Publications 2014 Global Chemical Industry Mergers And Acquisitions Outlook

- Publications

2014 Global Chemical Industry Mergers And Acquisitions Outlook

- Christopher Kummer

SHARE:

By Deloitte

Overview of the 2014 Global chemicals mergers and acquisitions outlook

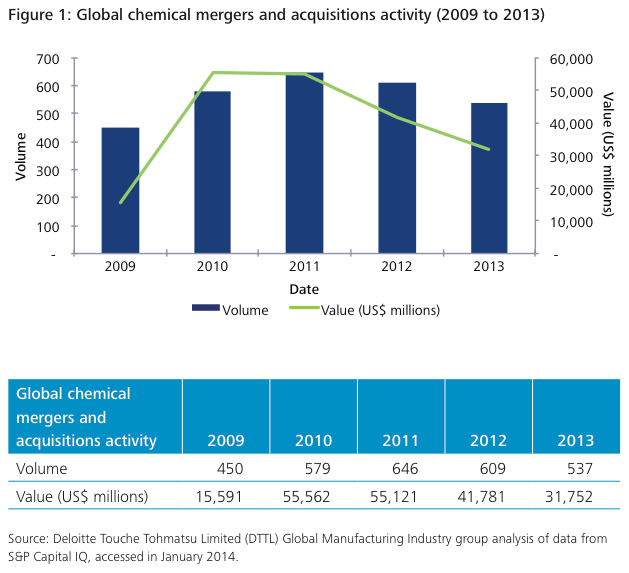

In 2013, the year’s activity validated once again that the only constant driver in chemicals mergers and acquisitions (M&A) is change. The year began with strong levels of M&A activity, but change and a slowdown emerged in the second quarter with moderate volume levels and deal sizes (see Figure 1). The recent development of shareholder activism and hedge fund investment in the industry, amid the perception that management is not doing enough to boost shareholder value, caused many chemical companies to reevaluate their business portfolio. Another area of change observed in 2013, as well as over recent years is the particular business lines that seem to become the favorite for M&A activity in any given period. A few years ago, styrenics businesses were being activity traded by the industry players. Next came the coatings businesses and now 2013 appears to have been the year of titanium dioxide with a number of notable transactions including Huntsman Corporation’s announced acquisition of the TiO2 business from Rockwood Holdings Inc., DuPont’s announced spin off of their Performance Chemicals business which includes the Ti02 business, and Tronox’ emergence as the only fully integrated global producer in the sector.

What will 2014 hold in terms M&A activity? Will megatrends push agrochemicals to be the more popular business line to be traded as the industry leaders continue to strategically engage in portfolio realignment? What are the key end markets for M&A? Which regions are ideal for chemical M&A and which are not? These topics and more will be further explored in this chemical M&A outlook.

Megatrends will drive activity in key end markets

M&A strategic plans often include models that take into account changing dynamics and trends in key end markets, as well as potential new solutions to unmet needs that enable growth and value creation. This section identifies three of the key end markets that have been a focus for global chemical companies in 2013 and how megatrend influences on these chemical end markets are expected to drive 2014 M&A activity.

Agrochemicals

Accelerating population growth and an expanding middle class in the developing world are two megatrends driving the demand for agrochemical commodities. Food security has become top-of-mind to many world economies, prompting an emphasis to develop innovative products (e.g. herbicides, pesticides, fertilizers, as well as genetically modified seeds) that can either help ensure the supply or increase the abundance of agricultural commodities.

Global chemical companies have been increasing their M&A focus on expanding presence in the value-added crop protection marketplace in favor of the more commoditized fertilizer marketplace (e.g. potash, nitrogen, phosphorus) for which capacity increases have served to temper pricing. Furthermore, producers are looking and are willing to pay for new, environmentally friendly ways to counter yield-damaging pests, and weeds that are becoming increasingly resistant to traditional herbicides and pesticides.

This focus on innovative crop protection products has driven M&A deals including BASF’s acquisition of Becker Underwood, Syngenta’s acquisition of Pasteuria Bioscience and Devgen, and FMC Corp’s recent acquisition of Center for Agricultural and Environmental Biosolutions and its alliance with Chr. Hansen.

With solidly rooted population megatrends, agrochemical solutions, especially those offering differentiating innovation, will likely continue to be featured in M&A activity during 2014.

Bio-based/Green chemicals

Sustainability continues to be a predominant theme pushing greater demand from the consumer market to replace and/or substitute conventional petro-based feedstock and chemicals with bio-based or green chemicals. The bio-based/green chemicals end markets touch nearly all areas of the chemicals industry, including agrochemicals, polymers, plasticizers, resins, water treatment, lubricants, paint, and health and nutrition.

It is still uncertain whether many bio-based/green chemicals can be developed with the characteristics necessary to replace traditional carbon-based chemicals, or whether they can be produced economically and in the volumes demanded by the market, especially considering the lower-cost natural gas feedstocks with which they must compete. This is driving a more risk-adverse M&A model being used by many global chemical companies as they venture into the bio-based arena. Many companies are utilizing joint ventures or research agreements versus outright acquisitions to spread the investment capital and risk. Recent examples include BASF and Corbion Purac’s joint venture to produce bio-based succinic acid BASF’s joint venture to produce bio-based acrylic acid, and Royal DSM’s partnership with POET to open a commercial-scale ethanol plant using corn crop residue as feedstock.

However, with chemical companies and end-users eager to tap into the growing green consumer base, bio-based/green chemicals is expected to continue to be an area of growth and a focus of M&A and joint venture activity in 2014 for the global chemicals industry.

Health and nutrition

A growing and aging global population, as well as an expanding global middle class is increasing consumers’ basic health and nutrition awareness and their demand for health and nutrition products. Furthermore, world governments are seeking solutions as they recognize that chronic diseases and the lack of a healthy population represent a significant economic and societal challenge as it leads to absenteeism and increasing social welfare costs.

Not surprisingly, more global chemical companies are focused on building their health and nutrition offerings to take advantage of the market opportunity. For example, DuPont has committed to invest US$10 billion in research and development dedicated to the food, agrochemicals, and nutrition sectors to advance 4,000 new products by the end of 2020. This focus on health and nutrition has also impacted M&A activity in the global chemicals industry with recent deals including, Royal DSM’s acquisition of Fortitech Inc., BASF’s acquisitions of Equateq Ltd and Pronova BioParma, and FMC Corp’s acquisition of Epax.

Commodity chemicals continue to dominate M&A activity

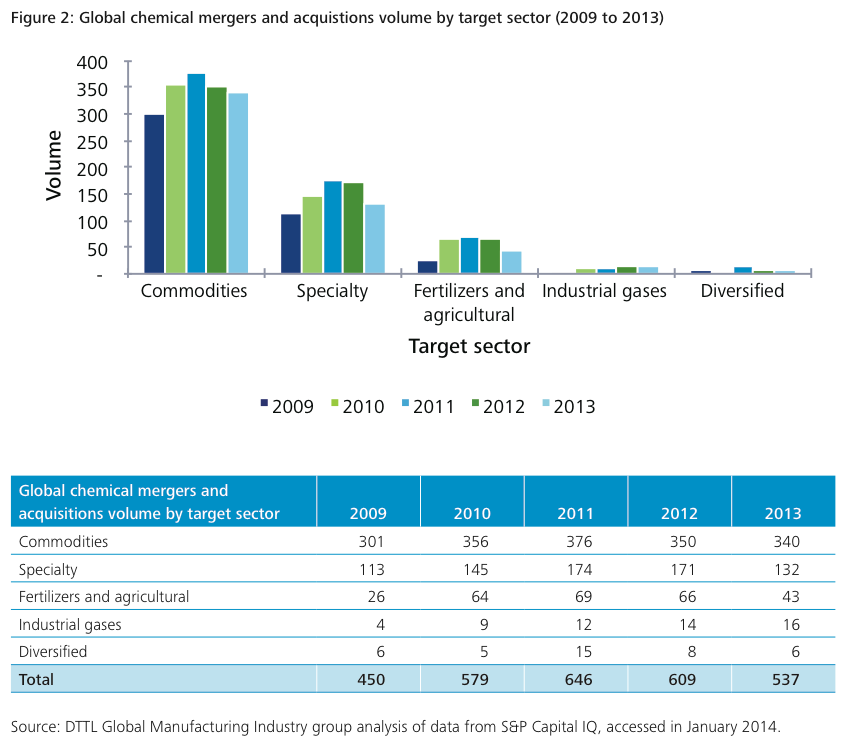

M&A volume (number of transactions) declined in every global chemicals sector except industrial gases during 2013 when compared to 2012 (see Figure 2). This section explores the M&A activity in each of the chemicals sector (designated by the target’s sector) and highlights recent transactions.

Commodity chemicals has historically been the dominate target sector for M&A activity, comprising approximately 60 percent of all deal volume from 2010 through 2013 (see Figure 2). However, transaction volume peaked in 2011 followed by two consecutive years of M&A volume declines in 2012 and 2013. This trend in commodity chemicals is likely to continue in 2014 as many chemical companies are focusing on downstream value-added opportunities and seeking acquisitions in various specialty chemical areas, such as agrochemicals. However, divestitures by large diversified chemical companies of non-strategic or lower-margin commodity chemical businesses as they look to specialize and find their value niche could drive future M&A activity in the commodity sector.

Specialty chemical targets comprise an ever-increasing portion of the global chemical M&A activity, as chemical companies seek a competitive advantage and opportunities to bring value-added solutions to meet previously unmet market needs. Like other chemicals sectors, specialty chemical M&A activity slowed during 2013, yet there were some notable transactions including, Huntsman Corporation’s announced acquisition of Rockwood Holding Inc.’ titanium dioxide business, Toray Industries’ acquisition of Zoltek Companies, and Merck KGaA’s acquisition of AZ Electronic Materials SA. Expect continued strength in the specialty chemical space as larger commodity players continue to refocus their portfolios.

Agrochemical deals were also down last year compared to the peak of 69 transactions in 2011 and only one deal in sector in 2013 exceeded US$500 million in value. Despite the recent slowdown, agrochemicals and fertilizers are likely to be a growing M&A sector in 2014 and beyond as innovative new agricultural products are in high demand to combat increasingly resistant weeds, insects, nematodes, and microbes and to meet the food demand of a growing world population.

Industrial gases bucked the downward trend experienced in other sectors showing a steady increase in deal volume during 2013. Representative transactions in the sector include Praxair Inc’ acquisition of NuCO2 and Air Products’ acquisition of Indura.

The number of acquisitions of diversified chemical companies has been infrequent during the last 5 years and its likely to remain this way in 2014. Significant acquisition activity of diversified chemical companies is unlikely, as many of the large diversified chemical companies continue to focus on portfolio realignment and move towards specialized sectors. Additionally, a block-buster deal between the large diversified companies appears unlikely in the short term horizon given the continued global economic uncertainty.

North America and Europe will be top regions for chemical M&A

United States (U.S.) and Canada

M&A activity in the U.S. and Canada had been on a consistent increase since 2009 in terms of both volume and value, but declined in 2013 (see Figure 3). Some of the decrease in early 2013 was related to timing as a many U.S. sellers rushed to get deals done before the end of 2012 as a result of the pending increases in the capital gains tax rates. There were 35 U.S. transactions announced in December 2012, more than any other month since 2008. Further adding to the 2013 decrease in deal activity has been the relatively rich valuations, evidenced by the 2013 stock market gains reflected the S&P 500 (29 percent) and Dow Jones Industrial Average (26 percent) for the year. The increase in valuations has driven some bargain hunters away from pursuing M&A activity.

One trend continuing to gain momentum is large structural portfolio realignments. Examples in 2013 include DuPont’s July announcement that it is realigning its leadership team and its October announcement that it will spin-off its performance chemicals segment, FMC Corp’s April announcement of it realignment into three core platforms and the sale of its peroxygens business to One Equity Partner in December, and Dow Chemical’s announcement that it had divestiture target between US$3 to 4 billion in proceeds over the next 18 to 24 months, as it looks to shed businesses exposed to commodity price swings. United States’ chemical companies are continuing to transform their business portfolios from less commoditized and cycle platforms to higher growth platforms which they believe are their core strategic strengths and where they have differentiation in the global market. Given the continued realignment activity, a continuation of large deals in the first half of 2014 is anticipated.

Europe

The European chemical industry has continued to experience relatively high levels of deal activity over the last four years. This has been driven by the major participants seeking to improve their industry position in the face of increasing competition from Asia and the expected disruptive influence that shale gas may have towards creating a U.S. competitive advantage.

European chemical producers are responding to their uncompetitive domestic feedstock cost position (relative to U.S. shale gas and Middle East gas) and challenging home markets. This involves realigning their product portfolios and accelerating the shift downstream towards higher value-added, more specialized product portfolios, heightening exposure to high-growth markets, and securing advantageous supply cost positioning.

Low leverage and lower interest rates are promoting M&A activity, although the continuing sluggish Eurozone economy resulted in many companies steering away from large, transformational M&A transactions, with small, lower risk bolt-ons becoming more prevalent, and fewer big ticket transactions (in excess of €2 billion of enterprise value) occurring during 2013. Bolt-on acquisitions are happening where targets meet specific criteria such as synergies with the acquiring company, high growth strategies, or access to new or complementary technologies and end markets. Some of Europe’s largest chemical players have demonstrated this trend through their deal activity during the last 18 months, including BASF’s acquisition of Pronova (fish oil maker) and Verenium (biotech enzymes) in September 2012; Clariant’s acquisitions of Ultimate EOR services in May 2013, Champion Technologies’ Gulf of Mexico assets in April 2013, and investment in a polypropylene catalyst JV with Lummus Novolen in August 2013; and Johnson Matthey PLC’s acquisition of Formox (high performance catalysts) in March 2013.

Private equity continues to play an influential role in the European chemical M&A landscape, providing an exit route for some corporate assets, as well as secondary and tertiary buyouts. Private equity investors that have been active in the sector recently include SK Capital, Black Diamond Capital Management LLC, Cinven Group, and Charterhouse.

The outlook for European chemical M&A activity in 2014 is more of the same. This includes relatively small divestitures and bolt-on acquisitions to continue the transition downstream and position for future growth, becoming larger, and more ambitious as the European recovery gains traction.

Asia Pacific

Asia Pacific chemical M&A activity has experienced different cycles of transaction performance over the past three years, reaching its peak volume in year 2011 followed by a dip in 2012 (see Figure 3) and rebound in 2013. The Asia-Pacific region participated in 141 deals in 2013 compared to 120 deals in 2012, representing 17.5 percent growth.

Transaction activity in the Asia-Pacific region continues to be largely driven by China as the most active and largest market. However, structural imbalances evidenced by overcapacity in certain segments are likely to drive Chinese companies to identify and fill market gaps as they strategically pursue M&A as a means to enhance shareholder value. The phosphate fertilizer sector in China, for example, has increased consolidation as evidenced by companies such as Sinofert, Liuguo Chemical, and Shindoo Chemical. Chinese chemical companies are expected to look for both domestic and international transactions, as small and mid-sized specialists with distinctive capabilities have begun to appear as potential targets of foreign companies. In searching for complementary capabilities through vertical and/or horizontal integration, a trend toward consolidation has emerged where Chinese players either acquire or push aside other existing players.

A growing number of Chinese and international private equity firms are actively pursuing the Chinese chemical industry to identify attractive targets, typically surfing the megatrend wave. One example is Morgan Stanley’s landmark investment through its MSPE Asia Fund in Tianhe Chemicals Group specializing in lubricating oil additives and special fluorides.

Chinese chemical companies are increasingly aware of the capabilities that a strategic buyer (whether international corporations or private equity funds) can bring to enhance value and help growing companies navigate complex international barriers. For 2014, organic growth for the industry will likely be modest, enabling M&A to play a prominent role in driving growth. Global chemical companies are also expected to continue their emphasis on portfolio realignment to capture above-average revenue growth and capitalize on new market opportunities in China for high-value applications, product lines, and technologies.

Latin America

Latin America M&A activity has been strong over the past few years, yet in 2013 there was a slight slowdown and shift of M&A activity to less consolidated markets such as specialty chemicals. Relevant chemicals sectors such as commodity chemicals, fertilizers, and industrial gases are already demonstrating high consolidation levels in this region.

In terms of geography, the most relevant markets in Latin America are Brazil and Mexico. These countries have experienced the largest M&A deals in recent years. Brazil petrochemical company Braskem’s acquisition of Quattor enabled the company to become the largest thermoplastic resins producer in the Americas, achieving 70 percent of marketshare in Mercosul and Vale’s fertilizer play in its acquisition of Fosfertil. In this deal, Vale leveraged the synergies from its phosphate mining activities, while diversifying its business risk. Further emphasizing the consolidation trend, the four largest fertilizers players now comprise more than 70 percent of the Brazilian market.

As such, market consolidation is significant in the petrochemical and fertilizer markets in Latin America, especially in Brazil, thus leaving little space for new entrants and reinforcing the competitive positions for Vale and Braskem. Similarly, for the industrial gases segment, in which Praxair and Air Products hold about 65 percent of the Latin American market, there was only one major deal in 2013 as Air Products acquired Indura, becoming the second largest manufacturer in the Latin America region.

Also, Braskem announced the acquisition of two plants of PVC and soda from Solvay (Santo Andre-BR and Bahia Blanca-Argentina). With this movement, Braskem has increased its production capacity to 1.25 million tons of PVC and 890 tons of soda becoming one of the four largest resins producers in the region.

Because the specialty chemicals sector is less consolidated than other sectors in this region, it experienced fewer significant M&A transactions including 32 small value deals since 2009 totaling US$511 million in transaction value. However, in the specialty chemicals coating segment, one large deal that is still pending is Sherwin Williams’ proposed acquisition of the largest paint maker in Mexico, Consorcio Comex.

In 2014, further consolidation in the specialty chemical sector within Latin America is anticipated and larger industry players will likely focus on capturing synergies, gaining operational efficiency, and becoming more competitive. Braskem perhaps revealed a move in that direction with its recent expansion to North America and Europe, and partnerships in Mexico; all are regions with more competitive feedstock.

Middle East

At the recent 5th Gulf Petrochemical and Chemical Association conference held in Dubai, industry specialists were bullish on the prospects for the Middle East’s petrochemical industry through 2020 despite current tensions in the region.

Despite an increase in overall M&A activity in the region, the regional outlook for the chemicals industry is somewhat mixed. Earlier this year, Saudi Arabian Basic Industries Corporation (SABIC) reported a year-over-year drop in net income alongside guidance that no significant acquisitions were likely in the near-term. Smaller companies appear to be making consolidation plays as a result of having focused on efficiency savings through the downturn.

While political tension prevails in other parts of the Middle East, the Kingdom of Saudi Arabia, the UAE, and Qatar have also seen deals due to the relative stability and security they offer. One example is the acquisition of Specialty Plastics Inc. by the UAE’s Future Pipe Industries Group Ltd. Easing political tensions in the region, increased demand from Asia, and continued recovery in America and Europe is likely to drive a renewed focus on opportunities in the Middle East’s chemicals industry. In 2014, look to see more stabilization in the region and growth in M&A.

Closing and outlook for 2014

While deal activity seemed to have taken a break in 2013, recent mega-deals announced in the fourth quarter and the underlying M&A drivers make the global chemicals industry primed for increased activity in 2014.

The recovering global economy bodes well for chemical industry M&A activity as economic growth continues in North America and Europe’s economy stabilizes. In highly fragmented markets, consolidation will be important as companies seek to rationalize capacity and gain economies of scale, while demonstrating top-line growth. Furthermore, addressing global megatrends and unmet needs will continue to push chemical companies to evaluate acquisitions and innovation strategies to enhance shareholder value. This may prompt companies to seek accretive acquisitions of businesses possessing high-growth opportunities and unique competitive positions, while refocusing portfolios with selected dispositions.

While 2013 did not result in record deal levels, it has been another solid year of activity for the global chemical industry. For 2014, a number of compelling industry and global trends will serve as a base for continued strength in M&A activity and announcements of planned divestiture activity by players such as Chemtura and Ashland ensure that there will be a strong cadre of targets for M&A activity.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter