M&A News M&A News: Global M&A Deals Week of Aug 12 to 18, 2024

- M&A News

M&A News: Global M&A Deals Week of Aug 12 to 18, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

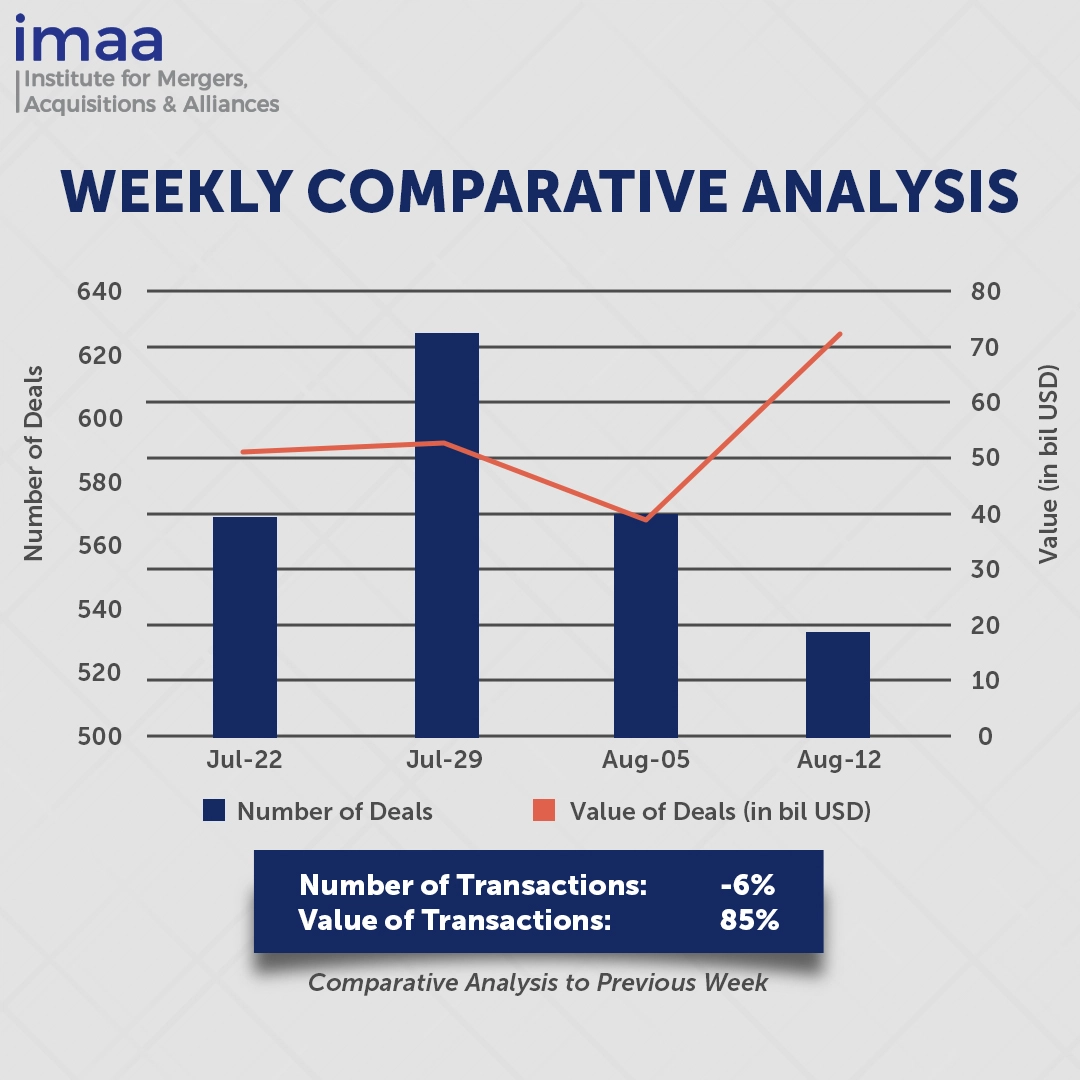

For the week of August 12 – August 18, the global mergers and acquisitions (M&A) market reported 533 deals with a combined value of USD 71.91 billion. Out of these transactions, 21 exceeded the USD 500 million mark, totaling USD 62.63 billion and accounting for 87% of the week’s overall deal value.

The top five deals this week were concentrated in the U.S. The largest transaction was Mars’ USD 35.9 billion acquisition of Kellanova, marking one of the biggest deals of the year to date. This acquisition will create a global snacks powerhouse, adding a range of new products to Mars’ existing portfolio, which includes Snickers, M&M’s, and Mars bars. The deal is noteworthy not only for its size but also for its strategic intent to cater to increasingly health-conscious consumers. Mars plans to leverage its brand-building expertise to enhance Kellanova’s brands, drive innovation to align with changing consumer preferences, and invest locally to broaden its reach, while introducing healthier nutrition options.

Compared to the previous week, there was a 6% decline in the number of deals, from 570 to 533. However, the total deal value surged by 85%, increasing from USD 38.85 billion to USD 71.91 billion, driven by several high-value transactions during this period.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of August 12 to 18, 2024 in detail:

Deal No. 1: Mars, Incorporated to Acquire Kellanova for USD 35.90 Billion

Deal No. 2: Carlyle Group to Acquire Vantive for USD 3.80 Billion

Deal No. 3: Lone Star Funds to Acquire Commercial and Residential Fire Business of Carrier Global Corporation for USD 3.00 Billion

Deal No. 4: Performance Food Group Company to Acquire Cheney Bros., Inc. for USD 2.10 Billion

Deal No. 5: Standard Insurance Company to Acquire AllState Benefits for USD 2.00 Billion

Deal No. 1:

Mars, Incorporated to Acquire Kellanova for USD 35.90 Billion

Mars, a global leader in the confectionery industry, has agreed to acquire Kellanova in a deal valued at USD 35.9 billion, including debt. This acquisition is set to significantly bolster Mars’s position in the global snack market, with the potential to double Mars’s snack business within the next decade.

Kellanova, previously known as Kellogg Co., is the owner of iconic brands such as Cheez-It, Pop-Tarts, Pringles, Nutri-Grain, and Eggo. With 2023 net sales exceeding USD 13 billion, the company operates in 180 markets and employs approximately 23,000 people.

This transaction, the largest M&A deal of the year, will bring two billion-dollar brands—Pringles and Cheez-It—under Mars’s umbrella, adding to its existing portfolio of 15 major brands. Moreover, Mars’s health and wellness snack offerings will be strengthened with the inclusion of RXBAR and Nutri-Grain, aligning with global trends toward healthier snacking options.

The expanded product lineup is expected to meet diverse consumer demands across various price points and tastes, particularly in rapidly growing regions like Africa and Latin America. The integration of complementary routes-to-market, supply chains, and local operations will further enhance the combined company’s reach.

Mars plans to complete the acquisition by the first half of 2025, financing the deal through a mix of cash reserves and new debt. Citi is acting as Mars’s financial advisor, with both J.P. Morgan and Citi providing financing support. Kellanova is being advised by Goldman Sachs.

Deal No. 2:

Carlyle Group to Acquire Vantive for USD 3.80 Billion

Baxter International, a leading medtech company, has announced the sale of its kidney care division to the Carlyle Group for USD 3.8 billion. Following the acquisition, the business unit will be rebranded as Vantive.

Vantive is a global leader in kidney care, offering a comprehensive range of products and services, including peritoneal dialysis, hemodialysis, and organ support therapies such as continuous renal replacement therapy (CRRT). With a workforce of over 23,000 employees worldwide, Vantive generated USD 4.5 billion in revenue in 2023.

Carlyle has been a prominent private equity investor in the medtech sector over the past decade, with investments in medical technology and diagnostic companies exceeding $40 billion in enterprise value. Carlyle’s investment in Vantive is in collaboration with Atmas Health, a partnership of three industry executives focused on building a market-leading healthcare business.

This transaction positions Vantive as a leading independent kidney care company, supported by Carlyle’s global investment expertise and resources. It also provides both Baxter and Vantive with greater flexibility to allocate capital toward opportunities that align with their respective growth strategies.

The transaction is expected to close in late 2024 or early 2025. Baxter is being advised by Perella Weinberg Partners LP and J.P. Morgan Securities LLC, while Carlyle is receiving financial advice from Barclays and Goldman Sachs & Co. LLC.

Deal No. 3:

Lone Star Funds to Acquire Commercial and Residential Fire Business of Carrier Global Corporation for USD 3.00 Billion

Private equity firm Lone Star is acquiring Carrier Global’s commercial and residential fire safety business for USD 3 billion. This deal is part of Carrier’s strategic shift to focus on its core heating and cooling equipment sectors.

The transaction represents a significant milestone in Carrier’s portfolio reorganization, following its acquisition of Viessmann Climate Solutions in January and the successful divestitures of its Industrial Fire and Global Access Solutions units.

The unit being sold, which includes products such as smoke and carbon monoxide detectors, is expected to close by the end of the year. Carrier plans to allocate approximately USD 2.2 billion of the net proceeds from this sale toward share repurchases.

Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC are serving as financial advisors to Carrier.

Deal No. 4:

Performance Food Group Company to Acquire Cheney Bros., Inc. for USD 2.10 Billion

Performance Food Group Company (PFG) has announced its acquisition of Cheney Bros., a major foodservice distributor, in a move to enhance its presence in the Southeast and expand its distribution capabilities. Valued at USD 2.1 billion, this all-cash transaction is expected to close in 2025.

Cheney Bros. caters to a wide range of clients, including independent restaurants, restaurant chains, hotels, country clubs, and institutional groups, generating annual net sales of USD 3.2 billion.

The integration of Cheney Bros.’ distribution network will enhance PFG’s platform by adding five state-of-the-art broadline distribution centers in key states such as Florida, Georgia, North Carolina, and South Carolina. These facilities will provide additional capacity for future expansion.

While Cheney Bros. has a strong focus on independent restaurants, its private brand presence is comparatively limited. PFG plans to leverage its extensive private brand portfolio to expand sales among Cheney Bros.’ independent restaurant clients.

J.P. Morgan is serving as the financial advisor to PFG, and Morgan Stanley & Co. LLC is advising Cheney Bros.

Deal No. 5:

Standard Insurance Company to Acquire AllState Benefits for USD 2.00 Billion

Standard Insurance Company (The Standard), the U.S. subsidiary of Japan’s Meiji Yasuda Life Insurance, is set to acquire Allstate’s Employer Voluntary Benefits division (Allstate Benefits) in an all-cash deal valued at approximately USD 2 billion (JPY 293.94 billion). This acquisition will significantly enhance The Standard’s growth and strengthen its competitive position in the U.S. employee benefits market.

Allstate Benefits is a prominent provider of supplemental and voluntary workplace benefits, including Whole Life, Universal Life, Accident, Hospital Indemnity, Cancer, and Critical Illness coverage, serving over 3.5 million customers.

The merger will combine Allstate’s high-quality products, employer relationships, and distribution network with The Standard’s group benefits business, offering customers expanded protection and greater value. Allstate agents will also have access to a broader range of options through a five-year exclusive distribution agreement.

Under this arrangement, The Standard will become Allstate’s sole provider for group life and disability, guaranteed standard issue individual disability, and supplemental and voluntary products distributed by Allstate’s exclusive agents. This acquisition will provide Allstate’s customers with a trusted partner for their group benefits needs.

The transaction is anticipated to be completed in the first half of 2025. Citi is serving as the exclusive financial advisor to The Standard, while J.P. Morgan and Ardea Partners are advising Allstate.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of August 12 to 18, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter