M&A News M&A News: Global M&A Deals Week of June 24 to 30, 2024

- M&A News

M&A News: Global M&A Deals Week of June 24 to 30, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

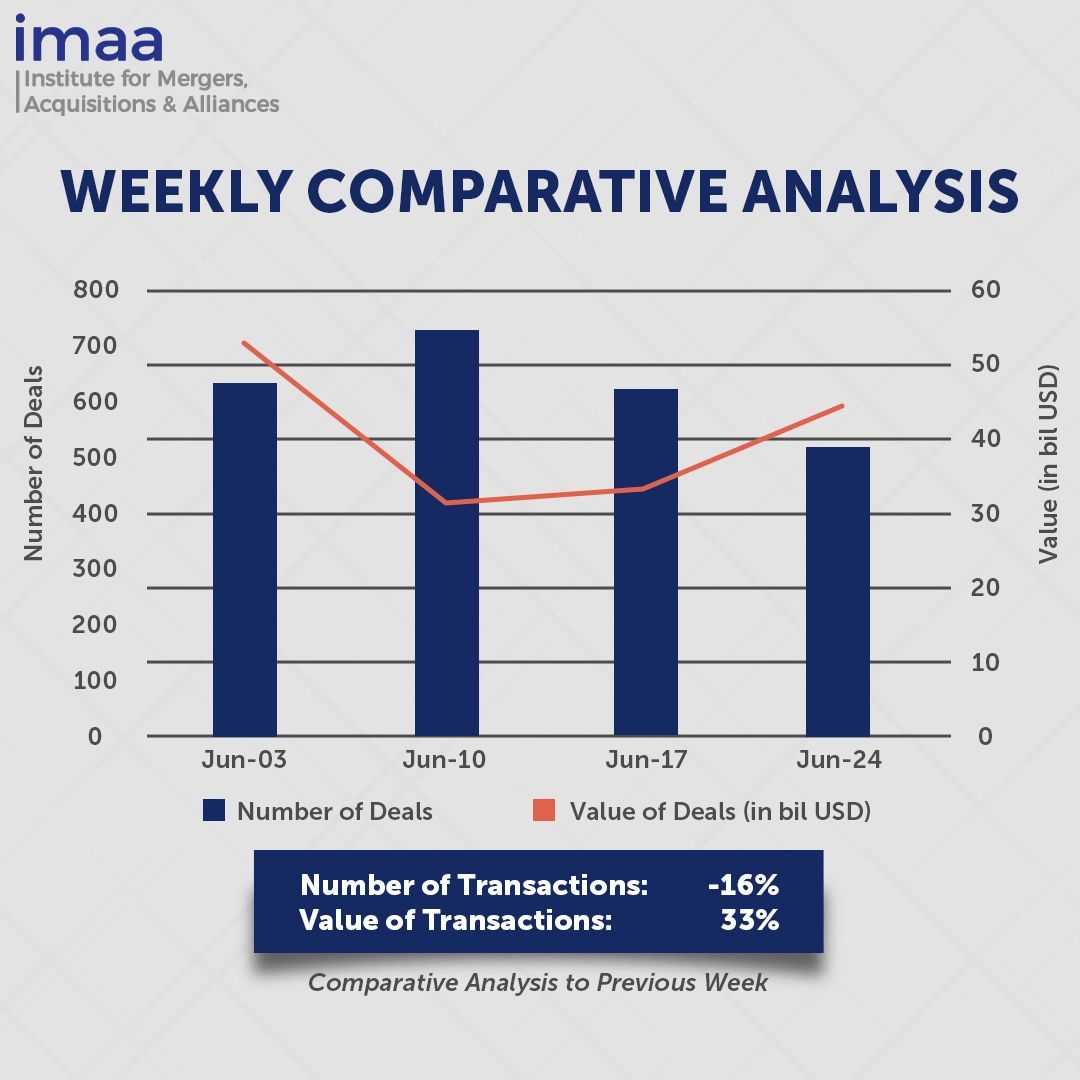

During the week of June 24 to June 30, the global market witnessed 521 mergers and acquisitions (M&A) transactions, totaling USD 44.33 billion in value. Among these, 14 deals surpassed USD 500 million, amounting to USD 37.05 billion, comprising 84% of the total deal value for the week.

Abu Dhabi National Oil Company (ADNOC)’s proposed acquisition of Covestro AG stands out as the major deal of the week, valued at a significant USD 12.5 billion. ADNOC has been actively pursuing the chemicals firm for over a year. This acquisition would enable the energy giant to access advanced materials crucial for electric vehicles, thermal insulation in buildings, coatings, adhesives, and engineering plastics. Moreover, it aligns with Abu Dhabi’s economic diversification strategy, aiming to reduce reliance on energy resources. ADNOC’s pursuit of European chemical firms underscores its strategic focus on this sector. Shifting from basic chemicals to specialties will fortify ADNOC’s chemicals portfolio, ensuring resilience and profitability amidst a projected slowdown in oil demand during the energy transition.

Comparing week-on-week data, there was a 16% decrease in deal count, dropping from 623 to 521 deals. Despite this decline, total deal value surged by 33%, rising from USD 33.30 billion to USD 44.33 billion during the period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of June 24 to 30, 2024 in detail:

Deal No. 1: Abu Dhabi National Oil Company to Acquire Covestro AG for USD 12.50 Billion

Deal No. 2: TPG Capital, L.P.; Caisse de dépôt et placement du Québec to Acquire Aareon AG for USD 4.20 Billion

Deal No. 3: Sonoco Products Company to Acquire Eviosys Packaging Switzerland GmbH for USD 3.90 Billion

Deal No. 4: Cinven Limited to Acquire idealista, S.A.U. for USD 3.10 Billion

Deal No. 5: Northern Oil and Gas, Inc.; SM Energy Company to Acquire Uinta Basin Oil and Gas Assets of XCL Resources, LLC for USD 2.55 Billion

Deal No. 1:

Abu Dhabi National Oil Company to Acquire Covestro AG for USD 12.50 Billion

Abu Dhabi National Oil Co. (ADNOC) is in formal talks to acquire Covestro AG, potentially valuing the German chemicals firm at USD 12.5 billion. ADNOC’s initial informal offer emerged in June 2023, but formal discussions began in September last year.

Covestro is a leading global manufacturer of high-quality polymer materials, operating 50 production sites with a workforce of 18,000 employees. The company serves key industries worldwide, including automotive, electronics, healthcare, and construction.

Middle Eastern oil and gas majors, including ADNOC, are eyeing European chemical businesses for strategic reasons, including the long-term decline in fuel demand. This trend is prompting energy companies to seek more stable markets for their hydrocarbons.

While ADNOC does have chemical operations, they primarily focus on commodity petrochemicals. In contrast, Covestro specializes in highly advanced polyurethane and polycarbonate products.

In addition to pursuing Covestro, ADNOC has shown interest in other European chemical firms. In December, it agreed to purchase OCI’s stake in the ammonia and urea producer Fertiglobe for USD 3.6 billion

If successful, the acquisition of Covestro would be ADNOC’s largest-ever deal. Covestro is moving forward with negotiations promptly.

Deal No. 2:

TPG Capital, L.P.; Caisse de dépôt et placement du Québec to Acquire Aareon AG for USD 4.20 Billion

Aareal Bank and Advent International have agreed to sell Aareon AG, a leading European provider of Software-as-a-Service (SaaS) solutions for the property industry, to TPG and Caisse de dépôt et placement du Québec (CDPQ) for EUR 3.9 billion (USD 4.2 billion).

Aareon AG specializes in delivering innovative Property Management System solutions that enhance efficient and sustainable property management and maintenance. Its comprehensive portfolio enables seamless, automated end-to-end processes, connecting property managers and owners across residential and commercial real estate sectors.

This strategic transaction with TPG will equip Aareon with additional resources and expertise to accelerate innovation and growth. TPG will invest in Aareon through TPG Capital, its U.S. and European private equity platform. CDPQ will co-invest alongside TPG, acquiring a minority stake in Aareon.

The deal is anticipated to close in the latter half of 2024.

Deal No. 3:

Sonoco Products Company to Acquire Eviosys Packaging Switzerland GmbH for USD 3.90 Billion

Sonoco, a global leader in packaging solutions, has announced plans to acquire Eviosys, Europe’s leading manufacturer of food cans, ends, and closures, in a significant transaction valued at USD 3.9 billion.

Eviosys operates the largest metal food can manufacturing footprint in the EMEA region, with approximately 6,300 employees across 44 manufacturing facilities in 17 countries. Its product portfolio consists entirely of infinitely recyclable metal packaging, supported by strong sustainability performance across various metrics.

Sonoco anticipates achieving synergies exceeding USD 100 million within 24 months post-acquisition through the integration of Eviosys with its current metal can operations. This acquisition is expected to promptly strengthen Sonoco’s Adjusted EPS and contribute more than 25% to the projected Adjusted EPS for 2025.

This initiative aligns with Sonoco’s strategy to enhance its core businesses and capitalize on lucrative growth opportunities, reinforcing its commitment to sustainable packaging solutions.

The deal is scheduled to close by the end of 2024, with Morgan Stanley & Co. LLC and J.P. Morgan Securities LLC advising Sonoco, and Rothschild & Co. advising Eviosys.

Deal No. 4:

Cinven Limited to Acquire idealista, S.A.U. for USD 3.10 Billion

Private equity firm Cinven is set to acquire Idealista, Spain’s largest online real estate company, from EQT in a transaction valued at EUR 2.9 billion (USD 3.1 billion). Cinven intends to purchase a 70% stake in Idealista, while EQT will maintain an 18% ownership interest.

As part of the agreement, funds managed by Apax and Oakley, which held stakes of 17% and 11% in Idealista respectively, will also divest their interests.

Idealista operates online real estate classifieds portals across southern Europe, facilitating property sales and rentals for real estate agents and private individuals. In addition to listings, Idealista offers digital services such as mortgage brokerage, CRM software, rental and agency services, and insurance brokerage, enhancing the efficiency of real estate transactions.

Cinven sees Idealista as an appealing investment opportunity due to its established presence in a large and expanding market segment, underpinned by a strong business and financial model. The company is well-positioned to capitalize on growth opportunities with its recognized brand and compelling value proposition.

The completion of the transaction is subject to regulatory approvals and customary closing conditions.

Deal No. 5:

Northern Oil and Gas, Inc.; SM Energy Company to Acquire Uinta Basin Oil and Gas Assets of XCL Resources, LLC for USD 2.55 Billion

SM Energy and Northern Oil and Gas Inc have entered into an agreement to acquire Uinta Basin oil and gas assets from XCL Resources for a total of USD 2.55 billion. SM Energy will purchase 80% of these assets for USD 2.04 billion, while Northern Oil and Gas Inc (NOG) will acquire the remaining 20% for USD 510 million.

Following the transaction, SM Energy will assume primary operational control over the assets, while NOG will participate in development efforts through collaborative agreements.

This acquisition is expected to significantly enhance financial metrics, bolster the asset portfolio, increase oil production volumes, and extend the lifespan of cost-effective reserves. SM Energy anticipates an 11% increase in its 2025 estimated cash production margin, driven by higher oil content, reduced operational expenses, and secured transportation capacities in the Uinta Basin.

The transaction is slated to close in September 2024, with Kirkland & Ellis LLP acting as legal counsel to SM Energy and Jefferies LLC serving as XCL’s sole financial advisor.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of June 24 to 30, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter