M&A News M&A News: Global M&A Deals Week of November 11 to 17, 2024

- M&A News

M&A News: Global M&A Deals Week of November 11 to 17, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

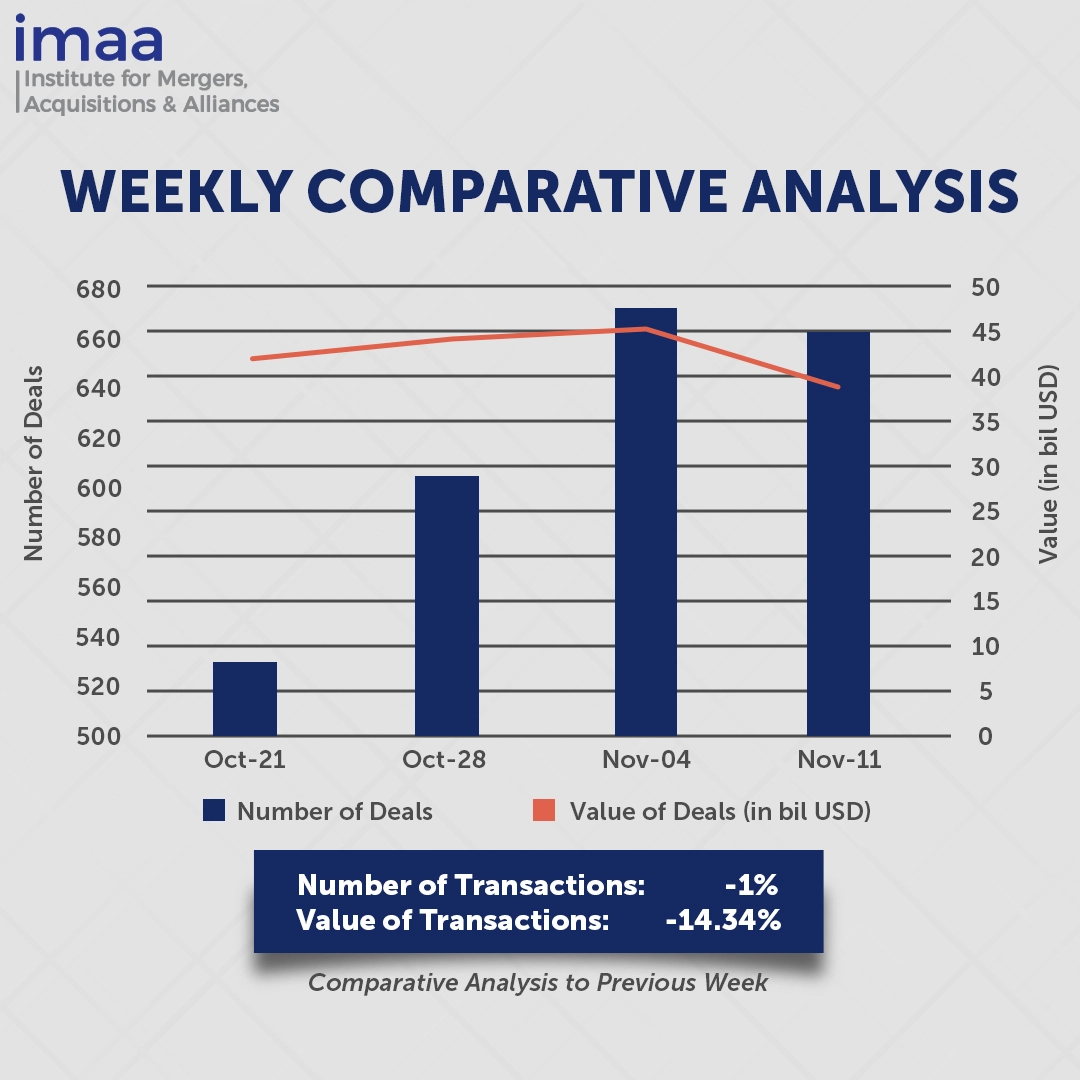

Between November 11 and November 17, the global mergers and acquisitions (M&A) market saw 661 deals announced, with a combined value of USD 38.73 billion. Notably, 22 deals surpassed the USD 500 million mark, totaling USD 28.17 billion, which accounts for 73% of the week’s total deal value.

A key highlight this week was Cardinal Health’s acquisition of a majority stake in GI Alliance for USD 2.8 billion, a move that accelerates the company’s multi-specialty growth strategy. GI Alliance, the nation’s leading gastroenterology management services organization (MSO) with over 900 physicians, provides a wide range of gastroenterology care through its affiliated practices. In addition to this acquisition, Cardinal Health is also purchasing Advanced Diabetes Supply Group, a leading provider of diabetes medical supplies, marking another significant step in its ongoing billion-dollar acquisition strategy. This follows the earlier purchases of Integrated Oncology Network, a community cancer center operator, for USD 1.12 billion, and Specialty Networks for USD 1.2 billion, as healthcare companies increasingly diversify beyond traditional drug distribution.

In terms of week-over-week performance, deal volume slightly decreased from 671 to 661, while total deal value fell by 14%, dropping from USD 45.21 billion to USD 38.73 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of November 11 to 17, 2024 in detail:

Deal No. 1: Cardinal Health, Inc. to Acquire The GI Alliance Management, LLC for USD 2.80 Billion

Deal No. 2: Ovintiv Inc. to Acquire Certain Montney assets of Paramount Resources Ltd. for USD 2.38 Billion

Deal No. 3: Halozyme Therapeutics, Inc. to Acquire Evotec SE for USD 2.10 Billion

Deal No. 4: FourPoint Resources, LLC; Quantum Energy Partners, LLC; Kayne Anderson Capital Advisors, L.P. to Acquire Substantially All Uinta Basin Assets of Ovintiv Inc. for USD 2.00 Billion

Deal No. 5: AviAlliance GmbH to Acquire AGS Airports Limited for USD 1.95 Billion

Deal No. 1:

Cardinal Health, Inc. to Acquire The GI Alliance Management, LLC for USD 2.80 Billion

Cardinal Health is acquiring a 71% majority stake in GI Alliance (GIA), a leading provider of gastroenterology management services, for USD 2.8 billion in cash. The transaction will integrate GIA into Cardinal Health’s Pharmaceutical and Specialty Solutions segment, establishing a foundation for its multi-specialty platform and supporting future growth initiatives.

GI Alliance’s network includes over 900 physicians across 345 locations in 20 states, offering a full spectrum of care. Its services extend beyond gastroenterology to include anesthesiology, pathology, radiology, infusion therapy, and clinical research. The organization operates 135 ambulatory surgical centers, partners with 165 hospital networks, and manages 95 infusion centers, ensuring broad access to specialized healthcare.

This acquisition aligns with Cardinal Health’s strategy to expand its specialty healthcare offerings. It complements prior acquisitions, such as Specialty Networks, which focuses on urology, rheumatology, and gastroenterology, and Integrated Oncology Network, specializing in medical and radiation oncology. Together, these acquisitions strengthen Cardinal Health’s capabilities in specialty practice management and technology-driven healthcare solutions.

Additionally, Cardinal Health has the option to acquire the remaining interest in GIA three years after the transaction closes, further cementing its commitment to expanding its presence in specialty healthcare services.

Deal No. 2:

Ovintiv Inc. to Acquire Certain Montney assets of Paramount Resources Ltd. for USD 2.38 Billion

Ovintiv, a prominent North American exploration and production company, has announced the acquisition of Montney oil and gas assets from Paramount Resources in an all-cash transaction valued at USD 2.38 billion.

This acquisition will enhance Ovintiv’s portfolio by adding approximately 70 MBOE/d of production, 900 net well locations with 10,000-foot equivalents, and 109,000 net acres, about 80% of which remain undeveloped. These assets, located in the core of Alberta’s Montney region, are strategically positioned near Ovintiv’s existing operations and benefit from access to midstream infrastructure with available capacity.

The Montney is recognized as North America’s second-largest undeveloped oil resource. Through this transaction, Ovintiv strengthens its position as a key operator in the region. The acquired assets have demonstrated strong well performance, complementing Ovintiv’s operational expertise and existing acreage. The midstream capacity associated with these assets also provides opportunities for mid-single-digit growth in Montney oil and condensate production.

With this acquisition, Ovintiv’s premium oil and condensate inventory is extended to approximately 15 years, incorporating 600 premium return locations and an additional 300 potential upside locations.

Following the transaction, Ovintiv’s portfolio will focus on its anchor positions in the Montney and Permian, supported by robust cash flows from its Anadarko asset. This strategic realignment highlights Ovintiv’s commitment to operational efficiency and long-term growth.

Deal No. 3:

Halozyme Therapeutics, Inc. to Acquire Evotec SE for USD 2.10 Billion

German biotech company Evotec has received a USD 2.1 billion cash acquisition proposal from Halozyme Therapeutics. The offer values Evotec at EUR 11 per share, with plans to acquire all outstanding shares.

Evotec specializes in providing end-to-end solutions, from target identification to preclinical development, across therapeutic areas such as oncology, neurology, diabetes, and rare diseases. Its innovative approach accelerates the development of novel therapies and fosters strategic partnerships aimed at addressing unmet medical needs. Halozyme, on the other hand, is known for its proprietary Enhanze drug delivery technology, which facilitates subcutaneous administration of therapeutics, including Johnson & Johnson’s Darzalex.

The proposed acquisition seeks to merge the complementary strengths of both companies, forming a U.S.-European biopharma services leader with an expanded portfolio and robust pipeline. This integration would enhance their collective technological capabilities, positioning the combined entity as a premier strategic partner to the global biopharma industry. The collaboration promises increased scale, a diversified service offering, and greater appeal to industry stakeholders.

For Halozyme, the acquisition represents an opportunity to broaden and stabilize its revenue streams and EBITDA growth, ensuring long-term financial sustainability well into the next decade.

Centerview Partners is acting as Halozyme’s financial advisor for the transaction.

Deal No. 4:

FourPoint Resources, LLC; Quantum Energy Partners, LLC; Kayne Anderson Capital Advisors, L.P. to Acquire Substantially All Uinta Basin Assets of Ovintiv Inc. for USD 2.00 Billion

FourPoint Resources, alongside Quantum Capital Group and Kayne Anderson, has entered into an agreement to acquire Ovintiv’s Uinta Basin assets for USD 2 billion in cash.

This acquisition includes 126,000 net acres and a production capacity of 29,000 barrels per day. The Uinta Basin is distinguished by its extensive hydrocarbon-rich reservoirs, high-quality crude oil, and a long-standing history of effective stakeholder collaboration, making it an exceptional asset.

With a commitment to operational excellence and sustainable management, FourPoint sees this asset as a prime opportunity to create long-term value for its investors, employees, and the surrounding community. Partnering with renowned private equity firms Quantum and Kayne Anderson brings together a team with a proven track record of strategic foresight and operational success.

The transaction is anticipated to close by the end of Q1 2025. Wells Fargo Securities, LLC is serving as the exclusive financial advisor to FourPoint Resources.

Deal No. 5:

AviAlliance GmbH to Acquire AGS Airports Limited for USD 1.95 Billion

Airport management firm AviAlliance is acquiring AGS Airports for GBP 1.53 billion (USD 1.95 billion). AGS Airports, which operates Aberdeen, Glasgow, and Southampton airports, plays a vital role in the UK’s aviation sector. This acquisition represents a significant investment in the industry.

AGS Airports is a joint venture, equally owned by Ferrovial and Macquarie. Both companies have agreed to divest their 50% stakes in AGS Airports to AviAlliance.

The three airports together serve more than 10.8 million passengers annually and contribute GBP 2 billion (USD 2.54 billion) to the UK economy each year. They are essential for maintaining air connectivity for communities in Scotland and the South East of England.

Since its founding in 2014, AGS Airports has invested GBP 250 million in infrastructure, including GBP 20 million at Aberdeen International, GBP 9 million at Glasgow, and GBP 17 million for a runway extension at Southampton. These investments have strengthened airport infrastructure and services, even amid the challenges of the Covid-19 pandemic.

AviAlliance, with a proven track record in airport investments and management, currently oversees a portfolio of four airports and brings extensive industry expertise to this acquisition. The firm is committed to unlocking the full potential of the airports, expanding their route networks, enhancing passenger services, and advancing sustainability initiatives.

The deal is pending regulatory approval and is expected to close in Q1 2025.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of November 11 to 17, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter