Publications Direct And Indirect International Experience Of Shareholders, Ownership Structure And Cross-Border M&A

- Publications

Direct And Indirect International Experience Of Shareholders, Ownership Structure And Cross-Border M&A

- Christopher Kummer

SHARE:

By Chenxi Guo, Ping Lv

Abstract

Prior research suggests that international experience only are directly learnt by firms’ international operations. In this study, we argue that majority shareholders are part and parcel of the network of internal and external international experience. Based on the sample of 307 cross-border M&A of 741 majority shareholders in 188 Chinese listing enterprises for the 2005–2014 time period, we measure direct international experience and indirect international experience using centrality analysis in two-model social network. We find that internal and external international experience jointly facilitate cross-border M&A. Furthermore, the moderate effect of ownership structure on the relationship between different international experience and cross-border M&A are complete opposite.

1. Main text

The conceptualization of international experience, is the extent to which the firm’s international experience can be learnt and applied across its international operations, giving its role in explaining firm internationalization. From the knowledge based view and transaction cost economics, firms’ prior international experience represented firm-specific knowledge that is difficult to imitate, helps reduce the risks involved in going abroad, influences managers’ perceived costs of internationalization and make greater commitments to a foreign investment. Nevertheless, as the value of international experience lies in the FSAs that the firm develops as a consequence of its experience, whether can firms acquire or gain access to international experience from other sources? A key objective of this paper is to propose an explanation for this puzzle. Our explanation as well as its test makes several novel contributions to the relevant literature using ample of 307 cross-border merge and acquisition (M&A) of 741 majority shareholders in 188 Chinese listing enterprises for the 2005–2014 time period. First, international experience are divided into two parts based on their sources. We accept the traditional premise that direct international experience are learnt by doing. However, we argue that this premise is logically compatible with the idea that indirect international experience are learnt by alliances. For example, majority shareholders in a listing company are kind of capitalism alliances or strategic alliances. Put simply, we propose that direct and indirect international experience jointly facilitate the probability and acquired equity of cross-border M&A.

Second, we measure direct and indirect international experience using centrality analysis in two-model social network. Many large real-world networks, which are composed of a number of actors and some events, exhibit a two-mode nature because the events and actors are linked by the affiliations, relationships or interactions between them. The relationship between the cross-shareholders and cross-border M&A (S–M) is not only an investment relationship but also a type of affiliation relationship. We propose that degree centrality (DC) presents direct international experience, which means the cross-border M&A involvement of shareholders; betweenness centrality (BC) refers indirect international experience, which evaluate the alliances between each pair of shareholders.

Third, our empirical analysis also uniquely highlights an important but underexplored moderate effect of ownership structure on the relationship between international experience and cross-border M&A. Our results show that highly concentrated ownership structure helps strength the positive relationship between direct international experience and cross-border M&A, but weaken the positive relationship between indirect international experience and cross-border M&A.

Our arguments and evidence are critical to understanding the direct international experience learnt by doing and indirect international experience learnt by alliances. We point out that moderate effect of ownership structure are complete opposite of the relationship between direct and indirect international experience and cross-border M&A. The remainder of this article is organized as follows. First the literature review that has inspired our research questions is explored. Next, the hypothesis is described, followed by the research design. At last, we analysis the result and make conclusions.

2. Literature review

The firms’ shareholders (principals) are interested in a maximization of the firm value. While firm internationalization are accompanied by huge risk, there is a positive relationship between the degree of internationalization and the market value of equity. In this context various researchers highlight risks such as ‘‘liability of foreignness’’ and ‘‘double-layered acculturation’’. Shareholders other than management can potentially influence the actions taken by management. The cross-border M&A process is a complex systematic project, which run through numerous essential stages. Very and Schweiger identify four stages about an cross-border acquisition strategy: identifying, selecting, and analyzing acquisition candidates; target analysis, first contacts, valuing and pricing, structuring deals; negotiating with targets and other stakeholders; the post-acquisition integrating. International experience is important in explaining the internationalization pattern of firms in the inter nationalization process model. An important aspect of the conceptualization of traditional international experience, given its role in explaining firm internationalization process, is the extent to which the firm’s international experience can be acquired and applied across its international operations.

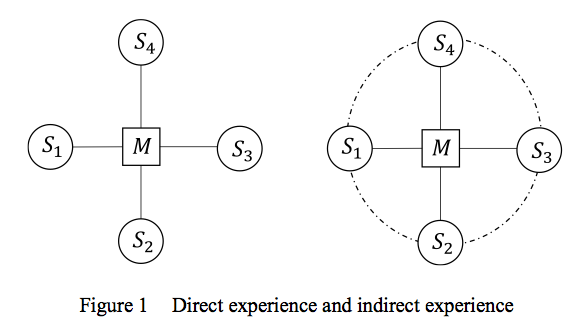

According to organizational learning and knowledge literature, international experience are divided into two types: explicit knowledge which is more easily codified and tacit knowledge which is difficult to codify or explain. Rugman & Verbeke link the source of the firm’s international tacit experience to the type of FSA, namely location-bound FSAs versus non-location-bound FSAs. Non-location-bound FSAs were traditionally considered to be exploitable globally without significant adaptation, but are now thought to be limited in their application to the firm’s home region, such as government approval support. In contrast, location-bound FSAs can only be exploited in a specific location or set of locations, because firms develop them in response to ‘specific local customer needs and market conditions, as well as government regulation’ in host country, such as post-acquisition integrating. These direct international experience are learnt by doing shown in left side of Figure 1. S1, S2, S3 and S4 represent four majority shareholders of firm A and M is one of cross-border M&A of firm A.

Nevertheless, as the value of international experience lies in the FSAs that the firm develops as a consequence of its experience, whether can firms acquire or gain access to international experience from other sources? The prior studies identified rarely address these substitutes for international experience. Clarke, Tamaschke & Liesch propose some substitutes for direct international experience, such as, alliances with internationally experienced firms. Majority shareholders in a listing company are kind of capitalism alliances or strategic alliances. They learn by alliances shown in right side of Figure 1. S1 and S2 represent two majority shareholders of firm A, and M is one of cross-border M&A that they participate. S1 and S2 connected with M learn by doing and form direct international experience displayed by solid line. S1 and S2 connected with each other learn by alliances and form indirect international experience displayed by dashed line..

3. Hypotheses

3.1. International experience and cross-border M&A

While a substantial amount of attention within social network analysis (SNA) has been given to the study of one-mode networks, there is an increasing consideration of two-mode networks. It is now recognized that such data are particularly important. These kind of social network relations consist of the linkages among actors through their joint participation in social activities or membership in collectivities. Such networks of actors tied to each other through their participation in activities, and activities linked through multiple memberships of actors, are referred to as affiliation networks, membership networks, dual networks, or hyper networks. A theoretically important property of an affiliation network is that actors create linkages between events and events create linkages between actors. Formally, a two-mode network consists of two key elements: a set of actors and a collection of subsets of actors (called events).

Nevertheless, the decision as to whether to opt for full or partial ownership in a foreign investment carries significant strategic importance owing to the inherent benefits and risks of each foreign establishment and entry mode. From the knowledge based view, a firm’s prior entry experience represents firm-specific knowledge that is difficult to imitate. Simultaneously, according to transaction cost economics, firms with prior entry experience develop organizational capabilities that enable them to make greater commitments to a foreign investment. In addition to a local knowledge base, firms’ prior international experience helps reduce the risks involved in going abroad and influences managers’ perceived costs of internationalization. From the above, more direct international experience learnt by doing help multinational corporations decrease the uncertainty of environment and overcome the liability of foreignness.

Hypothesis 1a: Direct international experience learnt by doing will facilitate cross-border M&A.

Preceding arguments assume firms gain crucial knowledge about home and host countries and develop organizational capabilities only through incremental and time consuming learning-by-doing processes of conducting business abroad. Empirical studies suggest that a transfer of knowledge may considerably benefit from embeddedness into networks. As one kind of alliances between major shareholders, the opportunities for interfirm transfer of capabilities afforded by different alliance structures influences the choice among them, since equity-based joint ventures are more effective vehicles for the transfer of tacit knowledge between the partners. These external relationships permit shareholders to access explicit knowledge possessed by its alliance partners. Collaborative equity-based alliances that involve the exchange and sharing of multiple resources for the development of international experience and information also helps reduce the risks involved in going abroad and influences managers’ perceived costs of internationalization. These arguments lead to the first cluster of hypothesis.

Hypothesis 1b: Indirect international experience learnt by alliances will facilitate cross-border M&A.

3.2. International experience, ownership structure and cross-border M&A

Eclectic paradigm highlights the importance of the advantages of ownership in shaping internationalization decisions. In order to overcome the differences in risk preferences and the incongruence of goals between principals and agents in typical agency relationships, ownership gives CEOs and TMTs an incentive to assume the potential risks associated with international expansion. Oesterle, Richta, & Fisch test that the degree of ownership concentration has a complex impact on the choice where the firm conducts its international activities.

As many multinational firms in reality with multiple shareholders such a structure appears to be suboptimal for governance, leads to a free-rider problem: each investor individually has insufficient incentives to bear the cost of monitoring and participation. While splitting a block reduces the effectiveness of direct intervention, it increases the power of a second governance mechanism: speculative trading. Since cross-border M&A provide a rich opportunity for knowledge spillovers, the shareholders following the “Wall Street Rule” of “voting with their feet” are difficult to gain experience of cross-border M&A. Consequently, majority shareholders with greater direct international experience face fewer local knowledge disadvantages through learning by doing in firms with highly concentrated shareholders. Hence, we propose the following hypothesis:

Hypothesis 2a: Highly concentrated ownership structure helps strength the positive relationship between direct international experience and cross-border M&A.

Social network theorists have focused much of their attention on structural properties of networks, such as tie strength at the dyadic level. Tie strength characterizes the closeness of a relationship between two parties, in our case experience share and knowledge source, and is as a combination of closeness and interaction frequency of shareholders. Weak ties are less costly to maintain, having a network of predominantly weak ties is advantageous for firms requiring the receipt of mostly explicit knowledge. In firms with highly concentrated shareholders (family business and state owned enterprises), while strong ties with stable and trusting relationships lead to greater knowledge exchange, interaction of explicit and tacit knowledge are quite homogeneous. Consequently, weak ties in firms with highly dispersed shareholders, access to more indirect international experience through learning by alliances, which help overcome the liability of foreignness. Then, we propose the following hypothesis:

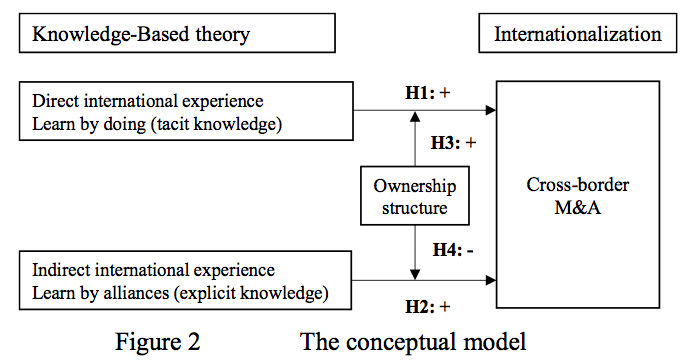

Hypothesis 2b: Highly concentrated ownership structure helps weaken the positive relationship between indirect international experience and cross-border M&A. Fig. 2 illustrates the conceptual model.

4. Research design

We test our hypotheses on a sample of Chinese listing corporations, deriving our sample from M&A database of Thomson Reuters. Since the restructuring of the government and enterprises started in 2005, which leaded to the cross-shareholding in Chinese listing enterprises, we collect our data from 2005 onwards. After deleting cases with missing values, there are a sample of 307 cross-border M&A of 741 major shareholders in Chinese listing enterprises for the 2005–2014 time period.

4.1. Dependent variables

We choose M&A success as the dependent variable of our study, which is a broadly discussed issue in the M&A literature. M&A success of 307 cross-border M&A have four conditions, completed, pending, withdrawn and unknown. Based on annual report of list companies, we check these information again. We categorize acquisitions completed after public announcement as 1, and other withdrawn or pending acquisitions as 0. This categorization method has been also used on the likelihood of completion such as Rossi & Volpin.

4.2. Independent variables

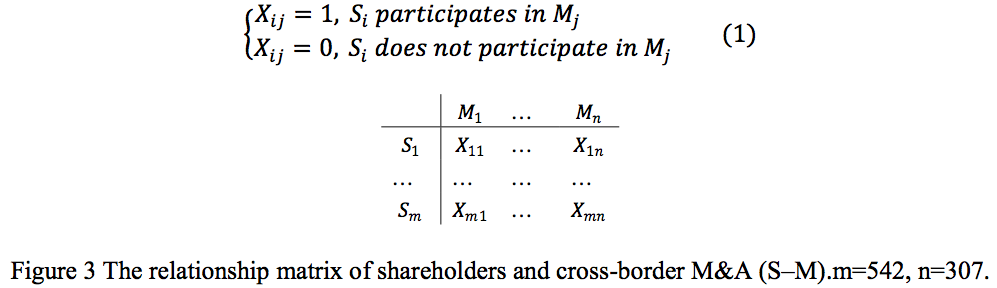

The relationship between the cross-shareholders and cross-border M&A (S–M) is not only an investment relationship but also a type of affiliation relationship. Usually, the network constructed by the so-called affiliation relationship is one of the two-mode networks, and it is also known as the membership-network or the hyper-network. The two-mode network is often formed by a set of actors (S) as well as a set of events (M). Figure 4 shows the relationship matrix between S (shareholders) and M (cross-border M&A), where Si represents each of the shareholders of Chinese listed companies, Mi represents each of cross-border M&A, and Xij represents the investment relationships (or the affiliation relationships) between the shareholders of Chinese listed companies and their cross-border M&A, which is defined as follows:

The measurement of centrality in two-model network analysis is quite different from that in one-mode network. Following Faust, we employ degree centrality (DC) and betweenness centrality (BC) of 2-model network to evaluate the direct experience learnt by doing and indirect experience learnt by alliances in cross-border M&A.

Direct experience. Degree Centrality (DC), is one of the most straightforward centrality indices, which measures the direct experience learnt by doing. In an affiliation network motivations for degree centrality are that actors are important because of their level of activity or the number of contacts that they have, as we describe in expression (2). We explicate the following abbreviated mathematical symbols. h is the number of total cross-border M&A.

4.3. Control variables

We controlled for the effect of Acquirer and host country. The effect of Acquirer includes firm size, firm age, industry, ownership, revenue, and ROA. We measured firm size as the natural logarithm of total assets, lagged by one year. Firm age equaled the total number of years since the firm’s inception. We controlled for industry and ownership by coding a dummy variable (1 if they belonged to manufacturing, 0 otherwise; 1 if they belonged to state-own enterprises, 0 otherwise). We next controlled for the influence of revenue and ROA, lagged by one year. To capture conditions in foreign markets, we add GDP per capita, technological readiness and culture distance. We controlled for real GDP per capita (constant 2000 US dollars), measured as the natural logarithm of GDP per capita. Technological readiness indicates the level of technological development of host country from the Global Competitiveness Report compiled by World Economic Forum for the period of 2005–2014. Then, we control culture distance by calculating the gap between China and host country based on the method of Hofstede. In addition, we included 9 dummy variables for the different years in the sample to control for time trends.

5. Results

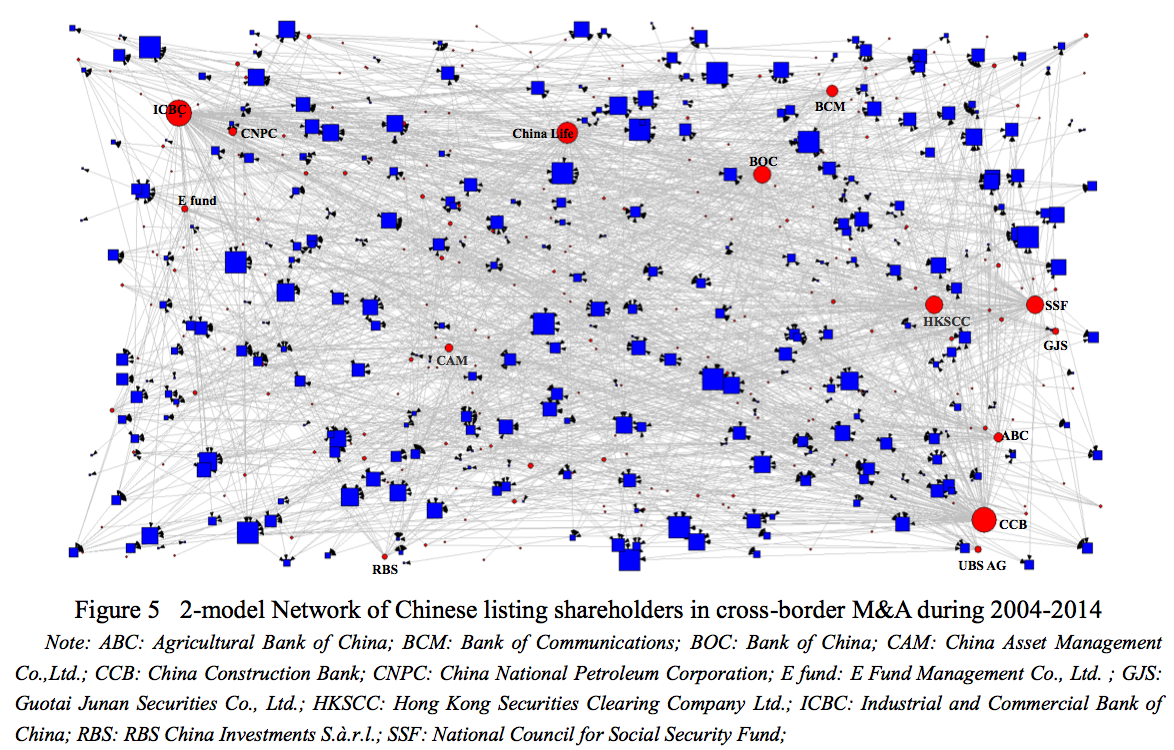

5.1. Two-model Network of Shareholders

In the cross-border M&A and shareholders affiliation network, shareholders can only be directly connected via cross-border M&A and not by other shareholders. Therefore, for the measurement of centrality, a different method and interpretation are used than those used in one-mode network analysis. The structural composition of the network was described and visualized using UCINET 6.287 in Figure 6. To calculate the degree in UCINET, the two-mode matrix was transformed into a bipartite one-mode representation, while normalized degree was obtained via the two-mode data procedure in UCINET.

5.2. Regression analysis

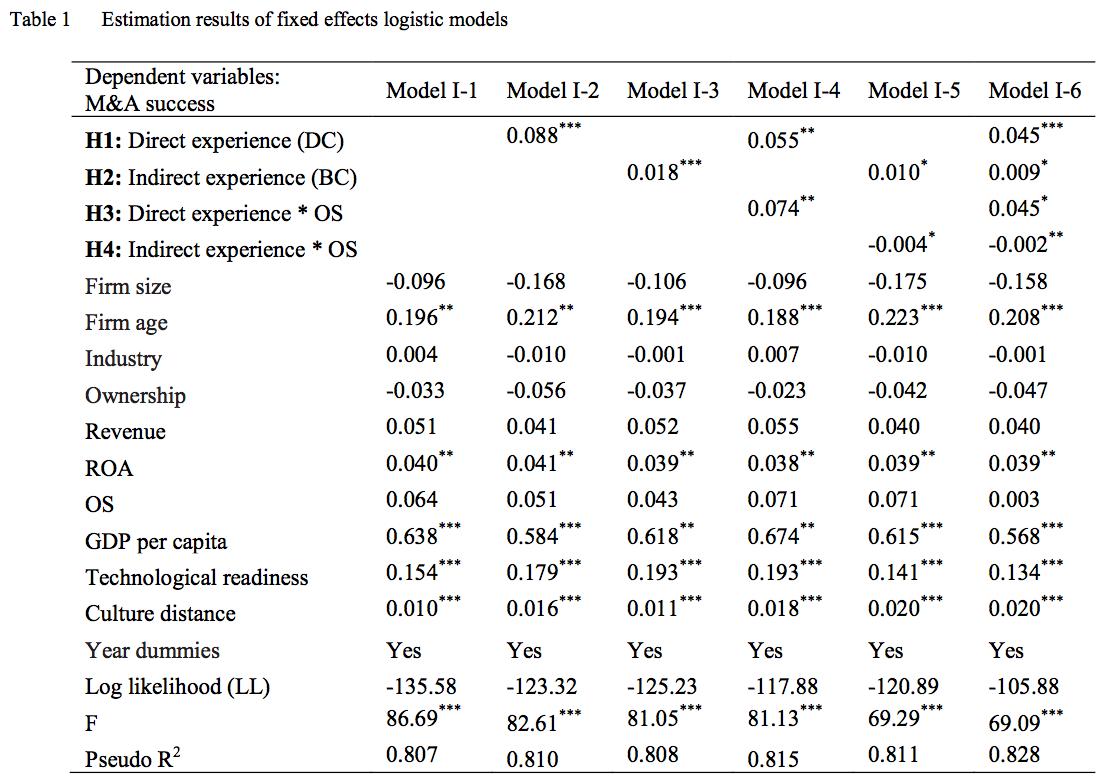

Table 1 present estimation results of logistic models explaining the likelihood of successful cross-border M&A. Testing Hypotheses 1a, we introduce the hypothesized direct international experience measured by degree centrality. Results in Model I-2 show that shareholders’ direct international experience learnt by doing have strongly significant and positive effects on cross-border M&A, in line with our theoretical expectations in Hypotheses 1. Prior entry experience, representing firm-specific tacit knowledge, face fewer local knowledge disadvantages and overcome obstacles to a foreign market entry. Direct international experience learnt by doing help improve the successful probability and commitments to cross-border M&A. In Model I-3, indirect international experience measured by betweenness centrality is significant and positive, supporting Hypothesis 1b. Cross-border M&A as collections of shareholders create conduits for the connection of pairs of shareholders. Partners in a cross-border M&A share and gain their international experience, leading to firm-specific explicit knowledge. Indirect international experience learnt by alliances also help overcome the liability of foreignness.

Then, we considered the moderate effects of ownership structure of firm on the relationship between different international experience and cross-border M&A. Results in Model I-4 represent highly concentrated ownership structure helps strength the positive relationship between direct international experience and cross-border M&A. In firms with highly dispersed shareholders, “free riding” and “voting with their feet” are relatively common. Their nonfeasance lead to few direct international experience and impede enterprise internationalization. On the contrary, in firms with highly concentrated shareholders, major shareholders take an active part in cross-border M&A and cultivate specific tacit knowledge, resulting to facilitate firm internationalization.

Furthermore, in H2b we suggested that firms with concentrated ownership would weaken the relationship between centrality of shareholders and cross-border M&A, supported by the results in Model I-5. The relationship between shareholders in firms with concentrated ownership are stable and reliable, which is called “strong ties”, leads to invalid exchange of homogeneous explicit knowledge. Nevertheless, since speculative trading is the main governance mechanism, pair shareholders in firms with highly dispersed ownership forms “weak ties” with low entry barriers and exit barriers. Through capitalism alliances or strategic alliances, they share and communicate heterogeneous explicit experience and information. Ultimately, weak ties between dispersed shareholders will help cross-border M&A.

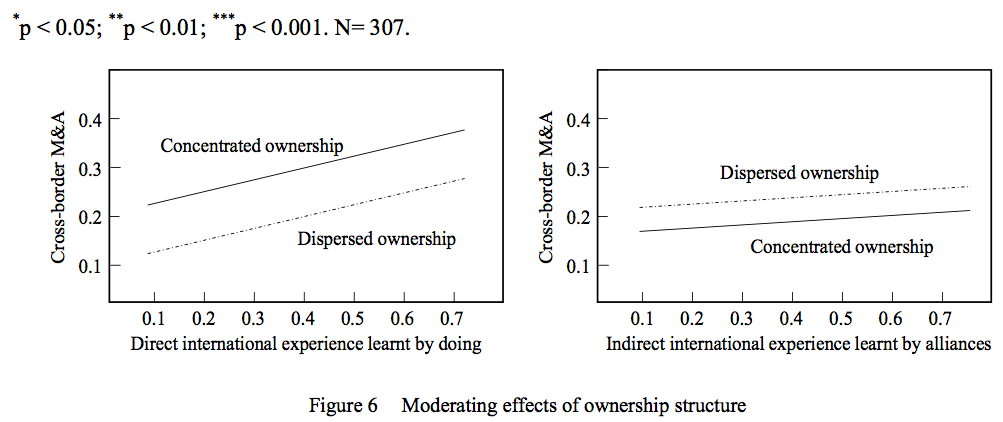

However, since statistical significance does not equal economic significance, very small coefficients may have little economic impact. Therefore, to explain better the moderating effects of ownership structure, we have graphically presented these relationships in Fig. 6.

6. Conclusions

Both the prior entry international experience learnt by doing and the effect of direct international experience have been widely understood in firm internationalization. The central argument in this paper has been that this is not inconsistent with the idea that the source of international experience are respectively learnt by doing and learnt by alliances from two-mode networks of shareholders and cross-border M&A, forming direct international experience and indirect international experience. In addition, ownership structure have different moderate effect on the relationship between international experience and cross-border M&A. We find robust support for our theory about the effect of international experience and moderate effect of ownership structure on cross-border M&A. Consistent with the analysis of past studies, traditional international experience can be acquired and applied across its international operations, but it is ignored that firms can acquire or gain access to international experience from other sources, such as alliances with internationally experience firms.

Empirically, we contribute in several ways. First, ours is among the first papers in the international experience effects literature to take into account the different sources – the direct and indirect international experience. We are able to do this by estimating two-mode networks using cross-border M&A data on Chinese listed firms in our sample. In contrast, most prior literature has focused on only direct international experience. Second, we assess disparate moderate effect of ownership structure on the relationship international experience and cross-border M&A shown in Fig. 6.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter