M&A News M&A News: Global M&A Deals Week of July 15 to 21, 2024

- M&A News

M&A News: Global M&A Deals Week of July 15 to 21, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

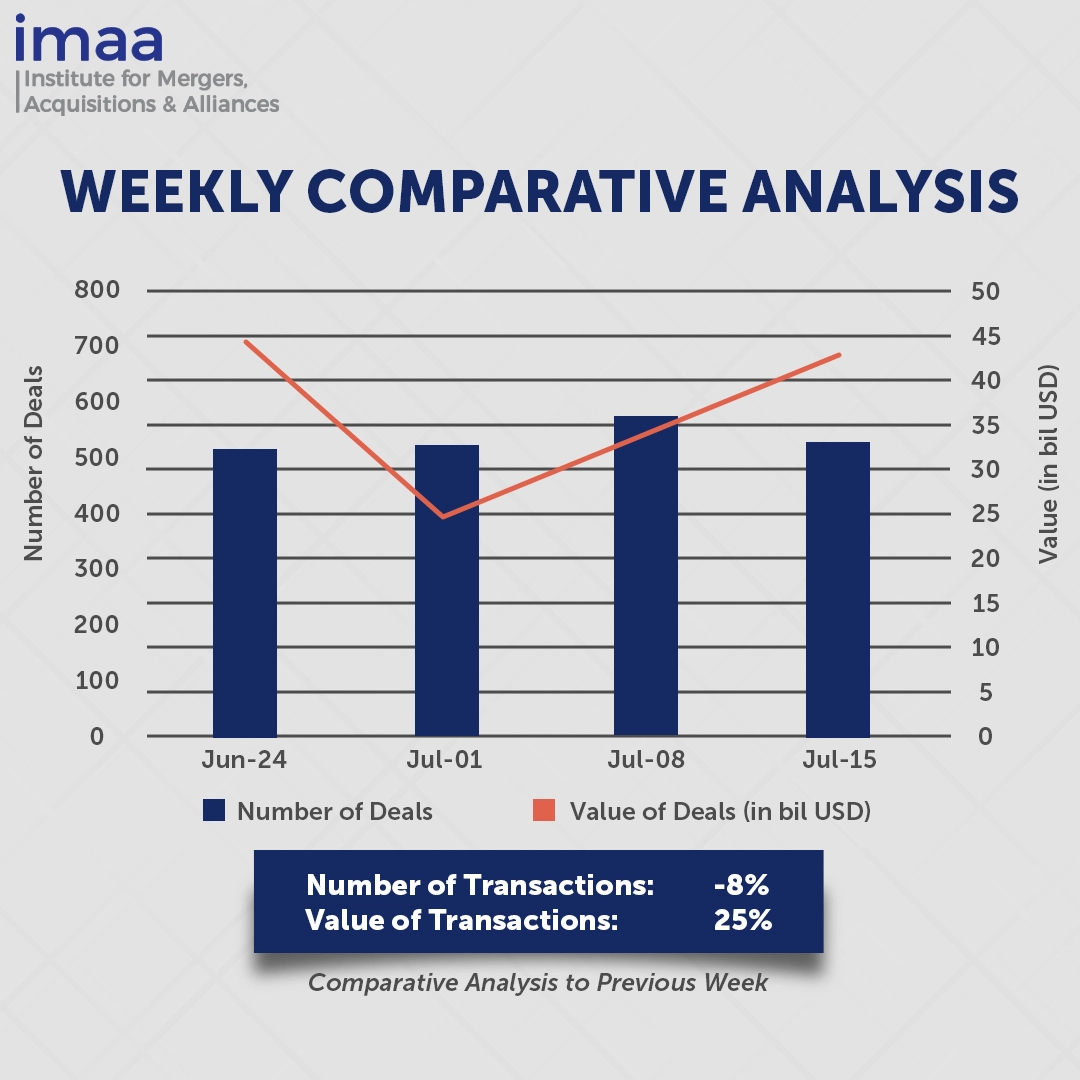

Between July 15 and July 21, the global mergers and acquisitions (M&A) landscape saw 533 deals announced, with a total value of USD 42.65 billion. Of these, 18 transactions each exceeded USD 500 million, aggregating to USD 34.08 billion and accounting for 80% of the week’s total deal value.

The most notable transaction of the week was KKR and Carlyle’s acquisition of Discover Financial Services’ Prime Student Loans Portfolio, valued at USD 10.8 billion. This sale is part of Discover’s ongoing efforts to reorganize its asset base in light of Capital One’s intention to acquire the company. Discover had been actively looking for a buyer for its student loan portfolio since last November, due in part to regulatory issues that have plagued its student loan business. Moreover, the deal illustrates the growing influence of large private lenders in the financial sector, especially as traditional banks reassess their strategic priorities.

In comparison to the previous week, the number of M&A deals declined by 8%, from 579 to 533. Despite this drop in deal volume, the total value of transactions saw a significant increase of 25%, rising from USD 33.99 billion to USD 42.65 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of July 15 to 21, 2024 in detail:

Deal No. 1: KKR & Co. Inc.; The Carlyle Group Inc. to Acquire Approximately $10.1 Billion Prime Student Loans Portfolio of Discover Financial Services for USD 10.80 Billion

Deal No. 2: Intouch Holdings Public Company Limited; Gulf Energy Development Public Company; Singtel Strategic Investments Pte Ltd. to Acquire Advanced Info Service Public Company Limited for USD 6.40 Billion

Deal No. 3: Cleveland-Cliffs Inc. to Acquire Stelco Holdings Inc. for USD 2.50 Billion

Deal No. 4: Amphenol Corporation to Acquire Outdoor Wireless Networks and Distributed Antenna Systems Business of CommScope Holding Company, Inc. for USD 2.10 Billion

Deal No. 5: Allianz Europe BV to Acquire Income Insurance Limited for USD 1.64 Billion

Deal No. 1:

KKR & Co. Inc.; The Carlyle Group Inc. to Acquire Approximately $10.1 Billion Prime Student Loans Portfolio of Discover Financial Services for USD 10.80 Billion

Global asset managers KKR and Carlyle have agreed to purchase a portfolio of prime student loans valued at USD 10.1 billion from Discover Financial Services, a prominent digital banking and payment services firm. The total purchase price for the complete loan portfolio is USD 10.8 billion.

Carlyle plans to leverage its comprehensive investment platform to offer bespoke asset-focused financing solutions. This will support a wide range of entities, including businesses, specialty finance firms, banks, asset managers, and other asset originators. KKR, on the other hand, is focusing on its asset-based finance strategy and credit vehicles for this investment. Since 2016, KKR has completed over 80 asset-based finance (ABF) investments globally through a mix of portfolio acquisitions, platform investments, and structured deals.

This move reflects a growing trend of private equity firms stepping into areas where banks are pulling back. Earlier this year, Carlyle acquired a USD 415 million private student loan portfolio from Truist and invested in Monogram, a platform that helps financial institutions offer student loans.

The transaction is anticipated to be finalized by the end of 2024. KKR Capital Markets and TCG Capital Markets structured and arranged the debt for this deal, while Wells Fargo acted as the exclusive financial advisor to Discover Financial Services.

Deal No. 2:

Intouch Holdings Public Company Limited; Gulf Energy Development Public Company; Singtel Strategic Investments Pte Ltd. to Acquire Advanced Info Service Public Company Limited for USD 6.40 Billion

Sarath Ratanavadi, Thailand’s second-richest tycoon, has announced a major restructuring plan to merge his energy and telecommunications holdings, Gulf Energy Development (GULF) and Intouch Holdings, into a single entity, tentatively named “NewCo.” This initiative is aimed at boosting operational efficiency and optimizing investment strategies.

As part of this restructuring, Intouch, Gulf, and Ratanavadi are making a voluntary tender offer (VTO) to acquire a 36.25% stake in Advanced Info Service (AIS), Thailand’s leading provider of mobile, broadband, and digital services. The offer is priced at THB 216.3 per share, totaling approximately THB 233.2 billion (around USD 6.4 billion).

Singtel Strategic Investments Pte. Ltd. (SSI), a wholly-owned subsidiary of Singtel holding approximately 23.3% of AIS shares, intends to participate in the VTO alongside Gulf, Intouch, and Ratanavadi.

The merger is expected to capitalize on the combined expertise of the companies, positioning the new entity as a significant player in both the energy and telecommunications sectors.

The restructuring is projected to be completed in the second quarter of 2025, subject to regulatory approvals. Bualuang Securities and UBS AG are serving as advisers to Gulf for this transaction.

Deal No. 3:

Cleveland-Cliffs Inc. to Acquire Stelco Holdings Inc. for USD 2.50 Billion

US-based Cleveland-Cliffs is set to acquire Canadian steel producer Stelco Holdings in a transaction valued at CAD 3.4 billion (USD 2.5 billion). This acquisition will notably expand Cliffs’ steelmaking operations and substantially increase its footprint in the flat-rolled steel market.

Stelco is renowned for its efficient, integrated steelmaking operations and boasts one of the most advanced steel production facilities in North America. The company manufactures a variety of flat-rolled, high-value steels, including premium coated, cold-rolled, and hot-rolled products, as well as pig iron and metallurgical coke.

Following the acquisition, Cliffs will enhance its existing Canadian operations, which include seven Tooling and Stamping plants and a Ferrous Processing and Trading Company (FPT) site, all based in Ontario.

The integration of Stelco will enhance Cliffs’ product portfolio and broaden its customer base, offering greater diversification in the construction and industrial markets. The deal promises significant integration benefits, such as potential reductions in procurement, overhead, and public company costs.

The transaction is expected to be completed by the end of the fourth quarter of 2024. BMO Capital Markets is advising Stelco, while BMO Capital Markets is advising Stelco, while Wells Fargo, J.P. Morgan, and Moelis & Company LLC are serving as financial advisors to Cleveland-Cliffs.

Deal No. 4:

Amphenol Corporation to Acquire Outdoor Wireless Networks and Distributed Antenna Systems Business of CommScope Holding Company, Inc. for USD 2.10 Billion

Amphenol Corporation, a major manufacturer of electronic and fiber optic connectors, will acquire CommScope’s mobile networks businesses for USD 2.1 billion in cash. This acquisition is set to enhance Amphenol’s product lineup for next-generation wireless networks.

The deal encompasses CommScope’s Outdoor Wireless Networks (OWN) segment and the Distributed Antenna Systems (DAS) business from the Networking, Intelligent Cellular, and Security Solutions (NICS) segment. The OWN segment serves major clients including Vodafone Group, AT&T, Verizon, and T-Mobile U.S.

The combined entities are expected to generate approximately USD 1.2 billion in sales and achieve EBITDA margins of about 25% for the full year of 2024. The acquisition is also projected to increase Amphenol’s diluted earnings per share in the first full year following the closing, excluding acquisition-related costs.

This acquisition is part of Amphenol’s broader expansion strategy. By late 2023, the company had already acquired several other firms, including PCTEL Inc., which specializes in antennas and RF solutions; Connor Manufacturing Services, known for precision manufacturing; Q Microwave, recognized for high-frequency microwave components; and XMA Corp., which focuses on advanced manufacturing services.

The transaction is projected to be finalized in the first half of 2025. Goldman Sachs & Co. LLC is providing financial advisory services to Amphenol.

Deal No. 5:

Allianz Europe BV to Acquire Income Insurance Limited for USD 1.64 Billion

German multinational financial services leader Allianz SE, through its wholly owned subsidiary Allianz Europe B.V., has announced its plan to acquire a 51% stake in Singapore’s Income Insurance to enhance its position in Asia.

Valued at SGD 2.2 billion (approximately USD 1.64 billion), this acquisition will significantly bolster Allianz’s presence in the dynamic Singapore insurance market and position the company as a leading composite insurer in the region.

This deal represents Allianz’s largest acquisition in Asia to date and its most significant transaction in the past three years.

Allianz, which already has a strong presence in Southeast Asia, is committed to investing in Singapore and partnering with a respected local institution. Income Insurance’s market leadership, strong brand reputation, and established history provide a solid foundation for Allianz to strengthen its position in Singapore’s financial services sector. The integration of Income Insurance’s local strengths with Allianz’s global expertise is expected to create a highly competitive insurer in Singapore.

The Asia-Pacific region is crucial for Allianz’s growth, contributing nearly EUR 7.7 billion in Total Business Volume across its Property-Casualty and Life/Health segments in 2023.

The transaction is expected to close in the fourth quarter of 2024 or the first quarter of 2025. Morgan Stanley is serving as the exclusive financial advisor to Income Insurance.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of July 15 to 21, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter