M&A News M&A News: Global M&A Deals Week of Dec 2 to 8, 2024

- M&A News

M&A News: Global M&A Deals Week of Dec 2 to 8, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

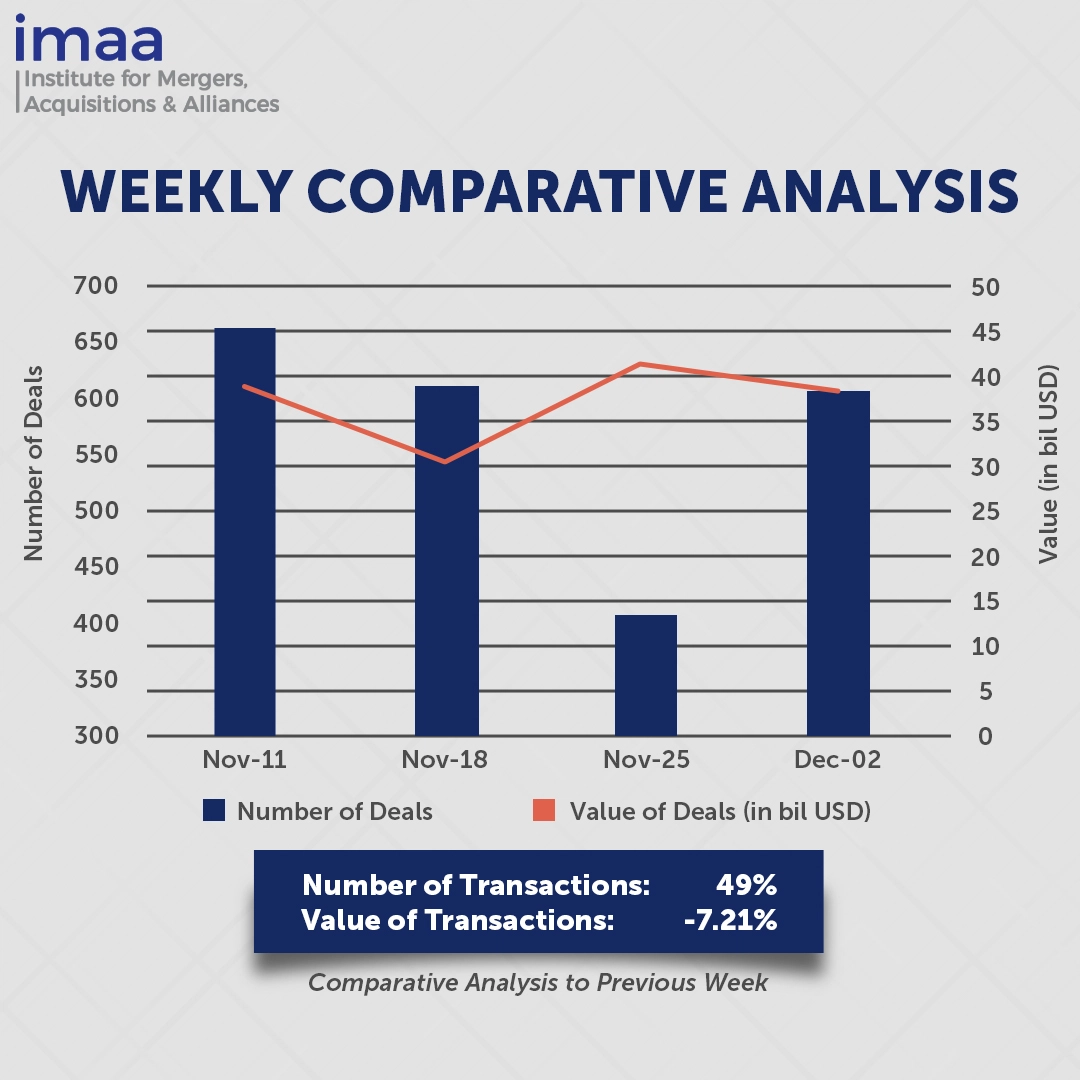

From December 2 to December 8, the global mergers and acquisitions (M&A) market saw heightened activity, with 606 deals announced, totaling USD 38.11 billion in combined deal value. Among these, 15 transactions exceeded USD 500 million each, collectively accounting for USD 31.70 billion, or 77% of the total deal value for the week.

At the top of the list during this period is BlackRock’s acquisition of HPS Investment Partners, a prominent global credit investment manager, for USD 12 billion in stock. This acquisition underscores BlackRock’s strategy to strengthen its position in the growing private credit market. As the largest asset manager globally, BlackRock is focused on diversifying portfolios through both public and private investments that optimize liquidity, yield, and diversification. The rise of private credit is being driven by technological advances, evolving regulations, and shifting market dynamics, positioning it as a major growth sector. BlackRock anticipates that the private debt market will more than double, reaching USD 4.5 trillion by 2030. The characteristics of private credit—such as its duration, returns, and yield—are well-suited to investors with long-term capital, including insurance firms, pension funds, sovereign wealth funds, and wealth managers. The HPS acquisition enables BlackRock to offer comprehensive alternative asset management services, further advancing its growth objectives in the private market space.

Week-on-week data shows a 49% increase in deal volume, rising from 407 to 606 transactions. However, the total deal value saw a 7% decline, dropping from USD 41.08 billion to USD 38.11 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of Dec 2 to 8, 2024 in detail:

Deal No. 1: BlackRock, Inc. to Acquire HPS Investment Partners, LLC for USD 12.00 Billion

Deal No. 2: EQT AB; GIC Private Limited to Acquire Calisen Group (Holdings) Limited for USD 5.00 Billion

Deal No. 3: Northern Star Resources Limited to Acquire De Grey Mining Limited for USD 3.25 Billion

Deal No. 4: Aelios Pte. Ltd to Acquire Suntec Real Estate Investment Trust for USD 2.53 Billion

Deal No. 5: TotalEnergies SE to Acquire VSB Holding GmbH for USD 1.65 Billion

Deal No. 1:

BlackRock, Inc. to Acquire HPS Investment Partners, LLC for USD 12.00 Billion

BlackRock, the world’s largest asset manager, has announced plans to acquire HPS Investment Partners in a USD 12 billion stock transaction. This strategic move seeks to expand BlackRock’s presence in the rapidly growing private credit market and enhance its ability to provide diverse financing solutions.

HPS Investment Partners, a globally recognized alternative investment firm, specializes in credit-focused strategies that deliver innovative capital solutions and generate attractive, risk-adjusted returns. The acquisition will unite BlackRock’s extensive corporate and asset owner relationships with HPS’s expertise in credit origination and flexible capital deployment. This partnership aims to establish a robust private credit platform that complements BlackRock’s USD 3 trillion public fixed-income business, offering integrated public and private income solutions to address a broad spectrum of client needs.

Integrating HPS is expected to enhance BlackRock’s ability to provide financing solutions for businesses of all sizes, from small enterprises to multinational corporations. A new private financing solutions unit will be formed, combining expertise across senior and junior credit, asset-based finance, real estate, private placements, and collateralized loan obligations (CLOs). The platform will also incorporate BlackRock’s existing strengths in direct lending, fund finance, and GP and LP solutions, delivering comprehensive financing services for alternative asset managers.

The transaction, expected to close by mid-2025, is projected to increase BlackRock’s private markets fee-paying assets under management by 40% and management fees by 35%. It is also anticipated to be accretive to BlackRock’s adjusted earnings per share within the first full year following the deal’s completion.

Perella Weinberg Partners LP served as the lead financial advisor to BlackRock, with Morgan Stanley & Co. LLC providing additional advisory services. HPS received financial counsel from J.P. Morgan Securities LLC as lead advisor, supported by Goldman Sachs & Co. LLC, BofA Securities, Deutsche Bank Securities, BNP Paribas, and RBC Capital Markets as co-advisors.

Deal No. 2:

EQT AB; GIC Private Limited to Acquire Calisen Group (Holdings) Limited for USD 5.00 Billion

Global investors EQT and GIC are acquiring a majority stake in Calisen Group, a prominent UK energy infrastructure company, for GBP 4 billion (approximately USD 5 billion).

The shares will be purchased from funds managed by BlackRock, Goldman Sachs, and Mubadala Investment Company, with Equitix retaining a minority stake following the transaction. Calisen was previously acquired in 2020 by the same consortium for GBP 1.43 billion, less than a year after its initial public offering.

Specializing in energy infrastructure, Calisen focuses on the provision and management of smart meters and energy efficiency technologies. By supporting utility companies and consumers, the company plays a crucial role in advancing cleaner energy systems. With 16 million smart meters installed, Calisen is well-positioned to capitalize on the growing demand for energy transition solutions.

The deployment of smart meters is a key driver of the energy transition, enhancing energy efficiency and contributing to the balancing of electricity grids. Demand for these devices is expected to increase, driven by supportive regulatory policies and growing interest from energy providers and consumers. Calisen’s scale, expertise, and strong client relationships have established it as a trusted provider of long-term energy infrastructure solutions in the UK.

EQT and GIC plan to build on Calisen’s success by expanding its portfolio of energy transition technologies, such as smart meters, heat pumps, and renewable energy systems, both domestically and internationally. The acquisition remains subject to customary regulatory approvals and other conditions.

Deal No. 3:

Northern Star Resources Limited to Acquire De Grey Mining Limited for USD 3.25 Billion

Australian gold producer Northern Star Resources has reached an agreement to acquire De Grey Mining for USD 3.25 billion (AUD 5 billion), creating a powerful entity in the sector.

The merger will result in a combined company with pro forma mineral resources totaling 74.9 million ounces (moz) and ore reserves of 26.9moz. The new entity will operate across two Tier-1 jurisdictions and four production centres, strengthening its position in the market.

The acquisition will provide Northern Star with full ownership of De Grey Mining’s flagship Hemi gold project, situated in Western Australia’s Pilbara region. The Hemi project is a large-scale, low-cost, and long-life gold development project, with mineral resources of 11.2 million ounces and ore reserves of six million ounces. Once operational, the project is expected to produce 530,000 ounces of gold annually over its first decade, significantly enhancing Northern Star’s portfolio and boosting its cash earnings potential.

For De Grey Mining, the transaction offers an attractive premium for its shareholders, as well as continued exposure to the Hemi project and access to Northern Star’s broader portfolio.

The deal is expected to close by late April or early May 2025. Upon completion, Northern Star and De Grey shareholders will hold approximately 80.1% and 19.9% of the merged entity, respectively. The transaction will proceed through a court-approved scheme of arrangement. Northern Star has enlisted Macquarie Capital as its financial advisor, while De Grey Mining has appointed Azure Capital, Barrenjoey, and Barclays.

Deal No. 4:

Aelios Pte. Ltd to Acquire Suntec Real Estate Investment Trust for USD 2.53 Billion

Aelios, an investment vehicle owned by billionaires Gordon and Celine Tang, has made an offer to acquire the remaining shares of Suntec Real Estate Investment Trust (REIT) that it does not already own for a total of USD 2.53 billion.

Suntec REIT, one of Singapore’s pioneering real estate investment trusts, focuses on owning and managing commercial properties that generate income, such as office spaces, retail units, and mixed-use developments. Its portfolio spans Singapore and international markets, with key properties like the Suntec City complex, which includes office towers, a retail mall, and a convention center.

Aelios, which currently holds nearly a third of Suntec REIT’s units, has proposed a cash offer of SGD 1.16 per share. This bid follows Aelios’ recent purchase of over 62 million shares (2.14%), increasing its stake from 29.31% to 31.45%, which triggered a mandatory general offer under Singapore’s regulatory framework.

Aelios has confirmed its intention to keep Suntec REIT listed on the Singapore Exchange, despite the acquisition offer. The company also assured that it has the financial capability to fulfill the offer, with United Overseas Bank and DBS serving as its financial advisors.

Deal No. 5:

TotalEnergies SE to Acquire VSB Holding GmbH for USD 1.65 Billion

France’s energy giant TotalEnergies has agreed to acquire German renewable energy developer VSB Group for USD 1.65 billion, further expanding its renewable energy footprint in Europe, including wind, solar, and battery storage. This acquisition reinforces TotalEnergies’ position as one of the top three renewable energy providers in France.

VSB Group is a pan-European company specializing in the development, construction, and management of wind and photovoltaic energy projects. With a project pipeline exceeding 18GW across wind, solar PV, and battery storage, VSB operates over 475MW of active projects. The company is involved in diverse renewable energy sectors, including solar, wind, and hydro, with a presence in France, Germany, Poland, and Italy, and employs over 500 staff across 21 global offices. This acquisition will strengthen TotalEnergies’ integrated power value chain, particularly in Germany, which constitutes half of VSB’s portfolio.

TotalEnergies is confident that clean energy, alongside liquefied natural gas, will become increasingly vital as governments move away from polluting coal and oil. With a goal of achieving 100 gigawatts of renewable energy capacity by 2030, TotalEnergies is making significant progress, with VSB’s ability to contribute more than 5GW of production and storage assets in Europe in the coming years. This acquisition is a key step toward meeting these ambitious targets. VSB Group will bring valuable experience in renewable energy development across six European energy markets, as well as its strong reputation for quality and reliability. Meanwhile, VSB will benefit from TotalEnergies’ financial strength, global reach, and strategic positioning.

The deal is subject to approval by the relevant merger control authorities.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of Dec 2 to 8, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter