M&A News M&A News: Global M&A Deals Week of September 23 to 29, 2024

- M&A News

M&A News: Global M&A Deals Week of September 23 to 29, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

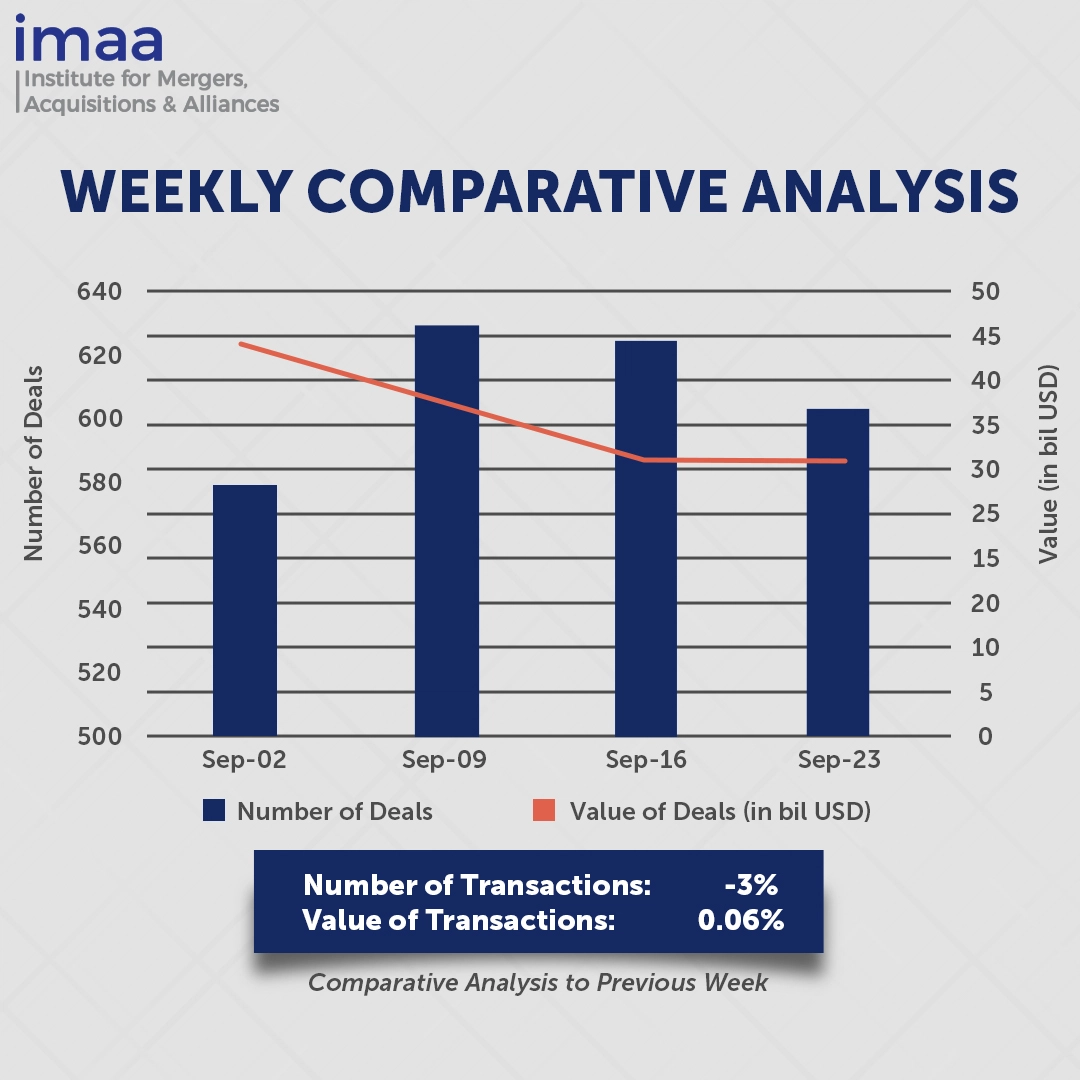

The global mergers and acquisitions (M&A) market reported 603 deals with a total cumulative value of USD 30.96 billion from September 23 to September 29. Among these, 13 transactions surpassed the USD 500 million threshold, collectively accounting for USD 21.91 billion—71% of the week’s total deal value.

A significant highlight of this week was Vista Equity Partners and Blackstone’s acquisition of Smartsheet for USD 8.4 billion. This transaction marks one of the largest recent acquisitions in the software sector, further enhancing the portfolios of both Vista and Blackstone, which are dedicated to enterprise technology investments. Smartsheet has demonstrated remarkable growth, consistently exceeding performance expectations in recent quarters.

Earlier this year, Vista expanded its portfolio by acquiring Jaggaer, a provider of enterprise procurement and collaboration software, and securing a majority stake in Nasuni, a data storage software company. Similarly, Blackstone has made notable strides in the market, recently acquiring data center operator AirTrunk and public sector software solutions provider Civica. The acquisition of Smartsheet underscores the strategic commitment of both firms to bolster their investments in the rapidly evolving tech landscape.

In terms of week-on-week performance, the deal volume decreased by 3%, from 624 to 603. Conversely, deal value experienced a slight increase, rising from USD 30.94 billion to USD 30.96 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of September 23 to 29, 2024 in detail:

Deal No. 1: Vista Equity Partners; Blackstone Inc. to Acquire Smartsheet Inc. for USD 8.40 Billion

Deal No. 2: Prio S.A. to Acquire Peregrino and Pitangola Oil Field In Brazil for USD 1.92 Billion

Deal No. 3: Shenzhen China Star Optoelectronics Technology Co., Ltd. to Acquire LG Display’s LCD plant in Guangzhou, China for USD 1.54 Billion

Deal No. 4: Abu Dhabi Future Energy Company PJSC (Masdar) to Acquire Saeta Yield, S.A. for USD 1.40 Billion

Deal No. 5: CMA CGM S.A. to Acquire Santos Brasil Participações S.A. for USD 1.16 Billion

Deal No. 1:

Vista Equity Partners; Blackstone Inc. to Acquire Smartsheet Inc. for USD 8.40 Billion

Vista Equity Partners and Blackstone have reached an agreement to acquire Smartsheet, a leading software-as-a-service (SaaS) platform for workplace collaboration, in an all-cash transaction valued at USD 8.4 billion.

Smartsheet offers user-friendly and scalable tools that enable enterprises to streamline critical business processes. The platform enhances collaboration, boosts productivity, and accelerates data-driven decision-making. It integrates with both Google Workspace and Microsoft Office, and connects with widely-used cloud storage and customer relationship management platforms like Salesforce and Dropbox. Competing with solutions such as Asana and Monday.com, Smartsheet is trusted by 85% of Fortune 500 companies, including industry leaders Pfizer and Procter & Gamble.

Vista Equity Partners, a global investment firm focused on enterprise software and technology-driven businesses, will collaborate with Blackstone to fuel Smartsheet’s growth. Their combined efforts will support Smartsheet’s mission to broaden its platform’s accessibility to teams and organizations globally, driving success through collaborative work.

The deal is expected to close in the fourth quarter of Smartsheet’s fiscal year, which concludes on January 31, 2025. Qatalyst Partners is serving as Smartsheet’s exclusive financial advisor, while Goldman Sachs & Co. LLC and Morgan Stanley & Co. LLC are advising Blackstone and Vista Equity Partners.

Deal No. 2:

Prio S.A. to Acquire Peregrino and Pitangola Oil Field In Brazil for USD 1.92 Billion

Brazilian oil and gas firm Prio is poised to acquire a 40% stake in the Peregrino and Pitangola oilfields from China’s Sinochem for USD 1.92 billion. These oilfields are situated in Brazil’s Campos Basin.

Upon the deal’s completion, the consortium will consist of Norwegian state-owned Equinor, which will maintain its 60% stake, alongside Prio, which will hold a 40% interest in the fields.

The Peregrino field, located offshore east of Rio de Janeiro in the Campos Basin, represents Equinor’s largest asset outside of Norway, producing approximately 110,000 barrels of oil per day in the previous year. With peak production expected in 2024, the field is projected to maintain output until it reaches its economic limit in 2055, contributing roughly 2% of Brazil’s daily oil production.

This acquisition will enhance Prio’s production capacity by adding around 35,000 barrels per day to its existing output of approximately 80,000 barrels of oil equivalent. Prio plans to leverage synergies in marketing the oil produced at Peregrino, enabling it to combine the offtake from the field—approximately 650,000 barrels—with cargoes from its other operational fields to optimize logistics.

In addition, Equinor recently launched Phase 2 of the Peregrino development, which will introduce new drilling facilities and a gas pipeline for power generation, linking to the existing floating production, storage, and offloading unit.

The deal is pending regulatory approval from Brazil’s Administrative Council for Economic Defense (CADE), as well as consent from Equinor and other customary conditions. Prio was advised by Bank of America on the transaction.

Deal No. 3:

Shenzhen China Star Optoelectronics Technology Co., Ltd. to Acquire LG Display’s LCD plant in Guangzhou, China for USD 1.54 Billion

LG Display, South Korea’s leading flat-screen supplier, has announced its decision to divest a significant LCD manufacturing plant in China for CNY 10.8 billion (approximately USD 1.54 billion) to TCL China Star Optoelectronics Technology (TCL CSOT), a prominent Chinese manufacturer of liquid crystal displays.

Under this agreement, TCL CSOT will acquire 80% of LG Display’s 8.5-generation LCD panel plant, along with the entirety of its LCD module factory. The 8.5-generation plant specializes in producing large television panels, boasting a monthly capacity of 180,000 units. Last year, it recorded a net profit of CNY 600 million (around USD 85.6 million) on revenues of CNY 6.3 billion (approximately USD 898.5 million). Meanwhile, the module factory, capable of producing 2.3 million units per month, reported a profit of CNY 536 million and revenues of CNY 11.9 billion.

LG Display’s factories in Guangzhou primarily supply panels to South Korean and Chinese television manufacturers, including industry leaders Samsung Electronics, LG Group, and Skyworth Group.

This divestiture marks the end of LG Display’s LCD panel production in China. The sale is viewed as a critical move to enhance LG Display’s asset efficiency, as its LCD business has contributed significantly to the company’s ongoing losses. This transaction is expected to offer LG Display greater financial flexibility, enabling the company to intensify its focus on OLED technology. Additionally, it provides an opportunity for LG Display to recalibrate its stance in the oversaturated large LCD market, where it faces intense competition from cost-effective Chinese competitors.

The completion of the deal is anticipated by March 31, 2025. The transaction is projected to close by March 31, 2025, with Latham & Watkins serving as legal advisor to LG Display.

Deal No. 4:

Abu Dhabi Future Energy Company PJSC (Masdar) to Acquire Saeta Yield, S.A. for USD 1.40 Billion

UAE’s clean energy leader, Masdar, is set to acquire Saeta Yield from Brookfield Renewables for USD 1.4 billion, reinforcing its commitment to advancing the energy transition across Spain, Portugal, and Europe while supporting its growth initiatives in the region.

Saeta Yield is a well-established independent developer, owner, and operator of renewable energy assets with expertise across the entire value chain. The acquisition includes a diverse portfolio of 745 megawatts (MW) of primarily wind energy projects—comprising 538 MW in Spain, 144 MW in Portugal, and 63 MW of solar photovoltaic (PV) assets in Spain. Additionally, it comes with a substantial development pipeline of 1.6 gigawatts (GW). However, the transaction excludes a regulated portfolio of 350 MW of concentrated solar power assets, which Brookfield will retain and continue to manage.

This acquisition will enhance Masdar’s presence in the Iberian Peninsula by leveraging Saeta’s strong platform and growth potential. Masdar has invested in renewable projects worldwide, totaling around 20 GW of capacity valued at over USD 30 billion. The company views Europe as crucial to achieving its ambitious goal of 100 GW of capacity by 2030.

Masdar has engaged Citigroup Global Markets Limited as its transaction advisor, while Brookfield has retained Santander and Société Générale for advisory support in the deal.

Deal No. 5:

CMA CGM S.A. to Acquire Santos Brasil Participações S.A. for USD 1.16 Billion

French shipping conglomerate CMA CGM has reached an agreement to acquire a 48% stake in Brazilian port operator Santos Brasil Participações for BRL 6.33 billion (USD 1.16 billion). This strategic move aims to enhance CMA CGM’s footprint in Brazil amid rising demand for port services.

Santos Brasil manages five terminals and operates a total of eight industrial assets, including the largest container terminal in Brazil and South America. The Tecon Santos Terminal, located in Santos, currently boasts a capacity of 2.5 million TEUs, with plans for expansion to 3 million TEUs. It is equipped to accommodate three vessels of 14,000 TEUs simultaneously and handles approximately 40% of Brazil’s total container volume. In addition to its three container terminals, Santos Brasil operates one vehicle terminal and one liquid bulk terminal, as well as three logistics facilities situated in the Port of Santos, Imbituba, Vila do Conde, Itaqui, and São Paulo.

This acquisition strengthens CMA CGM’s 20-year presence in Brazil and aligns with its strategic goal of expanding terminal operations and logistics services. The investment in Santos Brasil represents a significant advancement in CMA CGM’s global port development strategy, further establishing the company as a leading multi-user terminal operator with interests in around 60 terminals globally.

CMA CGM plans to support the development of Santos Brasil and other ports while integrating these operations with its broader logistics network, including CEVA Logistics. The completion of the acquisition is anticipated in the first quarter of 2025, pending regulatory approvals.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of September 23 to 29, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter