Blog Maximising M&A Synergies: 5 Steps to Realising Deal Value

- Blog

Maximising M&A Synergies: 5 Steps to Realising Deal Value

- Tom Allen

SHARE:

5 Steps to Unlock M&A Synergy Value

M&A deals don’t fail because of bad intentions—they fail because capturing synergies is harder than it looks. Ambitious financial projections are great, but without a structured plan to turn those numbers into reality, deals stall, momentum is lost and what looked like a great acquisition quickly becomes an expensive headache.

The real work begins after the ink dries on the contract. Companies that consistently get M&A right don’t just cross their fingers and hope for the best—they approach synergy capture as a disciplined, strategic process from Day One.

To maximise deal value and ensure integration success, follow these five essential steps to realising synergies:

1. Think of Synergies Before the Deal Closes

Too many deals get signed based on overly optimistic synergy estimates. Smart acquirers know that synergy capture starts before the deal is done—not months after. Before you sign, take the time to run a proper synergy assessment to figure out what’s achievable and what’s just wishful thinking. The correct approach:

- Aligns leadership on realistic synergy targets – Avoid overestimating potential synergies. Targets should be based on detailed financial modelling and benchmarking against industry peers. A clear, data-driven approach prevents inflated expectations and sets a firm foundation for post-merger success.

- Identify quick wins and longer-term opportunities – Some synergies can be realised immediately, such as procurement savings through consolidated supplier contracts, while others—like IT integration—require time. Establishing a timeline for execution helps balance early momentum with sustained value creation.

- Helps determine the level of integration required – Some businesses benefit from full integration, while others require only partial alignment. A deep understanding of which areas to integrate and which to keep separate prevents unnecessary disruption. A one-size-fits-all approach does not work.

- Forms the foundation for a detailed M&A integration strategy – Without a structured roadmap, synergy capture becomes reactive. A clear, pre-defined strategy ensures integration teams remain focused, proactive and aligned on execution priorities from Day One.

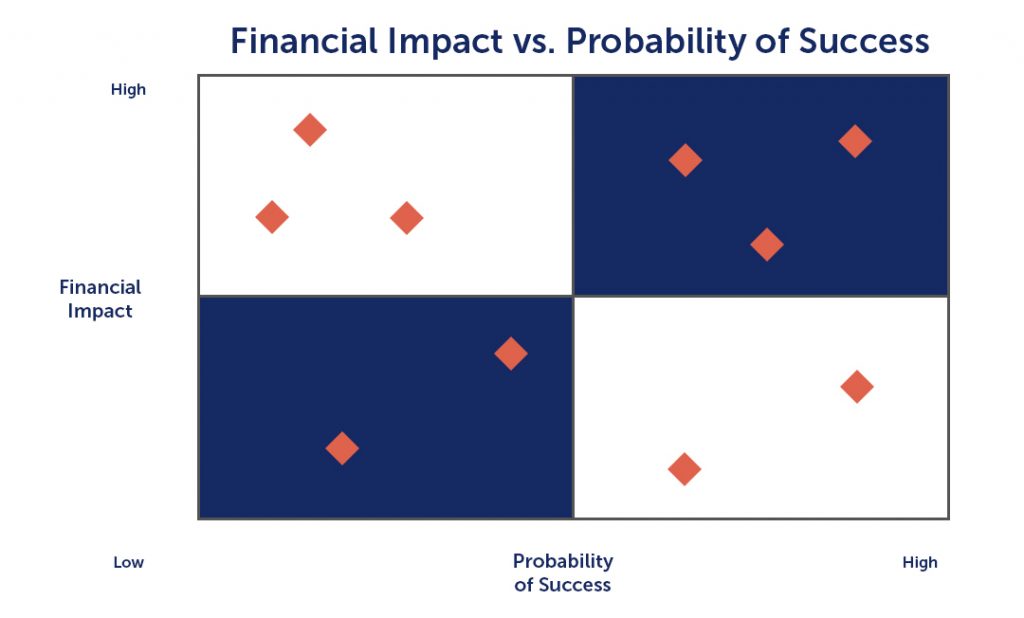

2. Focus on Synergies That Actually Move the Needle

Not all synergies are created equal. Chasing every possible efficiency can waste time and resources, so you need to focus on the ones that deliver the biggest impact with the least resistance. To focus on the right ones:

By concentrating on high-impact synergies, acquirers ensure faster integration, smoother execution and stronger financial performance.

- Prioritise cost synergies – Areas such as procurement, supply chain and shared services often deliver immediate value. Consolidating suppliers, optimising logistics and eliminating redundant functions can produce rapid cost savings without disrupting operations.

- Identify revenue synergies – Cross-selling, bundling products and market expansion are powerful revenue drivers—but they must be backed by solid data. Understanding customer overlap, aligning sales teams and ensuring seamless product integration is key to making these synergies a reality.

- Assess cultural and operational fit to determine feasibility – Cultural misalignment is one of the biggest killers of synergy realisation. Assessing leadership styles, employee values and operational approaches before integration begins helps mitigate resistance and ensure smoother execution.

- Categorise synergies as short-term (quick wins) vs. long-term – Immediate gains, such as reducing duplicated costs, should be prioritised in the first 100 days. Longer-term opportunities, such as process automation or joint innovation, should be phased in gradually to avoid disruption.

3. Build a Playbook (Because Winging It Won’t Work!)

This is where things often go wrong. Deals get signed and suddenly everyone’s scrambling to figure out what happens next. The best acquirers have a playbook ready to go that turns synergy plans into action.

- Clear financial targets and measurable KPIs – Every synergy should be quantified with SMART (Specific, Measurable, Achievable, Relevant and Time-bound) objectives. Examples include achieving a 15% reduction in procurement costs within the first year or increasing cross-sell revenue by 10% within 18 months.

- Defined ownership and accountability for each synergy – Each synergy should have a designated owner, whether an integration lead, function head, or workstream manager. Defined responsibility ensures tracking, accountability and swift issue resolution.

- A phased implementation timeline aligned with Day One planning – A step-by-step roadmap prevents teams from attempting to do too much at once. Breaking integration into phases, such as immediate, mid-term and long-term, keeps execution focused and manageable.

- Contingency plans to address integration risks – Synergy realisation rarely goes exactly to plan. Having fallback options and alternative execution strategies in place ensures that integration roadblocks don’t derail overall value capture.

4. Make Integration a Team Effort

Synergies don’t capture themselves— you need a cross-functional effort to bring them to life. The most successful acquirers make integration a company-wide priority rather than leaving it to a small M&A team.

- Establish an Integration Management Office (IMO) to drive synergy realisation – A dedicated IMO provides oversight, ensures clear reporting lines and drives execution momentum while resolving roadblocks.

- Leverage M&A technology platforms to track progress and enhance collaboration – Digital dashboards, KPI tracking and collaboration tools provide real-time visibility into synergy capture progress, allowing teams to adjust strategies proactively.

- Assign dedicated teams for finance, operations, HR, IT and sales integration – Each business function must have clearly defined synergy goals, implementation plans and dedicated resources to ensure seamless execution.

- Develop a structured communication plan to align employees and stakeholders – Uncertainty breeds resistance. Proactive communication, stakeholder engagement and clear messaging ensure buy-in at all levels of the organisation.

A well-orchestrated post-merger integration ensures that identified synergies become tangible business results rather than theoretical projections.

5. Measure, Adapt and Course-Correct

M&A isn’t a “set it and forget it” game. Even the best synergy plans need adjustments along the way. The key to staying on track is continuous monitoring, learning and refining the approach as you go.

- Track synergy realisation against predefined KPIs – Financial, operational and cultural synergies must be tracked rigorously. Regular performance dashboards ensure visibility into whether targets are being met.

- Review progress with executive leadership regularly – Synergy realisation should be a standing agenda item in leadership meetings. Frequent check-ins allow for early intervention when issues arise.

- Identify and address integration roadblocks in real-time – If a synergy isn’t materialising as expected, integration teams should adjust execution strategies quickly rather than waiting for post-mortem analysis.

- Refine strategies to accelerate value capture – If new synergy opportunities arise, or initial assumptions prove inaccurate, strategies should be adapted accordingly. The ability to pivot ensures sustained value creation beyond initial expectations.

Without active oversight, deals can drift off course, eroding potential value. Continuous measurement ensures that M&A goals remain on track and deliver lasting impact.

Takeaway

Capturing synergies isn’t automatic—it requires structured planning, execution and ongoing monitoring.

- Early synergy assessment sets realistic expectations and drives integration success.

- Prioritising high-value synergies ensures teams focus on what matters most.

- A structured integration plan keeps teams aligned and accelerates synergy capture.

- Real-time tracking and adjustments prevent deal value erosion over time.

The Bottom Line: The most successful M&A deals don’t just happen—they are strategically planned, executed with precision and continuously optimised. By applying these five steps, acquirers can maximise deal value, accelerate integration and drive long-term growth.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter