M&A News M&A News: Global M&A Deals Week of Dec 16 to 22, 2024

- M&A News

M&A News: Global M&A Deals Week of Dec 16 to 22, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

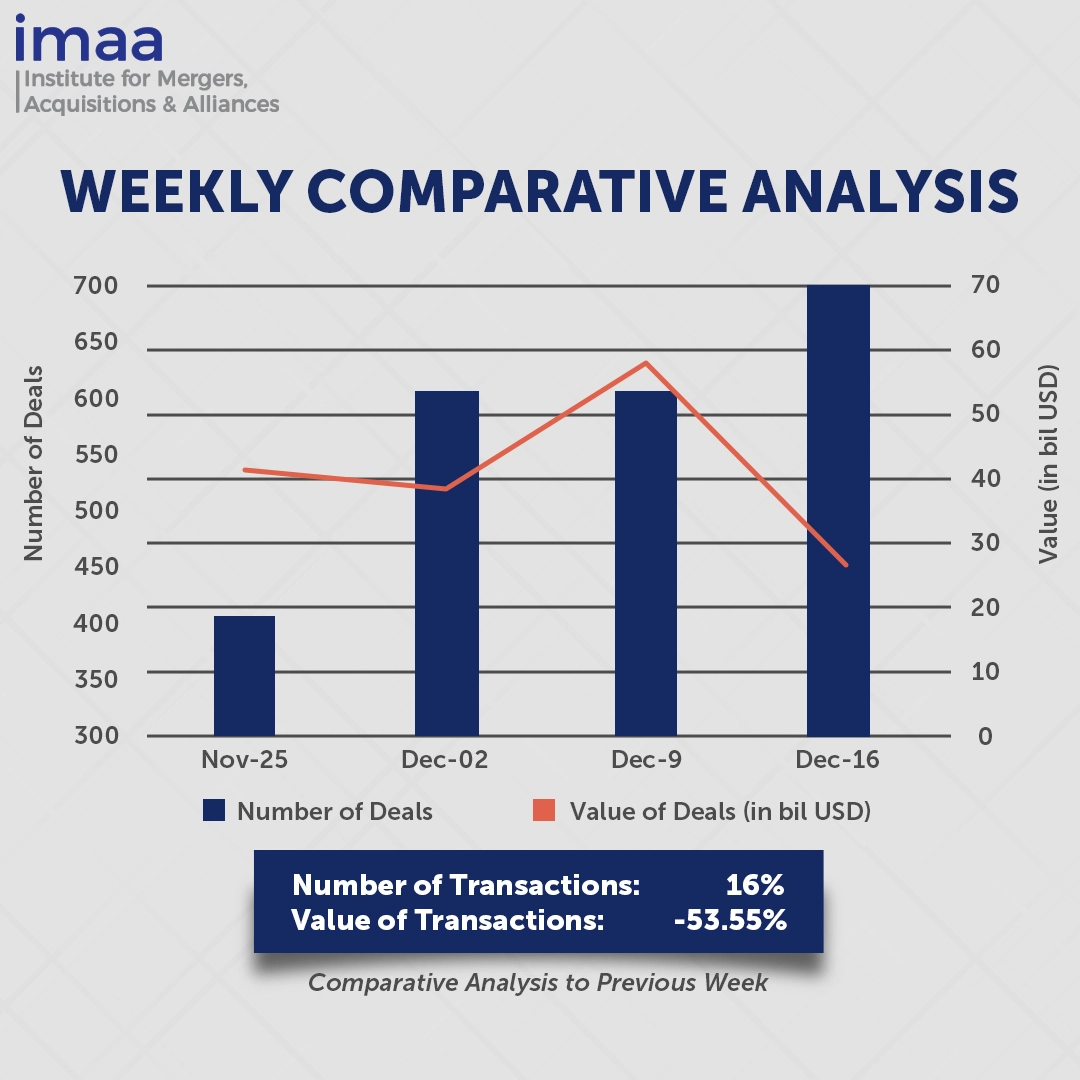

The global mergers and acquisitions (M&A) market saw 705 deals announced between December 16 and December 22, with a total value of USD 26.84 billion. Among these, 10 transactions surpassed the USD 500 million threshold, collectively accounting for USD 16.68 billion, or 62% of the week’s total deal value.

A significant transaction during this period was the UK Ministry of Defence’s acquisition of over 36,000 properties in the Married Quarters Estate, located in England and Wales, for £5.99 billion (approximately USD 7.6 billion). This acquisition reverses a sale undertaken by the government in 1996 and aims to revitalize the UK Armed Forces estate by initiating new housing projects for military families and necessary refurbishments. The deal is also expected to yield substantial savings for taxpayers over the next decade.

In terms of week-on-week performance, deal volume increased by 16%, rising from 606 to 705 transactions. However, deal value experienced a significant decline of 53.5%, dropping from USD 57.78 billion to USD 26.84 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of Dec 16 to 22, 2024 in detail:

Deal No. 1: UK Ministry of Defense to Acquire Married Quarters Estate located in England and Wales for USD 7.60 Billion

Deal No. 2: TOPPAN Holdings Inc. to Acquire Thermoformed and Flexibles Packaging Business of Sonoco Products Company for USD 1.80 Billion

Deal No. 3: A New Third-Party Consortium to Acquire Soho House & Co Inc. for USD 1.75 Billion

Deal No. 4: SoftwareONE Holding AG to Acquire Crayon Group Holding ASA for USD 1.40 Billion

Deal No. 5: ArcLight Capital Partners, LLC to Acquire Gulf Coast Express Pipeline LLC for USD 0.87 Billion

Deal No. 1:

UK Ministry of Defense to Acquire Married Quarters Estate located in England and Wales for USD 7.60 Billion

The UK Ministry of Defense (MoD) has secured a deal to reacquire 36,347 properties in the Married Quarters Estate, situated in England and Wales, from Annington for approximately GBP 6 billion (USD 7.6 billion). This strategic move is expected to generate significant savings for taxpayers over the next decade and support enhanced investments in housing for military families.

This reacquisition marks a significant opportunity for the MoD to undertake major redevelopment and modernization efforts across the housing portfolio. The initiative is part of a broader government strategy to improve living conditions for service members, address challenges related to recruitment and retention, and reaffirm the nation’s commitment to its armed forces.

The MoD originally sold the entire portfolio of 55,000 properties in the Married Quarters Estate to Annington in 1996 for GBP 1.67 billion and subsequently leased thousands of the homes through long-term agreements. By repurchasing these properties, the government reclaims assets now valued at nearly ten times the original sale price while eliminating an annual rental cost of GBP 230 million. The transaction is projected to save over GBP 600,000 in taxpayer funds daily.

Additionally, the agreement enables the MoD to modernize and expand the Service Family Accommodation estate, reducing maintenance costs and expediting plans to build new housing. These developments aim to provide military families with improved living environments while reinforcing the government’s dedication to supporting the armed forces.

Deal No. 2:

TOPPAN Holdings Inc. to Acquire Thermoformed and Flexibles Packaging Business of Sonoco Products Company for USD 1.80 Billion

Japan’s Toppan Holdings has announced the acquisition of Sonoco’s Thermoformed and Flexible Packaging (TFP) business for USD 1.8 billion, a move aimed at strengthening its presence in the Americas’ sustainable packaging market.

TFP specializes in thermoformed and flexible packaging, serving diverse sectors, including food, retail, and medical industries. In 2023, TFP generated approximately USD 1.3 billion in revenue on a pro forma standalone basis.

The acquisition aligns with Toppan’s strategic goals, combining TFP’s established sales network, extensive customer base, and solution development expertise across North and South America with Toppan’s advanced technical knowledge and manufacturing capabilities in global packaging.

This transaction marks a significant step in Toppan’s broader initiative to transform its business portfolio and scale sustainable packaging solutions globally. The company has been actively innovating in sustainable packaging by creating a comprehensive supply chain spanning film to final packaging production. Toppan’s cost-optimization strategies aim to meet the demands of local and global brand owners effectively.

The deal, expected to close in the first half of 2025, is being supported by multiple financial advisors. Houlihan Lokey is serving as the lead financial advisor to Toppan, with Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. also providing advisory services. Sonoco has engaged Goldman Sachs & Co. LLC as its lead financial advisor, with additional support from RBC Capital Markets, LLC.

Deal No. 3:

A New Third-Party Consortium to Acquire Soho House & Co Inc. for USD 1.75 Billion

Soho House & Co, a global network of private members’ clubs, has received a takeover proposal from a third-party consortium, valuing the company at USD 1.75 billion (GBP 1.39 billion), or USD 9 per share.

Founded in London in 1995, Soho House caters primarily to professionals in creative fields such as film, media, art, and fashion. The organization has expanded its footprint worldwide, with clubs in major cities like New York, Los Angeles, Berlin, and Hong Kong. Its offerings include lounges, restaurants, coworking spaces, spas, screening rooms, and boutique hotel accommodations in select locations. By the end of last year, Soho House operated more than 42 clubs, nine coworking spaces, and a beach resort in Mykonos, Greece, serving over 200,000 members globally.

Backed by billionaire investor Ron Burkle, Soho House went public in 2021 but has faced consistent financial challenges, reporting annual losses since its listing. The takeover proposal, supported by Ron Burkle and Yucaipa, follows a comprehensive strategic review led by Yucaipa and its financial advisors. This review aimed to address declining shareholder value after a significant drop in the company’s stock price.

Despite a challenging economic environment, Soho House has demonstrated resilience. Member numbers grew by 4.8% year-on-year, reaching 267,494 by the end of September. Revenue for the same quarter rose by 13.6%, totaling USD 333.4 million (GBP 265.7 million). The company attributes this growth to its commitment to operational excellence and its ongoing efforts to deliver a superior experience for its members.

Deal No. 4:

SoftwareONE Holding AG to Acquire Crayon Group Holding ASA for USD 1.40 Billion

SoftwareOne, a Swiss global leader in software and cloud solutions, is acquiring Crayon Group, a Norwegian technology and IT services company. Valued at USD 1.4 billion in a combination of cash and stock, this acquisition will create a major pan-European software licensing firm.

Crayon, headquartered in Oslo, specializes in software asset management (SAM), cloud optimization, and digital transformation. The company helps organizations manage their technology assets, optimize software licensing, and accelerate cloud adoption, driving both cost efficiency and operational improvements. Crayon’s services include cloud migration, licensing advisory, and IT cost management, providing customized solutions to navigate complex IT ecosystems.

The acquisition brings together two major players with complementary geographical reach, customer bases, and offerings. The combined entity is poised to capitalize on the USD 150 billion addressable market, projected to grow at a mid-teens rate, driven by trends such as increased public cloud adoption, cloud spend management, and advances in data, AI, and security. Both companies share a customer-focused approach and aligned go-to-market strategies.

This merger is expected to generate substantial value, with projected cost synergies of CHF 80-100 million within 18 months of closing, in addition to SoftwareOne’s previously announced savings of over CHF 50 million. The combined company anticipates a 25% earnings per share (EPS) increase, including implementation costs and phased synergies, and over 40% by 2026, excluding implementation costs.

The transaction is slated to close in Q3 2025, subject to regulatory approvals. Jefferies is acting as the sole financial advisor to SoftwareOne.

Deal No. 5:

ArcLight Capital Partners, LLC to Acquire Gulf Coast Express Pipeline LLC for USD 0.865 Billion

Phillips 66 has reached an agreement to sell its 25% interest in the Gulf Coast Express pipeline to ArcLight Capital Partners for USD 865 million.

The Gulf Coast Express pipeline is an essential 500-mile infrastructure that carries natural gas from the Permian Basin in West Texas to the U.S. Gulf Coast. With a daily throughput capacity of about 2 billion cubic feet, it serves as a vital connection between one of the nation’s largest natural gas production areas and key energy markets. The pipeline plays a crucial role in meeting the growing demand for natural gas, supports exports to Mexico, and enhances the region’s energy distribution capabilities.

After the transaction, the pipeline will be jointly owned by Kinder Morgan and ArcLight Capital Partners. ArcLight has been gradually increasing its ownership, purchasing a 25% stake from Targa Resources in 2022 for USD 857 million. In June 2024, Kinetik sold its 16% share of the pipeline to an ArcLight affiliate.

For Phillips 66, the sale represents a milestone in exceeding its goal of USD 3 billion in asset divestitures, as part of its ongoing strategy to streamline its portfolio and divest non-core assets.

The deal is expected to close in January 2025.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of Dec 16 to 22, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter