M&A News M&A News: Global M&A Deals Week of November 18 to 24, 2024

- M&A News

M&A News: Global M&A Deals Week of November 18 to 24, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

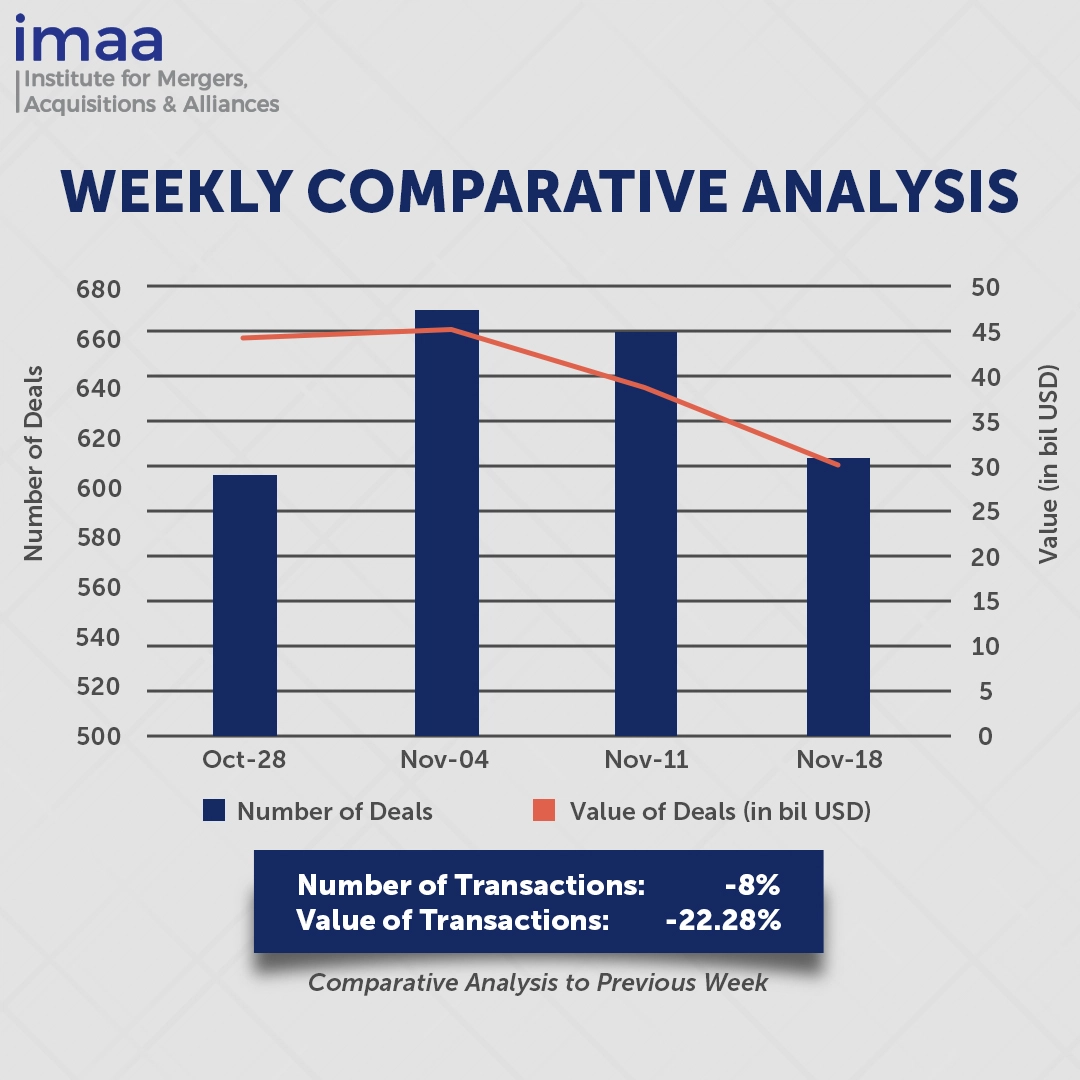

From November 18 to November 24, the global mergers and acquisitions (M&A) market recorded 611 deals, totaling USD 30.10 billion in value. Among these, 11 transactions exceeded USD 500 million, accounting for USD 20.75 billion, or 69% of the total deal value for the week.

A standout deal during this period was the all-stock acquisition between Amcor plc and Berry Global, valued at USD 8.4 billion. This transaction, the largest in Amcor’s history, will create a global leader in plastics and healthcare packaging. The merger is expected to enhance product offerings in both consumer and healthcare sectors, emphasizing sustainability, innovation, and global scale, with increased flexibility in supply chains. This acquisition is part of a wider consolidation trend in the packaging industry, joining other significant transactions such as International Paper Co.’s acquisition of DS Smith Plc and Smurfit Kappa Group’s purchase of WestRock, which resulted in the creation of Smurfit WestRock Plc.

On a week-on-week basis, M&A activity decreased by 8%, with deal volume dropping from 661 to 611. Similarly, deal value fell by 22.3%, from USD 38.73 billion to USD 30.10 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of November 18 to 24, 2024 in detail:

Deal No. 1: Amcor plc to Acquire Berry Global Group, Inc. for USD 8.40 Billion

Deal No. 2: AeroVironment, Inc. to Acquire BlueHalo LLC for USD 4.10 Billion

Deal No. 3: Protective Industrial Products, Inc. to Acquire Personal Protective Equipment Business of Honeywell International Inc. for USD 1.33 Billion

Deal No. 4: DT Midstream, Inc. to Acquire Guardian Pipeline, L.L.C./Midwestern Gas Transmission Company/Viking Gas Transmission Company for USD 1.20 Billion

Deal No. 5: Novartis AG Acquired Kate Therapeutics, Inc. for USD 1.10 Billion

Deal No. 1:

Amcor plc to Acquire Berry Global Group, Inc. for USD 8.40 Billion

Switzerland-based packaging giant Amcor plc has announced plans to acquire Berry Global in an all-stock transaction valued at USD 8.4 billion. The merger will establish the combined entity as a prominent global provider of packaging solutions for consumer and healthcare markets.

Berry Global, a Fortune 500 company, specializes in manufacturing and marketing plastic packaging, engineered materials, and nonwoven specialty products. Operating with a workforce of over 46,000 across more than 300 locations, the company is recognized for its commitment to innovation and sustainability, offering packaging solutions designed to address environmental challenges and meet changing market demands.

The integration of these two complementary businesses will strengthen their position in high-growth, high-margin sectors, including healthcare, protein, pet food, liquids, beauty and personal care, and food service. Together, they will provide an expanded product range and enhanced capabilities, serving customers in over 140 countries through 400 manufacturing facilities.

The transaction is expected to yield annual synergies of USD 650 million by the third year after closing. Furthermore, the combined company plans to allocate USD 180 million annually for research and development initiatives, emphasizing sustainable packaging solutions and innovative projects.

The merged entity will continue to operate under the name Amcor plc, with its global headquarters remaining in Zurich, Switzerland, while maintaining a significant presence in Evansville, Indiana.

The acquisition is anticipated to close by mid-2025. UBS Investment Bank and Goldman Sachs & Co. LLC are advising Amcor, while Lazard and Wells Fargo are serving as financial advisors to Berry Global.

Deal No. 2:

AeroVironment, Inc. to Acquire BlueHalo LLC for USD 4.10 Billion

AeroVironment, a leading defense contractor and drone manufacturer, is set to acquire BlueHalo, a technology and defense solutions provider, in an all-stock transaction valued at USD 4.1 billion.

BlueHalo focuses on cutting-edge engineering across several domains such as space systems, directed energy, autonomous platforms, cybersecurity, and artificial intelligence. The company is recognized for its innovative approach to addressing national security challenges, including counter-drone systems, satellite communications, and critical infrastructure protection.

This acquisition aims to establish a well-rounded defense technology company with a diverse portfolio encompassing uncrewed systems, loitering munitions, counter-UAS solutions, space technologies, electronic warfare, and cybersecurity. By combining BlueHalo’s capabilities in AI and autonomous systems with AeroVironment’s established expertise, the two companies aim to expand their reach in emerging defense markets and enhance their international presence through AeroVironment’s global network.

BlueHalo’s extensive portfolio, featuring 10 flagship solution families and more than 100 patents, is expected to align seamlessly with AeroVironment’s expertise in designing and manufacturing advanced defense technologies. This strategic combination is anticipated to strengthen the combined company’s position in addressing complex global security challenges while diversifying its customer base, product offerings, and revenue streams.

AeroVironment anticipates the acquisition will positively impact revenue, adjusted EBITDA, and non-GAAP EPS in the first full fiscal year following the deal’s completion. The transaction is expected to close in the first half of 2025. RBC Capital Markets is advising AeroVironment, while J.P. Morgan Securities LLC is providing financial advice to BlueHalo.

Deal No. 3:

Protective Industrial Products, Inc. to Acquire Personal Protective Equipment Business of Honeywell International Inc. for USD 1.33 Billion

Honeywell is divesting its Personal Protective Equipment (PPE) business to Protective Industrial Products (PIP) for USD 1.33 billion in cash. PIP is a leading global supplier of PPE products to industrial wholesalers and distributors.

The PPE business being sold encompasses a wide range of trusted brands serving a varied customer base through an extensive distributor network worldwide. With approximately 5,000 employees, the business benefits from a streamlined global manufacturing and distribution structure, featuring 20 manufacturing facilities and 17 distribution centers across the U.S., Mexico, Europe, North Africa, Asia Pacific, and China. Key brands within the portfolio include Fendall, Fibre-Metal, Howard Leight, KCL, Miller, Morning Pride, North, Oliver, Salisbury, and UVEX, among others.

This acquisition enhances PIP’s already broad product offering, which spans hand protection, head and face protection, workwear, and footwear, and is supported by operations in 35 locations across 18 countries. The addition of Honeywell’s PPE business will not only expand PIP’s brand portfolio but also strengthen its global presence, unlocking new growth opportunities for its customers.

The deal is anticipated to close in the first half of 2025.

Deal No. 4:

DT Midstream, Inc. to Acquire Guardian Pipeline, L.L.C./Midwestern Gas Transmission Company/Viking Gas Transmission Company for USD 1.20 Billion

DT Midstream has agreed to acquire regulated natural gas transmission pipelines from ONEOK for USD 1.2 billion, expanding its footprint in the Midwest amid ongoing consolidation in the U.S. energy sector.

The transaction encompasses three key pipelines: Guardian Pipeline, Midwestern Gas Transmission, and Viking Gas Transmission. These assets collectively have a capacity exceeding 3.7 billion cubic feet per day (Bcf/d) and span approximately 1,300 miles across seven states in the strategically important Midwest region, which is projected to see sustained growth in power demand.

Guardian Pipeline is a 260-mile interstate pipeline connected to DT Midstream’s Vector Pipeline and the Chicago Hub, serving major demand centers in Wisconsin. Midwestern Gas Transmission is a 400-mile bi-directional pipeline linking the Appalachian supply region to the Midwest between Tennessee and the Chicago Hub. It also connects to Guardian Pipeline. Viking Gas Transmission, stretching 675 miles, links utility customers in Minnesota, Wisconsin, and North Dakota to Canadian supply at Emerson, Manitoba.

This acquisition aligns with DT Midstream’s strategy of expanding its portfolio of natural gas assets, which connect high-quality supply basins to important demand centers. The transaction is expected to increase the pipeline segment’s contribution to adjusted EBITDA to approximately 70% by 2025. The acquired assets are primarily supported by long-term, take-or-pay contracts with a highly creditworthy customer base, with around 85% of revenues coming from investment-grade customers. The deal also enhances the company’s backlog of organic growth projects.

The transaction is anticipated to close in late 2024 or early 2025. Barclays is acting as the financial advisor to DT Midstream and has committed financing to support the acquisition.

Deal No. 5:

Novartis AG Acquired Kate Therapeutics, Inc. for USD 1.10 Billion

Novartis has acquired Kate Therapeutics, a biotechnology company based in San Diego, for USD 1.1 billion, reinforcing its commitment to advancing gene therapies for patients.

Kate Therapeutics, currently in its preclinical stage, focuses on adeno-associated virus (AAV)-based gene therapies. Its leading programs target Duchenne muscular dystrophy (DMD), facioscapulohumeral dystrophy (FSHD), and myotonic dystrophy type 1 (DM1).

The company’s proprietary platforms combine advanced capsid and cargo technologies, optimizing the delivery of gene therapy payloads to specific tissues while minimizing off-target effects, such as those on the liver. This approach aims to enhance the therapeutic efficacy and safety of gene therapies, offering new treatment possibilities for challenging diseases, including inherited neuromuscular disorders, which current therapies have struggled to address.

This acquisition complements Novartis’ established leadership in neuroscience drug discovery, bringing new talent and expertise that align with its internal research efforts. With the addition of Kate Therapeutics, Novartis gains a portfolio of preclinical gene therapies aimed at rare, muscle-debilitating diseases, reinforcing its dedication to meeting the medical needs of patients with inherited neuromuscular disorders and improving gene therapy options for these conditions.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of November 18 to 24, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter