M&A News M&A News: Global M&A Deals Week of Dec 30 to Jan 5, 2025

- M&A News

M&A News: Global M&A Deals Week of Dec 30 to Jan 5, 2025

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

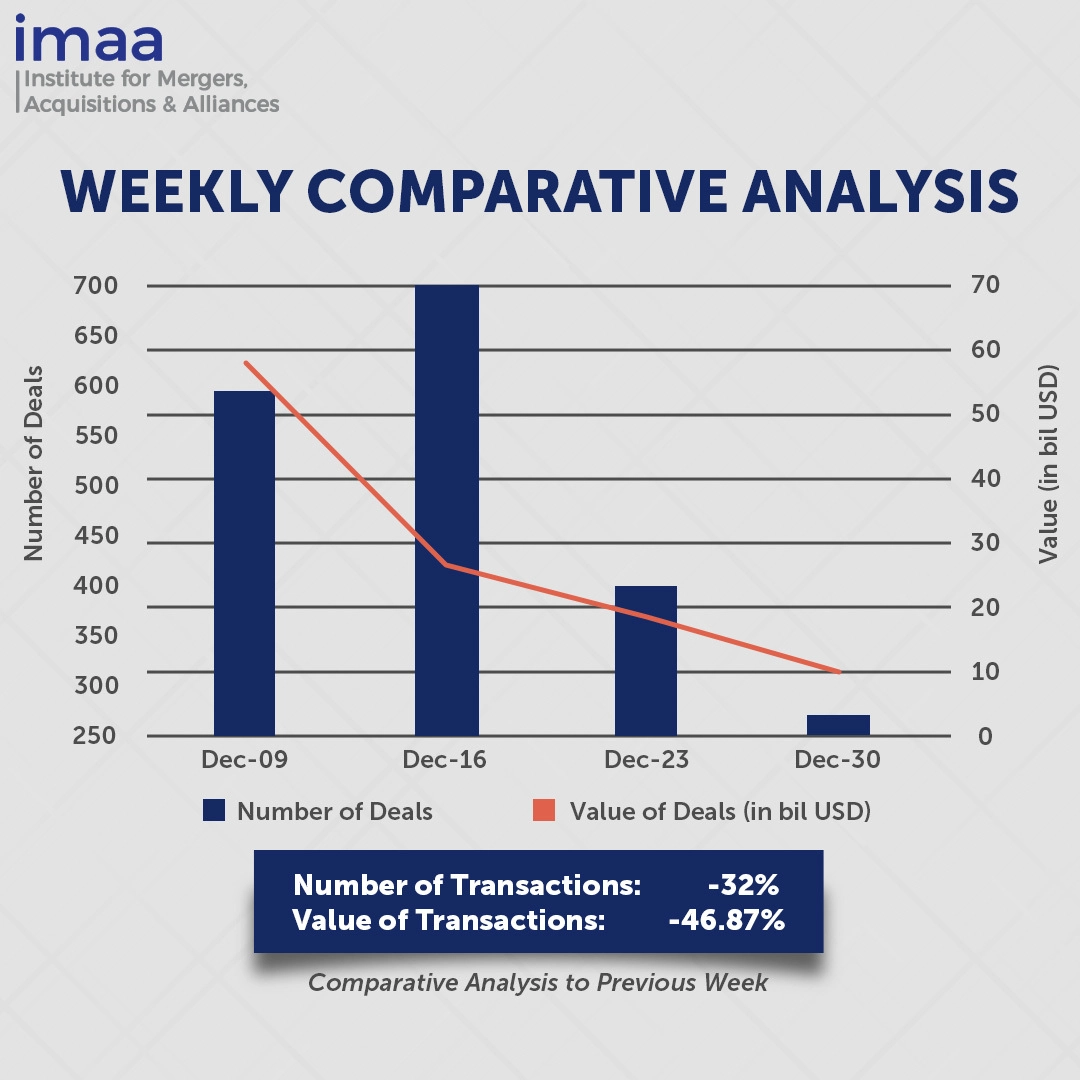

During the week of December 30 to January 5, the global mergers and acquisitions (M&A) market experienced a subdued start, with 271 deals announced, totaling a combined value of USD 9.91 billion. Among these, six transactions exceeded the USD 500 million threshold, collectively accounting for USD 5.63 billion, or 57% of the total deal value for the period.

The largest transaction during this period was DCP Capital’s acquisition of Sun Art Retail Group for USD 1.58 billion. This deal involved the purchase of the hypermarket operator from Alibaba, China’s leading e-commerce company, as it continued to divest physical commerce assets at discounted valuations to concentrate on its core online business. Sun Art Retail Group is a leading Chinese hypermarket operator specializing in modern retail formats, including a network of hypermarkets, shopping malls, and e-commerce platforms under brands such as RT-Mart. This transaction marks Alibaba’s second significant divestment of a bricks-and-mortar business. In December, it sold its entire stake in Intime Retail Group, a department store chain, reflecting a strategic shift toward its e-commerce and cloud computing businesses.

Compared to the prior week, the M&A market witnessed a 32% decline in deal volume, dropping from 399 to 271 transactions. Deal value also fell sharply, decreasing by 46.9% from USD 18.66 billion to USD 9.91 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of Dec 30 to Jan 5, 2025 in detail:

Deal No. 1: DCP Capital to Acquire Sun Art Retail Group Limited for USD 1.58 Billion

Deal No. 2: World Wide Technology Holding Co, LLC to Acquire Softchoice Corporation for USD 1.25 Billion

Deal No. 3: Norges Bank Investment Management to Acquire 1.3m sq US Logistics Portfolio Consisting of 48 Buildings and 5 Land Plots for USD 1.07 Billion

Deal No. 4: GP Health Service Capital Co., Ltd.; Shanghai Pharmaceuticals Holding Co., Ltd. to Acquire Shanghai Hutchison Pharmaceuticals Limited for USD 0.61 Billion

Deal No. 5: Thomson Reuters Corporation to Acquire cPaperless, LLC doing business as SafeSend for USD 0.60 Billion

Deal No. 1:

DCP Capital to Acquire Sun Art Retail Group Limited for USD 1.58 Billion

E-commerce giant Alibaba is selling its 78.7% majority stake in Sun Art Retail Group, a prominent hypermarket operator in China, for USD 1.58 billion (HKD 12.3 billion). The buyer is private equity firm DCP Capital Partners, acting through its subsidiary Paragon Shine.

Sun Art Retail Group is a key player in China’s hypermarket sector, operating well-established brands such as RT-Mart, RT-Super, and M-Club. These brands provide a comprehensive selection of groceries and general merchandise, catering to diverse consumer needs. Sun Art has built a strong presence across China through its extensive store network and the integration of online and offline retail strategies. By leveraging advanced digital tools and logistics capabilities, the company enhances customer convenience and reinforces its position in the highly competitive retail market.

This divestment aligns with Alibaba’s strategic focus on optimizing its asset portfolio and reallocating resources to strengthen its core business areas. The move underscores Alibaba’s intent to prioritize shareholder value while scaling back investments in physical retail—an initiative championed by former CEO Daniel Zhang. This sale marks another step in Alibaba’s broader plan to streamline its operations by merging domestic and international e-commerce activities and divesting from non-core holdings.

Despite this shift, Alibaba remains optimistic about the growth potential of China’s consumer sector. The company reiterates its commitment to driving industry-wide progress by leveraging technological innovations that elevate the consumer experience and promote high-quality growth.

Deal No. 2:

World Wide Technology Holding Co, LLC to Acquire Softchoice Corporation for USD 1.25 Billion

World Wide Technology (WWT), a global leader in advanced technology solutions, has agreed to acquire Softchoice, a Toronto-based IT services provider, for CAD 1.8 billion (USD 1.25 billion) in cash.

Softchoice, a key player in North America’s IT solutions market, excels in cloud migration, software asset management, and managed services. It specializes in optimizing IT environments through customized solutions in cloud computing, security, collaboration, and data center modernization. Working with leading technology partners such as Microsoft, AWS, and Cisco, Softchoice develops and implements scalable IT strategies that enhance business efficiency and foster growth.

This acquisition will expand WWT’s presence in the commercial, small, and medium business sectors, strengthening its footprint in the U.S., Canada, and other international markets. As industries adopt AI-driven transformations, the combined entity will be well-positioned to capitalize on this trend. The integration of Softchoice’s expertise in software, cloud, cybersecurity, and AI with WWT’s service portfolio will accelerate digital transformation for clients, delivering enhanced outcomes.

The deal is expected to close by late Q1 or early Q2 2025, after which Softchoice will be delisted from the TSX. TD Securities is serving as Softchoice’s lead financial advisor, with BDT & MSD and BofA Securities advising WWT.

Deal No. 3:

Norges Bank Investment Management to Acquire 1.3m sq US Logistics Portfolio Consisting of 48 Buildings and 5 Land Plots for USD 1.07 Billion

Norges Bank Investment Management (NBIM) has acquired a 45% stake in a U.S. logistics portfolio from CPP Investments for USD 1.07 billion. This transaction includes 48 buildings located in Southern California, New Jersey, and Pennsylvania, in a new joint venture with Goodman Group.

The portfolio spans a total leasable area of 1.3 million square meters, featuring 48 buildings and five land plots. These assets are situated in prime locations, representing high-quality logistics properties. NBIM is confident in the long-term potential of this investment, viewing the limited new supply in these regions as a strong driver for future growth.

The agreement was finalized on January 1, 2025, following its signing on December 20, 2024.

The assets are concentrated in key logistics hubs within the US supply chain—Southern California, New Jersey, and Pennsylvania—which have limited opportunities for new development. This scarcity makes the existing properties highly valuable. Goodman Group, holding a 55% interest in the portfolio, brings extensive logistics property management expertise, complementing NBIM’s financial capabilities.

This venture marks a strategic expansion of NBIM’s real estate portfolio, traditionally focused on office and retail assets in Europe and North America. By diversifying into logistics, NBIM seeks to tap into an asset class that has proven resilient amid economic uncertainties, particularly with the growth of e-commerce, which is increasing demand for distribution and fulfillment centers.

Deal No. 4:

GP Health Service Capital Co., Ltd.; Shanghai Pharmaceuticals Holding Co., Ltd. to Acquire Shanghai Hutchison Pharmaceuticals Limited for USD 0.61 Billion

China’s Hutchmed has reached an agreement to divest its 45% equity stake in Shanghai Hutchison Pharmaceuticals (SHPL) for approximately USD 608 million in cash. The buyers are China-based private equity firm GP Health Service Capital and Shanghai Pharmaceuticals.

SHPL is a key player in China’s pharmaceutical industry, specializing in the production of its own-brand prescription medicines, particularly for cardiovascular diseases. The company is also involved in the development and distribution of drugs in oncology, cardiology, and respiratory medicine. In 2023, SHPL generated a consolidated net income of USD 47.4 million attributable to Hutchmed.

Under the terms of the transaction, GP Health Service Capital will acquire a 35% stake in SHPL for USD 473 million, while Shanghai Pharmaceuticals will purchase an additional 10% equity interest for USD 135 million. Hutchmed will retain a 5% equity interest in SHPL. Following the sale, a three-year transition period will begin, during which Hutchmed will propose a new general manager for SHPL and guarantee a minimum net profit growth of 5% per year to GP Health Service Capital, with a cap on compensation set at USD 95 million.

This divestment is in line with Hutchmed’s strategy to refocus on its core business, which centers on developing novel therapies for immunological diseases and cancers, with particular emphasis on its antibody-drug conjugate platform.

The transactions are expected to be completed by the end of the first quarter of 2025, with the closing of both deals contingent upon their simultaneous completion.

Deal No. 5:

Thomson Reuters Corporation to Acquire cPaperless, LLC doing business as SafeSend for USD 0.60 Billion

Global content and technology firm Thomson Reuters has acquired cPaperless, LLC, operating under the name “SafeSend,” in a USD 600 million cash transaction.

SafeSend, a cloud-native technology provider, delivers innovative solutions tailored for tax and accounting professionals, simplifying the management and exchange of sensitive financial documents. Its platform includes tools for tax return delivery, e-signature collection, payment processing, workflow automation, and compliance management, addressing the growing demands on accounting firms transitioning to paperless operations.

SafeSend employs 235 staff and serves accounting firms of all sizes across the United States, including 70% of the nation’s top 500 firms. The company is projected to generate approximately USD 60 million in revenue in 2025 (excluding fair value adjustments to acquired deferred revenue) and anticipates annual growth exceeding 25% in the coming years.

Thomson Reuters plans to continue offering SafeSend’s products as part of its broader strategy to enhance efficiency for tax professionals and their clients. The SafeSend platform will remain available as a standalone market solution, designed to integrate seamlessly with multiple vendors in a connected tax software ecosystem.

For SafeSend, joining Thomson Reuters provides an opportunity to accelerate product innovation and advance a shared vision of creating a comprehensive end-to-end tax workflow solution. This collaboration aims to deliver greater value and efficiency to accounting firms and their clients nationwide.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of Dec 30 to Jan 5, 2025. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter