M&A News M&A News: Global M&A Deals Week of September 2 to 8, 2024

- M&A News

M&A News: Global M&A Deals Week of September 2 to 8, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

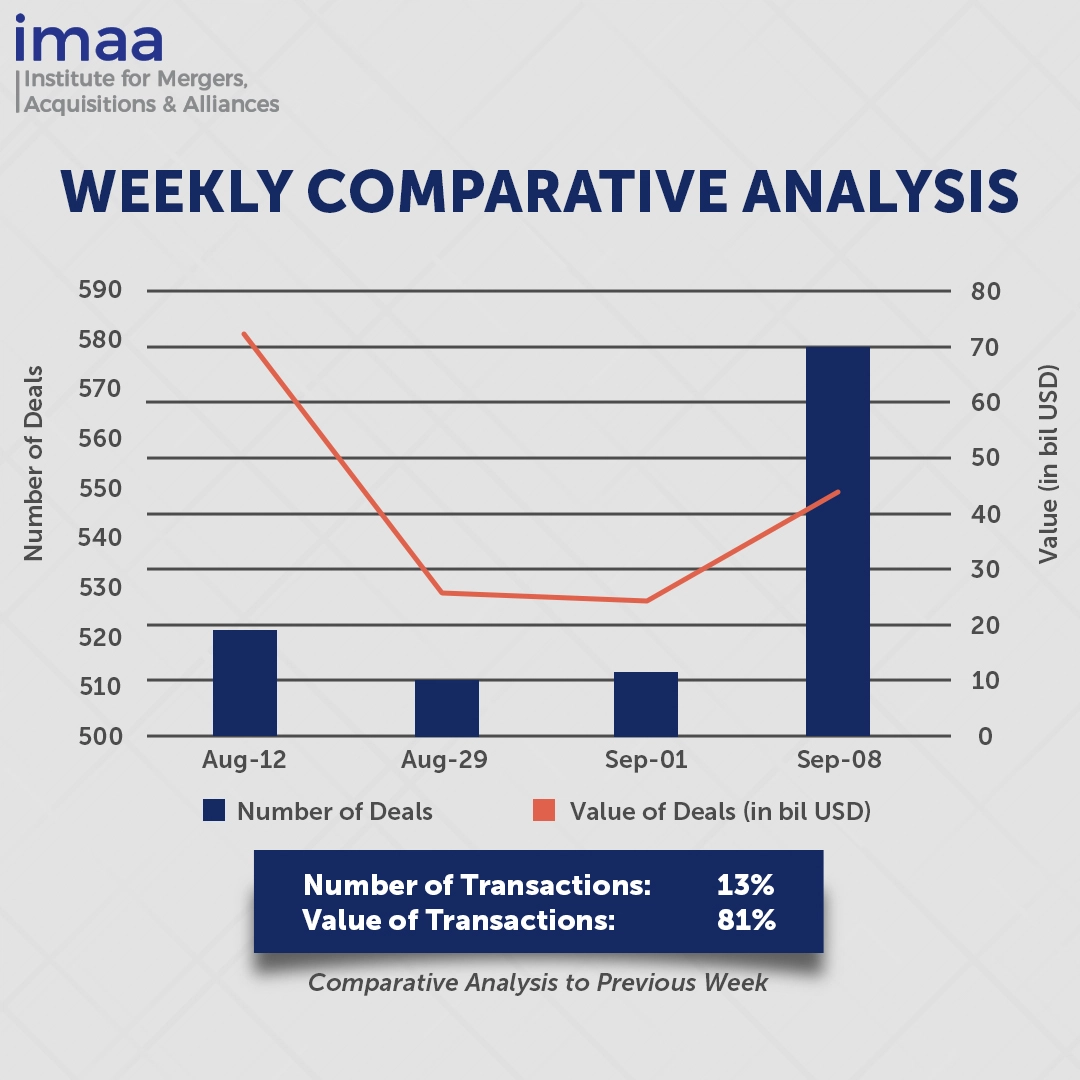

During the week of September 2 to September 8, the global mergers and acquisitions (M&A) landscape saw 579 deals with a combined value of USD 43.91 billion. Notably, 12 transactions surpassed the USD 500 million mark, collectively amounting to USD 37.1 billion—representing 84% of the total deal value for the week.

The standout deal of the period is Verizon’s USD 20 billion acquisition of Frontier Communications, a strategic move to significantly expand Verizon’s fiber network nationwide and enhance its competitive stance against AT&T. Post-acquisition, Verizon and Frontier will operate fiber networks reaching over 25 million premises across 31 states and Washington, D.C.

In another significant move, Bain Capital made a counteroffer of USD 4.1 billion to acquire software developer Fuji Soft, surpassing rival KKR’s bid by 5%. This development has heightened the bidding war, with expectations of a potential response from KKR. As of now, Fuji Soft’s stance on KKR’s offer remains unchanged.

Comparing week-over-week data, there was a 13% increase in deal volume and an 81% surge in deal value. The number of deals rose from 513 to 579, and deal value nearly doubled from USD 24.20 billion to USD 43.91 billion, largely driven by Verizon’s acquisition of Frontier.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of September 2 to 8, 2024 in detail:

Deal No. 1: Verizon Communications Inc. to Acquire Frontier Communications Parent, Inc. for USD 20.00 Billion

Deal No. 2: Bain Capital, LP to Acquire Fuji Soft Incorporated for USD 4.10 Billion

Deal No. 3: El Puerto de Liverpool, S.A.B. de C.V. to Acquire Nordstrom, Inc. for USD 3.80 Billion

Deal No. 4: Salesforce, Inc. to Acquire OwnCompany Inc. for USD 1.90 Billion

Deal No. 5: CapitaLand Integrated Commercial Trust to Acquire ION Orchard and ION Orchard Link for USD 1.42 Billion

Deal No. 1:

Verizon Communications Inc. to Acquire Frontier Communications Parent, Inc. for USD 20.00 Billion

Verizon, a leading telecommunications service provider, is set to acquire Frontier Communications in a landmark USD 20 billion transaction, including debt, which will significantly expand its fiber network across the United States.

This move will strengthen Verizon’s competitive position against major rivals AT&T and T-Mobile.

Frontier operates the largest dedicated fiber internet network in the U.S., with 2.2 million subscribers across 25 states. Over the last four years, the company has invested USD 4.1 billion to upgrade and expand its network, now deriving more than 50% of its revenue from fiber services.

By integrating Frontier’s advanced fiber network into its existing portfolio of fiber and wireless assets, including the Fios platform, Verizon will significantly expand its reach. Frontier’s 2.2 million fiber subscribers across 25 states will complement Verizon’s 7.4 million Fios connections across nine states and Washington, D.C. Frontier’s 7.2 million fiber locations, along with its plan to build an additional 2.8 million locations by 2026, will further bolster Verizon’s market presence.

This acquisition will also provide Verizon access to Frontier’s strong customer base in regions that align well with Verizon’s core Northeast and Mid-Atlantic markets.

The transaction is expected to be accretive to both revenue and Adjusted EBITDA growth upon closing, with anticipated annual cost synergies of at least USD 500 million.

The deal is slated to close in 18 months. Centerview Partners LLC and Morgan Stanley & Co. LLC acted as financial advisors to Verizon, while Barclays advised Frontier.

Deal No. 2:

Bain Capital, LP to Acquire Fuji Soft Incorporated for USD 4.10 Billion

U.S. private equity firm Bain Capital has presented a counteroffer of USD 4.1 billion (JPY 600 billion) to acquire Japanese software developer Fuji Soft, surpassing KKR’s initial bid by 5%.

KKR had previously reached an agreement to acquire Fuji Soft for USD 3.8 billion, with plans to take the company private.

Fuji Soft is a prominent software developer for Fujitsu, delivering essential clearance and network systems for major Japanese banks such as Mizuho Financial Group and various government agencies.

Fuji Soft has indicated it will assess Bain’s counteroffer to determine its impact on shareholder interests, but its position on KKR’s bid remains unchanged for now. Should KKR respond with a revised bid, it could ignite a bidding war, a rare occurrence in Japan’s traditionally discreet corporate acquisition landscape.

The company has been under pressure from its largest shareholder, Singapore-based 3D Investment Partners, to enhance shareholder value, potentially through privatization. This counteroffer signifies that the process of realizing shareholder value is progressing.

Deal No. 3:

El Puerto de Liverpool, S.A.B. de C.V. to Acquire Nordstrom, Inc. for USD 3.80 Billion

Mexican retail leader Liverpool, alongside CEO Erik Nordstrom, President Pete Nordstrom, and other members of the Nordstrom family, has made a buyout offer for the U.S. department store chain Nordstrom. Valued at USD 3.8 billion (USD 2.3 per share) in cash, this proposal offers Liverpool a significant opportunity for geographic diversification.

Liverpool operates over 300 stores across Mexico, complemented by a robust e-commerce platform and financial services, including 7.2 million store credit card holders. Additionally, Liverpool manages nearly 120 boutiques in Mexico for U.S. brands such as Gap, Banana Republic, Williams Sonoma, Pottery Barn, West Elm, MAC, and Kiehl’s.

Currently, Liverpool holds approximately 9.6% of Nordstrom’s stock. Should the acquisition proceed, Liverpool and the Nordstrom family would hold 49.9% and 50.1% of Nordstrom’s capital stock, respectively.

Morgan Stanley & Co. LLC and Centerview Partners LLC are advising Nordstrom’s special committee on the offer. The committee, along with other independent directors, will conduct a comprehensive evaluation of the proposal with the support of financial and legal advisors to ensure that it serves the best interests of Nordstrom and its shareholders.

Deal No. 4:

Salesforce, Inc. to Acquire OwnCompany Inc. for USD 1.90 Billion

Salesforce, the top AI-powered CRM provider, is acquiring data management and protection solutions firm Own Company (Own) in a cash deal valued at USD 1.9 billion.

This acquisition marks Salesforce’s largest since the purchase of Slack for USD 27.7 billion in 2021 and ranks as one of its most significant deals, following ExactTarget (Marketing Cloud) at USD 2.5 billion and preceding Vlocity (Salesforce Industries) at USD 1.33 billion.

Own is renowned for its advanced enterprise data backup and protection solutions, including automated backups, disaster recovery, and a range of tools for security, compliance, and data archiving. The company has gained recognition for its innovative products, including AI-powered insights from historical data.

As the importance of data security continues to grow, Own’s expertise will enhance Salesforce’s ability to deliver robust data protection and management solutions. This acquisition addresses the increasing demand for effective strategies to prevent data loss from system failures, human errors, and cyberattacks.

The integration of Own’s solutions will complement Salesforce’s existing products, such as Salesforce Backup, Shield, and Data Mask, providing a more comprehensive suite for data protection and loss prevention.

The deal is anticipated to close in the fourth quarter of Salesforce’s fiscal year 2025.

Deal No. 5:

CapitaLand Integrated Commercial Trust to Acquire ION Orchard and ION Orchard Link for USD 1.42 Billion

CapitaLand Integrated Commercial Trust (CICT) has proposed acquiring a 50% stake in Singapore’s ION Orchard mall and the adjacent Orchard Link underpass for USD 1.42 billion (SGD 1.85 billion) from its sponsor, CapitaLand Investment Limited (CLI).

This acquisition of the renowned ION Orchard mall is anticipated to strengthen CICT’s high-quality and diversified portfolio of retail and office properties, further solidifying its position as the largest owner of private retail assets in Singapore. The deal is expected to be immediately accretive to CICT’s distribution per unit (DPU) while maintaining a relatively stable leverage ratio of 39.9%.

ION Orchard, renowned for its distinctive architectural design and broad appeal, drawing millions of local and international visitors each year. The mall features nearly 300 brands, including luxury and everyday retailers, spread across eight floors. With a rise in tourist arrivals and retail rents along Orchard Road, CICT is well-positioned to benefit from favorable supply and demand trends and capitalize on the ongoing revitalization of the Orchard Road area. This acquisition represents a significant step in CICT’s growth strategy, expanding its presence in key downtown retail and transport hubs.

CICT plans to fund the transaction through net proceeds from a private placement and a pro-rata non-renounceable preferential offering, aiming to raise at least USD 1.1 billion.

Currently, ION Orchard is jointly owned by CLI and Sun Hung Kai Properties, a Hong Kong-based property developer. The transaction is expected to close by the fourth quarter of 2024.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of September 2 to 8, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter