M&A News M&A News: Global M&A Deals Week of July 1 to 7, 2024

- M&A News

M&A News: Global M&A Deals Week of July 1 to 7, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

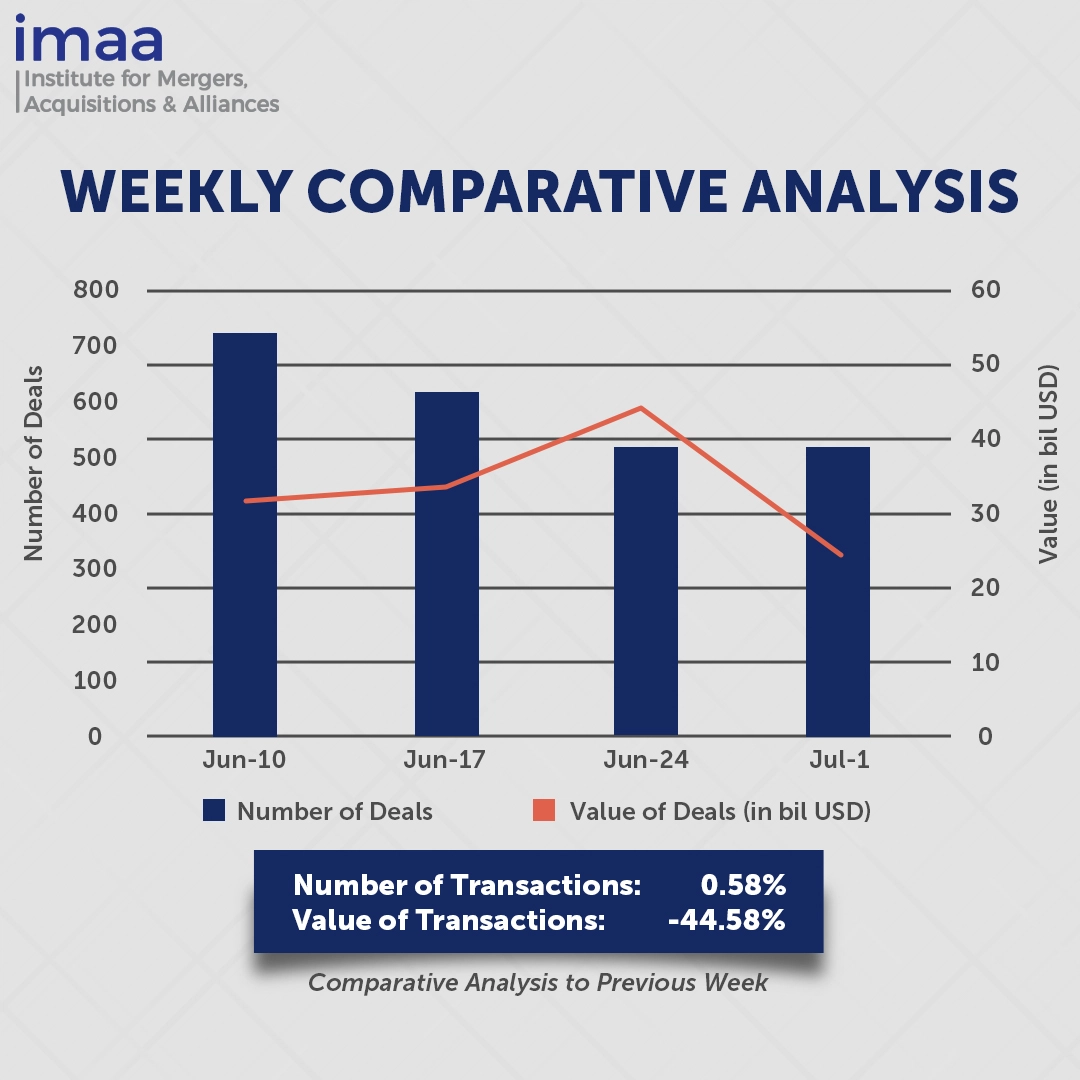

During the period from July 1 to July 7, the global market saw 524 mergers and acquisitions (M&A) deals, totaling USD 24.57 billion in value. Notably, 10 of these transactions exceeded the USD 500 million mark, cumulatively reaching USD 16.94 billion, which accounts for 69% of the week’s total deal value.

Among the significant deals, Boeing’s acquisition of AeroSystems for USD 4.7 billion stands out. This acquisition aims to enable the aircraft manufacturer to conserve funds while addressing safety and quality issues following months of negotiations amidst significant turmoil at the company over regulatory challenges.

Another notable deal was EQT’s acquisition of UK-listed Keyword Studios for approximately USD 2.7 billion. Keyword Studios, which debuted on public markets in 2013, has become one of London AIM’s largest and fastest-growing companies, driven by strategic acquisitions. The rise of streaming models and the surge in mobile gaming have amplified growth prospects within the video gaming sector, making companies in this industry increasingly appealing as acquisition targets.

Comparing this week to the previous one, while the number of deals saw a slight increase from 521 to 524, there was a notable 45% decrease in total deal volume, declining from USD 44.33 billion to USD 24.57 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of July 1 to 7, 2024 in detail:

Deal No. 1: The Boeing Company to Acquire Spirit AeroSystems Holdings, Inc. for USD 4.70 Billion

Deal No. 2: EQT Private Capital Asia; CPP Investments; Rosa Investments Pte. Ltd to Acquire Keywords Studios plc for USD 2.70 Billion

Deal No. 3: Hudson’s Bay Company to Acquire Neiman Marcus Group for USD 2.65 Billion

Deal No. 4: Semnur Pharmaceuticals, Inc. to Acquire Denali Capital Acquisition Corp. for USD 2.00 Billion

Deal No. 5: DOF Group ASA to Acquire Maersk Supply Service A/S for USD 1.11 Billion

Deal No. 1:

The Boeing Company to Acquire Spirit AeroSystems Holdings, Inc. for USD 4.70 Billion

Boeing, a prominent global aerospace company, has announced plans to acquire Spirit AeroSystems in an all-stock transaction valued at USD 4.7 billion (USD 37.25 per share). This strategic move follows extensive negotiations and aims to address manufacturing challenges amid ongoing safety and quality concerns within Boeing’s operations.

Spirit AeroSystems, a key player in aerostructures for commercial airplanes and defense platforms, plays a crucial role in manufacturing key components for Boeing aircraft, including fuselages for the 737 Max.

The acquisition will integrate virtually all of Spirit’s Boeing-related commercial operations into Boeing’s portfolio, alongside additional commercial, defense, and aftermarket activities. The transition will include collaborative efforts between Boeing and Spirit to ensure seamless continuity for customers and programs inherited through the acquisition, including engagements with the U.S. Department of Defense and Spirit’s defense clientele for ongoing defense and security commitments.

The transaction is expected to conclude by mid-2025. PJT Partners is serving as Boeing’s primary financial advisor, supported by Goldman Sachs & Co, LLC and Consello. Meanwhile, Spirit is advised by Morgan Stanley & Co. LLC as its lead financial advisor, with additional advisory support from Moelis & Company LLC.

Deal No. 2:

EQT Private Capital Asia; CPP Investments; Rosa Investments Pte. Ltd to Acquire Keywords Studios plc for USD 2.70 Billion

A consortium led by Swedish private equity group EQT has agreed to acquire Irish video games company Keywords Studios in a deal valued at GBP 2.1 billion (USD 2.7 billion).

Keywords Studios is a global leader in providing creative and technology-enabled solutions to the video games and entertainment industries. With over 70 facilities in 26 countries across Asia, Australia, the Americas, and Europe, Keywords Studios offers services spanning the entire content development cycle. Their impressive client roster includes major companies such as Activision Blizzard, Bandai Namco, Bethesda, Electronic Arts, Epic Games, Konami, Microsoft, Netflix, Riot Games, Square Enix, Supercell, Take-Two, Tencent, and Ubisoft.

Keywords Studios is strategically positioned to excel in the growing global gaming services market, offering end-to-end solutions across the video games value chain. EQT sees potential for accelerated growth by expanding into adjacent media and entertainment markets and leveraging fast-growing technologies. This approach aims to enhance Keywords Studios’ capabilities and better meet evolving customer demands.

EQT aims to provide additional capital to support Keywords Studios’ M&A strategy, leveraging its deep technology expertise and global network to further international expansion. Following the acquisition, EQT’s BPEA Fund VIII, part of EQT Private Capital Asia, will own 51% of the company, with equity co-investors CPP Investments and Rosa Investments holding 24.5% each.

The acquisition is expected to be completed in the fourth quarter of 2024. J.P. Morgan Cazenove served as financial advisor to EQT, while Robey Warshaw LLP advised Keywords Studios.

Deal No. 3:

Hudson's Bay Company to Acquire Neiman Marcus Group for USD 2.65 Billion

Hudson’s Bay Co. (HBC), the Canadian retail giant and owner of Saks Fifth Avenue, is set to acquire Neiman Marcus Group for USD 2.65 billion, positioning itself to capture a larger share of the luxury retail market amidst industry slowdowns.

This acquisition will pave the way for the establishment of Saks Global, a premier entity combining luxury retail and real estate assets. Under Saks Global, Saks Fifth Avenue, Saks OFF 5TH, Neiman Marcus, and Bergdorf Goodman will operate independently under their respected brands. The new entity will also integrate HBC’s U.S. real estate assets and Neiman Marcus Group’s real estate, creating a robust USD 7 billion portfolio focused on high-end retail locations.

Simultaneously, Hudson’s Bay Co. intends to restructure its Canadian operations as a standalone business, separate from Saks Global. This initiative aims to reduce leverage and enhance liquidity for HBC’s Canadian retail and real estate assets, including Hudson’s Bay stores and TheBay.com.

Funding for the USD 2.65 billion acquisition will come from a combination of equity capital from new and existing shareholders and debt facilities. Notably, Amazon, Rhône Capital, Insight Partners, and Salesforce will play strategic roles as investors post-transaction, contributing to innovation and growth initiatives within Saks Global.

M. Klein & Company is advising HBC on the acquisition and related financing, serving as the lead financial and capital markets advisor. J.P. Morgan and Lazard are providing financial advisory services to Neiman Marcus Group throughout the transaction process.

Deal No. 4:

Semnur Pharmaceuticals, Inc. to Acquire Denali Capital Acquisition Corp. for USD 2.00 Billion

Semnur Pharmaceuticals, a unit of Scilex Holding Company, is poised to enter the public market through a merger with Denali Capital Acquisition Corp, a special purpose acquisition company (SPAC), in a deal valued at USD 2 billion. This strategic initiative aims to expand Semnur’s market presence and accelerate the development of its pioneering therapies.

Specializing in novel non-opioid pain treatments, Semnur Pharmaceuticals is known for its lead program, SP-102 (SEMDexa), a Phase 3 viscous gel formulation of a widely used corticosteroid designed for epidural injections to treat lumbosacral radicular pain, or sciatica. The merger’s expected proceeds will significantly bolster the advancement of SP-102, reinforcing its potential impact on pain management.

The combined entity will continue to operate under the Semnur Pharmaceuticals name, with Scilex maintaining majority ownership. The merger anticipates substantial growth, with projected peak sales potential reaching up to USD 3.6 billion annually within five years post-launch.

The transaction is expected to be finalized in the second half of 2024, marking a significant milestone for both companies as they work together to bring innovative pain management solutions to market.

Deal No. 5:

DOF Group ASA to Acquire Maersk Supply Service A/S for USD 1.11 Billion

Norway’s DOF Group has finalized an agreement to acquire Denmark’s leading offshore marine services provider, Maersk Supply Service (MSS), in a deal valued at approximately USD 1.11 billion through a combination of shares and cash. This acquisition is set to establish one of the largest oil services companies listed on the Oslo Stock Exchange, with a combined market capitalization of around USD 2.3 billion.

Upon completion, the merged entity will operate under the DOF Group name, positioning itself as a premier offshore service provider with extensive global reach and a diversified portfolio of services across all continents in the offshore energy industries. The strategic and geographical alignment between DOF and MSS’ operations positions them favorably for future growth and synergy realization.

Post-acquisition, the DOF Group will boast a workforce exceeding 5,400 employees and a fleet of 78 modern offshore/subsea vessels, including 65 owned vessels, enhancing their engineering capacity to cater to both offshore and subsea markets. The transaction excludes MSS’ operations in Brazil.

The transaction is slated to close in the fourth quarter of 2024. Carnegie AS is serving as financial advisor, while Advokatfirmaet Thommessen AS is acting as legal advisor to DOF Group in connection with the acquisition.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of July 1 to 7, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter