M&A News M&A News: Global M&A Deals Week of Aug 26 to Sept 1, 2024

- M&A News

M&A News: Global M&A Deals Week of Aug 26 to Sept 1, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

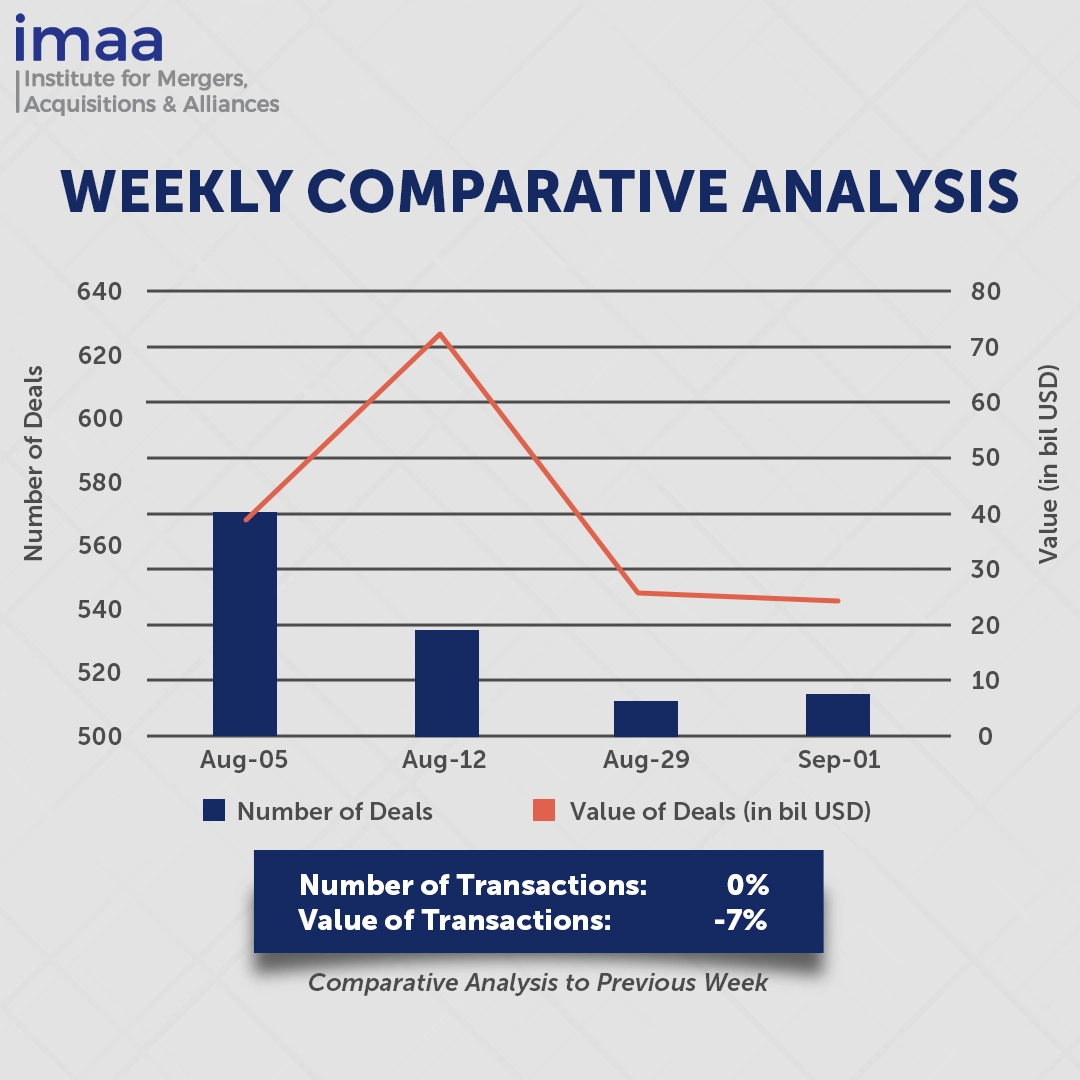

From August 26 to September 1, the global mergers and acquisitions (M&A) market recorded 513 deals with a total value of USD 24.20 billion. Among these, 12 transactions exceeded USD 500 million each, totaling USD 17.3 billion, which accounts for 71% of the total deal value for the week.

A notable transaction during this period was ONEOK’s acquisition of Global Infrastructure Partners’ (GIP) full stake in Medallion Midstream and its 43% stake in EnLink Midstream. Valued at a total of USD 5.9 billion, these acquisitions will form a fully integrated Permian Basin platform. This strategic move will significantly enhance ONEOK’s position in the midstream energy sector, broaden its footprint across North Texas and the Mid-Continent, and establish a new presence in Louisiana. The integration of these assets is expected to strengthen ONEOK’s market position, improve operational efficiencies, and offer new service solutions to regional producers.

Another significant deal was Seres’ acquisition of a 10% stake in Huawei’s Yinwang Intelligent Technology Co., Ltd., making Seres the second Chinese automaker to invest in the company in less than a month.

Comparing week-over-week figures, there was a slight increase in the number of deals, from 511 to 513. However, the total deal value decreased by 7%, dropping from USD 26.15 billion to USD 24.20 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of August 26 to September 1, 2024 in detail:

Deal No. 1: ONEOK, Inc. to Acquire EnLink Midstream, LLC for USD 3.30 Billion

Deal No. 2: ONEOK, Inc. to Acquire Medallion Midstream, LLC for USD 2.60 Billion

Deal No. 3: Mckesson Corp. to Acquire Community Oncology Revitalization Enterprise Ventures, LLC for USD 2.49 Billion

Deal No. 4: Seres Automobile Co., Ltd. to Acquire Shenzhen Yinwang Intelligent Technology Co., Ltd. for USD 1.61 Billion

Deal No. 5: IMM Investment, Corp.; IMM Private Equity, Inc. to Acquire Ecorbit CO., Ltd. for USD 1.56 Billion

Deal No. 1:

ONEOK, Inc. to Acquire EnLink Midstream, LLC for USD 3.30 Billion

ONEOK, a major player in the midstream sector, is set to acquire a 43% interest in EnLink Midstream from Global Infrastructure Partners for USD 3.3 billion in cash. This strategic acquisition is poised to extend ONEOK’s reach into the Mid-Continent, North Texas, and Louisiana regions.

EnLink Midstream operates a robust energy infrastructure network, delivering services for natural gas, crude oil, and NGLs in vital production areas and demand hubs. This acquisition aligns seamlessly with ONEOK’s existing infrastructure in the Permian Basin, positioning the company to expand its offerings to producers within the region.

The acquisition includes North Texas gas gathering and processing facilities, which are directly connected to Mont Belvieu via ONEOK’s NGL pipelines, providing a solid revenue stream. Additionally, ONEOK will gain a significant position in Louisiana, adding 220,000 barrels per day of NGL fractionation capacity and approximately 4.0 billion cubic feet per day of natural gas pipeline capacity, both crucial to meeting demand in the area.

Expected to immediately boost earnings per share and free cash flow, the transaction will further solidify ONEOK’s financial strategy, including its share repurchase initiatives.

Once the transaction closes, ONEOK will assume control of EnLink’s managing member and plans to appoint new board members in place of those selected by GIP. EnLink will be a consolidated subsidiary of ONEOK for GAAP financial reporting purposes. Goldman Sachs & Co. LLC serves as ONEOK’s lead financial advisor on this deal.

Deal No. 2:

ONEOK, Inc. to Acquire Medallion Midstream, LLC for USD 2.60 Billion

ONEOK has announced its plan to acquire Medallion Midstream, a prominent midstream solutions provider in West Texas, from Global Infrastructure Partners for USD 2.6 billion. Medallion Midstream operates the Midland Basin’s largest privately held crude oil gathering and transportation network, a crucial part of the Permian Basin.

This acquisition will significantly bolster ONEOK’s pipeline infrastructure, adding over 1,000 miles of pipeline with a daily capacity exceeding 670,000 barrels. Integrating Medallion’s assets will enhance ONEOK’s operations in the Permian Basin, improving its service to producers and reinforcing its competitive edge in this key growth region.

Additionally, this deal aligns with ONEOK’s strategy to strengthen its position as a leading midstream service provider in the U.S., especially with its concurrent acquisition of a controlling interest in EnLink Midstream. The transaction is expected to close early in Q4 2024, subject to regulatory approvals.

Goldman Sachs & Co. LLC is serving as the lead financial advisor for ONEOK, with J.P. Morgan Securities LLC and BofA Securities also providing advisory support. JPMorgan Chase Bank, N.A., and Goldman Sachs Bank USA are fully committed to financing the transaction.

Deal No. 3:

Mckesson Corp. to Acquire Community Oncology Revitalization Enterprise Ventures, LLC for USD 2.49 Billion

Drug distributor McKesson will acquire a 70% controlling interest in Community Oncology Revitalization Enterprise Ventures, LLC (Core Ventures) for USD 2.49 billion in cash.

Core Ventures, established by Florida Cancer Specialists & Research Institute, LLC (FCS), provides nonclinical administrative support and operational services to FCS clinics across Florida. FCS physicians will retain a minority stake following the acquisition. Core Ventures was formed in early 2024 to address rising drug shortages and prices by partnering with distributors.

Following the acquisition, Core Ventures will become part of McKesson’s Oncology platform, with financial results reported within McKesson’s US Pharmaceutical segment. FCS, which includes over 250 physicians and 280 advanced practice providers at nearly 100 locations in Florida, will maintain its independent ownership while joining McKesson’s US Oncology Network.

McKesson’s US Oncology Network enhances cancer care by offering operational support, clinical assistance, and advanced technology to community-based practices. The integration of Core Ventures and the addition of Florida Cancer Specialists & Research Institute (FCS) will further enhance McKesson’s platform. This expansion will provide more robust, patient-centered solutions and solidify McKesson’s leadership in the oncology market.

Deal No. 4:

Seres Automobile Co., Ltd. to Acquire Shenzhen Yinwang Intelligent Technology Co., Ltd. for USD 1.61 Billion

Chinese automaker Seres has announced its plan to acquire a 10% stake in Huawei’s Shenzhen Yinwang Intelligent Technology Co., Ltd. for CNY 11.5 billion (USD 1.61 billion). This makes Seres the second Chinese automaker to invest in Huawei’s intelligent driving subsidiary. The acquisition aims to fuel new growth for Seres and bolster its Aito smart new energy vehicle brand, which is developed in partnership with Huawei, helping it to evolve into a premier luxury brand.

Yinwang leverages Huawei’s advanced intelligent automotive technologies. Huawei is committed to supporting Yinwang in sustaining its leadership position and driving the intelligent transformation of the automotive industry. This acquisition deepens the strategic partnership between Huawei and Seres, setting the stage for further development of the Aito brand and the introduction of new products.

The deal mirrors a recent investment by Changan Automobile, where Avatr Technology—a joint venture between Changan, Huawei, and Contemporary Amperex Technology Co.—also acquired a 10% stake in Shenzhen Yinwang.

Huawei employs three partnership models with carmakers: vertical parts supplier, intelligent systems provider through the Huawei Inside model, and full-set solutions provider via the Harmony Intelligent Mobility Alliance. The collaboration with Seres on Aito falls under the full-set solutions provider category.

Deal No. 5:

IMM Investment, Corp.; IMM Private Equity, Inc. to Acquire Ecorbit CO., Ltd. for USD 1.56 Billion

A consortium comprising IMM Private Equity and IMM Investment is poised to acquire Ecorbit, one of South Korea’s leading waste management firms, in a transaction valued at KRW 2.1 trillion (USD 1.56 billion).

Ecorbit is being sold as part of Taeyoung Group’s restructuring efforts following its debt workout filing in December of last year. The sale is expected to be completed within the year.

The acquisition will place South Korea’s largest landfill company under the IMM consortium’s management. Taeyoung Group, which holds a 50% stake in Ecorbit, will use the proceeds from this sale to expedite its restructuring process. KKR & Co. Inc., which co-owns Ecorbit with TY Holdings, will receive KRW 1.05 trillion for its share, along with KRW 400 billion in loans to Taeyoung Group and around KRW 100 billion in interest over two years.

The sale of Ecorbit drew considerable interest from leading private equity firms, including the IMM consortium, Carlyle Group Inc., Keppel Infrastructure Trust, and Gaw Capital Partners. The competitive bids were driven by Ecorbit’s strong business performance and reliable cash flow.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of August 26 to September 1, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter