M&A News M&A News: Global M&A Deals Week of June 10 to 16, 2024

- M&A News

M&A News: Global M&A Deals Week of June 10 to 16, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

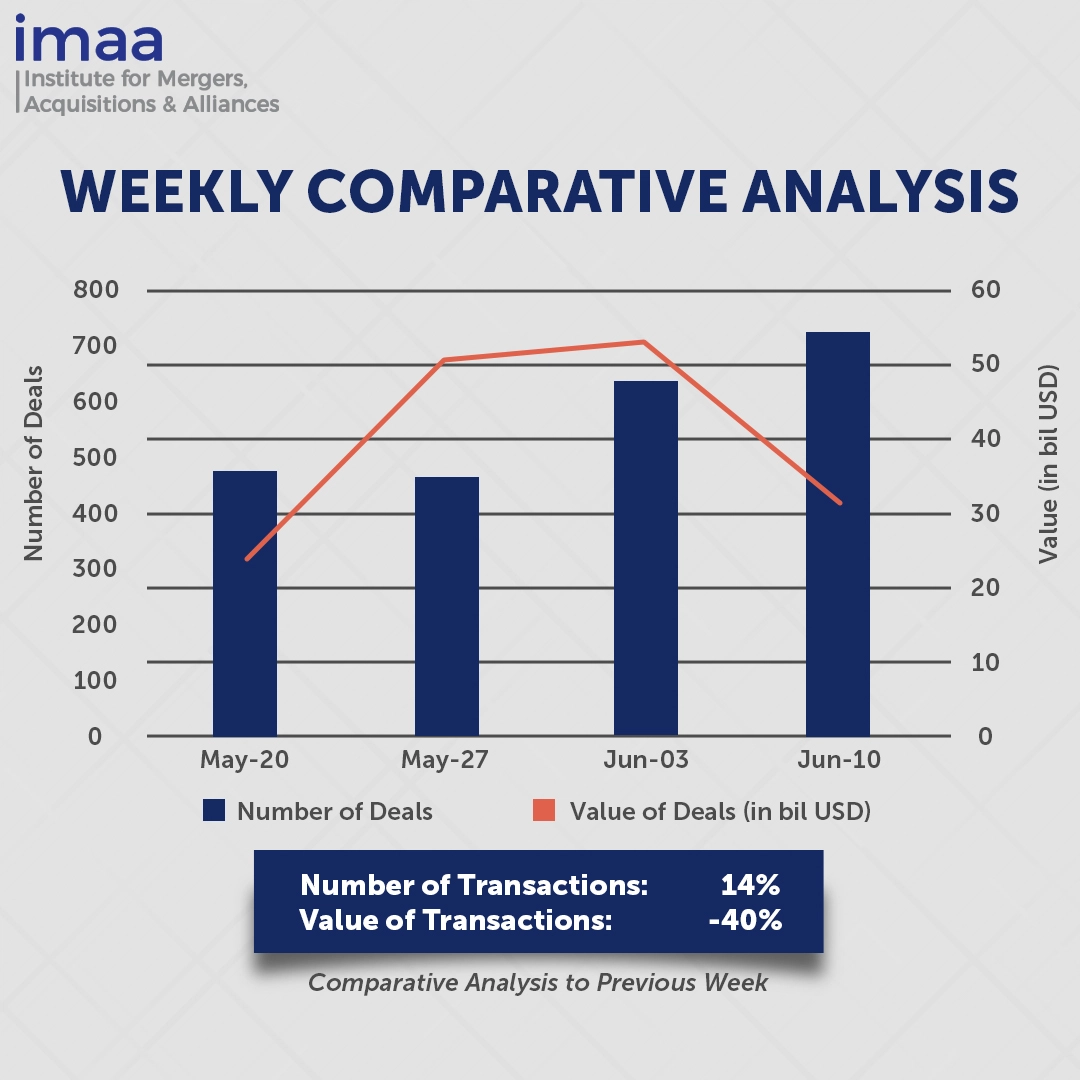

During the week of June 10 to June 16, the global market saw 727 Mergers and Acquisitions (M&A) transactions totaling USD 31.59 billion. Among these, 17 deals surpassed USD 500 million, amounting to USD 22.54 billion, constituting 71% of the week’s total deal value.

A notable transaction was National Bank of Canada’s acquisition of Canadian Western Bank for USD 3.63 billion. Ranked sixth in Canada, National Bank expects this acquisition to significantly bolster its presence in the western region and enhance its competitive standing nationwide. This move reflects the ongoing consolidation in Canada’s tightly regulated and competitive banking sector, which is dominated by the big six lenders. It follows closely after Royal Bank of Canada’s USD 9.96 billion acquisition of HSBC Canada earlier this year.

In comparison to the previous week, there was a 14.5% increase in deal volume, rising from 635 to 727 deals. However, deal value saw a notable 40% decrease, dropping from USD 52.95 billion to USD 31.59 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of June 10 to 16, 2024 in detail:

Deal No. 1: National Bank of Canada to Acquire Canadian Western Bank for USD 3.63 Billion

Deal No. 2: Abu Dhabi Investment Authority; Advent International, L.P. to Acquire Minority Stake in Fisher Investments, Inc. for USD 3.00 Billion

Deal No. 3: Matador Resources Company to Acquire Ameredev Stateline II, LLC for USD 1.91 Billion

Deal No. 4: Noble Corporation plc to Acquire Diamond Offshore Drilling, Inc. for USD 1.59 Billion

Deal No. 5: Kirin Holdings Company Limited to Acquire Fancl Corporation for USD 1.39 Billion

Deal No. 1:

National Bank of Canada to Acquire Canadian Western Bank for USD 3.63 Billion

National Bank of Canada is poised to acquire Canadian Western Bank (CWB), a diversified financial services institution, for CAD 5 billion (USD 3.63 billion).

This acquisition will enable the Quebec-focused National Bank to broaden its geographic reach by incorporating Canadian Western’s operations.

Canadian Western Bank specializes in commercial banking, equipment financing, trust services, and wealth management, with 39 branches serving 65,000 clients, predominantly in Alberta and British Columbia.

Through this acquisition, National Bank aims to enhance its comprehensive service offerings, including expanding digital capabilities, wealth management, and risk advisory services. This move will also expand National Bank’s lending portfolio outside Quebec by 37%, adding Canadian Western Bank’s CAD 37 billion in commercial-focused loans. Furthermore, it will boost National Bank’s commercial banking portfolio by approximately 52%, enhancing its domestic earning power and diversifying its loan and revenue streams.

The transaction is anticipated to close by the end of 2025. J.P. Morgan is serving as the exclusive financial advisor to CWB, while NBF is acting as the lead financial advisor to National Bank.

Deal No. 2:

Abu Dhabi Investment Authority; Advent International, L.P. to Acquire Minority Stake in Fisher Investments, Inc. for USD 3.00 Billion

US-based private equity firm Advent International and a unit of the Abu Dhabi Investment Authority (ADIA) have entered into an agreement to acquire a minority stake in Fisher Investments, a leading money management firm. The deal, valued at up to USD 3 billion, aims to bolster ADIA’s portfolio diversification strategy while leveraging Advent’s expertise to enhance Fisher Investments’ growth trajectory.

Fisher Investments manages approximately USD 275 billion across three primary sectors: Institutional, US Private Client, and Private Client International, serving over 150,000 clients globally.

Founder and Executive Chairman Ken Fisher will sell personal holdings in Fisher Investments to Advent-managed funds and ADIA as part of his long-term estate planning. This transaction ensures Fisher Investments remains independently operated as a private investment adviser and asset management firm.

For Advent and ADIA, this marks a significant long-term investment opportunity in one of the world’s largest investment advisory firms. Notably, this deal represents the first external investment in Fisher Investments, with Ken Fisher retaining approximately 70% ownership.

J.P. Morgan Securities LLC and RBC Capital Markets acted as joint financial advisors, while Paul Hastings provided legal counsel to Fisher Investments. Advent received legal counsel from Ropes & Gray, and ADIA was advised by Gibson Dunn in this transaction.

Deal No. 3:

Matador Resources Company to Acquire Ameredev Stateline II, LLC for USD 1.91 Billion

Matador Resources has finalized an agreement to acquire Ameredev Stateline II, LLC, a subsidiary of Ameredev II Parent, which includes specific oil and natural gas assets located in Lea County, New Mexico, and Loving and Winkler Counties, Texas. The transaction, valued at USD 1.91 billion in cash, also encompasses a 19% stake in Piñon Midstream.

Following the acquisition, Matador anticipates consolidating its presence in the Delaware Basin with over 190,000 net acres and around 2,000 net drilling locations. The company projects daily production exceeding 180,000 barrels of oil equivalent (BOE), along with proven reserves totaling more than 580 million BOE and an enterprise value surpassing USD 10 billion. This strategic move is expected to enhance Matador’s financial metrics significantly.

This acquisition aligns with Matador’s strategy to solidify its position among the leading oil and gas producers in the United States.

The transaction is contingent upon customary closing conditions and is slated for completion in the latter part of the third quarter of 2024. Matador was advised by Baker Botts LLP, while Vinson & Elkins LLP and JP Morgan acted as legal and financial advisors to Ameredev, respectively.

Deal No. 4:

Noble Corporation plc to Acquire Diamond Offshore Drilling, Inc. for USD 1.59 Billion

Noble Corp., the largest offshore oil-rig contractor globally by market value, has agreed to acquire Diamond Offshore Drilling Inc. in a USD 1.59 billion cash-and-stock transaction.

Upon closing, Diamond Offshore shareholders will receive 0.2316 shares of Noble Corp. (NE) stock and USD 5.65 in cash per share of Diamond Offshore’s common stock. This will result in Diamond Offshore shareholders collectively owning approximately 14.5% of Noble Corp.’s outstanding shares.

The acquisition is set to strengthen Noble’s fleet, adding to its existing portfolio of 14 operational and 15 total dual BOP seventh-generation drillships, positioning the company as a leading provider of drillship services with a premier fleet in the industry.

A significant enhancement to Noble’s capabilities will come from Diamond Offshore’s Ocean GreatWhite semi-submersible rig, known for its high-specification design suitable for challenging environments. Additionally, the inclusion of five more semi-submersible rigs from Diamond Offshore is expected to substantially increase Noble’s contracted free cash flow.

Following the completion of the deal, Noble will manage a combined backlog of USD 6.5 billion and operate a fleet comprising 41 rigs, including 28 floaters and 13 jackups. The transaction is also expected to deliver pre-tax cost synergies totaling USD 100 million, with 75% projected to materialize within a year of closing in the first quarter of 2025.

For Diamond Offshore, merging with Noble promises long-term benefits by creating a fully scaled platform capable of consistently delivering value to shareholders and customers, along with access to Noble’s dividend program.

The transaction is expected to close by the first quarter of 2025, with Morgan Stanley & Co. LLC serving as Noble’s lead financial advisor, providing committed financing. Wells Fargo and SB1 Markets have also played a supportive role for Noble in this transaction, while Guggenheim Securities, LLC and TPH&Co. have acted as lead financial advisors to Diamond Offshore.

Deal No. 5:

Kirin Holdings Company Limited to Acquire Fancl Corporation for USD 1.39 Billion

Japanese beverage giant Kirin Holdings plans to fully acquire the skincare and cosmetics brand Fancl for approximately JPY 220 billion (USD 1.39 billion) as part of its strategy to expand its health business and diversify amid a challenging beer market.

Kirin’s alcoholic beverages currently dominate its profit stream, contributing JPY 119.9 billion last year, while its health science division recorded a loss of JPY 12.5 billion.

The acquisition of Fancl is expected to bolster Kirin’s health science segment, enhancing global market opportunities for its products.

Kirin already holds a 33% stake in Fancl and intends to convert it into a wholly-owned subsidiary through a public tender offer. This move aims to synergize their strengths, leveraging natural fermentation technologies and deep consumer relationships across the Asia-Pacific region. By integrating management resources and expanding product channels, Kirin aims to address consumer health needs in both the cosmetics and health food sectors, reinforcing its global market presence alongside its strong foothold in Japan.

For Fancl, the acquisition will strengthen its domestic operations and facilitate strategic investments in overseas markets to drive future growth.

Kirin anticipates completing the acquisition by the year’s end.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of June 10 to 16, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter