Publications 2023 M&A Mid-Year Update

- Publications

2023 M&A Mid-Year Update

- IMAA

SHARE:

Table of Contents

Global M&A Industry Trends

Bold doesn’t need to be big: with a drop in megadeals, executives are counting on mid-market M&A to drive strategic transformation and accelerate growth.

A lot has changed since the start of the year: inflation is decelerating; interest rates may be near their apex; some banks have failed; the US debt ceiling crisis has been averted; and it seems people everywhere are buzzing about the next Big Thing in tech: generative AI. For very different reasons—from digitalisation to decarbonisation to doubling down on value creation—all the ferment is creating dynamic market conditions that we believe will create transformation opportunities and the right conditions for a more buoyant M&A market over the coming months.

The M&A activity ahead may not all be eye-catching megadeals, which have ebbed since hitting their peak in 2021, but rather a healthier level of mid-market deals as companies pursue their strategic growth agendas. These smaller deals can also drive transformation and growth. While cash-rich corporates remain well positioned to make larger moves, we see mid-market transactions dominating the market in coming months as CEOs use a program of both strategic acquisitions and select divestitures to transform their portfolios for the future.

We began 2023 with a cautious M&A outlook. The global economy was clouded by recession fears and rising interest rates as central bankers sought to tame record inflation in many regions. And there’s no disputing that the first half of this year has been challenging for many dealmakers, with deal volumes declining by 4% from already subdued levels in the second half of 2022. Deal volumes nonetheless remain above pre-pandemic 2019 levels.

Deal flow could open up in the second half of the year, especially if sellers focus on pre-sale preparation and readjust expectations about pricing. But for many buyers, financing has become more difficult—and a lot more expensive. That is placing more emphasis on alternative funding and how to create value from a deal.

Value creation has, of course, always been a guiding principle for dealmakers, but today, there is a real need to go deeper and identify additional—often transformational—levers of value that can help realise each transaction’s full potential. We are already seeing greater focus on strategic repositioning—for example, through portfolio optimisation, digitalisation and business model changes. But some less-considered levers, such as energy efficiency, green tax credits and sustainable financing, are worth a closer look.

Transformation and disruption go hand in hand

Technology is empowering decision-making and enabling CEOs to digitalise and transform businesses. And AI has just upped the game. AI’s disruptive impact on companies and the economy will create M&A opportunities as both corporates and private equity (PE) firms move to acquire new businesses or potentially exit them to monetise returns. We’ve been seeing for some time the growing skills challenge faced by organisations driving acquisition strategies. AI has upped the game here too, with AI talent being one of the scarcest resources to find.

Transformation is happening elsewhere, too. Companies are increasingly looking to reduce their impact on climate and pursue net-zero strategies. The energy transition is creating huge disruption in some sectors, with opportunities for M&A along the way. For example, automotive and industrial OEMs are acquiring mining companies to secure supply of critical minerals necessary for battery production and energy storage.

In a world of rapid change, CEOs need to adopt a bold M&A strategy to enable them to keep ahead of the competition. But bold doesn’t have to mean big. M&A can transform business models in many forms. Portfolio reviews will be a key area of focus for both corporates and PE firms as they look to make a series of smaller transactions on their transformation journey. Smaller, more mid-market deals may be easier to get done in today’s difficult financing and regulatory environment—and they can be transformational, too, if they form part of a well-planned acquisition or disposal program. Cash-rich corporates are best positioned to do larger, more transformational deals while balancing the regulatory influences being encountered. Lower public company valuations will create public to private opportunities for private equity. The expected uptick in restructuring may lead to distressed M&A. But before sellers make their move, preparation is key.

'The M&A market is more resilient than the headline numbers might suggest. It’s a buyer’s market out there now, especially for cash-rich corporate acquirors and middle-market deals. So it’s essential for sellers to work harder to prepare for upcoming sales—or risk losing out.’

Brian Levy, Global Deals Industries Leader, Partner, PwC US

Prepare for the current market … and what’s coming

The macroeconomic conditions and tight financing markets have created a deal environment in which processes are taking longer, with more uncertain outcomes, more challenging business cases, and the need for deeper due diligence.

Buyers are already feeling the pressure to justify their investment thesis and a robust business case. If they can’t also identify opportunities for value creation and quantify various outcomes, their deal may never see the light of day. They will also need to invest incremental resources and be purposeful about securing capital. In today’s market, financing should not be taken for granted. Traditional funding sources may no longer be available or may only be on terms that do not align with the deal’s expected return.

Sellers cannot prepare enough. We repeat: in this market, sellers cannot prepare enough. A year ago, with an abundance of cheap capital powering a highly competitive M&A market, sellers could limit buyer information and questions and still extract a premium. Today, to complete a deal and avoid price reductions, sellers should anticipate a greater level of scrutiny from buyers and their funding sources, and they will need to be “deal ready”. Warning: this process can be time-consuming. But a classic mistake we see all too often is sellers and their bankers establishing aggressive sale timelines. These limit management’s ability to adequately plan, prepare and optimise the business before it hits the market and, in the worst case, can cause the deal to fall through.

What buyers want

How can sellers get “deal ready”?

Buyers are paying more attention to:

Savvy sellers need to prepare:

- new strategic growth and value creation levers

- business model transformation opportunities

- technological capabilities (i.e., cloud, cyber, AI)

- a clear hypothesis of impact of generative AI on the business model (opportunities and threats)

- deeper data analysis

- operating model robustness and durability

- acquiring and retaining talent

- roadmaps to sustainable transformation

- a compelling equity story with quality supporting data

- a transformation strategy with targets and KPIs

- a detailed M&A roadmap

- new growth levers

- cost reduction opportunities

- a technology roadmap

- a scenario analysis of upsides and risks (including AI)

- an operations strategy and leverage

- a workforce strategy and metrics

- financial and operating data to meet sustainability reporting requirements

A trusted vision of the business’s full potential

'Deals that can bring about strategic business model transformations are more relevant than ever in the current market, and we expect “Transact to Transform” to be a major theme as M&A starts to pick up again in coming months.’

Portfolio reviews and divestitures create deal flow for the mid-market

We expect portfolio reviews will be a key area of focus for both corporates and PE firms. Such reviews represent a hallmark of strong leadership and smart business decision-making that can help identify key strategic gaps (in capabilities or products) that acquisitions can help to fill. They also serve to identify non-core or underperforming assets that can be divested and enable businesses facing challenges in their funding structure to take action to optimise their balance sheets. Three main factors will influence these decisions:

- A more capital-constrained environment: we expect to see greater focus on divestitures as companies look to deleverage balance sheets, free up capital to reinvest or, in the case of private equity, return capital to their investors.

- The technology revolution: The costs involved with technology transformation will force choices. Companies will have to double down in areas where they could win—jettisoning peripheral nice-to-have businesses, as well as those at risk of disintermediation.

- Geopolitical or regulatory dynamics: These may also create the impetus for companies to sell assets in difficult markets or divest assets that require a disproportionate amount of management attention.

According to PwC’s recent study, The power of portfolio renewal and the value in divestitures, companies most likely to create value proactively review their portfolio and consider and complete divestitures via timely decision-making processes. With acquisitions having outnumbered divestitures by more than a four-to-one ratio over the past two years, we believe it is likely that a significant number of assets within corporate portfolios today may be good candidates to divest—and the to-be-divested assets will provide buying opportunities for others.

Mid-market deals are the staple of dealmaking

We are seeing a divergence in the current M&A market between larger deals and smaller, mid-market ones. Larger deals, while often more transformational in nature, have become harder to complete in the current financing environment and are facing more regulatory scrutiny. Smaller deals are less affected by market volatility, often being viewed as the staple of dealmaking activity, allowing companies to take a series of steps on their transformation journey rather than one giant leap.

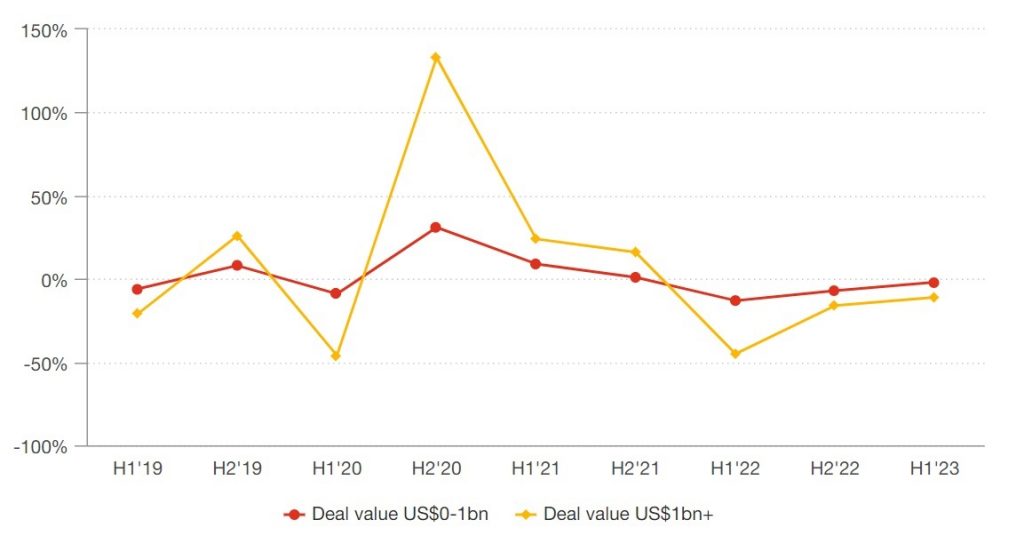

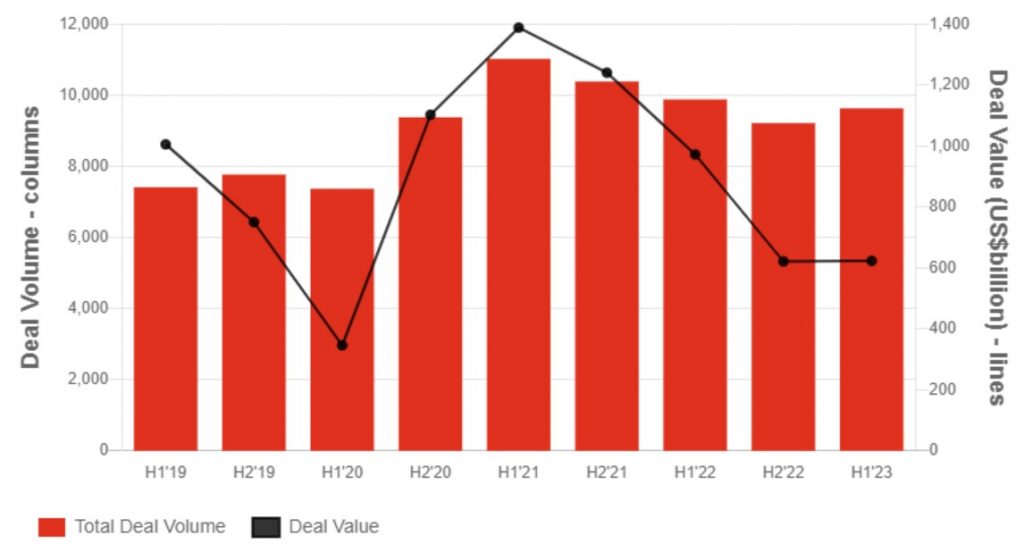

Deal volumes decreased by approximately 4% between the second half of 2022 and the first half of 2023. For the larger deals greater than US$1bn in deal value, the decline was 11%. The number of deals of US$1bn or more has declined by approximately 56% since the record M&A year in 2021. By contrast, deal volumes for deals less than US$1bn declined by approximately 20% over the same period.

Percentage change in global deal volume, H1'19-H1'23

Sources: Refinitiv (LSEG) and PwC analysis.

Note: The above chart does not include deals with an undisclosed deal value.

Cash-rich corporates still have an edge

Corporates with strong balance sheets and sound M&A processes will likely have a competitive advantage in the current market. They have the cash and the ability to extract synergies and may seize the moment to make acquisitions while the tough financing environment is reducing competition for assets. However, this window of opportunity won’t stay open forever.

Corporates have set the pace for larger deals this year—with corporate buyers accounting for two-thirds of the announced megadeals—as PE has focused more heavily on portfolio company transformation and M&A, as well as on public-to-private deals. Some of the largest deals in the first half of 2023 are also examples of how companies are doing transformational transactions: for instance, Pfizer’s US$43bn announced acquisition of Seagen; Glencore’s approximately US$23bn proposed merger with Teck Resources; Newmont’s US$19.2bn announced acquisition of Newcrest Mining; Carrier’s US$13.2bn announced acquisition of Viessmann Climate Solutions; and Xylem’s approximately US$7.5bn announced acquisition of Evoqua Water Technologies.

The sectors witnessing the highest level of megadeals activity—pharma and life sciences and the energy, utilities and resources sectors—are those associated with megatrends such as technological innovation, digitalisation, ESG and the energy transition.

Private Equity firms focus on portfolio optimisation and public to private deals

Don’t underestimate the ingenuity of PE firms. While the macro environment and financing challenges from rising interest rates and tightening credit have hampered leveraged dealmaking, PE players have shifted their focus towards the portfolio, performing portfolio reviews, executing bolt-on acquisitions, and investing in cloud transformation and data and analytics capabilities. While larger buyouts have been less prevalent than in prior years, PE firms with conviction around a specific asset will not shy away from pursuing strategic platform acquisitions, acquiring alternative asset classes within private markets and taking advantage of public market valuations via take-privates.

Recent US bank failures led to a further tightening of credit in what was already a difficult financing market. The PE-leveraged buyout model involves acquiring a company by borrowing and then leveraging the target company’s assets and cash flow to repay the debt. As such, although PE dry powder remains at record levels (US$2.5tn1 as of June 2023), access to debt financing is fundamental. PE players are using a combination of financing structures such as term loans, seller notes, all-equity funding, earn-outs, consortium deals (including with sovereign wealth funds, pension funds and family offices), and minority investments to finance important deals.

Private credit has provided a much-needed source of capital to PE funds, albeit at a premium, and is opening up new transaction avenues for them. In addition, some of the biggest PE funds have raised credit funds or announced plans to acquire them, such as TPG’s US$2.7bn proposed acquisition of Angelo Gordon, an alternative investment firm focused on credit and real estate investing.

The higher cost of capital is creating greater pressure on PE firms to generate returns. However, PE funds grow ever more sophisticated in their investment approach and—with a greater emphasis on identifying different sources of value within a deal, together with a focus on sustainable investments—are employing a combination of operational enhancements and more transformational moves to create value for their investors. Take-private deals are an example of where PE is typically less constrained than public companies, enabling them to implement strategic changes, focus on value creation and generate higher returns.

Some recent examples of take-private deals include the US$15.2bn proposed acquisition of Toshiba Corp by Japan Industrial Partners and the US$12.5bn proposed acquisition of Qualtrics by Silver Lake and CPP Investments. With the current market conditions, we expect PE firms will find further opportunities, particularly in the tech sector, to acquire some good quality companies with strong earnings potential at lower valuations.

'While a valuation gap and macro challenges are undoubtedly slowing some M&A activity, the appetite of private equity appears undiminished. Deals with a strong strategic rationale, potential for significant value upside, and which are well-aligned to the global megatrends of digitalisation, deglobalisation and decarbonisation—such as in the tech, healthcare, infrastructure and renewables sectors—will get done.’

Eric Janson, Global Private Equity and Real Assets Leader, Partner, PwC US

Restructuring on the rise

The uptick in restructuring activity in the first half of 2023 is expected to continue in the second half as financing pressures are becoming insurmountable for some, including the higher cost of debt, tight credit and challenges raising capital. These issues, combined with inflationary impacts, continued supply chain disruption and a low-growth economic environment, mean that several companies now face weak top line growth, margin pressures and a less certain future. The sectors expected to experience a higher level of restructuring activity include retail and consumer discretionary, real estate and industrials.

All things being equal, with a growing number of companies under stress, we would typically expect to see restructuring activity triggered by bank workout processes. For those companies with private credit debt rather than bank debt, we expect to see earlier action being taken to address problems and this more proactive approach to stimulate increased distressed M&A activity.

Companies that were able to secure fixed-rate debt at historically low rates during the pandemic are benefiting from lower financing costs. But those facing a refinancing event or with variable-rate debt are feeling the impact and need to take action. Restructuring to improve the ability to refinance is not just financial and it may come in different forms; for example, portfolio assessments to improve the balance sheet by selling parts of the business or operational restructuring to improve profitability and reduce risk.

On the not-too-distant horizon, the leveraged loan maturity wall in the US and Europe will see approximately US$250bn of institutional loans mature before 2026, of which approximately US$200bn will mature in 20252. If interest rates remain at current levels, this may reset borrowing rates to substantially higher levels. Or, in an even less favourable scenario, companies unable to refinance may need to restructure. In addition to traditional refinancings, we are seeing increased bond-for-loan takeouts to lock in fixed rates, as well as amend-to-extend activity to push out maturities with existing investors. Companies should keep a watchful eye on refinancing risks, and those that take early action to secure alternative capital sources when the opportunities present themselves will be better positioned for future success.

Global M&A volume and value trends

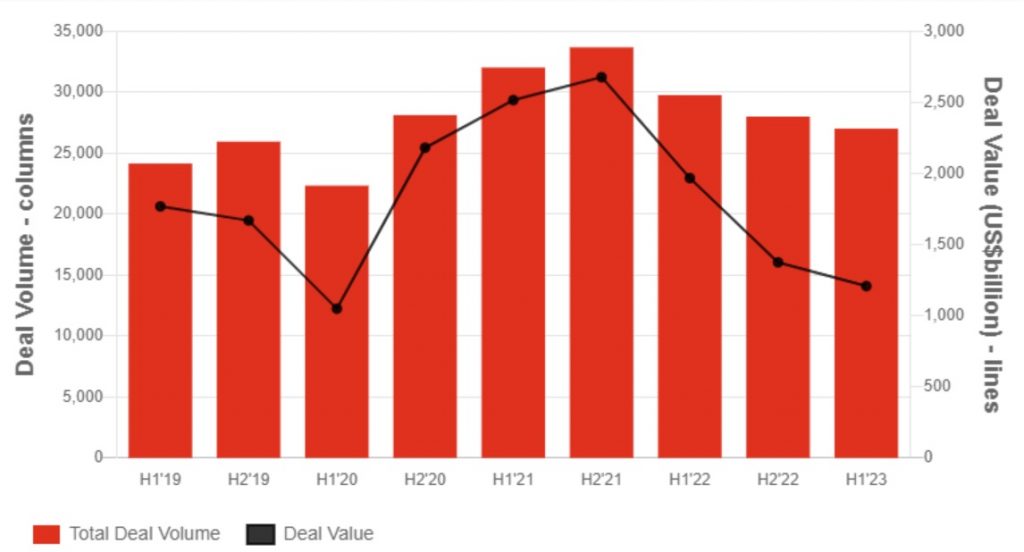

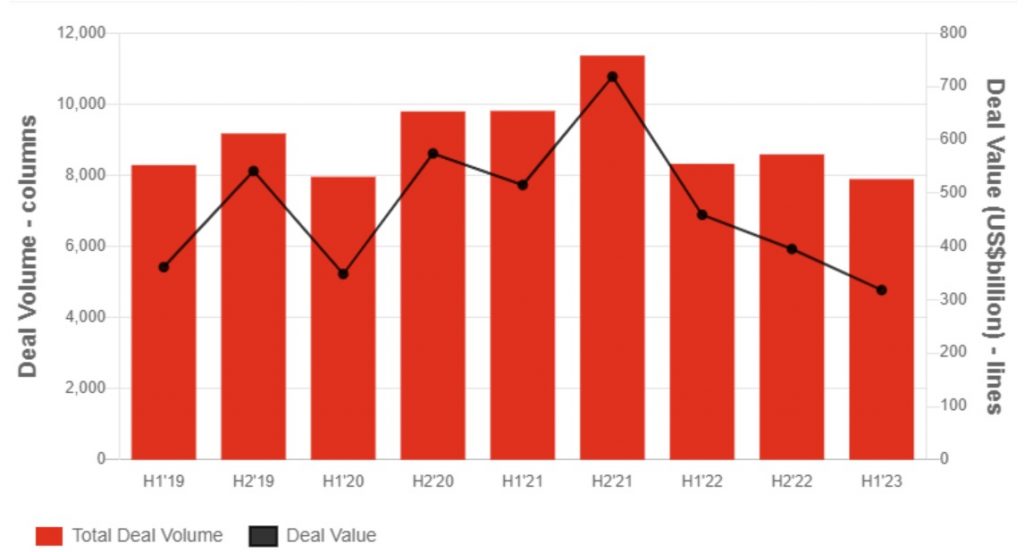

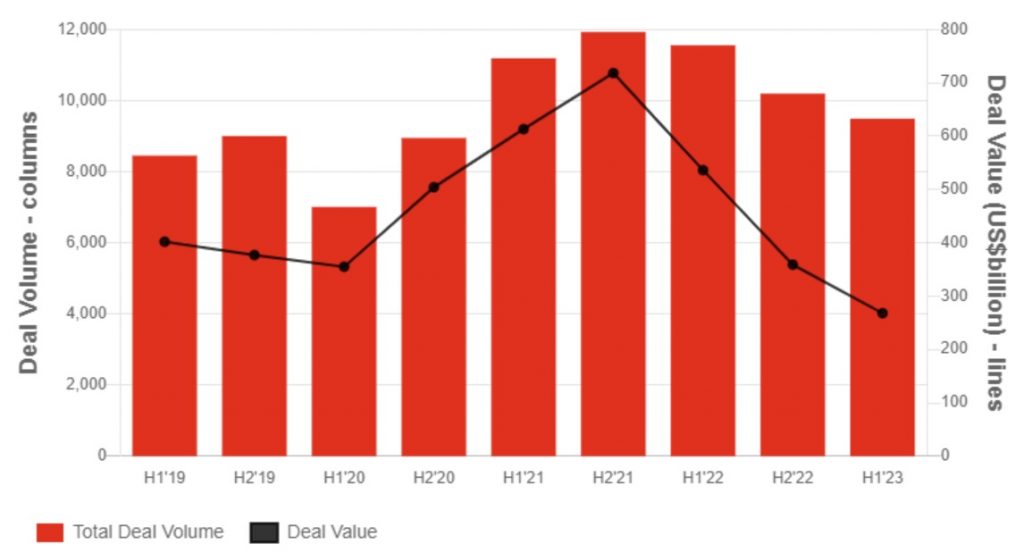

Deal volumes and values, H1'19-H1'23

Click the tabs to view the chart and commentary for each region.

Sources: Refinitiv (LSEG) and PwC analysis

Global

Global M&A volumes and values declined during the first half of 2023 (H1’23) by 4% and 12%, respectively, from already subdued levels in the second half of 2022 (H2’22). When compared to the first half of 2022, the declines were 9% and 39%, respectively. Overall M&A activity has been uneven across regions and territories as different macroeconomic and other factors have played out, creating opportunities for investors who are willing to seek growth in other markets.

The technology, media and telecommunications (TMT) sector was the most active sector for dealmaking in H1’23, accounting for approximately 26% of all global deal activity. However, when it came to deal values, the industrial manufacturing and automotive (IM&A) and energy, utilities and resources (EU&R) sectors led the way with 25% and 21% of deal value, respectively. The EU&R sector’s share of overall deal value of 21% (on just 9% of deal volumes) highlights how investment funding continues to flow into the sector, with investors attracted by substantial investments in the energy transition as companies seek to deliver on net zero emissions commitments.

Click the above tabs to view the chart and commentary for each region.

Originally published at PwC

Footnotes:

[1] Private equity dry powder of US$2.5tn is based on Preqin data as of 16 June 2023, as accessed on 16 June 2023.

[2] US and European leveraged loan maturity data is based on Pitchbook (LCD) data as of 31 May 2023, as accessed on 19 June 2023.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter