M&A News M&A News: Global M&A Deals Week of September 9 to 15, 2024

- M&A News

M&A News: Global M&A Deals Week of September 9 to 15, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

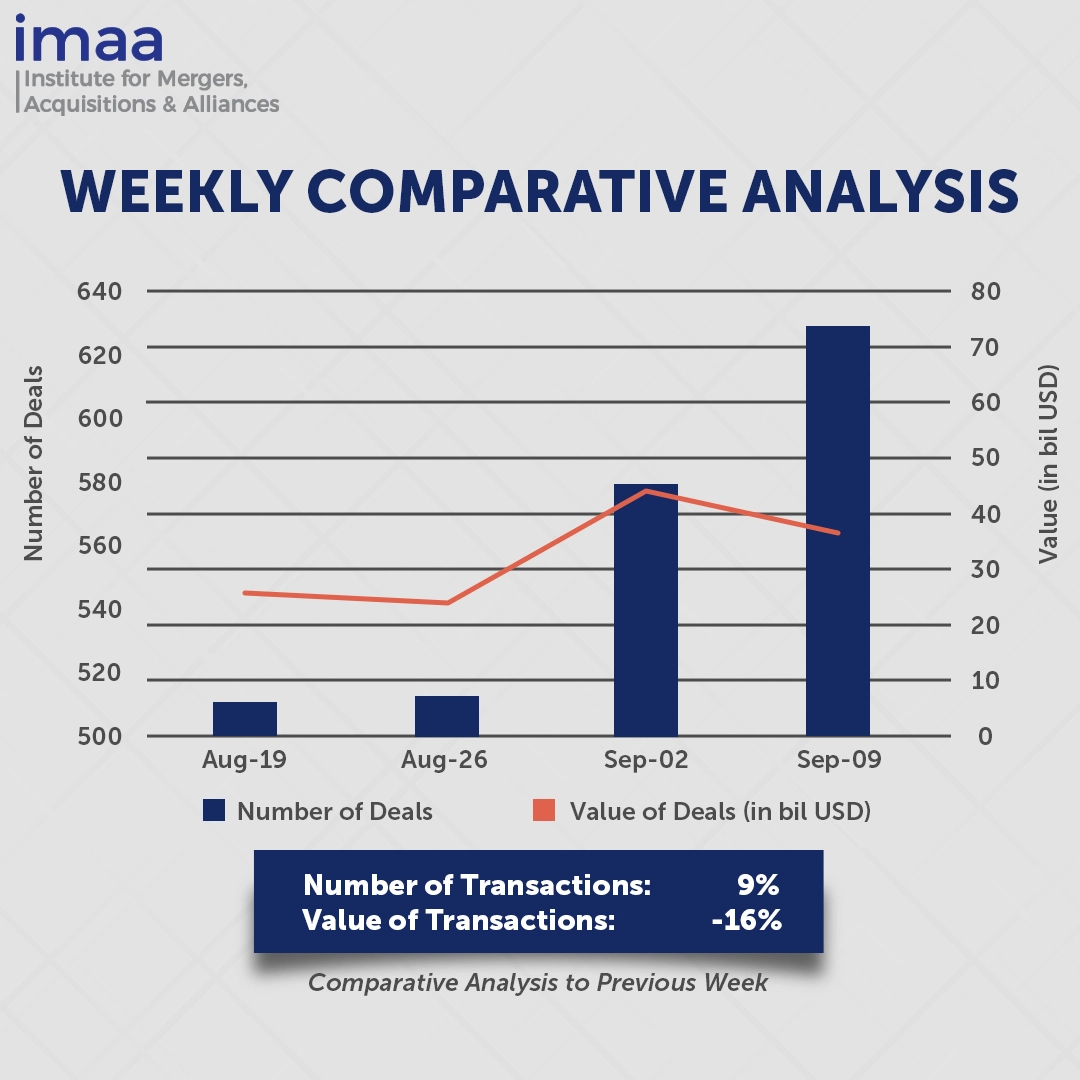

Between September 9 and September 15, the global mergers and acquisitions (M&A) market recorded 629 deals, with a combined value of USD 36.85 billion. Of these, 12 transactions each surpassed USD 500 million, totaling USD 28.7 billion, which accounted for 78% of the total deal value during the week.

A major highlight was the USD 15.9 billion acquisition of Schenker by DSV, which will position DSV as the largest logistics company worldwide by both revenue and volume. It also represents the largest acquisition by a Danish company to date and marks a major strategic move that will boost DSV’s competitive positioning, putting it ahead of key industry players such as DHL and Kuehne+Nagel. The acquisition is expected to improve DSV’s service capabilities, promote innovation, and offer greater flexibility in supply chain management, benefiting customers with more efficient and advanced solutions.

Compared to the previous week, the number of deals rose by 9%, increasing from 579 to 629. However, the total value of deals dropped by 16%, declining from USD 43.91 billion to USD 36.85 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of September 9 to 15, 2024 in detail:

Deal No. 1: DSV A/S to Acquire Schenker AG for USD 15.85 Billion

Deal No. 2: Mastercard Incorporated to Acquire Recorded Future, Inc. for USD 2.65 Billion

Deal No. 3: AngloGold Ashanti plc to Acquire Centamin plc for USD 2.50 Billion

Deal No. 4: Sentry Insurance to Acquire The General Automobile Insurance Services Inc. for USD 1.70 Billion

Deal No. 5: Contact Energy Limited to Acquire Manawa Energy Limited for USD 1.14 Billion

Deal No. 1:

DSV A/S to Acquire Schenker AG for USD 15.85 Billion

Global transport and logistics firm DSV is acquiring its German competitor Schenker for a significant sum of USD 15.85 billion (EUR 14.3 billion), marking DSV’s largest acquisition to date. This deal will position DSV as the world’s leading freight forwarder by both revenue and volume.

This acquisition will significantly expand DSV’s global footprint, expertise, and competitive advantage while unlocking new market opportunities in a rapidly evolving industry. Germany will play a pivotal role in DSV’s future operations, with key functions, including Schenker’s office in Essen, remaining in the country. In addition, DSV plans to invest EUR 1 billion in Germany over the next three to five years to support growth in this strategic market.

The deal will enhance DSV’s three main divisions—Air & Sea, Road, and Solutions—by incorporating Schenker’s expertise, improving service quality, and strengthening competitiveness across all sectors.

Upon completion, the combined entity will generate pro forma revenue of approximately EUR 39.3 billion, employing about 147,000 people across more than 90 countries.

The all-cash transaction, expected to close by Q2 2025, will be financed through a combination of equity and debt.

Deal No. 2:

Mastercard Incorporated to Acquire Recorded Future, Inc. for USD 2.65 Billion

Mastercard, a leader in financial services, has announced plans to acquire cybersecurity firm Recorded Future for USD 2.65 billion, marking a significant step in expanding its cybersecurity capabilities. The deal is intended to enhance Mastercard’s use of threat intelligence and insights to further secure its financial services infrastructure.

Recorded Future, a leading provider of threat intelligence, supports over 1,900 clients across 75 countries, including 45 national governments and more than half of the Fortune 100. The company excels in delivering real-time threat visibility through extensive data analysis, enabling its clients to proactively manage risks. Its expertise in artificial intelligence and cutting-edge technologies will enhance Mastercard’s identity verification, fraud prevention, real-time decision-making, and cybersecurity solutions, benefiting its extensive network of financial institutions and merchants.

This acquisition comes on the heels of a recent partnership between Mastercard and Recorded Future, where they jointly launched a tool to detect compromised payment cards. By bringing Recorded Future in-house, Mastercard can align the firm’s technological development more closely with its product roadmap and prevent potential competitor acquisition.

The transaction is expected to close by the first quarter of 2025.

Deal No. 3:

AngloGold Ashanti plc to Acquire Centamin plc for USD 2.50 Billion

AngloGold Ashanti has agreed to acquire Egyptian gold miner Centamin in a deal valued at USD 2.5 billion, as the global mining giant seeks to expand its portfolio amid rising gold prices. This acquisition adds one of the world’s largest gold-producing assets to AngloGold’s operations.

AngloGold Ashanti is a major global gold producer with a diversified portfolio of mining operations and exploration activities spanning nine countries across four continents. This deal grants AngloGold control of the Sukari mine, Egypt’s first large-scale modern gold mine, which has produced over 5.9 million ounces of gold since it began operations in 2009. Sukari is widely regarded as one of the most valuable gold deposits not yet owned by one of the industry’s top producers.

In addition to Sukari, Centamin is developing a pipeline of growth projects, including the Doropo project in Côte d’Ivoire, which is advancing toward development, and the early-stage EDX Blocks in Egypt. Centamin is also working on the ABC Project, a greenfield exploration in Côte d’Ivoire.

The acquisition is expected to be immediately accretive to AngloGold Ashanti’s cash flow per share in its first year. Leveraging its global scale, expertise, and asset optimization capabilities, AngloGold expects to unlock further value from Centamin’s assets.

Deal No. 4:

Sentry Insurance to Acquire The General Automobile Insurance Services Inc. for USD 1.70 Billion

Sentry Insurance plans to acquire Nonstandard Auto Insurer The General from American Family Insurance for USD 1.7 billion, including debt and required capital. This acquisition unites two prominent players in the non-standard auto insurance sector.

Sentry, known for its expertise in business insurance, also offers comprehensive coverage for non-standard auto, motorcycle, and off-road vehicles through its Dairyland brand. Non-standard auto insurance caters to drivers who face difficulties securing standard auto coverage.

The acquisition strategically aligns with Sentry’s business model, as The General specializes in direct-to-consumer non-standard auto insurance. The General has seen substantial growth, with revenue increasing more than fivefold, driven by consistent profitability and expansion into new states, all while maintaining a strong commitment to its customers.

Sentry’s expertise and reputation in the industry, combined with its supportive employment culture, are expected to benefit The General’s customers and facilitate a smooth transition for its employees. During the integration process, the brands will operate independently.

The deal is anticipated to close by the end of 2024, subject to regulatory approvals. J.P. Morgan is advising Sentry, while Goldman Sachs & Co. LLC is advising American Family Insurance.

Deal No. 5:

Contact Energy Limited to Acquire Manawa Energy Limited for USD 1.14 Billion

New Zealand’s Contact Energy has announced its decision to acquire Manawa Energy in a cash-and-stock transaction worth USD 1.14 billion. This strategic acquisition aims to strengthen Contact Energy’s ability to meet the evolving energy needs of the South Pacific region.

Manawa Energy has a total installed generation capacity of 510 MW, distributed across 26 generation sites throughout New Zealand. The company operates 25 hydroelectric facilities and is advancing over 1,200 MW in wind and solar projects, which are geographically diversified.

The merger will result in a combined development pipeline exceeding 10 TWh, significantly bolstering Contact Energy’s development capabilities. This aligns with Contact’s strategy to expand its renewable generation and accelerate the decarbonization of its energy portfolio.

By integrating Manawa Energy, Contact Energy seeks to build a more diversified and resilient business, leveraging complementary hydro assets to offer increased volumes of fixed-price electricity to the market.

The transaction is expected to be finalized in the first half of 2025 and comes in response to increasing electricity shortages in New Zealand, following a decade-low in hydropower generation in August.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of September 9 to 15, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter