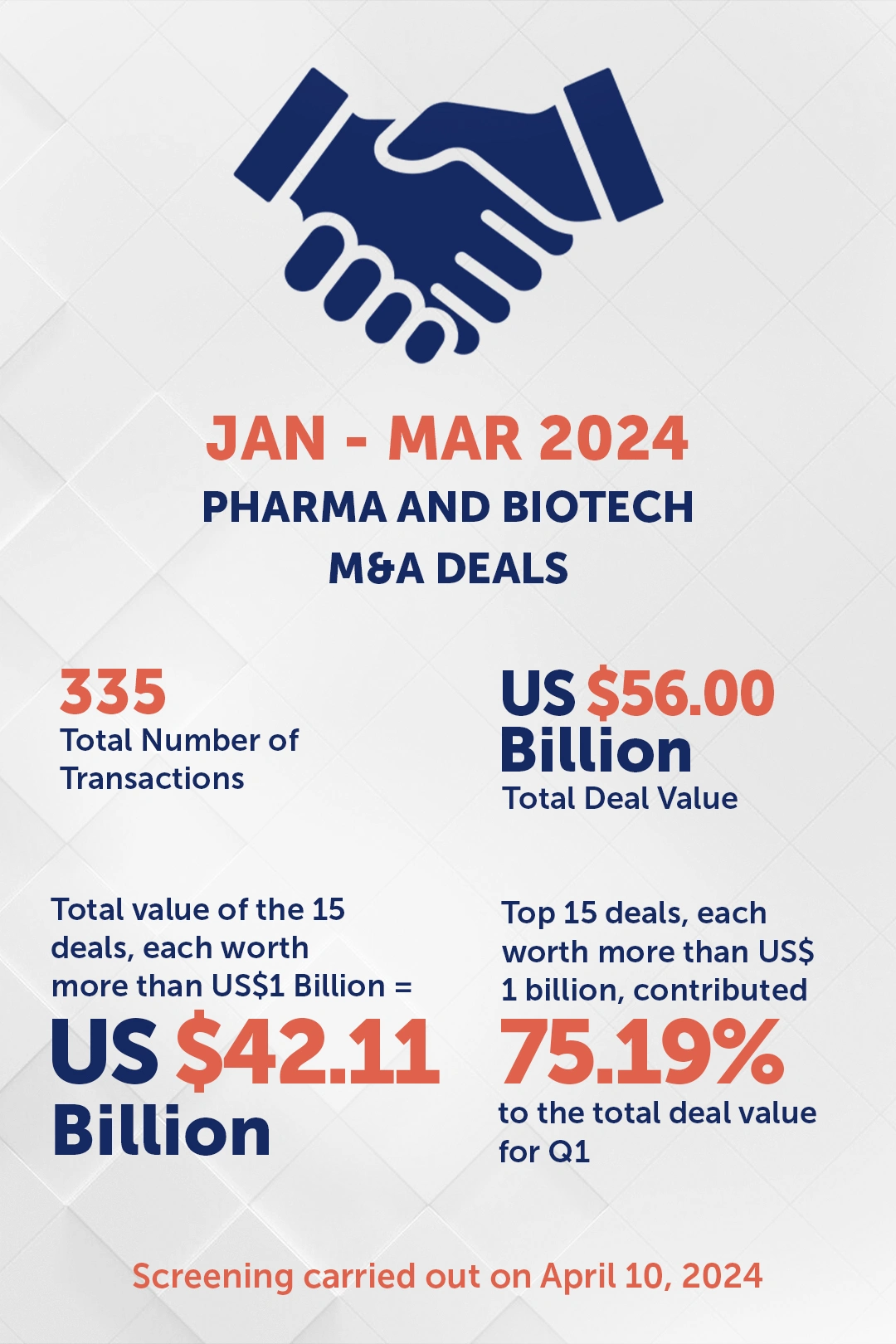

Executive Summary

The first quarter of 2024 has showcased a remarkable flurry of mergers and acquisitions within the pharmaceutical and biotechnology sectors, highlighting a strategic push towards addressing critical healthcare challenges, enhancing therapeutic portfolios, and seizing growth opportunities in emerging markets.

These top 15 M&A deals, ranging from Novo Holdings A/S’s acquisition of Catalent, Inc. to AstraZeneca’s purchase of Amolyt Pharma SAS, represent a multifaceted approach to achieving strategic growth, diversification, and innovation. Each transaction underpins a unique strategic intent, from strengthening capabilities in drug development and manufacturing to enhancing treatments in oncology, liver diseases, traditional Chinese medicine, and rare diseases. This period has been marked by a calculated move towards strengthening global healthcare through strategic investments, reflecting an overarching industry trend towards consolidating capabilities to better meet the evolving needs of patients worldwide. The analysis provided offers a detailed exploration of the motives behind each deal, the anticipated impacts on the industry, and the potential benefits for healthcare outcomes globally.

Introduction

Amidst a rapidly evolving global healthcare environment, pharmaceutical and biotechnology companies have embarked on a series of strategic mergers and acquisitions to fortify their market positions, address unmet medical needs, and harness innovation. The first quarter of 2024 has been emblematic of this trend, with companies across the spectrum leveraging M&A as a strategic tool to accelerate growth, expand into new therapeutic areas, and enhance research and development capabilities.

Analyses on 15 Deals

1. Novo Holding A/S to acquire Catalent, Inc.

Danish pharmaceutical company Novo Holdings has announced its acquisition of Catalent, Inc. in an all-cash transaction valued at USD 16.5 billion. Under the terms of the deal, Novo Holdings will purchase all outstanding shares of Catalent for USD 63.50 per share.

Catalent, Inc. is recognized globally for its role in assisting pharmaceutical, biotech, and consumer health partners in optimizing product development, launch, and supply chain management for patients worldwide.

As part of the acquisition strategy, Novo Holdings plans to divest three Catalent fill-finish sites and related assets to Novo Nordisk, a company in which Novo Holdings holds a controlling interest. These sites, situated in Italy, USA, and Belgium, represent crucial components of Catalent’s operations.

The decision to transfer these sites to Novo Nordisk aligns with the latter’s imperative to bolster production capabilities, particularly concerning filled injection pens and semaglutide, a key ingredient in medications like Ozempic and Wegovy. While these new sites won’t immediately resolve supply chain challenges, they are poised to enhance filling capacity starting from 2026 onward.

The transaction aligns with Novo Holdings’ strategy of investing in established life science companies. Novo Holdings will retain the rest of Catalent’s assets, adding to its portfolio of life sciences services.

The merger is expected to close by the end of the calendar year 2024, after which Catalent will become a private company and cease trading on the New York Stock Exchange. Citi and J.P. Morgan are advising Catalent, while Morgan Stanley is advising Novo Holdings on the transaction.

2. Gilead Sciences, Inc. to acquire CymaBay Therapeutics, Inc.

Gilead Sciences has set its sights on bolstering its liver portfolio through the strategic acquisition of Drugmaker CymaBay Therapeutics. In a landmark deal, Gilead will procure CymaBay for a substantial USD 32.50 per share in cash, amounting to a total equity value reaching USD 4.3 billion.

A key asset in this acquisition is CymaBay’s leading experimental drug, seladelpar. Projections suggest that seladelpar could achieve sales of USD 1.9 billion by 2029. This promising drug candidate has demonstrated its ability to regulate crucial metabolic and liver disease pathways. This acquisition seamlessly complements Gilead’s existing liver-focused product portfolio, reflecting its steadfast dedication to delivering groundbreaking medications to patients worldwide.

The transaction is poised to conclude in the initial quarter of 2024. Gilead has enlisted the expertise of BofA Securities, Inc. and Guggenheim Securities, LLC as financial advisors, while Centerview Partners LLC and Lazard are serving as financial advisors to CymaBay.

3. Sinopharm Common Wealth Company Limited to Acquire China Traditional Chinese Medicine Holdings Co. Limited

A consortium led by the state-owned pharmaceutical company Sinopharm has proposed a significant move to take drug maker China Traditional Chinese Medicine Holdings (China-TCM) private in a deal worth USD 3.0 billion (HKD 23.16 billion).

Sinopharm, the parent company of China-TCM, currently holds a 32.46 percent stake in the company and has put forward an offer of HKD 4.6 (USD 0.79) per share in cash to acquire the remaining shares. This isn’t the first time Sinopharm has pursued privatization of China-TCM; however, its previous attempt in 2021 was unsuccessful. Sinopharm is firm on its offer price and considers this proposal to be its final offer.

Should this deal come to fruition, it would mark one of the largest privatization endeavors for a Hong Kong-listed firm since Haier Electronics’ USD 5 billion acquisition in 2020.

The success of the privatization hinges upon the outcomes of negotiations among various stakeholders.

4. Novartis data42 AG to acquire MorphoSys AG

Novartis is moving to bolster its oncology pipeline with an agreement to acquire German biotech firm MorphoSys AG for EUR 68 per share, totaling EUR 2.7 billion (USD 2.9 billion) in cash. This acquisition is aimed at enhancing Novartis’s portfolio with a potential treatment for a rare bone marrow cancer.

The focal point of the deal is pelabresib, a treatment being developed by MorphoSys for myelofibrosis, a rare bone marrow cancer. Pelabresib recently met its late-stage study goals and demonstrated effectiveness in treating myelofibrosis in combination with ruxolitinib, a type of drug known as a JAK inhibitor.

MorphoSys intends to submit its application for the combined treatment to the U.S. market in the second half of 2024. With Novartis’s resources, MorphoSys aims to accelerate the development and maximize the commercial potential of pelabresib.

Novartis’s strategic repositioning, characterized by streamlining operations, cost-saving initiatives, and the divestment of its generic drugs arm, Sandoz, enables the company to concentrate its efforts on specific therapeutic domains and vital markets, enhancing its competitive edge in the pharmaceutical sector.

The completion of the deal is anticipated in the first half of 2024, contingent upon customary closing conditions, including the acceptance of the takeover bid by at least 65% of MorphoSys AG’s outstanding shares. Until the conclusion of the transaction, MorphoSys AG will maintain its independent operations.

5. Roquette Frères S.A. to Acquire Pharma Solutions Business of International Flavors & Fragrances Inc.

Roquette, a prominent French leader in plant-based ingredients, has announced its acquisition of the Pharma Solutions Business of International Flavors & Fragrances Inc. (IFF Pharma Solutions) for USD 2.85 billion. This acquisition marks a strategic move for Roquette, aiming to strengthen its presence in the pharmaceutical sector.

IFF Pharma Solutions is recognized for its expertise in developing and manufacturing pharmaceutical excipients, along with supporting industrial and methyl cellulosic food applications through its Global Specialty Solutions business. With 10 research and development and production sites globally and approximately 1100 employees, Pharma Solutions achieved a revenue of approximately USD 1 billion in 2023.

By integrating these complementary businesses, Roquette aims to rebalance its portfolio around the pillars of Health and Nutrition. This acquisition will expand Roquette’s range of pharmaceutical products and is expected to accelerate the company’s growth significantly.

The deal is projected to be finalized in the first half of 2025, pending regulatory approvals and customary closing conditions.

6. AstraZeneca AB to Acquire Fusion Pharmaceuticals Inc.

AstraZeneca, a global pharmaceutical giant, recently disclosed its acquisition of Fusion Pharmaceuticals, a clinical-stage biopharmaceutical company, in a deal valued at USD 2.41 billion. This strategic move aims to enhance AstraZeneca’s oncology portfolio. AstraZeneca’s oncology segment accounted for over a third of its total revenue, with sales reaching USD 17.15 billion in 2023.

The agreement entails an initial cash payment of USD 2 billion, equivalent to USD 21 per share, along with a potential contingent payment of up to USD 400 million, or USD 3 per share, contingent upon reaching specified regulatory milestones.

By integrating Fusion Pharmaceuticals, AstraZeneca gains access to novel expertise and cutting-edge research and development capabilities, particularly in actinium-based Radioconjugates (RCs). This acquisition not only expands AstraZeneca’s global footprint but also reinforces its commitment to the Canadian market.

RCs, a rapidly advancing modality in cancer therapy, leverage a combination of targeted agents for identifying cancer cells and radioactive isotopes for precise tumor eradication. This innovative approach holds promise for transforming cancer treatment paradigms, aiming to improve outcomes for patients by shifting away from conventional therapies such as chemotherapy and radiotherapy.

Fusion Pharmaceuticals will transition into a wholly-owned subsidiary of AstraZeneca, maintaining its operations in both Canada and the United States. The deal is anticipated to conclude in the second quarter of 2024. Centerview Partners LLC has been enlisted as the exclusive financial advisor to Fusion, facilitating the transaction process.

7. Sanofi to acquire Inhibrx, Inc.

Sanofi, a leading French healthcare company, has announced its intention to acquire the U.S. biotech firm Inhibrx through its subsidiary, Aventis Inc. This acquisition aims to enhance Sanofi’s drug development portfolio by incorporating an experimental treatment for Alpha-1 Antitrypsin Deficiency (AATD), a rare genetic disease-causing lung tissue deterioration.

Post-acquisition, Inhibrx will operate as a subsidiary under Aventis’ parent company, Sanofi. Sanofi will gain access to Inhibrx’s INBRX-101 treatment for AATD, while Inhibrx’s non-INBRX-101 assets and liabilities will be spun off into a new publicly traded company. Sanofi will retain an 8% equity stake in the newly formed entity.

The total transaction value, inclusive of the initial cash component, potential contingent payments, and assumption of Inhibrx’s debt, amounts to approximately USD 2.20 billion.

Sanofi, predominantly deriving revenue from anti-inflammatory treatments, decided to forego its 2025 earnings targets last year to prioritize the enhancement of the company’s research and development (R&D) efforts. This acquisition bolsters Sanofi’s portfolio growth strategy and complements its established track record in rare diseases and leadership in immunology and inflammation over the past three decades.

This acquisition reflects a broader trend in the pharmaceutical sector, marked by a series of recent mergers and acquisitions aimed at replenishing pipelines with promising assets. Notable recent transactions include Johnson & Johnson’s acquisition of Ambrx Biopharma for around USD 2 billion and Merck’s purchase of Harpoon Therapeutics for USD 680 million.

The transaction is expected to close in the second quarter of 2024. Sanofi has engaged Lazard as its exclusive financial advisor, while Inhibrx is represented by Centerview Partners LLC in this deal.

8. Johnson & Johnson to acquire Ambrx Biopharma Inc.

Johnson & Johnson (J&J) is set to acquire Ambrx, a biotechnology firm specializing in tumor-targeting antibodies, in an all-cash merger valued at approximately USD 2 billion, resulting in a net equity value of USD 1.9 billion after adjusting for cash holdings.

Ambrx is renowned for its synthetic biology platform, primarily focusing on developing antibody drug conjugates (ADCs) to combat various cancers. The company’s portfolio includes clinical and preclinical programs aimed at optimizing efficacy and safety across multiple cancer indications.

This acquisition allows Johnson & Johnson to leverage Ambrx’s expertise in designing targeted oncology therapeutics. Collaborative efforts between J&J and Ambrx aim to expedite the clinical trial of ARX517, a proprietary ADC targeting PSMA for metastatic castration-resistant prostate cancer, and advance a pipeline of biologic products.

With Ambrx’s pipeline and ADC platform, Johnson & Johnson foresees promising avenues to introduce precision biologics, thus revolutionizing cancer treatment methods.

The transaction is expected to close in the first half of 2024, after which Ambrx’s common stock will cease trading on the NASDAQ Global Select Market. Financial advisory services are being provided to Ambrx by Centerview Partners LLC and Cantor Fitzgerald & Co.

9. ALPS Global Holding Berhad to acquire Globallink Investment Inc.

In a strategic move to penetrate the U.S. public market, ALPS Global Holding Berhad, a prominent Malaysian developer of personalized medicines, has announced a merger with the blank-check company Globallink Investment Inc.

This merger, valuing the biotech firm at USD 1.6 billion, represents a significant leap towards ALPS’s expansion and its commitment to personalized, precise, and preventive medicine. Through this transaction, set for completion in Q2, ALPS aims to bolster its working capital, facilitate growth capex, and address general corporate needs.

The merged entity, poised to be renamed Alps Life Science, is slated for a Nasdaq listing. The deal features an earn-out provision, promising Alps shareholders up to 48 million additional shares based on future revenue milestones.

This merger symbolizes a notable return to blank-check mergers as a viable alternative for companies aiming for a swift public listing, amidst a backdrop of regulatory scrutiny.

10. GSK plc to acquire Aiolos Bio, Inc.

British pharmaceutical giant GSK plc has finalized an agreement to acquire Anglo-American biotech company Aiolos Bio for a substantial USD 1.4 billion.

The acquisition entails an initial payment of USD 1 billion, supplemented by USD 400 million contingent upon meeting specified milestones.

This strategic move underscores GSK’s commitment to diversifying its array of asthma therapies.

Aiolos Bio is a clinical-stage biopharmaceutical company specializes in the development of therapies for patients grappling with various respiratory and inflammatory conditions.

Through this acquisition, GSK aims to enhance its respiratory pipeline by incorporating AIO-001, an asthma treatment that is poised to enter mid-stage clinical trials. GSK currently offers a portfolio of both marketed and investigational medicines designed to address various respiratory diseases, including biologics tailored for asthma patients with elevated eosinophil levels or high T2 inflammation.

By integrating AIO-001, GSK hopes to provide a potential biologic option to a wider segment of the 315 million individuals worldwide living with asthma, regardless of their biomarker status.

11. Intervet International B.V. to acquire Assets of Aqua Business of Elanco Animal Health Incorporated

Elanco Animal Health Incorporated has struck a deal to divest its aqua business to Intervet International B.V., a subsidiary of MSD Animal Health, for USD 1.3 billion in cash. This transaction encompasses the transfer of assets including product inventories, real properties, and intellectual property, alongside certain employees.

Slated for completion by mid-2024, this acquisition enriches MSD Animal Health’s aquaculture offerings with leading medicines, vaccines, nutritionals, and supplements for aquatic species. It includes the acquisition of two manufacturing facilities in Canada and Vietnam, and a research facility in Chile. Highlighting the deal is the inclusion of CLYNAV®, a DNA-based vaccine for Atlantic salmon, and IMVIXA®, a sea lice treatment, which complement MSD’s existing warm water vaccine portfolio.

This acquisition is a testament to MSD Animal Health’s commitment to enhancing fish health, welfare, and sustainability across the aquaculture, conservation, and fisheries sectors.

12. Lonza Group AG to Acquire Genentech Manufacturing Facility in Vacaville, California

Roche has agreed to sell its large-scale biologics manufacturing site in Vacaville, California, to Lonza, a Swiss multinational company specializing in pharmaceuticals, biotechnology, and nutrition sectors. The acquisition, valued at USD 1.2 billion in cash, represents Lonza’s strategic move to enhance its capacity in large-scale biologics manufacturing.

This transaction aims to augment Lonza’s capabilities in commercial mammalian contract manufacturing to meet the industry’s growing demand. The Vacaville facility, with a total bioreactor capacity of approximately 330,000 liters, is recognized as one of the significant biologics manufacturing sites globally. By acquiring this facility, Lonza aims to better serve its clients’ needs in the United States, providing access to increased production capabilities.

Furthermore, Lonza plans to invest around CHF 500 million (equivalent to USD 557 million) in additional capital expenditure to improve and upgrade the Vacaville facility, ensuring its alignment with market demands.

Upon completion of the deal, the Vacaville site will integrate into Lonza’s network of biologics network. The transaction is expected to be finalized in the second half of 2024, with Lonza receiving financial advice from BofA Securities.

13. Cardinal Health, Inc. to acquire Specialty Networks LLC

Cardinal Health has announced a definitive agreement to acquire Specialty Networks LLC for USD 1.2 billion in cash, marking a significant expansion into multi-specialty group purchasing and practice enhancement. Specialty Networks, known for its robust platforms such as UroGPO, Gastrologix, GastroGPO, and United Rheumatology, enhances clinical and economic value for over 11,500 specialty providers.

This acquisition is a strategic move by Cardinal Health to bolster its Specialty business, offering advanced technologies, capabilities, and talent that cater to essential business and customer needs. A notable component of this acquisition is the PPS Analytics platform, which employs AI to transform vast amounts of data from various healthcare systems into actionable insights.

The integration of Specialty Networks underlines Cardinal Health’s commitment to enhancing its service offerings and analytics capabilities across specialty therapeutic areas, promising a significant impact on the quality of care delivered to patients nationwide.

The transaction, expected to close subject to regulatory approvals, reinforces Cardinal Health’s position as a leader in pharmaceutical distribution and specialty solutions.

14. Novo Nordisk A/S to Acquire Cardior Pharmaceuticals GmbH

Denmark’s Novo Nordisk has reached an agreement to acquire Cardior Pharmaceuticals for EUR 1.03 billion (USD 1.11 billion). This deal includes an upfront payment and potential additional payments contingent upon meeting certain development and commercial milestones. The acquisition is geared towards fortifying Novo Nordisk’s cardiovascular pipeline, marking a pivotal step in its commitment to addressing heart-related ailments.

Renowned for its pioneering work in RNA-targeted therapies aimed at preventing, repairing, and even reversing heart diseases, Cardior stands at the forefront of innovation in this domain. The cornerstone of this acquisition is Cardior’s lead compound, CDR132L, currently undergoing phase 2 clinical trials for heart failure treatment. Engineered to interrupt and potentially reverse the progression of heart failure, CDR132L holds promise for significantly enhancing heart function and quality of life for patients grappling with this condition.

Novo Nordisk’s strategic focus on cardiovascular health aligns with the pressing global concern surrounding cardiovascular diseases, which stand as the foremost cause of mortality worldwide.

The completion of the acquisition is anticipated to occur in the second quarter of 2024.

15. AstraZeneca PLC to Acquire Amolyt Pharma SAS

AstraZeneca PLC, a leading Anglo-Swedish pharmaceutical company, has announced its acquisition of biotech firm Amolyt Pharma for USD 1.05 billion. The deal, conducted on a cash and debt-free basis, involves an initial payment of USD 800 million upon closure, with an additional contingent payment of USD 250 million on achieving a specified regulatory milestone.

This acquisition will fortify Alexion, AstraZeneca’s rare disease division, further enhancing its position in the market. AstraZeneca’s rare disease portfolio, which received a significant boost from the USD 39 billion acquisition of Alexion in 2021, has witnessed substantial growth, reaching nearly USD 7.8 billion in revenue in 2023.

Moreover, the acquisition of Amolyt Pharma expands AstraZeneca’s bone metabolism franchise, primarily with the inclusion of eneboparatide, an investigational therapeutic peptide in Phase III development designed to address hypoparathyroidism, a prevalent rare disease with significant unmet medical needs.

The transaction is expected to be completed by the end of the third quarter of 2024, subject to standard closing conditions. Financial advisory for Amolyt Pharma was provided by Centerview Partners LLC and Goldman Sachs Bank Europe SE.

Conclusion

The strategic M&A activities that characterized Q1 2024 within the pharmaceutical and biotechnology industries underscore a dynamic and forward-looking approach to global healthcare challenges. These 15 landmark deals demonstrate the industry’s commitment to advancing medical research, improving patient care, and expanding access to innovative treatments across a broad spectrum of diseases. By strategically acquiring and integrating complementary capabilities, technologies, and expertise, the involved companies are poised to drive significant advancements in healthcare, offering promising new therapies and solutions that could reshape patient outcomes and treatment paradigms. As the industry continues to evolve, the strategic foresight and collaborative efforts exemplified by these transactions will likely play a pivotal role in shaping the future of healthcare, underscoring an enduring commitment to innovation, growth, and the relentless pursuit of better health for people around the world. This comprehensive overview of Q1 2024’s M&A landscape not only highlights the strategic priorities of leading pharmaceutical and biotech firms but also signals the ongoing transformation and resilience of the global healthcare industry.