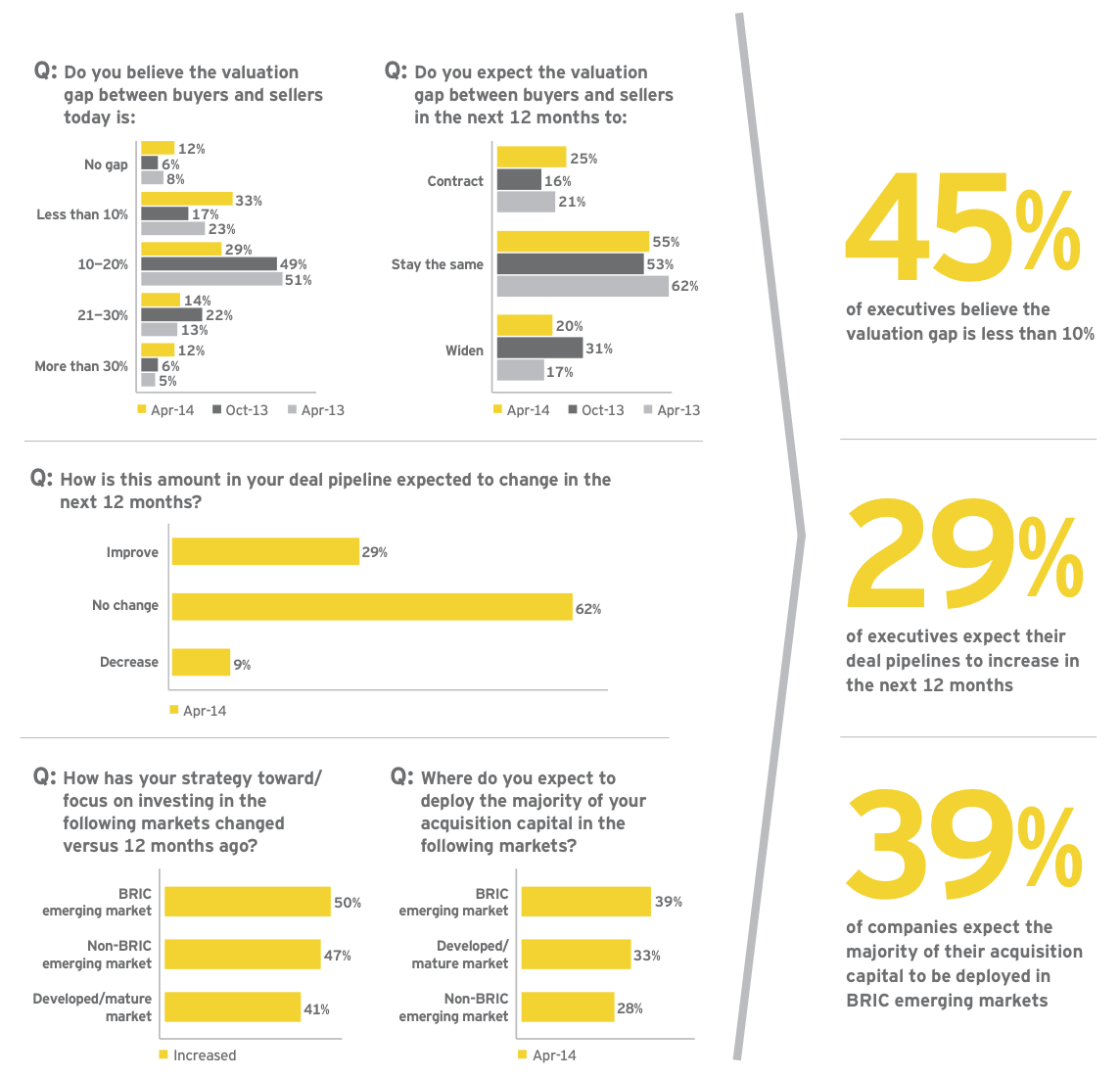

• Valuation gap narrows

As the economic recovery takes hold and the demand for growth accelerates, the gap is contracting between the price companies are willing to pay for assets and underlying valuations. Almost half of respondents believe the valuation gap is now less than 10%, and a vast majority expect valuation gaps to remain the same or contract over the next year. This dynamic creates an environment where companies can close larger, more strategic deals.

• Marginal improvement anticipated in deal pipelines

Over the last 12 months, deal pipelines have declined slightly as companies have focused on improving the performance of their existing businesses and pursuing organic growth strategies. However, looking at the next 12 months, our respondents anticipate some growth in their deal pipelines. Roughly 3 in 10 respondents expect their pipelines to increase; only 9% expect a decrease. That suggests improving sentiment — but with 60% reporting no change in outlook, any rise in M&A volumes this year is likely to be modest.

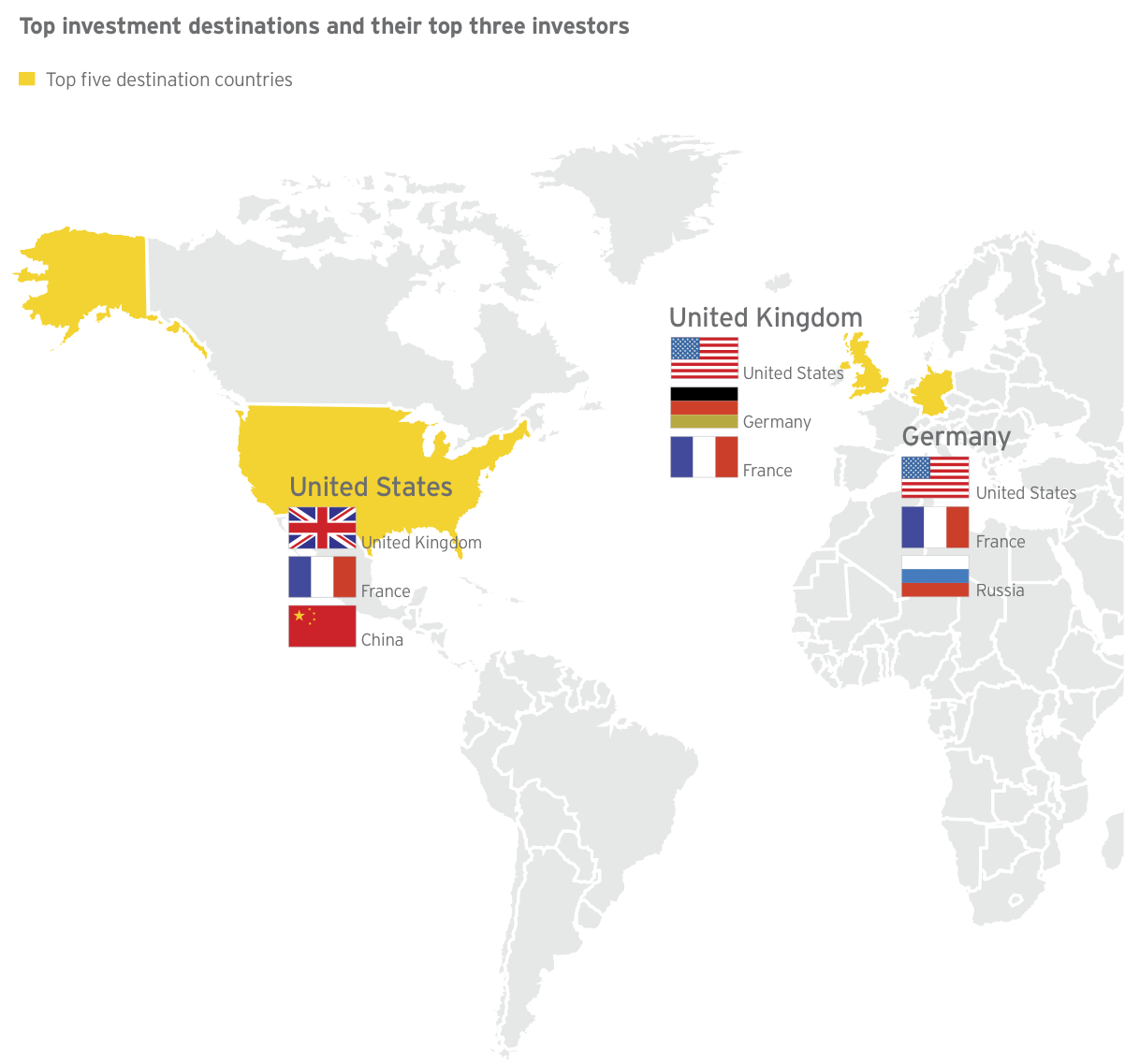

• Balanced investment intentions

Investment intentions are broadly similar across all markets, suggesting companies are looking at balancing emerging market and mature market investments. Emerging markets remain very important — BRICs for medium-term growth and non-BRICs for longer-term growth. However, developed markets are critical for precious short-term growth. The resurgence of mature-market investment intentions is evidenced by our respondents’ desire to invest in the US, UK and Germany.

Companies continue to diversify and developed markets across emerging

European economies attract capital, along with certain BRIC economies

The most notable entrants into our top five capital destinations since the last Barometer are the United Kingdom and Germany. This signals a rebalancing of emerging and mature market investment priorities and a return to confidence in Europe after austerity measures. However, among our top investment destinations, companies plan to allocate their most significant capital (more than 10%) to China, India and Brazil. The benefits of these BRIC economies — especially their growing middle-income populations — outweigh their considerable challenges, including political and currency risk and slowing growth. Holding steady within the top five is the United States, a perpetual destination for global capital.

Next top destinations:

Brazil

Ireland

Japan

Singapore

United Arab Emirates

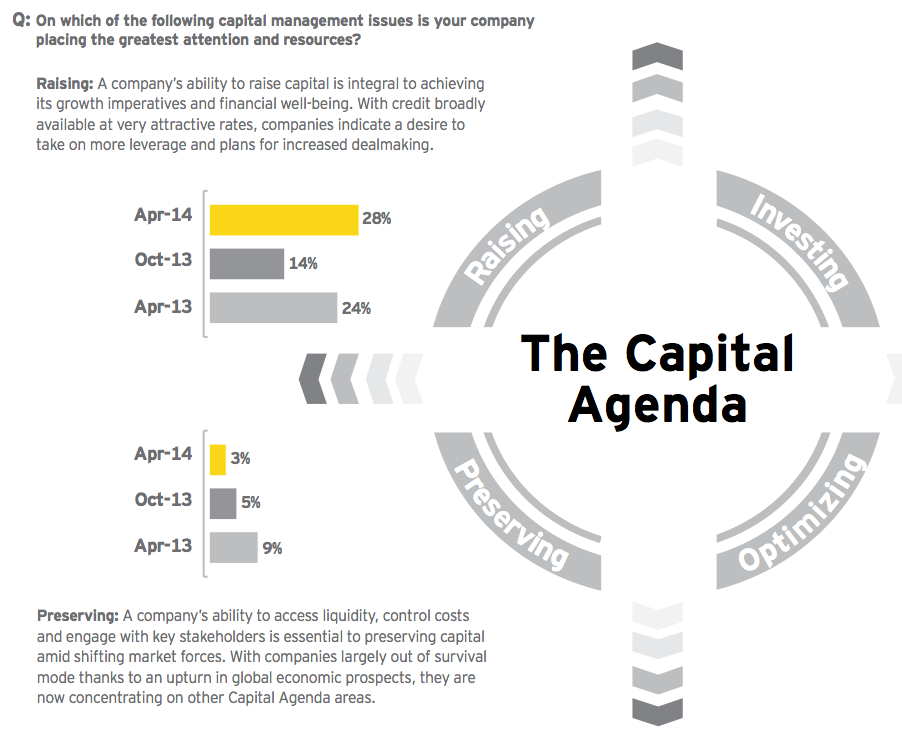

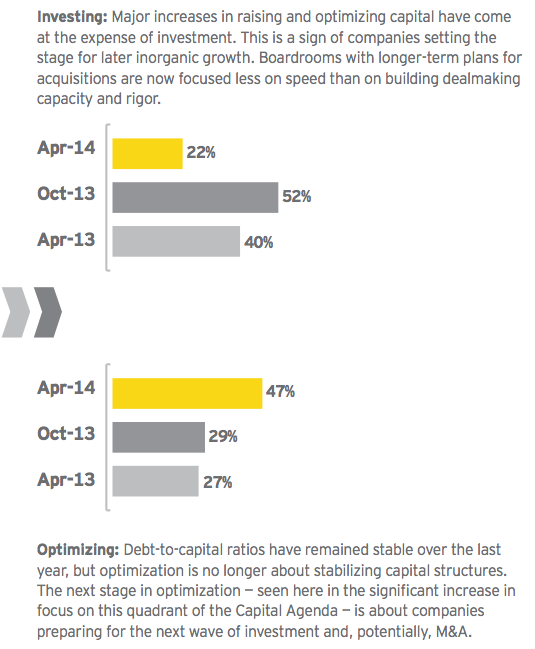

Shift toward optimizing and raising capital

Increasing leverage and further optimization point to focused growth strategies and selective M&A investment

About this survey

The Global Capital Confidence Barometer gauges corporate confidence in the economic outlook and identifies boardroom trends and practices in the way companies manage their Capital Agendas — EY’s framework for strategically managing capital.

It is a regular survey of senior executives from large companies around the world, conducted by the Economist Intelligence Unit (EIU). Our panel comprises select global EY clients and contacts and regular EIU contributors.

• In March we surveyed a panel of more than 1,600 executives in 54 countries; half were CEOs, CFOs and other C-level executives.

• Respondents represented 22 sectors, including financial services, consumer products, technology, life sciences, automotive, oil and gas, power and utilities, mining and metals, diversified industrial products and construction.

• Companies’ annual global revenues ranged from less than US$500m to greater than US$5b: <US$500m (17%); US$500m—US$999.9m (25%); US$1b—US$4.9b (31%); and >US$5b (27%).

• More than 800 companies would have qualified for the Fortune 1000 based on revenue.

• Company ownership was publicly listed (68%), privately owned (21%), family-owned (6%), government/state-owned (3%) and PE/portfolio-owned (2%).

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter