M&A News M&A News: Global M&A Deals Week of Dec 9 to 15, 2024

- M&A News

M&A News: Global M&A Deals Week of Dec 9 to 15, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

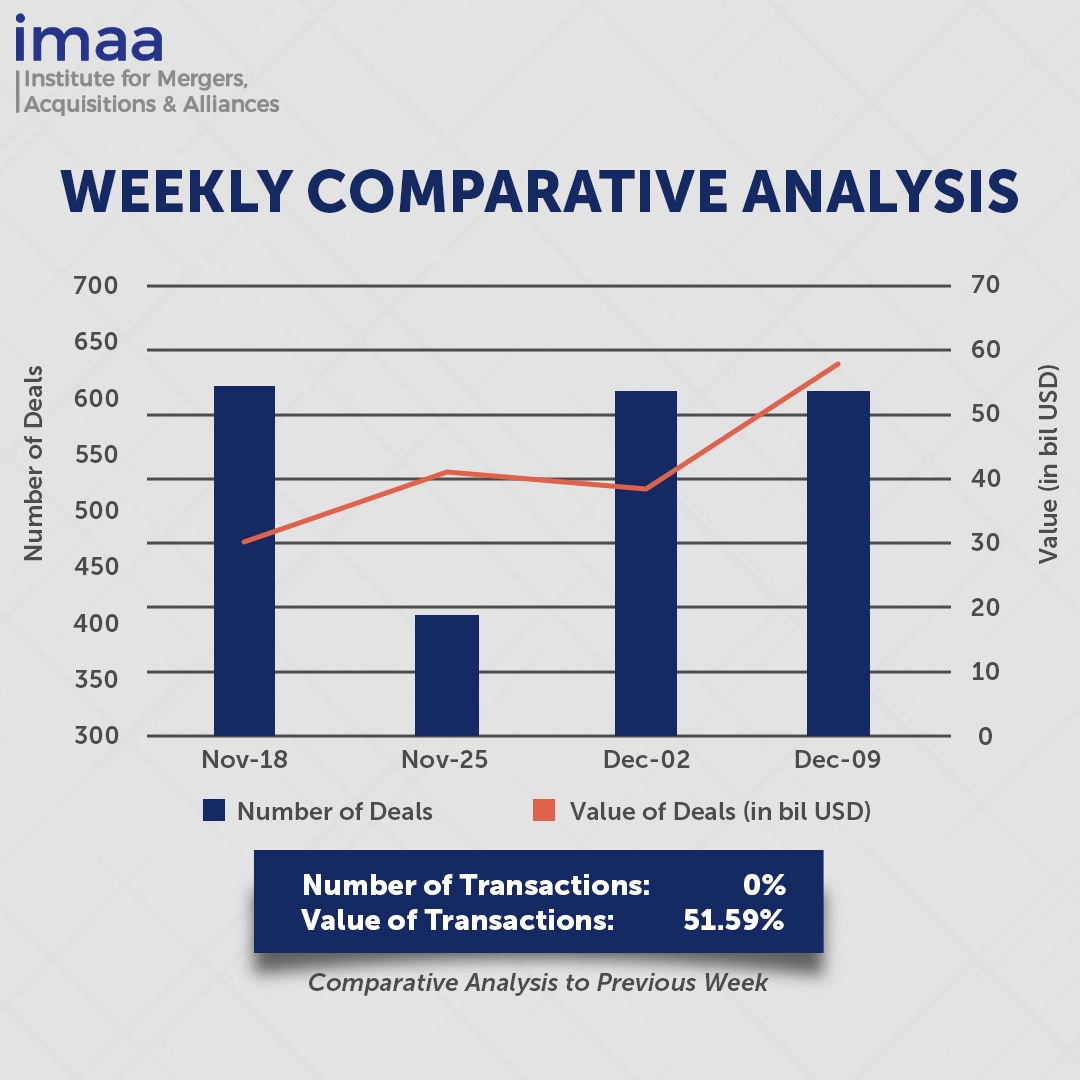

The global mergers and acquisitions (M&A) market recorded 606 deals announced between December 9 and December 15, with a total deal value of USD 57.78 billion. Of particular note, 16 transactions each exceeded the USD 500 million mark, contributing a combined value of USD 49.58 billion—representing 86% of the week’s total deal value.

The standout deal during this period was Arthur J. Gallagher’s acquisition of AssuredPartners for USD 13.45 billion, its largest acquisition to date. This deal significantly enhances Gallagher’s retail middle-market property and casualty operations across the U.S., aligning with its “tuck-in” M&A strategy. The acquisition also creates new opportunities for Gallagher’s wholesale, reinsurance, and claims management businesses, while adding scale, expertise, and talent to its operations in the UK and Ireland. Furthermore, the deal unites two highly compatible, entrepreneurial, and sales-driven organizations, both with strong local connections and a shared focus on growth and client service.

In comparison to the previous week, the volume of deals remained unchanged at 606. However, the total deal value experienced a substantial increase of 52%, rising from USD 38.11 billion to USD 57.78 billion. This growth was largely driven by several multi-billion-dollar transactions, which significantly boosted the overall deal value.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of Dec 9 to 15, 2024 in detail:

Deal No. 1: Arthur J. Gallagher & Co. to Acquire AssuredPartners, Inc. for USD 13.45 Billion

Deal No. 2: Omnicom Group Inc. to Acquire The Interpublic Group of Companies, Inc. for USD 13.30 Billion

Deal No. 3: Patient Square Capital, LP to Acquire Patterson Companies, Inc. for USD 4.10 Billion

Deal No. 4: Nykredit Realkredit A/S to Acquire Spar Nord Bank A/S for USD 3.50 Billion

Deal No. 5: Blackstone Inc. to Acquire Tokyo Garden Terrace Kioicho for USD 2.60 Billion

Deal No. 1:

Arthur J. Gallagher & Co. to Acquire AssuredPartners, Inc. for USD 13.45 Billion

Arthur J. Gallagher, a major player in the insurance brokerage industry, has announced its acquisition of AssuredPartners for USD 13.45 billion in cash. This move is designed to strengthen Gallagher’s presence in the US middle-market property and casualty (P&C) and employee benefits sectors.

AssuredPartners manages a vast network of around 400 offices located across the United States, the United Kingdom, and Ireland. The company provides a wide array of services, including commercial property and casualty insurance, specialty lines, employee benefits, and personal insurance solutions.

The acquisition is expected to enhance Gallagher’s reach in the US middle market, providing opportunities to expand its client base and capitalize on its advanced data analytics and comprehensive product offerings. Additionally, it will enhance Gallagher’s capabilities in specialized sectors, including transportation, energy, healthcare, government contracting, and public sector services.

From a financial perspective, the deal is projected to deliver significant benefits, with expectations of double-digit adjusted EPS growth driven by operational synergies.

Anticipated to close in the first quarter of 2025, this deal represents one of the largest transactions in the insurance brokerage space, underlining its significance within the industry.

Deal No. 2:

Omnicom Group Inc. to Acquire The Interpublic Group of Companies, Inc. for USD 13.30 Billion

Omnicom, a global leader in marketing and corporate communications, has revealed its plan to acquire rival Interpublic Group in an all-stock transaction valued at USD 13.3 billion. The merger will create the world’s largest advertising company, with a combined revenue exceeding USD 25 billion.

Upon completion, Omnicom shareholders will own 60.6% of the merged entity, while Interpublic shareholders will hold 39.4%. This marks Omnicom’s largest acquisition to date, underscoring its strategic move to strengthen its position in the industry.

Omnicom is renowned for delivering data-driven, creative marketing and sales solutions, serving over 5,000 clients across more than 70 countries. Interpublic, on the other hand, is recognized for its values-oriented, data-focused, and creativity-led marketing services, housing globally acclaimed brands such as Acxiom, Craft, FCB, and FutureBrand.

The merger will unite an unparalleled pool of marketing expertise with the industry’s most comprehensive suite of innovative services and products. Leveraging a cutting-edge sales and marketing platform, the combined entity aims to deliver end-to-end solutions that drive superior outcomes for the world’s most sophisticated clients.

The transaction is anticipated to generate USD 750 million in annual cost synergies and enhance adjusted earnings per share for both Omnicom and Interpublic shareholders.

The deal is expected to close in the second half of 2025, pending regulatory and shareholder approvals. PJT Partners is serving as financial advisor to Omnicom, while Morgan Stanley is advising Interpublic.

Deal No. 3:

Patient Square Capital, LP to Acquire Patterson Companies, Inc. for USD 4.10 Billion

Patterson Companies has entered into an agreement to be acquired by the healthcare investment firm Patient Square Capital for USD 4.1 billion, marking its transition to a privately held entity.

Under the terms of the deal, Patterson shareholders will receive USD 31.35 in cash per share.

As a key distributor of products and services for the dental, veterinary, and rehabilitation sectors across North America and the UK, Patterson views this acquisition as a significant step forward. The deal offers immediate value for shareholders and positions Patterson to continue investing in customer service while fostering future growth

Patient Square Capital, a healthcare investment firm, focuses on generating strong returns by partnering with high-growth companies and top-tier management teams dedicated to improving health through their products, services, and technologies. Patient Square sees considerable potential in Patterson Companies and is eager to collaborate with its management team to build on the company’s legacy and drive future expansion.

The transaction is expected to close in the fourth quarter of Patterson’s fiscal 2025, at which point the company will become privately held. Guggenheim Securities, LLC is serving as Patterson’s exclusive financial advisor, while Citi, UBS Investment Bank, and Wells Fargo Securities, LLC are acting as financial advisors to Patient Square.

Deal No. 4:

Nykredit Realkredit A/S to Acquire Spar Nord Bank A/S for USD 3.50 Billion

Danish mortgage lender Nykredit is acquiring Spar Nord Bank in an all-cash transaction valued at DKK 24.7 billion (approximately USD 3.5 billion). The acquisition will create Denmark’s third-largest banking institution.

Nykredit currently holds a 19.6% stake in Spar Nord, and, alongside its fully owned subsidiary Totalkredit, commands a dominant market share of around 45% in Denmark’s mortgage credit sector.

The merger of Spar Nord and Nykredit is poised to offer a formidable, customer-owned alternative to Denmark’s largest publicly listed banks. Post-merger, the combined entity will rank as the third-largest bank in Denmark, with total lending around DKK 160 billion as of Q3. The new institution will command a market share of approximately 13% in lending and 11% in deposit volumes.

Through this merger, Nykredit aims to enhance its competitive edge by leveraging the strengths of both banks’ business models. The combined entity will ensure a robust local presence, backed by scalable back-office functions and competence centers in Aalborg and Copenhagen.

Spar Nord is an integral member of Nykredit’s Totalkredit alliance. Both banks share the same data processing center, BEC, and have a history of close collaboration, which is expected to facilitate a smooth integration post-acquisition.

Following the merger, Nykredit plans to retain the Spar Nord brand, which is well-regarded among customers. Branches and joint locations may feature both Nykredit Bank and Spar Nord branding, though full integration of operations will be pursued swiftly.

The transaction is expected to be finalized in the first half of 2025. Spar Nord is being advised by Carnegie Investment Bank as its exclusive financial advisor.

Deal No. 5:

Blackstone Inc. to Acquire Tokyo Garden Terrace Kioicho for USD 2.60 Billion

Blackstone has agreed to acquire the mixed-use office complex Tokyo Garden Terrace Kioicho, marking its largest deal across its businesses in the Japanese market and the largest real estate investment by a foreign investor in Japan. The deal is valued at USD 2.6 billion.

Tokyo Garden Terrace Kioicho is a 2.4-million-square-foot development that comprises two high-rise towers, including a Grade A+ office space, which is currently 100% occupied; 135 high-end residential units; a 250-key luxury hotel; conference and wedding venues; and over 30 cafes, restaurants, and retail stores.

This acquisition presents a significant opportunity to obtain a prime Tokyo asset from Seibu Holdings, one of Japan’s most respected corporations. Blackstone has been a reliable partner to Japanese companies for over 17 years, assisting them in divesting businesses and assets to drive growth. It is a prominent investor in Japan, with a diversified real estate portfolio in sectors such as hotels, rental housing, logistics, and data centers.

For Seibu, the company has been reviewing all properties as potential sale targets to use the proceeds for developing and acquiring new properties.

Blackstone’s proposal aims to foster the continued growth and development of the asset, with a valuation that reflects its value. Seibu Group companies will remain involved in managing the asset, including overseeing its asset management and hotel operations.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of Dec 9 to 15, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter