M&A News M&A News: Global M&A Deals Week of Jul 29 to Aug 4, 2024

- M&A News

M&A News: Global M&A Deals Week of Jul 29 to Aug 4, 2024

- IMAA

SHARE:

The Institute for Mergers, Acquisitions and Alliances (IMAA) provides a detailed weekly roundup of mergers and acquisitions news, highlighting the most significant global M&A deals. This essential update offers a snapshot of the latest movements and trends within the M&A market, showcasing the top transactions that stand out in the corporate world. Through this coverage, IMAA aims to furnish M&A professionals and enthusiasts alike with a comprehensive overview of the week’s M&A activities, helping them stay informed about the evolving landscape of global mergers and acquisitions.

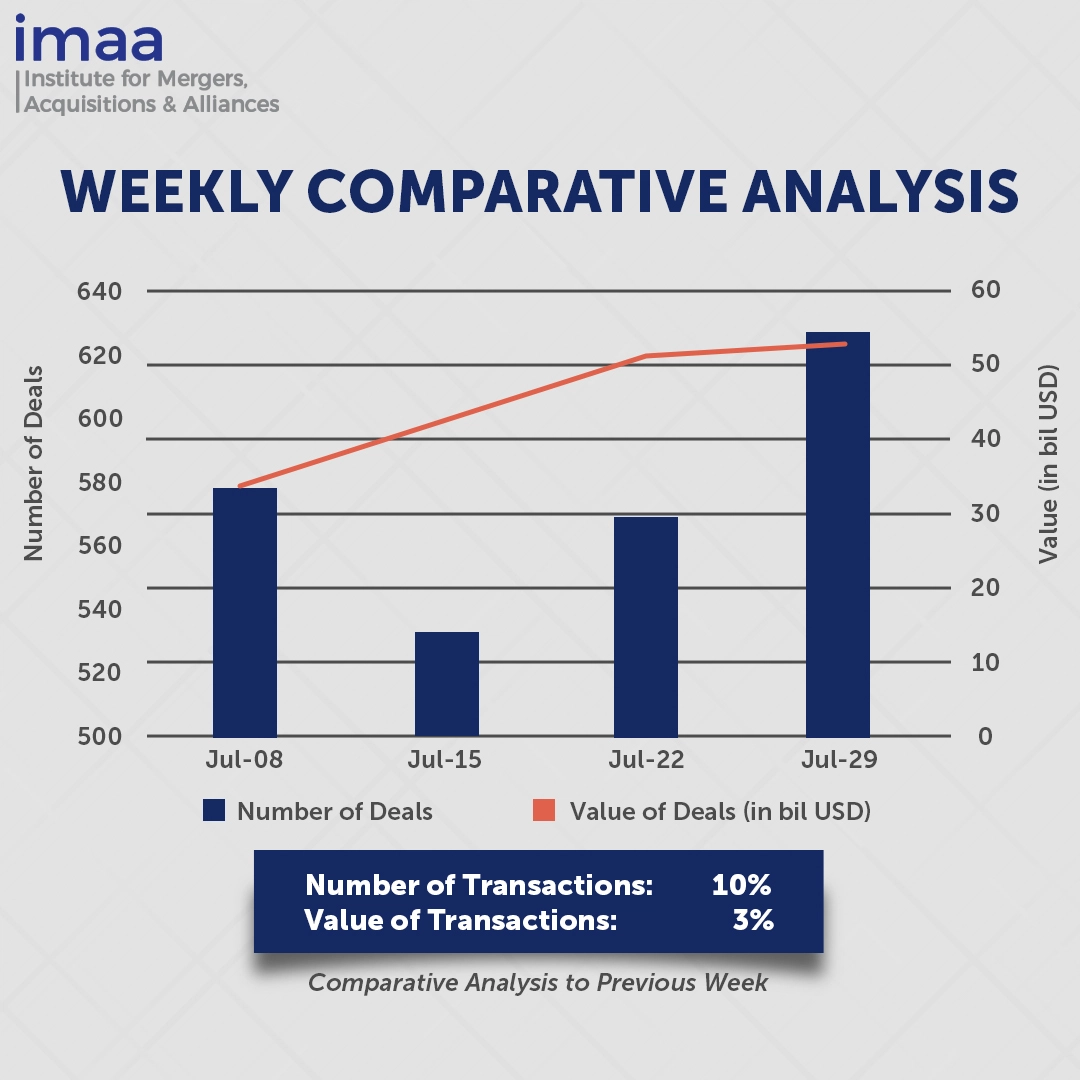

During the week from July 29 to August 4, the global mergers and acquisitions (M&A) market announced 627 deals with a total value of USD 52.73 billion. Among these transactions, 21 exceeded the USD 500 million mark, contributing USD 42.62 billion—81% of the week’s total deal value.

This highlight deal of the week is the USD 8.9 billion acquisition of R1 RCM by TowerBrook Capital Partners and Clayton, Dubilier & Rice. This deal concluded a lengthy competition among private equity firms to acquire the large healthcare billing and collections company. It underscores private equity’s growing interest in RCM vendors due to their substantial growth potential, stable revenue, and increasing demand driven by the complexity of healthcare billing. As healthcare systems evolve and adopt new technologies, RCM vendors that provide efficient and innovative solutions are becoming increasingly attractive investment opportunities.

Additionally, two of the top five deals of the week were in the insurance sector. Insurers, managing substantial capital from customer premiums, have become appealing targets for private equity and alternative asset managers seeking high returns. These partnerships offer insurers enhanced investment opportunities through private equity firms’ financial market expertise.

This week, the M&A market experienced a notable uptick in activity compared to the previous week, with deal volume increasing by 10%, from 569 to 627 transactions. Similarly, the total deal value rose by 3%, growing from USD 51.18 billion to USD 52.73 billion.

Top 5 M&A Deals for the Week

Here are the top 5 M&A Deals for the week of July 29 to August 4, 2024 in detail:

Deal No. 1: TowerBrook Capital Partners L.P.; Clayton, Dubilier & Rice, LLC to Acquire R1 RCM Inc. for USD 8.90 Billion

Deal No. 2: BNP Paribas SA to Acquire AXA Investment Managers S.A. for USD 5.50 Billion

Deal No. 3: Sixth Street Partners, LLC to Acquire Enstar Group Limited for USD 5.10 Billion

Deal No. 4: Lundin Mining Corporation; BHP Investments Canada Inc. to Acquire Filo Corp. for USD 3.02 Billion

Deal No. 5: Iberdrola, S.A. to Acquire Electricity North West Limited for USD 2.70 Billion

Deal No. 1:

TowerBrook Capital Partners L.P.; Clayton, Dubilier & Rice, LLC to Acquire R1 RCM Inc. for USD 8.90 Billion

R1 RCM, a company specializing in healthcare revenue cycle management, is set to be acquired by private equity firms TowerBrook Capital Partners and Clayton, Dubilier & Rice (CD&R) for USD 8.9 billion.

TowerBrook, already holding about 36% of R1 RCM’s shares, will partner with CD&R to take the company private, paying USD 14.30 per share for the remaining shares.

R1 RCM is a prominent provider of technology-driven solutions for health systems, hospitals, and physician groups offering tools and services for front-, middle-, and back-office operations. Serving over 3,700 hospitals and 30,000 doctors, R1 RCM’s scalable operating models integrate with healthcare organizations to deliver sustainable improvements in net patient revenue and cash flows, enhance revenue yield, reduce operating costs, and improve the patient experience.

Since 2016, TowerBrook has supported R1 RCM’s development as a leader in healthcare revenue management. Together with CD&R, TowerBrook aims to further improve customer performance and value, while advancing the company’s leadership in intelligent automation and General Artificial Intelligence (GAI) for revenue management.

The transaction is expected to close by year-end. Centerview Partners LLC is serving as the lead financial advisor to TowerBrook and CD&R. Financing for the deal is being provided by Deutsche Bank and Royal Bank of Canada, with Deutsche Bank Securities, Inc. and RBC Capital Markets, LLC also acting as financial advisors to TowerBrook and CD&R.

Deal No. 2:

BNP Paribas SA to Acquire AXA Investment Managers S.A. for USD 5.50 Billion

French multinational bank BNP Paribas is in exclusive negotiations with AXA, a leading European insurer, to purchase AXA Investment Managers (AXA IM) for EUR 5.1 billion (USD 5.5 billion). This move is driven by increasing demand for alternative assets.

The integration of AXA IM and BNP Paribas would establish a top-tier European asset manager with total assets under management of EUR 1.5 trillion. The combined entity would enhance AXA IM’s global footprint and expand its product range, while both firms aim to strengthen their leadership in responsible investing. AXA will retain oversight of product design, asset allocation, and asset-liability management.

The agreement includes a long-term strategic partnership, where BNP Paribas would offer investment management services to AXA.

For AXA, this transaction represents a strategic shift to streamline its business and focus on its core insurance sectors, including Life & Savings, Property & Casualty, and Health insurance.

The deal is projected to have a 25 basis point effect on BNP Paribas’s CET1 ratio and is expected to achieve a return on invested capital of over 18% by the third year after the acquisition.

Completion of the transaction is anticipated by mid-2025.

Deal No. 3:

Sixth Street Partners, LLC to Acquire Enstar Group Limited for USD 5.10 Billion

Global investment firm Sixth Street has finalized an agreement to acquire Bermuda-based insurer Enstar Group for USD 5.1 billion (USD 338 per share) in cash, taking the company private.

Liberty Strategic Capital, J.C. Flowers & Co. LLC, and other institutional investors are also involved in the deal.

Enstar is renowned for its innovative legacy property and casualty (P&C) insurance solutions and expertise in the reinsurance market. The company is known for its conservative financial practices and strong risk management. Enstar provides capital release solutions through its global network, which includes operations in Bermuda, the United States, the United Kingdom, Continental Europe, Australia, and other regions. Since its inception in 2001, Enstar has acquired more than 117 companies and portfolios.

The transaction is expected to be completed by mid-2025. Goldman Sachs & Co. LLC is advising Enstar, while Ardea Partners LP, Barclays PLC, and J.P. Morgan Securities LLC are providing advisory services to Sixth Street.

Deal No. 4:

Lundin Mining Corporation; BHP Investments Canada Inc. to Acquire Filo Corp. for USD 3.02 Billion

BHP and Lundin Mining Corporation, a diversified Canadian base metals mining company, have reached an agreement to jointly acquire Filo Corp for CAD 4.1 billion (USD 3.02 billion). Filo Corp fully owns the Filo del Sol (FDS) copper project.

As part of the deal, BHP and Lundin Mining will form a 50/50 joint venture to manage the FDS project in Argentina and the Josemaria project in Chile’s Vicuña district. Lundin Mining currently owns the Josemaria project. The joint venture aims to develop a significant copper district with considerable potential.

Upon completion of the acquisition, both BHP and Lundin Mining will each hold a 50% interest in Filo Corp and the FDS project. Additionally, BHP will purchase a 50% stake in the Josemaria project from Lundin Mining for approximately USD 690 million in cash.

This acquisition aligns with BHP’s strategy to invest in promising early-stage copper projects and form strategic partnerships that leverage complementary expertise. The FDS project is regarded as one of the most notable copper discoveries in recent decades due to its large-scale, high-grade sulphide deposit.

For Filo Corp, the transaction provides a route to advance the FDS project with support from experienced mining partners and offers shareholders immediate value at a substantial premium.

The transaction is anticipated to close in the first quarter of 2025. BMO Capital Markets is advising Filo Corp, while TD Securities Inc. is advising BHP.

Deal No. 5:

Iberdrola, S.A. to Acquire Electricity North West Limited for USD 2.70 Billion

Spanish utility company Iberdrola has reached an agreement to acquire an 88% stake in UK-based Electricity North West (ENW) for GBP 2.1 billion (USD 2.7 billion). This acquisition will make the UK Iberdrola’s largest market by regulated asset base, valued at EUR 14 billion.

ENW provides electricity to nearly five million customers in the North West of England, including major cities like Manchester, Lancaster, and Barrow, through approximately 60,000 km of distribution networks. Following this acquisition, Iberdrola will become the second-largest electricity network operator in the UK, managing a distribution network that serves around 12 million people across over 170,000 km and employs more than 8,500 people in the region.

The acquisition aligns with Iberdrola’s strategy to enhance and expand power grids like those managed by ENW, driven by the stable and predictable returns such assets offer amid challenges in the renewable energy sector, including high interest rates and debt costs.

In the UK, Iberdrola also owns ScottishPower, a vertically integrated energy company engaged in renewable energy and transmission and distribution networks. ENW’s location complements the existing ScottishPower network areas.

The transaction is expected to be finalized in the fourth quarter of the year, with Iberdrola anticipating full control of ENW by the first half of 2025.

This concludes our M&A news coverage of the top global mergers and acquisitions deals for the week of July 29 to August 4, 2024. For continuous and detailed insights into the evolving landscape of M&A news, we invite you to follow the Institute for Mergers, Acquisitions, and Alliances (IMAA).

Stay up to date with M&A news!

Subscribe to our newsletter