By Steve Allan – Willis Towers Watson

Introduction

In recent years, with the global financial crisis arriving on the heels of a near collapse of the financial establishment in the West, increased investment and development diverted to emerging markets has produced a wealthy new economic class with plenty of power to spend. Against this backdrop, Asian companies are beginning to play a more significant role in the world economy. They are rapidly globalizing, crossing borders into other markets in Asia, emerging markets around the world, and the developed markets of North America and Europe.

While domestic and intra-regional mergers and acquisitions (M&A) still dominate deals in every region of the globe, in the first half of 2012, Asian firms conducted more transactions outside Asia than the rest of the world did inside Asia — for the first time ever.

“Asian companies are beginning to play a more significant role in the world economy.”

This unprecedented surge of transactions presents unfamiliar challenges to these organizations, not least of which is understanding what’s required to make the deal in new geographies a success. Although deals are entered into for myriad reasons — which may include acquiring assets or acquiring a business that will be left to run independently of the parent — in the majority of cases, M&A is a people business, and many deals fail due to poor integration or cultural misunderstandings.

People-related issues have such a significant impact on business performance, companies must be prepared to devote considerable time and attention to such critical issues as retaining key talent, supporting necessary employee mobility, managing cultural integration and globalization, evaluating the costs of needed changes in HR and other workforce programs, and defining a clear governance framework. The most successful acquirers get ahead of these challenges by involving HR in each stage of the M&A process, from early target selection, to due diligence, to post-merger integration.

When included as part of an M&A team, HR is typically able to provide insight throughout the life cycle of a deal:

- Pre-deal support with target evaluation, due diligence and pre-close activities

- Employee integration, including identifying and retaining the key talent needed to run the combined business, and engaging them quickly in the new organization’s strategic goals

- Managing costs and cost volatility stemming from significant disparities in workplace programs and local regulations

Target Evaluation and Due Diligence

Early in the process, HR can play a valuable role in identifying potential impediments to smooth integration by comparing a potential target’s leadership style, talent management programs, cultural and communication style, HR and related workplace programs and practices, and other factors to those of the parent.

Moreover, HR can also provide specific guidance on the often overlooked harder costs of a target’s pension, health care, retiree medical and related reward programs. In recent years, more than one proposed M&A has been aborted late in the game because due diligence exposed unforeseen pension liabilities. Once just an implementation afterthought, corporate benefit programs — pension plans in particular — now demand a thorough assessment of financial liabilities.

In fact, accurately assessing both quantitative and qualitative people-related costs before pricing a target’s value is critical to protecting and enhancing shareholder value in any transaction. But in cross-border deals — where major differences in corporate culture and tradition are more likely — it is especially important.

HR Pre-Deal Preparation Activities

Pre-deal preparations should include activities such as:

- Anticipating the resources that HR will need to commit to ensure full support, including creating a project management office and identifying key project leads, as well as other geographic and functional resources

- Drawing up a detailed project plan (an “M&A blueprint” of actions) during each phase of the transaction and determining who needs to be involved

- Conducting team training for HR practitioners on the business case behind the deal and how to drive value

- Developing an M&A playbook customized to the unique circumstances of the deal — clearly documenting connection points between HR and other functions at every step — to enhance the capability, credibility and consistency of HR’s transaction support.

Employee Issues

During a critical period of integration in most M&A transactions, a tug of war ensues between the acquiring organization’s need for human capital certainty and the needs of the employees of the acquired company for reassurance about their future. The latter need to understand the vision of their new owner — or else, they can flounder, not knowing what will happen to them, their company and their livelihood. This uncertainty poses a huge risk to retention of critical human capital for the acquiring organization, whose leaders must ascertain if they have the right mix of people for the company’s needs, and how they will implement new strategic changes in a palatable way and engage employees to excel post-acquisition.

It is easy for an acquiring company to assume that employees of a target have limited choices outside the merged organization due to high unemployment and ongoing economic difficulties in parts of the world. The reality is that companies the world over are engaged in a global talent war for workers with critical skills. They continually cite a mismatch between their demand for skilled human capital to fuel their growth ambitions and the availability of these high-caliber professionals. And as the world becomes ever more global, they find themselves competing for this talent with global peers on the international stage, just as they do for market share.

Attraction and retention of key talent

What are the most effective ways of retaining top talent at acquired businesses? Towers Watson recently completed global research on the topic in its 2012 Global M&A Retention Study. We surveyed corporate acquirers to assess the state of affairs in employee retention.

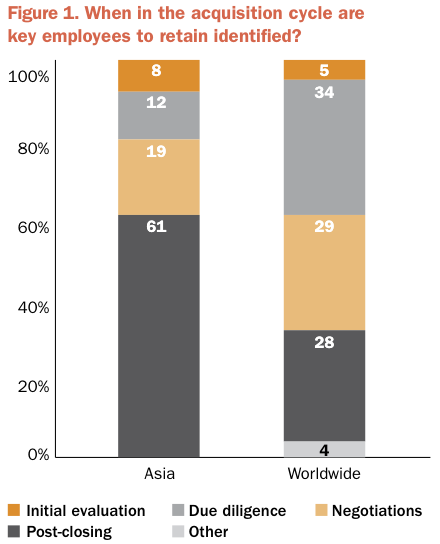

According to the study, the acquirers “more successful” at retaining employees start identifying retention candidates as early in the process as possible. Yet the study showed that only 12% of Asian companies identify these key employees during due diligence, with 19% doing it during negotiations and another 61% after the deal has closed. This may put Asian companies at a disadvantage relative to their global counterparts, which start identifying talent for retention programs far earlier in the process (Figure 1).

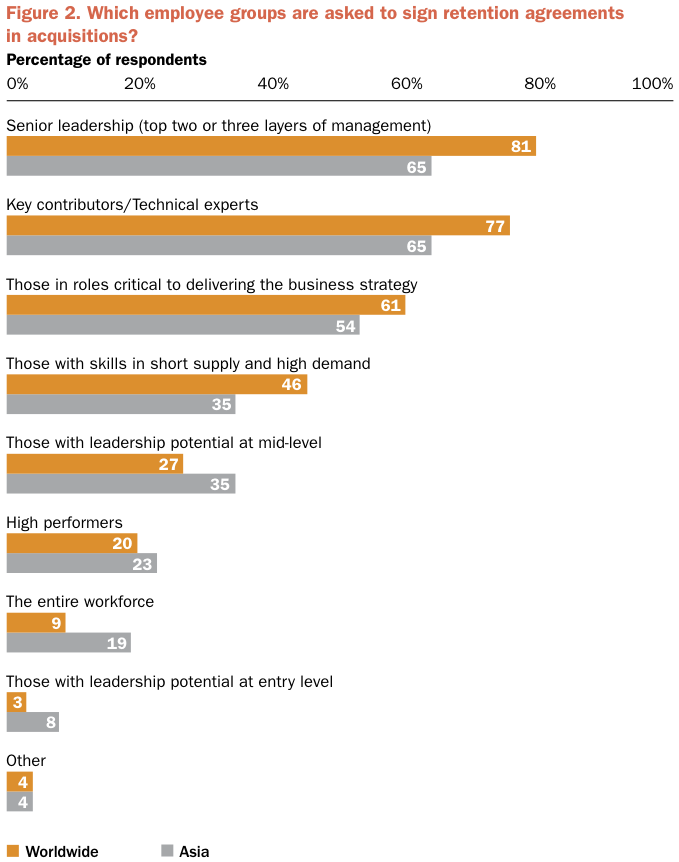

The study also shed light on which employees companies choose for retention agreements, which remains the most prevalent way to keep employees post-deal. It found that:

- 65% of Asian respondents offer agreements to senior leaders in the acquired business.

- An identical percentage also focus on key contributors or technical experts.

- 54% cite individuals critical for delivering the business strategy, many of whom are likely to be technical or other experts in key areas for the business.

- For 35%, talent in high demand and limited supply also merits special focus with retention agreements.

Beyond these groups, use of retention agreements drops considerably (Figure 2).

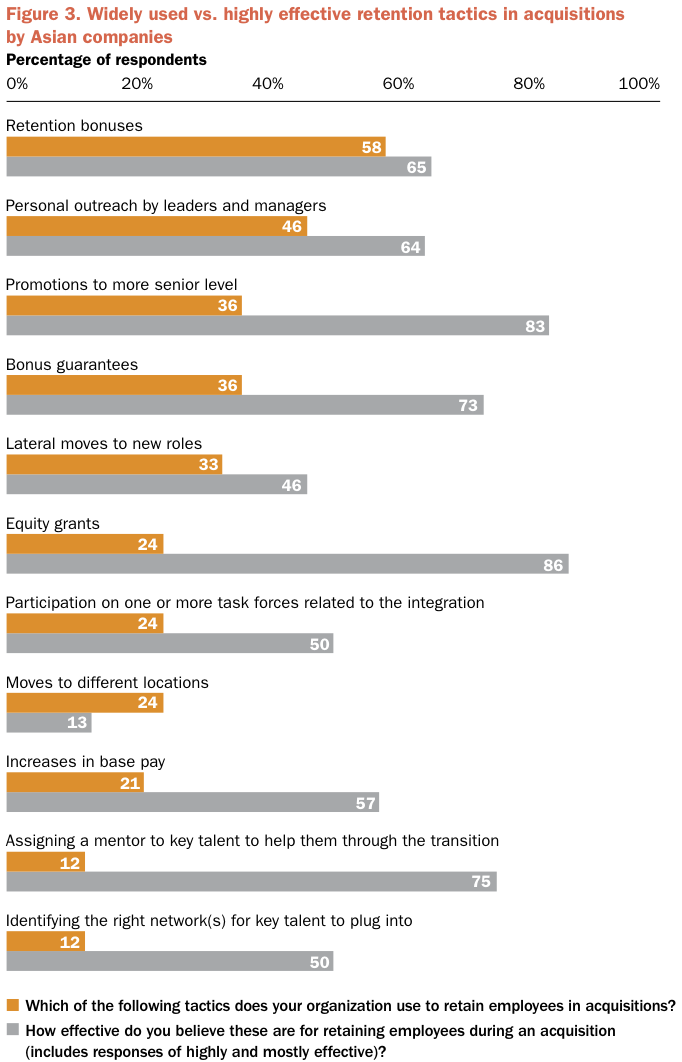

After selecting which employees to retain in the acquired company, companies in our survey offer incentives to these employees in a number of ways, with monetary vehicles being most common. However, Towers Watson’s research also confirms that a combination of monetary and nonmonetary tactics achieves the best results, for instance, when bonuses or equity are accompanied by an array of interpersonal actions, such as outreach from the acquirer’s leadership to show their interest and commitment, or having a mentor assigned to new employees to help them get connected within the new organization (Figure 3).

Talent mobility

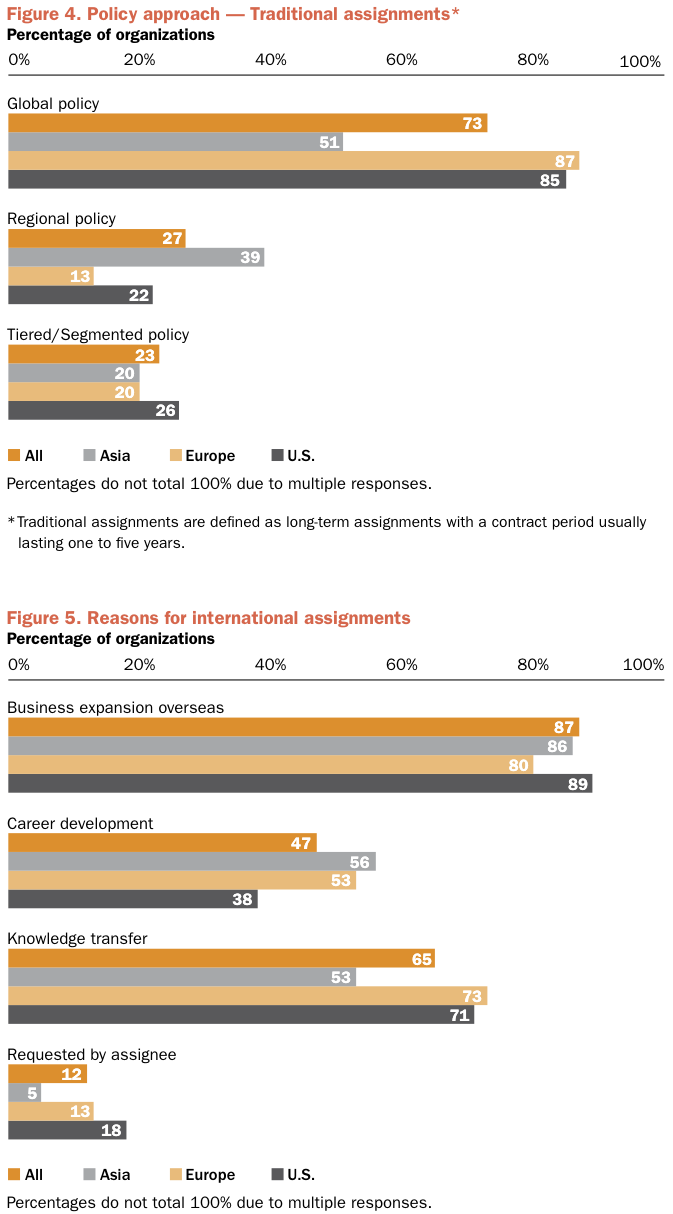

As Asian companies become more global, another challenge they face to ensure a successful transaction is the ability to maintain a globally mobile workforce. At the moment, according to another recent Towers Watson survey, our Global Talent Mobility Study, HR practices related to mobility for Asian companies vary significantly from those of their developed-economy peers. The survey found that only 51% of Asian multinationals have a global talent mobility program, compared to more than 85% of North American and 87% of Western European respondents (Figure 4).

The study also confirmed that the primary reason companies relocate employees internationally — cited by nearly 90% of the survey participants overall — is business expansion (Figure 5).

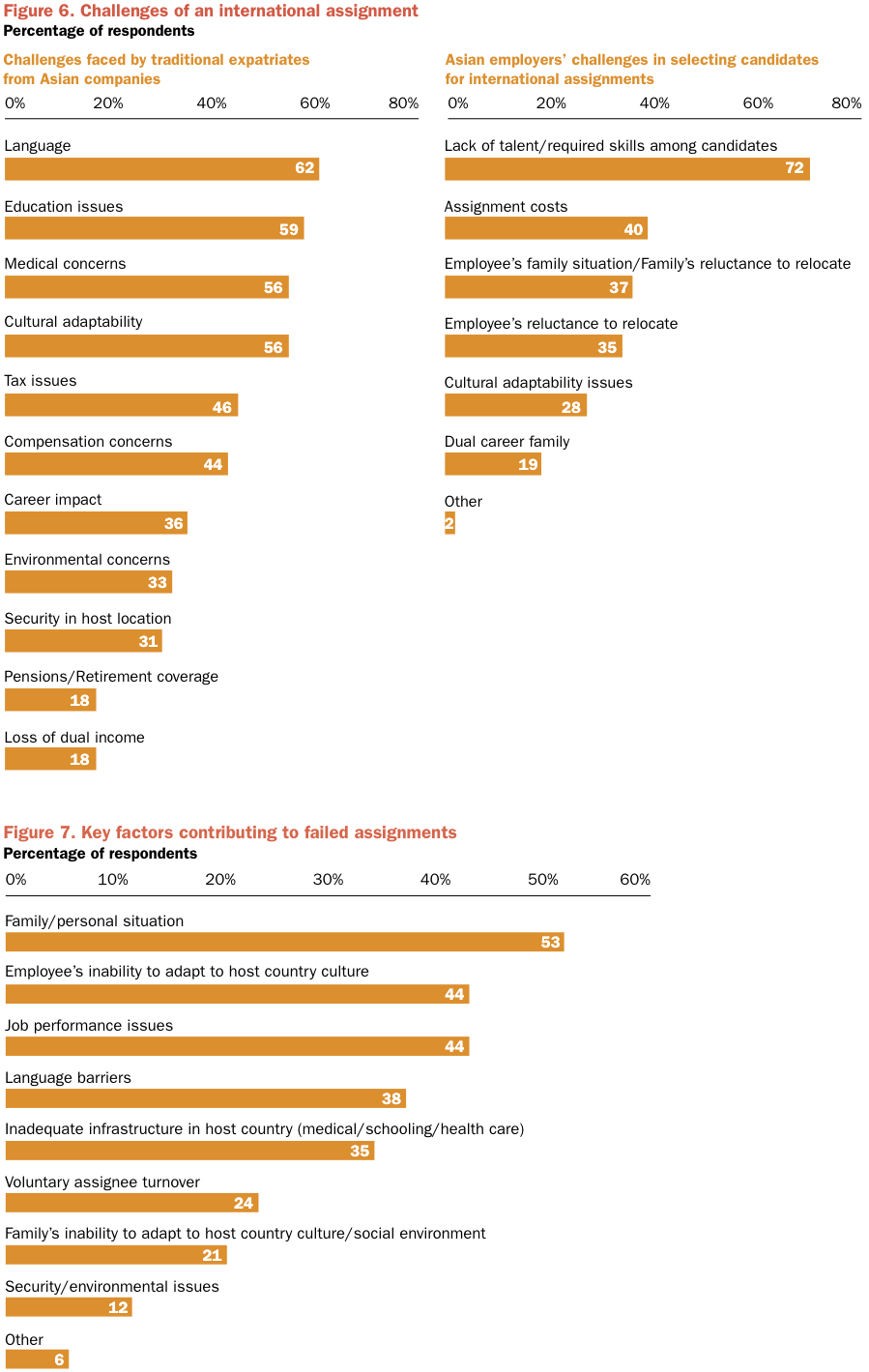

Relocating employees does not come without its challenges. In our Global Talent Mobility Study, Towers Watson noted specific challenges for Asian expatriates. Chief among them, not surprisingly, is language, cited by 62% of the participants (Figure 6).

The survey looked at challenges faced from both an employee and employer perspective, which gave rise to some interesting results. Although many of the challenges faced are common, employers tend to underestimate the importance of “softer” factors like culture when selecting candidates for international assignments — despite 56% of employees citing it as a challenge (Figure 6) and 44% of employees (the highest of all regions) citing inability to adapt to culture as a contributing factor to a failed assignment (Figure 7).

Among factors that lead to failed international assignments, language again is overwhelmingly a challenge for Asian employers: 26% cite it as a contributing factor to failed assignments, compared to only 7% of U.S. and European employers.

Compensation and Benefits

The costs and risks associated with compensation and benefit programs are another key challenge for Asian acquirers, especially when purchasing operations in more developed markets such as North America and Western Europe, where long-term employee benefit liabilities can be very large. For many Asian companies, these benefit liabilities have proved to be a deal breaker. In some scenarios, costs to Asian companies to settle long-term employee benefit obligations have risen beyond the total price of the acquisition. Conducting comprehensive and detailed due diligence on the target’s programs is an essential step in developing a complete cost picture and ensuring there are no hidden or unforeseen costs or risks that could emerge over time.

Involving HR early in this level of due diligence can help ensure a truly comprehensive assessment that encompasses:

- Identifying the financial impact of unfunded, underfunded or under-reserved retirement and related plans, including:

- Defined benefit plans

- Cash balance plans

- Termination or severance plans

- Postemployment medical plans

- Other postemployment benefit plans and programs

- Evaluating integration strategy and costs, including:

- Cost of a benefit platform now and if integrated

- Reduction-in-force costs and legal restrictions

- HR information system costs and timing

- Retention and severance costs

“Conducting comprehensive and detailed due diligence on the target’s programs is an essential step in developing a complete cost picture and ensuring there are no hidden or unforeseen costs or risks that could emerge over time.”

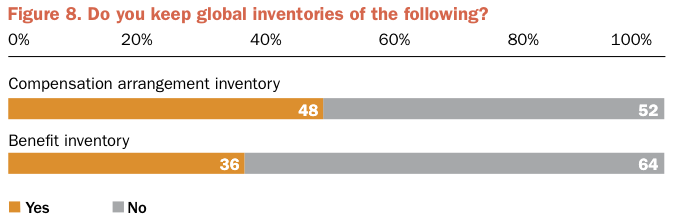

These considerations comprise a significant challenge for Asian multinationals. According to Towers Watson’s survey report, Asian Trailblazers: The Accelerating Globalization of Asian Companies, nearly two-thirds (64%) of the multinational participants indicated they have no global inventory of benefit arrangements (Figure 8), suggesting that current systems of governance and oversight are not as strong as they could be. Improving these systems is the first step in not only overcoming challenges related to post-merger integration and cost management, but also in becoming an effective global organization.

Governance Challenges and Solutions

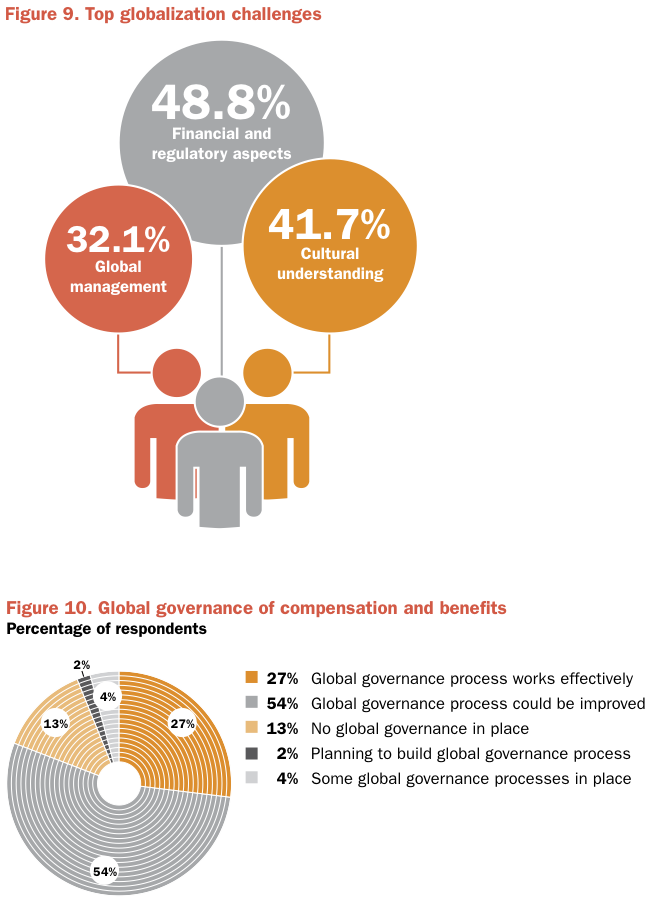

As part of Towers Watson’s Asian Trailblazers research, the Asian companies studied were asked to describe challenges associated with globalization (Figure 9). Their most common answers were related to:

- Insufficient due diligence, especially in HR — specifically, the inability to integrate new businesses — as well as legal and political risks. Perhaps unsurprisingly, the research found that organizations with a history of operating in multiple countries are better at addressing challenges than their counterparts newer to international expansion, indicating experience certainly pays off.

- Cultural understanding, a common challenge for any company operating in a foreign market, but more so for Asian companies due to the likelihood of vastly different cultural norms.

- The management of a global company, with respondents highlighting issues related to organizational structure and management incentives in an acquired company. More specifically, defining clear roles of different stakeholders presents challenges for Asian companies surveyed, as does incentivizing local leadership to work toward common organizational goals.

Global governance structures

Global systems of governance, particularly pertaining to HR functions, affect the attraction, retention and motivation of a global workforce, and therefore should be viewed as a key strategic initiative for any globalizing organization. A clearly defined governance framework leads to higher operational efficiency as well as collaboration across locations, helping global companies manage their relationship with leadership outside the home country. Evolving HR governance involves company leaders at headquarters setting appropriate guidelines, while giving decision-making authority to local leadership.

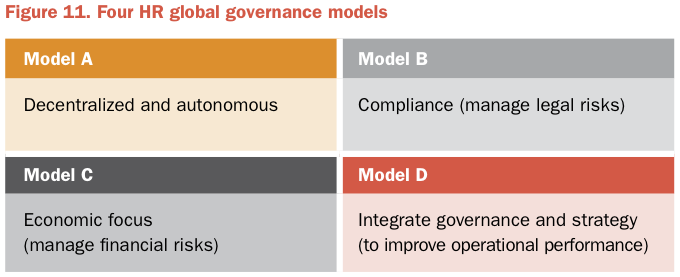

As we saw previously, many Asian companies are not aware of benefit liabilities they hold in various geographies, and much of the reason for this can be traced to incomplete or weak governance. In fact, according to Towers Watson’s Asian Trailblazers, global Asian companies are aware their governance processes are not the most effective or efficient: More than half (54%) say their organization’s processes need improvement, whereas only slightly more than one-quarter (27%) report they are effective (Figure 10).

Figure 11 shows four different models of global HR governance. Models A, B and C involve global HR in a simple role of managing certain legal and financial risks from an HR perspective. However, as companies become global, particularly when the employees outside the home country begin to outnumber those inside, global governance model D (integrating governance and strategy) can lead to significant improvement in operational performance and HR risk management.

Having a clearly defined global governance philosophy and framework in place allows a company to take a structured approach to understanding and managing human capital assets and liabilities in multiple locations. The choice of a governance structure depends on a range of factors, such as the organization’s structure, the size of the workforce outside the home country and the size of long-term employee benefit liabilities, among others.

Managing cultural differences

A massive part of an M&A transaction is managing cultural differences, which actively play into deal processes and, more importantly, into integrating the two businesses. Cultural differences include both national culture and organizational culture, which involve everything from business practices to language and core organizational values.

Although many deals fall short of expectations because of cultural issues, in our experience, too many organizations still view cultural integration as a soft or abstract concept. The fact is, failing to align culture has hard costs attached to it. It goes far beyond aspects like collaboration and collegiality, which a merged organization may embrace as core tenets of work style and relationships. Culture is nothing less than the basic DNA of an organization. It forms the foundation for the structures, systems, processes and actions that support business strategy, and explicitly or implicitly defines interactions among employees, customers and stakeholders. In short, culture is a key driver of how an organization operates and whether it succeeds or fails in the marketplace.

Culture also produces rules for operational behavior. When two organizations agree to something entirely new, cultures and rules can change. In an M&A, it’s important for the organization and its leadership to assess and model behaviors that support the right culture. That may entail working to create an entirely new culture, though in reality this is not required of all deals. More frequently, the culture integration challenge is one of the acquired company acceding to the acquirer’s culture. Organizations that don’t define and communicate a clear culture during this period risk letting a new, counterproductive set of values and behaviors develop organically.

Asian acquirers tend to move more slowly in the pre-deal process. Furthermore, anecdotal evidence from mergermarket sources shows that Asian bidders, particularly those from Japan and China, tend to have difficulty in managing cultural aspects of deals. One source said, “Japanese companies, when compared with European bidders, tend to be ‘too serious or honest’ in their written correspondence, even when such written correspondence is not legally binding. This may be due to the difference in language and culture, as by way of example, Londoners would use terms such as ‘lovely,’ ‘brilliant’ and ‘fantastic’ on a daily basis, where in Japan such words are used less frequently. Subtle differences may result in Japanese companies being perceived by the seller or the seller’s agent as being unenthusiastic, which can be detrimental in a competitive auction.”

Given vast cultural disparities both within Asia and between Asian countries and much of the developed world, adapting to new cultures can be daunting in an M&A transaction. This is compounded when certain synergies are to be achieved quickly by bringing employees from the two companies together effectively — the key to seeing a deal succeed. However, with the right HR functions in the M&A process — thorough integration planning in due diligence stages, understanding the cultures of both organizations (as well as the culture of the combined organization) and laying out a clear path to achieving these plans, while also recognizing that culture is difficult to measure and change — Asian acquirers can see success in M&A as they continue on the path to becoming global companies.

Among the questions that leaders should ask as they assess a culture for the new organization:

• What are the current cultural profiles of each company?

• How compatible are the cultures?

• What are the most likely areas for conflict?

• Which elements are most critical to retain, and which need to be integrated and changed?

• How do the current cultures compare with external benchmarks?

• What do the senior leaders believe the future culture should look like?

• How well aligned is this ideal culture with the strategic goals of the company?

• Is there agreement among leaders of each company on this ideal culture?

• Where are the gaps between the current and ideal cultures for each legacy company?

Conclusion

As the world’s economic center shifts eastward, Asian companies from nearly all corners of the region are globalizing, and as relatively new players on the world stage, face new challenges. When all is said and done, businesses are human organizations, with a diversity of personalities, cultures and attitudes. In a global organization, this diversity is even more pronounced. Asian firms aspiring to ride the next wave of globalization to become rising stars on the world stage must be aware of the challenges ahead, particularly on an organizational and human capital level.