M&A News M&A News: Global M&A Deals Week of July 22 to 28, 2024

- M&A News

M&A News: Global M&A Deals Week of July 22 to 28, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

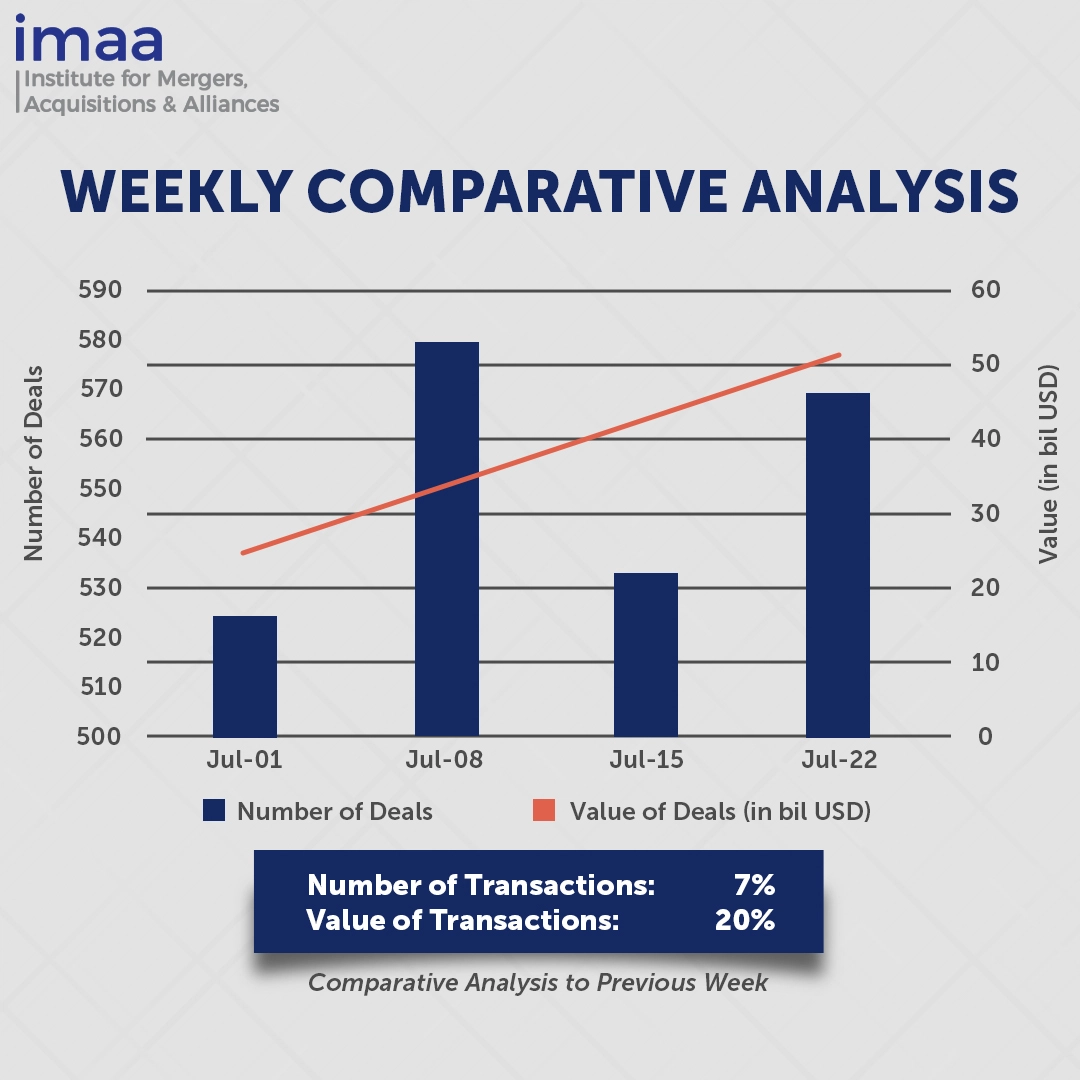

For the week of July 22 to July 28, the global mergers and acquisitions (M&A) market recorded 569 deals with a cumulative value of USD 51.18 billion. Notably, 25 transactions each exceeded the USD 500 million mark, collectively contributing USD 42.19 billion—representing 82% of the total deal value for the week.

The standout transaction was Bosch’s acquisition of the Residential and Light Commercial (R&LC) HVAC business from Johnson Controls International and Hitachi. This acquisition follows Johnson Controls’ recent divestiture of its Air Distribution Technologies division to private equity firm Truelink Capital, as part of its strategy to focus more narrowly on commercial building solutions. Bosch’s acquisition not only enhances its footprint in the US and Asia but also positions the company to capitalize on the anticipated 40% global growth in the market for heat pumps, ventilation, and air conditioning systems by 2030. This growth is driven by a projected 50% increase in the US and a 30% rise in Europe, making Bosch’s strategic expansion highly relevant to these emerging opportunities.

Week-on-week comparisons show a 7% increase in the number of deals, rising from 533 to 569, and a 20% increase in total deal value, from USD 42.65 billion to USD 51.18 billion. This week’s top 10 deals, each valued at over USD 1 billion, include several multi-billion-dollar transactions, contributing to the overall rise.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of July 22 to 28, 2024 in detail:

Deal No. 1: Robert Bosch GmbH to Acquire Residential and Light Commercial (R&LC) HVAC business of Johnson Controls International and Hitachi for USD 8.10 Billion

Deal No. 2: KKR & Co. Inc.; Dragoneer Investment Group, LLC. to Acquire Instructure Holdings, Inc. for USD 4.80 Billion

Deal No. 3: Apollo Global Management, Inc. to Acquire Gaming & Digital Business of International Game Technology PLC for USD 4.05 Billion

Deal No. 4: National Westminster Bank Plc to Acquire Residential mortgage portfolio of Metro Bank for USD 3.10 Billion

Deal No. 5: Terex Corporation to Acquire Environmental Solutions Group for USD 2.10 Billion

Deal No. 1:

Robert Bosch GmbH to Acquire Residential and Light Commercial (R&LC) HVAC business of Johnson Controls International and Hitachi for USD 8.10 Billion

Johnson Controls has reached an agreement to sell its Residential and Light Commercial (R&LC) HVAC business to German conglomerate, Robert Bosch GmbH (Bosch) in an all-cash transaction valued at USD 8.1 billion. This sale includes the North America Ducted business and the global residential joint venture with Hitachi Ltd., in which Johnson Controls holds a 60% stake, with Hitachi owning the remaining 40%.

Johnson Controls’ R&LC HVAC business designs and manufactures both ducted and ductless HVAC equipment and components for residential and light commercial use worldwide. This business segment comprises 16 production facilities and 12 development sites spread across more than 30 countries, generating around USD 4.5 billion in consolidated revenue in fiscal 2023.

This acquisition will enhance Bosch’s footprint in the US and Asian markets, providing a better regional balance and positioning Bosch as a leading global player in the HVAC industry.

For Johnson Controls, this sale will allow for a more streamlined portfolio and greater strategic focus.

The transaction is expected to be finalized within approximately 12 months. Centerview Partners and Citi acted as financial advisors to Johnson Controls.

Deal No. 2:

KKR & Co. Inc.; Dragoneer Investment Group, LLC. to Acquire Instructure Holdings, Inc. for USD 4.80 Billion

KKR has announced the acquisition of Instructure Holdings, an education software company, for USD 4.8 billion (equivalent to USD 23.60 per share) in cash.

With the involvement of Dragoneer Investment Group, KKR will purchase all outstanding shares of Instructure (INST), including those owned by the current majority stakeholder, Thoma Bravo.

Instructure is a global leader in learning management systems, educational technology, and credentialing solutions. The company serves around 200 million learners in over 100 countries and works with more than 1,000 partners. Its flagship product, Canvas, competes with other systems like Google Classroom, Blackboard Learn, and Schoology.

KKR plans to support Instructure by increasing investment in technology and innovation across its global learning platform, focusing on enhancing its core products, Canvas and Parchment. Earlier this year, Instructure acquired the academic credential management platform Parchment for USD 835 million.

The transaction is expected to close later this year. J.P. Morgan Securities LLC served as the lead financial advisor, with Macquarie Capital also advising Instructure. Financial advisors for KKR included Morgan Stanley & Co. LLC, Moelis & Company LLC, and UBS Investment Bank.

Deal No. 3:

Apollo Global Management, Inc. to Acquire Gaming & Digital Business of International Game Technology PLC for USD 4.05 Billion

High-growth asset manager Apollo Global is poised to acquire International Game Technology’s (IGT) gaming and digital business, along with Everi Holdings Inc., a fintech company specializing in slot machines and cashless solutions for casinos, in an all-cash deal valued at USD 6.3 billion.

IGT will receive USD 4.05 billion in cash for IGT Gaming, while Everi shareholders will receive USD 14.25 per share in cash, totaling USD 1.2 billion.

This acquisition involves merging IGT’s gaming business with Everi to form a combined enterprise headquartered in Las Vegas. The new entity will consolidate a diverse portfolio of assets encompassing gaming, online wagering, and sports betting under Apollo’s management. Apollo has significantly expanded into the gaming sector through numerous recent acquisitions. The takeover will integrate IGT’s offerings, including video and electronic table games and Wheel of Fortune, with Everi’s bingo and casino products.

Apollo has a proven track record of successful investments in leisure, particularly within the gaming and entertainment sectors. The private ownership of these complementary gaming platforms is expected to better position the new company to seize growth opportunities and create value.

The transaction is anticipated to close by the end of the third quarter of 2025. Macquarie Capital, Deutsche Bank, and Mediobanca are acting as financial advisors to IGT. Global Leisure Partners LLC is the exclusive financial advisor to Everi, with Deutsche Bank and Macquarie Capital providing financing commitments for the deal.

Deal No. 4:

National Westminster Bank Plc to Acquire Residential mortgage portfolio of Metro Bank for USD 3.10 Billion

Metro Bank has agreed to sell its prime residential mortgage portfolio to NatWest Group for GBP 2.4 billion (USD 3.1 billion) in cash. This transaction will be executed through NatWest’s subsidiary, National Westminster Bank plc, as part of its effort to strengthen its retail banking operations.

This sale is part of Metro Bank’s strategy to reposition its balance sheet and improve risk-adjusted returns on capital. The transaction is expected to reduce Metro Bank’s risk-weighted assets by approximately GBP 824 million, thereby enhancing the lender’s Common Equity Tier 1 (CET1) ratio by about five basis points.

For NatWest Group, acquiring Metro Bank’s prime residential mortgages will bring approximately 10,000 new customers, increasing its presence in the residential mortgage market.

The transaction is expected to be completed during the second half of 2024.

Deal No. 5:

Terex Corporation to Acquire Environmental Solutions Group for USD 2.10 Billion

Terex Corp, a global leader in materials processing machinery and aerial work platforms, has reached an agreement to acquire Environmental Solutions Group (ESG) from Dover for USD 2 billion. This move is intended to capitalize on the increasing opportunities within the waste management sector.

ESG is known for its expertise in designing and manufacturing refuse collection vehicles, waste compaction equipment, and related parts and digital solutions. The group includes well-known brands such as Heil, Marathon, Curotto-Can, and Bayne Thinline, along with digital solutions like 3rd Eye and Soft-Pak. These brands are highly regarded in the solid waste industry for their quality, durability, reliability, and strong customer return on investment.

Terex intends to merge its existing utilities group with ESG to create a new environmental solutions business segment. ESG’s comprehensive range of equipment, digital solutions, and aftermarket services will complement Terex’s existing operations. This merger will allow Terex to broaden its customer base, offer a wider range of environmental equipment solutions, and achieve economies of scale.

The deal is anticipated to close in the second half of this year, with UBS Investment Bank serving as the exclusive financial advisor.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of July 22 to 28, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter