M&A News M&A News: Global M&A Deals Week of Nov 25 to Dec 1, 2024

- M&A News

M&A News: Global M&A Deals Week of Nov 25 to Dec 1, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

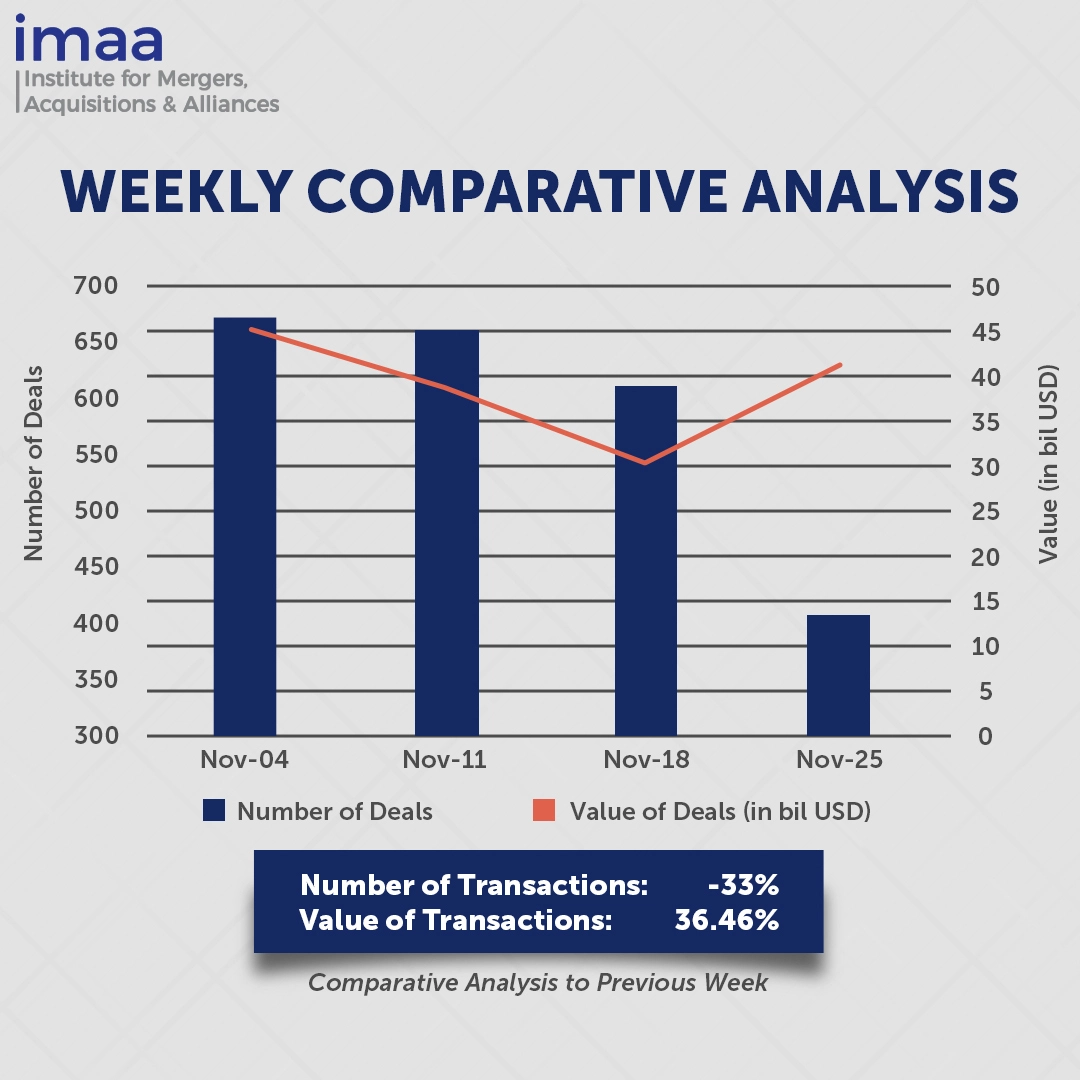

Between November 25 and December 1, the global mergers and acquisitions (M&A) landscape saw 407 deals announced, with a total deal value of USD 41.08 billion. Of these, 19 transactions exceeded USD 500 million, accounting for USD 31.98 billion, or 78% of the week’s total deal value.

The major transaction of the week was Quikrete’s USD 11.5 billion acquisition of Summit Materials, which will create a major North American player in the construction materials sector. The acquisition combines Summit’s strengths in aggregates, cement, and ready-mix concrete with Quikrete’s concrete and cement-based products. This strategic move reflects growing demand in the building materials industry, driven in part by increased U.S. government infrastructure spending. This transaction comes shortly after Summit’s USD 3.2 billion merger with Cementos Argos’ U.S. operations, completed just over a year ago.

In terms of weekly trends, the number of deals fell by 33%, from 611 to 407, compared to the previous week. However, deal value experienced a 36.5% rise, increasing from USD 30.10 billion to USD 41.08 billion. This indicates a shift toward larger, high-value transactions.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of Nov 25 to Dec 1, 2024 in detail:

Deal No. 1: Quikrete Holdings, Inc. to Acquire Summit Materials, Inc. for USD 11.50 Billion

Deal No. 2: Peabody Energy Corporation to Acquire Steelmaking Coal Business in Australia of Anglo American plc for USD 3.78 Billion

Deal No. 3: Mubadala Capital to Acquire CI Financial Corp. for USD 3.40 Billion

Deal No. 4: Roche to Acquire Poseida Therapeutics, Inc. for USD 1.50 Billion

Deal No. 5: Old National Bancorp to Acquire Bremer Financial Corporation for USD 1.40 Billion

Deal No. 1:

Quikrete Holdings, Inc. to Acquire Summit Materials, Inc. for USD 11.50 Billion

Quikrete, a leading manufacturer of concrete products, has announced its acquisition of Summit Materials in a transformative deal valued at USD 11.5 billion, including debt. This transaction is poised to expand Quikrete’s operational capabilities and broaden its geographic reach, reinforcing its position in the construction materials sector.

Summit Materials, a key player in construction materials, operates extensively across the United States and parts of Canada. The company supports a variety of markets, including infrastructure, residential, and commercial construction, by supplying aggregates, cement, and ready-mix concrete. Known for its focus on sustainability, Summit prioritizes environmental initiatives, reduces its carbon emissions, and fosters strong relationships within the communities it serves.

The combination of Summit’s portfolio of aggregates, cement, and ready-mix concrete with Quikrete’s expertise in concrete and cement-based products will establish a vertically integrated construction materials supplier with a robust North American presence. The merged entity aims to enhance customer relationships while delivering a diverse range of high-quality products.

The transaction is anticipated to close in the first half of 2025. Following its completion, Summit will operate as a privately held subsidiary of Quikrete, and its shares will be delisted from the New York Stock Exchange (NYSE). Financial advisory support for the deal includes Morgan Stanley & Co. LLC and Evercore for Summit, while Wells Fargo serves as the exclusive financial advisor to Quikrete and has committed debt financing for the acquisition.

Deal No. 2:

Peabody Energy Corporation to Acquire Steelmaking Coal Business in Australia of Anglo American plc for USD 3.78 Billion

British mining giant Anglo American has agreed to sell its steelmaking coal business to Peabody Energy, a major global coal producer, for USD 3.78 billion. The payment structure includes USD 2.05 billion in upfront cash at closing, USD 725 million in deferred cash, a potential price-linked earnout of up to USD 550 million, and a contingent cash consideration of USD 450 million.

The sale encompasses four metallurgical coal mines—Moranbah North, Grosvenor, Aquila, and Capcoal—located in Australia’s Bowen Basin, renowned for its premium steelmaking coal. These mines produce approximately 80% hard coking coal and are expected to contribute 11.3 million tons of output by 2026. With over 306 million tons of marketable reserves and an additional 1.7 billion tons of coal resources, the mines have an estimated lifespan exceeding 20 years. The acquisition complements Peabody’s Australian operations and enhances its position in metallurgical coal markets.

This transaction significantly advances Peabody’s strategy to reorient its coal portfolio toward seaborne metallurgical coal, enabling the company to meet rising demand in Asian markets. These markets have driven global steel demand growth over the past decade and are projected to account for most future growth in metallurgical coal demand through 2050. Following the acquisition, Peabody’s metallurgical coal production is expected to increase from 7.4 million tons in 2024 to 21–22 million tons by 2026, transforming its metallurgical coal segment.

Additionally, the acquisition aligns with Peabody’s sustainability goals by supporting its long-term emissions reduction plans.

The transaction, expected to close by mid-2025, Moelis & Company LLC and MA Moelis Australia are serving as financial advisors, while Jefferies leads the financing consortium.

Deal No. 3:

Mubadala Capital to Acquire CI Financial Corp. for USD 3.40 Billion

Mubadala Capital has made a cash offer to acquire CI Financial, a prominent Canadian asset management firm, in a deal valued at CAD 4.7 billion (approximately USD 3.4 billion). This move represents one of the largest privatizations in the financial sector by an Abu Dhabi-based entity.

Mubadala Capital is the asset management division of Mubadala Investment Company, overseeing assets worth more than USD 24 billion. The firm operates across four key business areas, including private equity, venture capital, alternative solutions, and a Brazil-focused investment business.

The acquisition provides CI Financial with long-term, stable capital, which will help the company reinvest in its overall business and strategy. It will further support CI’s efforts to build a top-tier wealth and asset management firm committed to the highest standards for clients and employees. Additionally, the transaction aligns with CI’s U.S. expansion, where it operates under the Corient brand. CI will continue to operate independently under this brand in the U.S., maintaining its current Canadian operations, management team, and headquarters, and remaining independent from Mubadala Capital’s other portfolio businesses.

The deal is expected to close in the second quarter of 2025. Legal counsel to CI includes Stikeman Elliott LLP and Skadden, Arps, Slate, Meagher & Flom LLP, with RBC Capital Markets serving as an advisor to CI. Mubadala Capital is advised by Jefferies Securities Inc. as its lead financial advisor.

Deal No. 4:

Roche to Acquire Poseida Therapeutics, Inc. for USD 1.50 Billion

Poseida Therapeutics, a clinical-stage biotechnology firm based in the United States, is set to be acquired by Roche for USD 1.5 billion, positioning Roche as a major player in the growing field of donor-derived, off-the-shelf cell therapies.

Poseida’s R&D pipeline features both pre-clinical and clinical-stage allogeneic (off-the-shelf) CAR-T therapies targeting a range of therapeutic areas, including hematological malignancies, solid tumors, and autoimmune diseases. The company’s lead program, P-BCMA-ALLO1, is an allogeneic CAR-T therapy aimed at B-cell maturation antigen (BCMA). P-BCMA-ALLO1 has garnered Regenerative Medicine Advanced Therapy designation for relapsed/refractory multiple myeloma (MM) after at least three prior treatments and has received FDA Orphan Drug Designation for MM. A second clinical-stage therapy, P-CD19CD20-ALLO1, is an allogeneic dual CAR-T therapy targeting B-cell malignancies. The FDA has recently cleared investigational new drug (IND) applications for this program, exploring its potential for treating multiple sclerosis and systemic lupus erythematosus. In addition, Poseida has launched another allogeneic dual CAR-T program targeting antigens commonly found in hematologic cancers (Poseida PR).

This acquisition further strengthens the collaboration between Roche and Poseida, following a licensing and partnership agreement established in 2022 to develop off-the-shelf CAR-T therapies for patients with hematological malignancies.

The deal is expected to finalize by the first quarter of 2025. Citi is acting as the exclusive financial advisor to Roche, while Centerview Partners LLC is advising Poseida in the transaction.

Deal No. 5:

Old National Bancorp to Acquire Bremer Financial Corporation for USD 1.40 Billion

Old National Bank (ONB), a regional financial institution based in Indiana, is significantly expanding its presence in the Midwest with the acquisition of Bremer Financial, a leading farm lender, in a cash and stock transaction valued at USD 1.4 billion.

With Bremer’s total assets of USD 16.2 billion, USD 11.5 billion in loans, and USD 13.2 billion in deposits, this transaction will elevate ONB to the third-largest bank in the St. Paul-Minneapolis region. The deal will also strengthen Old National’s presence in Minnesota, North Dakota, and Wisconsin, making it the largest regional bank acquisition by assets in 2024. Following the merger, the combined entity will have more than USD 70 billion in assets and operate over 70 banking centers across these states.

This strategic partnership merges two banks with a shared focus on community engagement and relationship-driven banking. As part of the deal, Bremer’s majority shareholder, the Otto Bremer Trust, will have an approximately 11% ownership stake in Old National.

The transaction is anticipated to close by mid-2025. Citi served as exclusive financial advisor to Old National, while J.P. Morgan advised Bremer, and Keefe, Bruyette & Woods, a Stifel Company, represented the Otto Bremer Trust.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of Nov 25 to Dec 1, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter