Publications Asia-Pacific Health Industries 2015: Keeping You Up-To-Date With The Latest Developments

- Publications

Asia-Pacific Health Industries 2015: Keeping You Up-To-Date With The Latest Developments

- Christopher Kummer

SHARE:

Special Report: Healthcare in Asia

South East Asia

New Health Era in South East Asia

There is no other sector as important as health. Health matters to each of us as individuals. It is our most precious and valuable asset and connects us all like no other.

Health also matters to society. It lies at the heart of our economic, political, social and environmental prosperity and is now the world’s largest industry – with a value and cost three times greater than the banking sector. Technological advances, empowered consumers, disruptive new entrants, and rising demand by an ageing population are ushering in a new era in healthcare. While many of these trends have been emerging for some time, never before have they been accompanied by a rapid shift in dollars – triggering major changes in behaviour and fundamentally altering the business of healthcare.

In the New Health Era in South East Asia, patients will become first and foremost consumers, with the freedom that comes with making more decisions on their health through a rise in financial affluence. These consumers will demand a continuum of wellbeing – a series of seamlessly integrated, customised health services aligned to their personal health philosophy. Consumers in this era will reward trusted service providers that can help achieve this.

In the New Health Era, the mere collection of data will be replaced with lightning-fast analysis delivered directly to a care team that anticipates problems before they arise. Individuals will be co-creators of their health decisions, spending more of their discretionary dollars on tools that help them live well. Care delivery, following the move from inpatient to outpatient services, will inch ever closer to the home – via retail businesses, remote monitoring and mobile devices. For incumbent health companies, the emergence of these popular technologies presents a central challenge: to partner or compete? Successful organisations will squeeze out administrative waste, improve the health of entire communities, reduce costly errors, better manage chronic conditions, understand consumer preferences or develop targeted therapies with proven advantages for a given patient group. Transparency in cost and quality will fuel these developments.

PwC Observations

A New Health Era has begun across South East Asia. We dive into this realm through our Healthcare in South East Asia market insight series. This series will look to articulate our long-term view of how healthcare is changing; show how technological advances can shape, disrupt and change the future of the industry; explore new ideas and fresh approaches to the challenges facing healthcare and the problems that innovation can help solve in future. We will share these views in the context of delivering greater value by achieving better results, greater efficiency in delivering products and services, and enhancing the health and wellbeing of individuals and society.

Japan

Challenges to control incremental healthcare expenditure in Japan

Community Based Integrated Care Systems

Japan is facing an aging population. Its 8 million baby boomers will be around 75 years old in 2025. As this will likely lead to a shortage of beds in hospitals, the Japanese government is trying to prepare by establishing “Community Based Integrated Care Systems” where seamless transfer of patients among medical care, preventive care, elderly care and home care is encouraged in local communities. The concept of this system is to have elderly patients stay in the hospital for as short a time as possible, then ask them to return home or transfer to elderly care service institutions if support is needed.

The implication for pharmaceutical companies in Japan is that they will need to develop and implement regional strategies. Companies are now trying to align their sales and marketing strategies with local communities by connecting hospitals and clinics, thus promoting continuous usage of their products as patients are transferred to different institutions.

Health Technology Assessment to be introduced in 2016

Further, pharmaceutical companies are under pressure from the government to reduce costs. The Ministry of Health, Labour and Welfare (MHLW) is now discussing introducing a Japanese version of the Health Technology Assessment (HTA) on a trial basis. It will be timed for introduction in 2016, at the time of medical fees revision planning. If this moves forward, pharmaceutical companies will need to submit cost effectiveness data to the MHLW, which may lead to further price cuts on existing products in the market as well as reductions to the prices of newly launched products.

Promoting the use of generic drugs

Another movement towards cost reduction is the policy to expand the use of generic drugs. The Japanese government has announced that new policies will be implemented to achieve an 80% usage rate within the term 2018-2020 (currently the usage rate is approximately 50%). The government is expected to introduce new incentives to further accelerate generic product usage at the next revision of medical fees. In Japan, branded drugs have usually been prescribed by doctors even after generic drugs have become available in the market.

PwC Observations

The implementation of a regional-based care system, HTA and generic usage expansion policies in Japan will force pharmaceutical companies to rethink their sales and marketing, specifically regarding:

• the roles of sales reps;

• the ideal size for a sales force; and

• new marketing approaches for regional care systems.

Compliance

Australia

Transparency reporting in Australia

The Medicines Australia Code of Conduct Edition 18 was authorised by the ACCC (Australian Competition and Consumer Commission) in April 2015. The code introduces ‘transparency reporting’, requiring Medicines Australia member companies to report payments and transfers of value to health care professionals.

Here are some of the highlights in updates in the new edition.

• There are two new reports “Healthcare professionals report” and “Sponsorship of third party educational events” and the HCO (Health Compliance Office) report will continue as per the edition 17 requirements.

• The first period for the collection of reportable data is 1 October 2015.

Thus member companies should be in the process of assessing their internal process, system and data collection requirements to prepare for the new reports.

Assessment and implementation of new requirements will ensure that organisations are collecting the right information, have the requisite consent from HCPs for publishing the information on their websites, and that the information being reported is correct and validated by the HCPs.

PwC Observations

• International experience suggests that the time and effort required to prepare and produce reports on an ongoing basis could significantly exceed the estimated time and effort. In addition, the risk that the information was not accurate or manually collated, therefore at risk of error, led to significant checking and reviewing to ensure accuracy.

• We recommend that organisations automate the process as much as possible and allocate appropriate effort now to ensure that the process has been mapped out, systems architecture understood, teams trained and the reporting process trialled/tested prior to going live with the reporting solution.

M&A

Philippines

Future outlook of Philippines M&A market in the pharma and healthcare industries

Pharmaceutical industry

Overview

The Philippines is considered one of the largest pharmaceutical markets in the ASEAN region, joining the likes of Indonesia and Thailand. The industry is worth a considerable US$3.3billion in 2014, and is forecasted to grow at 5.1% CAGR in the next five years. According to the Philippine Institute of Development Studies, it is one of the fastest-growing industries in the country, and makes up about 46% of households’ out-of-pocket medical expenditures. Prescription drugs (or branded medicines) continue to dominate the market; however the generics market has a high growth potential due to the government’s initiatives to make medicine more accessible and affordable, through laws such as the Cheaper Medicines Act of 2008 and the Universal Healthcare Act of 2013. An estimated 5 out of 10 Filipinos now use generic drugs – a sign of their growing acceptance by the people – and it is estimated that the generics market will grow at a CAGR of 6.8% in the next 5 years.

Reasons for consolidation

With the recent M&A deals happening in the pharma retail sector, chief reasons for acquisitions are to take advantage of the optimistic industry prospects and to expand the buyer’s reach or retail network.

Major players

• Robinsons Retail Holdings, Inc. has shown itself to be in an acquisitive mood, by its recent purchases coursed through its subsidiary South Star Drug, Inc.

• Dairy Farm International, a Hong Kong-based company, has entered the Philippine pharma market through its 49% stake in Rose Pharmacy, a major drugstore company in Visayas and Mindanao.

• Aside from hospitals, the Ayala Group has broken into the pharma sector through its recent purchase of a 50% stake in Generika, one of the leading distributors of generic medicines in the country.

Future plans

Given the promising prospects of the industry, major industry players such as Robinsons Retail Holdings, Inc. are on the lookout for more companies to add to their portfolio.

Healthcare industry – Hospitals

Overview

The Philippines continues to struggle to provide even the most basic medical needs to the people, particularly to those on low incomes. A large proportion of the population is highly dependent on public hospitals, most of them already operating beyond capacity. At present, the country’s hospital system is operating at a ratio of 10 beds per 10,000 people – one of the lowest in the world. It is estimated that the country needs to set up at least 100 new hospitals, equivalent to 10,000 beds, to improve access to medical services. However, with the government’s goal to improve healthcare services, it has earmarked around US$44.0 billion for the construction and improvement of health facilities, with the goal of privatisation in the future.

Reasons for consolidation

With a population estimated at 101.8 million, the country’s system of 1,700 decentralised Department of Health-licensed hospitals is certainly feeling the pressure of meeting the needs of so many patients. Currently, the Philippines is the 12th most populous country in the world. With a young population, Business Monitor International estimates its population will be worth US$110.4 million by 2020. At present, 33.7% of the total population are aged 0-14 years old, 19% aged 15-24, and 37% aged 25-54.

The WHO estimates that only 30% of the population is able to afford the services of private hospitals. The country’s tropical climate heightens the incidence of communicable diseases, increasing the need for more health centres, particularly those that specialise in tropical diseases. In addition, there is a push to keep the Philippines in pace with modern medical technology through the introduction of the latest medical practices and equipment.

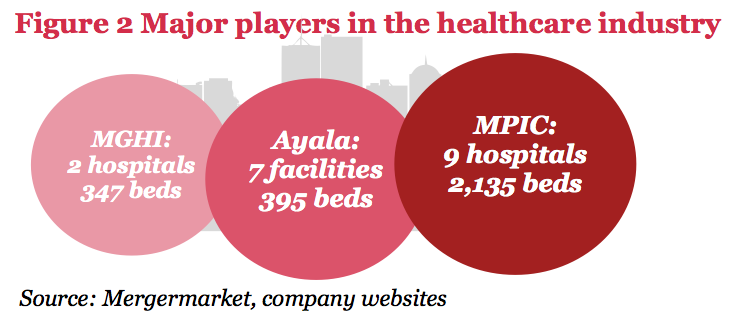

Major players

Metro Pacific Investments Corporation (MPIC) has been especially active in its acquisition of hospitals all over the country, with its purchase of stakes in De Los Santos General Hospital (51%), Asian Hospital (56.5%) and Colinas Verdes Hospital. Ayala broke into the healthcare sector through its 33% purchase of Mercado General Hospital and aims to increase its hospital portfolio through its subsidiary QualiMed. Cross-border transactions have also occurred recently, with the Singapore-based Chandler Corporation investing in a significant minority stake in Professional Services Inc., owner and operator of The Medical City hospitals in 2013. Lastly, United Laboratories, through subsidiary Mount Grace Hospitals, Inc. (MGHI), has stepped into the healthcare industry through the purchase of VRP Medical Center and Medical Center Manila.

Future plans

Conglomerates such as MPIC have announced their intention to acquire more hospitals. In particular, MPIC is interested in buying about 15 hospitals, as well as polyclinic, diagnostic and clinic chains. Meanwhile, Robinsons Land is also considering entering the healthcare industry, mainly through agreements with potential JV partners. Ayala Corporation is mulling over whether to bid in PPP hospital projects in order to grow its hospital group. Further, Mitsubishi Corporation is looking to enter the sector as well, aiming to set up 10 hospitals in the country by 2020. Lastly, Japanese investors are also planning to invest in Philippine hospitals, mainly because of the country’s demographics.

Regulatory

India

Regulatory updates on clinical trials and e-commerce in India

Clinical trials amendments

India’s drug regulatory body – the Central Drugs Standard Control Organization – has recently issued a number of guidelines to strengthen clinical trial regulations in India. These amendments are seen in schedule Y of the drugs and cosmetics acts. It enlists the following changes:

• introduction of Rule 122DAB – specifying the procedures for payment of compensation to the subjects of the trial in cases of injury or death;

• introduction of Rule 122DAC – specifying various conditions for conduct and inspection of clinical trials;

• introduction of Rule 122DD – specifying the detailed guidelines for registration of an Ethics Committee; and

• Gazette Notification for audio-visual recording of informed consent, which has become mandatory.

The Drugs and Cosmetics (Amendment) Bill 2013 is yet to be introduced.

PwC Observations

These initiatives will give the necessary impetus to revive clinical research conduct in India.

E-commerce regulations are becoming a dire need in India

Sale of medicines online, prevalent in developed markets, is now mushrooming in India. This is a consequence of the booming e-commerce sector in India. India’s e-commerce market has tripled in the last 3-4 years.

India today has a total of 259.14 million Internet and broadband subscribers. This penetration of the net, coupled with the increasing confidence of Internet users in online purchase, has led to an enormous growth in the e-commerce space, with an increasing number of customers registering on e-commerce websites and purchasing products through the use of mobile phones.

Currently, there is no single law in the country to regulate, monitor and supervise e-commerce. Hence, the government is mulling over e-commerce laws. One area to be covered would be the regulation of online pharmacies in India. There has been a call for regulation because the existing Drugs and Cosmetics Act does not have any guidelines in place for e-commerce players in the pharmaceutical industry.

PwC Observations

A strong e-commerce regulatory framework is a must for selling drugs online – as failing to do so could lead to unnecessary use of drugs and adverse complications resulting from self-medication of prescription drugs.

Regulatory

Taiwan

Healthcare regulatory: New Long-term Care Services Act passed

On 15 May 2015, Taiwan’s parliament passed a long-awaited Long-term Care Services Act that will regulate the provision of care professionals and the establishment and management of long-term care institutions in Taiwan.

The new law, which will take effect from June 2017 to allow a grace period to integrate resources, aims to establish a more comprehensive care and support system to cope with an unusually rapid demographic transition. According to government estimates, people aged 65 and over will account for 12.5% of Taiwan’s population in 2015, 24.1% by 2030 and 36.9% by 2050.

A key policy in response to a fast aging population, the Long-term Care Services Act prioritises development of long-term care capabilities for Taiwanese citizens with at least six months of documented conditions. At present, long-term care service is confined to those aged over 65, aboriginal people over 55, and people over 50 who are physically challenged or mentally impaired, living alone and unable to care for themselves.

The legislation provides a legal framework for the integration of various types of long-term care services, which include home care; community care; institutional residency, providing the care recipient with full-time or night-time accommodation; household caregiver support services, provided at a specified time, at the home, etc. to a family care giver; and other types that may be announced by the competent authorities.

An estimated 760,000 individuals with disabilities and their families are expected to benefit from the new law. Families will be able to hire foreign caregivers as is the current situation, or they can apply to long-term care centres to provide services. To balance out the development of long- term care resources, the government will limit the establishment or expansion of long-term care centres in those areas with ample resources, and provide incentives to set up long-term care services in areas where resources are limited. Once the Act comes into effect, the government will integrate existing nursing homes and retirement centres within five years.

The Act authorises the establishment of a Long-Term Care Services Development Fund, with a minimum amount of NT$12 billion (US$395 million), to be developed by the government over a five-year period. The government also plans to launch a long-term care insurance system, similar to the National Health Insurance scheme, to further fund care services. A draft bill was approved by Cabinet on 4 June and is being fast-tracked for legislative review. If passed without delay, the insurance programme is expected to launch in 2018 with a backing of NT$110 billion (US$3.5 billion), and benefit approximately 820,000 people.

PwC Observations

Taiwan’s fast ageing population will increase demand and opportunities for long-term care and related services in the future, but also present significant challenges for public healthcare policy. Taiwan currently does not have adequate long-term care facilities or personnel, but progress is slowly being made with the passage of the Long-term Care Services Act. We expect the anticipated passage of the long-term care insurance to provide a more stable source of funding for long-term care services, and also help encourage more private investment in related sectors going forward.

Tax

Australia

Revised tax guidance on Advance Pricing Agreements (APAs)

The Australian Taxation Office (ATO) has released a new practice statement, PS LA 2015/4, which outlines the process it will follow for advance pricing arrangement (APA) negotiations. The new process applies to all ongoing APA negotiations and future APA requests (both new APAs and renewals).The key changes include a more intense “early engagement” phase prior to taxpayers being accepted into the APA program, and a greater focus on identifying and appropriately considering collateral tax issues related to the matter covered by the APA.

Practice Statement PSLA 2015/4

The new APA practice statement replaces the previous guidance in PS LA 2011/1. The stated aims of the ATO’s “reinvention” of the APA program are “to reflect a principle-based approach, streamlined process and practices to improve timeliness, and a reduction of red tape.” The ATO has consulted with various taxpayer and advisor stakeholder groups during the development of the new practice statement, and has already begun to implement the new processes on recent APA applications and renewals.

Under the new guidance, the APA process will be divided into the following phases:

• Early engagement

• APA application

• Monitoring compliance.

An attachment to the practice statement summarises the overall process and sets a maximum time limit of six months for early engagement, and 18 months for completion of the APA after a formal application is submitted.

The ‘New’ Early engagement phase

The stage which has changed most significantly from the previous APA process is the early engagement phase. This stage has been developed based on the ATO’s experience of the early engagement process in private binding ruling applications. The early engagement process brings forward a greater amount of work to be completed before a formal APA application is submitted to the ATO. The early engagement phase commences when the taxpayer submits an early engagement request to the ATO.

Application phase

The APA application phase involves the ATO reviewing and evaluating the application, and then negotiations between the ATO and the taxpayer (and the other tax authority if the request is bilateral) to negotiate the APA. This phase has not changed significantly from the previous process. Collateral tax issues identified in the early engagement phase may be addressed and resolved in parallel with the APA.

Monitoring and compliance

The performance of a taxpayer under an existing APA will be monitored by the ATO, and, as noted above, this may influence the ATO when they are evaluating APA renewal requests. It is implied that the ATO may be less receptive to renewing APAs with taxpayers who have consistently returned results at the bottom end of the range agreed in an APA (unless this was caused by external factors).

PwC Observations

The reinvention of the ATO’s APA program has been taking place amidst a backdrop of intense political and media focus on the taxation of multinationals in Australia. Perhaps as a consequence of this, the ATO has designed its new APA process to be more rigorous and involve a greater number of ATO stakeholders throughout the APA process in order to ensure it can justify what is agreed in APAs.

Our experience to date of the new process indicates that it may take some time before the objectives of improved timeliness, streamlined processes and reduced red tape are realised. Taxpayers considering requesting an APA should be prepared to disclose detailed information to the ATO in the early engagement phase, even for renewal requests, and should give some thought to how they may be evaluated against the ATO’s criteria for acceptance into the APA program. While the APA process can be difficult in some complex cases, there are also many cases where APAs have been able to be agreed efficiently and effectively.

APAs can be complex and challenging to negotiate, but are likely to appeal to Pharma companies who want certainty on their transfer pricing arrangements, particularly if the alternative is an audit. Companies who are considering applying for a new APA or renewing an existing APA should be prepared for rigorous scrutiny from the ATO and should expect to submit detailed information to the ATO prior to being accepted into the APA program. Identifying the key ATO stakeholders on the case, particularly the APA team leader, and establishing a good working relationship with them will be important for ensuring an APA progresses in a timely manner.

Tax

Singapore

A new chapter in Singapore’s transfer pricing regime

On 6 January 2015, the Inland Revenue Authority of Singapore (IRAS) released revised Transfer Pricing Guidelines (Guidelines): an update to those first published in February 2006.

Aside from consolidating and clarifying certain aspects of the IRAS’ position with regard to transfer pricing and the arm’s length principle (as detailed in the first edition of the Guidelines and a number of circulars issued post-February 2006), these Guidelines drive home key points which clearly resonate with the changing landscape in transfer pricing (hereinafter “TP”) globally.

In particular, the Guidelines represent the IRAS’ clear recognition of the increasing complexity in TP arrangements, and the need for timely and more transparent reporting of TP within a multinational group. These are also some of the running themes observed in the recent Base Erosion and Profit Shifting (BEPS) project driven by the Organisation for Economic Co-operation and Development (OECD).

From a TP compliance perspective, the Guidelines emphasise the benefits of TP documentation being contemporaneous and IRAS’ legislative powers to endorse the arm’s length principle. Examples include explicit mention of Section 34D of the Singapore Income Tax Act (ITA), stipulating the use of the arm’s length principle for related-party transactions, and disallowance of a retrospective downward adjustment in the absence of contemporaneous TP documentation – to name a few.

In summary, the Guidelines are helpful to taxpayers in Singapore in preparation for an increasingly transparent global tax reporting environment, by:

• providing more comprehensive and explicit guidance on the application of the arm’s length principle and TP documentation requirements; in doing so, the IRAS also addresses a number of elements of ambiguity which were present before; and

• addressing the practical considerations confronting taxpayers when complying with the arm’s length principle. On this note, the Guidelines focus not only on the concept of comparability and application of TP methodologies, but also on the implementation of TP policies; and they advise on instances when more comprehensive TP documentation may be necessary, or otherwise.

PwC Observations

The issuance of the Guidelines is a clear indication of the IRAS’ endorsement of international best practices for the preparation of TP documentation, seeking to ensure local taxpayers maintain adequate and appropriate analysis and documentation to demonstrate compliance with the arm’s length principle in the face of a changing global tax environment. The IRAS goes a step further in the Guidelines – citing more than once its legislative powers to enforce the arm’s length principle and TP documentation requirements in the event that a taxpayer is unable to provide TP documentation when requested by the IRAS. The Authority has also indicated that it may consider more stringent measures – including specific record-keeping regulations for TP in future where necessary.

In terms of adopting the Guidelines, whilst most of the requirements laid out are not new and should not require major changes in taxpayers’ practices for the preparation of TP documentation, they provide explicit detail on documentation requirements and address ambiguity (in the past) on common topics for compliance with the arm’s length principle.

Implementation-wise, the Guidelines are likely to provide for increased visibility over Group transfer pricing policies, a review of those policies, implementation and review procedures. The Guidelines appear to prepare local taxpayers for the recent outcomes we have observed under BEPS with regard to master file, local file documentation and country-by-country reporting, and likely reaction from other tax authorities.

In our opinion, it is increasingly critical for Singapore taxpayers to engage in TP risk management and planning. For these taxpayers, the Guidelines serve as a basis to review where current operations fall short of meeting the revised expectations of the IRAS.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter