M&A News M&A News: Global M&A Deals Week of October 28 to November 3, 2024

- M&A News

M&A News: Global M&A Deals Week of October 28 to November 3, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

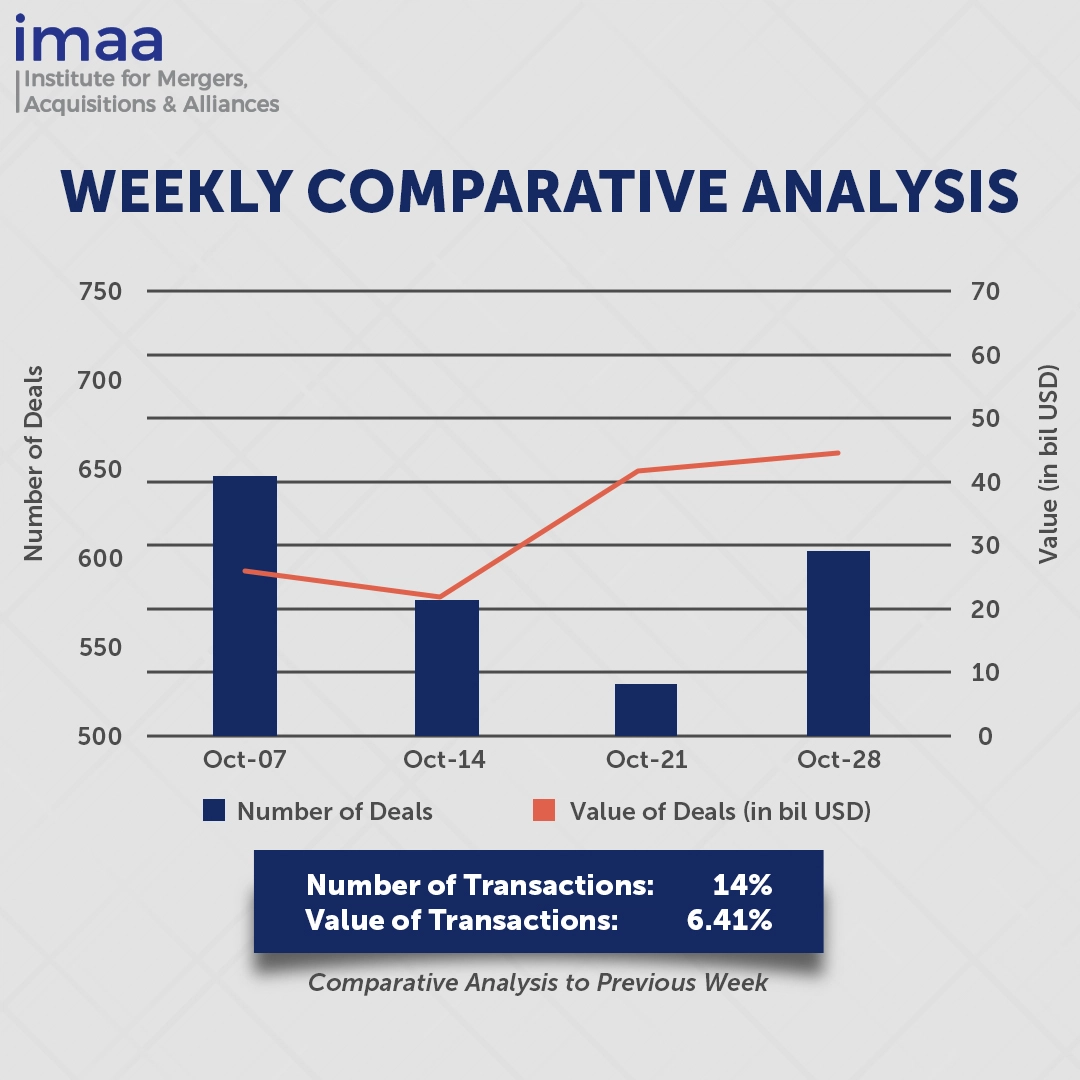

The global mergers and acquisitions (M&A) market recorded 604 deals from October 28 to November 3, totaling an impressive USD 44.25 billion in value. A significant portion of this value—USD 33.65 billion, or approximately 76%—came from 12 high-value deals exceeding USD 500 million each.

The highlight of the week was Siemens AG’s USD 10.6 billion acquisition of Altair Engineering, aimed at bolstering Siemens’ leadership in industrial software and artificial intelligence (AI). Altair is active in the product lifecycle management (PLM) sector, which encompasses systems that manage product lifecycles from conception to disposal. Currently valued at USD 10 billion annually, the PLM simulation software market is projected to grow by 10% over the next five years. This acquisition will integrate Siemens’ digital platform Xcelerator with Altair’s capabilities, resulting in a comprehensive AI-powered design and simulation portfolio.

Siemens’ digital industry division, which includes software for industrial and factory automation, has been a key driver of growth in recent years. Following this acquisition, Siemens is expected to increase its market share from 9% to 15%, moving up from the fourth to the second position in the market, trailing only Ansys, which currently holds a 23% share.

In a week-over-week comparison, deal volume rose by 14%, increasing from 530 to 604 deals. Similarly, total deal value experienced an uptick from USD 41.59 billion to USD 44.25 billion during the same period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of October 28 to November 3, 2024 in detail:

Deal No. 1: Siemens AG to Acquire Altair Engineering Inc. for USD 10.60 Billion

Deal No. 2: GardaWorld Founder; HPS Investment Partners, LLC; Oak Hill Advisors, LP; One Investment Management Ltd to Acquire Garda World Security Corporation for USD 9.72 Billion

Deal No. 3: Nippon Paint Holdings Co., Ltd. To Acquire AOC for USD 2.30 Billion

Deal No. 4: Brookfield Asset Management Ltd. to Acquire Four UK Offshore Wind Farms of Ørsted A/S for USD 2.28 Billion

Deal No. 5: NEC Corporation to Acquire NEC Networks & System Integration Corporation for USD 1.58 Billion

Deal No. 1:

Siemens AG to Acquire Altair Engineering Inc. for USD 10.60 Billion

Siemens, a prominent force in industrial and infrastructure technologies, has announced plans to acquire Altair Engineering, a recognized provider of simulation, analysis, and AI-driven software solutions for industrial applications, in a deal valued at USD 10.6 billion. This acquisition aligns with Siemens’ goal of advancing its industrial software and artificial intelligence capabilities.

Altair Engineering specializes in software and cloud solutions that support simulation, analysis, data science, and high-performance computing (HPC). By leveraging AI-powered simulation, Altair enables both engineers and non-specialists to apply advanced simulation tools, helping to reduce time-to-market and expedite design processes.

This acquisition presents significant synergies, supporting Siemens’ balanced approach to capital allocation, which combines investment in growth with returns for shareholders. Siemens anticipates an 8% boost to its digital business revenue, adding EUR 600 million to the EUR 7.3 billion reported in its digital segment for fiscal year 2023.

Integrating Altair’s advanced simulation tools will enhance Siemens’ mechanical and electromagnetic capabilities, furthering its ability to offer a complete, physics-based simulation suite within the Siemens Xcelerator portfolio. Altair’s data science expertise will also augment Siemens’ industrial knowledge in product lifecycle management and manufacturing processes, enabling Siemens to further democratize AI and data benefits across various industries.

The acquisition is projected to close in the second half of 2025, with Citi and J.P. Morgan Securities LLC acting as Altair’s financial advisors.

Deal No. 2:

GardaWorld Founder; HPS Investment Partners, LLC; Oak Hill Advisors, LP; One Investment Management Ltd to Acquire Garda World Security Corporation for USD 9.72 Billion

Stephan Crétier, founder and CEO of GardaWorld, along with HPS Investment Partners, Oak Hill Advisors, and One Investment Management, has finalized an agreement to purchase a majority stake in GardaWorld Security Corp. from BC Partners. The acquisition, valued at CAD 13.5 billion (approximately USD 9.72 billion), represents a strategic move in the security sector.

GardaWorld has cultivated a reputation as a forward-looking company that manages a diverse portfolio of services, including security solutions, AI-powered security technology, integrated risk management, and cash automation. It has established itself as a key player in the industry through its robust, independently operating businesses designed to drive growth, innovation, and strong financial performance. GardaWorld’s portfolio includes GardaWorld Security, Crisis24, ECAMSECURE, and Sesami, with over 132,000 professionals across North America, EMEA, and APAC.

Following the acquisition’s completion, Crétier and key members of GardaWorld’s executive team will collectively own about 70% of the company, with HPS leading a coalition of minority investors holding the remaining equity. BC Partners will continue to hold a minority stake.

The transaction is anticipated to close by February 28, 2025. Legal counsel for GardaWorld, Crétier, and senior management was provided by Simpson Thacher & Bartlett LLP and Langlois Lawyers LLP, while Stikeman Elliott LLP and Latham & Watkins LLP advised HPS. Kirkland & Ellis LLP represented BC Partners in the deal.

Deal No. 3:

Nippon Paint Holdings Co., Ltd. To Acquire AOC for USD 2.30 Billion

Lone Star Funds has finalized a deal to sell AOC, a U.S. specialty chemicals manufacturer, to Japan’s Nippon Paint for USD 2.3 billion. This strategic acquisition enables Nippon Paint to capitalize on AOC’s substantial market share in specialized coatings and related applications.

AOC is a key player in formulating CASE (Coatings, Adhesives, Sealants, and Elastomers), colorants, and composite solutions. The company commands a strong presence in the North American market and maintains a significant share in the fragmented European market. AOC caters to a diverse range of industries, including infrastructure, residential and commercial construction, transportation, and recreational sectors.

With an impressive margin profile, AOC’s success is attributed to its highly customized products, a diverse customer base, and a supportive market structure. The management team at AOC has demonstrated a proven ability to drive growth and create value.

Nippon Paint has actively pursued expansion through several acquisitions in recent years. The acquisition of AOC aligns with Nippon Paint’s strategic AA model, allowing AOC to continue its successful trajectory of growth and margin enhancement under private equity ownership. This transition will enable AOC to explore additional avenues for value creation through both organic and inorganic initiatives.

The transaction is expected to be completed in the first half of 2025. AOC’s management was advised by Jamieson Corporate Finance and Katzke & Morgenbesser LLP.

Deal No. 4:

Brookfield Asset Management Ltd. to Acquire Four UK Offshore Wind Farms of Ørsted A/S for USD 2.28 Billion

Danish energy leader Ørsted is divesting a 12.45% minority stake in four UK offshore wind farms to Brookfield and its affiliates for GBP 1.75 billion (approximately USD 2.28 billion).

The wind farms included in the transaction are Hornsea 1, Hornsea 2, Walney Extension, and Burbo Bank Extension, which collectively have a capacity of about 3.5 GW.

This investment marks Brookfield’s inaugural foray into the UK offshore wind sector, allowing the firm to collaborate with Ørsted, recognized as a leading player in the global offshore wind market. The investment provides Brookfield with a chance to engage in a substantial, fully operational offshore wind portfolio, aligning with the increasing demand for clean energy. Brookfield expressed enthusiasm about partnering with Ørsted to invest in these four high-quality assets, which play a vital role in supplying renewable energy to the UK and advancing the country’s decarbonization goals.

For Ørsted, this deal represents a significant step in its farm-down strategy as outlined in its business plan, enabling further reinvestment in new projects. After the transaction closes, Ørsted will retain a 37.55% ownership interest in the wind farms and will retain a comparable level of control and governance. The company will also continue to manage the operations and maintenance of these facilities as per existing service agreements.

The transaction is expected to be finalized by the end of 2024, pending the usual regulatory approvals.

Deal No. 5:

NEC Corporation to Acquire NEC Networks & System Integration Corporation for USD 1.58 Billion

NEC Corp. is set to take its subsidiary, NEC Networks & Systems Integration Corp (NESIC), private by acquiring the remaining shares it does not already own in a transaction valued at JPY 235.5 billion (approximately USD 1.58 billion). The proposed acquisition price is JPY 3,250 per share.

As a vital part of the NEC Group, NEC Networks & Systems Integration focuses on the construction and maintenance of IT infrastructure. It caters to a wide array of clients, including corporations, telecommunications providers, government entities, municipalities, and social infrastructure organizations. NESIC offers a broad spectrum of ICT systems and services, which encompass planning, consulting, design, construction, operation, monitoring, outsourcing, and cloud solutions. Additionally, the company engages in the manufacturing and sales of network and communications equipment.

The decision to take NESIC private reflects NEC’s ambition to enhance sustainable growth and improve its competitive stance within the fast-changing network solutions and IT markets. By making NESIC a private entity, NEC seeks to resolve potential conflicts of interest that may arise from being a publicly traded subsidiary. This shift will allow for better alignment of management resources and expertise between NEC and NESIC, positioning NESIC as a stronger partner in digital transformation for local governments and businesses.

Moreover, the privatization will enable quicker decision-making and facilitate strategic investments, creating a unified operational framework capable of swiftly adapting to market dynamics and technological innovations. Overall, this strategic move aims to solidify NESIC’s business foundation and boost its value within the NEC Group.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of October 28 to November 3, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter