M&A News M&A News: Global M&A Deals Week of October 21 to 27, 2024

- M&A News

M&A News: Global M&A Deals Week of October 21 to 27, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

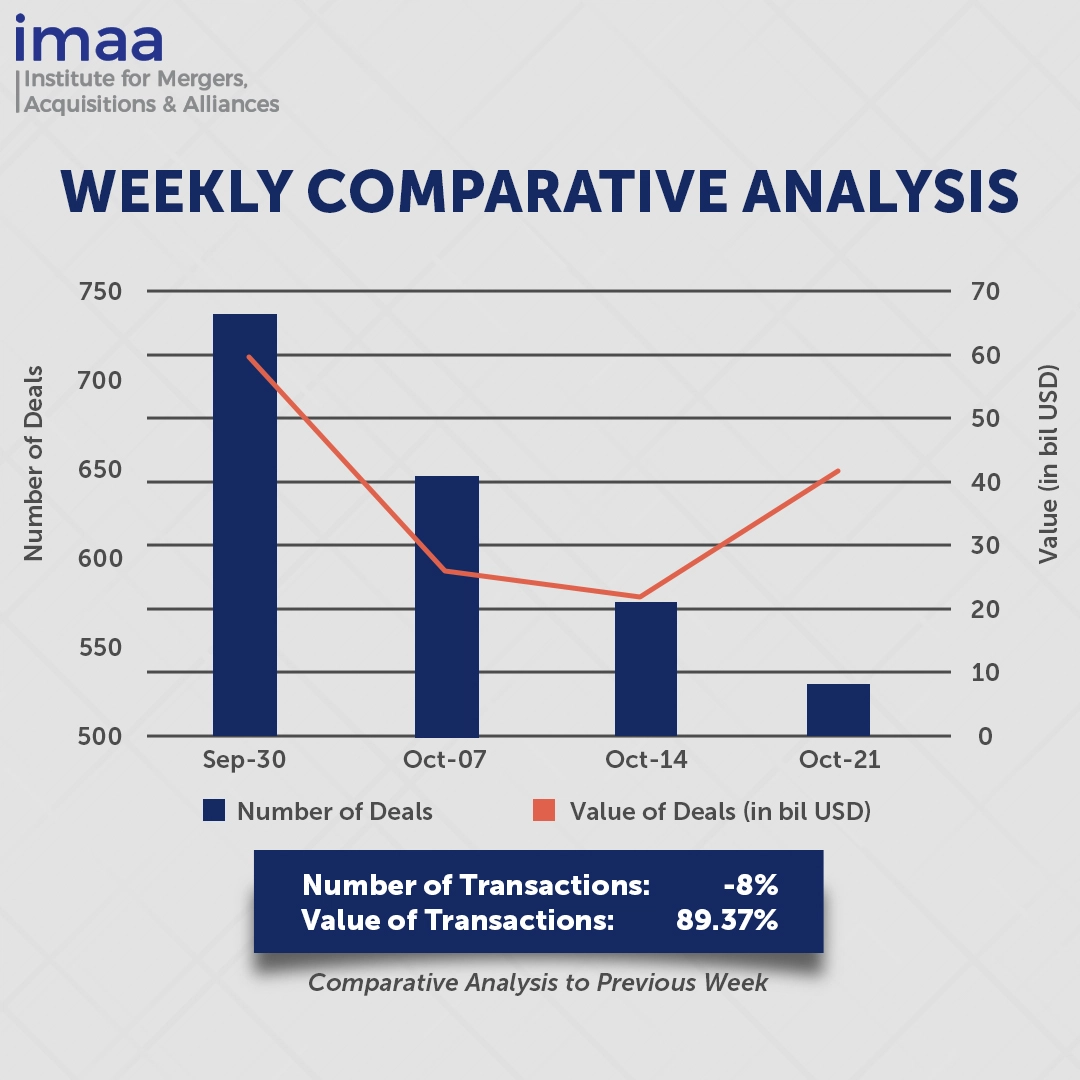

During the week of October 21 to October 27, the global mergers and acquisitions (M&A) market reported 576 announced deals, totaling USD 41.59 billion in deal value. Notably, 16 of these transactions surpassed the USD 500 million threshold, collectively contributing USD 33 billion, which accounts 77% of the week’s overall deal value.

The largest transaction during this period was the USD 14.5 billion acquisition of Nord Anglia Education, a leading international school organization, by a consortium led by Neuberger Berman, the Canada Pension Plan Investment Board (CPPIB), and EQT. This acquisition is expected to enhance Nord Anglia’s dedication to educational excellence by fostering innovative curricula and forming partnerships with esteemed institutions. With an increasing number of families prioritizing high-quality and innovative educational experiences, Nord Anglia is strategically positioned to meet the evolving demands of students and parents alike.

When compared to the previous week, M&A activity reflected an 8% decline in deal volume, falling from 576 to 530 announced deals. However, despite the decrease in the number of transactions, the total deal value experienced a substantial increase of 89.4%, rising from USD 21.96 billion to USD 41.59 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of October 21 to 27, 2024 in detail:

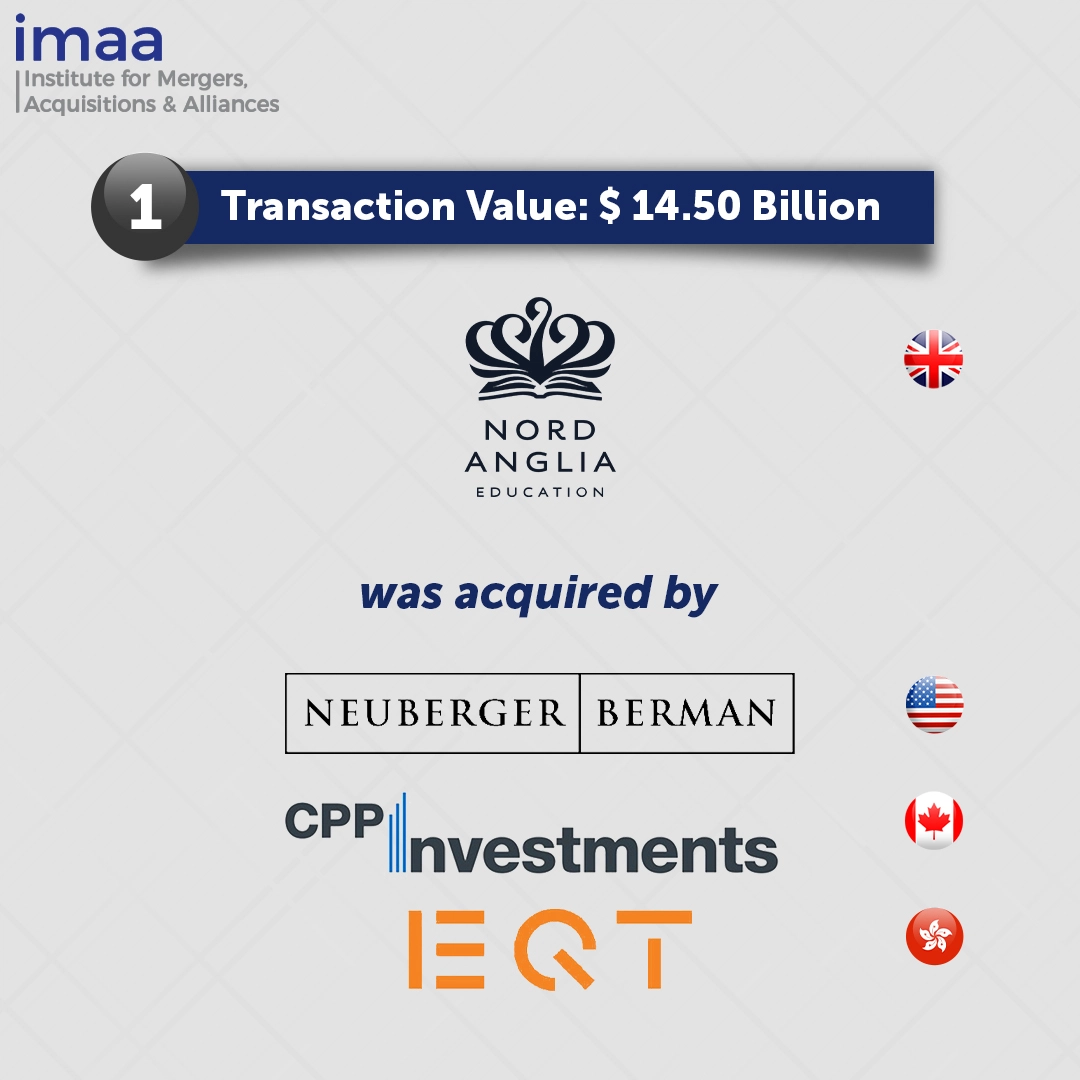

Deal No. 1: Neuberger Berman Group LLC; Canada Pension Plan Investment Board; EQT Private Capital Asia; to Acquire Nord Anglia Education Limited for USD 14.50 Billion

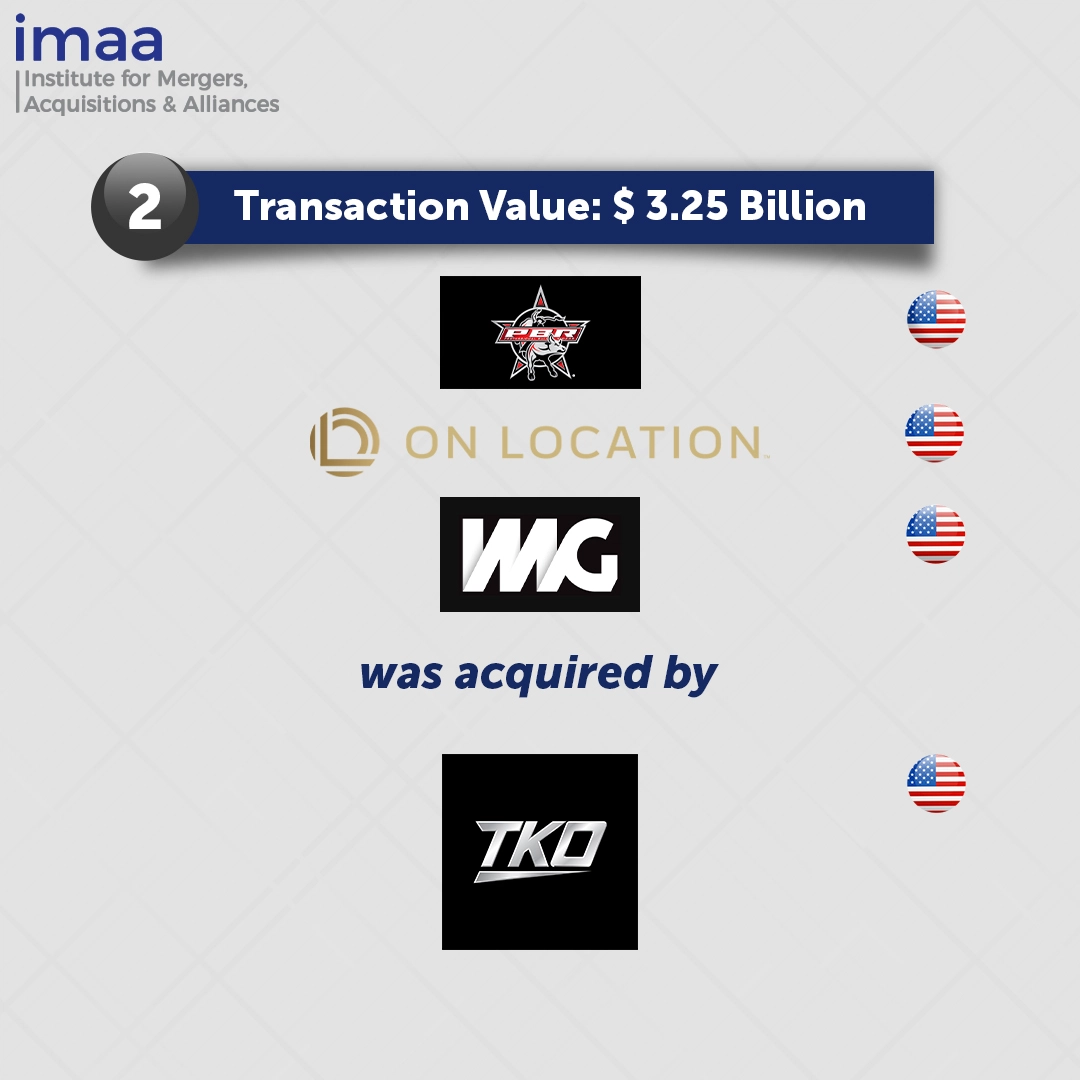

Deal No. 2: TKO Group to Acquire Professional Bull Riders, On Location, and IMG for USD 3.25 Billion

Deal No. 3: Jab Holding Company S.à.R.L. to Acquire JDE Peet’s N.V. for USD 2.30 Billion

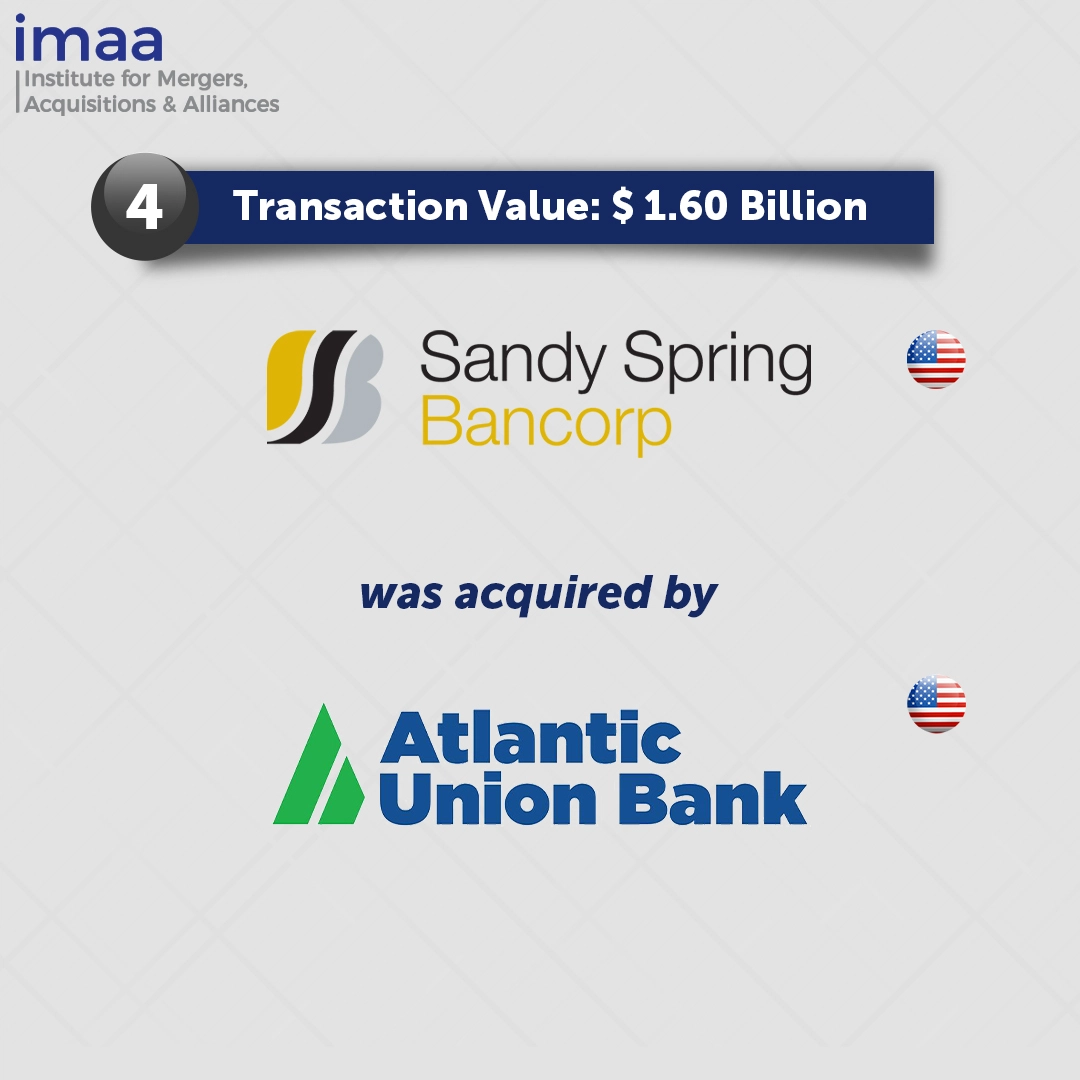

Deal No. 4: Atlantic Union Bankshares Corporation to Acquire Sandy Spring Bancorp, Inc. for USD 1.60 Billion

Deal No. 5: HMC Capital Limited to Acquire Global Switch Australia Holdings Pty Limited for USD 1.40 Billion

Deal No. 1:

Neuberger Berman Group LLC; Canada Pension Plan Investment Board; EQT Private Capital Asia; to Acquire Nord Anglia Education Limited for USD 14.50 Billion

Neuberger Berman has joined EQT and CPP Investments in acquiring the UK-based private school operator Nord Anglia Education for USD 14.5 billion. This acquisition reinforces Nord Anglia’s commitment to delivering premium educational experiences and nurturing future global leaders and innovators.

Nord Anglia operates a network of over 80 international schools across 33 countries, serving more than 85,000 students aged 2 to 18. Through exclusive partnerships with leading institutions, such as UNICEF, MIT, Juilliard, and IMG Academy, along with its proprietary digital learning platforms, Nord Anglia offers unique and enriched educational opportunities.

With Neuberger Berman as a new strategic partner, the consortium reaffirms its dedication to Nord Anglia’s growth through both organic and acquisition-driven strategies. Neuberger Berman, EQT, and CPP Investments will collaborate closely with Nord Anglia to lead it into its next growth phase, further expanding its ability to deliver quality education in major global markets.

This acquisition builds on EQT’s long-standing relationship with Nord Anglia, which began in 2008 and saw an expansion in 2017 when CPP Investments joined as a partner, marking CPP Investments’ first direct equity venture in private education. Neuberger Berman, alongside other global institutional investors, joins as a new stakeholder.

Goldman Sachs, J.P. Morgan, and Morgan Stanley serve as lead financial advisors to Nord Anglia, with Lazard advising on private capital matters. Deutsche Bank and HSBC are also engaged as financial advisors.

Deal No. 2:

TKO Group to Acquire Professional Bull Riders, On Location, and IMG for USD 3.25 Billion

TKO Group, the parent company of WWE and UFC, is broadening its reach into related sports and entertainment assets by acquiring Professional Bull Riders, On Location, and IMG from Endeavor Group in an all-stock transaction valued at USD 3.25 billion.

Professional Bull Riders operates over 200 live events each year, drawing approximately 1.25 million fans and reaching more than 285 million households across 65 territories. On Location is a premier live event company, managing experiences for over 1,200 high-profile events, including the Super Bowl, Ryder Cup, and NCAA Final Four. IMG is a prominent distributor and producer of sports content, responsible for managing media rights, brand partnerships, consulting, digital services, and event management for clients such as the NFL and NHL. However, the acquisition of IMG excludes its licensing, models and tennis representation, and certain segments of its event portfolio.

This strategic acquisition enhances TKO’s position in the rapidly growing premium sports market, allowing direct engagement with lucrative opportunities through media rights, live events, ticket sales, premium experiences, brand partnerships, and venue fees. By broadening its operational footprint, TKO aims to strengthen its market presence and drive sustainable growth, ultimately increasing shareholder value.

This sale is part of Endeavor’s strategy to streamline its assets as it considers going private in a potential deal with private equity firm Silver Lake.

The transaction is expected to close in the first half of 2025, increasing Endeavor’s ownership stake in TKO from 53% to 59%, while existing TKO shareholders will retain 41%. Morgan Stanley & Co. LLC is acting as the financial advisor for TKO in this acquisition.

Deal No. 3:

Jab Holding Company S.à.R.L. to Acquire JDE Peet's N.V. for USD 2.30 Billion

German conglomerate JAB Holding Company is set to increase its stake in Dutch coffee producer JDE Peet’s to 68% by acquiring 86 million shares from Mondelez for USD 2.30 billion.

Recognized as the world’s leading pure-play coffee and tea enterprise, JDE Peet’s manages an extensive portfolio of over 50 brands, including L’OR, Peet’s Coffee, Jacobs, Senseo, Tassimo, Douwe Egberts, OldTown, Super, Pickwick, and Moccona.

With more than USD 50 billion in managed assets, JAB focuses on fast-moving consumer goods (FMCG), including coffee, soft drinks, and confectionery, as well as investments in hospitality and insurance. JAB also holds a controlling interest in Panera Brands, which includes fast-casual chains such as Panera Bread, Caribou Coffee, and Einstein Bros. Bagels, in addition to UK-based Pret A Manger and Sweden’s Espresso House. Furthermore, JAB maintains minority stakes of 44% in Krispy Kreme and 34% in Keurig Dr Pepper.

This acquisition represents a meaningful development for JDE Peet’s, reinforcing its status as a recognized blue-chip company. JAB’s investment indicates confidence in the stability of the global coffee market and the long-term growth prospects of JDE Peet’s. Additionally, JAB has distributed 43 million shares—representing 9% of the company’s total share capital—to over 70 limited partners within JAB Consumer Partners (JCP), increasing JDE Peet’s public float to 32% and improving its market visibility.

Deal No. 4:

Atlantic Union Bankshares Corporation to Acquire Sandy Spring Bancorp, Inc. for USD 1.60 Billion

Atlantic Union Bank is strategically expanding its footprint by acquiring Sandy Spring Bank of Maryland in an all-stock transaction valued at USD 1.6 billion. This merger will establish the largest regional bank based in the lower Mid-Atlantic and significantly bolster the combined entity’s presence in Northern Virginia and Maryland.

Sandy Spring offers a comprehensive range of financial services, including personal and commercial banking, mortgage lending, wealth management, and insurance solutions. As of September 30, 2024, the bank reported USD 14.4 billion in assets, USD 11.7 billion in total deposits, and USD 11.5 billion in total loans.

Post-merger, the combined organization is projected to have total assets of USD 39.2 billion, total deposits of USD 32.0 billion, and gross loans amounting to USD 29.8 billion. The merger will enhance Atlantic Union’s Mid-Atlantic banking footprint by adding 53 branch locations and will nearly double its wealth management division, increasing assets under management by over USD 6.5 billion. This strategic combination is expected to provide increased scale, greater market diversity, and improved capabilities for clients, as well as expanded growth opportunities for employees within a larger corporate structure.

The companies aim to finalize the transaction by the end of the third quarter of 2025. Morgan Stanley provided advisory services to Atlantic Union, while Sandy Spring was advised by Keefe, Bruyette & Woods.

Deal No. 5:

HMC Capital Limited to Acquire Global Switch Australia Holdings Pty Limited for USD 1.40 Billion

HMC Capital has finalized an agreement to acquire Global Switch Australia for USD 1.40 billion, establishing it as the cornerstone asset for a new real estate investment trust (REIT) concentrating on digital infrastructure.

Global Switch Australia operates a 26MW colocation data center that offers high-density, low-latency IT capacity, along with advanced technological solutions and expertise to leading technology firms on a flexible basis. In the 2023 calendar year, it reported earnings of AUD 86 million and boasts 72,800 square meters of floor space accommodating 86 distinct customers. This space accounts for approximately 17% of the total floor area of Global Switch’s data centers located in Europe and the Asia-Pacific, including cities such as Amsterdam, Madrid, Singapore, and Hong Kong.

As a prominent owner, operator, and developer of large-scale data centers in Europe and the Asia-Pacific, Global Switch is well-positioned to leverage the proceeds from this transaction to enhance its balance sheet. The capital infusion will facilitate significant growth opportunities in key markets through redevelopment, the incorporation of cutting-edge cooling technologies, and the construction of new data centers to meet the rising demand for artificial intelligence (AI) and high-performance computing (HPC).

For HMC Capital, this acquisition is part of a strategy to leverage infrastructure-focused investments. Data centers have become highly sought after, particularly as the AI sector continues to expand, prompting firms like HMC to establish a presence in this dynamic market.

Global Switch anticipates that the transaction will conclude by late 2024 or early 2025. Upon completion, the center will be integrated into HMC’s new global DigiCo Infrastructure REIT, which is set to be listed on the ASX alongside a new unlisted institutional fund.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of October 21 to 27, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter