Publications Taxation Of Cross-Border Mergers And Acquisitions: Korea 2016

- Publications

Taxation Of Cross-Border Mergers And Acquisitions: Korea 2016

- Christopher Kummer

SHARE:

Introduction

Opportunities for mergers and acquisitions (M&A) in the Republic of Korea (Korea) have increased in recent years. A growing number of companies are turning their attention to M&A to compete in the global economy, expand operations and gain various synergistic benefits. As the number of M&A deals in Korea grows, the Korean government continues to provide tax and other benefits to encourage them. With regard to the taxation of cross-border M&A, this report focuses on the following issues:

- asset purchase or share purchase

- choice of acquisition vehicle

- choice of acquisition funding.

Tax is only one part of transaction structuring. The Korean Commercial Law governs the legal form of a transaction, and accounting issues are also highly relevant when selecting the optimal structure. When investors are planning cross-border M&As, they should consider these other matters.

Asset purchase or share purchase

Investors may purchase a company by way of an asset purchase or a share purchase. Each method has its own tax advantages and disadvantages.

Purchase of assets

Under Korean tax laws, there are two main types of asset purchases — individual asset transfers and comprehensive business transfers. Where, at the seller/purchaser’s discretion, only selected assets or liabilities are transferred, the transfer is classified as an individual asset transfer. Where substantially all the business-related rights, assets, liabilities and employees of a company or a division of a company are transferred in a comprehensive manner, such that the nature and the continuity of the business are sustained after the transfer, the transaction is deemed to be a comprehensive business transfer for Korean tax purposes.

Purchase price

Assets and liabilities are valued in the course of an asset purchase, which may result in a capital gains tax liability for the seller and affect the depreciable amount for the buyer. Where a comprehensive business is purchased at its fair market value, the acquisition cost of the target business’s assets may be stepped-up (or down) to their fair market value. In this case, the buyer needs to apportion the total consideration to the assets acquired.

Goodwill

Goodwill is the excess amount of the consideration paid over the fair value of the net assets transferred. For tax purposes, goodwill can only be recognized if it is traceable to a valuable intangible asset and if an appropriate method has been used to calculate the goodwill. Goodwill can be amortized on a straight-line basis over a period of 5 years or more within the tax limit to the extent that the amortization expenses are recognized for accounting purposes.

Depreciation

The depreciation cost of the assets charged in the accounts is deductible for tax purposes within the tax limit, provided it is calculated based on the depreciation method and useful life stipulated for each type of asset under the corporate income tax law. Taxpayers typically choose either the straight-line method, declining-balance method or unit of production method to depreciate assets.

Tax attributes

Tax losses or historical tax liabilities are not transferred with the assets in an asset acquisition. In the case of an individual asset transfer, the purchaser does not incur a secondary tax liability for any unpaid tax or tax liabilities of the seller that relate to the transferred assets on the official transfer date. However, in a comprehensive business transfer, the purchaser assumes a secondary tax liability on any already fixed and determinable tax liabilities of the seller on the official transfer date.

Value added tax

Value added tax (VAT) implications on the asset transfer depend on whether the transfer is classified as an ‘individual asset transfer’ or ‘comprehensive business transfer’ under Korean tax law. In the case of an individual asset transfer, a seller should withhold VAT at 10 percent from a buyer and remit the collected VAT to the relevant tax authority. A comprehensive business transfer is exempt from VAT.

Transfer taxes

Stamp duty

Stamp duty is levied on the transfer of certain assets listed in the stamp duty law. The rate of stamp duty varies according to the asset acquired. Transfers of real estate are subject to stamp duty ranging from 20,000 to 350,000 Korean won (KRW), depending on the acquisition price.

Acquisition tax

Under the Korean Local Tax Law, a company acquiring land, buildings, vehicles or certain memberships (e.g. golf memberships, condominium memberships and/or sports complex memberships) are liable for acquisition tax, based on the transfer price, type and location of such taxable assets. In certain cases, the applicable acquisition tax rate is higher than the normal rate.

Purchase of shares

Under Korean tax law, the following tax implications may arise on the transfer of shares.

Tax indemnities and warranties

In a share transfer, the purchaser takes over all assets and related liabilities together with contingent asset and liabilities. Therefore, the purchaser normally requires more extensive indemnities and warranties than in the case of an asset transfer.

Tax losses

In principle, on a change of ownership, the tax losses of a Korean company transfer along with the company.

Crystallization of tax charges

Since the purchase in a share transfer should assume the historical tax liability of the target company for the previous periods within the statute of limitations in Korea, it is usual for the purchaser to obtain an appropriate indemnity from the seller.

Transfer taxes

Security transaction tax

A securities transaction tax (STT) is imposed on the transfer of stock of a corporation established under the Commercial Code or any special act, or on the transfer of an interest in a partnership, limited partnership or limited liability company established under the Commercial Code. The securities settlement corporation and securities companies are required to collect tax at the time of a transaction. The tax is computed by multiplying the tax base by the tax rate (0.3 percent or 0.5 percent). Where the transfer price is lower than the fair market value in the case of a related-party transaction, the fair market value is used as the tax basis for calculating STT.

Deemed acquisition tax

In the case of a share transfer, no acquisition tax is generally levied. An exception applies where the invested company has certain statute-defined underlying assets (e.g. land, buildings, structures, vehicles, certain equipment, various memberships) that are subject to acquisition tax. Where the investor and its affiliates collectively acquire in aggregate more than 50 percent of the shares in the target company, they are deemed to have indirectly acquired those taxable properties through the share acquisition, so they are subject to deemed acquisition tax.

Tax clearances

It is possible to obtain a tax clearance certificate in advance from the Korean tax authority to confirm whether there are outstanding tax liabilities as of the tax clearance certificate issuance date.

Choice of acquisition vehicle

Several acquisition vehicles are available to a foreign investor. The tax burden may differ according to the type of acquisition vehicle.

Local holding company

A local holding company may be used as a vehicle for the acquisition of a local company. In this case, by borrowings, the local company can deduct the interest expense against its taxable income within the limits prescribed by Korean tax law. Where the debt is borrowed from a related foreign shareholder, the interest rate should be set at an arm’s length rate equal to the market rate.

The general types of the business entity include the following (among others).

Chusik Hoesa

The Chusik Hoesa is the business organization permitted to issue shares to the public, so it is the most common form of business entity in Korea.

Yuhan Hoesa

A Yuhan Hoesa is a limited liability company. One advantage of a Yuhan Hoesa is that it may be possible to obtain flow-through tax treatment for US tax purposes. As such, a Yuhan Hoesa is eligible to check-the-box under US tax law.

Hapmyong Hoesa (partnership)

A Hapmyong Hoesa is organized by two or more partners who bear unlimited liability for the obligations of the partnership. A Hapmyong Hoesa is a separate entity and subject to corporate income tax.

Hapja Hoesa (limited partnership)

A Hapja Hoesa consists of one or more partners having unlimited liability and one or more partners having limited liability. Similar to a Hapmyong Hoesa, a Hapja Hoesa is a separate entity and subject to corporate income tax.

Foreign parent company

The foreign investor may make an acquisition itself. Under Korean tax law, dividend and interest payments to a foreign company that does not maintain a permanent establishment in Korea are subject to withholding tax (WHT). Where the foreign country has a tax treaty with Korea, the WHT may be reduced.

Non-resident intermediate holding company

Capital gains on the disposal of shares in a Korean company by a foreign shareholder company are generally subject to Korean tax, except for certain cases.

Dividends and interest payments made to a foreign company are also generally subject to tax. As a foreign shareholder residing in a foreign jurisdiction that has a double tax treaty with Korea may enjoy the tax treaty benefits, an intermediate holding company that is resident in a more favorable jurisdiction may be considered. However, to be eligible for tax treaty benefits, the intermediate holding company should meet the anti-treaty shopping provisions (i.e. beneficial owner of the income) under Korean tax law and the relevant tax treaty.

Joint venture

In most industries, foreign investors may invest without any ownership restrictions. For certain industries, such as newspapers, telecommunications and broadcasters, the Korean government encourages foreign investors to establish joint venture companies with Korean partners rather than establish wholly owned subsidiaries. In these industries, the government restricts the amount of foreign ownership to a designated percentage.

Choice of acquisition funding

Debt

The investor can use debt and/or equity to fund its investment. The dividend is not tax-deductible, but interest can be deducted from taxable income. Expenses incurred in the course of borrowing, such as guarantee fees and bank fees, can also be deducted for tax purposes. Therefore, the investor often prefers to use debt.

Deductibility of interest

In general, interest expenses incurred in connection with a trade or business are deductible for Korean corporate tax purposes. However, certain interest expenses are not deductible, including (among others):

- interest on debt incurred specifically for use in construction projects or for the purchase of fixed assets

- interest on private loans where the source is unknown

- interest the recipient of which cannot be identified

- interest on debt used for the purchase of non-business-related assets

- interest paid to the foreign controlling shareholder that exceeds the limit under the thin capitalization rules.

Under Korea’s thin capitalization rules, where a Korean company borrows from its foreign controlling shareholder an amount in excess of two times the equity from the foreign controlled shareholder (six times in the case of a financial institution), interest on the excess portion of the borrowing is not deductible in computing taxable income. Money borrowed from a foreign controlling shareholder includes amounts borrowed from an unrelated third party based on guarantees provided by a foreign controlling shareholder. The non-deductible amount of interest is treated as a deemed dividend or other outflow of income, and WHT may apply.

Withholding tax on debt and methods to reduce or eliminate it

Where a Korean company pays interest to its foreign lender, the payment is subject to Korean WHT at a rate of 22 percent, inclusive of local surtax (including a 15.4 percent surtax in the case of interest on bonds). This WHT could be reduced where the recipient is a foreign lender resident in a jurisdiction that has an applicable double tax treaty with Korea. Other interest payments to foreign lenders may be exempt from WHT where certain conditions are met.

Checklist for debt funding

- Consider whether the use of debt may trigger disallowed interest deductions under the thin capitalization rules and whether the interest rate is arm’s length, as required by transfer pricing rules.

- Withholding tax of 22 percent, inclusive of local surtax, applies on interest payments made to a foreign lender that does not have a Korean permanent establishment unless a lower WHT rate is available under the relevant tax treaty.

Equity

An investor may use equity to fund its acquisition.

When capital is injected into a Korean company by an investor, a registration license tax is imposed at a base rate of 0.48 percent (including local surtax) of the par value of the shares issued on incorporation and of the par value of the shares issued in subsequent capital increases. In certain cases, the applicable capital registration tax rate is triple the normal rate.

Dividends made to a foreign shareholder that is not considered to have permanent establishment in Korea are not deductible for tax purposes and are subject to WHT at the rate of 22 percent, in the absence of a relevant tax treaty.The actual rate depends on the treaty.

Merger

Mergers are allowed in Korea between Korean domestic companies. Usually, a merger may result in various tax implications for the parties involved (i.e. dissolving company, shareholders of the dissolving company or the surviving company). However, where the merger is carefully planned and executed, a substantial part of the merger-related taxes may be mitigated or deferred, especially where the merger is considered to be a ‘qualified merger’.

A merger satisfying the following basic conditions is considered a qualified merger for Korean tax purposes:

- Both companies (i.e. surviving and dissolving companies) have engaged in business for at least one year as of the merger date.

- Where consideration is paid, at least 80 percent of the consideration paid to the shareholder of the dissolving company consists solely of shares in the surviving company.

- The surviving company continues to carry out the operations of the transferred business until the end of the fiscal year of the merger.

In the case of a merger, tax loss carry forwards of the surviving company can only be used to offset profits generated from the original business of the surviving company. Similarly, the tax loss carry forwards of the dissolved company can only be used to offset the profits from the business of the dissolved company.

Hybrids

Not applicable.

Discounted securities

Securities can be issued at a discount when the nominal interest rate is below the market interest rate. The difference between the nominal price and the issue price may be deducted over the life of the security. However, where the lender is a related party, the interest rate should be based on an arm’s length rate to avoid any transfer pricing tax adjustments.

Deferred settlement

Not applicable.

Other considerations

Company law and accounting

The Commercial Law prescribes conditions and procedures related to establishing and liquidating an entity and to M&A-type transactions, such as mergers, split-offs and spin-offs. Where the company fails to comply with the legal and other procedures necessary for such a transaction, the applicable contracts may be considered invalid.

Group relief/consolidation

Group relief/consolidation is available where the controlling company holds 100 percent of the outstanding shares of the subsidiary company and the subsidiary company’s head office is located in Korea.

The tax rates for the consolidated group are the corporate income tax rates. Consolidated tax returns must be submitted to the competent tax authority within 4 months of the end of each fiscal year.

Transfer pricing

Under Korean tax law, where the transfer price used between a Korean company and its foreign related party is below or above the arm’s length price, the tax authority has the power to adjust a transfer price and recalculate a resident’s taxable income.

The arm’s length price should be determined by the most reasonable method applicable to the situation. The method and the reason for adopting it should be disclosed by the taxpayer to the tax authorities in a report submitted with the annual tax return.

Dual residency

Not applicable.

Foreign investments of a local target company

Where a Korean resident company or individual invests in a company is located in a tax haven country and has unreasonably retained profits in the controlled foreign company (CFC), the retained profits are treated as dividends paid to that Korean company or individual, even though the reserved profits were not actually distributed.

Where the total shares in a CFC directly or indirectly held by a Korean resident individual or company and directly held by their family members together account for 10 percent or more of the voting shares in the foreign company, the Korean resident individual or company is subject to the anti-tax haven rules.

These rules are intended to regulate a company that has made abnormal overseas investments. They apply to Korean companies that have invested in a company incorporated abroad that is subject to an effective tax rate of 15 percent or less on average on accrued income for a period of 3 years.

However, where a company incorporated in a tax haven country actively engages in business operations through an office, shop or factory that is required for such business operations, the anti-tax haven rules do not apply.

Where a parent company whose main business is to hold and own stocks, etc., holds at least 40 percent of the shares of subsidiaries in the same jurisdiction for more than 6 months and interest income and dividend income from its subsidiaries in the same jurisdiction accounts for 90 percent or more of its income, the CFC rules do not apply.

Comparison of asset and share purchases

Advantages of asset purchases

- The purchase price can be depreciated (amortized) for tax purposes.

- The historical liabilities of the company are not transferred to the new or surviving company.

- No transfer of retained earnings and possible tax liabilities.

- Possible to acquire only part of a business.

Disadvantages of asset purchases

- Benefit of any tax losses incurred by the target company remains with the seller.

- Buyer may be subject to acquisition tax on purchasing applicable assets.

Advantages of share purchases

- Buyer may benefit from tax losses of the target company.

- Buyer may gain the benefit of existing supply or technology contracts.

Disadvantages of share purchases

- Buyer bears secondary tax liability of a target company as a majority shareholder.

- No deduction is available for the purchase price until the disposal of the shares.

- Seller is subject to securities transaction tax.

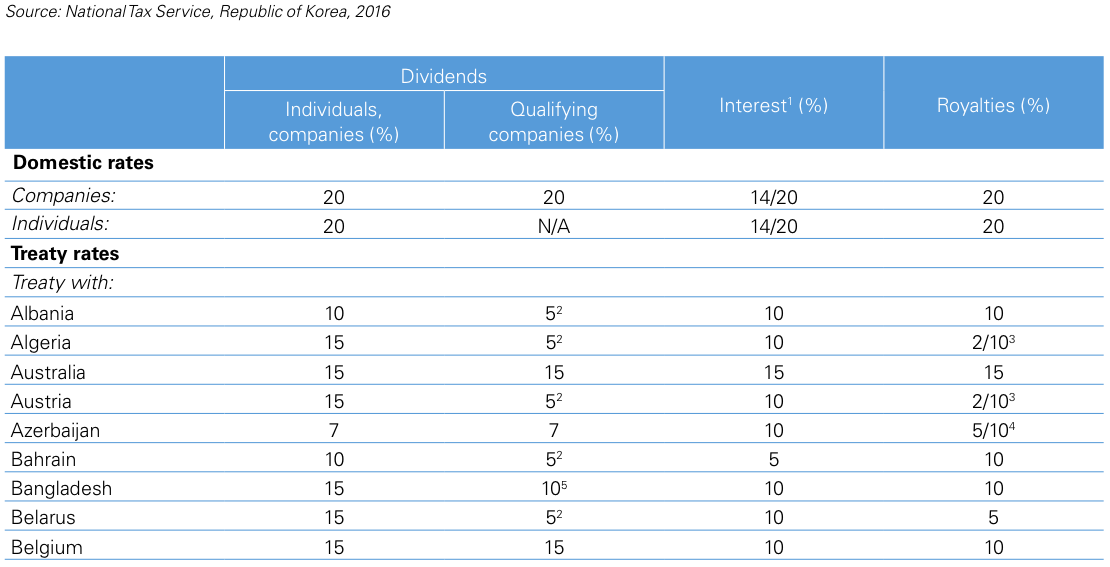

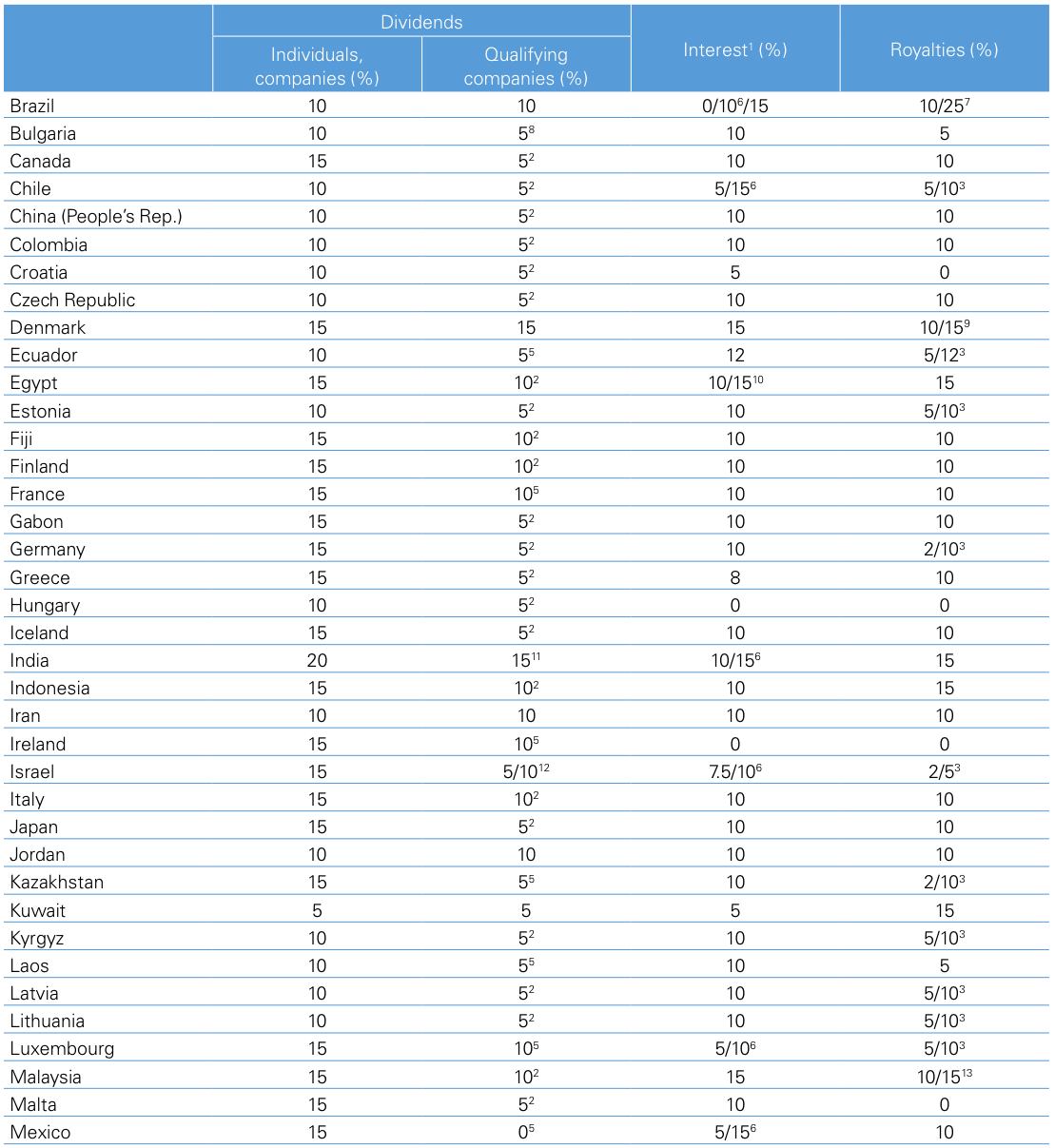

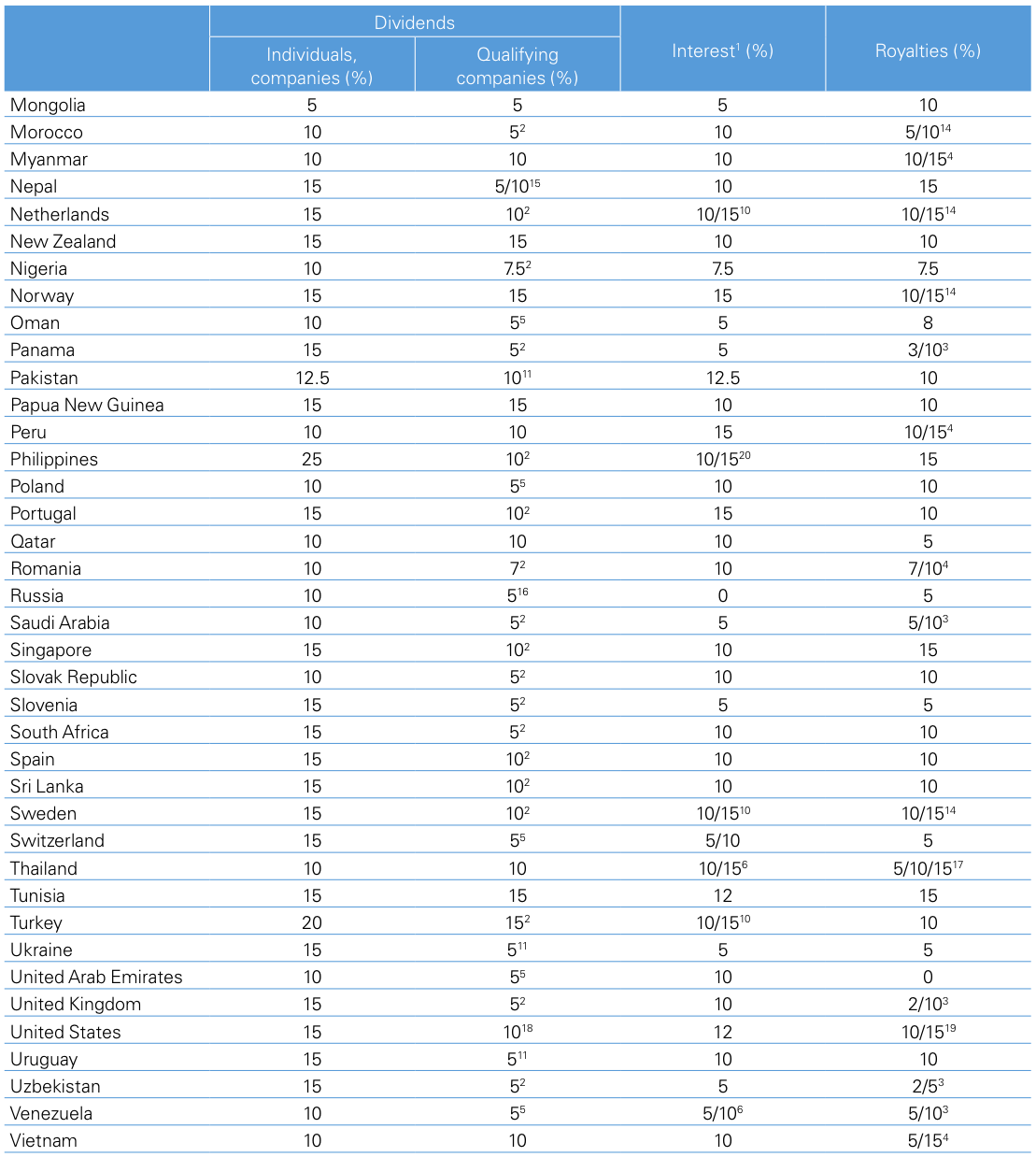

Korea — Withholding tax rates

This table is based on information available up to 31 December 2015.

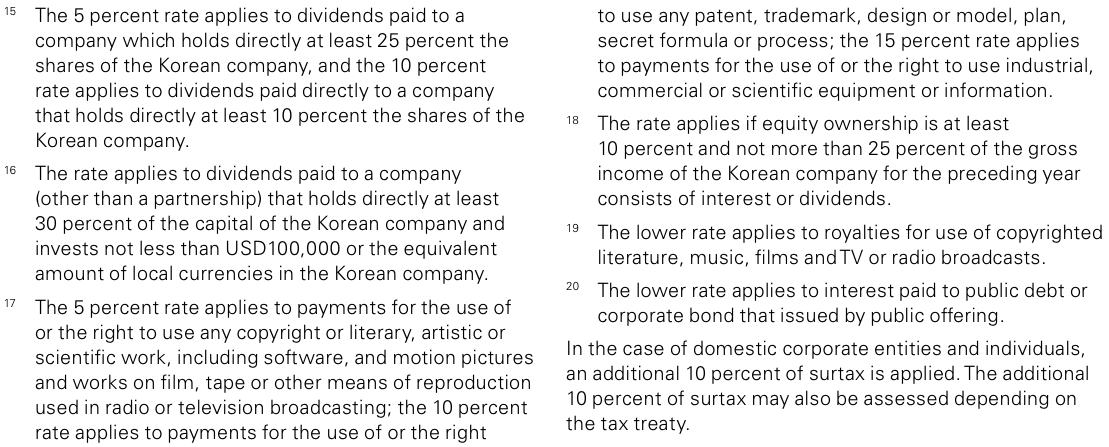

The following table contains the withholding tax rates that are applicable to dividend, interest and royalty payments from Korea to non-residents under the tax treaties currently in force. Where, in a particular case, a rate is higher than the domestic rate, the latter is applicable. If the treaty provides for a rate lower than the domestic rate, the reduced treaty rate may be applied at source if the appropriate residence certificate has been presented to the withholding agent making the payment.

However, a withholding agent should obtain pre-clearance from the tax office before applying a treaty to a resident of a country or a region designated by the Ministry of Strategy and Finance (Labuan, Malaysia is currently designated as such). Without the pre-clearance, the withholding agent should apply the domestic withholding tax rates.

An income recipient that claims a reduced tax rate under a tax treaty should submit an application to the income payer before the income is paid.

To identify the exact withholding taxes and calculate the total tax cost of your cross border transaction, further review should be required.

TAGS:

Stay up to date with M&A news!

Subscribe to our newsletter