Publications Global Capital Confidence Barometer – Growing Forward

- Publications

Global Capital Confidence Barometer – Growing Forward

- Christopher Kummer

SHARE:

By Pip McCrostie – Ernst & Young

An imperative to act: seizing first-mover advantage as confidence returns

Our eighth Global Capital Confidence Barometer shows a clear rebound in corporate confidence. After years of conservative decision-making, executives are steadily trending toward an investing agenda. But are companies being bold enough?

Expectations for global economic growth, corporate earnings and credit availability are at some of their highest levels in two years. Normally, this positive sentiment would translate into significant capital investment and M&A activity.

However, our respondents are gravitating toward lower-risk value-creation and growth strategies, including organic growth, smaller bolt-on acquisitions, optimizing capital structure, strategic divestments and more rigorous cost control and operational efficiency.

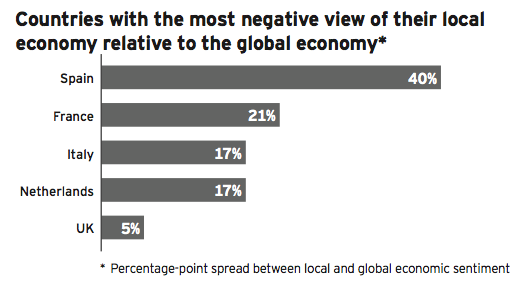

The current situation can best be described as a confidence paradox — a disconnect between confidence and M&A activity. Pre-financial crisis, economic sentiment and M&A activity moved in harmony. However, in the “new normal” economy, these indicators are decoupled. Macroeconomic risks, such as the Eurozone crisis, US sequestration and fiscal policy challenges alongside slowing emerging markets growth, have given companies pause. Consequently, some of the world’s richest and most mature economies, which would be expected to lead a recovery, lack confidence within their borders, lowering appetite for capital investment worldwide. But companies must not allow risk aversion to become the risk itself.

We may be at an inflection point: valuation levels and sentiment suggest there is a window of opportunity to seize first-mover advantage in a market gaining momentum. History shows that first movers in any economic cycle can create differential value and position themselves for sustained market leadership. Now is the time to invest and grow forward.

About this survey

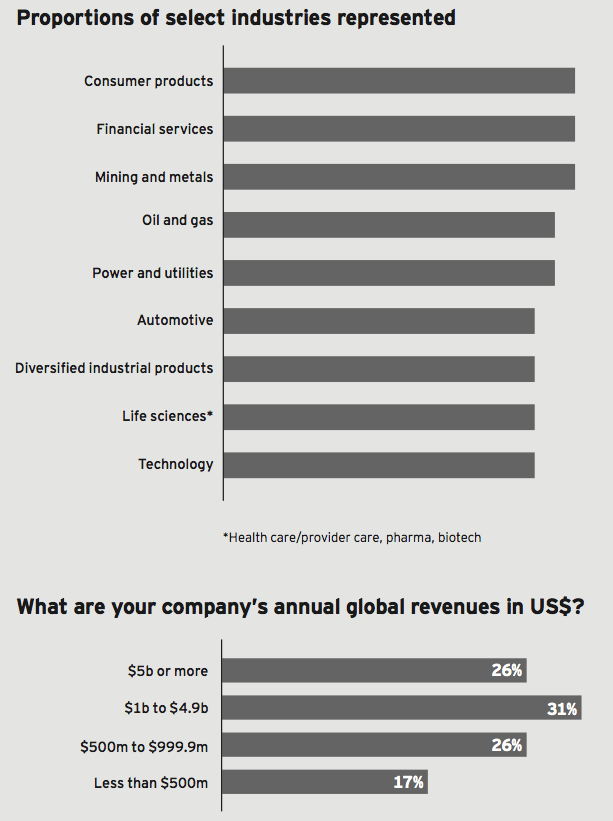

The Global Capital Confidence Barometer is a regular survey of senior executives from large companies around the world, conducted by the Economist Intelligence Unit (EIU). Our panel comprises select Ernst & Young clients and contacts and regular EIU contributors. This snapshot of our findings gauges corporate confidence in the economic outlook, and it identifies boardroom trends and practices in the way companies manage their Capital Agenda.

Profile of respondents

• Panel of almost 1,600 executives surveyed in February and March 2013

• Companies from 50 countries

• Respondents from more than 20 sectors

• 794 CEO, CFO and other C-level respondents

• 912 companies would qualify for the Fortune 1000 based on revenue

The Capital Agenda

Based around four dimensions, it helps companies consider their issues and challenges, understand their options and make more informed capital decisions.

1. Preserving capital: reshaping the operational and capital base

2. Optimizing capital: driving cash and working capital and managing the portfolio of assets

3. Raising capital: assessing future capital requirements and assessing funding sources

4. Investing capital: strengthening investment appraisal and transaction execution

Key findings

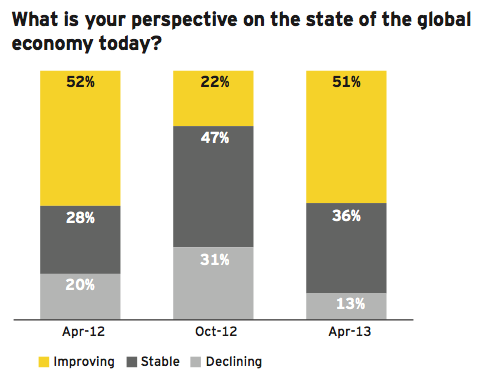

• 51% think the global economy is improving, up from 22% six months ago.

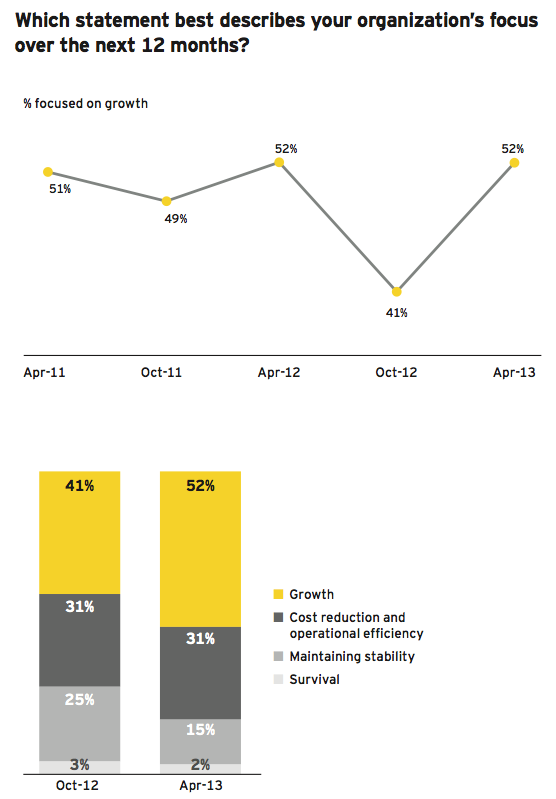

• 52% of companies focused on growth, up from 41% in October 2012.

• 49% view credit availability as improving.

• 72% expect global M&A volumes to improve; 29% expect to do a deal in the next 12 months.

• 44% expect valuations to rise in the next 12 months.

Economic outlook

Rebound in global economic confidence

Overall economic confidence has improved significantly from October 2012. In total, 87% view the economy as either stable or improving — up from both six months ago (69%) and April 2012 (80%).

51% of respondents believe the global economy is improving, compared with 22% in October 2012

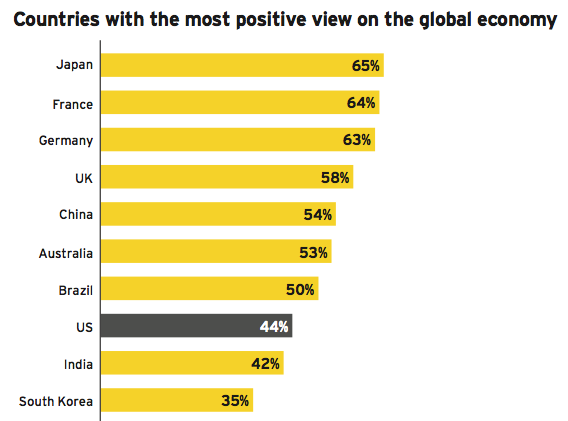

While global economic sentiment has improved significantly, Indonesia 5% some of the world’s most mature economies lack confidence within their borders, which has likely had an adverse influence on capital investment and M&A.

Confidence spans leading economic indicators

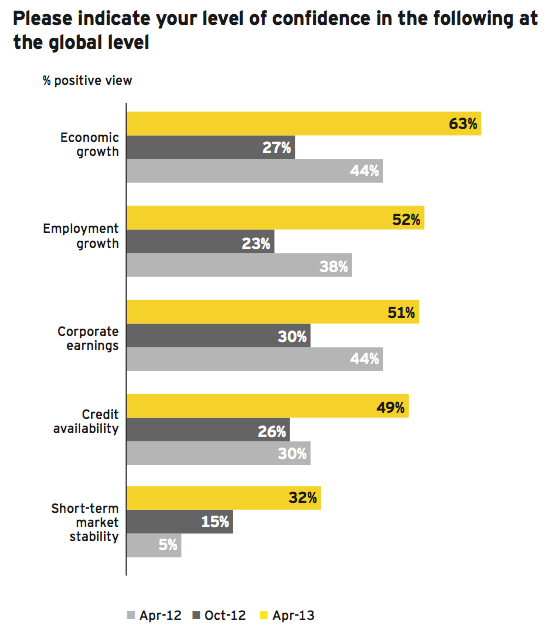

Our respondents’ increased confidence spans several leading economic indicators. At 63%, positive sentiment toward global economic growth is at its highest level in two years. More than half of the respondents are positive on corporate earnings and employment growth. Confidence about credit availability has also increased significantly over the last six months, and short-term market stability has more than doubled.

These increasingly positive views, coupled with favorable sentiment about the regulatory environment for business growth, would normally signal an increase in both capital investment and M&A. However, confidence is not translating into action.

51% of respondents are positive about corporate earnings, compared with 30% in October 2012

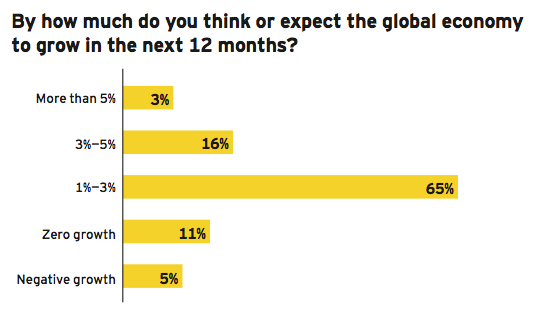

Low single-digit economic growth anticipated

In total, 84% of respondents expect to see some growth in the global economy, but most recognize it is unlikely to reach peaks last seen in 2006—07. The economic uncertainty that followed that period has been so long and pervasive that typical cyclical behaviors have changed.

65% of respondents expect the global economy to grow by 1%—3%

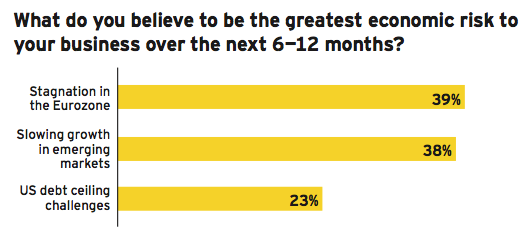

Global economic risks persist

Global market risks are well known by corporate boards. Eurozone issues and slowing growth in emerging markets pose material challenges to their businesses. In response, many companies have adjusted their strategies to compensate for these risks, while others view them as a source of opportunity.

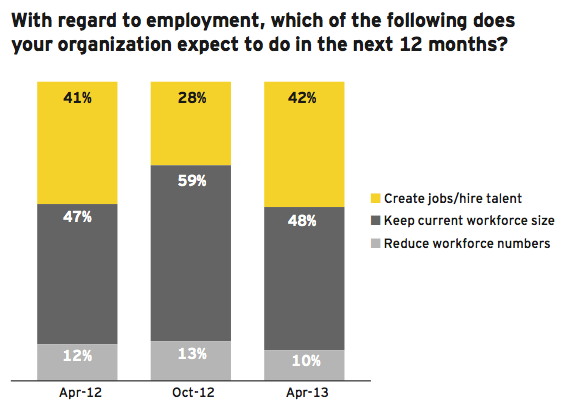

42% of respondents expect to create jobs or hire talent, compared with 28% in October 2012

Viewpoint: The growth dilemma

When does risk aversion itself become a risk?

Over several Barometers, we have observed a disconnect between macroeconomic conditions and corporate action — improving confidence and strong deal fundamentals have not led to a rebound in M&A.

This corporate caution is understandable. The global financial crisis has been drawn out, with moments that suggested turnaround that never materialized. Amid this persistent crisis environment, the current generation of corporate leaders has largely pursued growth through organic measures or optimization efforts. They have largely been rewarded by boards for these conservative instincts.

However, we may be nearing the point where this sustained caution itself becomes risky. Organizations in search of growth may need to take an informed risk — to achieve their strategic objectives and to outpace competitors. First-mover advantage is a constant, even in today’s markets.

Leading companies are laying the groundwork for taking action when the time is right. That means honing their Capital Agenda: fine-tuning the capital structure, defining core businesses, executing divestments when necessary, and putting in place proper risk management and governance. Most important, it means answering the questions, “Where do you want to grow?” and “What will it take?”

Job creation signals planned growth

Forty-two percent of respondents expect to hire talent or create jobs — a strong improvement from 28% in October 2012. Even more encouraging, plans for workforce reduction are at 10%, the lowest they have been in two years.

Access to capital

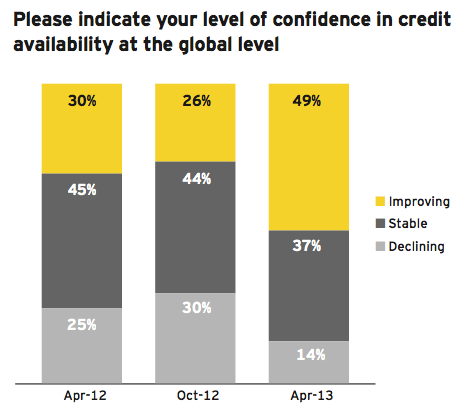

Credit increasingly available

In addition to having an improved outlook on the global economy, companies are more confident than ever about their ability to access the credit markets.

When asked about credit availability, almost half of respondents see improvement, the highest level in two years. Only 14% report a decline — again, the lowest level in two years.

Top five countries with the highest positive view on global credit availability

1. China

2. US

3. Australia

4. Canada

5. Japan

49% of respondents view credit availability as improving, compared with 26% in October 2012

Appetite for leverage grows

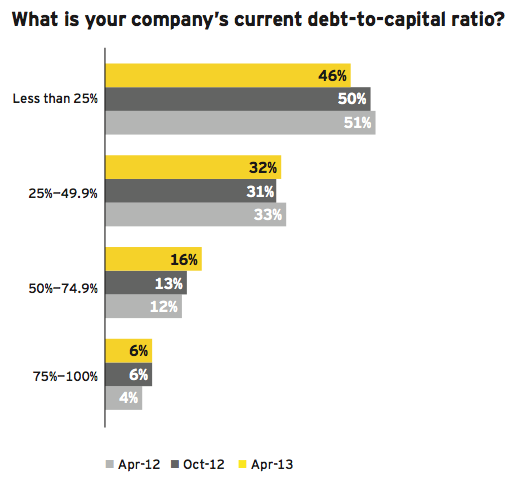

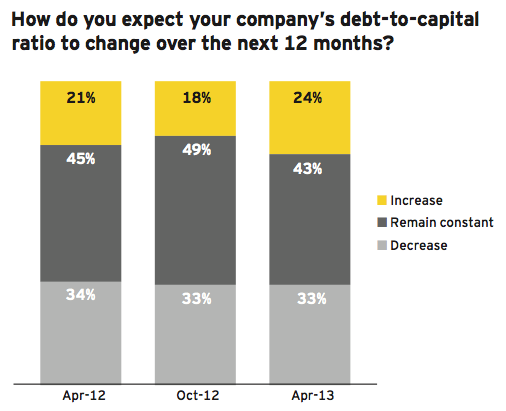

We may be near an inflection point, with companies’ large-scale changes to capital structure now nearing completion. Debt-to-capital ratios remain fairly constant today, but the appetite for leverage is expected to accelerate over the next year. However, the question remains why organizations are not already taking greater advantage of available credit.

24% of respondents plan to increase their debt-to-capital ratio — up from 18% six months ago

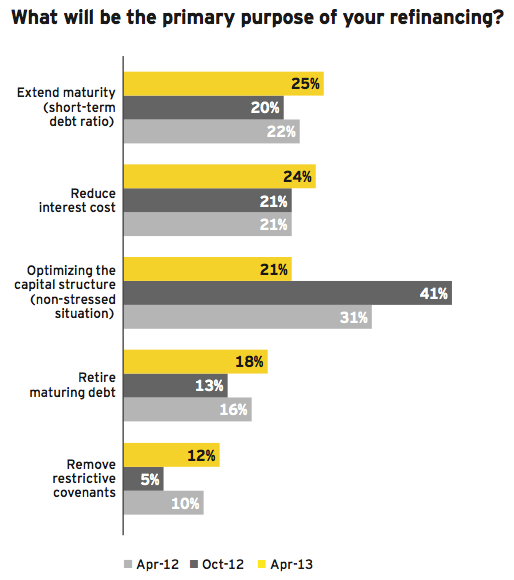

For the next 12 months, those companies that plan to refinance debt (29%) say they will focus on refinements, including reducing interest rates, extending maturities and removing covenants.

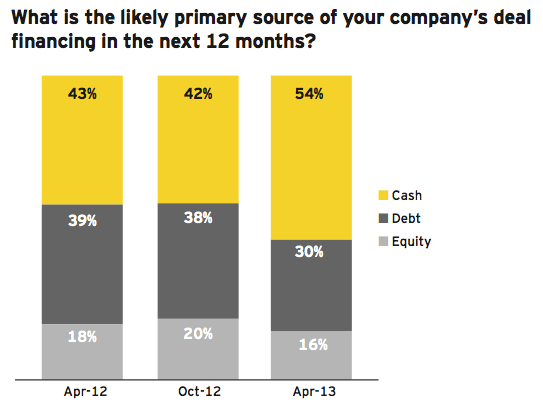

Cash dominates near-term deal financing

The predominant use of cash to finance transactions is indicative of companies’ ongoing cautionary mindset.

More than half of respondents point to cash as their primary source of deal financing over the next 12 months. Less than one-third say they plan to use debt (30%) as their primary source, despite reporting abundant credit availability. Companies’ reluctance to leverage their own equity may be a symptom of volatility in the capital markets.

29% of companies expect to refinance loans or debt obligations

Viewpoint: Credit availability as leading indicator

Our survey shows a higher number of companies expecting an increase in their debt-to-capital ratio, from 18% in October 2012 to 24% in this Barometer. Coupled with a large increase in those citing greater overall availability of credit (from 26% to 49%), this signals that respondents’ appetite for leverage is poised to rise.

Throughout the economic crisis, companies in preservation mode came to view the use of credit as negative. But the reputation of credit, like the economy at large, is slowly being rehabilitated. After several Barometers in which more than half of respondents had low debt-to-capital ratios, in this issue that metric falls to 46%.

At a time of ample credit availability and historically low pricing, leading companies are coming to view credit as a tool to fuel their growth agenda.

Growth

Appetite for growth rebounds

As confidence in the global economy returns and credit availability improves, companies are reporting an increased appetite for growth and a steady move toward investment.

When asked about their companies’ focus over the next 12 months, more than half of respondents (52%) cited growth — more than all other responses combined, and a major rebound from October 2012. Even amid this growing optimism, nearly one-third of companies (31%) remain focused on cost reduction and operational efficiencies. Companies focused on either stability or survival have decreased significantly.

Plans for excess cash shift toward growth strategies

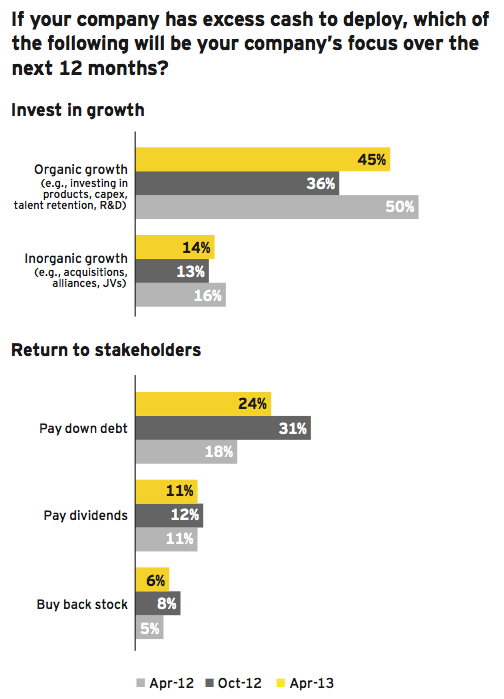

Companies with excess cash are deploying it toward growth and away from returning it to stakeholders. In total, 59% of respondents are pursuing either organic or inorganic growth with their excess cash; organic growth continues to be the major preference (45%). Only 41% in total say they are focused on returning cash — through paying down debt, paying dividends or buying back stock — a drop of 10 percentage points since October 2012.

Organic growth driven by balance risk portfolio

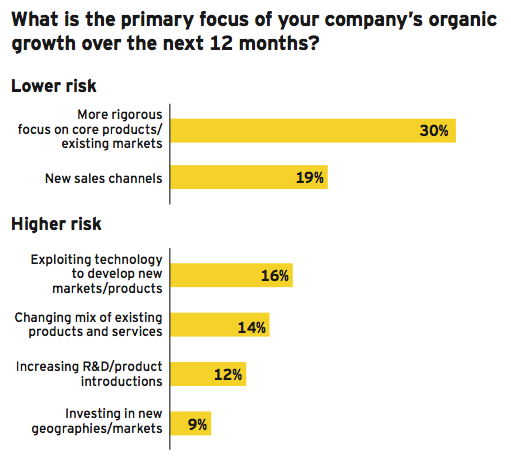

Companies are largely focused on lower-risk growth strategies — much more cautious approaches than one would expect, given increased confidence and credit availability. This has become the “new normal” in the post—financial crisis world: growth activities perceived as higher-risk are more cautiously pursued. Companies will want more and longer-lasting evidence of an upturn before making major investments.

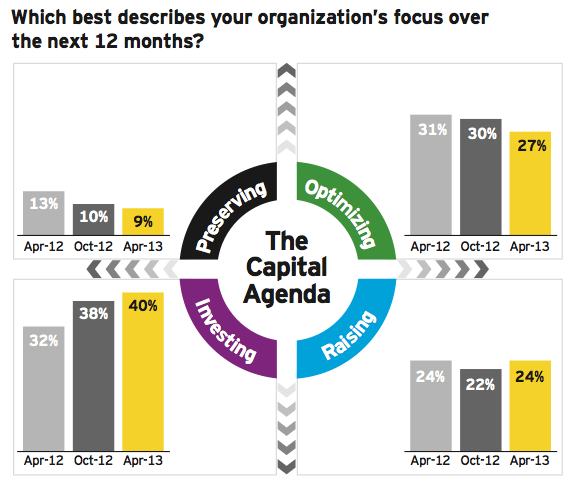

Investing dominates the Capital Agenda

Companies expect their Capital Agenda priorities to continue to move toward investing over the next 12 months. Their focus on investing has moved steadily upward over the last year (now at 40%), while plans to preserve, optimize and raise capital have held steady or declined slightly. While companies are repositioning toward an investment mindset, they continue to pursue organic growth and portfolio-optimization strategies.

Viewpoint

Boardrooms balancing governance and growth

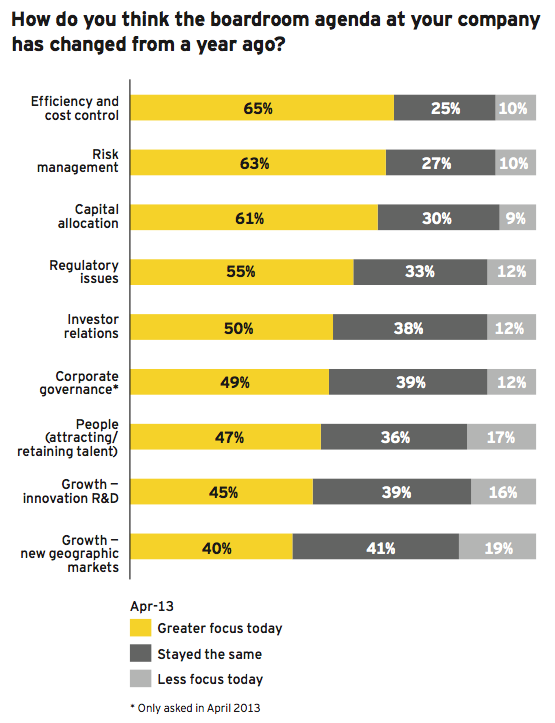

Boardrooms are currently focused on the fundamentals: efficiency, cost control, risk management, capital allocation, regulatory issues, investor relations and corporate governance. All of these agenda items, which were cited by half or more of our respondents, point toward companies building greater stakeholder accountability.

Riskier growth measures, including research and development, are lower on the agenda. However, the findings in this Barometer point to a window of opportunity for accelerated growth. Economic confidence, credit conditions and valuations — along with a recent rise in shareholder activism — all signal an imperative to act. Prudent discipline and governance are necessities. But now may be the time for boards to achieve first mover status.

Mergers and acquisitions outlook

Global deal volumes and appetite expected to improve

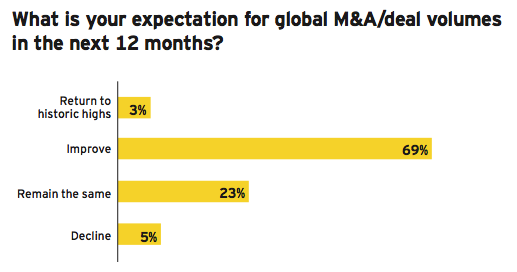

There is a strong consensus global M&A volumes will increase as confidence in the overall economy climbs. In total, 72% of companies expect global deal volumes to improve over the next 12 moths.

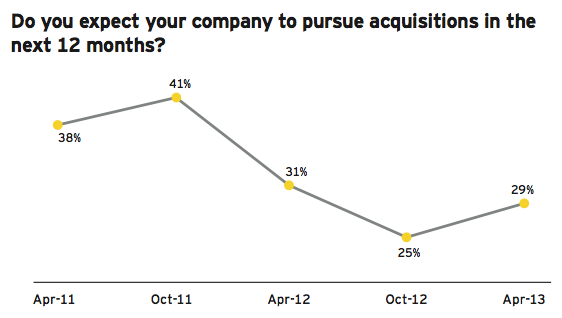

Twenty-nine percent of respondents expect their company will pursue one or more acquisitions in the next 12 months.

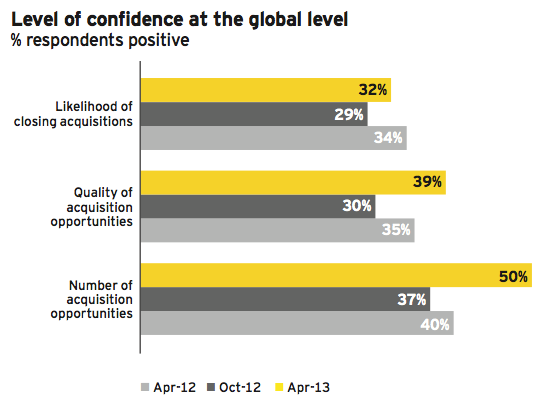

The improvement in acquisition plans (29%) is largely driven by an increasing number, and a higher quality, of acquisition opportunities. Thirty-nine percent of companies say there are quality acquisition opportunities available, compared with 30% six months ago; 50% feel more confident about the number of opportunities available, versus only 37% six months ago.

Bias toward smaller deals as conservatism persists

Consistent with sentiment over the past six months, deals are likely to remain smaller in size despite record amounts of available cash and improving credit conditions. In total, 88% of respondents planning acquisitions expect deals to be under US$500 million. The pursuit of smaller transactions aligns with companies’ overall strategy toward organic growth and lower-risk sentiment.

Sectors likely to see the most activity are those providing growth opportunities in emerging markets and North America.

Sectors with highest expected acquisition activity

1. Technology

2. Automotive

3. Life sciences

4. Consumer products

5. Oil and gas

53% expect to do deals between US$51 million and US$500 million in the next 12 months, up from 46% from October 2012

Valuations increasing

Expectations for increased valuations are now at their highest level in the history of our Barometer: 44% of companies expect prices/valuations to rise in the next year, up from 31% in October 2012. Just 7% of companies expect valuations to decline, compared with 27% six months ago, suggesting the market has stabilized.

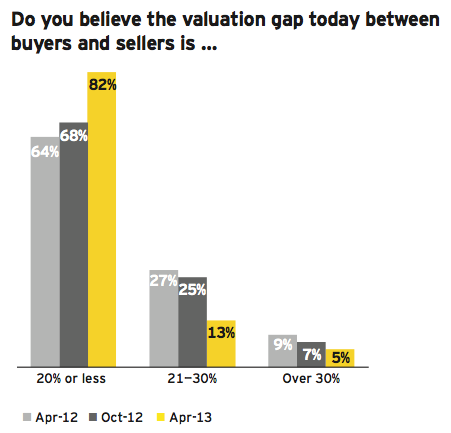

Most respondents (82%) say the valuation gap is 20% or less, compared with 68% in October 2012. However, while valuation gaps are narrowing, this trend is not expected to continue over the next year, as 79% of respondents expect the gap to widen or stay the same.

44% of respondents expect valuations to increase over the next 12 months, compared with 31% in October 2012

Viewpoint

A possible inflection point in asset valuations

A contributing cause to the ongoing slowdown in deal-making is a perceived gap in asset valuations between buyers and sellers. Companies pursuing divestments are seeking high valuations for their assets, while potential buyers are primed for discounts and reluctant to pay a premium.

However, we may now be nearing equilibrium between what buyers will pay and what sellers will accept. This equilibrium is vital, signaling the deal markets are at an inflection point and ready to rebound. The pendulum is primed to swing the other way — toward growing prices by buyers and more profitable exits for sellers. This also suggests a comeback in market fundamentals, corporate health and a stable foundation for deal-making.

With 44% of respondents expecting M&A assets to increase in value over the next 12 months (and only 7% anticipating a decrease), companies should consider taking advantage of this inflection point now.

Deals to span developed and emerging markets

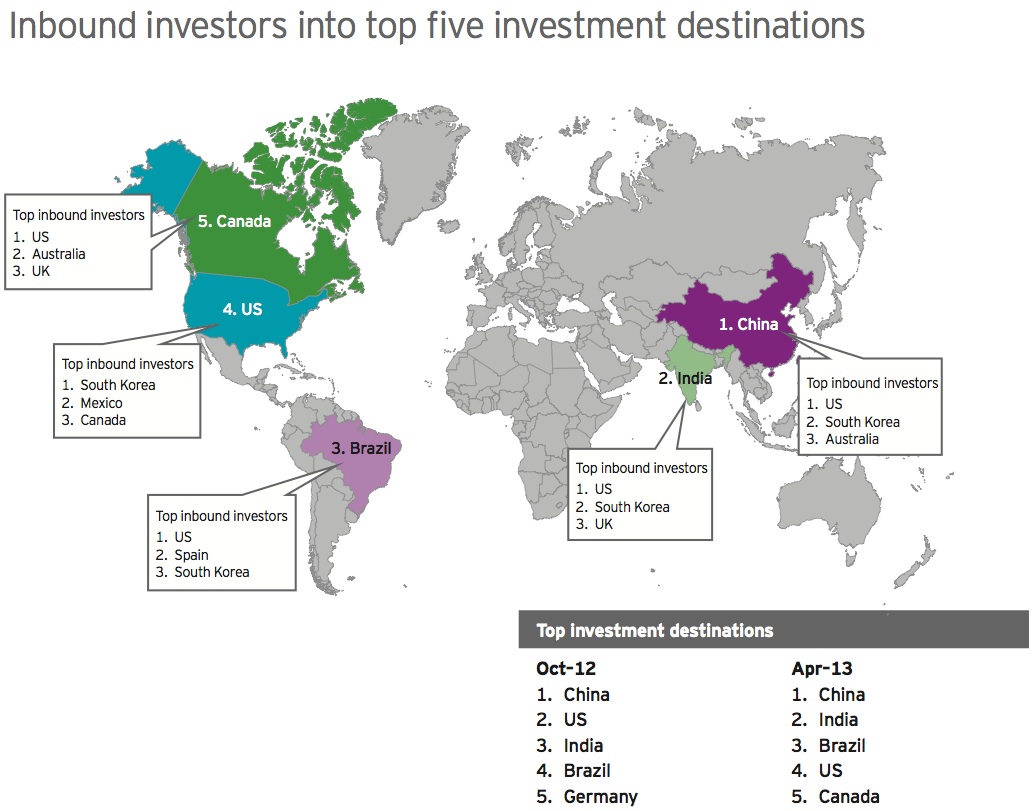

Investment destinations continue to evolve as companies challenge their growth strategies and underlying risk tolerance. The top five countries include both emerging and developed markets: China, India, Brazil, the United States and Canada. This is a shift from six months ago, when the US ranked second behind China, and Germany rounded out the top five instead of this year’s new entrant, Canada.

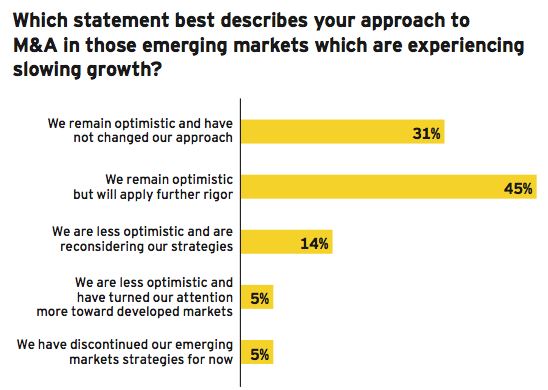

Companies remain optimistic about deals in emerging markets but are exercising more caution. In light of slowing growth, almost 70% of respondents have changed their approach to investing in these markets, of those, 45% say they will apply “further rigor”.

Divesting for value

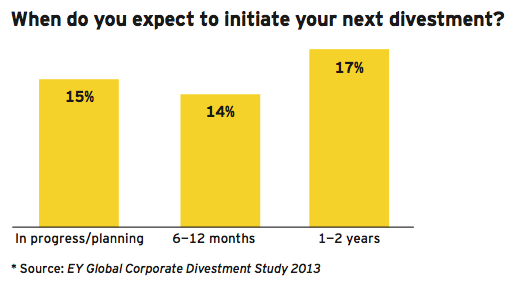

Divestments are now an established tool for creating shareholder value. In total, 29% of respondents* either have a divestment in progress or are planning one in the next 12 months, and nearly half expect to divest in the next two years. A steady stream of divestments will provide capital to fuel growth in the future.

Top reasons companies will pursue divestments

1. Focus on core assets

2. Enhance shareholder value

3. Raise capital

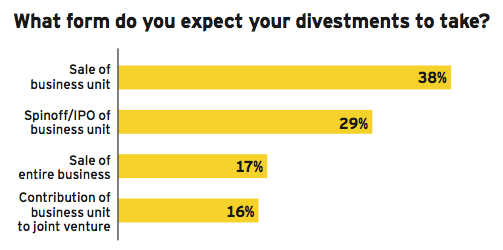

In total, 83% of the companies planning divestments expect that those divestments will involve the carve-out of one or more business units. These transactions — whether structured as an outright sale, spinoff, IPO or contribution to a joint venture — are highly complex and will require companies to employ formal and rigorous processes around divestment.

Survey demographics

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter