M&A News M&A News: Global M&A Deals Week of Oct 14 to Oct 20, 2024

- M&A News

M&A News: Global M&A Deals Week of Oct 14 to Oct 20, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

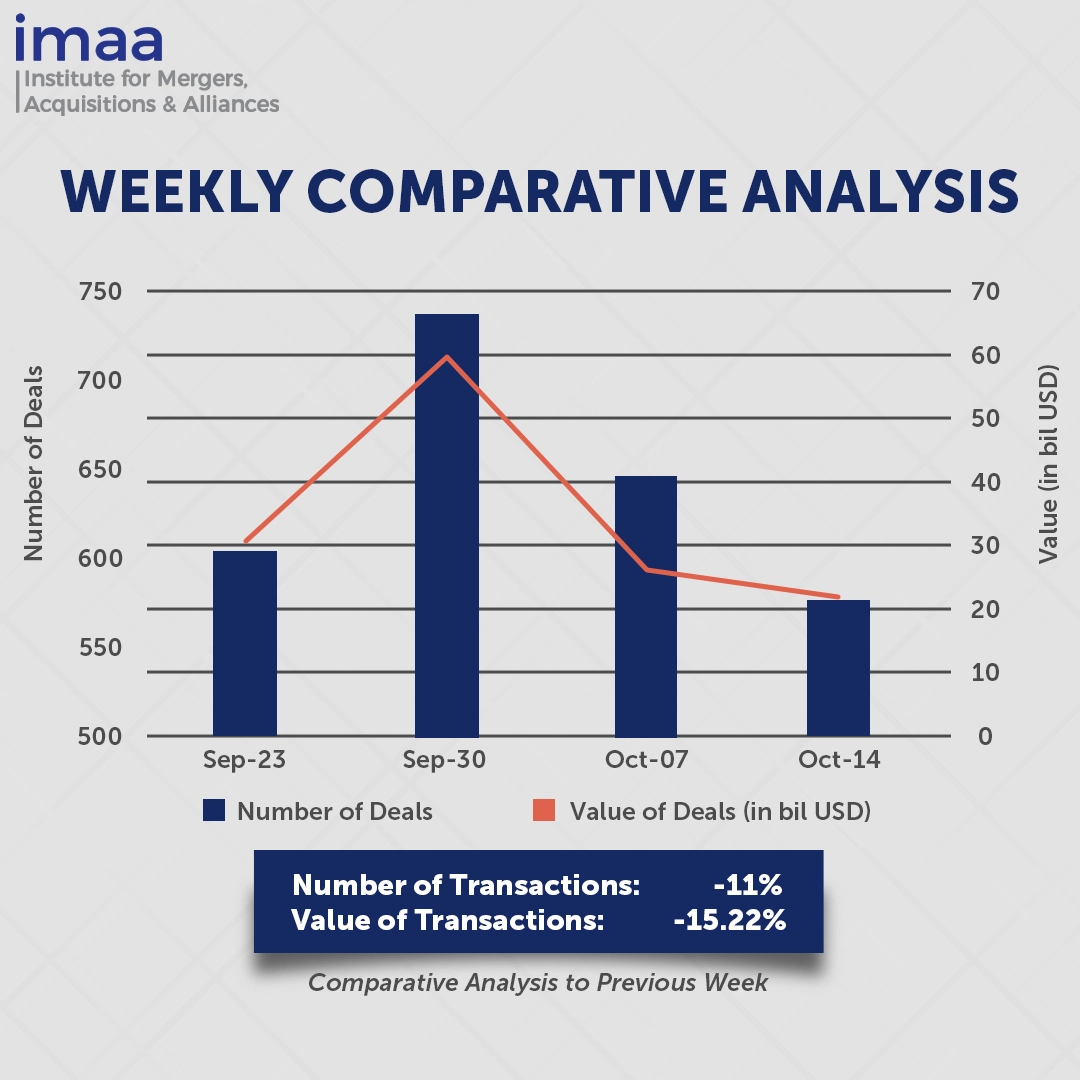

During the week spanning from October 14 to October 20, the global mergers and acquisitions (M&A) landscape recorded a total of 576 transactions, amounting to USD 21.96 billion in deal value. Among these, 10 deals surpassed the USD 500 million threshold, contributing a combined value of USD 11.44 billion, which accounts for 52% of the week’s total deal value.

The standout transaction of the week was Lundbeck’s acquisition of Longboard Pharmaceuticals for USD 2.6 billion, aimed at enhancing its drug pipeline for critical neurological conditions. This acquisition centers on Longboard’s flagship asset, bexicaserin, a promising treatment for patients with rare and severe epilepsies, for which effective therapies are currently scarce. Lundbeck anticipates launching bexicaserin in the U.S. market in 2028 and is open to pursuing additional acquisitions thereafter. This deal presents a strategic opportunity for Lundbeck to diversify and expand its portfolio beyond its existing offerings for neurological conditions, including Parkinson’s disease, Alzheimer’s disease, and migraines.

In a week-on-week comparison, M&A activity showed an 11% decline in deal volume, falling from 646 to 576 transactions. A similar trend was observed in deal value, which dropped by 16%, from USD 26.03 billion to USD 21.96 billion during this period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of October 14 to 20, 2024 in detail:

Deal No. 1: H. Lundbeck A/S to Acquire Longboard Pharmaceuticals, Inc. for USD 2.60 Billion

Deal No. 2: Silver Lake Technology Management, L.L.C.; GIC Special Investments Pte. Ltd. to Acquire Zuora, Inc. for USD 1.70 Billion

Deal No. 3: Coop Group to Acquire Coop Mineraloel AG for USD 1.24 Billion

Deal No. 4: Forum Real Estate Income and Impact LP to Acquire All Assets and Liabilities of Alignvest Student Housing Real Estate Investment Trust for USD 1.22 Billion

Deal No. 5: Kaspi.kz to Acquire D-Market Elektronik Hizmetler ve Ticaret A.S. (Hepsiburada) for USD 1.13 Billion

Deal No. 1:

H. Lundbeck A/S to Acquire Longboard Pharmaceuticals, Inc. for USD 2.60 Billion

Danish pharmaceutical firm Lundbeck has announced its plan to acquire U.S.-based Longboard Pharmaceuticals, a biopharmaceutical company focused on developing therapies for neurological disorders, in a USD 2.6 billion deal.

The acquisition is poised to strengthen Lundbeck’s portfolio, particularly in the area of rare neurological diseases. Longboard’s leading asset, bexicaserin, is being developed to address critical needs for patients with severe, rare forms of epilepsy. It has demonstrated promising seizure-reducing results in both preclinical and clinical trials and is currently undergoing a global Phase III trial under the DEEp Program.

Bexicaserin’s addition to Lundbeck’s mid- to late-stage development pipeline is anticipated to drive long-term growth, with the drug’s launch targeted for the fourth quarter of 2028. Lundbeck projects global peak sales for bexicaserin to reach between USD 1.5 billion and 2 billion.

Additionally, Longboard is advancing LP659, a potential treatment for neurological disorders such as multiple sclerosis, lupus, Parkinson’s disease, and Alzheimer’s disease.

The transaction is expected to close in the fourth quarter of 2024. PJT Partners LP is advising Lundbeck, while Longboard is being advised by Evercore and Centerview Partners LLC.

Deal No. 2:

Silver Lake Technology Management, L.L.C.; GIC Special Investments Pte. Ltd. to Acquire Zuora, Inc. for USD 1.70 Billion

Zuora, a software company specializing in monetization solutions, is set to be acquired for USD 1.7 billion by technology investment firm Silver Lake Management and Singapore’s sovereign wealth fund GIC, taking the company private.

Zuora’s platform offers a complete suite of tools that help businesses manage pricing, packaging, billing, payments, and revenue accounting. Its flexible, modular software is designed to evolve alongside customer demands, making it an ideal solution for companies navigating the complexities of the expanding Subscription Economy. Zuora’s established expertise in this growing sector positions it for continued success as a market leader.

The all-cash deal is expected to close in the first quarter of 2025. Foros is advising Zuora on the transaction.

Deal No. 3:

Coop Group to Acquire Coop Mineraloel AG for USD 1.24 Billion

Switzerland’s Coop Group is taking over the remaining 49% stake in Coop Mineraloel AG from Phillips 66 for USD 1.24 billion.

Coop Mineraloel manages 324 retail outlets and petrol stations across Switzerland and Liechtenstein, with Coop Pronto stores operating under a franchise model. This acquisition will significantly strengthen Coop’s presence in the expanding convenience market, allowing the company to secure valuable locations that enhance its core operations.

For Phillips 66, this divestiture is a pivotal move in its plan to divest non-core assets totaling USD 3 billion this year. The company is focused on streamlining its operations and cutting costs to improve overall financial performance.

The acquisition is subject to approval by the Swiss Competition Commission and is anticipated to be completed in the first quarter of 2025.

Deal No. 4:

Forum Real Estate Income and Impact LP to Acquire All Assets and Liabilities of Alignvest Student Housing Real Estate Investment Trust for USD 1.22 Billion

Forum Asset Management’s Real Estate Income and Impact Fund (Forum REIIF) has announced its intention to acquire the entire portfolio of Alignvest Student Housing Real Estate Investment Trust (ASH REIT) for CAD 1.69 billion (USD 1.22 billion).

Forum REIIF focuses on investments in high-quality, multi-family rental apartments, purpose-built student housing, and furnished rentals in Canada’s supply-constrained markets. This acquisition will create a leading portfolio of purpose-built student accommodations (PBSA) in Canada, enhancing REIIF’s presence in vital university markets.

This acquisition will also enhance unit holder access to a more extensive pipeline of high-quality projects across Canada’s top markets, promoting ongoing growth for the Fund. Over the past seven years, ASH REIT has developed a strong portfolio comprising 17 properties with 7,159 beds in seven university-centered markets.

Additionally, unit holders from both REIIF and Alignvest will gain access to Forum’s extensive development pipeline, which is valued at over CAD 3 billion, as new projects are brought to fruition.

The completion of the transaction is anticipated by the end of 2024.

Deal No. 5:

Kaspi.kz to Acquire D-Market Elektronik Hizmetler ve Ticaret A.S. (Hepsiburada) for USD 1.13 Billion

Kazakhstan’s prominent fintech company, Kaspi.kz, has acquired a 65.34% stake in Turkey’s leading e-commerce platform, Hepsiburada, in a deal valued at USD 1.13 billion.

Hepsiburada has established itself as a key player in Turkey’s e-commerce landscape by prioritizing customer service, advanced technology, efficient logistics, and a diverse range of products across multiple retail categories. In the fiscal year 2023, the platform generated approximately USD 4 billion in gross merchandise value (GMV), serving around 12 million consumers and partnering with 101,000 merchants.

Kaspi.kz has solidified its position as a digital sector leader, with its SuperApp boasting 14 million active users in 2023. The app’s payment feature, Kaspi Pay, became the preferred digital partner for 581,000 businesses and entrepreneurs in Kazakhstan, underscoring its dominance in the region. The acquisition of Hepsiburada aligns well with Kaspi.kz’s innovative ethos and commitment to providing exceptional services to consumers and merchants, marking a significant milestone in its expansion efforts across Central Asia.

The deal is anticipated to close in the first half of 2025. Legal counsel for Kaspi.kz in this transaction was provided by DLA Piper LLP (USA), Akol Law (Turkey), and Kinstellar Almaty.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of October 14 to 20, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter