M&A News M&A News: Global M&A Deals Week of Oct 7 to 13, 2024

- M&A News

M&A News: Global M&A Deals Week of Oct 7 to 13, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

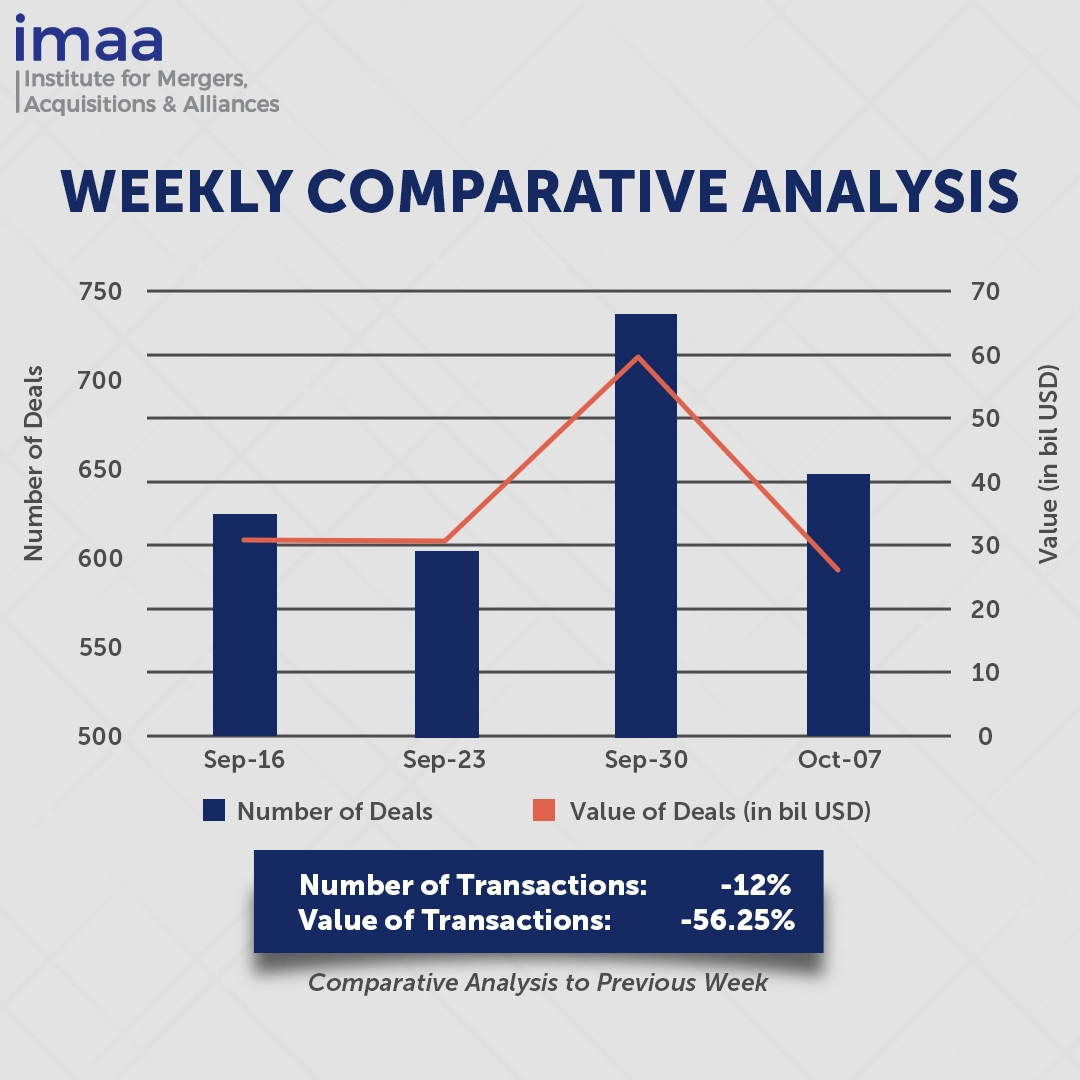

From October 7 to October 13, the global mergers and acquisitions (M&A) market recorded 646 transactions, totaling USD 26.03 billion. Notably, nine of these deals surpassed USD 500 million each, collectively accounting for USD 15.79 billion, which represents 61% of the week’s overall deal value.

Private equity firms led the way as the primary acquirers in the top four transactions of the week, reflecting a trend among alternative asset managers to pursue mergers for greater scale and expansion into new sectors and regions. This shift is transforming them into comprehensive investment firms that offer a wide range of strategies. The standout deal was Ares Management’s acquisition of GLP Capital Partners for USD 5.2 billion. This transaction positions Ares Real Estate as a major player with one of the largest vertically integrated platforms globally, significantly enhancing its footprint in the infrastructure sector. The deal aims to leverage the growing demand for industrial spaces and AI data centers, driven by enduring growth trends.

In comparison to the previous week, the M&A market experienced a 12% decrease in deal volume, declining from 735 to 646 transactions. Likewise, the total deal value fell sharply by 56%, from USD 59.48 billion to USD 26.03 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of October 7 to 13, 2024 in detail:

Deal No. 1: Ares Management Corporation to Acquire GLP Capital Partners, Inc. International Business (GCP International) for USD 5.20 Billion

Deal No. 2: Apollo Global Management, Inc. to Acquire Barnes Group Inc. for USD 3.60 Billion

Deal No. 3: Butterfly Equity LP to Acquire The Duckhorn Portfolio, Inc. for USD 1.95 Billion

Deal No. 4: Hillhouse Investment Management, Ltd.; Rava Partners to Acquire SAMTY HOLDINGS Co., Ltd. for USD 1.13 Billion

Deal No. 5: Zijin Mining Group Company Limited to Acquire Newmont’s Akyem Gold Mine Project in Ghana for USD 1.00 Billion

Deal No. 1:

Ares Management Corporation to Acquire GLP Capital Partners, Inc. International Business (GCP International) for USD 5.20 Billion

Ares Management Corp has reached an agreement to acquire GLP Capital Partners’ international operations (GCP International) for up to USD 5.2 billion. This deal consists of an initial cash and stock payment of USD 3.7 billion, along with an additional earn-out of up to USD 1.5 billion if certain performance milestones are achieved.

This acquisition will significantly expand Ares Real Estate’s global footprint, nearly doubling its assets under management (AUM) to approximately USD 96 billion across key regions, including North America, Europe, Asia, and Latin America. The move strengthens Ares’ position as one of the largest vertically integrated real estate platforms worldwide.

GCP International, a global alternative asset manager with around 29 offices, holds a strong presence in major markets like Japan, Europe, and the United States. As of June 2024, its AUM stands at USD 44 billion, with a focus on logistics real estate, digital infrastructure, and renewable energy. Notably, GCP has emerged as a leader in global data center investments, developing hyperscale projects that provide over 1GW of IT capacity in key locations such as London, Tokyo, Osaka, and São Paulo. The firm also has a robust pipeline for future growth.

This acquisition highlights Ares’ strategic focus on expanding its capabilities in regions and sectors set to benefit from long-term structural trends. The combined strengths of Ares and GCP International, including their investment expertise, operating capabilities, and extensive networks, will create a leading global real assets investment platform.

Following the deal, GCP International will separate from GLP Capital Partners, which will remain an independent entity headquartered in Singapore, concentrating on investments in Greater China.

The transaction is expected to close in the first half of 2025. Ares was advised by Eastdil Secured, Barclays, Goldman Sachs, and Wells Fargo Securities, while Citigroup, Morgan Stanley, Greenhill, UOB Group, Mizuho, and Deutsche Bank served as advisors to GCP International.

Deal No. 2:

Apollo Global Management, Inc. to Acquire Barnes Group Inc. for USD 3.60 Billion

Apollo Global, a prominent private equity firm, is set to acquire Barnes Group in a transaction valued at USD 3.6 billion (USD 47.50 per share), taking the industrial and aerospace components manufacturer private.

Barnes Group, a key player in industrial and aerospace component manufacturing, is recognized for its expertise in developing advanced automation solutions, applied technologies, and manufacturing processes that serve diverse sectors, including aerospace, medical & personal care, mobility, and packaging. The company’s history of engineering innovation and commitment to delivering value through cutting-edge technology has solidified its position in these industries.

Apollo’s acquisition of Barnes aligns with its strategy of expanding its industrial portfolio, capitalizing on increasing demand in the manufacturing sector. The firm believes Barnes is well-positioned to benefit from long-term growth in the aerospace market, especially as global travel demand rebounds.

With over 35 years of experience investing in businesses like Barnes, Apollo is known for supporting companies with strong leadership and operational success, positioning them for sustained growth. Under Apollo’s ownership, Barnes Group plans to accelerate its transformation, enhance its capabilities, expand its product range, and pursue new growth and innovation opportunities.

The deal is anticipated to close by the end of the first quarter of 2025. After the transaction is completed, Barnes will be delisted from the New York Stock Exchange and operate as a privately held entity while retaining its name and brand. Goldman Sachs & Co. LLC and Jefferies LLC are acting as financial advisors to Barnes.

Deal No. 3:

Butterfly Equity LP to Acquire The Duckhorn Portfolio, Inc. for USD 1.95 Billion

California-based luxury wine producer Duckhorn is poised for acquisition by private equity firm Butterfly Equity in a USD 1.95 billion cash transaction.

Duckhorn is renowned for its high-end wine offerings and boasts a curated selection of premium brands, including Duckhorn Vineyards, Decoy, Sonoma-Cutrer, and Kosta Browne. Its products reach luxury consumers in over 50 countries across five continents.

Butterfly Equity, which specializes in investments within the food and beverage industry, holds a diverse portfolio that includes Milk Specialties Global, Chosen Foods, MaryRuth Organics, Orgain, Bolthouse Fresh Foods, and QDOBA. With deep expertise in the sector, a data-driven investment strategy, and a hands-on operational approach, Butterfly aims to drive Duckhorn’s continued growth and expansion.

J.P. Morgan Securities LLC is acting as the financial advisor for Duckhorn, while KKR Capital Markets LLC is providing capital markets advisory services to Butterfly Equity.

Deal No. 4:

Hillhouse Investment Management, Ltd.; Rava Partners to Acquire SAMTY HOLDINGS Co., Ltd. for USD 1.13 Billion

Hillhouse Investment, along with its real estate assets division, Rava Partners, has announced the acquisition of Japanese real estate firm Samty Holdings for JPY 169 billion (approximately USD 1.13 billion).

Samty Holdings has rapidly established itself as a key player in Japan’s real estate sector, focusing on the development, operation, and management of properties across the country. The company operates two main divisions: one focused on development and investment properties and the other sponsoring the Tokyo-listed REIT, Samty Residential Investment Corporation. Samty’s real estate solutions division adopts a value-add investment strategy, acquiring, renovating, and leasing properties. Additionally, its hospitality division manages hotels in approximately a dozen Japanese cities and runs a real estate management business. Samty has also extended its reach beyond Japan into Singapore and Vietnam.

Samty Holdings selected Hillhouse as its strategic partner due to the latter’s extensive expertise in long-term asset management, a solid track record in the real estate sector, and commitment to cultivating high-quality business operations.

Upon completion, Hillhouse intends to enhance Samty Holdings by strengthening its asset management capabilities and leveraging its fundraising skills and global investor network. The strategy focuses on improving capital efficiency through the establishment of development and core funds, optimizing corporate governance, and identifying strategic investment opportunities both domestically and internationally to support Samty’s sustainable growth.

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd. serves as the lead financial advisor for the transaction, with Deutsche Bank and JPMorgan Securities Japan Co., Ltd. acting as co-financial advisors.

Deal No. 5:

Zijin Mining Group Company Limited to Acquire Newmont's Akyem Gold Mine Project in Ghana for USD 1.00 Billion

Newmont Corporation is selling its Akyem Gold Mine Project in Ghana to Zijin Mining Group of China for USD 1 billion. This sale is part of Newmont’s broader strategy to divest non-core assets and refocus on its high-quality Tier 1 projects.

The Akyem operation ranks among the largest gold mines in Ghana, boasting a processing facility with an annual capacity of 8.5 million metric tons. In terms of gold production, the mine yielded 11.9 metric tons in 2021, 13.1 metric tons in 2022, and 9.2 metric tons in 2023. As of December, the open-pit mine held reserves of 34.6 metric tons. Furthermore, the commencement of underground mining operations is anticipated in 2028, which will extend the mine’s lifespan to 2042, producing around 5.8 metric tons of gold each year.

This acquisition allows Zijin Mining to access high-grade ore from one of the world’s prominent gold belts. Over the past thirty years, Zijin Mining has expanded its global operations by extracting gold, copper, and lithium through various exploration and acquisition strategies. The company plans to increase its gold production from 68 metric tons in 2023 to 85 metric tons by 2025, with a potential goal of reaching 110 metric tons by 2028. As Beijing seeks to enhance its relationships with resource-rich nations in Africa, the continent has emerged as a significant focus for Chinese mining investments.

The sale is still pending regulatory approvals and is expected to be finalized in the fourth quarter.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of October 7 to 13, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter