Blog Thriving in Turbulence? M&A Valuations in the Age of High Interest Rates

- Blog

Thriving in Turbulence? M&A Valuations in the Age of High Interest Rates

- Nima Noghrehkar

SHARE:

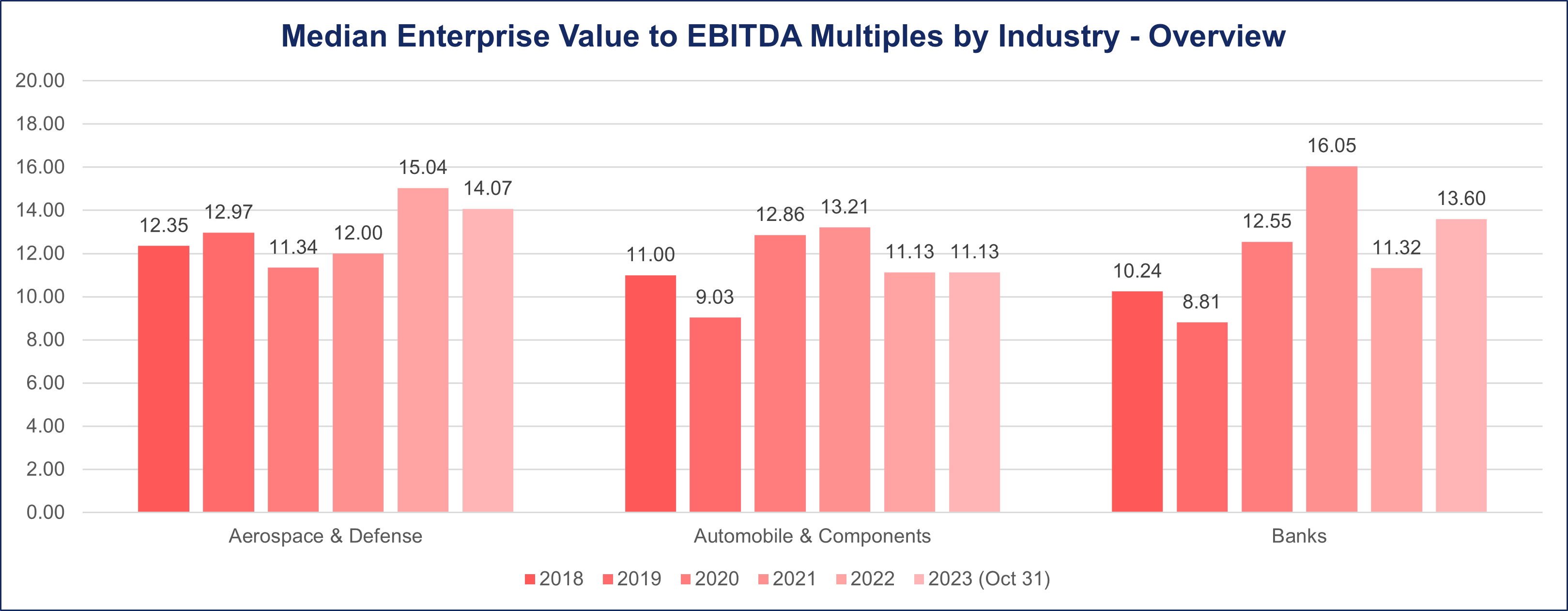

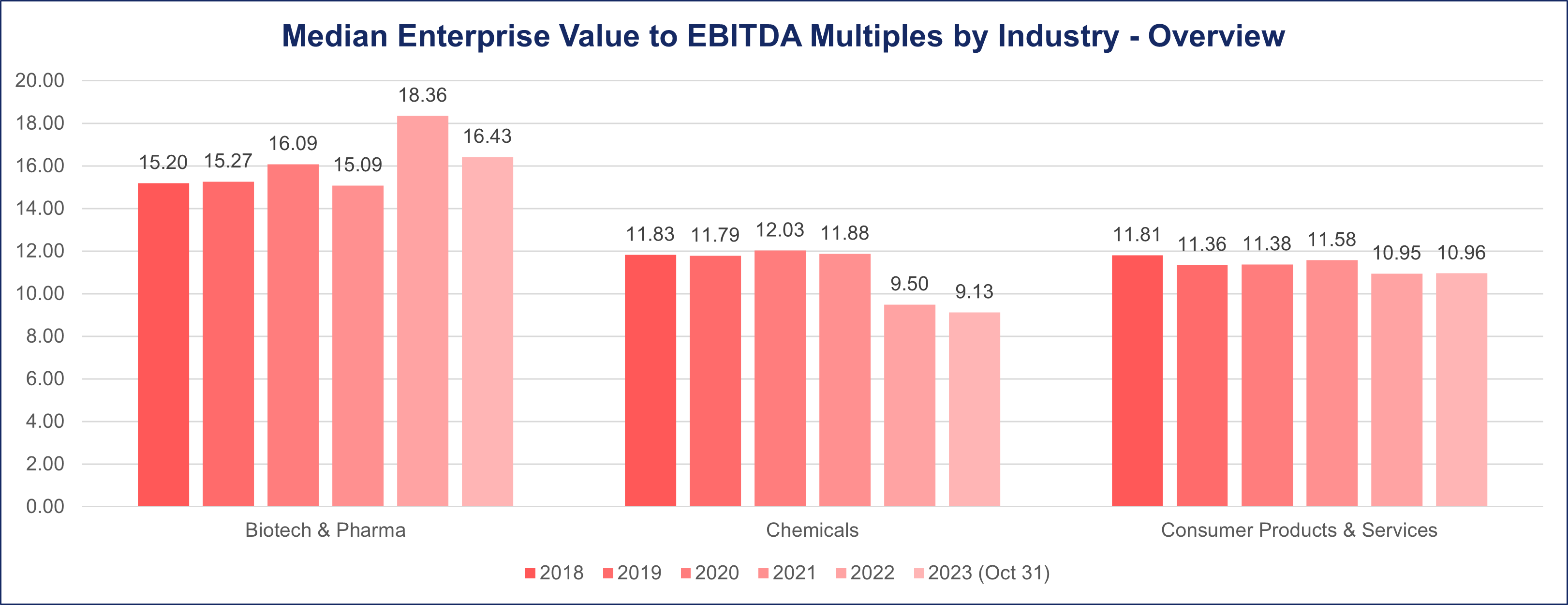

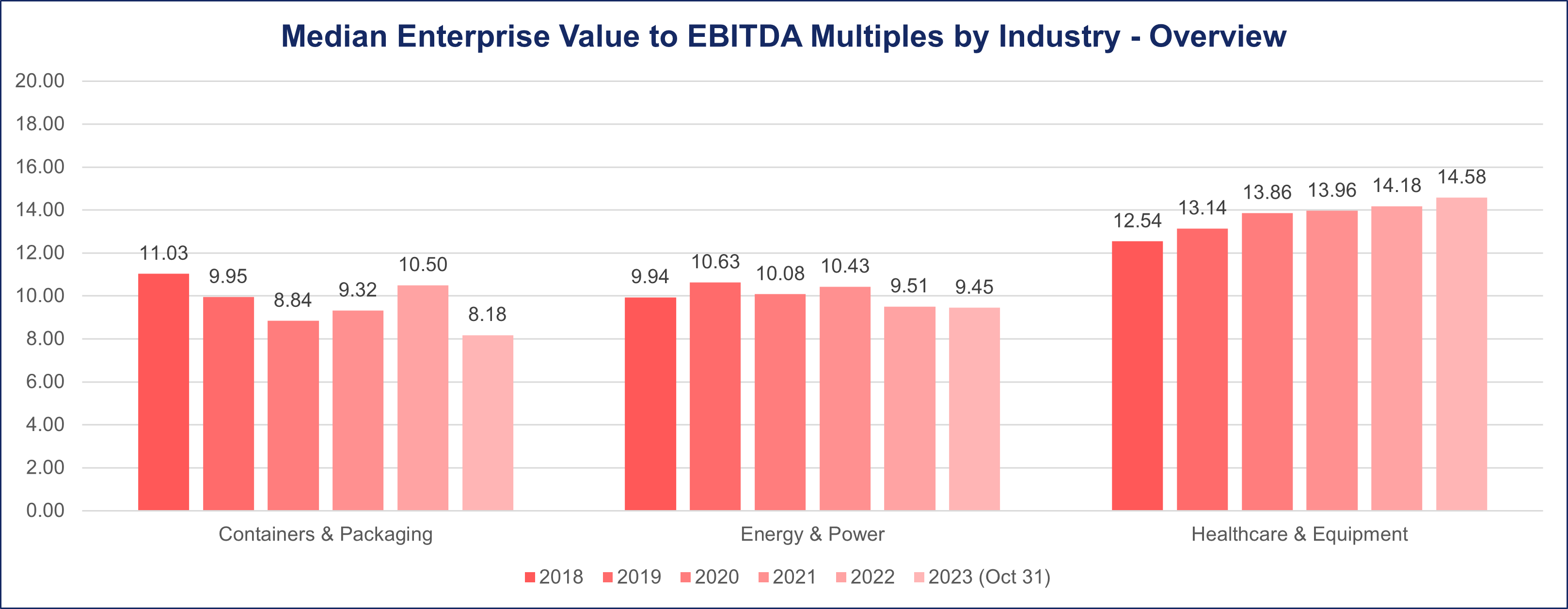

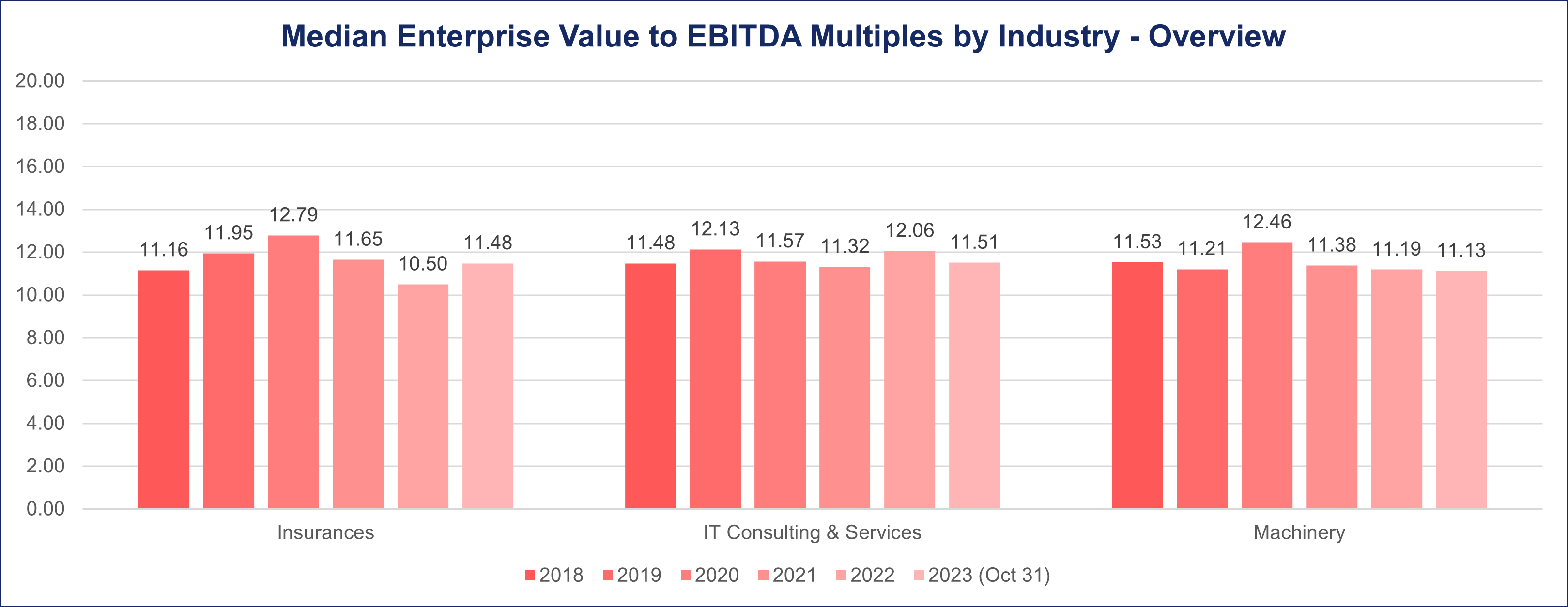

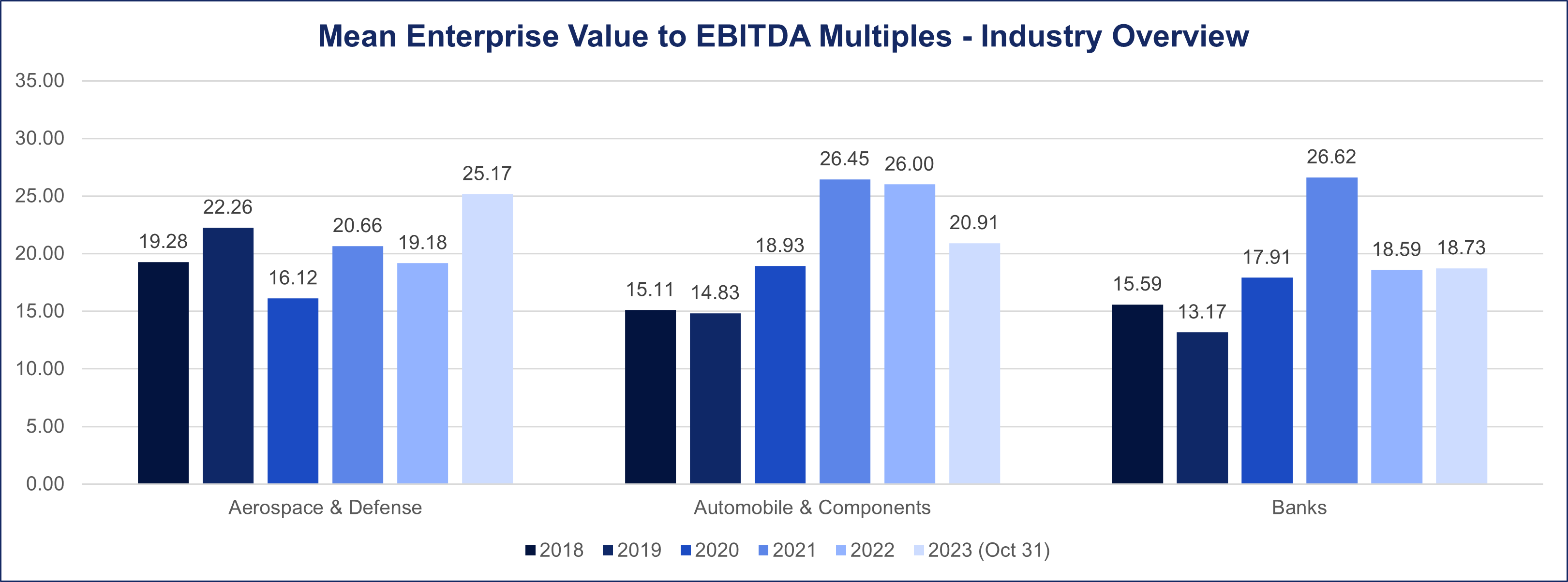

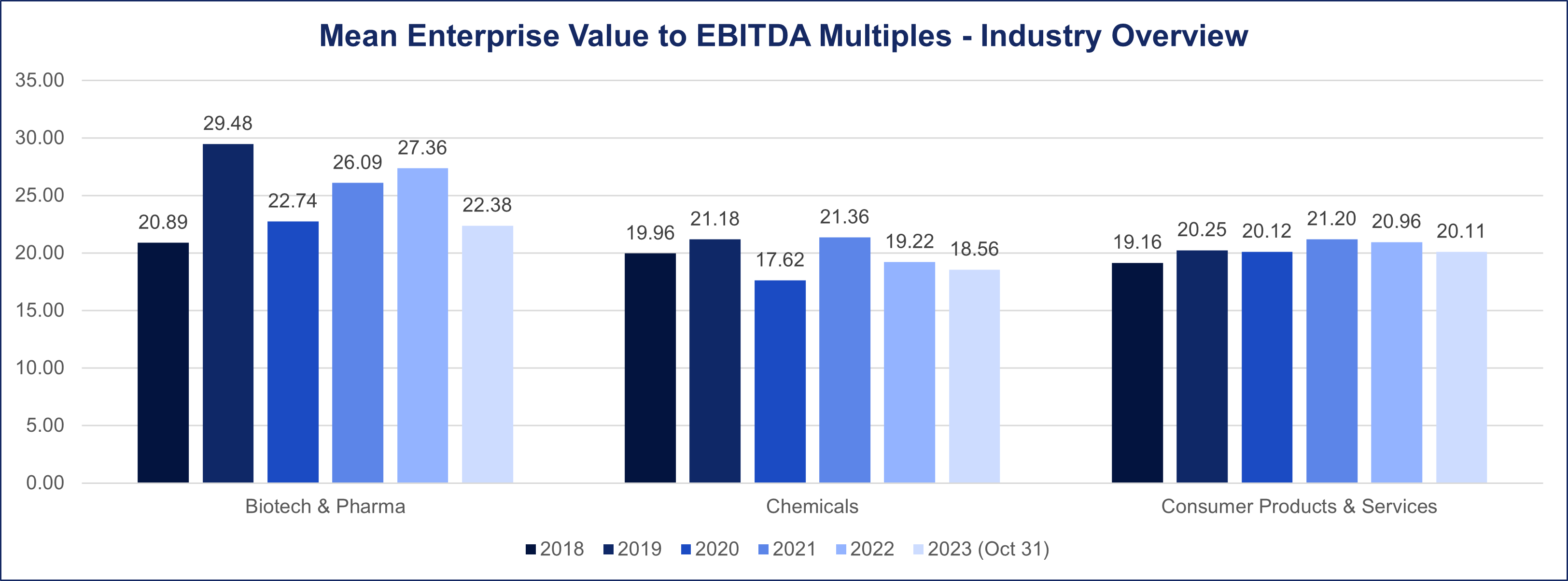

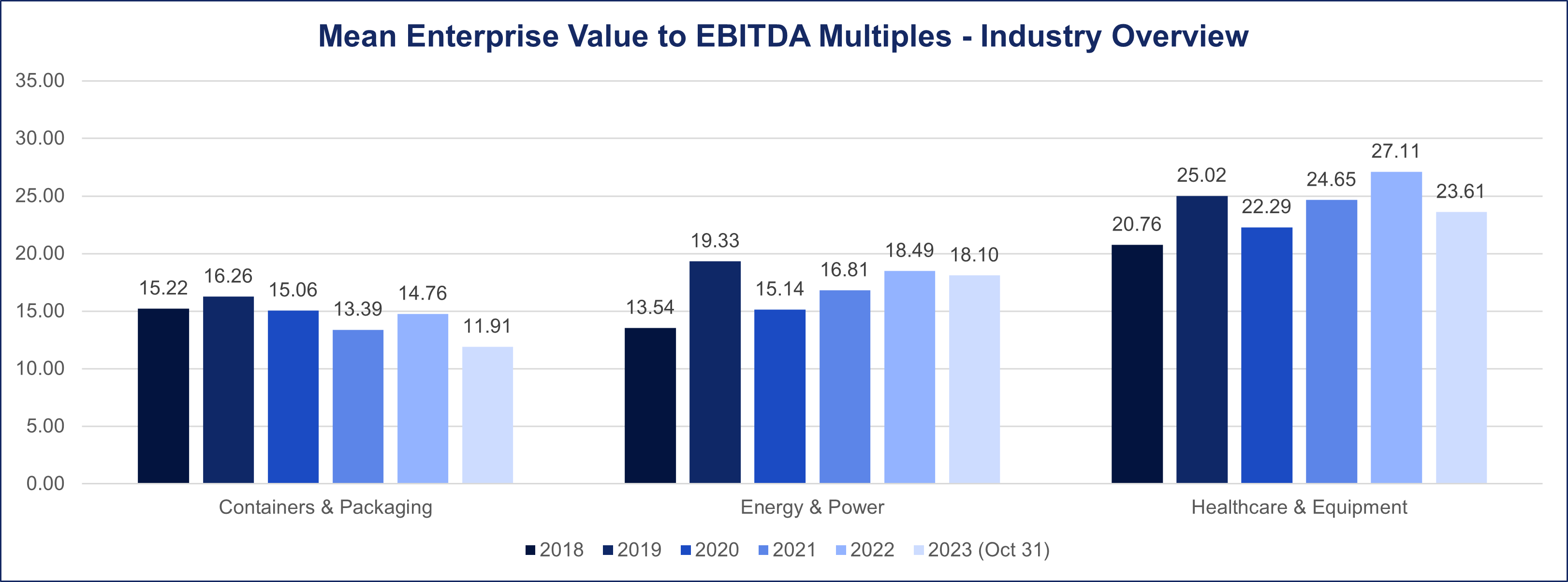

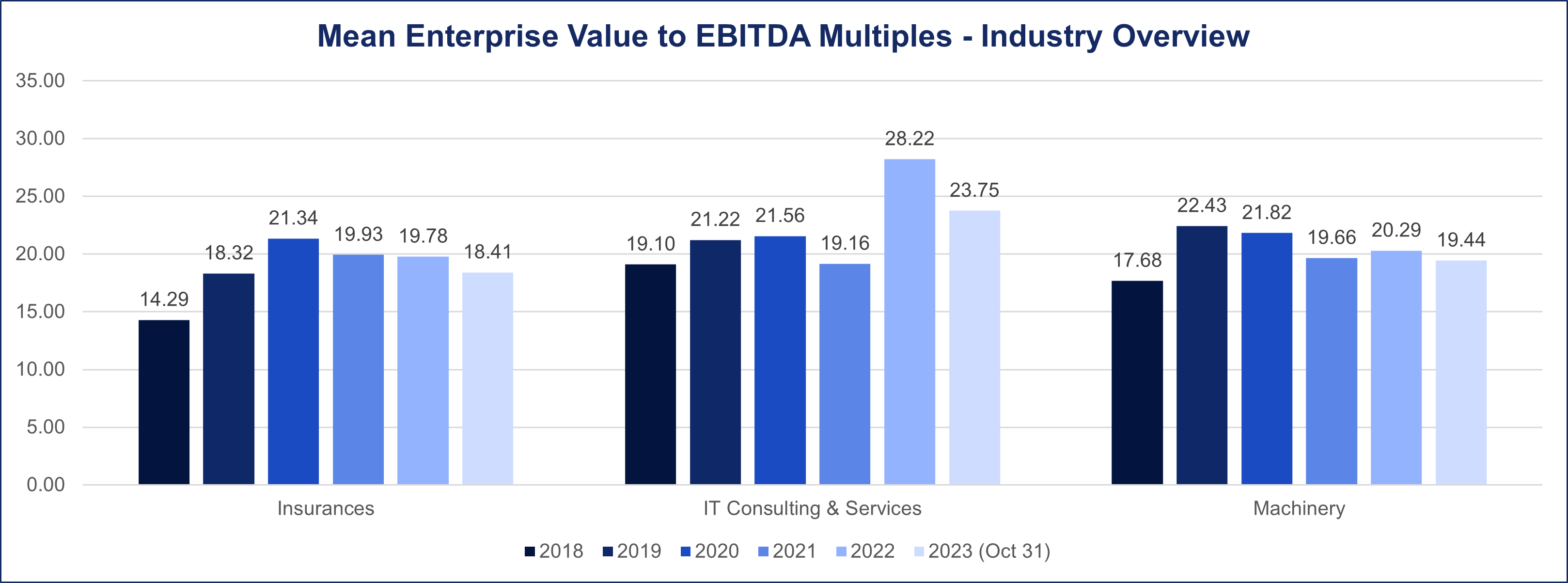

In this comprehensive report, we delve into the valuation dynamics of 18 diverse industries over the last six years, specifically focusing on the periods pre-pandemic, during the pandemic, and post-pandemic (2018 to October 31, 2023).

Overview

Our analysis employs two key valuation multiples: Enterprise Value to Earnings Before Interest, Taxes, Depreciation, and Amortization (EV/EBITDA) and Enterprise Value to Revenue (EV/Revenue). The goal is to provide a nuanced understanding of how industries have reacted and evolved in terms of deal multiples during these distinct economic phases.

EV/EBITDA and EV/Revenue Report

Our report covers 18 diverse industries, capturing the nuances of their valuation dynamics. The industries are as follows:

- Aerospace & Defense

- Automobile & Components

- Banks

- Biotech & Pharma

- Chemicals

- Consumer Products & Services

- Containers & Packaging

- Energy & Power

- Healthcare & Equipment

- Insurances

- IT Consulting & Services

- Machinery

- Media & Entertainment

- Oil & Gas

- Retail

- Software

- Steel

- Telecommunications

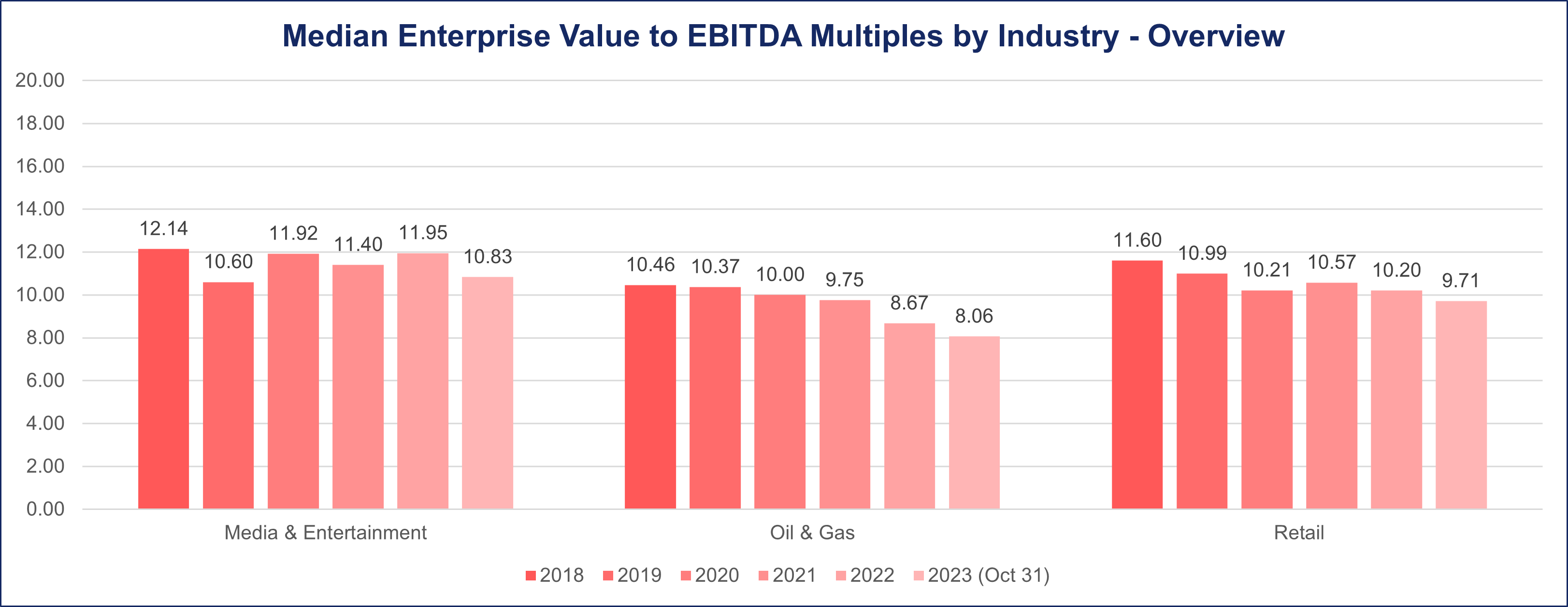

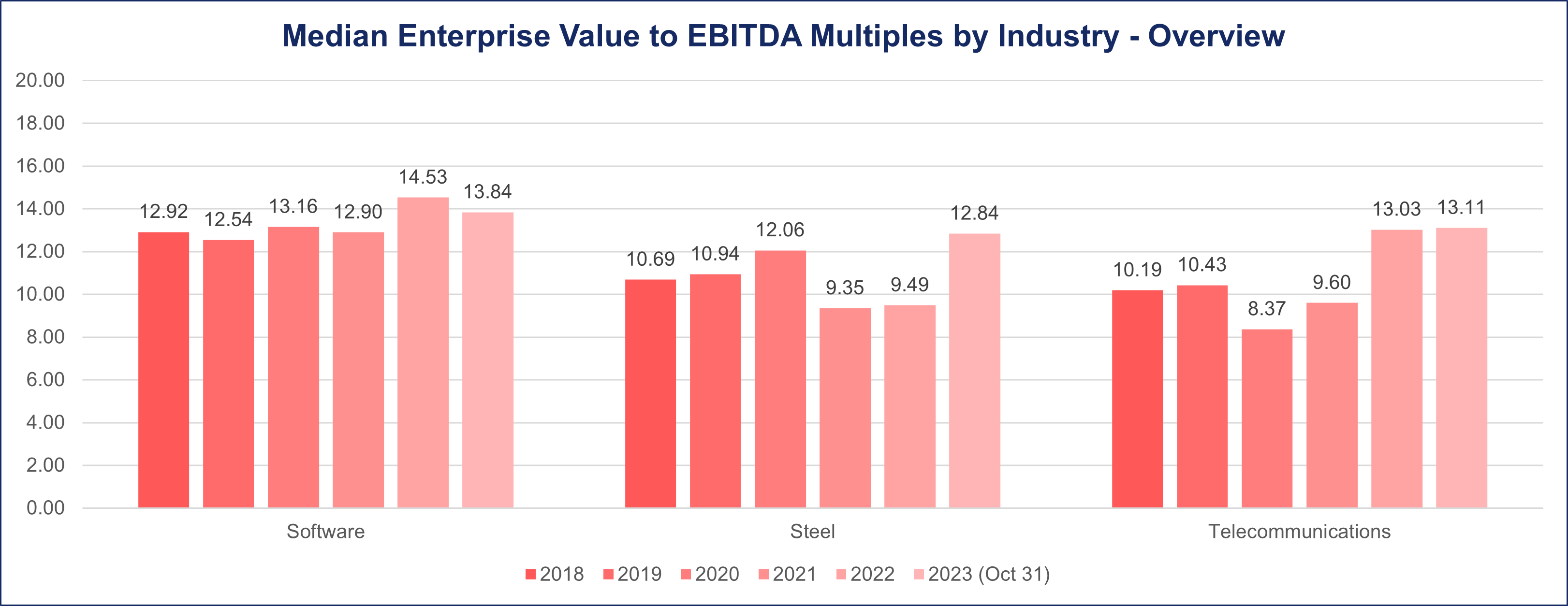

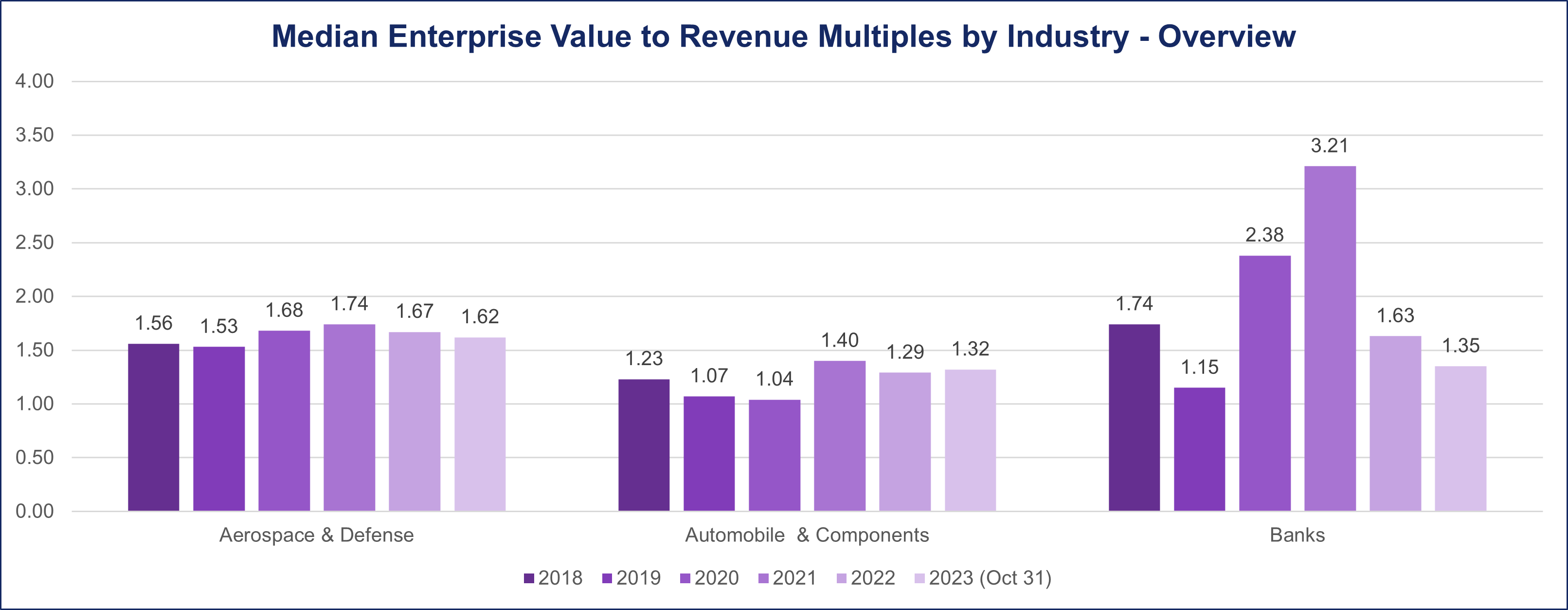

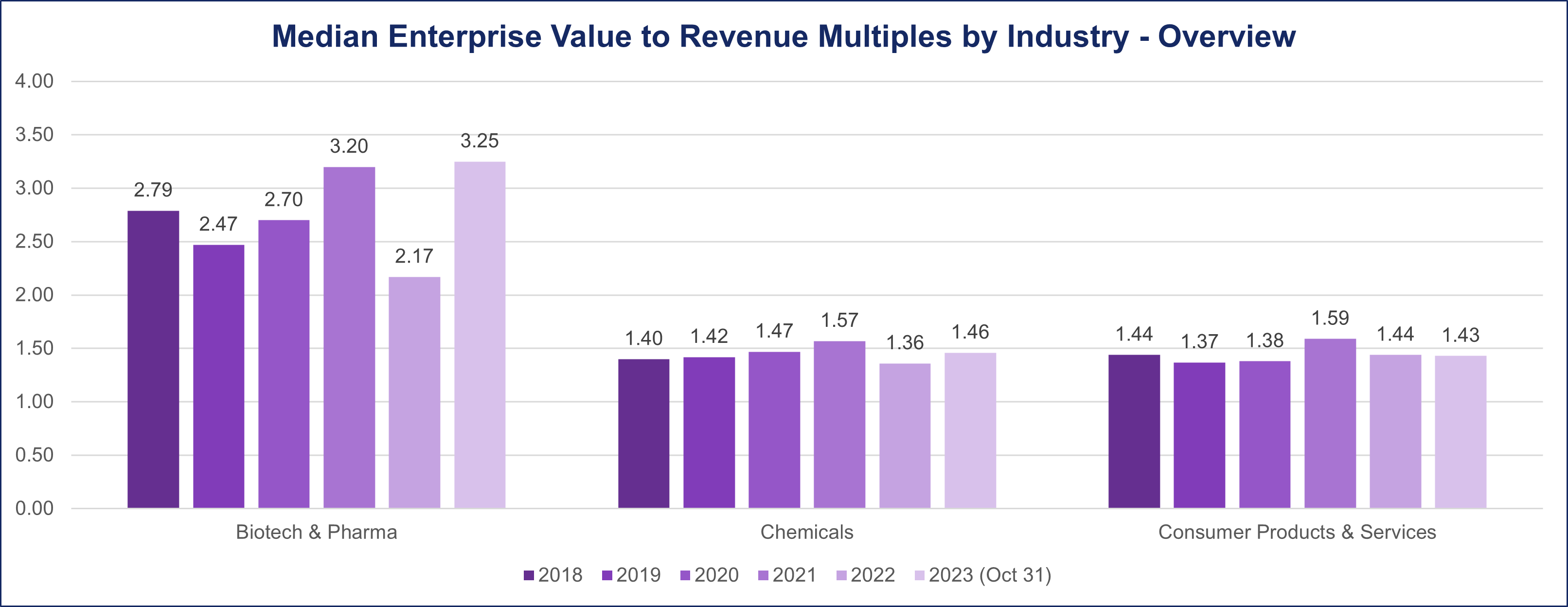

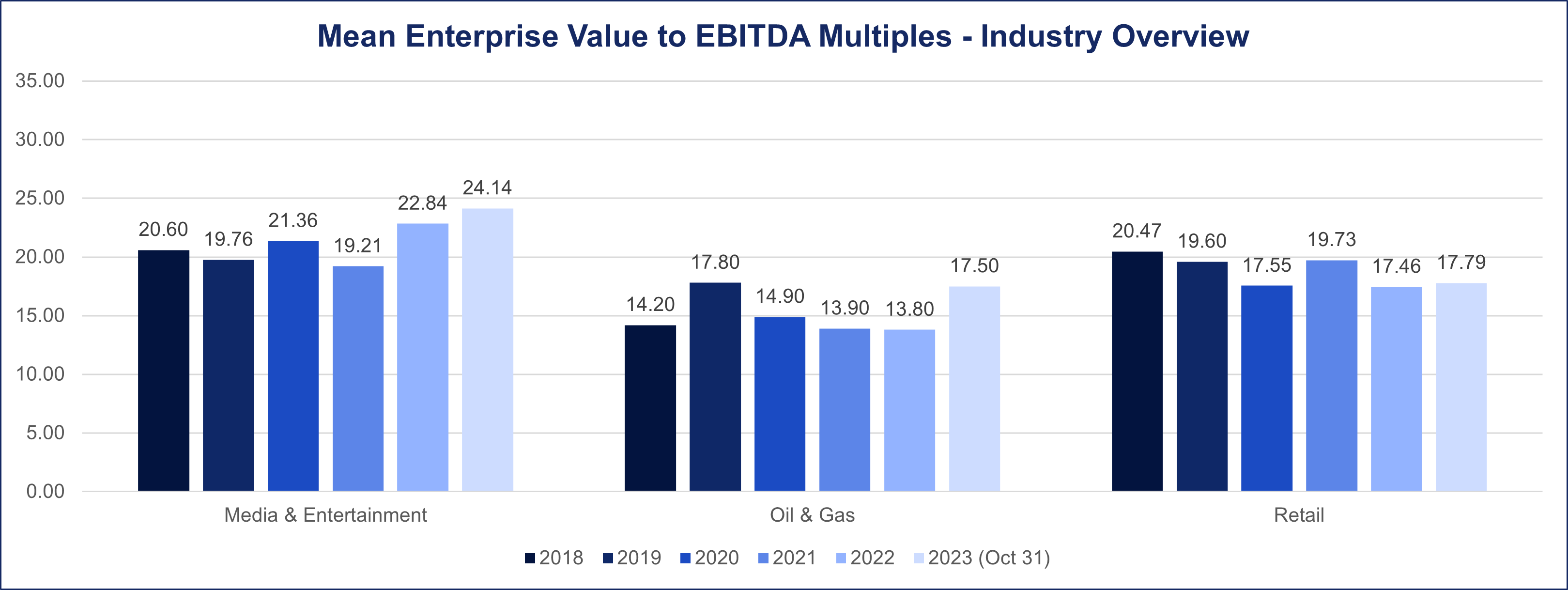

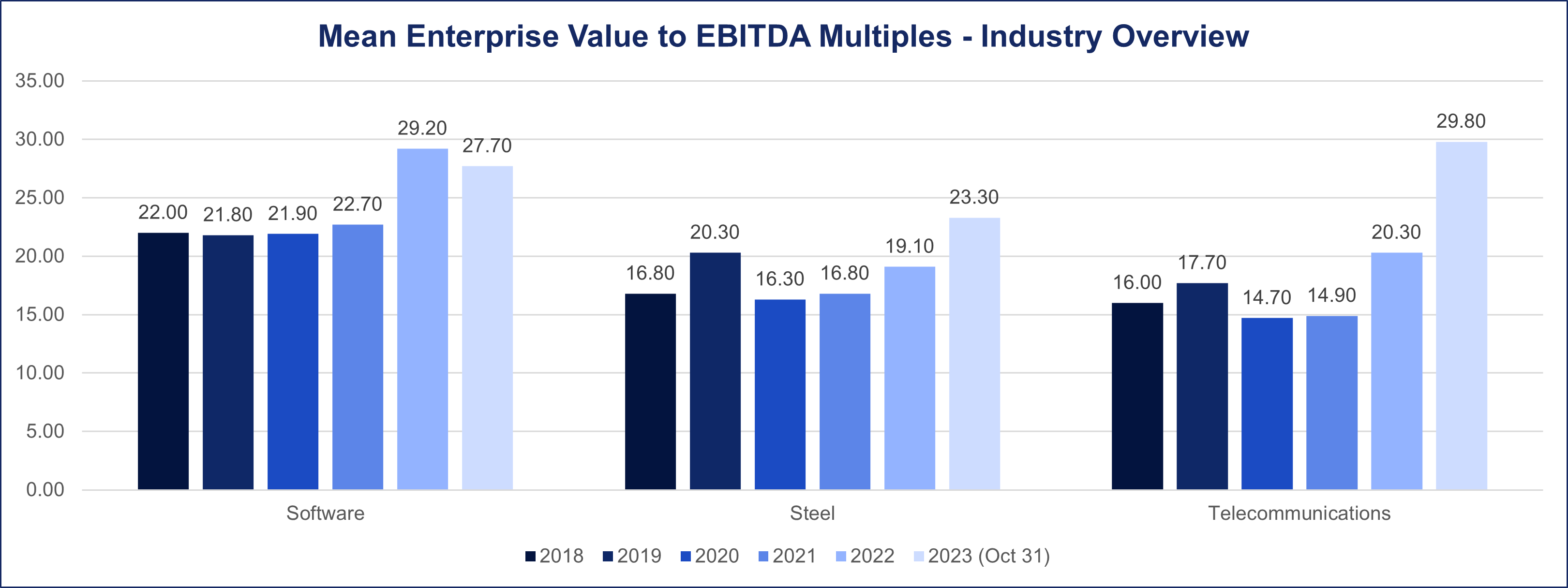

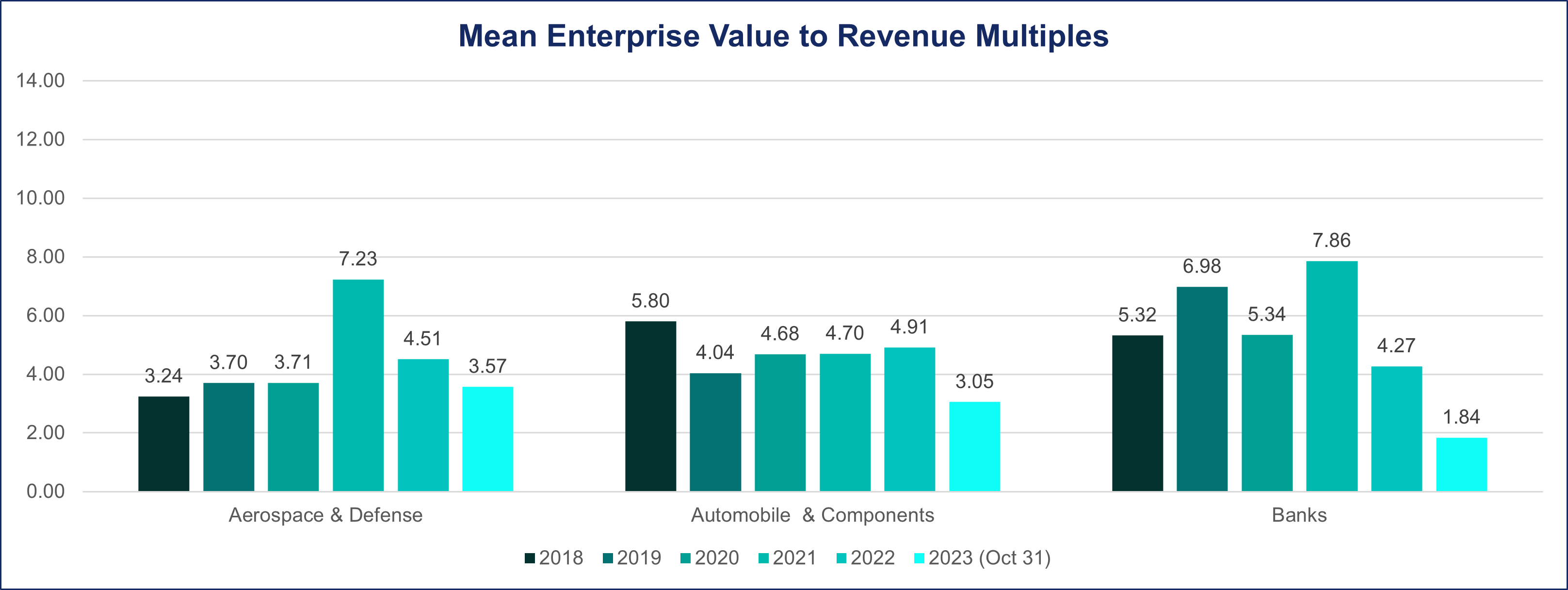

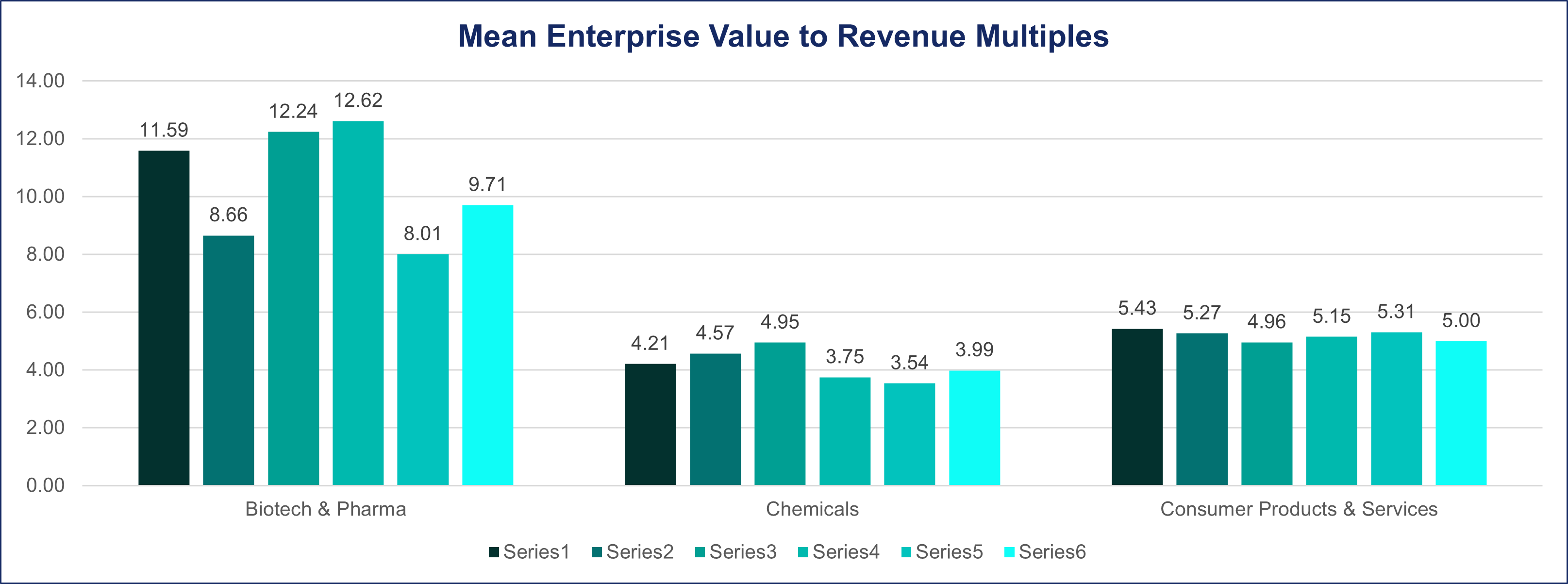

The analysis includes both median and mean deal multiples based on EV/EBITDA and EV/Revenue. The following charts and insights aim to elucidate how these industries responded to the challenges and opportunities presented in the pre-pandemic, during-pandemic, and post-pandemic periods.

Median Enterprise Value to EBITDA Multiples

by Industry – Overview

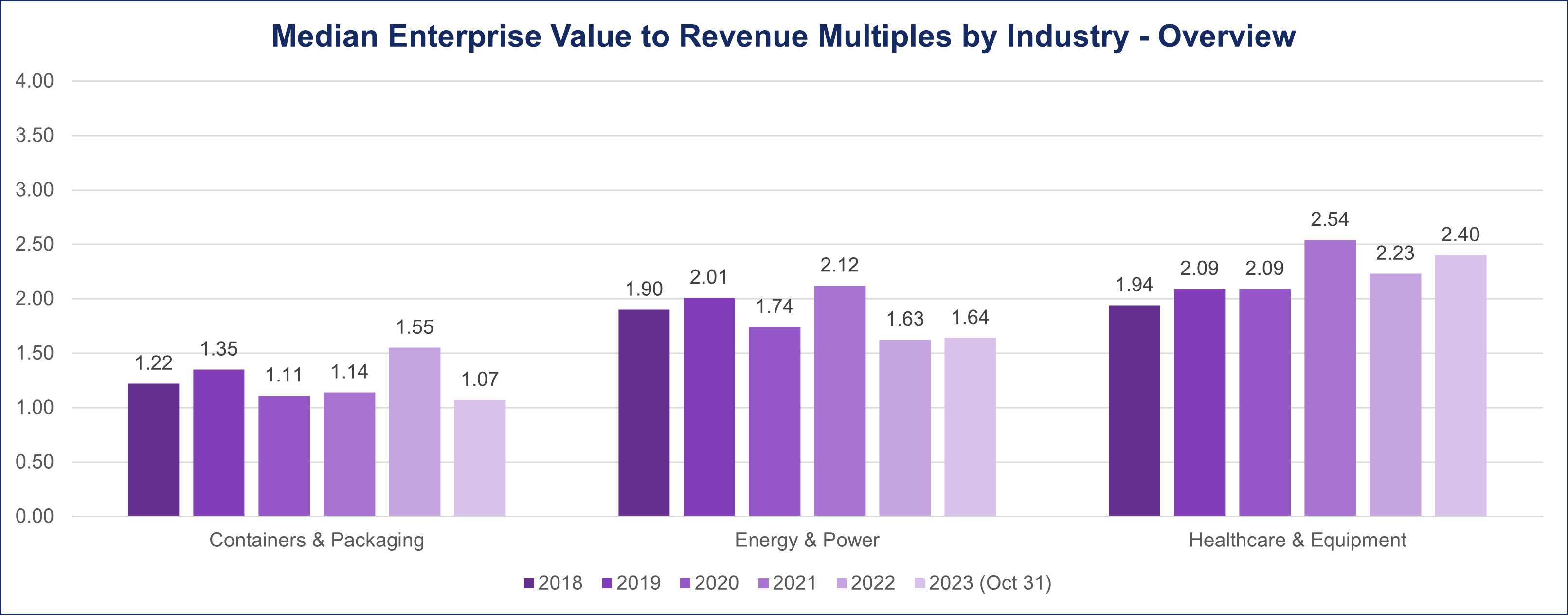

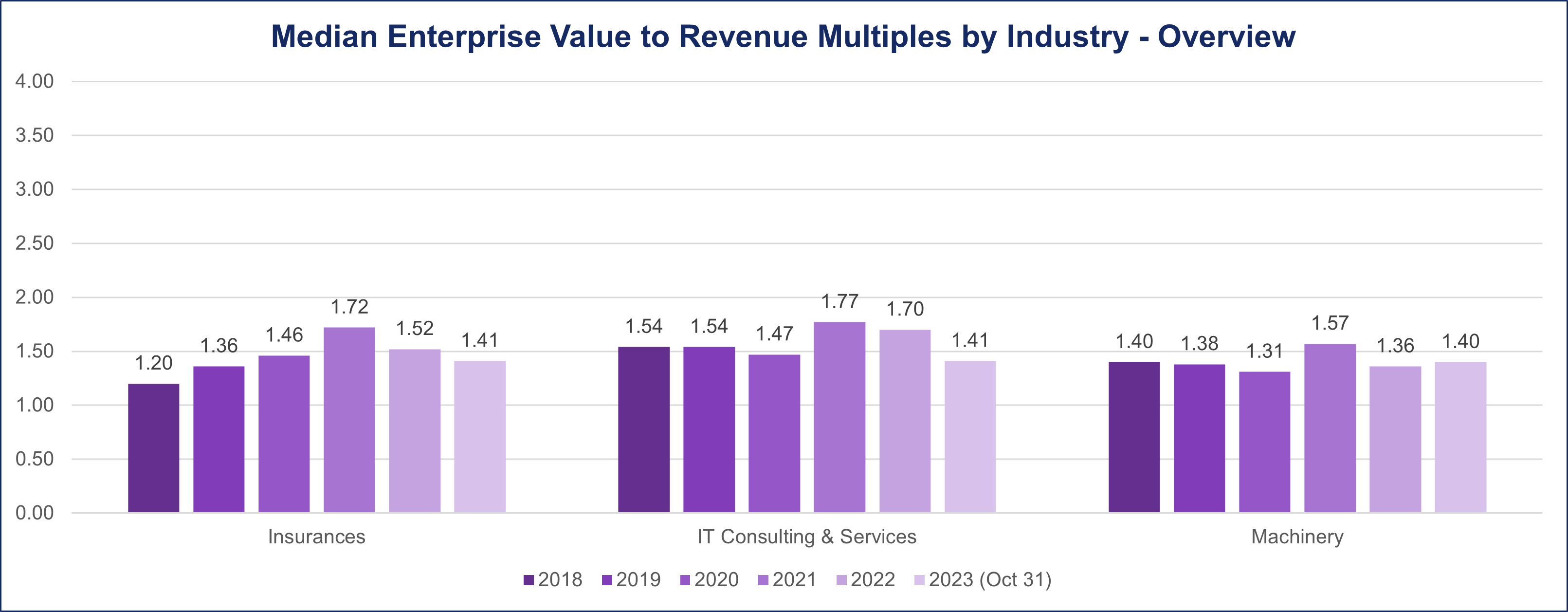

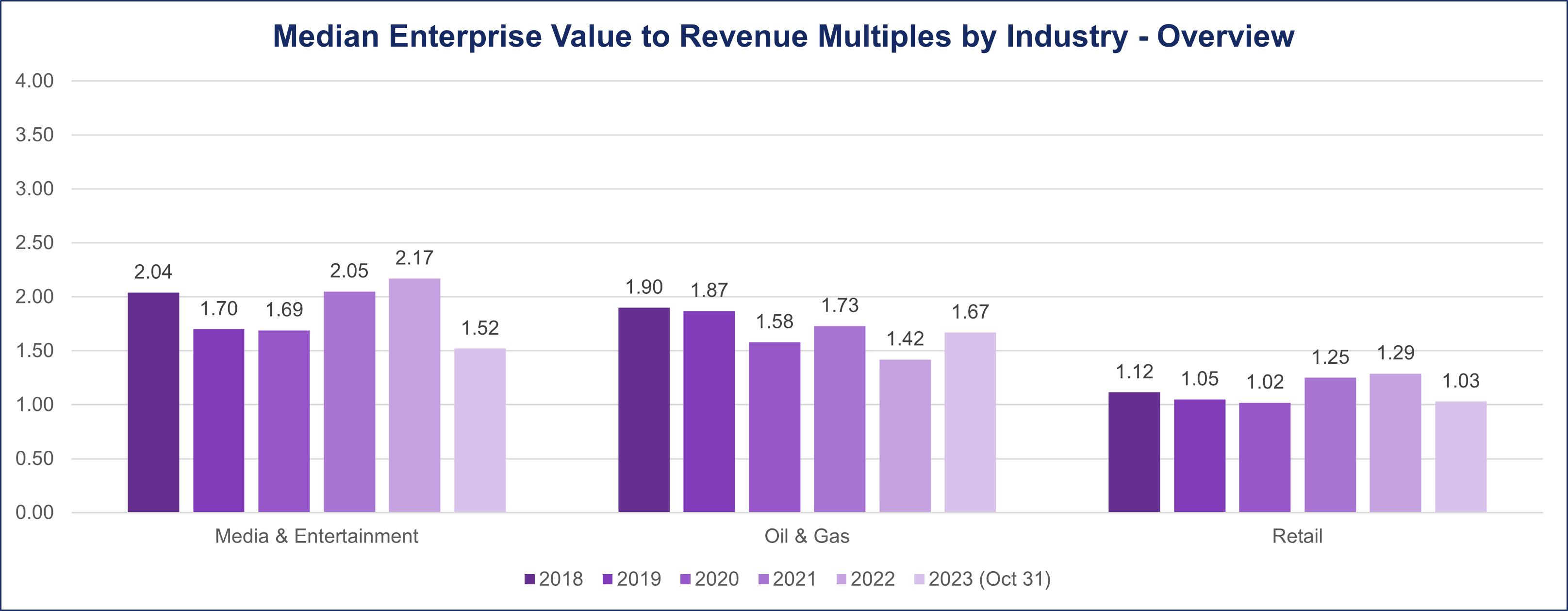

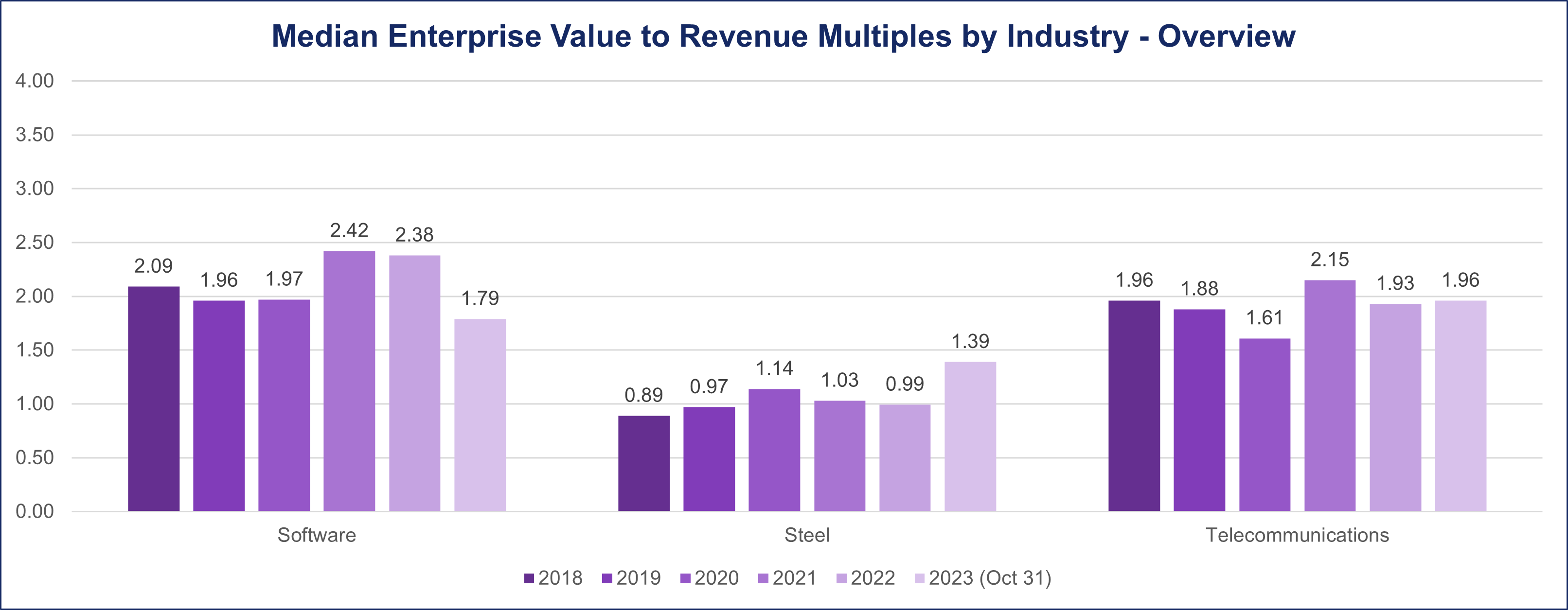

Median Enterprise Value to Revenue Multiples

by Industry – Overview

Mean Enterprise Value to EBITDA Multiples

by Industry – Overview

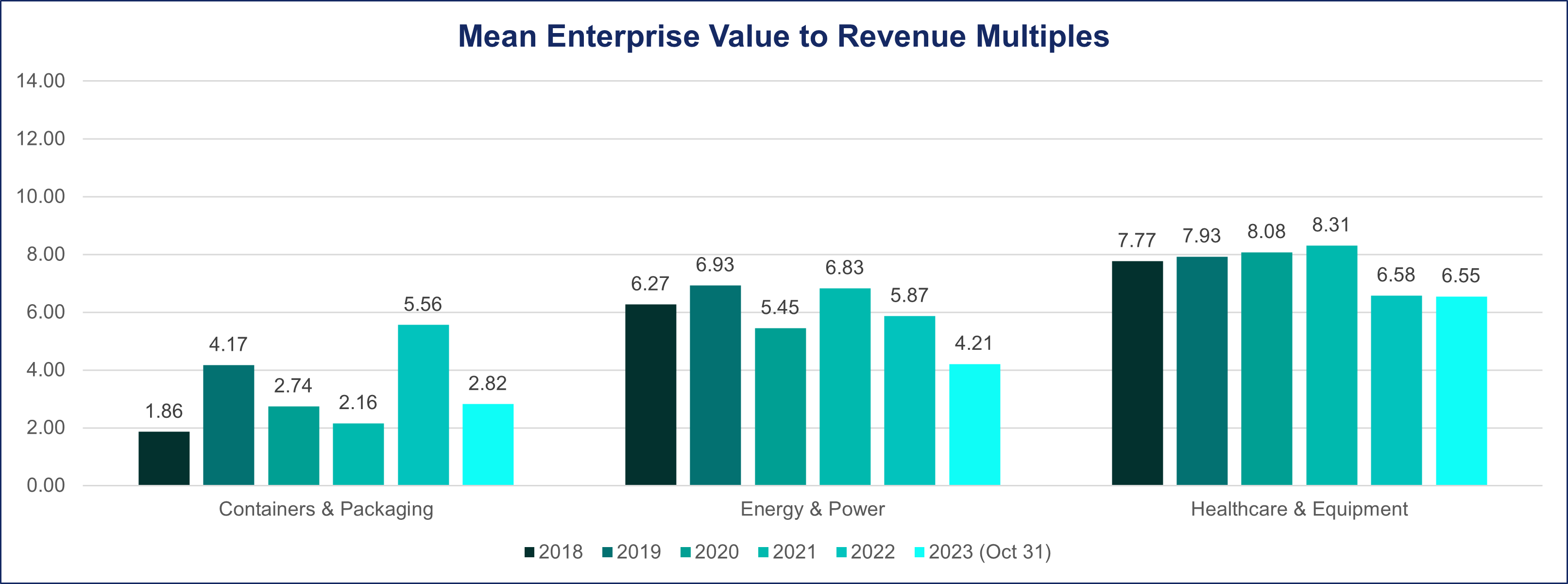

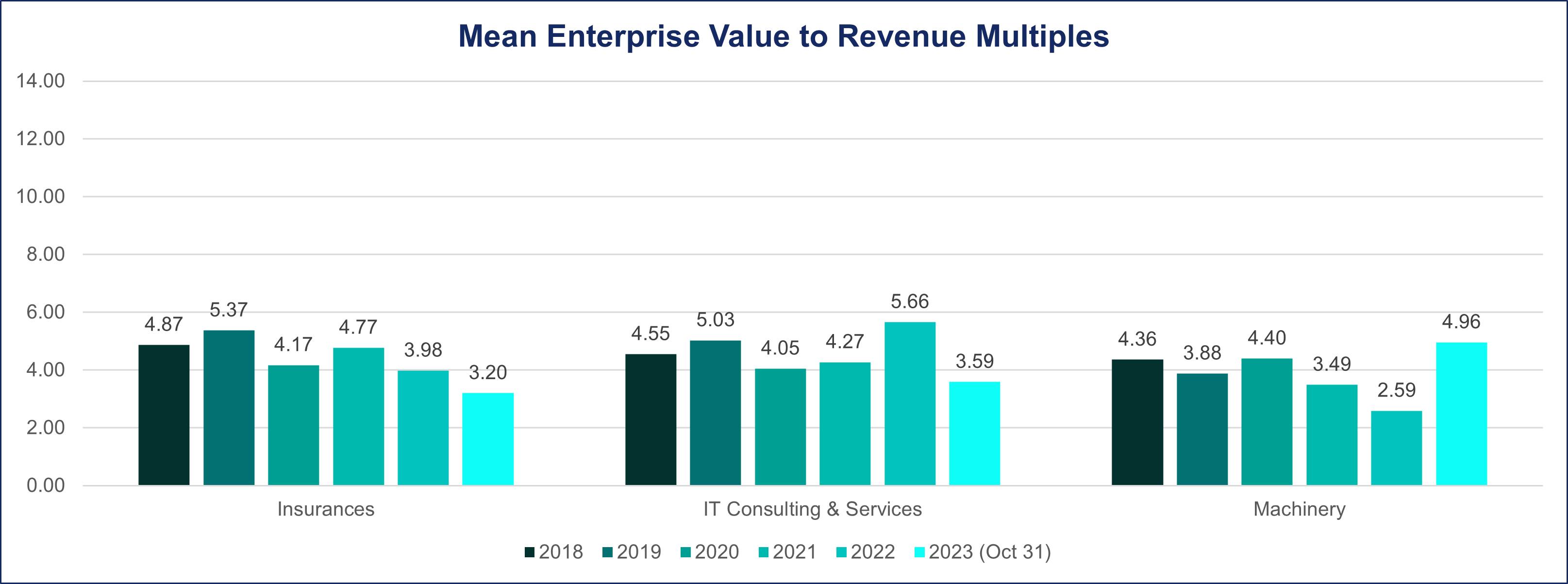

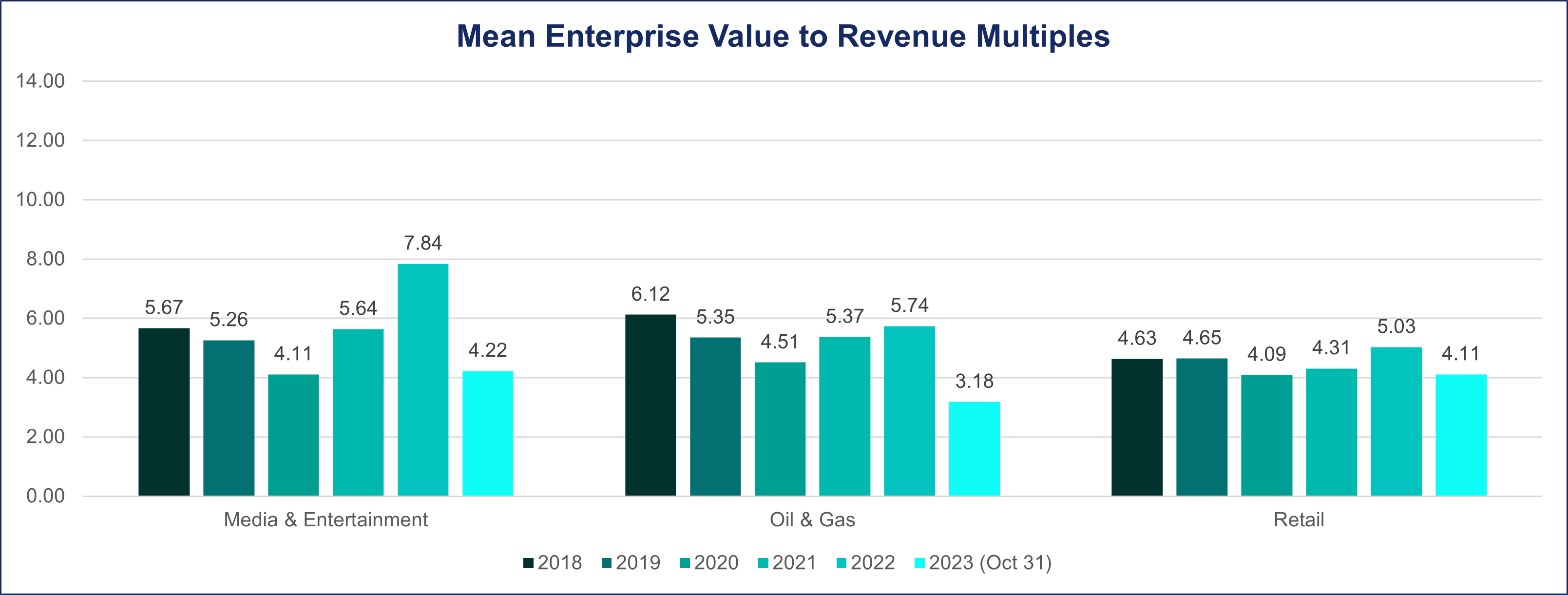

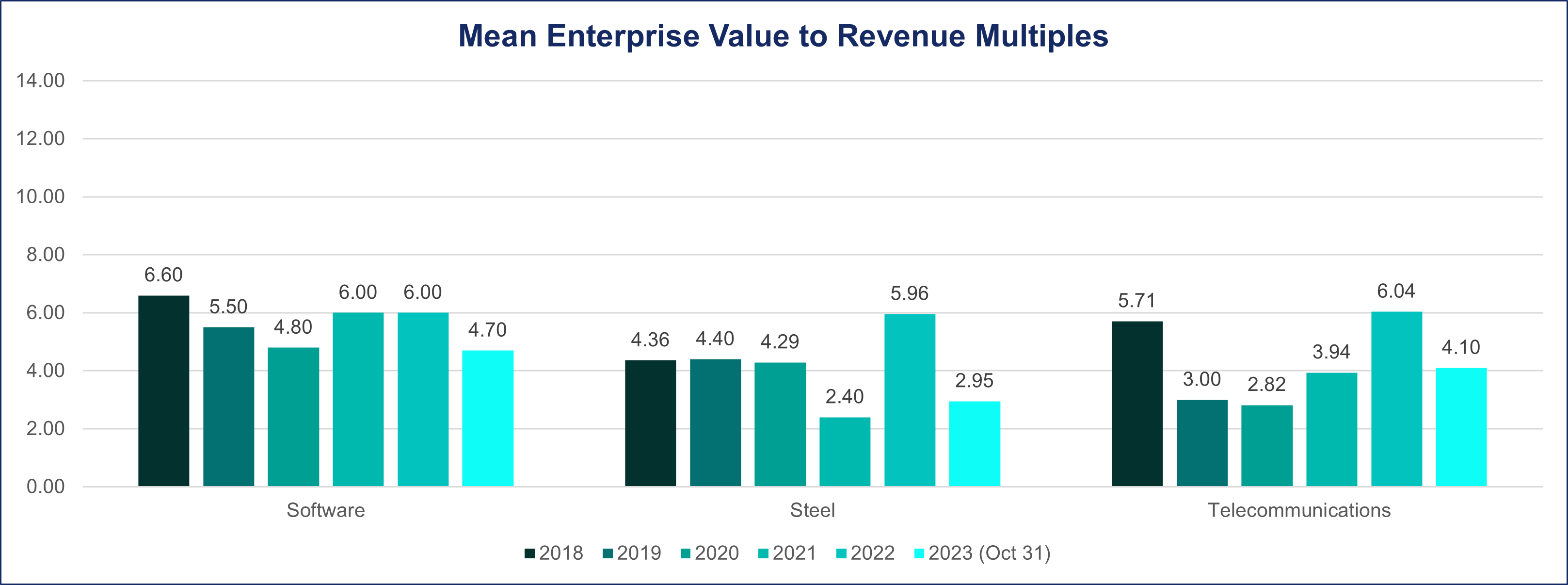

Mean Enterprise Value to Revenue Multiples

by Industry – Overview

To view the detailed charts per industry, click the thumbnails below:

As industries navigated through the evolving economic landscape of the last six years, the choice of valuation metric played a pivotal role in shaping deal multiples. This report aims to provide valuable insights for industry stakeholders, M&A professionals, and investors seeking a nuanced understanding of industry-specific valuation trends.

Valuation Metrics Overview

1. EV/EBITDA: Unveiling Profitability Dynamics

Definition: EV/EBITDA represents the ratio of a company’s Enterprise Value to its Earnings Before Interest, Taxes, Depreciation, and Amortization. It is a metric emphasizing profitability and operating efficiency.

Enterprise Value-to-EBITDA (EV/EBITDA):

EV/EBIDTA =

Enterprise Value

EBITDA

Where:

- Enterprise Value is the total value of a company’s equity and debt.

- EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

Applicability:

- Often preferred for mature companies with established profitability.

- Provides insights into a company’s operational performance, excluding non-operating expenses.

2. EV/Revenue: Unmasking Revenue-Centric Insights

Definition: EV/Revenue signifies the ratio of Enterprise Value to a company’s Revenue. This metric focuses on a company’s ability to generate revenue, irrespective of profitability.

Enterprise Value-to-Revenue (EV/R):

EV/R =

Enterprise Value

Revenue

Where:

- Enterprise Value is the total value of a company’s equity and debt.

- Revenue is the total income generated by the company from its primary operations.

Applicability:

- Particularly relevant for high-growth or early-stage companies.

- Emphasizes top-line growth and market presence.

- Industry-Specific Analysis

- In situations where a company is going through a downturn and is valued based on Forward Multiples (see next section).

Forward EV/Revenue and Forward EV/EBIDTA:

Forward EV / Revenue =

Estimated Enterprise Value

Estimated Revenue for the Next Year

Forward EV / EBITDA =

Estimated Enterprise Value

Estimated EBITDA for the Next Year

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter