M&A News M&A News: Global M&A Deals Week of September 16 to 22, 2024

- M&A News

M&A News: Global M&A Deals Week of September 16 to 22, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

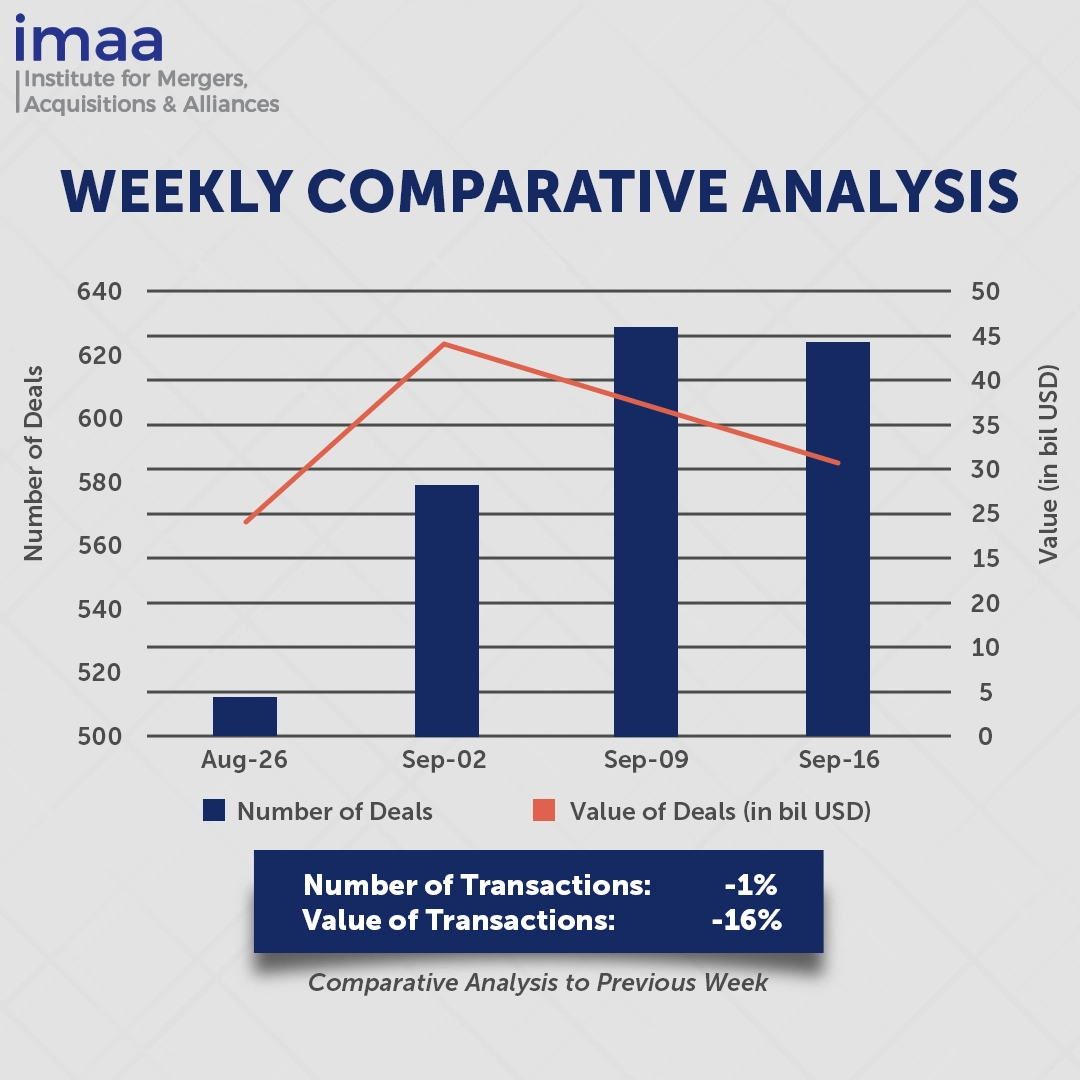

During the week of September 16 to September 22, the global mergers and acquisitions (M&A) market recorded 624 transactions, valued at USD 30.94 billion. Notably, 17 deals exceeded the USD 500 million threshold, collectively amounting to USD 22.36 billion, representing 72% of the total deal value for the week.

The media and entertainment sector is experiencing a resurgence, highlighted by the top three deals during this period. Leading the list is Rogers Communications’ acquisition of Maple Leaf Sports & Entertainment for USD 3.5 billion, positioning Rogers as the majority stakeholder in the organization that owns the NHL’s Toronto Maple Leafs and the NBA’s Toronto Raptors. This strategic move underscores Rogers’ commitment to enhancing its presence in the sports and entertainment landscape.

Further emphasizing this trend, the second and third largest deals involved acquisitions in the gaming sector—also within media and entertainment—with Flutter acquiring Snaitech for USD 2.6 billion and Playtika purchasing Superplay for USD 1.94 billion. These transactions reflect the companies’ strategies to expand their portfolios and seize growth opportunities in the dynamic gaming market.

Comparative data from the previous week shows a slight decline in deal volume, decreasing from 629 to 624. The total deal value also fell by 16%, from USD 36.85 billion to USD 30.94 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of September 16 to 22, 2024 in detail:

Deal No. 1: Rogers Communications Inc. to Acquire Maple Leaf Sports & Entertainment Ltd. for USD 3.50 Billion

Deal No. 2: Flutter Entertainment plc to Acquire Snaitech S.p.A. for USD 2.60 Billion

Deal No. 3: Playtika Ltd. to Acquire SUPERPLAY Ltd. for USD 1.95 Billion

Deal No. 4: General Atlantic Ltd.; Bridgepoint Group plc to Acquire Esker SA for USD 1.81 Billion

Deal No. 5: Patron Capital Limited; Sixth Street Partners, LLC to Acquire CALA Group Limited for USD 1.80 Billion

Deal No. 1:

Rogers Communications Inc. to Acquire Maple Leaf Sports & Entertainment Ltd. for USD 3.50 Billion

Canadian media and communications giant Rogers Communications is acquiring a 37.5% equity stake in Maple Leaf Sports & Entertainment (MLSE) for CAD 4.7 billion (USD 3.5 billion). MLSE, the renowned owner of the NHL’s Toronto Maple Leafs and the NBA’s Toronto Raptors, is considered one of the top sports and entertainment organizations worldwide.

This acquisition will increase Rogers’ stake in MLSE to 75%, solidifying its position as the majority shareholder. Rogers, which already owns Major League Baseball’s Toronto Blue Jays and their home stadium, the Rogers Centre, has established partnerships with several NHL teams, including the Vancouver Canucks, Edmonton Oilers, and Calgary Flames.

Live sports and entertainment remain central to Rogers’ business strategy. The company has invested CAD 14 billion in Canadian sports over the past decade. By expanding its ownership in MLSE, Rogers aims to further enhance its influence in the sports industry and continue its mission to bring championships to Canada.

The deal is projected to close by mid-2025.

Deal No. 2:

Flutter Entertainment plc to Acquire Snaitech S.p.A. for USD 2.60 Billion

Flutter Entertainment, a leading global player in online sports betting and iGaming, is set to acquire Playtech’s Italian gambling division, Snaitech, for USD 2.6 billion, including debt, in an all-cash deal. This acquisition enhances Flutter’s presence in Europe’s largest gambling market.

This move is part of Flutter’s ongoing international expansion strategy, which has gained momentum through substantial growth in the US market. After shifting its primary stock listing from London to New York, Flutter has reinforced its position in the US, thanks in part to its 2018 purchase of a majority stake in FanDuel. In February, the company expanded its portfolio further by acquiring UK-based gaming software firm BeyondPlay.

Snaitech ranks among Italy’s top consumer-facing gambling operators. Although Italy is the largest gambling market in Europe, its online segment remains underdeveloped, creating an opportunity for Flutter to leverage the anticipated shift to digital platforms. The Italian online gambling market is projected to grow by 10% over the next three years. By integrating Snaitech with its existing Sisal brand—acquired in 2022 and recognized as Italy’s online market leader—Flutter is positioned to capture approximately 30% of the Italian online market.

This acquisition is in line with Flutter’s emphasis on strategic, value-driven mergers and acquisitions and will provide Snaitech with the resources needed to accelerate its growth by accessing Flutter’s industry-leading products and expertise, both in the US and globally.

The transaction is expected to close by the second quarter of 2025.

Deal No. 3:

Playtika Ltd. to Acquire SUPERPLAY Ltd. for USD 1.95 Billion

Israeli mobile games developer Playtika has announced its plan to acquire gaming competitor SuperPlay, the creator of the popular mobile titles Dice Dreams and Domino Dreams, for up to USD 1.95 billion. The deal entails an initial payment of USD 700 million, with the potential for an additional USD 1.25 billion contingent on meeting specific financial milestones over the next three years.

This acquisition is a strategic move for Playtika, aimed at reinforcing its leadership in the mobile gaming sector, driving growth through established franchises, and unlocking new opportunities in the industry.

As of August 2024, SuperPlay’s Dice Dreams, a rapidly growing coin looter game, and Domino Dreams, a board game, boasted a combined average of 1.7 million daily active users. This strong user engagement positions Playtika to enhance its ability to deliver outstanding gaming experiences globally. Additionally, bringing SuperPlay’s seasoned team on board and expanding its game portfolio is expected to positively influence Playtika’s growth prospects in the coming years.

The transaction is anticipated to finalize in the fourth quarter of 2024, pending regulatory approvals. Morgan Stanley & Co. LLC is serving as the exclusive financial advisor for Playtika, while The Raine Group and Aream & Co. are advising SuperPlay.

Deal No. 4:

General Atlantic Ltd.; Bridgepoint Group plc to Acquire Esker SA for USD 1.81 Billion

British private equity firm Bridgepoint, alongside General Atlantic and members of Esker’s management, has put forth an all-cash proposal to acquire 100% of Esker’s shares for approximately EUR 1.62 billion (about USD 1.81 billion).

This acquisition positions Esker, a leader in the automation of Source-to-Pay and Order-to-Cash management processes, to advance its growth strategy with the strategic backing and flexibility offered by Bridgepoint and General Atlantic.

Esker’s vital software solutions empower enterprise clients to streamline and automate financial operations, resulting in significant efficiency improvements and cost reductions. The company is well-positioned for further growth, benefiting from favorable digitization trends and an expanding market as businesses navigate increasing operational challenges. With a stronghold in France, a robust presence across various European markets and the Asia-Pacific region, as well as significant operations in North America, Esker aligns well with Bridgepoint’s strategic vision.

The transaction is expected to close by the end of 2024 or in the first quarter of 2025. Deutsche Bank serves as the exclusive financial advisor to Esker, while Morgan Stanley & Co International is acting as the lead financial advisor for Bridgepoint. Legal counsel for General Atlantic is provided by Paul, Weiss, Rifkind, Wharton & Garrison and Bredin Prat.

Deal No. 5:

Patron Capital Limited; Sixth Street Partners, LLC to Acquire CALA Group Limited for USD 1.80 Billion

Cala Group, a prominent UK housebuilder, has been acquired by global investment firm Sixth Street Partners and Patron Capital, a pan-European institutional investor specializing in property-backed assets, for GBP 1.35 billion (approximately USD 1.80 billion) from Legal & General (L&G).

Cala is recognized for its commitment to high-quality construction and boasts an exceptional landbank, primarily developing premium homes in the South of England, the Cotswolds, and Scotland. The company aims to deliver 3,000 new homes by the end of 2024.

This acquisition is part of a broader trend in the UK housebuilding industry, as developers emerge from a challenging period marked by rising mortgage rates and look forward to a potential market rebound with declining interest rates. Notably, Barratt recently acquired Redrow, while Bellway attempted a bid for Crest Nicholson.

For L&G, the divestiture is a strategic move to streamline its operations and concentrate on its core business functions.

With this new ownership, Cala is well-equipped to pursue its next phase of growth. The completion of the sale is expected in the fourth quarter of 2024.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of September 16 to 22, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter