M&A News M&A News: Global M&A Deals Week of July 8 to 14, 2024

- M&A News

M&A News: Global M&A Deals Week of July 8 to 14, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

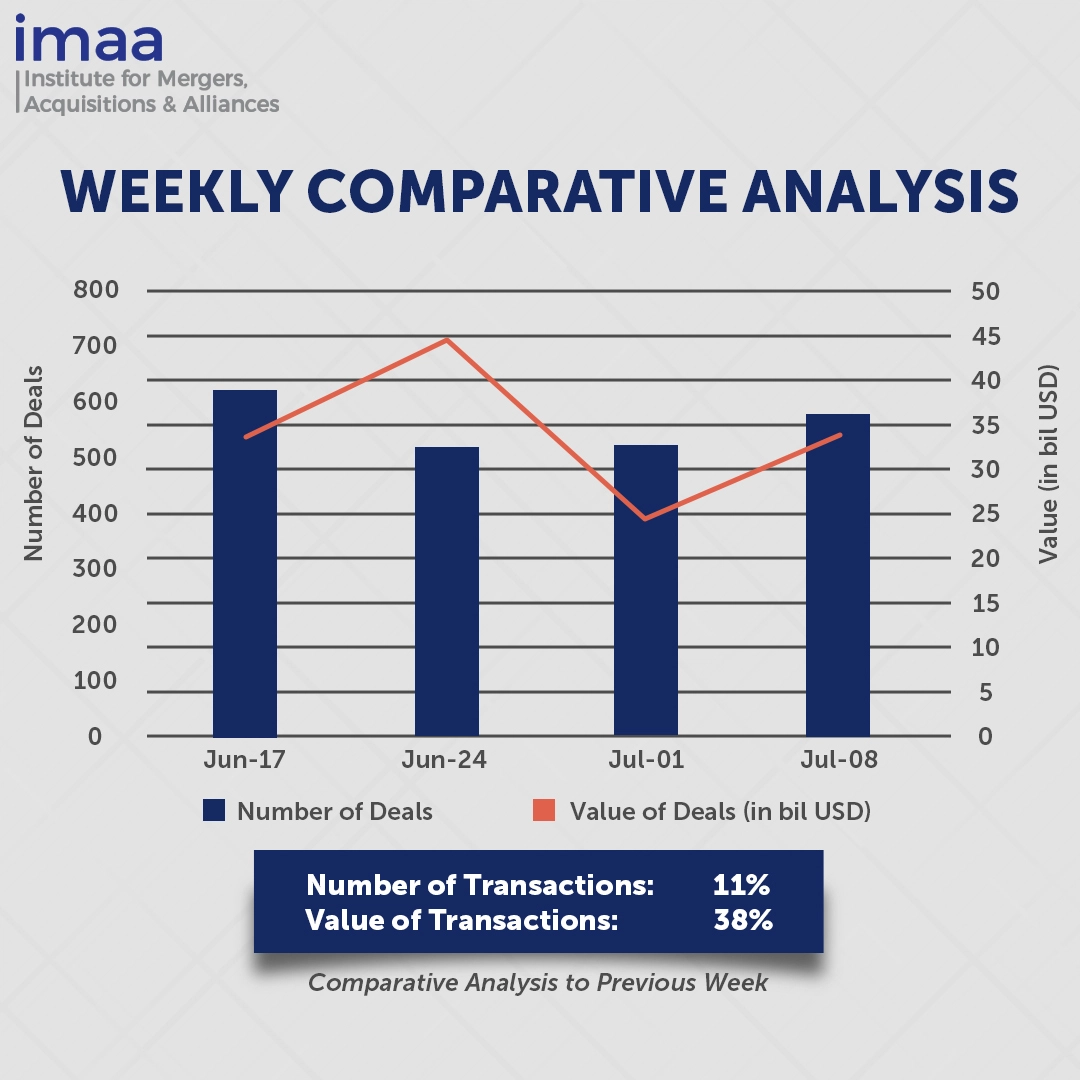

During the week of July 8 to July 14, the global market witnessed a robust activity in mergers and acquisitions (M&A), totaling 579 deals with a combined value of USD 33.99 billion. Notably, 15 transactions surpassed the USD 500 million mark, cumulatively amounting to USD 27.08 billion, accounting for 80% of the total deal value for the week.

The United States emerged as a focal point, hosting the top 5 deals of the week. A standout transaction was Devon Energy’s acquisition of Grayson Mill Energy, LLC’s Williston Basin Business for USD 5 billion, marking significant consolidation in the U.S. oil sector. Following a surge of USD 250 billion in deals in 2023, companies are continuing to consolidate to deploy capital and expand reserves, presenting opportunities for private equity firms to benefit from asset sales. Encap Investments, the owner of Grayson Mill Energy, has actively leveraged this consolidation trend. EnCap’s recent divestments, including the USD 2.55 billion sale of XCL Resources’ Uinta Basin assets to SM Energy Co. and Northern Oil and Gas, underscore this strategic shift.

Comparing week-on-week data reveals an 11% increase in deal volume from 524 to 579 deals, accompanied by a 38% surge in total deal value from USD 24.57 billion to USD 33.99 billion, indicating a heightened activity and investment momentum in the market.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of July 8 to 14, 2024 in detail:

Deal No. 1: Devon Energy Corporation to Acquire Williston Basin Business of Grayson Mill Energy, LLC for USD 5.00 Billion

Deal No. 2: Bain Capital Private Equity, LP; Reverence Capital Partners, L.P. to Acquire Envestnet, Inc. for USD 4.50 Billion

Deal No. 3: Eli Lilly and Company to Acquire Morphic Holding, Inc. for USD 3.20 Billion

Deal No. 4: Honeywell International Inc. to Acquire Liquefied Natural Gas Process Technology and Equipment Business of Air Products and Chemicals, Inc. for USD 1.81 Billion

Deal No. 5: Blackstone Inc. to Acquire Tallgrass Energy, LP for USD 1.10 Billion

Deal No. 1:

Devon Energy Corporation to Acquire Williston Basin Business of Grayson Mill Energy, LLC for USD 5.00 Billion

Devon Energy is set to acquire Grayson Mill Energy’s Williston Basin assets in a deal worth USD 5 billion, comprising USD 3.25 billion in cash and USD 1.75 billion in stock.

Devon Energy’s diverse portfolio covers five core areas, one of which is the Williston Basin. This acquisition will expand Devon’s footprint in the Williston Basin by adding 307,000 net acres with a 70% working interest. The acquired properties are projected to produce a steady output of approximately 100,000 barrels of oil equivalent per day by 2025, with oil accounting for 55% of this production.

Furthermore, the acquisition will bolster Devon Energy’s asset base by adding 500 gross drilling locations and 300 high-quality refracturing candidates, which will be competitive for capital within the company’s portfolio. Devon expects to achieve up to USD 50 million in average annual cash flow savings through operational efficiencies and marketing synergies.

The transaction is anticipated to close by the end of the third quarter of 2024, with Citi acting as Devon’s financial advisor.

Deal No. 2:

Bain Capital Private Equity, LP; Reverence Capital Partners, L.P. to Acquire Envestnet, Inc. for USD 4.50 Billion

Boston-based private equity firm Bain Capital has announced the acquisition of wealth management software company Envestnet for USD 4.5 billion, expanding its portfolio with a key industry player.

Envestnet provides a comprehensive suite of services, including data aggregation, analytics, reporting solutions, financial planning, wealth management, and portfolio management tools. It serves 17 of the 20 largest U.S. banks, manages over USD 6 trillion in assets, oversees nearly 20 million accounts, and supports over 109,000 financial advisors with an integrated, scalable digital platform. Additionally, Envestnet’s Wealth Management Platform supports more than 800 asset managers.

Reverence Capital will also participate in the transaction. Strategic partners BlackRock, Fidelity Investments, Franklin Templeton, and State Street Global Advisors have committed to invest in the proposed deal, taking minority positions in the company once the transaction is complete.

The acquisition is expected to close in the fourth quarter of 2024. Following the transaction, Envestnet’s common stock will no longer be publicly listed, and the company will become privately held.

Morgan Stanley & Co. LLC is serving as the exclusive financial advisor to Envestnet. Bain Capital is receiving lead financial advisory services from J.P. Morgan Securities LLC, with RBC Capital Markets, BMO Capital Markets, Barclays, and Goldman, Sachs & Co. LLC providing committed debt financing and additional financial advisory services.

Deal No. 3:

Eli Lilly and Company to Acquire Morphic Holding, Inc. for USD 3.20 Billion

Pharmaceutical giant Eli Lilly & Co. agreed to acquire Morphic Holding, a biopharmaceutical company specializing in oral medicines that target integrins, a family of cell surface receptors crucially involved in inflammation, fibrosis, and cancer. The acquisition is valued at USD 3.2 billion, equivalent to USD 57 per share in cash.

This acquisition includes MORF-057, Morphic’s leading drug candidate currently in Phase II trials for treating ulcerative colitis and Crohn’s disease. MORF-057 is a selective, oral small molecule inhibitor of α4β7 integrin, which shows promise in improving patient outcomes and expanding treatment options.

In addition to MORF-057, Morphic is developing a preclinical pipeline of other molecules aimed at treating autoimmune diseases, pulmonary hypertension, fibrotic diseases, and cancer.

With this acquisition, Lilly aims to leverage its extensive resources and commitment to the inflammation and immunology field. Morphic’s bowel disease treatment will enhance Lilly’s portfolio of treatments for inflammatory bowel disease, complementing its drug Omvoh, which was approved by the FDA last year for treating moderate-to-severe ulcerative colitis in adults.

The transaction is expected to close in the third quarter of 2024. Citi is serving as the exclusive financial advisor to Lilly, while Centerview Partners LLC is the exclusive financial advisor to Morphic.

Deal No. 4:

Honeywell International Inc. to Acquire Liquefied Natural Gas Process Technology and Equipment Business of Air Products and Chemicals, Inc. for USD 1.81 Billion

Air Products and Chemicals, Inc. (APD) has announced the sale of its liquefied natural gas (LNG) process technology and equipment business to the industrial key player, Honeywell International, for USD 1.81 billion in cash. This strategic move aims to strengthen Honeywell’s energy transition solutions and services division.

The acquisition will allow Honeywell to enhance its capabilities in energy transformation by integrating natural gas pre-treatment and advanced liquefaction technologies into its Forge and Experion digital automation platforms, improving the efficiency and reliability of managing natural gas assets.

Honeywell currently serves global LNG customers with pre-treatment solutions and will broaden its portfolio with Air Products’ coil-wound heat exchangers (CWHE) and related equipment. These technologies are valued for their high throughput, compact design, and safety features suitable for diverse onshore and offshore applications.

The transaction is expected to boost Honeywell’s sales growth, segment margins, and adjusted earnings per share (EPS) within the first year. This acquisition marks Honeywell’s fourth strategic investment this year, aligning with its focus on high-return opportunities in automation, aviation, and energy transition.

For Air Products, divesting the LNG business supports its strategy to focus on expanding industrial gas operations and advancing clean hydrogen solutions for industrial and heavy-duty transportation sectors.

Pending regulatory approvals and customary closing conditions, the deal is expected to be finalized by the end of the calendar year.

Deal No. 5:

Blackstone Inc. to Acquire Tallgrass Energy, LP for USD 1.10 Billion

Spain’s gas network operator, Enagas, has agreed to divest its 30.2% stake in Tallgrass Energy, a prominent energy infrastructure firm, to Blackstone Infrastructure Partners for USD 1.1 billion.

Tallgrass Energy LP operates an extensive network for transporting and storing crude oil and natural gas across 11 states in the US, utilizing strategically positioned pipeline and storage infrastructure in key production and distribution areas in the central and western United States.

Blackstone and Enagas were part of a consortium that initially invested in Tallgrass approximately five years ago. In 2019, Blackstone acquired a controlling stake in Tallgrass, privatizing the infrastructure company.

This divestment aligns with Enagas’ asset rotation strategy outlined in its 2022-2030 Strategic Plan, which prioritizes decarbonization and enhancing supply security in Spain and Europe. Despite the anticipated accounting loss of EUR 360 million in Enagas’ 2024 income statement, the sale is expected to significantly enhance its cash flow due to the proceeds from the transaction.

The deal is scheduled for closure by the end of July.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of July 8 to 14, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter