M&A News M&A News: Global M&A Deals Week of June 3 to 9, 2024

- M&A News

M&A News: Global M&A Deals Week of June 3 to 9, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

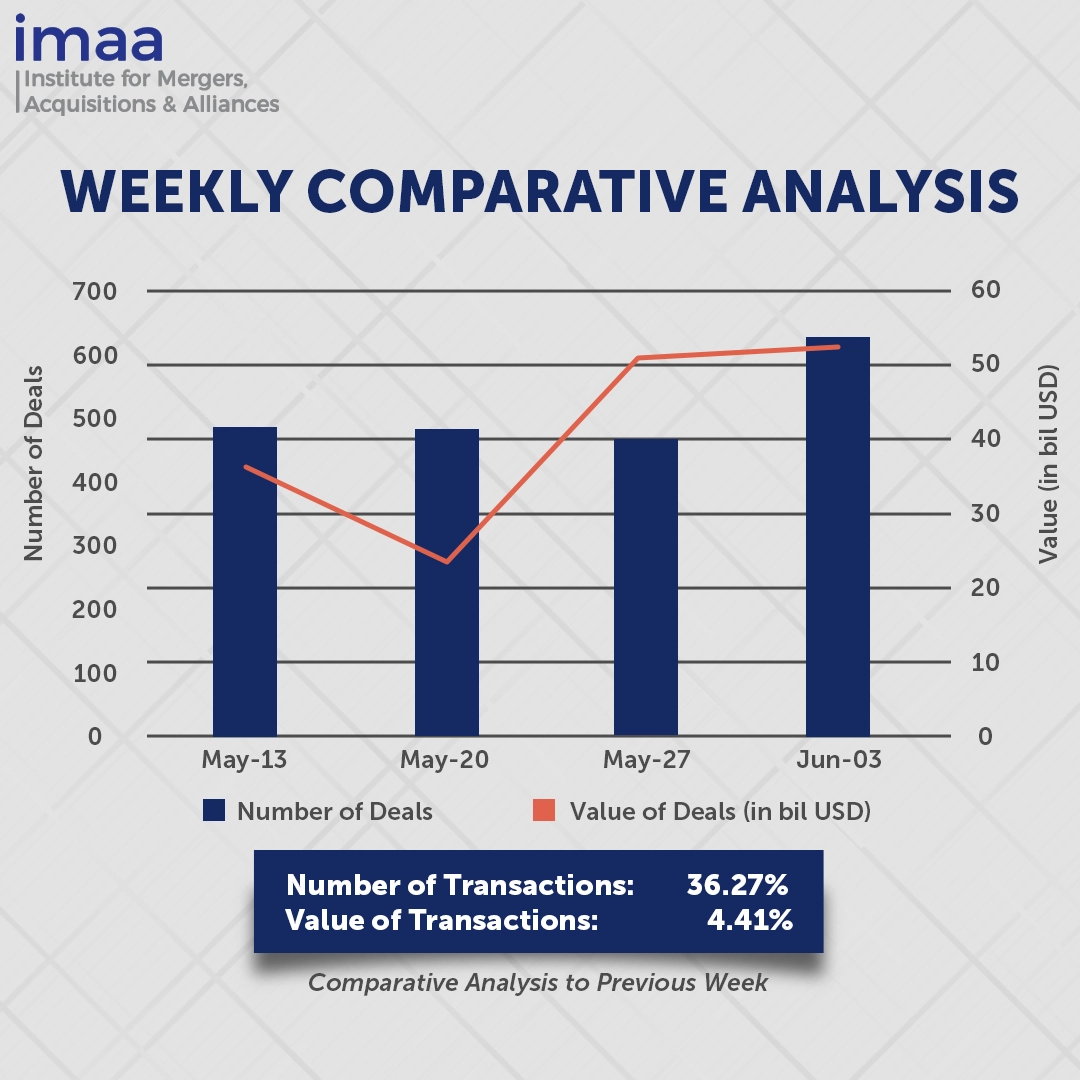

From June 3 to June 9, the global market experienced a surge in Mergers and Acquisitions (M&A) activity, witnessing a total of 635 deals valued at USD 52.95 billion. Among these transactions, 19 surpassed the USD 500 million mark, aggregating to USD 42.61 billion, constituting 84% of the week’s total deal value.

The standout deal of the week was Apollo Global’s acquisition of Fab 34, Intel’s cutting-edge fabrication facility, valued at USD 11 billion. This transaction represents the latest move in Intel’s strategic endeavors to finance an aggressive expansion of its global production capacity. Intel’s proactive approach includes plans, announced in 2022, to construct chip factories in Ireland and France, capitalizing on favorable European Commission funding regulations and subsidies, thereby reducing the bloc’s dependence on U.S. and Asian supply chains. Intel has previously collaborated with major private capital groups to finance the construction of semiconductor fabrication plants worldwide. This strategic approach allows Intel to maintain majority ownership and control of the plant while accessing necessary funding for expansion.

A comparison of week-on-week data shows a significant 36% increase in the number of deals, climbing from 466 last week to 635 during this period. Similarly, there has been a 4.4% uptick in deal value, rising from USD 50.71 billion to USD 52.95 billion over the same timeframe.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of June 3 to 9, 2024 in detail:

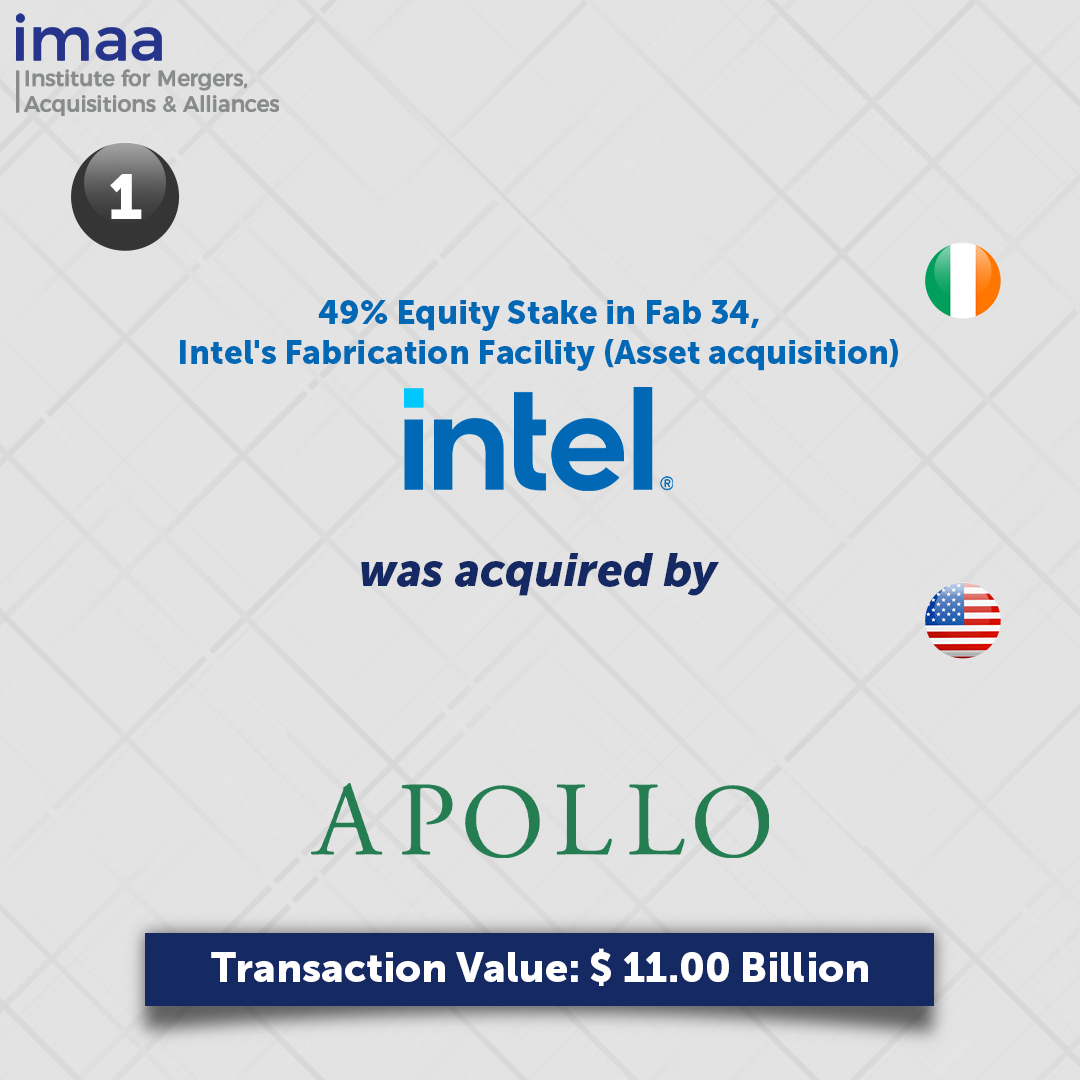

Deal No. 1: Apollo Global Management, Inc. to Acquire Fab 34, Intel’s leading-edge fabrication facility for USD 11.00 Billion

Deal No. 2: Waste Management, Inc. to Acquire Stericycle, Inc. for USD 7.20 Billion

Deal No. 3: Corvinus Nemzetközi Befektetési Zrt.; VINCI Airports SAS to Acquire Budapest Airport Zrt. for USD 4.70 Billion

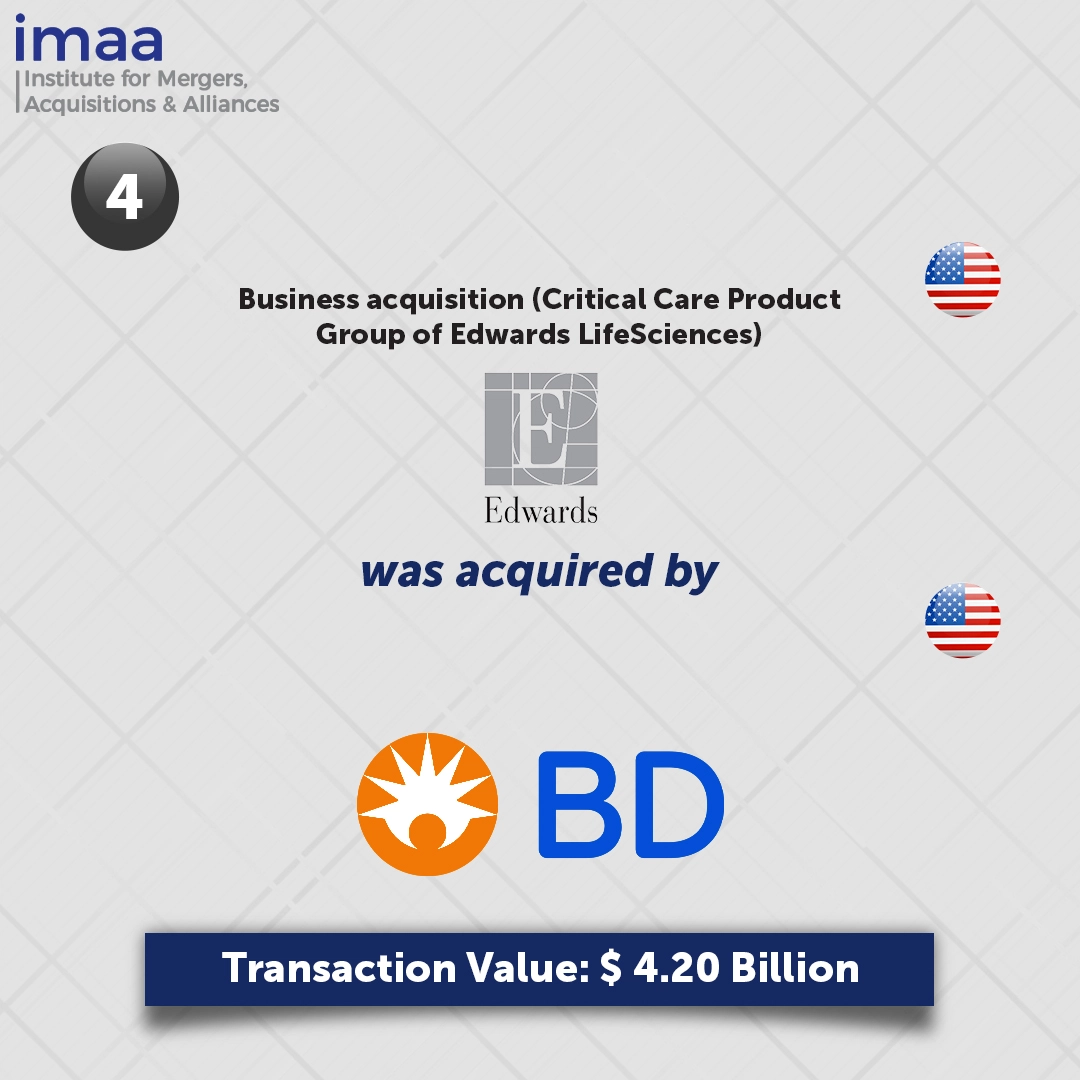

Deal No. 4: Becton, Dickinson and Company to Acquire Critical Care Product Group of Edwards Lifesciences Corporation for USD 4.20 Billion

Deal No. 5: Blackstone Inc.; GIC Private Limited; Abu Dhabi Investment Authority to Acquire Copeland LP for USD 3.50 Billion

Deal No. 1:

Apollo Global Management, Inc. to Acquire Fab 34, Intel's leading-edge fabrication facility for USD 11.00 Billion

Global asset manager, Apollo Global Management is poised to acquire a 49% stake in a joint venture involving Fab 34, Intel’s cutting-edge high-volume manufacturing (HVM) facility in Ireland, for USD 11 billion.

Fab 34 is Intel’s premier high-volume location for its Intel 4 and Intel 3 manufacturing processes, which employ extreme ultraviolet lithography technology.

This deal is Intel’s second Semiconductor Co-Investment Program (SCIP) arrangement, part of the company’s Smart Capital strategy. This strategy is designed to increase financial flexibility, allowing Intel to accelerate its strategic goals, including investing in global manufacturing operations, while keeping a strong balance sheet.

According to the agreement, the joint venture will have the rights to produce wafers at Fab 34, catering to the long-term demand for Intel’s products and providing capacity for Intel Foundry Services customers. Intel will retain a 51% controlling interest and maintain full ownership and operational control of Fab 34 and its assets.

For Apollo, this partnership is a significant strategic capital transaction and one of the largest private investments of its kind. It underscores Apollo’s ability to deliver large-scale, innovative capital solutions to major corporations and infrastructure projects, contributing to supply chain resilience.

The transaction is expected to be finalized in the second quarter of 2024. Goldman Sachs & Co. acted as the lead financial advisor to Intel. Paul, Weiss, Rifkind, Wharton & Garrison LLP is serving as legal counsel to the Apollo-managed funds and affiliates, while Latham & Watkins LLP is advising Apollo co-investors.

Deal No. 2:

Waste Management, Inc. to Acquire Stericycle, Inc. for USD 7.20 Billion

Waste Management Inc (WM), renowned for its comprehensive waste management solutions, is preparing to acquire Stericycle, an Illinois-based waste-disposal company, in an all-cash transaction valued at USD 7.2 billion (USD 62 per share), inclusive of debt.

Stericycle specializes in managing and disposing of healthcare-regulated waste streams, along with offering OSHA and HIPAA compliance training and resources.

This acquisition marks one of the largest in the waste management sector and will further cement WM’s position as a leading waste collector in the United States, offering a full suite of environmental solutions. It also opens doors for expansion into the healthcare market, which boasts promising growth prospects in the short and long term.

The deal is anticipated to contribute positively to WM’s earnings and cash flow within one year of closure and is projected to generate more than USD 125 million in annual synergies.

The transaction is slated to close as early as the fourth quarter of 2024. Centerview Partners LLC is providing exclusive financial advisory services to WM, while BofA Securities is fulfilling the same role for Stericycle.

Deal No. 3:

Corvinus Nemzetközi Befektetési Zrt.; VINCI Airports SAS to Acquire Budapest Airport Zrt. for USD 4.70 Billion

Hungary’s Budapest Ferenc Liszt International Airport (BUD) is undergoing a significant acquisition by Corvinus, an investment fund owned and operated by the Hungarian state, alongside French construction powerhouse Vinci SA, in a substantial USD 4.7 billion transaction. Corvinus will secure an 80% stake, with Vinci taking the remaining 20%. This move marks a return to majority state ownership of the airport after nearly two decades.

The selling entities include German airport management firm AviAlliance, Canadian investment group CDPQ, and Singaporean sovereign wealth fund GIC.

This acquisition aligns with Hungary’s strategic objective of increasing national ownership across key sectors. The airport’s ownership is deemed a matter of sovereignty, holding strategic significance not only for passenger transportation and tourism but also for the movement of goods, a critical component of economic circulation.

For Vinci, the acquisition of the Budapest stake is part of an ambitious expansion strategy, solidifying its position as a leading private airport operator globally. With a portfolio of 70 airports worldwide, including assets in France and Portugal, as well as significant operations in Latin America, Vinci is on track to reinforce its market dominance.

Under previous ownership, BUD has witnessed substantial growth in passenger traffic, nearly doubling from 8.4 million in 2008 to 16.2 million in 2019. This growth has been primarily driven by the expansion of low-cost carriers such as Wizz Air and Ryanair. Despite challenges posed by the pandemic, traffic rebounded to 14.7 million passengers in 2023, surpassing 90% of pre-pandemic levels. BUD concluded 2023 with a net profit of EUR 74 million, fueled by a 20% increase in revenues to EUR 337.8 million, effectively mitigating losses incurred during the COVID crisis.

The Hungarian government and its French co-investor and operator will collaborate to elevate Budapest airport into one of the premier aviation hubs, not only within the region but on a global scale.

Deal No. 4:

Becton, Dickinson and Company to Acquire Critical Care Product Group of Edwards Lifesciences Corporation for USD 4.20 Billion

Edwards Lifesciences Corporation is set to divest its critical care products unit to Becton Dickinson & Co. (BD) in a significant all-cash deal valued at USD 4.2 billion.

Edwards’ Critical Care product group, renowned for its advanced patient monitoring technologies enhanced with artificial intelligence algorithms, has pioneered the hemodynamic monitoring category extensively utilized in operating rooms and intensive care units. Notable innovations include the Swan Ganz pulmonary artery catheter, minimally invasive sensors, noninvasive cuffs, and tissue oximetry sensors and monitors. In 2023 alone, this segment generated over USD 900 million in revenue, showcasing its substantial market presence and potential for future growth through continued innovation and interoperability.

The acquisition presents a complementary opportunity for BD, a global leader in medical technology, to broaden its portfolio of smart connected care solutions. By integrating Critical Care’s hemodynamic monitoring technologies and AI-enabled clinical decision tools, BD aims to enhance its offerings and drive forward its innovation pipeline. With a workforce exceeding 70,000 employees, BD is well-positioned to capitalize on this strategic expansion.

The transaction is projected to yield immediate benefits across key financial metrics, demonstrating a strong return profile and reaffirming the commitment to delivering sustained shareholder value. This divestiture aligns closely with BD’s core innovation and business strategies, promising a seamless integration of Critical Care’s assets into its existing operations.

The transaction is scheduled to be finalized before the close of the calendar year, with BD receiving financial advisory services from Perella Weinberg Partners and Citi.

Deal No. 5:

Blackstone Inc.; GIC Private Limited; Abu Dhabi Investment Authority to Acquire Copeland LP for USD 3.50 Billion

Emerson Electric Co. has reached an agreement to divest its remaining stake in the Copeland joint venture (formerly known as Emerson Climate Technologies) to Blackstone for approximately USD 3.5 billion.

In this deal, private equity funds managed by Blackstone will acquire Emerson’s 40% common equity ownership, with a wholly owned subsidiary of the Abu Dhabi Investment Authority (ADIA) and GIC joining as investors.

With Copeland poised to capitalize on its esteemed 100-year legacy, global recognition, and influential presence within the HVACR industry, it is embarking on a new journey as a standalone entity. Focused on serving the global HVACR market, Copeland’s product portfolio boasts a range of market-leading compressors, controls, thermostats, valves, software, and monitoring solutions tailored for residential, commercial, and industrial clients. Leveraging Blackstone’s extensive track record of successful large-scale corporate partnerships, Copeland is well-positioned to accelerate its profitable, long-term growth trajectory.

These transactions have received unanimous approval from Emerson’s Board of Directors and are expected to be finalized in the second half of the calendar year 2024. Goldman Sachs & Co. LLC served as Emerson’s exclusive financial advisor, while Barclays acted as the lead financial advisor to Blackstone. Additionally, RBC Capital Markets, LLC provided financial advisory services to Blackstone and Copeland.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of June 3 to 9, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter