Publications Approach To The Issues Of Leadership In The Processes Of Companies’ Acquisitions

- Publications

Approach To The Issues Of Leadership In The Processes Of Companies’ Acquisitions

- Christopher Kummer

SHARE:

6th International Conference on Applied Human Factors and Ergonomics (AHFE 2015) and the Affiliated Conferences, AHFE 2015

Abstract

This paper presents the results of the research concerning five transactions in the pharmaceutical sector. The research aim was to diagnose an approach to the issues of leadership, which in the literature is often treated as a key success factor in the processes of acquisitions. The research showed that in the analyzed pharmaceutical companies which participated in the research little attention was paid to the issues of leadership. At the stage of due dilligence no audit of leadership competencies in the acquired company was carried out. The integration teams grouping the employees representing every transaction partner were rarely appointed. The integration processes which are of a key importance from the point of view of the transaction success are entrusted to line managers who are not prepared for them. In the companies in which the economic situation in the moment of the acquisition was not the best one, the board was changed within the first month after the merger and the CEO position was given to a person with experience in the processes of acquisitions. This fact has considerably influenced the dynamics of the integration of the merged companies and as a consequence a quicker realization of the defined transaction aims.

1. Leadership in the acquisition of companies versus a theoretical approach

The company’s entry onto the path of the accelerated development following the mergers and acquisitions entail radical changes forcing a revision of opinions and practices in the field of human resources management. An ability to convince people to cooperate in order to achieve difficult aims and a capacity to attract the supporters become key managerial skills. Radical changes make it necessary to reevaluate the paradigms of leadership both in theory and in practice. “For many organizations- as G. Avery notices- this means a passage from a traditional model of control towards alternative models where the attention is put on the cultural competencies, organizational learning and the skills to support communication and cooperation within a group. It is taken for granted that leadership is one of the key success factors in the processes of mergers and acquisitions, which are a tool of the exogenous development of the organization. They are an alternative for the internal growth based on investments. The acquisitions and mergers are mainly associated with the diversification strategy. The adoption of the concept of development by means of mergers and acquisitions is connected with the acceptance of the high risk which appear on every stage. The reports of the consulting companies Deloitte and KPMG International show that the discussed transactions often end with a failure understood as a decrease of the company’s value in comparison to the value before the transaction. The problems with personnel connected with the management, relations between employees and the cultural differences of the companies-transaction partners are among the most important factors which constitute a barrier for the process of the merger. While looking for the reasons of failures and the ways of limiting these problems, as the effect of the conducted research the list of the so-called critical success factors was defined. On this list the factors which have contexts connected with the quality management and leadership (“a proper choice of the managers”- 59% of answers and “leadership and the clarity of responsibility”- 48% of answers were enumerated as key success factors:) are clearly marked on this list.

Generally the leadership is understood as: personal power, authority, role in a system of power, capacity to create and change a structure of informal power or a specific way of executing power in the organization. On the different levels of the organization there are the differentiated mechanisms of the phenomena of leadership described within the different theoretical concepts. Some of them concentrate on a single leader (“the concepts of great people”, the concepts of features and behavioral concepts). The approaches of the following researchers can be considered as such: B.M. Bass or G. Yukl. A dynamic approach by S.J. Zacharro falls also within this trend. The second group are socio-cognitive theories within which a conviction was adopted that the leadership does not result directly from the features and behaviors but is implied by the perception of the supporters. The third group of the theories concentrate on the process of exchange between a leader and subordinates (leader-member exchange theory).

A group of situational theories is also clearly marked (situational leadership model by Horsey and Blanchard, a model of “situational adjustment” by Fiedler, a success path theory by House). A lot of attention is also devoted to the model of transformation leadership built by Burse at the end of 70s developed in the 90s by B.M. Bass and B.J. Avolio. A concept of servant leadership proposed a few years earlier has a marginal meaning.

This concept represented by J.E. Barbuto and D.W. Wheeler putting emphasis on such issues as: a sincere interest in serving others, knowledge and help in solving the emotional problems of employees was not interesting neither for the theorists nor for the practitioners of the management. The analysis of this problem in the literature leads to a conclusion that the issues of leadership constitute a central element of the analysis connected with the issues of the organization effectiveness. The basic question which the researchers are trying to answer is: does the leadership have a real impact on the organization result. Numerous research devoted to it did not give so far an accurate answer. Some of the analysis showed that this relationship is very important (compare: Bertrand and Schoar). However, there are also such research results which show that this influence is not particularly important.

The research conducted by Lieberson and O’Connor show that the leaders of the lower level have a small influence on the results of the organization. Also the research on visionary companies conducted by Collins and Porrasouse showed that there are no proves that the “perfect leadership” results from the development of this type of companies.” (…) the theory of the great leader does not explain sufficiently a difference between visionary companies and comparable companies”. The concept of M. Chamers falls also within the trend of the effective leadership. The effectiveness is categorized within three mutually dependent spheres: a vision of management, an image of the organization and a vision of the leader.

A situation of the company’s change of the strategy is one of the situations in which the leadership effectiveness is the most important. In this trend the research on the succession of top managerial positions were conducted. They showed that an appointment of a new president facilitates an implementation of changes and obtaining support on the lower levels of the organization hierarchy (compare: Collins, Porras, Aditya, Wasserman, Anand, and Nohria). The research showed that leadership was one of the key success factors in the processes of mergers and acquisitions. A creation within a period of time which was as short as possible of a management team which will implement a strategy of a new organization operating in the post-merger structure is an equally important element which influences the transaction success. The research of the company Hay Group showed that the organizations which appoint a new management team already in the due dilligence phase are twice as likely to have a full integration within one year. It is also important to provide this team with a proper level of decisiveness to help it implement a strategy of a new merged organization. The understanding of the leadership influence on the transaction effectiveness requires a simultaneous consideration of the different levels of leadership in the organization. It is common in case of acquisition processes to talk about a leadership vacuum on the lower levels of the organizational structure. A review of managerial skills of the employees of the acquired organization should be a priority activity, already at the stage of due diligence analysis. It is necessary to remember that the competencies required for managerial positions in the process of mergers are often one or two levels higher than the current skills of the managers. In order to diagnose a staff potential and to counteract the indicated problem of the leadership vacuum it is possible to use a few tools to check the competencies of managers and the results of their actions remembering that the leadership quality can have an influence on the process of the acquisition, mainly at the stage of the post-transaction integration. It is worth underlining that the management of the process of integration should be treated as a “separate business function” and the supervision of the described process should be given to the experienced managers. The acquisitions of companies should be approached from a business point of view with a conviction that the different phases of the described process create a demand for the different categories of leaders.

2. Research questions and methodology

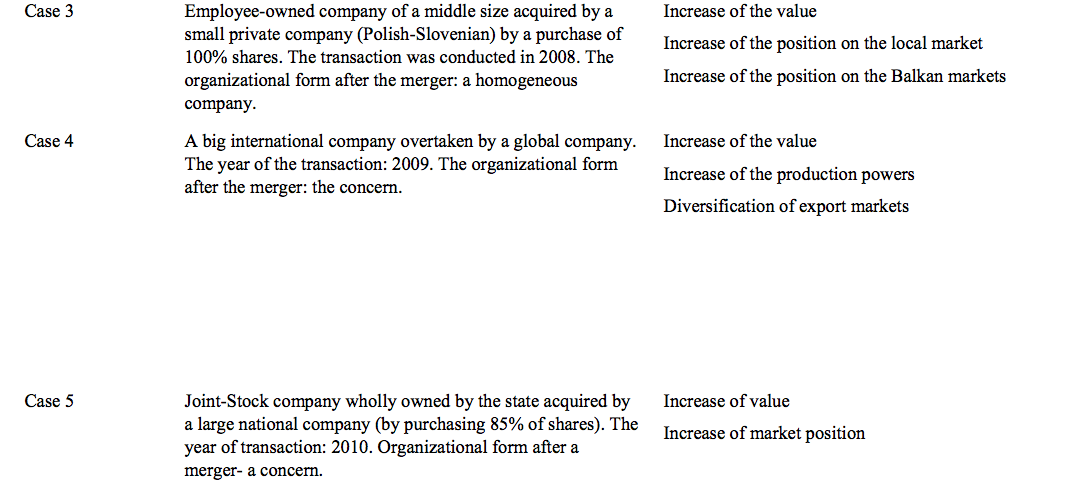

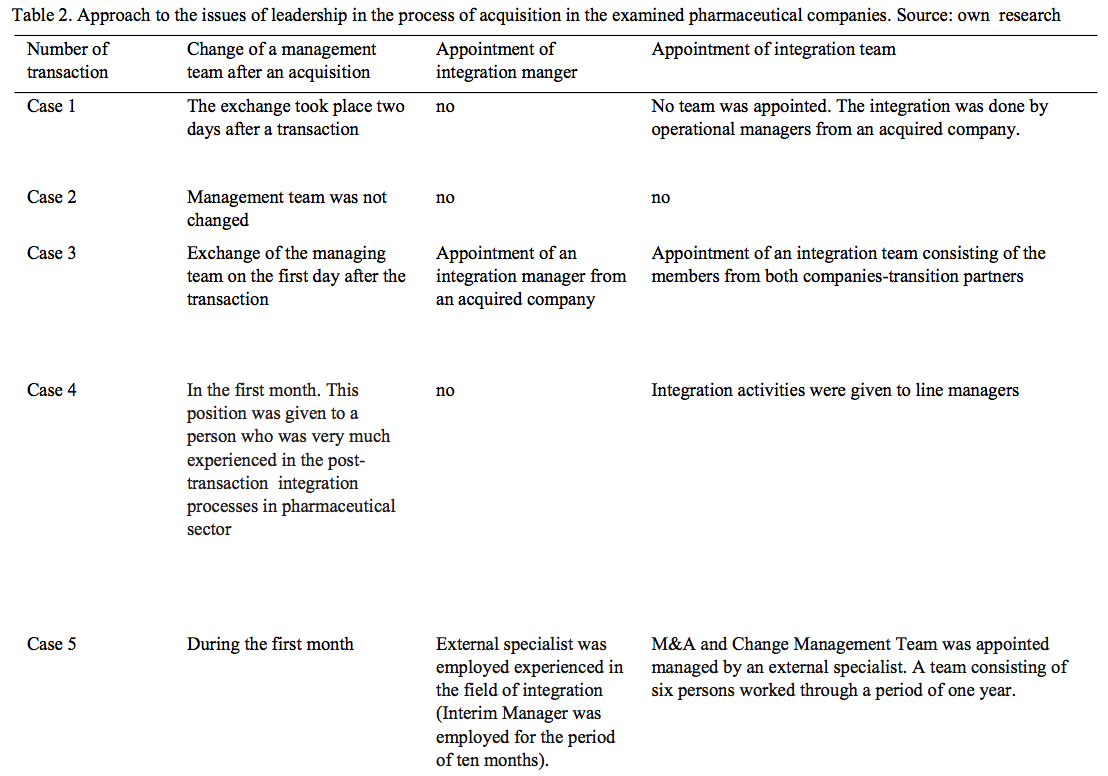

The results presented in this paper are a part of a wider research conducted in the years 2011-2013 in five, deliberately chosen companies belonging to the category of the pharmaceutics producers. In every case the examined company was acquired three years before the research. In the literature it is considered that such a time perspective is optimal from the point of view of the evaluation of the conducted transaction. An induction research of case study type was used together with a triangulation of research methods. A technique of IDI-Individual In-Depth Interview with presidents/managing directors and a panel interview conducted with presidents/managing directors, directors/managers of economic units, development directors and the managers of the HR departments of the acquired organizations were used.

A free-form interview with a structured list of the information which is required was used in case of line managers of the merged departments. The structure of the research sample is presented in table 1.

The research tried to diagnose an approach to the issue of leadership, which in the literature is often considered as the key success factor of mergers and acquisitions. It would be necessary to find the answer to the following questions:

1. Are new managers in the positions of CEO appointed after mergers and in which moment do these changes take place?

2. How does a change in the position of CEO after a merger influence a dynamics of integration and as a consequence an implementation of the defined transaction aims?

3. What is the character of the integration (centralized, decentralized?)

4. Do the changes in the position of the integration manager depend on the phases of the post-transaction process?

3. Results and discussion

From the point of view of achieving a synergy which is a determinant of the success in the acquisitions transaction, an examination of the staff competencies in the acquired company is really vital, already at the stage of the due diligence analysis. In the examined transactions this practice was never the case. In four out of five examined cases after a transaction a management team was changed. The moment in which the change took place is very important. In the described research a link between a pace of changing the staff from CEO level, the economic position of the company which is being taken over and the experience in the field of M&A was detected. If it was declared in the research that the financial condition of the company before the acquisition had not been the best one, then one of the first activities after a merger was a change of the managing team. This regularity was the case in two out of four examined companies in which the CEOs were changed. A construction of a new management team as well as a definition and an attribution of the new rules happened within 30 days after finalizing a transaction. In two of the described cases, within three years from the finalization of the transaction, the change in the position of the president and the managing director happened twice. In every case a new CEO had a previous experience in the mergers in the pharmaceutical sector. This approach influenced significantly the dynamics of the acquisition process and resulted in a visible acceleration of integration activities. For the need of an effective communication it is really crucial to appoint for a defined period of time an integration manager and to create a team which consists of the team members of both the organization which are being merged.

In the analyzed transactions in three out of five cases neither integration manager nor an integration team were appointed. The burden of conducting an integration in the single units was put on the line managers. In the interview it was underlined that line managers were not able to face the challenges created by the acquisition process the more so that in the majority of cases they fell into the category of acquisition opponents. In case of two examined companies it resulted in a problem of leaving an organization by the line managers, responsible for integration.

4. Conclusion and further research

In the literature it is often underlined that the leadership is a key success factor in the processes of the companies acquisitions. The research showed that in the analyzed pharmaceutical companies not enough attention was paid to the issues of leadership. At the stage of due diligence in none of the cases was the analysis of the leadership skills conducted. The integration teams were also rarely appointed; those processes were attributed to line managers of the functional areas whose level of competencies was not known. The acquisition is a complex, multi-stage process in which it is very difficult to foresee potential threats. However, it is obvious that going through a period of significant changes implied by the discussed transactions requires a leadership on every level of management. A lack of a clear leadership results in chaos, conflicts and a decrease of an engagement and as a consequence impedes the implementation of the defined aims and increases the risk of the described transactions. It seems that this problem requires further research. It would be important to analyze all the dependencies between a type of leadership and the achieved results of the acquisition processes.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter