M&A News M&A News: Global M&A Deals Week of November 4 to 10, 2024

- M&A News

M&A News: Global M&A Deals Week of November 4 to 10, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

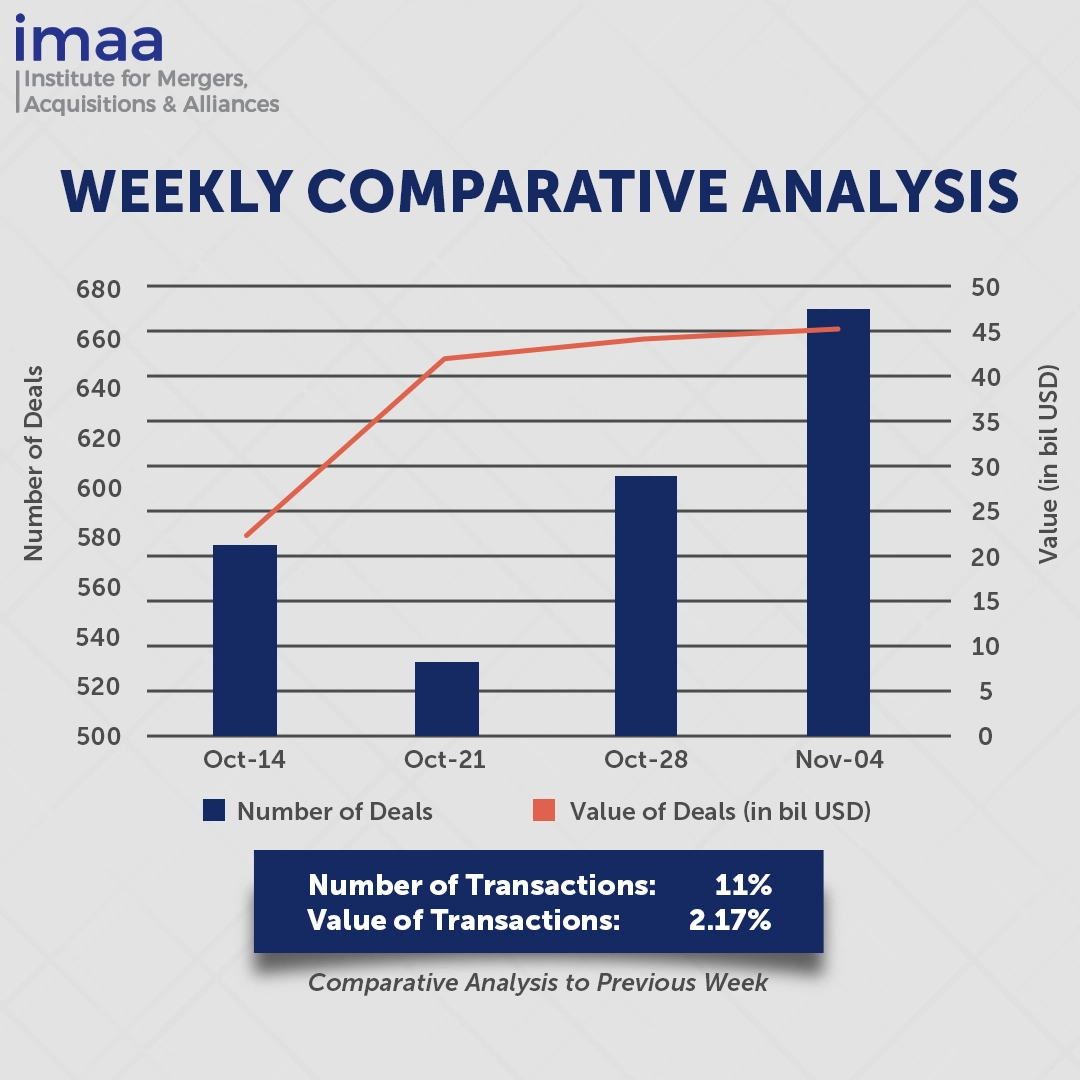

From November 4 to November 10, the global mergers and acquisitions (M&A) landscape recorded 671 announced deals with a combined value of USD 45.21 billion. Of these, 16 transactions exceeded USD 500 million each, collectively contributing USD 35.28 billion, or 78% of the total deal value for the week.

This week’s top deals showcased a diverse range of billion-dollar transactions across various sectors. Leading the list is Emerson’s proposed acquisition of AspenTech, a leading provider of software for asset optimization and sustainability in asset-intensive industries. Valued at USD 6.53 billion, the deal places AspenTech’s total valuation at USD 15.1 billion. This acquisition builds on Emerson’s 55% majority investment in AspenTech, completed in 2022, and highlights Emerson’s strategic pivot toward technology and automation, aligning with industry trends favoring advanced manufacturing processes.

Week-on-week comparisons indicate an 11% increase in deal volume, rising from 604 to 671 transactions. Additionally, the overall deal value experienced modest growth, increasing by 2.17% from USD 44.25 billion to USD 45.21 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of November 4 to 10, 2024 in detail:

Deal No. 1: Emerson Electric Co. to Acquire Aspen Technology, Inc. for USD 6.53 Billion

Deal No. 2: Bell Canada, Inc. to Acquire Ziply Fiber for USD 5.00 Billion

Deal No. 3: Cencora, Inc. to Acquire Retina Consultants of America for USD 4.60 Billion

Deal No. 4: Blackstone Real Estate Advisors L.P. to Acquire Retail Opportunity Investments Corp. for USD 4.00 Billion

Deal No. 5: Stonepeak Partners LP to Acquire Air Transport Services Group, Inc. for USD 3.10 Billion

Deal No. 1:

Emerson Electric Co. to Acquire Aspen Technology, Inc. for USD 6.53 Billion

Emerson Electric, a global innovator in technology, software, and engineering, plans to acquire the remaining shares of Aspen Technology (AspenTech) that it does not already own. The all-cash transaction, valued at USD 240 per share or approximately USD 6.53 billion, represents a key milestone in Emerson’s transformation into an industrial technology leader with a strong focus on automation.

AspenTech specializes in software solutions for asset performance management, process engineering, and industrial AI, serving diverse industries. Integrating AspenTech fully into Emerson’s portfolio is expected to drive significant advancements in industrial software capabilities. The acquisition aligns with Emerson’s strategy to accelerate innovation and create new growth opportunities, leveraging the combined strengths of both organizations.

The partnership between Emerson and AspenTech has already demonstrated strategic and operational success over the past two years, particularly in enhancing software-defined control capabilities. This success underpins Emerson’s confidence in the timing of the acquisition. By uniting as one company, Emerson aims to achieve greater alignment in priorities and investments, fostering growth, margin expansion, and enhanced shareholder value.

Emerson currently holds 57.4% of AspenTech’s outstanding common shares. Goldman Sachs & Co. LLC and Centerview Partners LLC are serving as financial advisors to Emerson in this transaction.

Deal No. 2:

Bell Canada, Inc. to Acquire Ziply Fiber for USD 5.00 Billion

Bell Canada (BCE) has announced its acquisition of Ziply Fiber, a U.S.-based fiber-optic broadband provider, in a deal valued at CAD 7 billion (USD 5 billion), including debt. This move supports Bell’s strategy to extend its fiber network across North America, marking its entry into the U.S. market.

Ziply Fiber, headquartered in Kirkland, Washington, serves 1.3 million residential and business customers across Washington, Oregon, Idaho, and Montana. Since its launch in 2020, the company has focused on technological advancements and network expansion, with an ambitious plan to reach over three million locations within four years.

The acquisition significantly enhances Bell’s growth potential by establishing a presence in the underutilized U.S. fiber market. It also broadens Bell’s geographic reach, increases operational scale, and positions the company for long-term growth. Once completed, the transaction will reinforce Bell’s standing as North America’s third-largest fiber Internet provider, with a total of nine million fiber connections and a goal of exceeding 12 million by the end of 2028.

The integration of Bell and Ziply Fiber aims to deliver enhanced Internet and data services to customers across Canada and the U.S., addressing the growing demand for high-speed, reliable connectivity. Following the transaction’s anticipated close in the latter half of next year, Ziply Fiber will retain its headquarters in Kirkland and operate as an independent business unit.

Deal No. 3:

Cencora, Inc. to Acquire Retina Consultants of America for USD 4.60 Billion

Cencora, a global leader in healthcare solutions, is advancing its specialty services through the acquisition of Retina Consultants of America (RCA) in a USD 4.6 billion all-cash transaction. The deal also includes the potential for up to USD 500 million in contingent payments, based on the successful achievement of specified business milestones in fiscal years 2027 and 2028.

RCA is a prominent management services organization that operates a network of retina specialists, providing a range of services focused on conditions such as macular degeneration, diabetic retinopathy, and retinal detachments. The organization utilizes state-of-the-art technologies and treatment protocols to deliver exceptional care. RCA also boasts a strong clinical track record, managing a comprehensive research network with 40 clinical trial sites across Phases I-IV, supported by a dedicated team of 400 full-time research professionals.

By acquiring RCA, Cencora aims to deepen its relationships with community providers in a rapidly growing segment, further solidifying its leadership in specialty services. As the specialty healthcare landscape evolves, providers are increasingly seeking partners who can support practice management while maintaining their autonomy and patient-centered focus. The integration of RCA will enhance Cencora’s specialty capabilities, expand its MSO business, and strengthen its relationships with physicians and manufacturers, ultimately boosting its value proposition to all stakeholders.

The transaction is subject to customary closing conditions. Lazard is acting as the exclusive financial advisor to Cencora, while Goldman Sachs & Co. LLC and Rothschild & Co. are serving as financial advisors to RCA.

Deal No. 4:

Blackstone Real Estate Advisors L.P. to Acquire Retail Opportunity Investments Corp. for USD 4.00 Billion

Blackstone, through its Blackstone Real Estate Partners X fund, plans to acquire Retail Opportunity Investments Corp. (ROIC) in a transaction valued at USD 4 billion, including debt, further expanding its portfolio of real estate assets.

ROIC owns a portfolio of 93 high-quality, grocery-anchored retail properties, totaling 10.5 million square feet, primarily located in major West Coast cities such as Los Angeles, Seattle, San Francisco, and Portland. As the largest publicly traded grocery-anchored shopping center REIT focused solely on the West Coast, ROIC holds a significant position in the sector.

This acquisition underscores the continued demand for grocery-anchored shopping centers in urban markets. The sector is benefiting from strong fundamentals, bolstered by nearly a decade of limited new construction. At the same time, demand for traditional grocery stores, as well as other lifestyle-focused retailers, such as restaurants and fitness centers, remains robust.

The deal is expected to close in the first quarter of 2025. J.P. Morgan served as ROIC’s exclusive financial advisor, while Morgan Stanley & Co. LLC, Newmark, and Eastdil Secured provided financial advisory services to Blackstone.

Deal No. 5:

Stonepeak Partners LP to Acquire Air Transport Services Group, Inc. for USD 3.10 Billion

Air Transport Services Group (ATSG), a key player in midsize aircraft leasing and air cargo transportation, will be acquired by private investment firm Stonepeak in an all-cash deal valued at USD 3.1 billion, including the assumption of debt.

ATSG has built a diverse portfolio of services, establishing itself as a global leader in midsize freighter leasing and operations. The company also provides passenger transport solutions for the U.S. Department of Defense and other government agencies. With the rise of e-commerce reshaping retail, ATSG plays a pivotal role in supporting the global shift toward online shopping. As of June 30, 2024, its fleet consisted of 114 freighter aircraft, predominantly Boeing 767 models, underscoring its operational scale.

Stonepeak’s expertise in transportation, logistics, and asset leasing aligns strategically with ATSG’s capabilities. This partnership is expected to drive ATSG’s expansion in the global air cargo market while enhancing its offerings. The company’s strong ties to major e-commerce players, a well-maintained fleet, and a commitment to safety and punctuality position it for continued growth under Stonepeak’s ownership.

The transaction is expected to conclude in the first half of 2025. Goldman Sachs & Co. LLC is serving as ATSG’s exclusive financial advisor, while Evercore is advising Stonepeak.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of November 4 to 10, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter