Blog 2024 Top Global M&A Deals

- Blog

2024 Top Global M&A Deals

- IMAA

IMAA’s 2024 Top Global M&A Deals industry coverage offers an overview of the year’s most significant M&A transactions across eight key industries. This monthly M&A activity overview provides the top 5 M&A deals for each industry, which offers a clear view of major market movements and highlights key players in each sector.

These monthly M&A insights can benefit M&A practitioners, corporate strategists, investment bankers, legal advisors, C-level executives, investors, and policymakers. It aids in identifying market trends, investment opportunities, and strategic decision-making, while also serving as a valuable resource for academic research in finance, business strategy, and economics.

SHARE:

M&A Activity per Industry

Click on any of the category tabs below to view the M&A Activity.

Filter by Month:

M&A Activity in the Consumer Products and Services Industry

The top global M&A deals in this industry list include companies that manufacture and sell goods or services directly to the end consumer, covering a wide array of products from household items to personal care.

January

Consumer Products and Services

- Deal 1: 337 Morrisons petrol forecourts & more than 400 Ultra-Rapid EV sites of Wm Morrison Supermarkets (United Kingdom) was acquired by Motor Fuel Limited (United Kingdom) for USD 3.16 billion.

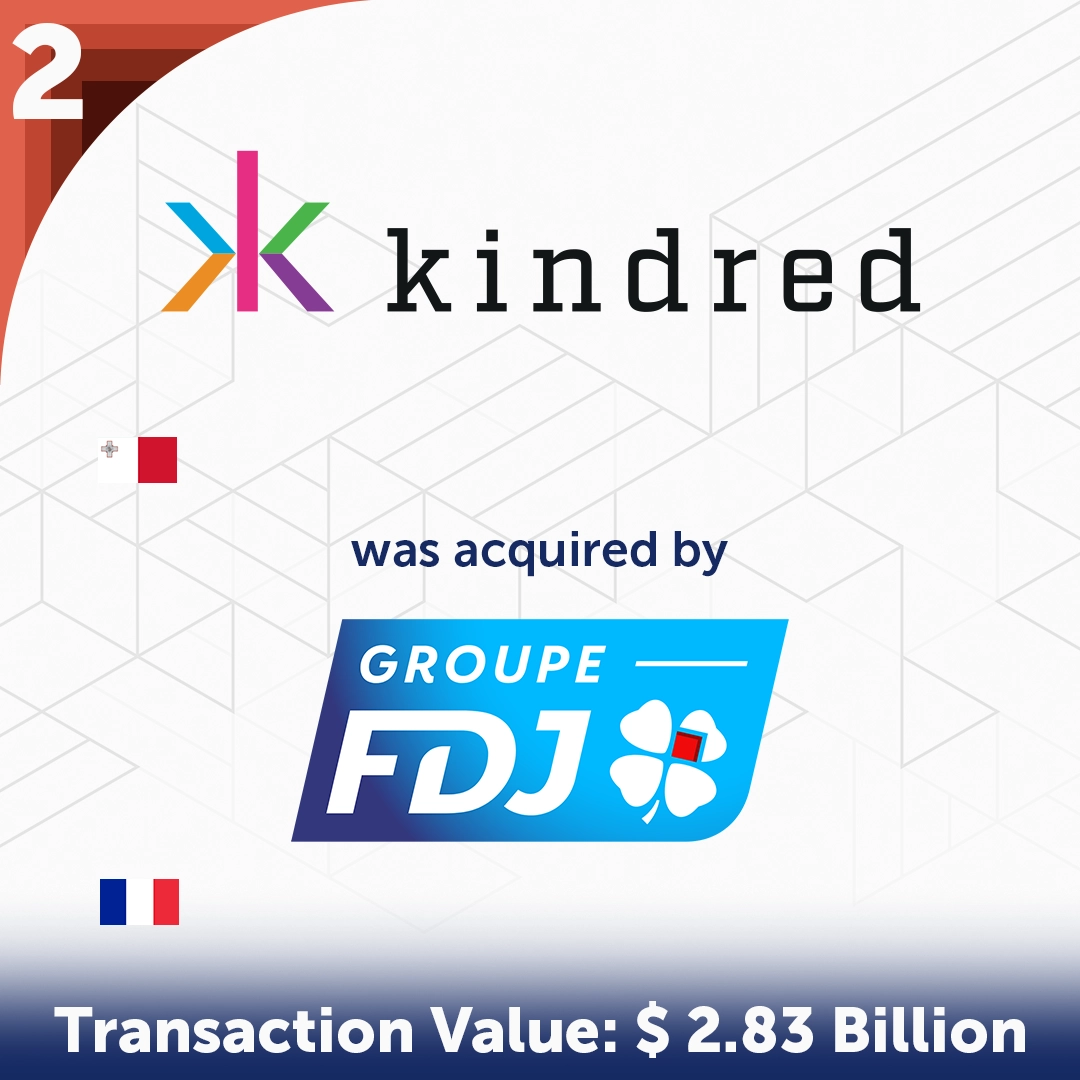

- Deal 2: Kindred Group plc (Malta) was acquired by La Française des Jeux Société anonyme (France) for USD 2.83 billion.

- Deal 3: Carrols Restaurant Group, Inc. (United States) was acquired by Restaurant Brands International Inc. (Canada) for USD 1.00 billion.

- Deal 4: 204 gas stations and convenience stores of Sunoco LP (United States) was acquired by 7-Eleven, Inc. (United States) for USD 0.95 billion.

- Deal 5: CH&CO (United Kingdom) was acquired by Compass Group PLC (United Kingdom) for USD 0.60 billion.

February

Consumer Products and Services

- Deal 1: VIZIO Holding Corp. (United States) was acquired by Walmart Inc. (United States) for USD 2.30 billion.

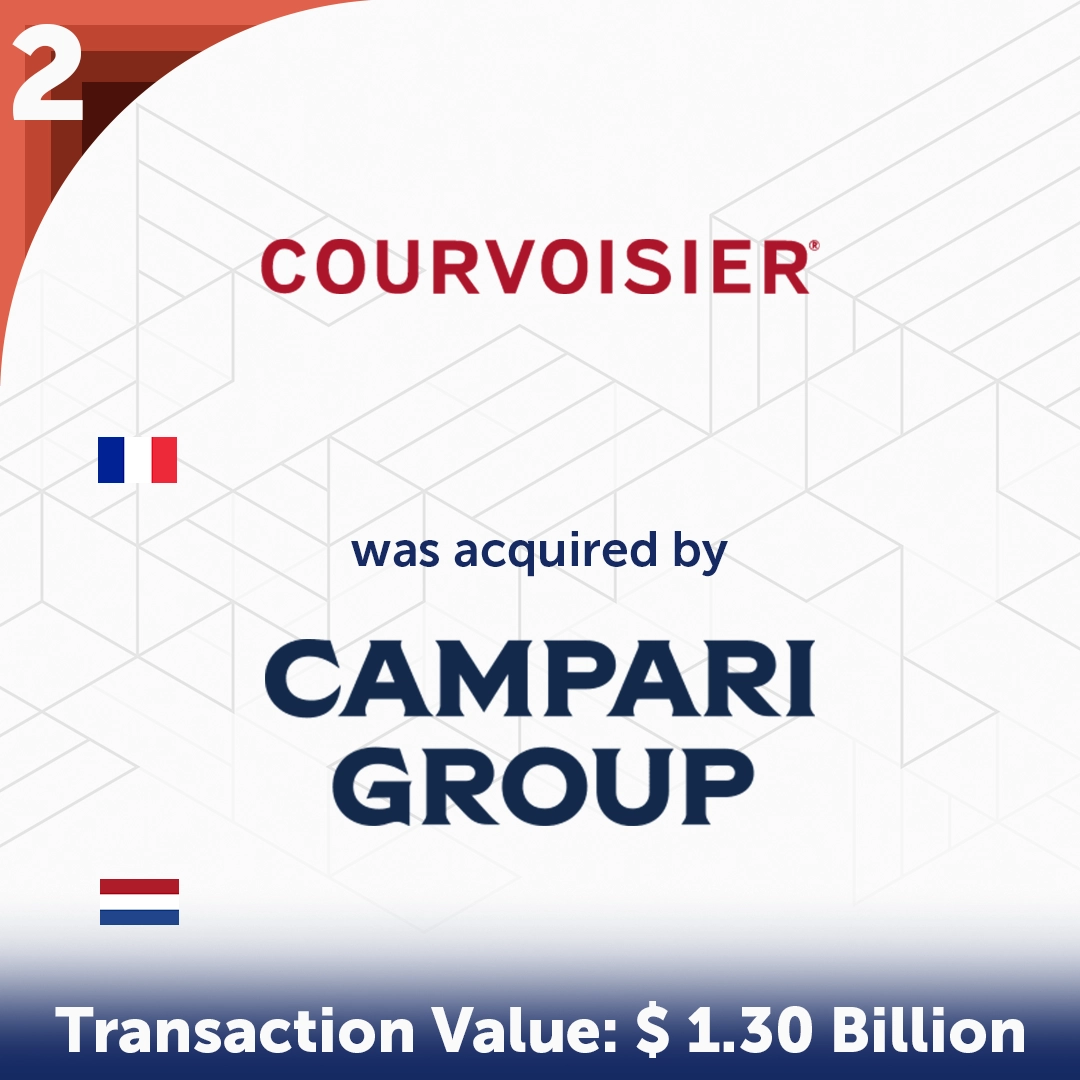

- Deal 2: Courvoisier S.A.S. (France) was acquired by Davide Campari-Milano N.V. (Netherlands) for USD 1.30 billion.

- Deal 3: Forno d’Asolo S.p.A (Italy) was acquired by InvestIndustrial (United Kingdom) and Sammontana S.p.A. (Italy) for USD 1.20 billion.

- Deal 4: Global Gaming and PlayDigital Businesses of International Game Technology PLC (United Kingdom) was acquired by Everi Holdings Inc. (United States) for USD 1.16 billion.

- Deal 5: Jackpocket, Inc. (United States) was acquired by DraftKings Holdings Inc. (United States) for USD 0.75 billion.

March

Consumer Products and Services

- Deal 1: SRS Distribution Inc. (United States) was acquired by The Home Depot, Inc. (United States) for USD 18.25 billion.

- Deal 2: Vista Outdoor Inc. (United States) was acquired by MNC Capital Partners, L.P. (Canada) for USD 2.90 billion.

- Deal 3: CWT US, LLC (United States) was acquired by Global Business Travel Group, Inc. (United States) for USD 0.57 billion.

- Deal 4: Autry International S.R.L. (Italy) was acquired by Style Capital Sgr S.P.A.; Q Group International (Italy) for USD 0.34 billion.

- Deal 5: Hilton Paris Opéra (France) was acquired by City Developments Limited (Singapore) for USD 0.26 billion.

April

Consumer Products and Services

- Deal 1: L’Occitane International S.A. (Luxembourg) was acquired by L’Occitane Groupe S.A. (Luxembourg) for USD 1.78 billion.

- Deal 2: Milanese building on via Monte Napoleone 8 in Milan (Italy) was acquired by Kering SA (France) for USD 1.41 billion.

- Deal 3: Snap One Holdings Corp. (United States) was acquired by ADI Global Distribution (United States) for USD 1.40 billion.

- Deal 4: Motel One Gmbh (Germany) was acquired by One Hotels & Resorts AG (Germany) for USD 1.36 billion.

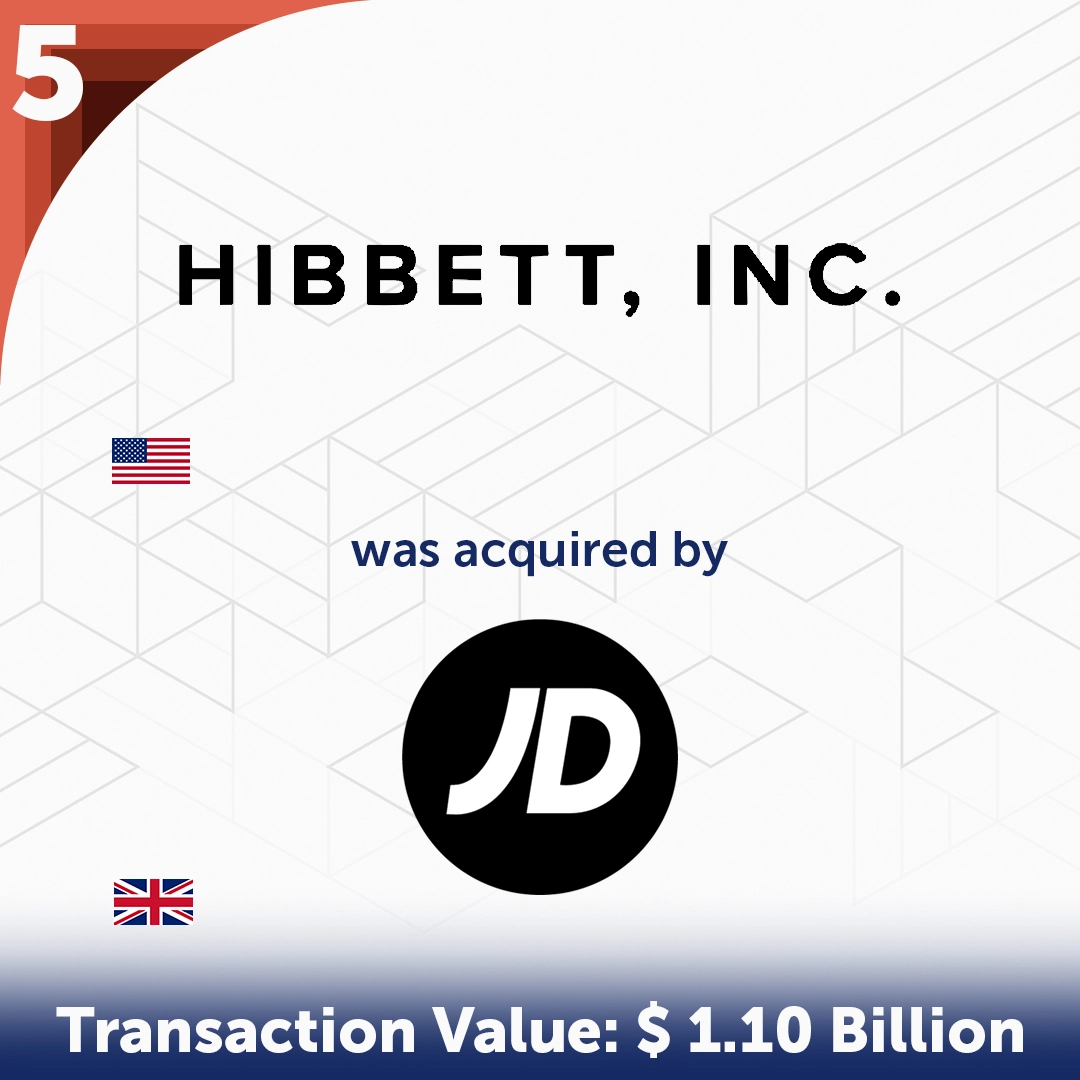

- Deal 5: Hibbett, Inc. (United States) was acquired by JD Sports Fashion Plc (United Kingdom) for USD 1.10 billion.

May

Consumer Products and Services

- Deal 1: PlayAGS, Inc. (United States) was acquired by Brightstar Capital Partners, L.P. (United States) for USD 1.10 billion.

- Deal 2: Hanon Systems (South Korea) was acquired by Hankook Tire & Technology Co., Ltd. (South Korea) for USD 1.00 billion.

- Deal 3: Foodpanda Taiwan Co., Ltd. (Taiwan) was acquired by Uber Eats (United States) for USD 0.95 billion.

- Deal 4: Princes Limited (United Kingdom) was acquired by Newlat Food S.p.A. (Italy) for USD 0.89 billion.

- Deal 5: Turtle Bay Resort Hotel, LLC (United States) was acquired by Host Hotels & Resorts, Inc. (United States) for USD 0.73 billion.

June

Consumer Products and Services

Deal 1: El Colorado (Chile), and Centro Farellones (Chile) was acquired by Mountain Capital Partners, LLC (United States) for USD 6.00 billion.

Mountain Capital Partners, LLC to acquire El Colorado and Centro Farellones

US-based Mountain Capital Partners (MCP) has proposed a significant acquisition of two prominent ski resorts, Farellones and El Colorado, for USD 6 billion, with the aim of establishing the largest ski area in South America. If successful, MCP will become the majority shareholder of Andacor, the entity currently controlling both venues.

MCP manages a diverse portfolio that includes over a dozen ski areas, bike parks, and golf courses across the US and Chile. Adding El Colorado and Farellones to its portfolio will complement its existing operations, which include Valle Nevado and La Parva, two ski resorts already under its management.

This strategic integration could streamline operations and offer visitors the convenience of accessing multiple resorts with a single ski pass, potentially positioning the Andes Valley as a premier global ski destination.

The timing of this acquisition offer is crucial for Andacor, which is undergoing financial restructuring due to debts accumulated during the COVID-19 pandemic. With liabilities totaling USD 15 billion, Andacor seeks a strategic partner to stabilize its financial position. MCP’s potential investment could provide the capital infusion needed to support Andacor’s recovery.

Moreover, integrating these ski centers under unified management has the potential to boost tourism, create new employment opportunities, and stimulate regional development.

Deal 2: CP Kelco ApS (United States) was acquired by Tate & Lyle plc (United Kingdom) for USD 1.80 billion.

Tate & Lyle plc to Acquire CP Kelco ApS

Tate & Lyle plans to acquire CP Kelco in a USD 1.8 billion deal, aimed at bolstering its specialty ingredients division and tapping into the growing market for plant-based products. The acquisition includes USD 1.15 billion in cash and 75 million new Tate & Lyle ordinary shares valued at USD 645 million.

With over 3,300 employees across 121 countries, Tate & Lyle specializes in developing products that enhance nutritional profiles by reducing sugar, calories, and fat while boosting fiber and protein content in food and beverages.

The merger aims to combine CP Kelco’s expertise in nature-based specialty ingredients—particularly in stabilization and texture enhancement—with Tate & Lyle’s strengths in sweetening and fortification. This integration is expected to strengthen market leadership across diverse product segments and explore new markets in consumer care and industrial applications.

Anticipated synergies include annual cost savings of at least USD 50 million within two years post-completion and potential revenue synergies of up to 10% of CP Kelco’s current revenue.

Pending regulatory approvals, the acquisition is scheduled to close by the fourth quarter of this year, positioning Tate & Lyle for significant growth in the global specialty ingredients market.

Deal 3: Fancl Corporation (Japan) was acquired by Kirin Holdings Company, Limited (Japan) for USD 1.39 billion.

Kirin Holdings Company, Limited to Acquire Fancl Corporation

Japanese beverage giant Kirin Holdings is set to acquire skincare and cosmetics brand Fancl for approximately JPY 220 billion (USD 1.39 billion), advancing its strategy to expand its health business amidst challenges in the beer market.

While Kirin’s alcoholic beverages contributed JPY 119.9 billion in profit last year, its health science division recorded a loss of JPY 12.5 billion. Acquiring Fancl is expected to strengthen Kirin’s health science segment, opening up new global market opportunities for its products.

Already owning a 33% stake in Fancl, Kirin plans to convert it into a wholly-owned subsidiary through a public tender offer. This strategic move aims to synergize their strengths in natural fermentation technologies and deepen consumer relationships across the Asia-Pacific region. By integrating management resources and expanding product channels, Kirin seeks to meet consumer health needs in both the cosmetics and health food sectors, reinforcing its global market presence alongside its strong Japanese foothold.

For Fancl, the acquisition promises to enhance domestic operations and support strategic investments in international markets to fuel future growth.

Kirin anticipates completing the acquisition by the year’s end.

Deal 4: Global Champion Business of Hanesbrands Inc. (United States) was acquired by Authentic Brands Group LLC (United States) for USD 1.20 billion.

Authentic Brands Group LLC to Acquire Global Champion Business of Hanesbrands Inc.

HanesBrands, a renowned global apparel company, has agreed to sell its sportswear business, Champion, to Authentic Brands in a substantial USD 1.2 billion transaction. This move allows HanesBrands to refocus on enhancing its leadership in the innerwear market and driving growth through consumer-driven product innovation and increased investment in its core brands such as Hanes, Bonds, Maidenform, and Bali.

For Authentic Brands, acquiring Champion presents an opportunity to enter the rapidly expanding sportswear market, leveraging Champion’s strong reputation for athletic tops and hoodies.

The deal includes provisions for additional contingent cash considerations of up to USD 300 million based on performance milestones, potentially bringing the total transaction value to USD 1.5 billion.

HanesBrands anticipates approximately USD 900 million in net proceeds from the sale of Champion, which will primarily be used to retire debt. Following the transaction’s completion, HanesBrands will provide transitional support for Champion, including managing operations in select regions for a specified transition period.

The transaction is scheduled to close in the latter half of 2024, pending regulatory approvals and customary closing conditions.

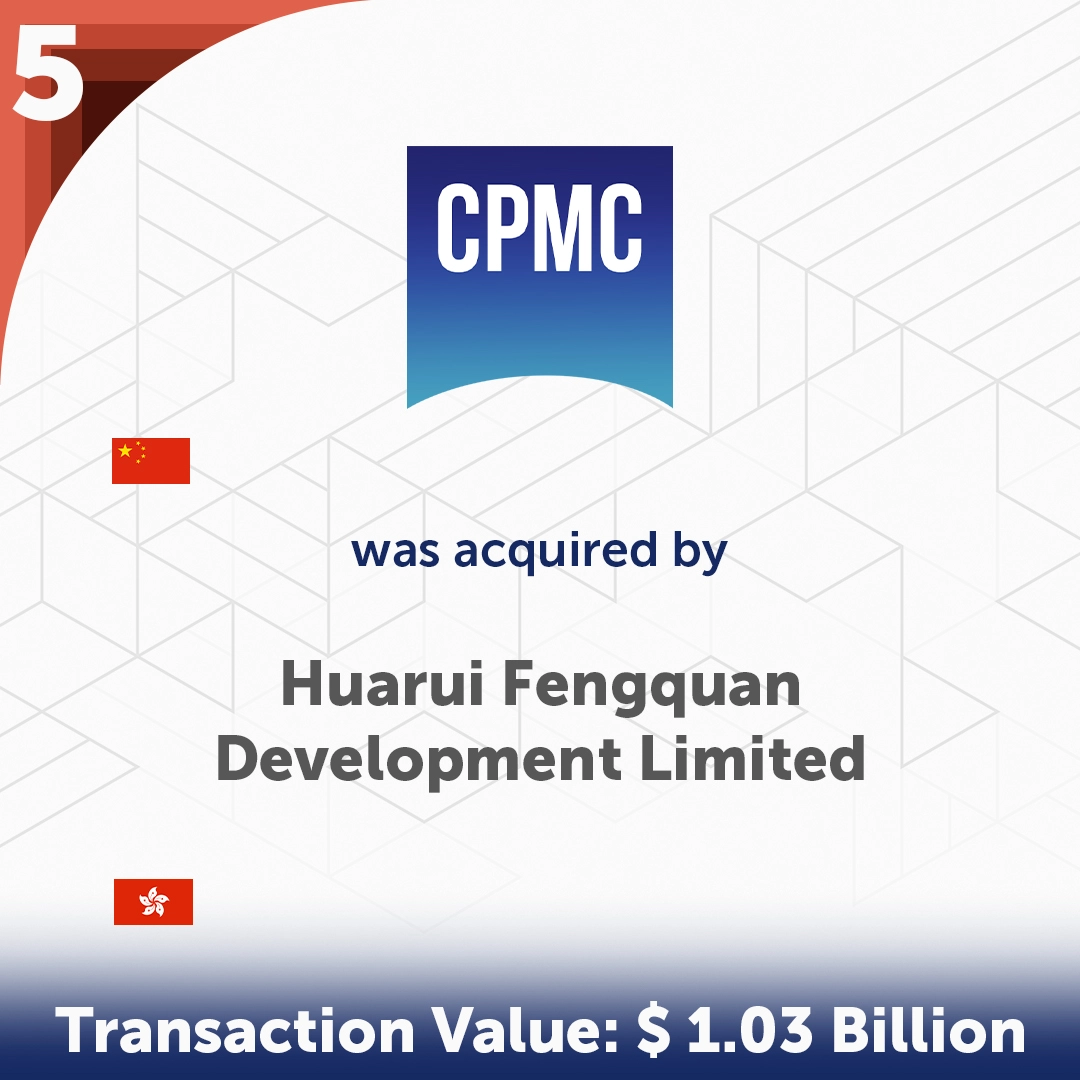

Deal 5: CPMC Holdings Limited (China) was acquired by Huarui Fengquan Development Limited (Hong Kong) for USD 1.03 billion.

Huarui Fengquan Development Limited to Acquire CPMC Holdings Limited

CPMC Holdings Limited recently announced that Huarui Fengquan Development Limited has made a voluntary conditional general cash offer to acquire all outstanding CPMC shares not currently held by Huarui and its affiliates. The transaction is valued at HKD 8.03 billion (approximately USD 1.03 billion).

As China’s largest integrated packaging group for consumer goods such as food, beverages, and household chemicals, CPMC specializes in three packaging segments: Tinplate Packaging, Aluminum Packaging, and Plastic Packaging.

Huarui’s acquisition aims to boost the competitiveness of Chinese packaging enterprises and establish a leading national brand in metal packaging. This move is expected to create synergies in technology, marketing strategies, production capabilities, and supply chain management. By diversifying its offerings and strengthening strategic partnerships, Huarui seeks to reduce dependence on single customer bases and promote sustainable growth.

Upon completion of the offer, CPMC will become a subsidiary of Huarui Parent. China Securities International served as the financial advisor to Huarui.

July

Consumer Products and Services

Deal 1: Neiman Marcus Group LTD LLC (United States) was acquired by Hudson's Bay Company (Canada) for USD 2.65 billion.

Hudson's Bay Company to acquire Neiman Marcus Group LTD LLC

Hudson’s Bay Co. (HBC), the Canadian retail powerhouse and owner of Saks Fifth Avenue, is set to acquire Neiman Marcus Group for USD 2.65 billion. This strategic move aims to expand HBC’s footprint in the luxury retail sector amid current industry challenges.

The acquisition will facilitate the creation of Saks Global, a leading entity that combines luxury retail and real estate assets. Saks Global will oversee Saks Fifth Avenue, Saks OFF 5TH, Neiman Marcus, and Bergdorf Goodman as distinct brands. It will also merge HBC’s U.S. real estate holdings with those of Neiman Marcus Group, forming a substantial USD 7 billion portfolio centered on premier retail locations.

In parallel, HBC plans to reorganize its Canadian operations into a separate entity from Saks Global. This restructuring is intended to lower leverage and improve liquidity for HBC’s Canadian retail and real estate assets, including Hudson’s Bay stores and TheBay.com.

The USD 2.65 billion acquisition will be financed through a mix of equity from new and existing shareholders and debt arrangements. Strategic investors such as Amazon, Rhône Capital, Insight Partners, and Salesforce will support Saks Global post-acquisition, driving innovation and growth.

M. Klein & Company is advising HBC on the acquisition and financing, serving as the lead financial and capital markets advisor. J.P. Morgan and Lazard are providing financial advisory services to Neiman Marcus Group throughout the transaction.

Deal 2: Supreme Holdings, Inc. (United States) was acquired by EssilorLuxottica Société anonyme (France) for USD 1.50 billion.

EssilorLuxottica Société anonyme to Acquire Supreme Holdings, Inc.

EssilorLuxottica, a global leader in the optical and eyewear industry, has agreed to acquire Supreme, the prominent American skateboarding and streetwear brand, from VF Corporation for USD 1.5 billion in cash. This acquisition marks EssilorLuxottica’s first foray into the apparel sector.

Supreme is renowned for its distinctive red-and-white logo, exclusive limited-edition releases, and high-profile collaborations with notable brands and artists. Known for its influence in street fashion, Supreme operates primarily through a digital-first model, supported by 17 retail stores located across the U.S., Asia, and Europe.

This strategic acquisition aligns with EssilorLuxottica’s broader innovation and growth objectives, providing a direct entry into new consumer segments and enhancing its connection with contemporary fashion trends. Supreme will become a distinct entity within EssilorLuxottica’s brand portfolio, complementing its existing licensed brands and expanding its presence in the lifestyle sector.

The transaction is anticipated to close by the end of 2024. J.P. Morgan is serving as the exclusive financial advisor to EssilorLuxottica in this deal.

Deal 3: Sleep Country Canada Holdings Inc. (Canada) was acquired by Fairfax Financial Holdings Limited (Canada) for USD 1.24 billion.

Fairfax Financial Holdings Limited to Acquire Sleep Country Canada Holdings Inc.

Fairfax Financial Holdings, a prominent Canadian financial holding company, will acquire Sleep Country Canada Holdings for CAD 1.7 billion (approximately USD 1.23 billion). This acquisition supports Fairfax’s strategy to broaden its non-insurance operations.

Sleep Country Canada, a leading specialty mattress retailer, operates under multiple banners including Sleep Country Canada, Dormez-vous, Endy, Silk & Snow, Hush, and Casper Canada. The company boasts 307 corporate-owned stores, 18 warehouses, and a robust e-commerce platform across Canada.

Sleep Country’s established market presence and strong bargaining power with mattress manufacturers contribute to its higher profitability compared to other North American bedding retailers.

The transaction is expected to close in the fourth quarter of 2024. Following the completion of the deal, Sleep Country will seek to delist from the Toronto Stock Exchange. CIBC Capital Markets is serving as the financial advisor to Sleep Country, while Torys LLP is providing legal counsel to Fairfax.

Deal 4: Fikes Wholesale, Inc. (United States) was acquired by Casey's General Stores, Inc. (United States) for USD 1.15 billion.

Casey's General Stores, Inc. to Acquire Fikes Wholesale, Inc.

Casey’s General Stores, the third-largest convenience store retailer in the United States, has agreed to acquire Fikes Wholesale, Inc., the owner of CEFCO Convenience Stores, in an all-cash transaction valued at USD 1.15 billion. This acquisition will significantly enhance Casey’s presence in key markets, particularly Texas and the Southern region of the U.S.

The deal will see Casey’s incorporate 198 retail locations and an extensive dealer network, increasing its total store count to nearly 2,900. Specifically, the acquisition will add 148 stores in Texas—a strategically important market for Casey’s—and 50 additional stores across Alabama, Florida, and Mississippi. The transaction also includes a fuel terminal and a commissary, which will support operations for the newly acquired Texas stores.

The acquisition is expected to be completed by the end of the fourth quarter of 2024. BMO Capital Markets Corp. is acting as the financial advisor to Casey’s General Stores, while BofA Securities is advising Fikes Wholesale, Inc.

Deal 5: Chuy's Holdings, Inc. (United States) was acquired by Darden Restaurants, Inc. (United States) for USD 0.61 billion.

Darden Restaurants, Inc. to Acquire Chuy's Holdings, Inc.

Chuy’s Holdings, the popular Tex-Mex restaurant chain, is set to be acquired by Darden Restaurants for USD 605 million, or USD 37.50 per share, in an all-cash transaction. This acquisition will enhance Darden’s diverse portfolio, which includes well-known dining brands such as Olive Garden, LongHorn Steakhouse, and Ruth’s Chris Steak House.

With this deal, Darden will integrate Chuy’s 101 locations across 15 states into its existing network of approximately 1,900 restaurants operating nationwide. This expansion will bolster Darden’s presence in the casual dining segment and diversify its offerings within the restaurant industry.

The acquisition is anticipated to be finalized in Darden’s fiscal second quarter. BofA Securities is serving as the financial advisor to Darden, while Piper Sandler is advising Chuy’s on the transaction.

August

Consumer Products and Services

Deal 1: Kellanova (United States) was acquired by Mars, Incorporated (United States) for USD 35.90 billion.

Mars, Incorporated to acquire Kellanova

Mars, a leading name in the confectionery industry, has agreed to acquire Kellanova in a USD 35.9 billion deal, including debt. This acquisition will significantly strengthen Mars’s position in the global snack market and could potentially double its snack business within the next decade.

Kellanova, formerly Kellogg Co., owns well-known brands like Cheez-It, Pop-Tarts, Pringles, Nutri-Grain, and Eggo. With 2023 net sales over USD 13 billion, the company operates in 180 markets and employs around 23,000 people.

This transaction, the largest M&A deal of the year, will bring two billion-dollar brands—Pringles and Cheez-It—under Mars’s umbrella, adding to its existing portfolio of 15 major brands. It will also enhance Mars’s health and wellness snack offerings with RXBAR and Nutri-Grain, in line with the trend toward healthier snacks.

The expanded portfolio will cater to diverse consumer tastes across various price points, especially in fast-growing regions like Africa and Latin America. The integration of supply chains and local operations will further boost market reach.

Mars aims to finalize the acquisition by mid-2025, financing it with a combination of cash reserves and new debt. Citi is serving as Mars’s financial advisor, with J.P. Morgan and Citi also providing financing support. Goldman Sachs is advising Kellanova on the transaction.

Deal 2: Vector Group Ltd. (United States) was acquired by Japan Tobacco Inc. (Japan) for USD 2.40 billion.

Japan Tobacco Inc. to Acquire Vector Group Ltd.

Japan Tobacco Inc. (JT) is set to acquire Vector Group Ltd., the fourth-largest tobacco company in the United States, in a USD 2.4 billion deal. This strategic move marks JT’s shift towards expanding its footprint in the U.S. market, which has become increasingly important due to growth challenges in Russia caused by geopolitical tensions. As the second-largest tobacco market globally by net sales, the U.S. offers significant opportunities for JT.

JT Group, recognized for its global tobacco portfolio, produces and markets well-known brands such as Winston and Camel (outside the U.S.), along with MEVIUS and LD, across more than 130 countries. The acquisition of Vector Group will notably increase JT’s U.S. market share from 2.3% to 8%.

Furthermore, JT plans to use the cash flow from this acquisition to bolster its investment in heated tobacco products. JT, in partnership with Altria Group, is working to introduce its Ploom heated tobacco line to the U.S. market. Earlier this year, JT announced a 50% increase in spending on this segment to explore new market opportunities.

The transaction is anticipated to close by the end of 2024, after which Vector Group will become a wholly-owned subsidiary of JT and will be delisted from the New York Stock Exchange. Jefferies LLC served as the exclusive financial advisor to Vector Group, while J.P. Morgan Securities acted as the exclusive financial advisor to JT Group.

Deal 3: Cheney Bros., Inc. (United States) was acquired by Performance Food Group Company (United States) for USD 2.10 billion.

Performance Food Group Company to Acquire Cheney Bros., Inc.

Performance Food Group Company (PFG) has announced its acquisition of Cheney Bros., a major foodservice distributor, in a strategic move to bolster its presence in the Southeast and broaden its distribution network. Valued at USD 2.1 billion, the all-cash deal is anticipated to finalize in 2025.

Cheney Bros. caters to a wide range of clients, including independent restaurants, restaurant chains, hotels, country clubs, and institutional groups, generating annual net sales of USD 3.2 billion.

The integration of Cheney Bros.’ distribution network will enhance PFG’s platform by adding five state-of-the-art broadline distribution centers in key states such as Florida, Georgia, North Carolina, and South Carolina. These facilities will provide additional capacity for future expansion.

Although Cheney Bros. has a significant presence among independent restaurants, its private brand portfolio is relatively modest. PFG intends to utilize its extensive private brand offerings to boost sales within Cheney Bros.’ independent restaurant segment.

J.P. Morgan is advising PFG on the transaction, while Morgan Stanley & Co. LLC is providing counsel to Cheney Bros.

Deal 4: Shenzhen Yinwang Intelligent Technology Co., Ltd. (China) was acquired by Seres Automobile Co., Ltd. (China) for USD 1.61 billion.

Seres Automobile Co., Ltd. to Acquire Shenzhen Yinwang Intelligent Technology Co., Ltd.

Chinese automaker Seres has unveiled its intention to acquire a 10% stake in Huawei’s Shenzhen Yinwang Intelligent Technology Co., Ltd., valued at CNY 11.5 billion (USD 1.61 billion). This investment makes Seres the second Chinese automaker to take a stake in Huawei’s intelligent driving subsidiary. The acquisition is expected to drive Seres’ growth and enhance its Aito smart new energy vehicle brand, which is developed in collaboration with Huawei, aiming to elevate it into a leading luxury brand.

Yinwang benefits from Huawei’s cutting-edge intelligent automotive technologies. Huawei is dedicated to supporting Yinwang in maintaining its leadership in the industry and advancing the intelligent transformation of automotive technology. This acquisition strengthens the strategic alliance between Huawei and Seres, paving the way for further development of the Aito brand and the launch of new products.

This deal follows a similar move by Changan Automobile, which recently saw Avatr Technology—a joint venture between Changan, Huawei, and Contemporary Amperex Technology Co.—acquire a 10% stake in Shenzhen Yinwang.

Huawei utilizes three partnership models with automotive manufacturers: as a vertical parts supplier, an intelligent systems provider through the Huawei Inside model, and a full-set solutions provider via the Harmony Intelligent Mobility Alliance. The collaboration with Seres on the Aito brand falls under the full-set solutions provider model.

Deal 5: Shenzhen Yinwang Intelligent Technology Co., Ltd. (China) was acquired by Avatr Technology Co Ltd (China) for USD 1.61 billion.

Avatr Technology Co., Ltd to Acquire Shenzhen Yinwang Intelligent Technology Co., Ltd.

Avatr Technology will acquire a 10% stake in Huawei’s smart car subsidiary, Yinwang Intelligent Technology Co. Ltd., for USD 1.6 billion.

Yinwang is dedicated to developing advanced automotive systems and components that integrate artificial intelligence (AI) and AI-based software.

Avatr Technology, a joint venture between Changan and CATL—the largest battery manufacturer globally—will strengthen its strategic relationship with Huawei through this investment. The deal follows a November agreement between Huawei and Changan to co-invest in a smart automotive technology firm. Huawei will retain a 90% ownership stake in Yinwang.

For Avatr Technology, this move will strengthen its position in the electric vehicle sector and aid Changan’s transition to becoming a technology-driven company focused on smart, low-carbon mobility. Huawei, on the other hand, aims to expand its emerging smart EV business and counteract the effects of U.S. sanctions on its other operations through this investment.

September

Consumer Products and Services

Deal 1: Nordstrom, Inc. (United States) was acquired by El Puerto de Liverpool, S.A.B. de C.V. (Mexico) for USD 3.80 billion.

El Puerto de Liverpool, S.A.B. de C.V. to acquire Nordstrom, Inc.

Mexican retail giant Liverpool has submitted a buyout proposal for the U.S. department store chain Nordstrom, spearheaded by CEO Erik Nordstrom, President Pete Nordstrom, and other members of the Nordstrom family. This cash offer is valued at USD 3.8 billion, translating to USD 2.3 per share, presenting Liverpool with a substantial opportunity for geographic diversification.

With over 300 stores throughout Mexico, Liverpool boasts a strong e-commerce presence and a range of financial services, including 7.2 million store credit card holders. Additionally, the company operates nearly 120 boutiques for U.S. brands like Gap, Banana Republic, Williams Sonoma, Pottery Barn, West Elm, MAC, and Kiehl’s.

Currently, Liverpool owns approximately 9.6% of Nordstrom’s stock. If the acquisition is successful, Liverpool and the Nordstrom family would control 49.9% and 50.1% of Nordstrom’s capital stock, respectively.

Nordstrom’s special committee is being advised by Morgan Stanley & Co. LLC and Centerview Partners LLC as they evaluate the buyout proposal.

Deal 2: CALA Group Limited (United Kingdom) was acquired by Patron Capital Limited (United Kingdom), and Sixth Street Partners, LLC (United States) for USD 1.80 billion.

Sixth Street Partners, LLC; Patron Capital Limited to Acquire CALA Group Limited

Cala Group, a notable UK housebuilder, has been acquired by global investment firm Sixth Street Partners and Patron Capital, a pan-European institutional investor focused on property-backed assets, for GBP 1.35 billion (approximately USD 1.80 billion) from Legal & General (L&G).

Cala Group is renowned for its dedication to high-quality construction and possesses a substantial landbank, primarily developing luxury homes across the South of England, the Cotswolds, and Scotland. The company has set an ambitious target to deliver 3,000 new homes by the end of 2024.

This acquisition reflects a larger trend in the UK housebuilding sector, where developers are adapting to a challenging environment marked by increasing mortgage rates while looking forward to a potential market recovery driven by declining interest rates.

For Legal & General, this divestment is a strategic move aimed at optimizing operations and concentrating on its primary business functions.

Under its new ownership, Cala Group is poised to embark on its next growth phase. The transaction is anticipated to close in the fourth quarter of 2024.

Deal 3: LG Display's LCD plant in Guangzhou, China (China) was acquired by Shenzhen China Star Optoelectronics Technology Co., Ltd. (China) for USD 1.54 billion.

Shenzhen China Star Optoelectronics Technology Co., Ltd. to Acquire LG Display's LCD plant in Guangzhou, China

LG Display, a prominent South Korean flat-screen manufacturer, has announced plans to divest a significant liquid crystal display (LCD) manufacturing facility in China, selling it for CNY 10.8 billion (approximately USD 1.54 billion) to TCL China Star Optoelectronics Technology (TCL CSOT), a leading Chinese display producer.

As part of the agreement, TCL CSOT will acquire 80% of LG Display’s 8.5-generation LCD panel plant, along with its entire LCD module factory. The 8.5-generation facility specializes in producing large television panels and has a monthly output capacity of 180,000 units. In the previous year, the plant achieved a net profit of CNY 600 million (around USD 85.6 million) on revenues of CNY 6.3 billion (approximately USD 898.5 million). The module factory, which can produce 2.3 million units monthly, reported a profit of CNY 536 million and revenues of CNY 11.9 billion.

Located in Guangzhou, LG Display’s factories primarily supply panels to both South Korean and Chinese television manufacturers, including industry leaders such as Samsung Electronics, LG Group, and Skyworth Group.

This divestiture signifies the conclusion of LG Display’s LCD production operations in China. The sale is considered a strategic step toward improving asset efficiency, as the LCD segment has been a significant contributor to the company’s ongoing financial losses. This transaction is expected to enhance LG Display’s financial flexibility, allowing the company to focus more intently on OLED technology. Moreover, it presents an opportunity for LG Display to reposition itself in the highly competitive and oversaturated large LCD market, where it faces intense pressure from cost-effective Chinese rivals.

The completion of the deal is anticipated by March 31, 2025. The transaction is projected to close by March 31, 2025, with Latham & Watkins serving as legal advisor to LG Display.

Deal 4: K.W. Bruun Import/K.W. Bruun NxT (Denmark) was acquired by Global Auto Holdings Limited (United Kingdom) for USD 1.20 billion.

Global Auto Holdings Limited to Acquire K.W. Bruun Import/K.W. Bruun NxT

Global Auto Holdings, Canada’s leading automotive retailer, is set to acquire K.W. Bruun Import, one of Denmark’s largest car importers, for approximately USD 1.2 billion, including debt. This acquisition encompasses K.W. Bruun’s extensive workshop chain, K.W. Bruun NxT.

With over 70 years of experience, K.W. Bruun Import has established itself as a significant player in the Nordic region, specializing in the import and distribution of new vehicles and OEM-branded spare parts for various Stellantis brands, including Peugeot, Citroen, DS, Opel, Fiat, Fiat Pro, Alfa Romeo, and Jeep, as well as Mitsubishi in Denmark.

Through this acquisition, Global Auto Holdings aims to enhance its position as a global leader in automotive retail and related services, emphasizing digital transformation and expanding its role as a major car importer in Europe.

This marks Global Auto’s second expansion into the European market; last year, it acquired U.K. competitor Lookers for approximately USD 645 million, gaining nearly 150 dealerships and additional assets, including a fleet and leasing business.

The transaction is anticipated to finalize in December 2024, with BNP Paribas serving as the lead financial adviser for Global Auto.

Deal 5: Yonghui Superstores Co., Ltd. (China) was acquired by Miniso Group Holdings Limited (China) for USD 0.89 billion.

Miniso Group Holdings Limited to Acquire Yonghui Superstores Co., Ltd.

Miniso Group, a global value retailer, is acquiring a 29.4% equity stake in Yonghui Superstores for approximately CNY 6.3 billion (USD 893 million).

Yonghui Superstores is a well-established retail chain in China, operating around 850 supermarkets that provide fresh produce and everyday necessities to consumers. Notably, it was one of the first distribution enterprises in the China to incorporate fresh produce into modern supermarkets, solidifying its status as the second-largest supermarket chain in the country by sales.

This acquisition offers significant growth opportunities for Miniso and aims to deliver long-term value for our shareholders. With Miniso’s design-focused product expertise, Yonghui is well-positioned to enhance its portfolio of self-branded products, catering to the evolving preferences of consumers. Additionally, the collaboration between Miniso and Yonghui on retail channel upgrades and supply chain optimization will facilitate resource sharing, enabling enhanced economies of scale and cost efficiencies while creating additional value for customers.

Furthermore, this strategic move will broaden Miniso’s access to the essential goods sector, facilitating business diversification and reducing cyclical risks.

The completion of this transaction is anticipated in the first half of 2025.

October

Consumer Products and Services

Deal 1: Nord Anglia Education Limited (United Kingdom) was acquired by Neuberger Berman Group LLC (United States), Canada Pension Plan Investment Board (Canada), and EQT Private Capital Asia (Hong Kong) for USD 14.50 billion.

Neuberger Berman Group LLC; Canada Pension Plan Investment Board; EQT Private Capital Asia to acquire Nord Anglia Education Limited

Neuberger Berman has joined EQT and CPP Investments in acquiring the UK-based private school operator Nord Anglia Education for USD 14.5 billion. This acquisition reinforces Nord Anglia’s commitment to delivering premium educational experiences and nurturing future global leaders and innovators.

Nord Anglia operates a network of over 80 international schools across 33 countries, serving more than 85,000 students aged 2 to 18. Through exclusive partnerships with leading institutions, such as UNICEF, MIT, Juilliard, and IMG Academy, along with its proprietary digital learning platforms, Nord Anglia offers unique and enriched educational opportunities.

With Neuberger Berman as a new strategic partner, the consortium reaffirms its dedication to Nord Anglia’s growth through both organic and acquisition-driven strategies. Neuberger Berman, EQT, and CPP Investments will collaborate closely with Nord Anglia to lead it into its next growth phase, further expanding its ability to deliver quality education in major global markets.

This acquisition builds on EQT’s long-standing relationship with Nord Anglia, which began in 2008 and saw an expansion in 2017 when CPP Investments joined as a partner, marking CPP Investments’ first direct equity venture in private education. Neuberger Berman, alongside other global institutional investors, joins as a new stakeholder.

Goldman Sachs, J.P. Morgan, and Morgan Stanley serve as lead financial advisors to Nord Anglia, with Lazard advising on private capital matters. Deutsche Bank and HSBC are also engaged as financial advisors.

Deal 2: Professional Bull Riders, On Location, and IMG (United States) was acquired by TKO Group (United States) for USD 3.25 billion.

TKO Group to Acquire Professional Bull Riders, On Location, and IMG

TKO Group, the parent company of WWE and UFC, is broadening its reach into related sports and entertainment assets by acquiring Professional Bull Riders, On Location, and IMG from Endeavor Group in an all-stock transaction valued at USD 3.25 billion.

Professional Bull Riders operates over 200 live events each year, drawing approximately 1.25 million fans and reaching more than 285 million households across 65 territories. On Location is a premier live event company, managing experiences for over 1,200 high-profile events, including the Super Bowl, Ryder Cup, and NCAA Final Four. IMG is a prominent distributor and producer of sports content, responsible for managing media rights, brand partnerships, consulting, digital services, and event management for clients such as the NFL and NHL. However, the acquisition of IMG excludes its licensing, models and tennis representation, and certain segments of its event portfolio.

This strategic acquisition enhances TKO’s position in the rapidly growing premium sports market, allowing direct engagement with lucrative opportunities through media rights, live events, ticket sales, premium experiences, brand partnerships, and venue fees. By broadening its operational footprint, TKO aims to strengthen its market presence and drive sustainable growth, ultimately increasing shareholder value.

This sale is part of Endeavor’s strategy to streamline its assets as it considers going private in a potential deal with private equity firm Silver Lake.

The transaction is expected to close in the first half of 2025, increasing Endeavor’s ownership stake in TKO from 53% to 59%, while existing TKO shareholders will retain 41%. Morgan Stanley & Co. LLC is acting as the financial advisor for TKO in this acquisition.

Deal 3: JDE Peet's N.V. (Netherlands) was acquired by Jab Holding Company S.à.R.L. (Luxembourg) for USD 2.30 billion.

Jab Holding Company S.à.R.L. to Acquire JDE Peet's N.V.

German conglomerate JAB Holding Company is set to increase its stake in Dutch coffee producer JDE Peet’s to 68% by acquiring 86 million shares from Mondelez for USD 2.30 billion.

Recognized as the world’s leading pure-play coffee and tea enterprise, JDE Peet’s manages an extensive portfolio of over 50 brands, including L’OR, Peet’s Coffee, Jacobs, Senseo, Tassimo, Douwe Egberts, OldTown, Super, Pickwick, and Moccona.

With more than USD 50 billion in managed assets, JAB focuses on fast-moving consumer goods (FMCG), including coffee, soft drinks, and confectionery, as well as investments in hospitality and insurance. JAB also holds a controlling interest in Panera Brands, which includes fast-casual chains such as Panera Bread, Caribou Coffee, and Einstein Bros. Bagels, in addition to UK-based Pret A Manger and Sweden’s Espresso House. Furthermore, JAB maintains minority stakes of 44% in Krispy Kreme and 34% in Keurig Dr Pepper.

This acquisition represents a meaningful development for JDE Peet’s, reinforcing its status as a recognized blue-chip company. JAB’s investment indicates confidence in the stability of the global coffee market and the long-term growth prospects of JDE Peet’s. Additionally, JAB has distributed 43 million shares—representing 9% of the company’s total share capital—to over 70 limited partners within JAB Consumer Partners (JCP), increasing JDE Peet’s public float to 32% and improving its market visibility.

Deal 4: The Duckhorn Portfolio, Inc. (United States) was acquired by Butterfly Equity LP (United States) for USD 1.95 billion.

Butterfly Equity LP to Acquire The Duckhorn Portfolio, Inc.

California-based luxury wine producer Duckhorn is poised for acquisition by private equity firm Butterfly Equity in a USD 1.95 billion cash transaction.

Duckhorn is renowned for its high-end wine offerings and boasts a curated selection of premium brands, including Duckhorn Vineyards, Decoy, Sonoma-Cutrer, and Kosta Browne. Its products reach luxury consumers in over 50 countries across five continents.

Butterfly Equity, which specializes in investments within the food and beverage industry, holds a diverse portfolio that includes Milk Specialties Global, Chosen Foods, MaryRuth Organics, Orgain, Bolthouse Fresh Foods, and QDOBA. With deep expertise in the sector, a data-driven investment strategy, and a hands-on operational approach, Butterfly aims to drive Duckhorn’s continued growth and expansion.

J.P. Morgan Securities LLC is acting as the financial advisor for Duckhorn, while KKR Capital Markets LLC is providing capital markets advisory services to Butterfly Equity.

Deal 5: Garza Food Ventures, LLC (United States) was acquired by PepsiCo, Inc. (United States) for USD 1.20 billion.

PepsiCo, Inc. to Acquire Garza Food Ventures, LLC (Siete Foods)

Food and beverage powerhouse PepsiCo is acquiring Garza Food Ventures (Siete Foods) for USD 1.2 billion, significantly enhancing its snacking portfolio in response to the growing demand for value-driven brands among budget-conscious consumers.

Siete Foods is known for its authentic, heritage-inspired offerings, which include tortillas, salsas, seasonings, sauces, cookies, and snacks. The brand’s products are widely available in over 40,000 grocery stores, club stores, and organic food retailers across the United States.

This acquisition will further diversify PepsiCo’s portfolio by integrating a well-established Mexican-American brand, while also expanding its better-for-you food segment. Siete’s products are expected to bring a fresh, vibrant dimension to PepsiCo’s multicultural range, offering consumers flavorful and culturally significant food choices that align with a variety of dining occasions.

The deal is anticipated to close in the first half of 2025. Centerview Partners LLC is serving as the lead financial advisor to PepsiCo, while Lazard is advising Siete Foods.

November

Consumer Products and Services

Deal 1: North American Premium Cat feeding and Pet Treating Business of Whitebridge Pet Brands, LLC (United States) was acquired by General Mills, Inc. (United States) for USD 1.45 billion.

General Mills, Inc. to acquire North American Premium Cat feeding and Pet Treating Business of Whitebridge Pet Brands, LLC

General Mills has unveiled plans to acquire the North American premium cat feeding and pet treating division of Whitebridge Pet Brands from NXMH for USD 1.45 billion. This acquisition represents the fifth deal General Mills has announced or completed within the pet care segment, underscoring its commitment to this growing market.

The acquisition includes the Tiki Pets and Cloud Star brands, which are recognized leaders in the cat feeding and pet treating segments—key categories that account for USD 24 billion of the broader USD 52 billion U.S. pet food market. These brands will complement General Mills’ existing Blue Buffalo portfolio, reinforcing its position in the high-growth premium pet food space and driving incremental growth in cat feeding and treats.

This transaction aligns with General Mills’ Accelerate strategy, which focuses on fostering long-term growth by prioritizing key markets and brands, expanding into adjacent categories, and improving operational efficiency to achieve sustainable and profitable growth.

The deal is expected to close in the third quarter of fiscal 2025. General Mills plans to finance the acquisition through a combination of cash on hand and new debt. Legal counsel for General Mills is being provided by Paul, Weiss, Rifkind, Wharton & Garrison LLP, while NXMH is advised by Houlihan Lokey as its exclusive financial advisor.

Deal 2: Personal Protective Equipment Business of Honeywell International Inc. (United States) was acquired by Protective Industrial Products, Inc. (United States) for USD 1.33 billion.

Protective Industrial Products, Inc. to Acquire Personal Protective Equipment Business of Honeywell International Inc.

Honeywell is divesting its Personal Protective Equipment (PPE) business to Protective Industrial Products (PIP) for USD 1.33 billion in cash. PIP is a leading global supplier of PPE products to industrial wholesalers and distributors.

The PPE business being sold encompasses a wide range of trusted brands serving a varied customer base through an extensive distributor network worldwide. With approximately 5,000 employees, the business benefits from a streamlined global manufacturing and distribution structure, featuring 20 manufacturing facilities and 17 distribution centers across the U.S., Mexico, Europe, North Africa, Asia Pacific, and China. Key brands within the portfolio include Fendall, Fibre-Metal, Howard Leight, KCL, Miller, Morning Pride, North, Oliver, Salisbury, and UVEX, among others.

This acquisition enhances PIP’s already broad product offering, which spans hand protection, head and face protection, workwear, and footwear, and is supported by operations in 35 locations across 18 countries. The addition of Honeywell’s PPE business will not only expand PIP’s brand portfolio but also strengthen its global presence, unlocking new growth opportunities for its customers.

The deal is anticipated to close in the first half of 2025.

Deal 3: LYNK & CO Automotive Technology Co., Ltd. (China) was acquired by ZEEKR Intelligent Technology Holding Limited (China) for USD 1.24 billion.

ZEEKR Intelligent Technology Holding Limited to Acquire LYNK & CO Automotive Technology Co., Ltd.

Zeekr, China’s premium electric vehicle (EV) brand, is acquiring a 50% stake in Lynk & Co for CNY 9 billion (approximately USD 1.24 billion), raising its ownership to a controlling 51%. Both Zeekr and Lynk & Co are brands under Geely, one of China’s leading automotive groups.

This acquisition is part of a broader strategic shift under the leadership of Li Shufu, the billionaire behind Geely Auto, one of China’s largest EV manufacturers. As part of the consolidation, Geely Holding will transfer 20% of its shares in Lynk & Co to Zeekr, while Volvo Cars will divest 30%. Once the transaction is complete, Zeekr will hold a 51% controlling stake in Lynk & Co, with Geely maintaining a 49% interest, while Volvo Cars will exit the venture entirely.

The integration of Zeekr and Lynk & Co comes in response to overlapping product offerings and unclear brand positioning, which have limited their individual growth potential. By consolidating their operations, the brands aim to enhance market coverage and eliminate intra-brand competition. However, the success of this strategy in the competitive new energy vehicle (NEV) market remains uncertain.

Despite the merger, Geely plans to retain a dual-brand strategy, allowing Zeekr and Lynk & Co to remain distinct and relatively independent. Geely Holdings envisions the two brands becoming globally competitive luxury new energy vehicle players, with a target of producing and selling more than one million units annually by the end of 2026, solidifying its leadership in the rapidly growing EV sector.

Deal 4: Rakuten Card Co.,Ltd. (Japan) was acquired by Mizuho Financial Group, Inc. (Japan) for USD 1.06 billion.

Mizuho Financial Group, Inc. to Acquire Rakuten Card Co.,Ltd.

Japan’s Mizuho Financial Group has reached an agreement to acquire a 14.99% stake in Rakuten Card, a financial services arm of Rakuten, Inc., for approximately USD 1.06 billion, further strengthening the strategic partnership between the two companies.

This move is part of an ongoing collaboration involving Mizuho FG, Mizuho Bank, UC Card, Orient Corporation, Rakuten Group, and Rakuten Card, aimed at advancing Japan’s digital payments ecosystem.

Mizuho and Rakuten have been working together to develop innovative retail business models focused on asset building and management by combining their financial expertise and fintech capabilities. As part of the partnership, they plan to launch a new co-branded credit card for retail customers in December. This card will offer Rakuten Points and benefits such as reduced ATM fees.

Additionally, the collaboration will introduce a digital installment payment option on Rakuten Ichiba, enabling immediate approval and repeat use. For corporate clients, Mizuho FG and Rakuten Group aim to streamline payment processes and digitalize transactions for Rakuten Card’s extensive network of approximately 900,000 affiliate stores.

This transaction is expected to generate a special profit of USD 1.02 billion in the financial year ending December.

Deal 5: ZEEKR Intelligent Technology Holding Limited (China) was acquired by Geely Automobile Holdings Limited (China) for USD 0.81 billion.

Geely Automobile Holdings Limited to Acquire ZEEKR Intelligent Technology Holding Limited

As part of its strategic plan to optimize operations and drive cost efficiencies across its diverse portfolio, Geely will acquire an additional 11.3% stake in Zeekr for USD 806 million, increasing its ownership to 62.8%.

This move enhances Geely’s control over Zeekr, strengthening its ability to leverage synergies between its brands, including Lynk & Co and Polestar, and reinforcing its position in the rapidly evolving global electric vehicle (EV) market.

Zeekr, a leader in premium electric mobility and connected vehicle technology, is set to drive innovation within the group, sharing its advancements with other Geely brands. In 2024, Zeekr achieved impressive growth, selling nearly 143,000 vehicles in the first nine months, an 81% increase compared to the same period last year.

This acquisition further positions Geely to capitalize on the growing demand for electric and connected vehicles, solidifying its future in the high-end EV segment.

M&A Activity in the Software and IT Industry

The top global M&A deals in this sector are at the heart of the digital revolution. This industry list includes companies that develop software, provide IT services, and offer technological solutions driving innovation and efficiency.

January

Software and IT

- Deal 1: ANSYS, Inc. (United States) was acquired by Synopsys, Inc. (United States) for USD 35.00 billion.

- Deal 2: Juniper Networks, Inc. (United States) was acquired by Hewlett Packard Enterprise Company (United States) for USD 14.00 billion.

- Deal 3: Procare Software, LLC (United States) was acquired by Roper Technologies, Inc. (United States) for USD 1.75 billion.

- Deal 4: Pagero Group AB (Sweden) was acquired by Thomson Reuters Finance S.A. (Luxembourg) for USD 0.80 billion.

- Deal 5: Habu, Inc. (United States) was acquired by LiveRamp, Inc. (United States) for USD 0.20 billion.

February

Software and IT

- Deal 1: Altium Limited (Australia) was acquired by Renesas Electronics Corporation (Japan) for USD 5.90 billion.

- Deal 2: Yandex LLC (Russia) was acquired by Multiple Buyers Including Russia-Based Yandex Senior Managers and Oil Company Lukoil (Russia) for USD 5.20 billion.

- Deal 3: End-User Computing Division of Broadcom Inc. (United States) was acquired by KKR & Co. Inc. (United States) for USD 4.00 billion.

- Deal 4: Everbridge, Inc. (United States) was acquired by Thoma Bravo, L.P. (United States) for USD 1.50 billion.

- Deal 5: Marlowe PLC’s Governance, Risk & Compliance Software and Services Assets (United Kingdom) was acquired by Inflexion Private Equity Partners LLP (United Kingdom) for USD 0.50 billion.

March

Software and IT

- Deal 1: Beta Cae Systems International Ag (Switzerland) was acquired by Cadence Design Systems, Inc. (United States) for USD 1.24 billion.

- Deal 2: Jama Software, Inc. (United States) was acquired by Francisco Partners Management, L.P. (United States) for USD 1.20 billion.

- Deal 3: One Network Enterprises, Inc. (United States) was acquired by Blue Yonder Group, Inc. (United States) for USD 0.84 billion.

- Deal 4: SanDisk Semiconductor (Shanghai) Co. Ltd (China) was acquired by JCET Management Co., Ltd. (China) for USD 0.62 billion.

- Deal 5: TASK Group Holdings Limited (Australia) was acquired by PAR Technology Corporation (United States) for USD 0.21 billion.

April

Software and IT

- Deal 1: ChampionX Corporation (United States) was acquired by Schlumberger Limited (United States) for USD 7.80 billion.

- Deal 2: HashiCorp, Inc. (United States) was acquired by International Business Machines Corporation (United States) for USD 6.40 billion.

- Deal 3: Darktrace plc (United Kingdom) was acquired by Thoma Bravo, L.P. (United States) for USD 5.32 billion.

- Deal 4: Matterport, Inc. (United States) was acquired by CoStar Group, Inc. (United States) for USD 1.60 billion.

- Deal 5: Model N, Inc. (United States) was acquired by Vista Equity Partners Management, LLC (United States) for USD 1.25 billion.

May

Software and IT

- Deal 1: Squarespace, Inc. (United States) was acquired by Accel Partners (United States), General Atlantic Service Company, L.P. (United States), and Permira Advisers LLC (United States) for USD 6.90 billion.

- Deal 2: AuditBoard, Inc. (United States) was acquired by HgCapital LLP (United Kingdom), and HgCapital Trust plc (United Kingdom) for USD 3.00 billion.

- Deal 3: Software Integrity Group Business of Synopsys, Inc. (United States) was acquired by Francisco Partners Management, L.P. (United States), and Clearlake Capital Group, L.P. (United States) for USD 2.10 billion.

- Deal 4: Venafi, Inc. (United States) was acquired by CyberArk Software Ltd. (Israel) for USD 1.54 billion.

- Deal 5: Foodpanda Taiwan Co., Ltd. (Taiwan) was acquired by Uber Eats (United States) for USD 0.95 billion.

June

Software and IT

Deal 1: Aareon AG (Germany) was acquired by Caisse de dépôt et placement du Québec (Canada), and TPG Capital, L.P. (United States) for USD 4.20 billion.

Caisse de dépôt et placement du Québec; TPG Capital, L.P. to acquire Aareon AG

Aareal Bank and Advent International have announced the sale of Aareon AG, a leading European provider of Software-as-a-Service (SaaS) solutions for the property industry, to TPG and Caisse de dépôt et placement du Québec (CDPQ) for EUR 3.9 billion (USD 4.2 billion).

Aareon AG is renowned for its innovative Property Management System solutions, which enhance efficient and sustainable property management and maintenance. The company’s comprehensive portfolio supports seamless, automated end-to-end processes, connecting property managers and owners across both residential and commercial real estate sectors.

This strategic acquisition by TPG will provide Aareon with enhanced resources and expertise to drive further innovation and growth. TPG will channel its investment through TPG Capital, its U.S. and European private equity platform, with CDPQ co-investing and acquiring a minority stake in Aareon.

The deal is expected to close in the latter half of 2024. Arma Partners served as the lead financial advisor, with Goldman Sachs also advising Advent International and Aareal. Morgan Stanley & Co. International Plc provided financial advisory services to TPG and CDPQ.

Deal 2: WalkMe Ltd. (Israel) was acquired by SAP SE (Germany) for USD 1.50 billion.

SAP SE to acquire WalkMe Ltd.

Enterprise software giant SAP SE is set to acquire Israeli software firm WalkMe for USD 1.5 billion in cash.

WalkMe specializes in digital adoption platforms (DAPs), offering solutions that help organizations navigate ongoing technology changes. Their advanced guidance and automation features enable seamless workflow execution across diverse applications, driving higher adoption rates and enhancing overall value for customers such as IBM, Nestle, Thermo Fisher Scientific, and the U.S. Department of Defense.

WalkMe’s platform automatically maps an organization’s software landscape and collects usage data for optimizing software licenses and procurement strategies. This acquisition will complement SAP’s Business Transformation Management portfolio, enhancing its SAP Signavio and SAP LeanIX solutions to better support customers in their transformation journeys.

WalkMe is also set to launch WalkMeX, an innovative AI-powered copilot designed to provide contextual guidance and suggest optimal workflows across various applications. This capability, which operates as an overlay compatible with different vendor copilots, promises to significantly boost productivity and efficiency. By combining WalkMe’s digital adoption capabilities with SAP’s AI assistant, Joule, SAP customers will experience enhanced AI assistant functionality and productivity gains.

The acquisition is slated to close in the third quarter of 2024.

Deal 3: Belcan, LLC (United States) was acquired by Cognizant Domestic Holdings Corporation (United States) for USD 1.30 billion.

Cognizant Domestic Holdings Corporation to acquire Belcan, LLC

Cognizant, a leading provider of digital, technology, and consulting services, has announced its acquisition of Belcan, a prominent digital engineering firm, for USD 1.3 billion in cash and stock. This transaction comprises USD 1.19 billion in cash and 1.47 million shares of Cognizant stock valued at USD 97 million.

Belcan operates a global workforce of 10,000 employees across 60 locations worldwide, serving high-profile clients such as Boeing, General Motors, Rolls-Royce, NASA, and the U.S. Navy.

The acquisition strategically positions Cognizant to strengthen its presence in the expanding Engineering Research & Development (ER&D) services market, which is projected to grow at a robust CAGR of over 10% through 2026. Belcan’s extensive engineering capabilities and domain expertise in aerospace & defense will complement Cognizant’s scale and decades-long digital engineering proficiency. This integration will provide Belcan’s prestigious client base access to Cognizant’s advanced AI, Cloud, and Data technologies, leveraging a combined team of over 6,500 engineers and technical consultants.

The acquired business is expected to contribute revenue exceeding USD 800 million annually to Cognizant starting in 2024, depending on the timing of the transaction closure, which is anticipated in Q3 2024.

Financial advisory services for Cognizant were provided by Perella Weinberg Partners, while Jefferies and Solomon Partners acted as financial advisors to Belcan.

Deal 4: eStruxture Data Centers Inc. (Canada) was acquired by Fengate Asset Management (Canada) for USD 1.30 billion.

Fengate Asset Management to acquire eStruxture Data Centers Inc.

Fengate Asset Management, a Toronto-based alternative asset managerhas acquired eStruxture Data Centers for CAD 1.8 billion (USD 1.3 billion), marking the largest transaction in Canada’s data center sector. Fengate now holds over two-thirds equity in eStruxture, following the purchase of shares previously held by Caisse de dépôt et placement du Québec (CDPQ).

The acquisition was funded with capital from institutional secondary investors, co-led by Partners Group and Pantheon. Investors also include Fengate Infrastructure Fund III and IV, as well as affiliated entities such as LiUNA’s Pension Fund of Central and Eastern Canada.

Significant stakeholders, including Jonathan Wener and the Wener Family Office, along with Todd Coleman, Founder, President, and CEO of eStruxture, and the company’s management team, will reinvest a substantial portion of their holdings in the firm.

As major technology companies continue to expand their cloud operations in Canada and increasingly rely on AI and machine learning, eStruxture is poised to meet these demands with scalable and sustainable data center solutions. This strategic acquisition is expected to accelerate eStruxture’s growth in hyperscale infrastructure, supporting its expansion and solidifying its leadership in Canada’s digital infrastructure market.

Financial advisory services for eStruxture were provided by DH Capital, while Campbell Lutyens served as Fengate’s exclusive financial advisor for the transaction.

Deal 5: Tegus, Inc. (United States) was acquired by AlphaSense, Inc. (United States) for USD 0.93 billion.

AlphaSense, Inc. to Acquire Tegus, Inc.

AI research firm AlphaSense has acquired rival Tegus, a significant provider of expert research, private company content, financial data, and workflow tools, in a transaction valued at USD 930 million.

This acquisition follows AlphaSense’s successful securing of a new USD 650 million funding round, co-led by Viking Global Investors and BDT & MSD Partners, with additional participation from J.P. Morgan Growth Equity Partners, SoftBank Vision Fund 2, Blue Owl, Alkeon Capital, and existing investors Alphabet Inc.’s CapitalG and Goldman Sachs Alternatives.

AlphaSense offers a comprehensive market intelligence platform utilized by asset management firms to identify investment opportunities through access to public and private content, including equity research, company filings, transcripts, and news. The company also provides an AI-powered enterprise solution that enables organizations to centralize and leverage their market intelligence with advanced search, summarization, and monitoring capabilities.

With Tegus’ extensive library covering more than 35,000 public and private companies across sectors including technology, media, consumer goods, energy, and life sciences, along with financial data on over 4,000 public companies, this acquisition strengthens AlphaSense’s competitive edge against industry leaders like Bloomberg L.P., Exabel AS, and FactSet.

AlphaSense’s client roster includes notable firms such as SAP SE, 3M, and Google, among others.

The transaction is expected to close in the third quarter of 2024, with Goldman Sachs & Co. LLC acting as AlphaSense’s financial advisor.

July

Software and IT

Deal 1: Instructure Holdings, Inc. (United States) was acquired by KKR & Co. Inc. (United States), and Dragoneer Investment Group, LLC (United States) for USD 4.80 billion.

KKR & Co. Inc.; Dragoneer Investment Group, LLC to acquire Instructure Holdings, Inc.

KKR has announced its acquisition of Instructure Holdings, an education software company, for USD 4.8 billion, or USD 23.60 per share, in cash. Dragoneer Investment Group is also involved in the transaction.

KKR will acquire all outstanding shares of Instructure (INST), including those held by the current majority stakeholder, Thoma Bravo.

Instructure is a global leader in learning management systems, educational technology, and credentialing solutions. Serving around 200 million learners across more than 100 countries, the company partners with over 1,000 organizations. Its flagship product, Canvas, competes with platforms such as Google Classroom, Blackboard Learn, and Schoology.

KKR intends to enhance Instructure’s global learning platform by increasing investment in technology and innovation, with a focus on advancing its core products, Canvas and Parchment. Earlier this year, Instructure acquired the academic credential management platform Parchment for USD 835 million.

The transaction is expected to be completed later this year. J.P. Morgan Securities LLC acted as the lead financial advisor for Instructure, with Macquarie Capital also advising the company. KKR was advised by Morgan Stanley & Co. LLC, Moelis & Company LLC, and UBS Investment Bank.

Deal 2: Envestnet, Inc. (United States) was acquired by Bain Capital Private Equity, LP (United States), and Reverence Capital Partners, L.P. (United States) for USD 4.50 billion.

Bain Capital Private Equity, LP; Reverence Capital Partners, L.P. to acquire Envestnet, Inc.

Bain Capital, a Boston-based private equity firm, has announced its acquisition of wealth management software company Envestnet for USD 4.5 billion, further enhancing its investment portfolio with a prominent industry player.

Envestnet offers a comprehensive range of services, including data aggregation, analytics, reporting solutions, financial planning, wealth management, and portfolio management tools. The company serves 17 of the 20 largest U.S. banks, manages over USD 6 trillion in assets, oversees nearly 20 million accounts, and supports over 109,000 financial advisors with its scalable digital platform. Envestnet’s Wealth Management Platform also supports more than 800 asset managers.

Reverence Capital will join Bain Capital in this transaction. Strategic partners BlackRock, Fidelity Investments, Franklin Templeton, and State Street Global Advisors have committed to investing in the deal and will acquire minority stakes in Envestnet upon completion.

The acquisition is expected to close in the fourth quarter of 2024. Following the deal, Envestnet will cease to be publicly traded and will become a privately held company.

Morgan Stanley & Co. LLC is acting as the exclusive financial advisor to Envestnet, while Bain Capital is receiving lead financial advisory services from J.P. Morgan Securities LLC. RBC Capital Markets, BMO Capital Markets, Barclays, and Goldman Sachs & Co. LLC are providing committed debt financing and additional advisory services.

Deal 3: Exclusive Networks SA (France) was acquired by Clayton, Dubilier & Rice, LLC (United States), and Permira Advisers Ltd. (United Kingdom) for USD 2.40 billion.

Clayton, Dubilier & Rice, LLC; Permira Advisers Ltd. to acquire Exclusive Networks SA

Exclusive Networks, a French cybersecurity firm, has received a buyout proposal from Clayton Dubilier & Rice (CD&R), in collaboration with Permira, its majority shareholder. The proposed deal is valued at EUR 2.2 billion (USD 2.4 billion).

Exclusive Networks is a key player in the global cybersecurity sector, serving as a market and technical service specialist. The company provides cybersecurity vendors with access to fragmented national markets and equips local partners with the necessary expertise to address their end-customers’ security needs. With operations in over 45 countries and the ability to serve customers across more than 170 countries, Exclusive Networks offers a comprehensive suite of products and services, including managed security, technical accreditation, and training.

As the cybersecurity landscape evolves, Exclusive Networks is strategically positioned to capitalize on trends such as increased vendor spend consolidation and product innovation, which demand advanced expertise and channel support.

CD&R brings extensive experience in the technology sector, particularly in IT services and solutions, while Permira offers over 35 years of expertise in technology investments. The combined resources and strategic support from this consortium are expected to drive Exclusive Networks’ growth and help the company seize new opportunities in the rapidly expanding cybersecurity market.

Deal 4: Seidor, S.A. (Spain) was acquired by The Carlyle Group Inc. (United States) for USD 1.09 billion.

The Carlyle Group Inc. to acquire Seidor, S.A.

The Carlyle Group is in advanced talks to acquire a 60% stake in Seidor, a Spain-based technology consulting and services firm currently controlled by the Benito family. The transaction is valued at EUR 1 billion (approximately USD 1.09 billion). The Benito family will retain a 40% interest and continue to oversee the company’s management.

Seidor is a prominent player in the IT sector, offering a broad range of services including enterprise resource planning (ERP), digital transformation, and business process optimization. Renowned for its expertise in implementing SAP solutions, Seidor’s impressive growth—evidenced by its EBITDA increasing from around EUR 30 million in 2021 to over EUR 80 million this year—makes it a compelling target for Carlyle.

The acquisition aligns with Seidor’s strategic goal of becoming a leading global technology consultancy. The company plans to broaden its presence in key markets such as Spain, the United States, Italy, France, Germany, and the United Kingdom, while further solidifying its position in Latin America, the Middle East, and Africa.

Carlyle’s involvement, supported by its successful investments in Spanish firms like Codorniu, Garnica, Altadia, and Cepsa, is anticipated to drive Seidor’s continued expansion and enhance its competitive position on the global stage.

Deal 5: LinQuest Corporation (United States) was acquired by KBR, Inc. (United States) for USD 0.74 billion.

KBR, Inc. to Acquire LinQuest Corporation

KBR Inc., a provider of science, technology, and engineering solutions across industries such as aerospace, defense, and intelligence, is preparing to acquire LinQuest in a cash transaction valued at USD 737 million.

LinQuest, a key player in the national security space, delivers advanced digital transformation solutions and develops, integrates, and operates mission-critical systems. The company specializes in addressing complex challenges in space, air dominance, and connected battlespace missions, leveraging advanced AI and machine learning technologies.

This acquisition supports KBR’s strategy to enhance its capabilities in delivering sophisticated technology and mission-critical expertise. The complementary nature of both companies’ offerings is expected to create significant synergies and stimulate revenue growth. Furthermore, with over 74% of LinQuest’s more than 1,500 employees holding security clearances, KBR will be better positioned to support U.S. government clients in meeting the demands of a rapidly evolving defense and national security landscape.

The deal is expected to close by the fourth quarter of 2024. Arena Strategic Advisors provided financial due diligence for KBR, while Baird served as the exclusive financial advisor to LinQuest.

August

Software and IT

Deal 1: ZT Group Int'l, Inc. (United States) was acquired by Advanced Micro Devices, Inc. (United States) for USD 4.90 billion.

Advanced Micro Devices, Inc. to Acquire ZT Group Int'l, Inc.

Semiconductor firm Advanced Micro Devices (AMD) is strengthening its artificial intelligence (AI) capabilities through the acquisition of ZT Systems, a leading provider of AI infrastructure for hyperscale computing, in a deal worth approximately USD 4.9 billion, consisting of both cash and stock.

ZT Systems is known for its advanced compute, storage, and accelerator solutions, partnering with major technology companies like Nvidia Corp. and Intel Corp. to serve cloud and enterprise clients. With its expertise in design, integration, manufacturing, and deployment, ZT Systems has become a significant player in AI training and inference infrastructure.

Once the transaction is finalized, ZT Systems will join AMD’s Data Center Solutions Business Group. This acquisition is a strategic move aimed at enhancing AMD’s AI capabilities. Over the last year, AMD has invested more than USD 1 billion in expanding its AI ecosystem and improving AI software, alongside its continued research and development efforts.

The transaction is anticipated to close in the first half of 2025. Citi is serving as the exclusive financial advisor to AMD, while Goldman Sachs & Co. LLC is acting as the exclusive financial advisor to ZT Systems.

Deal 2: Fuji Soft Incorporated (Japan) was acquired by KKR & Co. Inc. (United States) for USD 3.80 billion.

KKR & Co. Inc. to acquire Fuji Soft Incorporated

KKR has accelerated the timeline for its acquisition of Fuji Soft Inc., a major Japanese systems developer, moving the start date to September 5. This change reduces the possibility of a bidding war with Bain Capital. The acquisition remains valued at approximately USD 3.8 billion.

Fuji Soft, a leading system integrator in Japan, is known for its expertise in embedded, control, and operational software. With more than 10,000 engineers, the company delivers cutting-edge technological solutions across various industries, leveraging decades of experience. Its strategic focus includes improving profitability, enhancing group synergies, and pursuing growth opportunities.

KKR intends to utilize its global network and IT services expertise to drive Fuji Soft’s long-term growth, aiming to deliver greater value to Japanese businesses and their customers.

Japan continues to be a key market for KKR within the Asia-Pacific region and globally, especially as the country’s IT services sector experiences rapid digital transformation, marked by increased adoption of cloud computing, IoT, and generative AI. This acquisition aligns with KKR’s broader strategy in Japan, where it has operated since 2006, investing over USD 8 billion and managing USD 18 billion in assets across multiple sectors.

Despite receiving a higher bid from Bain, Fuji Soft opted for KKR’s offer, citing its legally binding nature and greater certainty of execution. Fuji Soft also noted that Bain’s offer lacked consent from 3D Investment Partners and raised concerns about financing for the deal.

Deal 3: Cloud-based digital banking business of NCR Voyix Corporation (United States) was acquired by Veritas Capital Fund Management, L.L.C (United States) for USD 2.55 billion.

Veritas Capital Fund Management, L.L.C. to acquire Cloud-based digital banking business of NCR Voyix Corporation

Veritas Capital, a prominent investor in the technology and government sectors, is set to acquire NCR Voyix’s cloud-based digital banking division for USD 2.45 billion in cash, with a potential additional payout of up to USD 100 million.

NCR Voyix’s digital banking platform stands as the largest independent solution of its kind in the U.S., offering a comprehensive suite of digital-first tools designed to elevate both consumer and business banking experiences. Serving over 1,300 financial institutions and 20 million active users, the platform is positioned for continued growth and innovation as a standalone business.

Veritas Capital sees this acquisition as a strategic opportunity to leverage the platform’s advanced features and capitalize on its substantial growth potential.

NCR Voyix is selling this business unit to concentrate on its core software and services for the restaurant and retail industries.

Goldman Sachs & Co. LLC served as the financial advisor to NCR Voyix, while Evercore advised Veritas Capital.

Deal 4: Thoughtworks Holding, Inc. (United States) was acquired by Apax Partners LLP (United Kingdom) for USD 1.75 billion.

Apax Partners LLP to Acquire Thoughtworks Holding, Inc.

Apax Partners, a British private equity firm, is poised to take IT consulting firm Thoughtworks private through a USD 1.75 billion acquisition.

Under the agreement, Apax will acquire all remaining shares of Thoughtworks’ common stock that it does not already own, at a price of USD 4.40 per share.

Thoughtworks provides consulting services across various industries, specializing in software engineering, IT modernization, customer experience, cloud computing, data, and artificial intelligence (AI). The firm assists enterprises in upgrading their IT infrastructure by optimizing databases, developing new applications, and refining code bases, among other software solutions.

Despite its broad service offerings, Thoughtworks has faced challenges in gaining traction on Wall Street since going public. The buyout follows the company’s decision to expand its restructuring efforts, aiming for additional savings of USD 85 million to USD 95 million, bringing the total targeted savings to between USD 185 million and USD 210 million.

Apax has been a long-term strategic partner of Thoughtworks. The acquisition will enable the firm to pursue necessary investments and further strengthen its position as a strategic partner to its clients. The shift to private ownership is expected to help the company refocus on its growth strategy.

The deal is expected to close in the fourth quarter of 2024. Goldman Sachs & Co. LLC serves as the exclusive financial advisor to Apax, while Paul Hastings LLP is providing legal counsel to Thoughtworks.

Deal 5: Transact Campus, Inc. (United States) was acquired by Roper Technologies, Inc. (United States) for USD 1.50 billion.

Roper Technologies, Inc. to Acquire Transact Campus, Inc.

Roper Technologies has agreed to acquire Transact Campus (Transact) for USD 1.5 billion, enhancing its offerings for higher education institutions and healthcare facilities.

Transact is a leading provider of advanced campus technology and payment solutions. Its services include campus ID software, secure access systems, tuition and fees management, payment processing, and point-of-sale campus commerce solutions. With over 12 million users, Transact caters to higher education institutions, healthcare facilities, and corporate campuses.

This acquisition aligns with Roper’s strategic goals, meeting criteria such as mission-critical solutions, strong customer retention, and robust cash conversion.

Following the acquisition, Transact will be integrated with Roper’s CBORD business, which delivers access and security solutions as well as campus commerce services to acute healthcare and senior living facilities, higher education institutions, and K-12 school districts.

Roper forecasts that Transact will contribute approximately USD 325 million in revenue and USD 105 million in EBITDA by 2025, with anticipated long-term organic revenue growth in the high single digits.

The deal, expected to be finalized within the current quarter, will be financed through Roper’s existing cash reserves and revolving credit facility.

September

Software and IT

Deal 1: Smartsheet Inc. (United States) was acquired by Vista Equity Partners (United States), and Blackstone Inc. (United States) for USD 8.40 billion.

Vista Equity Partners; Blackstone Inc. to Acquire Smartsheet Inc.

Vista Equity Partners and Blackstone have agreed to acquire Smartsheet, a prominent software-as-a-service (SaaS) platform designed for workplace collaboration, in an all-cash deal valued at USD 8.4 billion.