M&A News M&A News: Global M&A Deals Week of June 17 to 23, 2024

- M&A News

M&A News: Global M&A Deals Week of June 17 to 23, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

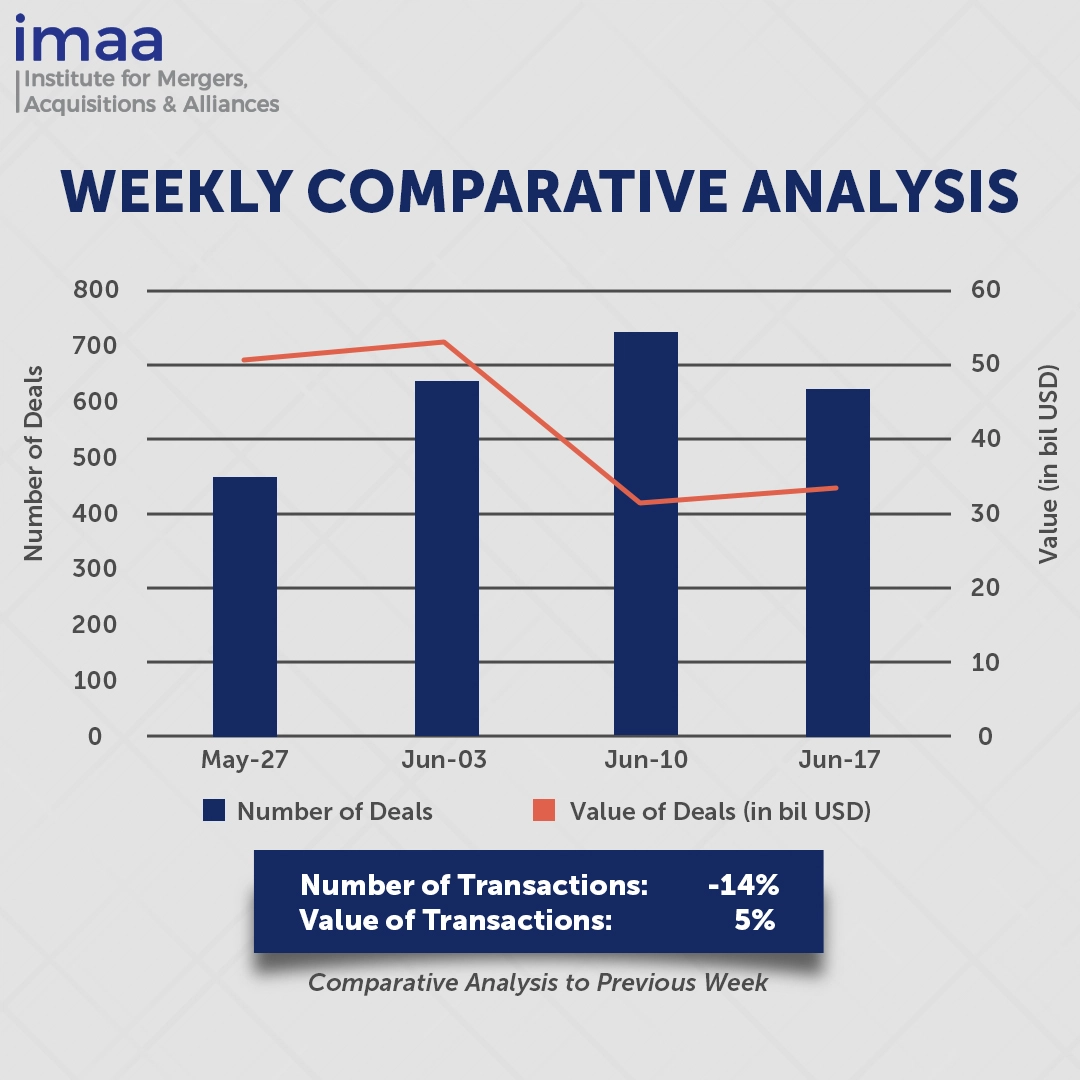

During the period from June 17 to June 23, the global market announced 623 Mergers and Acquisitions (M&A) deals amounting to USD 33.3 billion. Notably, 19 of these deals exceeded the USD 500 million mark, totaling USD 23.86 billion, which constituted 72% of the week’s total deal value.

A pivotal deal during this period was Sampo Oyj’s acquisition of Topdanmark for USD 4.73 billion. This acquisition significantly strengthens Sampo’s presence in the insurance sector, particularly in Denmark, where Topdanmark holds a prominent position. Sampo has been streamlining its operations, focusing on becoming a pure-play insurance company after divesting of Nordea in 2022. Last year, Sampo also spun off asset manager and life insurer Mandatum as part of this strategic shift.

In a week-on-week comparison, there was a 14% decrease in deal count, dropping from 727 to 623 deals. Despite the decline in deal volume, there was an increase in total deal value, rising from USD 31.59 billion to USD 33.3 billion during this period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of June 17 to 23, 2024 in detail:

Deal No. 1: Sampo Oyj to Acquire Topdanmark A/S for USD 4.73 Billion

Deal No. 2: Abu Dhabi Future Energy Company PJSC – Masdar to Acquire TERNA ENERGY Industrial Commercial Technical Societe Anonyme for USD 2.60 Billion

Deal No. 3: Honeywell International Inc. to Acquire Cobham Advanced Electronic Solutions Inc. for USD 1.90 Billion

Deal No. 4: Tate & Lyle plc to Acquire CP Kelco ApS for USD 1.80 Billion

Deal No. 5: Fengate Asset Management Acquired eStruxture Data Centers Inc. for USD 1.30 Billion

Deal No. 1:

Sampo Oyj to Acquire Topdanmark A/S for USD 4.73 Billion

Nordic insurance group Sampo has agreed to acquire Denmark’s property and casualty insurer Topdanmark A/S in an all-stock transaction valued at USD 4.73 billion (DKK 33 billion), building upon its existing 48.5% ownership of Topdanmark.

Upon completion of the acquisition, Sampo intends to bolster its position significantly within the Nordic P&C insurance sector, particularly enhancing its footprint in Denmark. The combined entity is expected to command a market share of approximately 20% across all lines of property and casualty insurance in the Nordic region. The integration strategy involves merging Topdanmark’s operations into If P&C’s pan-Nordic business structure. This strategic alignment is expected to create a leading P&C insurer in Denmark, potentially capturing a combined market share of approximately 21% in the Danish P&C insurance market.

The deal is anticipated to be finalized by Q3 2024, pending regulatory approvals and customary closing conditions. Post-completion, Sampo plans to seek a secondary listing of its A shares on Nasdaq Copenhagen. Sampo will retain its A shares’ primary listing on Nasdaq Helsinki and its Swedish Depository Receipts on Nasdaq Stockholm. Concurrently, all Topdanmark shares will be delisted from Nasdaq Copenhagen.

Goldman Sachs International is providing advisory services to Sampo as the lead financial advisor for the transaction.

Deal No. 2:

Abu Dhabi Future Energy Company PJSC – Masdar to Acquire TERNA ENERGY Industrial Commercial Technical Societe Anonyme for USD 2.60 Billion

United Arab Emirates’ renewable energy producer Masdar is poised to acquire Terna Energy SA in a EUR 2.4 billion (USD 2.6 billion) deal aimed at expanding its footprint in Europe.

With a history spanning over 25 years, Terna Energy is a prominent European clean energy platform known for its innovative and sustainable projects. The company excels in financing, developing, constructing, and operating renewable energy facilities, with a focus on wind, solar, hydroelectric, and pumped storage projects.

Under the agreement, Masdar will initially acquire 67% of Terna Energy’s outstanding shares. Following this, Masdar will initiate an all-cash mandatory tender offer to purchase the remaining shares.

This acquisition is expected to bring substantial capital investment to Greece and other European nations, bolstering Terna Energy’s contributions to Greece’s National Energy and Climate Plan (NECP) and the EU’s 2050 net-zero target.

The deal is also expected to significantly enhance Masdar’s European portfolio as it aims to reach a global capacity of 100GW by 2030. This move underscores Masdar’s confidence in Terna Energy’s growth prospects and the robust potential of the Greek renewable energy sector.

Masdar has appointed Rothschild & Co. as its sole financial advisor, with Morgan Stanley fulfilling the same role for Terna Energy.

Deal No. 3:

Honeywell International Inc. to Acquire Cobham Advanced Electronic Solutions Inc. for USD 1.90 Billion

Honeywell has announced the acquisition of CAES Systems Holdings, a prominent aerospace and defense technology provider previously known as Cobham Advanced Electronic Solutions, in an all-cash transaction valued at USD 1.9 billion.

This acquisition strengthens Honeywell’s position in key sectors of the defense industry and sets the stage for continued growth in its aerospace division.

CAES operates 13 facilities across North America, including state-of-the-art manufacturing sites with fully automated testing and tuning processes. The integration of CAES’ scalable offerings with Honeywell’s existing defense and space portfolio will enhance production and upgrade capabilities on critical platforms such as the F-35, EA-18G, AMRAAM, and GMLRS. Additionally, it will introduce new capabilities on platforms like the Navy Radar (SPY-6) and UAS/C-UAS technologies. With the expected rise in demand, these programs are anticipated to grow significantly, boosting revenue for Honeywell’s Aerospace Technologies business.

This is Honeywell’s third acquisition announcement this year as part of its strategic capital deployment plan, focusing on high-return investments to drive future growth. The CAES acquisition is expected to increase adjusted earnings per share within the first full year of ownership.

The transaction is expected to close in the second half of 2024.

Deal No. 4:

Tate & Lyle plc to Acquire CP Kelco ApS for USD 1.80 Billion

Fengate Asset Management, a Toronto-based alternative asset manager, has acquired eStruxture Data Centers for CAD 1.8 billion (USD 1.3 billion), marking the largest deal in Canada’s data center sector. Fengate now holds over two-thirds equity in eStruxture, following the purchase of equity previously held by Caisse de dépôt et placement du Québec (CDPQ).

The investment by Fengate includes capital raised from institutional secondary investors co-led by Partners Group and Pantheon. Notably, Fengate Infrastructure Fund III and IV, along with affiliated entities including LiUNA’s Pension Fund of Central and Eastern Canada, are among the investors.

Key stakeholders such as Jonathan Wener and the Wener Family Office, alongside Todd Coleman, Founder, President, and CEO of eStruxture, and the management team, will also reinvest a significant portion of their holdings in the company.

With major technology firms expanding their cloud presence in Canada and increasing reliance on AI and Machine Learning, eStruxture is well-positioned to meet these demands with scalable and sustainable data center solutions. This strategic acquisition is expected to accelerate eStruxture’s growth in hyperscale infrastructure, supporting its expansion and reinforcing its leadership in Canada’s digital infrastructure market.

DH Capital provided financial advisory services to eStruxture, while Campbell Lutyens served as Fengate’s exclusive financial advisor for the transaction.

Deal No. 5:

Fengate Asset Management Acquired eStruxture Data Centers Inc. for USD 1.30 Billion

Japanese beverage giant Kirin Holdings plans to fully acquire the skincare and cosmetics brand Fancl for approximately JPY 220 billion (USD 1.39 billion) as part of its strategy to expand its health business and diversify amid a challenging beer market.

Kirin’s alcoholic beverages currently dominate its profit stream, contributing JPY 119.9 billion last year, while its health science division recorded a loss of JPY 12.5 billion.

The acquisition of Fancl is expected to bolster Kirin’s health science segment, enhancing global market opportunities for its products.

Kirin already holds a 33% stake in Fancl and intends to convert it into a wholly-owned subsidiary through a public tender offer. This move aims to synergize their strengths, leveraging natural fermentation technologies and deep consumer relationships across the Asia-Pacific region. By integrating management resources and expanding product channels, Kirin aims to address consumer health needs in both the cosmetics and health food sectors, reinforcing its global market presence alongside its strong foothold in Japan.

For Fancl, the acquisition will strengthen its domestic operations and facilitate strategic investments in overseas markets to drive future growth.

Kirin anticipates completing the acquisition by the year’s end.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of June 17 to 23, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter