M&A News M&A News: Global M&A Deals Week of Aug 19 to 25, 2024

- M&A News

M&A News: Global M&A Deals Week of Aug 19 to 25, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

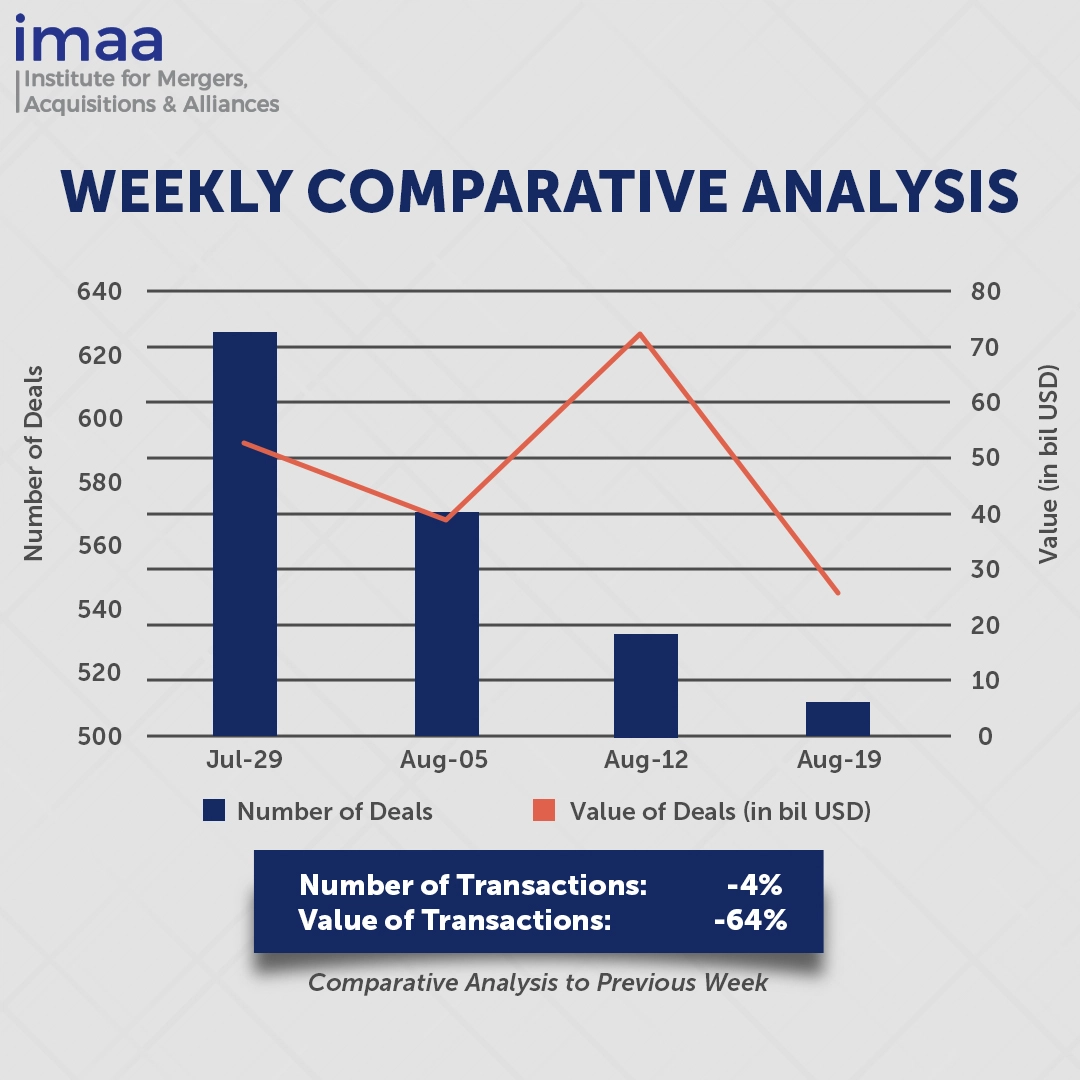

During the week of August 19 to August 25, the global mergers and acquisitions (M&A) market saw 511 transactions with a total value of USD 26.15 billion. Notably, 10 of these deals were valued over USD 500 million each, aggregating to USD 17.62 billion, which represents 67% of the week’s total deal value.

The standout deal of the week is Advanced Micro Devices (AMD)’s acquisition of ZT Group for USD 4.9 billion. ZT Group, a key provider of artificial intelligence infrastructure for hyperscale computing, will be integrated into AMD’s operations. This acquisition aims to bolster AMD’s position in the data center AI accelerator market, leveraging ZT Group’s technology to drive growth and enhance competitiveness, particularly as AMD seeks to catch up with NVIDIA in the AI and data center sectors.

Comparatively, M&A activity saw a 4% decrease in deal volume from the previous week, dropping from 533 to 511 transactions. The total deal value also fell sharply by 64%, from USD 71.91 billion to USD 26.15 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of August 19 to 25, 2024 in detail:

Deal No. 1: Advanced Micro Devices, Inc. to Acquire ZT Group Int’l, Inc. for USD 4.90 Billion

Deal No. 2: Japan Tobacco Inc. to Acquire Vector Group Ltd. for USD 2.40 Billion

Deal No. 3: CONSOL Energy Inc. to Acquire Arch Resources, Inc. for USD 2.30 Billion

Deal No. 4: Johnson & Johnson, Inc. to Acquire V-Wave Ltd. for USD 1.70 Billion

Deal No. 5: Avatr Technology Co Ltd to Acquire Shenzhen Yinwang Intelligent Technology Co., Ltd. for USD 1.60 Billion

Deal No. 1:

Advanced Micro Devices, Inc. to Acquire ZT Group Int'l, Inc. for USD 4.90 Billion

Semiconductor firm Advanced Micro Devices (AMD) is enhancing its artificial intelligence (AI) capabilities with the acquisition of ZT Systems, a provider of AI infrastructure for hyperscale computing providers, in a deal valued at USD 4.9 billion, comprising both cash and stock.

ZT Systems specializes in delivering sophisticated compute, storage, and accelerator solutions. The company collaborates with major tech firms, including Nvidia Corp. and Intel Corp., to provide services to cloud and enterprise customers. The company’s proficiency in design, integration, manufacturing, and deployment has established it as a key player in AI training and inference infrastructure.

Upon the completion of the transaction, ZT Systems will be integrated into AMD’s Data Center Solutions Business Group. This acquisition is a strategic move by AMD to significantly enhance its AI offerings. Over the past year, AMD has committed more than USD 1 billion to expanding its AI ecosystem and strengthening its AI software, alongside its ongoing R&D initiatives.

The transaction is anticipated to close in the first half of 2025. Citi is serving as the exclusive financial advisor to AMD, while Goldman Sachs & Co. LLC is acting as the exclusive financial advisor to ZT Systems.

Deal No. 2:

Japan Tobacco Inc. to Acquire Vector Group Ltd. for USD 2.40 Billion

Japan Tobacco Inc. (JT) is poised to acquire Vector Group Ltd., the fourth-largest tobacco company in the United States, in a USD 2.4 billion deal. This acquisition represents a strategic pivot for JT, which is now focusing on expanding its presence in the U.S. after geopolitical conflicts hindered its growth prospects in Russia. The U.S. market, the second-largest globally by net sales, is one of the most lucrative in the tobacco industry.

JT Group, known for its global tobacco business, manufactures and distributes iconic brands like Winston and Camel (outside the U.S.), along with MEVIUS and LD, in over 130 markets worldwide. Acquiring Vector Group will significantly enhance JT’s market share in the U.S., boosting it from 2.3% to 8%.

In addition to strengthening its market position, JT plans to leverage the cash flow generated from this acquisition to invest in the development of heated tobacco products. JT has a joint venture with Altria Group to commercialize its Ploom heated tobacco products in the U.S. Earlier this year, JT announced plans to increase spending on this category by 50% as it targets new markets.

The transaction is anticipated to close by the end of 2024, after which Vector Group will become a wholly-owned subsidiary of JT and will be delisted from the New York Stock Exchange. Jefferies LLC served as the exclusive financial advisor to Vector Group, while J.P. Morgan Securities acted as the exclusive financial advisor to JT Group.

Deal No. 3:

CONSOL Energy Inc. to Acquire Arch Resources, Inc. for USD 2.30 Billion

Coal producers Arch Resources and Consol Energy have announced a merger of equals in an all-stock transaction valued at USD 2.3 billion. The combined entity, Core Natural Resources, will become a leading North American natural resource company with an estimated market capitalization of USD 5.2 billion.

Core Natural Resources will be a significant player in the coal industry, specializing in the production and export of high-quality, cost-efficient coals, including both metallurgical and high calorific value thermal coals. The new company will oversee 11 mines across six states, featuring one of North America’s largest and most cost-effective thermal coal mining complexes and a top-tier portfolio of metallurgical coal mines in the United States.

The merger is expected to boost free cash flow for both Arch and Consol Energy within the first year after completion and generate up to USD 140 million in annual cost and operational synergies.

Upon finalization, Arch stockholders will own 45% of Core Natural Resources, while Consol Energy stockholders will hold a 55% stake. The merger is anticipated to close by the end of the first quarter of 2025. Perella Weinberg Partners is serving as the exclusive financial advisor to Arch, and Moelis & Company LLC is advising Consol Energy.

Deal No. 4:

Johnson & Johnson, Inc. to Acquire V-Wave Ltd. for USD 1.70 Billion

Israel-based V-Wave Ltd., a leader in medical technology, will be acquired by Johnson & Johnson in a deal worth USD 1.7 billion. The agreement includes an initial payment of USD 600 million and additional potential payments up to approximately USD 1.1 billion based on regulatory approvals and commercial milestones.

V-Wave will join Johnson & Johnson MedTech as part of this acquisition. The company’s innovative Ventura interatrial shunt (IAS) technology is designed to address heart failure with reduced ejection fraction (HFrEF) by creating a shunt between the left and right atria. This technology helps alleviate elevated left atrial pressure, a common issue in congestive heart failure.

This acquisition will bolster Johnson & Johnson MedTech’s position as a leader in cardiovascular innovation and support its expansion into high-growth markets. It will also deepen the company’s engagement with structural interventional cardiologists and heart failure specialists.

Johnson & Johnson MedTech is committed to advancing V-Wave’s innovative solutions to improve patient outcomes. The deal is expected to be finalized by the end of 2024 and aligns with Johnson & Johnson’s strategy to foster growth beyond 2025.

Deal No. 5:

Avatr Technology Co Ltd to Acquire Shenzhen Yinwang Intelligent Technology Co., Ltd. for USD 1.60 Billion

Avatr Technology will acquire a 10% stake in Huawei’s smart car subsidiary, Yinwang Intelligent Technology Co. Ltd., for USD 1.6 billion.

Yinwang is dedicated to developing advanced automotive systems and components that integrate artificial intelligence (AI) and AI-based software.

Avatr Technology, a joint venture between Changan and CATL—the largest battery manufacturer globally—will strengthen its strategic relationship with Huawei through this investment. The deal follows a November agreement between Huawei and Changan to co-invest in a smart automotive technology firm. Huawei will retain a 90% ownership stake in Yinwang.

This acquisition will enhance Avatr Technology’s role in the electric vehicle market and support Changan’s transition towards becoming a technology-centric company focused on smart, low-carbon mobility solutions. For Huawei, this investment aligns with its strategy to expand its emerging smart EV business and offset the impact of U.S. sanctions on its other divisions.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of August 19 to 25, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter