M&A News M&A News: Global M&A Deals Week of Dec 23 to 29, 2024

- M&A News

M&A News: Global M&A Deals Week of Dec 23 to 29, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

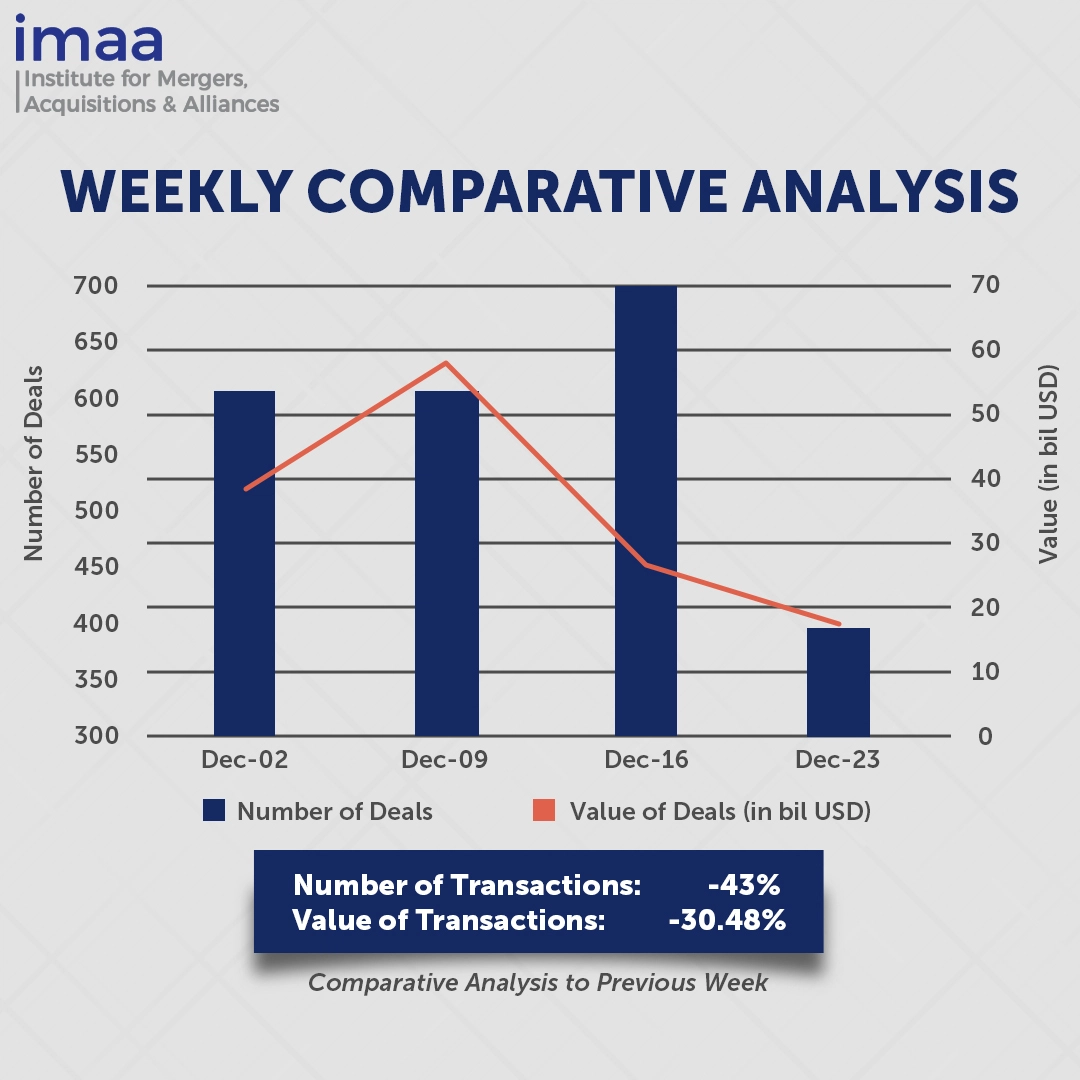

During the week of December 23 to December 29, the global mergers and acquisitions (M&A) market saw 399 deals with a combined value of USD 18.66 billion. Notably, 11 transactions surpassed the USD 500 million mark, totaling USD 12.48 billion, which accounted for 67% of the week’s total deal value.

A key transaction during this period was Prosus’s acquisition of Despegar, a leading travel agency in Latin America, for USD 1.7 billion. Despegar has been at the forefront of revolutionizing the region’s tourism industry through technology for over two decades. Prosus, a global investment group with a focus on sectors with high long-term growth potential, views this acquisition as a strategic move to strengthen its presence in Latin America. The deal expands Prosus’s footprint across local e-commerce, travel, and fintech, serving over 100 million customers in the region.

Week-on-week data for the last week of December shows a 43% decline in deal volume, dropping from 705 to 399, while the total deal value fell by 30.5%, from USD 26.84 billion to USD 18.66 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of Dec 23 to 29, 2024 in detail:

Deal No. 1: Prosus N.V. to Acquire Despegar.com, Corp. for USD 1.70 Billion

Deal No. 2: Nidec Corporation to Acquire Makino Milling Machine Co., Ltd. for USD 1.60 Billion

Deal No. 3: Xerox Corporation to Acquire Lexmark International Inc. for USD 1.50 Billion

Deal No. 4: JSW Neo Energy Limited to Acquire O2 Power Private Limited for USD 1.47 Billion

Deal No. 5: New Enterprise Associates, Inc. to Acquire NeueHealth, Inc. for USD 1.30 Billion

Deal No. 1:

Prosus N.V. to Acquire Despegar.com, Corp. for USD 1.70 Billion

Tech investor Prosus has announced its acquisition of Despegar, a prominent online travel platform in Latin America, in an all-cash transaction valued at USD 1.7 billion, equivalent to USD 19.5 per share. The deal aligns with Prosus’s strategy to expand its footprint in the region and leverage Despegar’s established presence to achieve operational scalability.

Despegar, a leader in travel technology across Latin America, operates in over 19 markets and facilitates more than 9.5 million transactions annually. In 2023, the company reported revenues of USD 706 million and an EBITDA of USD 116 million. It serves its customers through two core business models: an omnichannel B2C platform accessed via its website, mobile app, and conversational channels powered by its AI assistant, Sofia, and a rapidly growing B2B segment that provides white-label solutions for partners, including banks, airlines, and retailers.

With Latin America’s GDP projected to grow between 2% and 3% in the coming year, Prosus aims to capitalize on Despegar’s strong regional presence and drive economies of scale. This acquisition will complement Prosus’s existing portfolio in the region, which includes iFood, a leading food delivery platform, and Sympla, a prominent ticketing service. Together, these businesses will serve a combined customer base of 100 million after the transaction is completed.

The deal, expected to close in the second quarter of 2025, will see Morgan Stanley & Co. International PLC acting as the exclusive financial advisor to Prosus, while Goldman Sachs & Co. LLC will serve as the exclusive financial advisor to Despegar.

Deal No. 2:

Nidec Corporation to Acquire Makino Milling Machine Co., Ltd. for USD 1.60 Billion

Japanese motor manufacturer Nidec Corporation has made an offer to acquire machine tool builder Makino Milling Machine Co., Ltd. for JPY 257.3 billion (USD 1.6 billion).

Makino Milling Machine is renowned for its high-precision machinery, including machining centers and electrical discharge machines (EDMs), and serves industries such as automotive, aerospace, and electronics. The company focuses on driving innovation and automation to improve manufacturing efficiency worldwide.

This acquisition aligns with Nidec’s strategy to expand its footprint in the rapidly growing industrial automation and robotics markets. By integrating Makino’s advanced technology, Nidec aims to strengthen its manufacturing sector offerings and accelerate innovation in precision machinery.

The acquisition will combine Nidec’s expertise in gear cutting, large parts machining, and turning with Makino’s specialization in machining centers and EDMs. This synergy will enable both companies to meet a broader range of customer needs, particularly in sectors such as electric vehicles and data centers.

Additionally, the deal will enhance global production capabilities by merging the companies’ international manufacturing networks and expand their sales and service reach. Nidec expects this integration to drive business growth, boost market expansion, and generate significant profits.

Deal No. 3:

Xerox Corporation to Acquire Lexmark International Inc. for USD 1.50 Billion

Xerox Corporation is acquiring Lexmark International for USD 1.5 billion, including debt, as part of a strategic initiative to bring manufacturing in-house and expand its presence in key markets across Asia and Latin America.

Lexmark, a U.S.-based technology company, specializes in imaging solutions, including printers, multifunction devices, and managed print services. A trusted partner and supplier to Xerox, Lexmark’s expertise aligns seamlessly with Xerox’s goals. By combining Lexmark’s advanced offerings with Xerox ConnectKey® technology and its portfolio of Print and Digital Services, the acquisition is expected to enhance product capabilities and reinforce Xerox’s dedication to delivering greater value to its clients and partners.

The acquisition will also strengthen Xerox’s competitive edge in the growing A4 color printing segment while broadening its distribution channels and global footprint, particularly in the APAC region. The unified organization will serve over 200,000 clients in 170 countries, supported by 125 manufacturing and distribution facilities in 16 locations worldwide. Together, Xerox and Lexmark hold a top-five global market share in the entry-level, mid-range, and production print categories and are prominent players in the managed print services sector.

The transaction is expected to conclude in the second half of 2025. Jefferies LLC is providing financial advisory services to Xerox, with additional guidance from Citi, while Morgan Stanley & Co. LLC is acting as Lexmark’s financial advisor.

Deal No. 4:

JSW Neo Energy Limited to Acquire O2 Power Private Limited for USD 1.47 Billion

India’s JSW Neo Energy plans to acquire a 4,696 MW renewable energy platform from O2 Power Pooling, a joint venture between EQT Infrastructure and Temasek, for USD 1.47 billion. The acquisition includes O2 Power Midco Holdings and O2 Energy, further expanding JSW Neo’s renewable energy portfolio.

O2 Power’s platform has a total capacity of 4,696 MW, with 2,259 MW expected to be operational by June 2025, 1,463 MW currently under construction, and an additional 974 MW in the pipeline, scheduled for commissioning by June 2027. The platform features a blended average tariff of INR 3.37/KWh and a remaining project life of 23 years. Its assets are distributed across seven resource-rich states in India. This acquisition will increase JSW Neo’s locked-in generation capacity by 23%, from 20,012 MW to 24,708 MW.

As JSW Energy’s largest acquisition to date, the deal strengthens its position in India’s energy sector. It is expected to provide substantial value to shareholders, aligning with the company’s prudent capital allocation strategy and focus on high-return projects meeting its mid-teen equity IRR threshold.

The transaction is subject to regulatory approvals, including clearance from the Competition Commission of India (CCI). PWC acted as the transaction advisor to JSW Neo, while KPMG conducted financial and tax due diligence.

Deal No. 5:

New Enterprise Associates, Inc. to Acquire NeueHealth, Inc. for USD 1.30 Billion

Healthcare technology company NeuHealth is set to be acquired by New Enterprise Associates (NEA) in an all-cash transaction valued at USD 1.3 billion (USD 7.33 per share), providing NeuHealth with the resources and flexibility to further enhance its value-driven, customer-focused care model.

NeuHealth provides high-quality clinical care to over 500,000 consumers through its own clinics and partnerships with more than 3,000 affiliated providers. The company specializes in digital health services, utilizing artificial intelligence, telemedicine, and data analytics to improve patient care, streamline healthcare processes, and enhance outcomes for both patients and healthcare providers.

New Enterprise Associates (NEA) is a global venture capital firm that invests in early- and growth-stage companies across various sectors, including technology, healthcare, and consumer services. With a strong track record of successful investments, NEA has been a strategic partner to NeuHealth and looks forward to continuing its collaboration in support of NeuHealth’s growth as a leader in value-based care.

The acquisition is subject to approval by NeuHealth’s stockholders and other customary closing conditions, including regulatory approvals. Simpson Thacher & Bartlett LLP is serving as legal counsel to NeuHealth, while Latham & Watkins LLP is advising NEA.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of Dec 23 to 29, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter