M&A News M&A News: Global M&A Deals Week of Sep 30 to Oct 6, 2024

- M&A News

M&A News: Global M&A Deals Week of Sep 30 to Oct 6, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

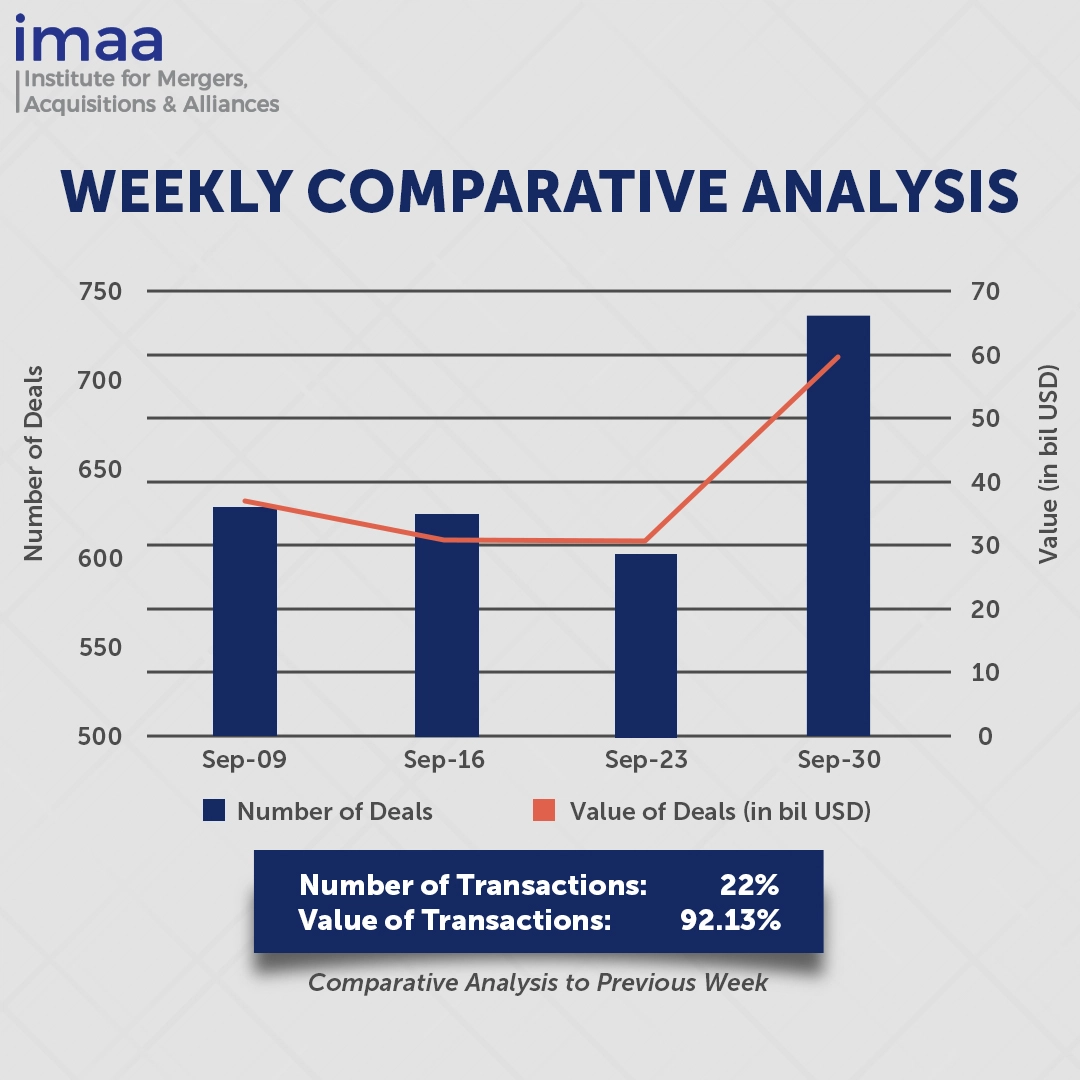

During the week of September 30 to October 6, the global mergers and acquisitions (M&A) landscape displayed strong momentum, with a total of 736 deals announced, resulting in an aggregate deal value of USD 59.48 billion. Notably, 18 transactions exceeded the USD 500 million threshold, accounting for USD 49.07 billion, or approximately 82% of the total deal value for the week.

The most notable transaction during this period was Marsh & McLennan’s cash acquisition of McGriff Insurance Services for USD 7.75 billion. This strategic acquisition positions Marsh & McLennan to take advantage of expected increases in business spending on insurance, fueled by a favorable economic outlook. The deal will enhance MMC’s foothold in the U.S. insurance market by expanding its capabilities in areas such as commercial property and casualty, employee benefits, and personal lines. Acquisitions remain a fundamental aspect of Marsh & McLennan’s growth strategy, allowing the company to enhance its service offerings, penetrate new markets, and strengthen its existing market presence.

Furthermore, private equity firm TPG Capital made headlines with its involvement in the week’s second and third largest transactions, acquiring DirecTV for USD 7.6 billion and Techem GmbH for USD 7.5 billion. These acquisitions underscore TPG’s strategic focus on diversified investments, operational improvements, and long-term value creation, positioning the firm to capitalize on emerging market trends and drive growth within its portfolio.

A comparative analysis reveals a 22% week-on-week increase in deal volume, rising from 603 to 736 transactions. Additionally, the total deal value soared by 92%, climbing from USD 30.96 billion the previous week to USD 59.48 billion during this period, driven by several multi-billion-dollar deals.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of September 30 to October 6, 2024 in detail:

Deal No. 1: Marsh & McLennan Agency LLC to Acquire McGriff Insurance Services, LLC for USD 7.75 Billion

Deal No. 2: TPG Capital, L.P. to Acquire DirecTV, LLC for USD 7.60 Billion

Deal No. 3: TPG Capital, L.P.; GIC Private Limited to Acquire Techem GmbH for USD 7.50 Billion

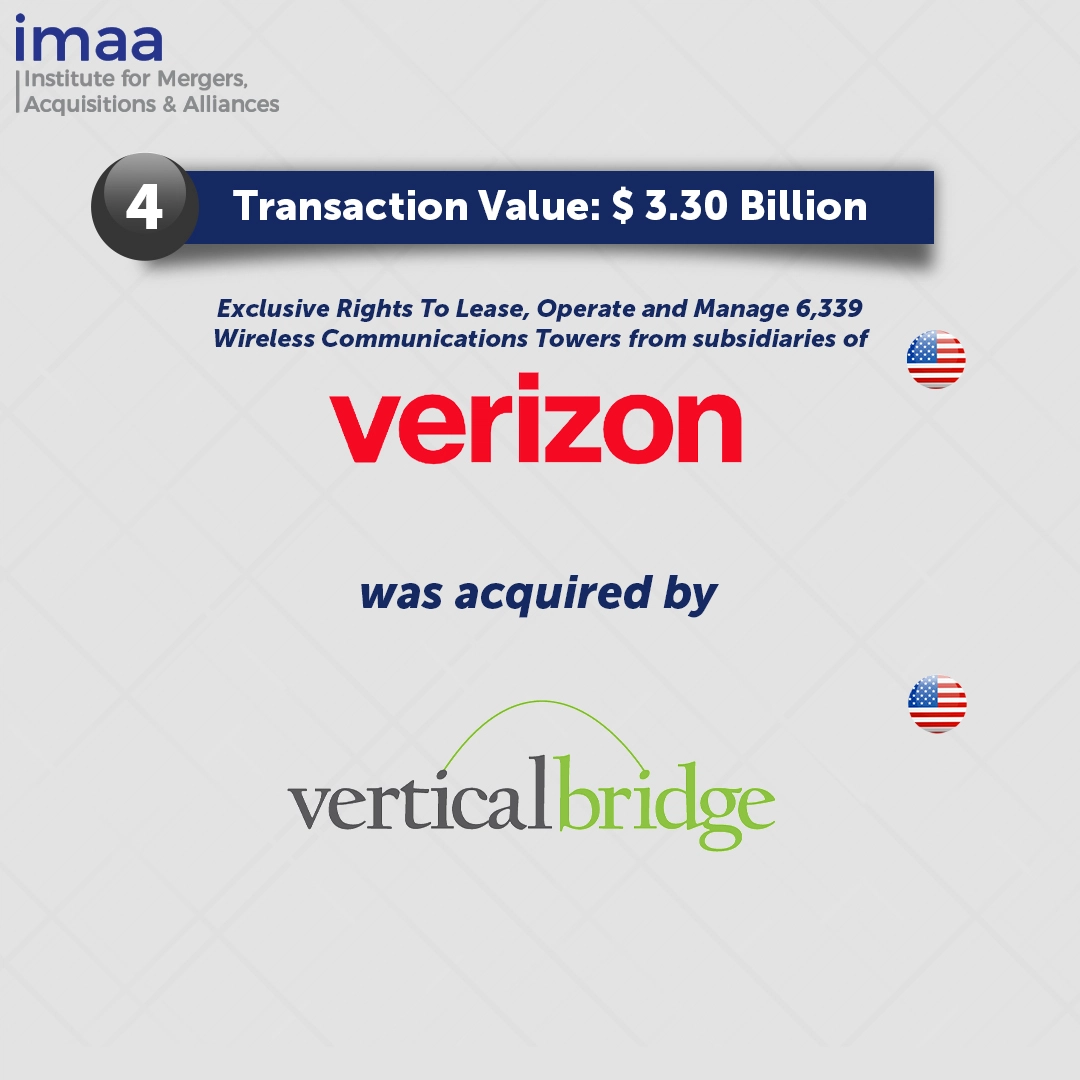

Deal No. 4: Vertical Bridge REIT, LLC to Acquire Exclusive Rights To Lease, Operate and Manage 6,339 Wireless Communications Towers Across US for USD 3.30 Billion

Deal No. 5: Coeur Mining, Inc. to Acquire SilverCrest Metals Inc. for USD 1.70 Billion

Deal No. 1:

Marsh & McLennan Agency LLC to Acquire McGriff Insurance Services, LLC for USD 7.75 Billion

Marsh McLennan has announced plans to acquire McGriff Insurance Services, a major player in the U.S. insurance brokerage and risk management sector, in a USD 7.75 billion cash deal.

This acquisition further solidifies Marsh McLennan’s position as the largest U.S. insurance broker, with the firm reporting USD 22.7 billion in revenue for 2023.

McGriff Insurance Services specializes in a wide range of offerings, including property and casualty insurance, employee benefits, personal insurance, and niche services such as corporate bonding, surety, cyber, and title insurance. The firm generated USD 1.3 billion in revenue for the 12 months ending June 30, 2024.

Upon completion, McGriff’s team of over 3,500 employees will merge with Marsh McLennan Agency (MMA) while maintaining their existing office locations. The addition of McGriff will strengthen MMA’s portfolio, particularly in commercial property and casualty, employee benefits, management liability, and personal insurance. This move builds on MMA’s acquisition of three firms earlier in 2024.

The transaction is anticipated to close by the end of 2024.

Deal No. 2:

TPG Capital, L.P. to Acquire DirecTV, LLC for USD 7.60 Billion

Telecom giant AT&T is selling its 70% stake in DIRECTV, a leading U.S. satellite television provider, to private equity firm TPG Capital for USD 7.6 billion.

Since 2021, DIRECTV has operated as a joint venture between AT&T and TPG, incorporating the services of DIRECTV, DIRECTV STREAM, and U-verse video, which were formerly managed by AT&T. As a leader in the pay-TV sector, DIRECTV delivers a wide array of programming, featuring live television, on-demand content, sports, movies, and premium channels.

This sale is expected to enhance DIRECTV’s financial foundation, allowing for increased investment in innovative video services that will benefit consumers. Additionally, it will strengthen TPG’s existing relationship with DIRECTV, leveraging TPG’s extensive experience in the internet, digital media, and communications sectors to facilitate the expansion of DIRECTV’s next-generation streaming service, which currently serves millions of subscribers and generates substantial annual revenue.

The transaction is projected to be finalized in the second half of 2025. Barclays is acting as the lead financial advisor for TPG, with additional financial guidance provided by BofA Securities, Evercore, LionTree, and Morgan Stanley.

Deal No. 3:

TPG Capital, L.P.; GIC Private Limited to Acquire Techem GmbH for USD 7.50 Billion

TPG Capital has partnered with Singapore’s sovereign wealth fund, GIC, to acquire German energy metering company Techem GmbH for EUR 6.7 billion (approximately USD 7.5 billion).

Techem specializes in energy management solutions, focusing on the measurement and billing of heating, water, and electricity consumption in both residential and commercial sectors. Its advanced technology and transparent consumption analytics provide essential services that help reduce costs and enhance the environmental performance of real estate assets throughout Europe. Recently, Techem surpassed the EUR 1 billion revenue threshold, driven by the launch of new digital services and expanded decarbonization initiatives, positioning the company for future growth.

The acquisition will be carried out through TPG Rise Climate, TPG’s dedicated climate investing strategy within its USD 19 billion global impact investing platform. GIC will participate as a significant minority investor in this venture.

With the backing of TPG and GIC, Techem aims to strengthen its “One Digital Platform,” leveraging digital innovation to unlock substantial energy efficiency improvements in the building sector, optimize operational workflows, and enhance the comfort of living spaces across Europe and beyond.

The deal is expected to close in the first half of 2025.

Deal No. 4:

Vertical Bridge REIT, LLC to Acquire Exclusive Rights To Lease, Operate and Manage 6,339 Wireless Communications Towers Across US for USD 3.30 Billion

Vertical Bridge, a prominent communications infrastructure firm, has secured an agreement with Verizon to obtain exclusive rights to lease, operate, and manage 6,339 wireless communications towers from Verizon’s subsidiaries across all 50 states and Washington, D.C. Valued at approximately USD 3.3 billion, this transaction includes various commercial benefits.

As part of the deal, Verizon will act as the anchor tenant, leasing back capacity on the towers for an initial term of 10 years, with options to extend the lease for up to 50 years. This partnership, in conjunction with Verizon’s existing build-to-suit joint venture with Vertical Bridge, is designed to lower tower-related costs and enhance vendor diversity in the telecommunications sector.

Vertical Bridge has emerged as one of the largest private operators of communication infrastructure in the United States, providing essential support to wireless carriers and telecommunications providers through lease agreements for its tower sites. The company is dedicated to advancing wireless communications, including 5G technology, by expanding its portfolio across urban, suburban, and rural areas.

This agreement represents a significant step forward for Vertical Bridge, solidifying its leadership position in the tower sector and strategically positioning it to address the growing demand for wireless infrastructure. This demand is largely driven by the evolving connectivity needs across industries, fueled by the rise of AI-driven technologies and the widespread adoption of 5G.

The deal is anticipated to close by the end of 2024. J.P. Morgan served as the financial advisor to Verizon, while Centerview Partners LLC acted as the financial advisor for Vertical Bridge.

Deal No. 5:

Coeur Mining, Inc. to Acquire SilverCrest Metals Inc. for USD 1.70 Billion

Canadian precious metals miner SilverCrest is on track to be acquired by U.S.-based Coeur Mining for USD 1.7 billion, a strategic move driven by the escalating demand for silver and the desire for mining companies to secure valuable reserves. This acquisition is set to establish a leading global player in silver production by enhancing the combined company’s low-cost silver and gold output.

The merger will unify SilverCrest’s flagship Las Chispas mine in Mexico with Coeur’s existing operations, which include the recently expanded Rochester mine in Nevada and the Palmarejo underground mine in Mexico. This consolidation is projected to result in an impressive silver production of 21 million ounces by 2025 across five North American sites.

In terms of financial performance, the merged company is expected to generate approximately USD 700 million in EBITDA and USD 350 million in free cash flow by 2025, benefiting from reduced costs and improved profit margins.

The transaction is expected to finalize in late Q1 2025. Coeur is being advised by BMO Capital Markets and Goldman Sachs & Co. LLC, while SilverCrest has enlisted Cormark Securities Inc. and Raymond James Ltd. as financial advisors.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of September 30 to October 6, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter